-

What is SDR? article just published in ILP Moneyfacts

Published on: 13/03/2024

-

'Adviser Sustainability Group' Terms of Reference and member names published

Published on: 05/03/2024

-

Fiduciary Duty, pensions and climate change

Published on: 27/02/2024

-

Appointment to Vice Chair of new working group for financial advisers

Published on: 16/01/2024

-

Introduction to SDR - video

Published on: 15/01/2024

-

Woke, war and waiting - ILP Moneyfacts article December 2023

Published on: 13/12/2023

-

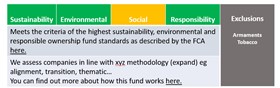

FCA Sustainability Disclosure and Labelling Regime published

Published on: 28/11/2023

-

New website finalised - live on the Fund EcoMarket url!

Published on: 24/11/2023

-

FCA finds further work required to embed its ESG and SI principles in funds

Published on: 20/11/2023

-

ESG and armaments

Published on: 15/11/2023

-

Dialshifter statements from event delegates

Published on: 09/11/2023

-

SRI Services & Partners event videos 2023

Published on: 17/10/2023

-

SRI Services welcomes TPT framework

Published on: 12/10/2023

-

Last chance to sign up to our annual event!

Published on: 29/09/2023

-

SRI Service opposes backtracking on UK climate strategy

Published on: 21/09/2023

-

Actuaries vs Econs - Investment Life and Pension Moneyfacts article

Published on: 14/09/2023

-

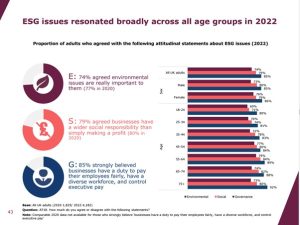

FCA Financial Lives survey shows - yes - growing interest in ESG

Published on: 13/09/2023

-

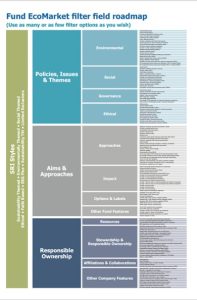

Fund EcoMarket v3 - new introductory video now live

Published on: 12/08/2023

-

Fund EcoMarket use January to June 2023

Published on: 31/07/2023

-

Rollercoasters and regulators - the ESG boom and beyond

Published on: 14/07/2023

-

Sign up to the annual SRI Services and Partners event on 5 October

Published on: 13/07/2023

-

IFoA report: The Emperors new climate scenarios

Published on: 10/07/2023

-

Church of England to exclude oil and gas companies

Published on: 10/07/2023

-

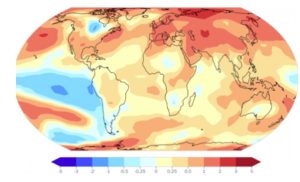

Climate Change Committee report critical of UK government progress towards Net Zero

Published on: 29/06/2023

-

ISSB issues inaugural standard for sustainability disclosure

Published on: 29/06/2023

-

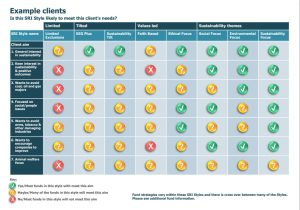

SRI StyleFinder fact find tool

Published on: 21/06/2023

-

ESG ratings consultation

Published on: 03/04/2023

-

UK Green Finance Strategy 2023

Published on: 03/04/2023

-

Latest IPCC climate change report

Published on: 29/03/2023

-

UN High Seas Treaty

Published on: 29/03/2023

-

TPR increases climate and ESG focus

Published on: 01/03/2023

-

FCA publishes 'Finance for positive sustainable change' discussion paper

Published on: 13/02/2023

-

Top 100 sustainable investment filter searches on Fund EcoMarket 2022

Published on: 08/02/2023

-

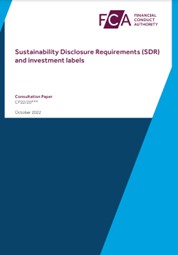

SDR consultation feedback

Published on: 31/01/2023

-

SDR: What and Why?

Published on: 14/12/2022

-

FCA SDR consultation paper video

Published on: 07/12/2022

-

Professional Adviser article - Whistle stop tour of sustainability disclosure requirements

Published on: 14/11/2022

-

FT Adviser article - will SDR confine greenwash to history

Published on: 14/11/2022

-

WMO - Eight Warmest Years

Published on: 07/11/2022

-

UN 'Closing Window' Emissions gap report 2022

Published on: 28/10/2022

-

SRI Services welcomes FCA's landmark SDR consultation.

Published on: 25/10/2022

-

SRI Services & Partners event videos

Published on: 24/10/2022

-

Scribe from our annual event!

Published on: 21/10/2022

-

Foundations for Growth (awaiting SDR) article - ILP Moneyfacts

Published on: 14/10/2022

-

SRI Services and Partners annual event 6 October 2022

Published on: 12/08/2022

-

FCA publishes review of TCFD aligned disclosures

Published on: 11/08/2022

-

FCA publishes review of TCFD aligned disclosures

Published on: 11/08/2022

-

ESG: A cautionary tale for Lionesses?

Published on: 09/08/2022

-

ILP Moneyfacts - Sustainability slow, slow, quick

Published on: 18/07/2022

-

How SDR should help financial advisers

Published on: 14/07/2022

-

London Climate Week - (free) Excel event tickets - 28 & 29 June

Published on: 15/06/2022

-

A collection of responses to HSBC's Kirk extraordinary climate speech

Published on: 27/05/2022

-

'Man who jumps on bandwagon accuses fellow passengers of being on bandwagon'

Published on: 23/05/2022

-

How global events are affecting impact and sustainable investments

Published on: 28/04/2022

-

Further thoughts on sustainable fund labelling

Published on: 31/03/2022

-

Some thoughts on the Purpose, Positioning and Priorities of sustainable investment

Published on: 18/03/2022

-

Ukraine tragedy highlights need for intermediaries to understand sustainable fund strategies

Published on: 14/03/2022

-

Citywire New Model Adviser - sustainability and technology comments

Published on: 01/03/2022

-

FT Adviser article - How should we label ESG funds?

Published on: 09/02/2022

-

Data sharing with Fidelity platforms

Published on: 08/02/2022

-

SRI Services response to FCA SDR and labels discussion paper DP21/4

Published on: 17/01/2022

-

Top 50 Fund EcoMarket sustainable investment searches 2021

Published on: 17/01/2022

-

ShareAction report on asset managers' proxy votes

Published on: 17/12/2021

-

Normalising Net Zero - ILP Moneyfacts sustainable investment article

Published on: 15/12/2021

-

Sustainable investment 4,3,2,1

Published on: 10/12/2021

-

Recent sustainable investment policy developments

Published on: 07/12/2021

-

Fund labelling article written for ESG Clarity

Published on: 02/12/2021

-

Feedback request to all Fund EcoMarket users

Published on: 11/11/2021

-

What recent sustainability developments may mean for financial advisers

Published on: 10/11/2021

-

Appointment to FCA 'Disclosure and Labels Advisory Group'

Published on: 04/11/2021

-

FCA publishes Climate Change Adaptation Report

Published on: 29/10/2021

-

Greening Finance roadmap & related developments

Published on: 21/10/2021

-

SRI Services WINS Investment Week 'Best ESG Support Service Provider' award

Published on: 04/10/2021

-

SRI Services & Partners Good Money Week event 2021

Published on: 18/09/2021

-

SRI Services shortlisted for two Investment Week ESG Awards

Published on: 09/09/2021

-

'The future of (sustainable) investment' - Moneyfacts article

Published on: 23/08/2021

-

Performance of 'Ethical/Sustainable' funds vs 'Non Ethical' July 2021

Published on: 23/08/2021

-

SRI Services welcomes new FCA 'ESG and Sustainable Investment Principles'

Published on: 19/07/2021

-

Six Monthly Fund EcoMarket user report - exploring sustainable investment trends.

Published on: 13/07/2021

-

Regulatory developments in sustainable investment (July 2021)

Published on: 12/07/2021

-

Sustainable Finance Festival video

Published on: 29/06/2021

-

Independent Assessment of UK Climate Risk - report

Published on: 17/06/2021

-

Net Zero and 'real' sustainability

Published on: 17/06/2021

-

The day everything changed for big oil?

Published on: 27/05/2021

-

'Stick or Twist' - our recent Investment Life and Pensions Moneyfacts article

Published on: 18/05/2021

-

UKSIF launches new policy vision - where next for UK Sustainable Finance?

Published on: 11/05/2021

-

Eurosif welcomes new EU Sustainable Finance Package

Published on: 11/05/2021

-

New Fund EcoMarket brochure available for download

Published on: 13/04/2021

-

Climate considerations now embedded across main UK financial regulators

Published on: 25/03/2021

-

SRI Styles update - 'ethical' funds now in single category

Published on: 16/03/2021

-

ESG: More Than a Protest - Citywire infographic and article

Published on: 08/03/2021

-

SRI Services & Fund EcoMarket February 2021 newsletter

Published on: 23/02/2021

-

Climate of Change - Investment Life and Pensions Moneyfacts article

Published on: 15/02/2021

-

Intelligent Partnership estate planning guide - SRI thoughtpiece

Published on: 10/02/2021

-

Buying an electric car – our 'personal' experience

Published on: 09/02/2021

-

Fund EcoMarket roundup and top 100 searches in 2020

Published on: 06/01/2021

-

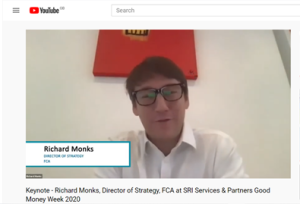

Building Trust in Sustainable Investment - FCA keynote speech at SRI Services Good Money Week event

Published on: 26/11/2020

-

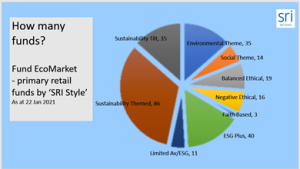

UK retail SRI market size

Published on: 24/11/2020

-

SRI Services & Partners Good Money Week 2020 event videos now live!

Published on: 28/10/2020

-

New Fund EcoMarket brochure

Published on: 27/10/2020

-

'Lessons from the Lorax' podcast

Published on: 24/10/2020

-

SRI Services & Partners Good Money Week event 21 October

Published on: 20/10/2020

-

Fund EcoMarket changes - New Styles and Subfund data

Published on: 24/09/2020

-

Keynote speaker announced for 21 October SRI Services and Partners event

Published on: 02/09/2020

-

Which? report on ethical investment

Published on: 05/08/2020

-

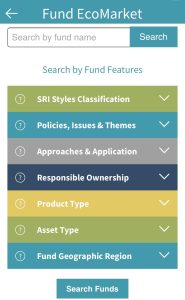

Fund EcoMarket App launched

Published on: 26/07/2020

-

Investment Life & Pension Moneyfacts SRI feature

Published on: 22/07/2020

-

Searches for ESG funds increase rapidly - with sustainability issues dominating

Published on: 02/07/2020

-

EU ESG consultations - SFDR & Disclosure

Published on: 19/06/2020

-

Adviser training video

Published on: 18/05/2020

-

Covid and the Future of ESG - Money Marketing Interview

Published on: 24/04/2020

-

What did Fund EcoMarket users search for in Q1 2020

Published on: 14/04/2020

-

21 October 2020 'SRI Services & Partners' annual event registration

Published on: 08/04/2020

-

March 2020 newsletter link

Published on: 31/03/2020

-

Coronavirus and ESG - early fund manager responses

Published on: 29/03/2020

-

Coronavirus and ESG - some early (personal) reflections

Published on: 27/03/2020

-

EU Taxonomy Final Report

Published on: 23/03/2020

-

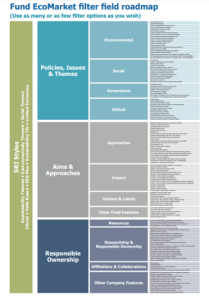

Fund EcoMarket filter options - annual update

Published on: 03/03/2020

-

BlackRock sustainability announcement

Published on: 17/01/2020

-

Top Fund EcoMarket Filter Searches in 2019

Published on: 06/01/2020

-

Fund EcoMarket use doubles in 2019

Published on: 03/01/2020

-

Newsletter

Published on: 01/01/2020

-

SRI Services and Partners 2019 event videos now live

Published on: 06/12/2019

-

Recent changes to Fund EcoMarket

Published on: 06/12/2019

-

Investment Association Responsible Investment Framework announced

Published on: 18/11/2019

-

Understanding Greenwash

Published on: 13/11/2019

-

New 'Find An Adviser' Map added to Fund EcoMarket

Published on: 08/11/2019

-

FCA Feedback Statement on Climate Change and Green Finance

Published on: 18/10/2019

-

More than a third of pension schemes considering appointing IFA - XPS. (So be informed about ESG!)

Published on: 17/10/2019

-

SRI Services & Partners event roundup

Published on: 14/10/2019

-

Top 100 Fund EcoMarket searches Jan - Sept

Published on: 04/10/2019

-

interactive investor launches ethical 'ACE' list with help from SRI Services

Published on: 10/09/2019

-

SRI Services & Partners event – 9 October 2019, London

Published on: 30/08/2019

-

July Newsletter

Published on: 22/07/2019

-

'Ethical Tipping Point'- Investment Life & Pensions Moneyfacts article

Published on: 12/07/2019

-

Media release: Use of Fund EcoMarket trebled

Published on: 09/07/2019

-

UK launches Green Finance Strategy & Green Finance Institute

Published on: 03/07/2019

-

Woman of the Year Award - Finalist

Published on: 13/06/2019

-

SRI fund tool filter searches May 2019

Published on: 10/06/2019

-

MiFID ii - ESG & Sustainability upgrade

Published on: 24/05/2019

-

Top 50 Fund EcoMarket searches April 2019

Published on: 07/05/2019

-

April 'inSRI' newsletter link

Published on: 02/05/2019

-

UKSIF 'Ownership Day' fund manager survey 'Oil Pressure Gauge'

Published on: 02/05/2019

-

Understanding Sustainability funds

Published on: 18/04/2019

-

Three new videos now live - Introducing Fund EcoMarket, SRI & SRI Jargon

Published on: 14/04/2019

-

Fund EcoMarket 'top 50 searches' Q1 2019

Published on: 08/04/2019

-

Global Sustainable Investment Alliance (GSIA) report published

Published on: 05/04/2019

-

PRA & FCA Climate Financial Risk Forum- first meeting

Published on: 22/03/2019

-

Top Fund EcoMarket searches February 2019

Published on: 12/03/2019

-

Link to our February 2019 newsletter

Published on: 06/03/2019

-

What did people search for on Fund EcoMarket in January?

Published on: 15/02/2019

-

Investment Association to consult on Sustainability and Responsible Investment

Published on: 04/02/2019

-

SRI Services responds to FCA Climate Change and Green Finance Consultation

Published on: 04/02/2019

-

ESMA MIFID II Sustainability Consultation

Published on: 20/01/2019

-

FCA DP18/8 consultation: Climate Change and Green Finance deadline looming

Published on: 16/01/2019

-

Newsletter update from SRI Services

Published on: 30/11/2018

-

'Sustainability & Suitability' SRI event videos

Published on: 08/11/2018

-

Why Climate Change Matters to Investors - Lord Deben video from our 3 October event

Published on: 25/10/2018

-

FCA opens discussion on impact of climate change and green finance on financial services

Published on: 15/10/2018

-

New PRA report: The Impact of climate change on the UK banking sector

Published on: 30/09/2018

-

How not to do SRI. Guardian article on Goldman Sachs 'Just' fund

Published on: 30/09/2018

-

UK Government changes pension trustee duties and rules to include ESG

Published on: 12/09/2018

-

'Exploring Sustainability & Suitability' - SRI event for intermediaries

Published on: 04/09/2018

-

Help Fund World’s First Sculpture Celebrating Green Finance

Published on: 24/08/2018

-

SRI Services welcomes FCAs proposed review on SRI, ESG & ethical concerns

Published on: 20/07/2018

-

DWP pension consultation - deadline 16 July

Published on: 12/07/2018

-

ILP Moneyfacts: SRI lightbulb moment editorial

Published on: 12/07/2018

-

Pension Funds and Social Investment - final government report

Published on: 18/06/2018

-

Sustainable Finance Initiative - MiFID II suitability requirements - feedback requested

Published on: 08/06/2018

-

EU proposes action to support sustainable finance

Published on: 25/05/2018

-

Fund Manager responses to 'Can you avoid investing in plastic?'

Published on: 22/05/2018

-

Latest inSRI newsletter

Published on: 17/05/2018

-

Green Finance Taskforce report

Published on: 10/04/2018

-

Its a cultural thing.

Published on: 15/03/2018

-

EU Announces Sustainable Finance Action Plan

Published on: 15/03/2018

-

FT Adviser Impact Investment article by Julia Dreblow

Published on: 06/03/2018

-

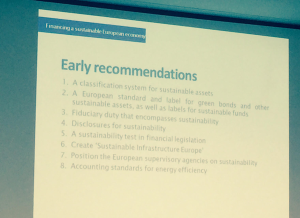

EU HLEG Final Report - Sustainable Finance

Published on: 15/02/2018

-

inSRI newsletter January 2018

Published on: 31/01/2018

-

Green Finance Inquiry (UK)

Published on: 16/01/2018

-

A taste of things to come - ILP Moneyfacts SRI article

Published on: 19/12/2017

-

Pension funds & Social Investment - plus ESG, Stewardship and Ethics

Published on: 18/12/2017

-

Why should DC pension schemes consider ESG and SRI (x 12!)

Published on: 13/12/2017

-

Obligatory ‘ethical’ fact finding?

Published on: 07/12/2017

-

Growing a Culture of Social Impact Investing in the UK

Published on: 27/11/2017

-

DWP consultation: Disclosure of costs, charges and investments in DC schemes

Published on: 21/11/2017

-

Citywire Wealth Manager 'Screened, Themed & Engaged' event article

Published on: 03/11/2017

-

'Screened, Themed and Engaged 2017' - panel videos

Published on: 26/10/2017

-

Good work Gov!

Published on: 06/10/2017

-

Fund EcoMarket: Sustainable Investment 'Award for Innovation' Finalist

Published on: 01/09/2017

-

ILP Moneyfacts SRI articles: Climate Risk and Ethical Fund Survey

Published on: 07/08/2017

-

NRG - a topsy turvy case study

Published on: 28/07/2017

-

Fund EcoMarket ESG / SRI research award finalist

Published on: 28/07/2017

-

HLEG - EU sustainable finance interim report published

Published on: 19/07/2017

-

SwissRe switch all assets to ESG indices

Published on: 06/07/2017

-

TCFD report final report - managing climate risk

Published on: 29/06/2017

-

Hold the date - 19 October SRI event

Published on: 28/06/2017

-

Pensions & Social Investment: Law Commission review

Published on: 27/06/2017

-

Actuaries issued climate change Risk Alert

Published on: 16/06/2017

-

See SRI Services for earlier blogs

Published on: 03/05/2017

-

Link to old SRI Services blog area

Published on: 03/02/2017

-

SRI Services shortlisted for 'Investment Week' Award

Published on: 24/08/2016

-

New Morningstar Sustainability Ratings - an opinion

Published on: 14/07/2016

-

inSRI newsletter 8

Published on: 11/07/2016

-

Transparency Times article

Published on: 20/06/2016

-

Fund EcoMarket expanded to include ESG Integration and Responsible Ownership

Published on: 10/06/2016

-

AXA to divest tobacco industry assets

Published on: 31/05/2016

-

Integrating SRI into advice process - IIL / PFS event podcast

Published on: 12/05/2016

-

New funds on Fund EcoMarket

Published on: 25/04/2016

-

Panama Papers: from point scoring to progress?

Published on: 11/04/2016

-

Synaptic Connections magazine SRI article: 'Enquiring Stewards'

Published on: 21/03/2016

-

Asset TV interview: SRI & ethical investing Masterclass

Published on: 11/03/2016

-

View Citywire / NMA ethical investment interview video here

Published on: 26/02/2016

-

sriServices Citywire video interview

Published on: 25/02/2016

-

Joining the 'Good With Money' expert panel

Published on: 25/02/2016

-

inSRI Newsletter 7 - Building momentum

Published on: 09/02/2016

-

Fund EcoMarket shortlisted for Sustainable City Award

Published on: 04/02/2016

-

Highest ever Ethical Fund sales in 2015: Investment Association

Published on: 26/01/2016

-

PFS event announced: 'Bringing SRI into the financial advice process'

Published on: 22/01/2016

-

Our FAMR SRI recommendations

Published on: 11/01/2016

-

Environmental Themed & Clean Technology SRI Styles merged

Published on: 10/01/2016

-

Updated SRI Styles Classifications

Published on: 04/01/2016

-

Fund EcoMarket Update

Published on: 06/12/2015

-

Fund EcoMarket and related news - roundup

Published on: 23/11/2015

-

New RSMR SRI Guide for Advisers

Published on: 13/11/2015

-

Fund EcoMarket v2 - Launch event

Published on: 10/11/2015

-

Fund EcoMarket launch release

Published on: 16/10/2015

-

EIRIS & Vigeo announce merger

Published on: 13/10/2015

-

Good Money Week - Fund EcoMarket 2.0 launch event

Published on: 02/10/2015

-

Synaptic Ethical Fact Find update

Published on: 17/09/2015

-

Guardian 'Fund EcoMarket' advertisement

Published on: 15/09/2015

-

'30 People, 30 Words, 30 Years' - Ethical Guide for IFAs

Published on: 07/09/2015

-

inSRI Newsletter 5 - Introducing Fund EcoMarket 2.0!

Published on: 02/09/2015

-

Ethical upgrade for financial advice - Salt blog

Published on: 01/09/2015

-

Stranded Assets article for advisers in this month's ILP Moneyfacts

Published on: 16/08/2015

-

Join our 'Find Adviser' listing

Published on: 29/07/2015

-

'A Greener Future' - ILP Moneyfacts article by Richard Eagling

Published on: 17/07/2015

-

Fund EcoMarket Quarterly Update Complete

Published on: 13/07/2015

-

SRI Database Fund EcoMarket 2.0 (beta site) now LIVE!

Published on: 09/07/2015

-

Capita Connection Magasine

Published on: 19/06/2015

-

Charles Jacob CBE

Published on: 03/06/2015

-

ILP Moneyfacts article 'Stepping Stones for SRI Success'

Published on: 19/05/2015

-

Impact Investment Questions added to Fact Find

Published on: 11/05/2015

-

WHEB publish innovative 'Impact' Report

Published on: 30/04/2015

-

sriServices 'Highly Commended' in Corporation of London Sustainabile City Awards

Published on: 25/03/2015

-

Fund EcoMarket Quarterly Update complete

Published on: 17/03/2015

-

New RSMR SRI Rated fund matrix

Published on: 04/03/2015

-

Ethical Investment / SRI's top influencers...

Published on: 23/02/2015

-

New SRI materials for advisers - from RobecoSAM, Parmenion & Friends'

Published on: 16/02/2015

-

"Ready to Play Ball?" New ILP Moneyfacts SRI feature

Published on: 26/01/2015

-

Seize the day: The Economist comments on falling oil prices

Published on: 16/01/2015

-

Xmas Email server issues - now sorted!

Published on: 05/01/2015

-

Fast growing ‘Visits’ to sriServices & Fund EcoMarket in 2014

Published on: 17/12/2014

-

Capita 'Connection' SRI Article by sriServices

Published on: 15/12/2014

-

Fund EcoMarket database quarterly update

Published on: 10/12/2014

-

inSRI - sriServices Newsletter now available

Published on: 05/12/2014

-

A 10 point 'Stewardship' roundup - given events

Published on: 04/12/2014

-

Rathbone Ethical Bond details now live on Fund EcoMarket

Published on: 03/12/2014

-

sriServices & Fund EcoMarket nominated for 'Sustainable City Award'

Published on: 02/12/2014

-

Friends Life, Stewardship - and Aviva

Published on: 23/11/2014

-

Improved SRI tool access on sriServices.co.uk

Published on: 21/11/2014

-

Impact Investment – 5 Adviser Tips

Published on: 20/11/2014

-

Website - Work in Progress!

Published on: 18/11/2014

-

Stranded Assets, APPCCG & Green Bear

Published on: 10/11/2014

-

It's raining SRI (& friends) events!

Published on: 03/11/2014

-

Unbiased feature sriServices article in Newsletter during Good Money Week

Published on: 03/11/2014

-

Mark Carney & the case for going Fossil Free

Published on: 23/10/2014

-

Listen in - SRI Fact Finding discussion

Published on: 21/10/2014

-

SRI fact finding - conference call Monday 20 October

Published on: 17/10/2014

-

New Eurosif report shows SRI growth all round

Published on: 13/10/2014

-

'SRI Fact Finding' adviser event announced

Published on: 24/09/2014

-

Moneyfacts SRI feature - just ahead of Good Money Week!

Published on: 10/09/2014

-

Fracking: Complicated

Published on: 08/09/2014

-

302 easy ways to invest in SRI

Published on: 11/08/2014

-

F&C looks forward to the next 30 years of responsible investment!

Published on: 10/07/2014

-

SRI adviser event videos - now Live!

Published on: 04/07/2014

-

SRI in the Adviser Press: Moneyfacts

Published on: 19/06/2014

-

New Rayner Spencer Mills / sriServices Literature and Rated SRI Fund List for Financial Advisers

Published on: 14/06/2014

-

RSM Launch new SRI rating service

Published on: 06/06/2014

-

Only one week to go to SRI IFA Event (Register now!)

Published on: 05/06/2014

-

Registration now open for sriServices & RSMR Adviser SRI event

Published on: 08/05/2014

-

RSMR & sriServices announce date for adviser event

Published on: 04/05/2014

-

National Ethical Investment Week rebranded Good Money Week

Published on: 23/04/2014

-

Parmenion refreshes ethical / SRI portfolio options

Published on: 15/04/2014

-

Ownership Day - encouraging investors to be part of the solution

Published on: 31/03/2014

-

Green Alliance: more jobs, less carbon infographic

Published on: 25/03/2014

-

Fund EcoMarket SRI Fund Database update

Published on: 06/03/2014

-

Missing piece of SRI puzzle found at Threadneedle

Published on: 21/02/2014

-

Welcome news from UNEP & Davos

Published on: 01/02/2014

-

Interesting but scary - BP Energy Outlook 2035

Published on: 17/01/2014

-

6 signs that say 'this client should think about ethical investment in 2014'

Published on: 11/01/2014

-

All things bright (red) and ethical

Published on: 17/12/2013

-

Would you rather hug an index or a tree?

Published on: 09/12/2013

-

Ethical SRI Style name change

Published on: 16/11/2013

-

Fund EcoMarket SRI Database - Quarterly update completed

Published on: 16/11/2013

-

New Unbiased.co.uk B2B site includes SRI Guide

Published on: 08/11/2013

-

UK ethical investment grows to £12.2 bn

Published on: 18/10/2013

-

Panacea Adviser updates

Published on: 15/10/2013

-

NEIW13 posts links to adviser support materials

Published on: 15/10/2013

-

Unbiased.co.uk publish SRI Guide ahead of NEIW13

Published on: 11/10/2013

-

NEIW 2013 est arrive - 5 Top SRI Tips for Advisers

Published on: 11/10/2013

-

SRI Supercharged September!

Published on: 10/10/2013

-

Parmenion 'Ethical Oversight Committee' appointment

Published on: 24/09/2013

-

National Ethical Investment Week 2013

Published on: 24/09/2013

-

SRI Bootcamp for Financial Advisers

Published on: 15/09/2013

-

Ethical Investment & SRI database 'Fund EcoMarket' - updated

Published on: 10/08/2013

-

Blue & Green Tomorrow Interview

Published on: 01/08/2013

-

Wonga wall

Published on: 29/07/2013

-

Funds Demand Climate Review

Published on: 17/07/2013

-

2 Minute Client Video Introducing SRI

Published on: 13/07/2013

-

Getting social with SRI

Published on: 01/07/2013

-

Climate Change - David Mitchell's soapbox

Published on: 16/05/2013

-

Fund EcoMarket SRI Database Quarterly update

Published on: 09/05/2013

-

Responsible Engagement Research summary

Published on: 02/05/2013

-

Triodos launches new ethical investment funds

Published on: 29/04/2013

-

Panacea Adviser SRI Twitterview

Published on: 24/04/2013

-

UKSIF appoints new Chief Executive

Published on: 17/04/2013

-

NEW: FTAdviser Guide to SRI

Published on: 22/03/2013

-

New Major Investor 'Responsible Engagement' Research

Published on: 12/03/2013

-

Horses for courses - non merci!

Published on: 04/03/2013

-

Unbiased.co.uk awards and adviser support

Published on: 07/02/2013

-

'Find Adviser' button now in use

Published on: 25/01/2013

-

UKSIF announces 'Ownership Day'

Published on: 24/01/2013

-

Fund EcoMarket database Update

Published on: 11/01/2013

-

A changing adviser market

Published on: 02/01/2013

-

Investors call for climate change action

Published on: 23/11/2012

-

Philanthropic Investments - Oxymoron or Win-Win?

Published on: 15/11/2012

-

Introduction to Fund EcoMarket - Powerpoint

Published on: 16/10/2012

-

sriServices welcomes PanaceaAdviser Ethical Zone

Published on: 09/10/2012

-

Its that time again!

Published on: 05/10/2012

-

SRI ‘StyleFinder’ client microsite NOW LIVE

Published on: 06/09/2012

-

Adviser views sought on regulatory barriers to Social Investment

Published on: 14/08/2012

-

Kay review of equity markets

Published on: 27/07/2012

-

Fund EcoMarket SRI database changes - July 2012

Published on: 09/07/2012

-

FSA Final Guidance 12/15 - SRI implications and comments

Published on: 19/06/2012

-

Ethical Advisers: which platforms should new SRI funds link to first?

Published on: 22/05/2012

-

NEW Adviser Guide to Sustainable and Responsible Investment

Published on: 16/05/2012

-

SRI Fund Database Updated

Published on: 30/04/2012

-

Former Henderson SRI team settling in well at WHEB AM

Published on: 19/03/2012

-

Unbiased.co.uk Responsible Investment IFA of the Year Media Award

Published on: 16/03/2012

-

Hendersons publish SRI fund destination

Published on: 14/02/2012

-

Kames Ethical Investment webinar success

Published on: 09/02/2012

-

Changes in SRI – comings and goings in a dynamic market

Published on: 02/02/2012

-

Wall Street Journal article on new 'Benefits Corporations'

Published on: 19/01/2012

-

SRI Fund Database Tool now live!

Published on: 10/01/2012

-

Fund EcoMarket to launch during National Ethical Investment Week

Published on: 30/09/2011

-

National Ethical Investment Week 2011 – events list hotting up

Published on: 28/09/2011

-

Ethical Investment Association - London IFA meeting

Published on: 20/09/2011

-

New 'Fund EcoMarket' SRI fund database pilot now LIVE!

Published on: 05/09/2011

-

SRI funds and performance: food for thought

Published on: 01/09/2011

-

Adviser focused SRI fund database ‘Fund EcoMarket’

Published on: 30/08/2011

-

Safeguarding access to SRI post RDR

Published on: 01/08/2011

-

UKSIF’s Call to Action on its 20th Anniversary

Published on: 21/07/2011

-

An organic dilemma for supermarkets

Published on: 21/07/2011

-

Ethical investment and the media...

Published on: 12/07/2011

-

Green and ethical investment fund market segmented into 7 ‘EcoStyles’

Published on: 05/07/2011

-

Making the most of the sun?

Published on: 28/06/2011

-

The Economist - Welcome to the Anthropocene

Published on: 09/06/2011

-

SRI Services: Launch news release

Published on: 09/06/2011

-

Platforum news: platform & wrap funds top £155bn

Published on: 20/05/2011

-

National Ethical Investment Week 2011 dates announced

Published on: 20/05/2011

-

SRI Services launches new IFA site with green and ethical fund tips and tools

Published on: 20/05/2011