Fund EcoMarket

the sustainable, responsible and ethical investment information hub

- EdenTree UK Equity Opportunities Fund

| Fund Name | SRI Style | Product | Region | Asset Type | Launch Date | |

|---|---|---|---|---|---|---|

EdenTree UK Equity Opportunities Fund |

Sustainable Style | OEIC | UK | Equity | 13/09/1999 | |

Fund Size: £98.75m Total screened & themed / SRI assets: £1638.79 Total Responsible Ownership assets: £1403.01 Total assets under management: £3041.81 As at: 30/04/25 Contact: adam.kelly@edentreeim.com |

||||||

OverviewThe EdenTree UK Equity Opportunities Fund seeks to invest at least 70% in companies which the Manager believes operate as sustainable businesses. It will therefore identify companies with positive sustainable business characteristics, by following EdenTree’s Sustainability Approach. This approach assesses, in a systematic way, multiple dimensions of sustainability, making for a rounded assessment of a company’s practices. Companies with material exposures to particular aspects of sustainability are assessed more closely on those topics. |

||||||

FiltersFund informationSustainability - GeneralSustainability theme or focus Encourage more sustainable practices through stewardship Circular economy theme Sustainable transport policy or theme Sustainability focus Sustainability policy UN Global Compact linked exclusion policy Transition focus Environmental - GeneralResource efficiency policy or theme Favours cleaner, greener companies Limits exposure to carbon intensive industries Environmental damage and pollution policy Environmental policy Waste management policy or theme Nature & BiodiversitySustainable fisheries policy Responsible palm oil policy Deforestation / palm oil policy Nature / biodiversity based solutions theme Biodiversity / nature policy Water stewardship policy Nature / biodiversity protection policy Illegal deforestation exclusion policy Climate Change & EnergyRequire net zero action plan from all/most companies Fossil fuel exploration exclusion - direct involvement Nuclear exclusion policy Energy efficiency theme Fracking and tar sands excluded Invests in clean energy / renewables Clean / renewable energy theme or focus Arctic drilling exclusion Coal, oil & / or gas majors excluded Fossil fuel reserves exclusion Climate change / greenhouse gas emissions policy Encourage transition to low carbon through stewardship activity Supply chain decarbonisation policy Paris aligned fund strategy Social / EmploymentDiversity, equality & inclusion Policy (fund level) Social policy Labour standards policy Favours companies with strong social policies Health & wellbeing policies or theme Mining exclusion Vulnerable / gig workers protection policy Ethical Values Led ExclusionsGambling avoidance policy Animal testing - excluded except if for medical purposes Pornography avoidance policy Armaments manufacturers avoided Civilian firearms production exclusion Animal welfare policy Alcohol production excluded Tobacco and related products - avoid where revenue > 5% Controversial weapons exclusion Military involvement exclusion Human RightsHuman rights policy Oppressive regimes (not free or democratic) exclusion policy Responsible supply chain policy or theme Child labour exclusion Modern slavery exclusion policy Meeting Peoples' Basic NeedsWater / sanitation policy or theme Healthcare / medical theme Antimicrobial resistance policy Banking & FinancialsInvests in banks Exclude insurers of major fossil fuel companies Invests in insurers Only invest in TCFD (ISSB) aligned banks / financial institutions Exclude banks with significant fossil fuel investments Governance & ManagementEncourage board diversity e.g. gender Governance policy UN sanctions exclusion Avoids companies with poor governance Anti-bribery and corruption policy Encourage TCFD alignment for banks & insurance companies Encourage higher ESG standards through stewardship activity Require investee companies to report climate risk in R&A Fund GovernanceESG integration strategy ESG factors included in Assessment of Value (AoV) report Asset SizeInvests in small, mid and large cap companies / assets Targeted Positive InvestmentsInvests >25% of fund in environmental/social solutions companies Invests >50% of fund in environmental/social solutions companies Impact MethodologiesPositive environmental impact theme Invests in social solutions companies Invests in environmental solutions companies Invests in sustainability / ESG disruptors Aim to deliver positive impacts through engagement Positive social impact theme Publish ‘theory of change’ explanation How The Fund WorksCombines norms based exclusions with other SRI criteria ESG weighted / tilt Focus on ESG risk mitigation Combines ESG strategy with other SRI criteria Positive selection bias Negative selection bias Significant harm exclusion SRI / ESG / Ethical policies explained on website Strictly screened ethical fund Do not use stock / securities lending Unscreened Assets & CashAll assets (except cash) meet published sustainability criteria Assets typically aligned to sustainability objectives 70 - 79% Assets typically aligned to sustainability objectives 80 – 89% Assets typically aligned to sustainability objectives > 90% Intended Clients & Product OptionsIntended for investors interested in sustainability Available via an ISA (OEIC only) Intended for clients interested in ethical issues Labels & AccreditationsACT signatory Fund management company informationAbout The BusinessBoutique / specialist fund management company Invests in newly listed companies (AFM company wide) Offer unstructured intermediary sustainable investment training Sustainable property strategy (AFM company wide) Integrates ESG factors into all / most (AFM) fund research Diversity, equality & inclusion engagement policy (AFM company wide) Responsible ownership / stewardship policy or strategy (AFM company wide) Vote all* shares at AGMs / EGMs (AFM company wide) Responsible ownership / ESG a key differentiator (AFM company wide) Invests in new sustainability linked bond issuances (AFM company wide) Offer structured intermediary training on sustainable investment ESG / SRI engagement (AFM company wide) In-house diversity improvement programme (AFM company wide) Senior management KPIs include environmental goals (AFM company wide) Vulnerable client policy on website (AFM company wide) Collaborations & AffiliationsPRI signatory UKSIF member Fund EcoMarket partner Investment Association (IA) member ResourcesUse specialist ESG / SRI / sustainability research companies In-house responsible ownership / voting expertise Employ specialist ESG / SRI / sustainability researchers AccreditationsUK Stewardship Code signatory (AFM company wide) PRI A+ rated (AFM company wide) Engagement ApproachEngaging on climate change issues Engaging on human rights issues Encourage responsible corporate taxation (AFM company wide) Regularly lead collaborative ESG initiatives (AFM company wide) Engaging on governance issues Engaging to reduce plastics pollution / waste Engaging to encourage a Just Transition Engaging on biodiversity / nature issues Engaging on responsible supply chain issues Engaging on labour / employment issues Engaging on diversity, equality and / or inclusion issues Engaging to stop modern slavery Engaging on the responsible use of AI Engaging with fossil fuel companies on climate change Stewardship escalation policy Company Wide ExclusionsControversial weapons avoidance policy (AFM company wide) Do not invest in companies with fossil fuel reserves Coal exclusion policy (group wide coal mining exclusion policy) Fossil fuel exclusion policy (AFM company wide) Climate & Net Zero TransitionCommitted to SBTi / Science Based Targets Initiative Encourage carbon / greenhouse gas reduction (AFM company wide) Net Zero commitment (AFM company wide) Voting policy includes net zero targets (AFM company wide) Net Zero - have set a Net Zero target date (AFM company wide) ‘Forward Looking Climate Metrics’ published / ITR (AFM company wide) TransparencyFull SRI / responsible ownership policy information available on request Publish full voting record (AFM company wide) Full SRI / responsible ownership policy information on company website Publish responsible ownership / stewardship report (AFM company wide) Dialshifter statement |

||||||

PolicySustainability Approach Companies operating as sustainable businesses The Fund seeks to invest at least 70% in companies identified which operate sustainable businesses. Following EdenTree’s Sustainability Approach, these companies are assessed in a systematic way, considering multiple dimensions of social and environmental sustainability to encompass a rounded assessment of a company’s practices Sustainability criteria and themes The suitability of potential assets is assessed across six key areas of sustainable business practice: Climate Change & Environment, Employment & Labour, Human Rights, Business Ethics, Community and Corporate Governance. In addition, investments aligned to the following sustainability themes are also favoured: Education & Financial Inclusion, Health & Wellbeing, Sustainable Solutions, and Social Infrastructure Excluded sectors and activities:

Oppressive Regimes

For further information on our screening process please see Oppressive Regimes. |

||||||

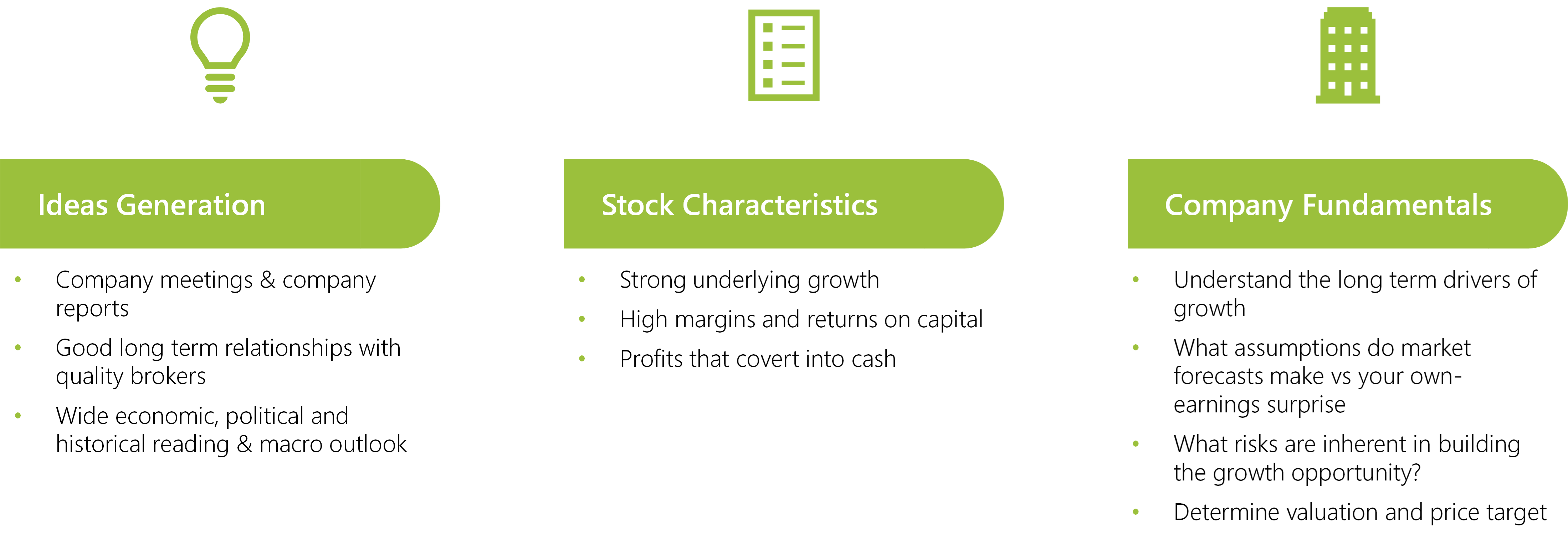

ProcessWith the aim of spreading risk our portfolios are well diversified and comprising between 55-70 stocks, with a typical new holding being around 1% and no stock accounting for more than 5% of a Fund. We use a broad spread of counterparties and do not participate in stock lending. We strongly believe in the merits of low portfolio turnover, believing that high trading activity acts as a drag on performance.

We pride ourselves on our independent thought and analysis and are not afraid to adopt positions which do not conform to conventional thinking or prevailing consensus. We do not have model portfolios or preferred stock lists, preferring to give fund managers the flexibility and responsibility to implement investment strategies that best match the needs of our investors. Finally, our investment process places a strong emphasis on portfolio diversification at all levels, including geographical, sector, company size and investment theme, with the aim of reducing risk. Responsible Investment Concurrently, the Responsible Investment (RI) Team will screen the companies for their responsible and sustainable attributes. All ideas are required to pass our negative and positive screens in order for investment to go ahead. The RI Team has final sanction on excluding from investment any proposed idea. The Team will then assess whether the company’s mid to long-term valuation is justified based on their interpretation of the intrinsic value of the stock which arises from interpreting the information gathered in the process articulated above. Stock Selection We look for businesses that are capable of strong secular growth, but where that growth is underrated by the market and an appreciation of this will lead to a rerating. Thus we expect to benefit from both underlying growth and rerating driving superior returns. There are three types of growth we look for: Dependable

Super Growth

Incubator

Our objective is to buy companies with high margins, high returns on capital and strong free cash flow as well as high growth. We avoid any form of creative accounting, especially the lack of conversion of profits into cash. We believe that significant leverage is toxic for shareholder returns and thus focus on low levels of leverage. We rate highly those companies that return excess capital to shareholders and avoid the temptation to make value destroying acquisitions. We take a long-term view and make investments on this basis. However, circumstances change and we keep all of our investments under review to ensure they continue to deliver against the Fund’s objectives. We undertake detailed fundamental analysis of our investments believing that structural mispricing is prevalent in small and mid-cap companies and that we can add significant value by our own due diligence and forecasting. We place a strong emphasis on company visits to really understand the value drivers of our companies. Investments are identified through a broad range of research resources both through trusted brokers and our own research.

|

||||||

Resources, Affiliations & Corporate StrategiesThe five person Responsible Investment (RI) Team is part of the wider Investment Team, and provides the specialist in-house resource for ESG screening, engagement, voting and thought-leadership. All members of the Investment Team are required to have an understanding of responsible and sustainable investing, and to include this into their thinking and analysis for the Responsible & Sustainable & Green fund range. The RI analysis is subject to peer review by the whole team with agreed sign off to ensure quality control and consistency. Our dedicated RI Team biographies are detailed below:

ESG risk exposure is constantly monitored by our data providers, ISS & Sustainalytics, who flag potential violations of global norms. In addition, if any of our holdings breach our screens, we are immediately notified by our data providers and can then review the breach with the ultimate sanction of divestment if we deem it necessary. Furthermore, periodically stocks and instruments held within our funds are reviewed by the RI Team to ensure that they remain suitable, whilst the team monitors any negative news flow, engaging with companies to provide clarity and assess the risk level involved. Our Responsible Investment Team hold overall responsibility of the ESG process. Whilst this involves some input from senior management, we view it as a crucial component of our investment decision-making process vis-à-vis determining a security’s suitability for portfolio inclusion on responsible grounds, that this ownership sits with the RI Team. Our RI team conducts research and analysis from publicly available materials including:

EdenTree plays a leading and longstanding role across multiple organisations. They are signatories, members and subscribers to a number of industry partnerships and initiatives including: Signatory organisations

Collaborative engagement initiatives

EdenTree believes these partnerships signals their commitment to having an active and positive role in the investment community. Collaborations are critical to driving change, whilst learning from expert sources allows them to provide more for their clients. EdenTree also sits on UKSIF’s Analyst Committee, which advises on the development of UKSIF’s knowledge sharing programme on evolving sustainability issues. They also sit on the PRI’s Circular Economy Reference Group, which explores how investors can better integrate the principles of a circular economy into investment processes. EdenTree’s CIO, Charlie Thomas, sits on the IA’s Sustainability and Responsible Investment Committee. Responsible Investment Advisory Panel Overview In addition to the review provided by the RI Team, this team itself has independent oversight from an external advisory panel of senior industry practitioners with expertise in the field of responsible investment. The EdenTree Responsible Investment Advisory Panel (“Panel”) meet three times each year to review the Responsible & Sustainable Fund portfolios, recent investment decisions and to discuss the latest responsible and sustainable research and trends. The purpose of the Panel is to:

The Panel is made up of a number of industry experts, including:

|

||||||

DialshifterThis fund is helping to ‘shift the dial from brown to green’ by… Our responsibility criteria has six different considerations which assess ESG risks and reflect our commitment to responsible investment. One of the six criteria is environment and climate, including support for biodiversity, climate change impact and carbon footprint, water conservation, air pollution, manage waste, recycling, and support renewable energy. We have four more thematic positive investment themes - one of which is sustainable solutions - this includes products and solutions, the circular economy, green finance, green buildings, renewable energy, water and waste.

|

||||||

LiteratureRegulatory Notice To obtain further information please speak to your EdenTree representative, visit www.edentreeim.com or call our support team on 0800 011 3821. This document has been prepared by EdenTree Investment Management Limited for Financial Advisors, other intermediaries and other investment professionals only. It is not suitable for private individuals. This document has been produced for information purposes only and as such the views contained herein are not to be taken as advice or recommendation to buy or sell any investment or interest thereto. A full explanation of the characteristics of the investments is given in the Key Investor Information Document (KIID). Any forecast, figures, opinions statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, EdenTree Investment Management’s own at the date of this document. There is no guarantee that any forecast made will come to pass. Please note that the value of an investment and the income from it can fall as well as rise as a result of market and currency fluctuations, you may not get back the amount originally invested. Past performance is not necessarily a guide to future returns. Last amended: 11/10/23 10:10 |

||||||

Important information

This report is for information purposes only and is intended to complement existing services used by UK based financial advisers only. sriServices is not authorised to give investment advice. The information on this site does not in any way constitute advice, recommendation or endorsement of any product or service. Investment decisions should not be based on this information alone. sriServices cannot be held in any way responsible for decisions made or advice offered as a result of using this site.

Whilst we take care to ensure information is as accurate as possible at time of publication we recommend you/financial advisers confirm specific fund details with fund providers. Please see www.sriServices.co.uk for additional information and for our contact details.

© Copyright sriServices 2025

07/25/2025