Fund EcoMarket

the sustainable, responsible and ethical investment information hub

- OMR EdenTree European Equity Life

| Fund Name | SRI Style | Product | Region | Asset Type | Launch Date | |

|---|---|---|---|---|---|---|

| OMR EdenTree European Equity Life | Sustainable Style | Life | Europe ex UK | Equity | 17/10/2008 | |

As at: 30/09/21 Contact: adam.kelly@edentreeim.com |

||||||

OverviewAs mentioned above, this fund invests in companies which make a positive contribution to society and the environment through sustainable and socially responsible practices. The fund seeks to invest at least 70% in companies which the Manager believes operate sustainable businesses. It will therefore identify companies with positive sustainable business characteristics, by following EdenTree’s Sustainability Approach. This approach assesses, in a systematic way, multiple dimensions of sustainability, making for a rounded assessment of a company’s practices. Companies with material exposures to particular aspects of sustainability are assessed more closely on those topics. |

||||||

FiltersFund informationSustainability - GeneralSustainability focus Sustainable transport policy or theme Sustainability theme or focus Sustainability policy Circular economy theme Encourage more sustainable practices through stewardship UN Global Compact linked exclusion policy Transition focus Environmental - GeneralLimits exposure to carbon intensive industries Environmental policy Resource efficiency policy or theme Favours cleaner, greener companies Waste management policy or theme Environmental damage and pollution policy Nature & BiodiversityNature / biodiversity protection policy Nature / biodiversity based solutions theme Deforestation / palm oil policy Sustainable fisheries policy Biodiversity / nature policy Responsible palm oil policy Water stewardship policy Illegal deforestation exclusion policy Climate Change & EnergyEncourage transition to low carbon through stewardship activity Fossil fuel exploration exclusion - direct involvement Arctic drilling exclusion Fracking and tar sands excluded Climate change / greenhouse gas emissions policy Coal, oil & / or gas majors excluded Require net zero action plan from all/most companies Invests in clean energy / renewables Nuclear exclusion policy Energy efficiency theme Fossil fuel reserves exclusion Clean / renewable energy theme or focus Supply chain decarbonisation policy Paris aligned fund strategy Social / EmploymentFavours companies with strong social policies Social policy Labour standards policy Health & wellbeing policies or theme Diversity, equality & inclusion Policy (fund level) Mining exclusion Vulnerable / gig workers protection policy Ethical Values Led ExclusionsAnimal testing - excluded except if for medical purposes Civilian firearms production exclusion Animal welfare policy Armaments manufacturers avoided Alcohol production excluded Gambling avoidance policy Pornography avoidance policy Tobacco and related products - avoid where revenue > 5% Controversial weapons exclusion Military involvement exclusion Human RightsChild labour exclusion Modern slavery exclusion policy Responsible supply chain policy or theme Oppressive regimes (not free or democratic) exclusion policy Human rights policy Meeting Peoples' Basic NeedsHealthcare / medical theme Water / sanitation policy or theme Antimicrobial resistance policy Banking & FinancialsInvests in banks Exclude insurers of major fossil fuel companies Invests in insurers Only invest in TCFD (ISSB) aligned banks / financial institutions Exclude banks with significant fossil fuel investments Governance & ManagementAnti-bribery and corruption policy Encourage TCFD alignment for banks & insurance companies Encourage board diversity e.g. gender Governance policy Encourage higher ESG standards through stewardship activity UN sanctions exclusion Avoids companies with poor governance Require investee companies to report climate risk in R&A Fund GovernanceESG integration strategy ESG factors included in Assessment of Value (AoV) report Asset SizeInvests in small, mid and large cap companies / assets Targeted Positive InvestmentsInvests >25% of fund in environmental/social solutions companies Invests >50% of fund in environmental/social solutions companies Impact MethodologiesInvests in social solutions companies Invests in environmental solutions companies Aim to deliver positive impacts through engagement Invests in sustainability / ESG disruptors Positive environmental impact theme Positive social impact theme Publish ‘theory of change’ explanation How The Fund WorksStrictly screened ethical fund Combines norms based exclusions with other SRI criteria SRI / ESG / Ethical policies explained on website Combines ESG strategy with other SRI criteria Focus on ESG risk mitigation Positive selection bias Negative selection bias Significant harm exclusion Do not use stock / securities lending ESG weighted / tilt Unscreened Assets & CashAll assets (except cash) meet published sustainability criteria Assets typically aligned to sustainability objectives 70 - 79% Assets typically aligned to sustainability objectives 80 – 89% Assets typically aligned to sustainability objectives > 90% Intended Clients & Product OptionsAvailable via an ISA (OEIC only) Intended for investors interested in sustainability Intended for clients interested in ethical issues Fund management company informationAbout The BusinessOffer unstructured intermediary sustainable investment training Offer structured intermediary training on sustainable investment ESG / SRI engagement (AFM company wide) Responsible ownership / ESG a key differentiator (AFM company wide) Invests in newly listed companies (AFM company wide) Vote all* shares at AGMs / EGMs (AFM company wide) Boutique / specialist fund management company In-house diversity improvement programme (AFM company wide) Responsible ownership / stewardship policy or strategy (AFM company wide) Invests in new sustainability linked bond issuances (AFM company wide) Integrates ESG factors into all / most (AFM) fund research Sustainable property strategy (AFM company wide) Diversity, equality & inclusion engagement policy (AFM company wide) Senior management KPIs include environmental goals (AFM company wide) Vulnerable client policy on website (AFM company wide) Collaborations & AffiliationsFund EcoMarket partner PRI signatory Investment Association (IA) member UKSIF member ResourcesEmploy specialist ESG / SRI / sustainability researchers In-house responsible ownership / voting expertise Use specialist ESG / SRI / sustainability research companies AccreditationsUK Stewardship Code signatory (AFM company wide) PRI A+ rated (AFM company wide) Engagement ApproachEngaging on diversity, equality and / or inclusion issues Encourage responsible corporate taxation (AFM company wide) Engaging on labour / employment issues Engaging to reduce plastics pollution / waste Engaging on governance issues Regularly lead collaborative ESG initiatives (AFM company wide) Engaging on biodiversity / nature issues Engaging on responsible supply chain issues Engaging on climate change issues Engaging to encourage a Just Transition Engaging on human rights issues Engaging to stop modern slavery Engaging on the responsible use of AI Engaging with fossil fuel companies on climate change Stewardship escalation policy Company Wide ExclusionsCoal exclusion policy (group wide coal mining exclusion policy) Fossil fuel exclusion policy (AFM company wide) Controversial weapons avoidance policy (AFM company wide) Do not invest in companies with fossil fuel reserves Climate & Net Zero TransitionCommitted to SBTi / Science Based Targets Initiative Encourage carbon / greenhouse gas reduction (AFM company wide) Net Zero commitment (AFM company wide) Voting policy includes net zero targets (AFM company wide) Net Zero - have set a Net Zero target date (AFM company wide) ‘Forward Looking Climate Metrics’ published / ITR (AFM company wide) TransparencyFull SRI / responsible ownership policy information on company website Full SRI / responsible ownership policy information available on request Publish full voting record (AFM company wide) Publish responsible ownership / stewardship report (AFM company wide) |

||||||

PolicySustainability Approach Companies operating as sustainable businesses The Fund seeks to invest at least 70% in companies identified which operate sustainable businesses. Following EdenTree’s Sustainability Approach, these companies are assessed in a systematic way, considering multiple dimensions of social and environmental sustainability to encompass a rounded assessment of a company’s practices Sustainability criteria and themes The suitability of potential assets is assessed across six key areas of sustainable business practice: Climate Change & Environment, Employment & Labour, Human Rights, Business Ethics, Community and Corporate Governance. In addition, investments aligned to the following sustainability themes are also favoured: Education & Financial Inclusion, Health & Wellbeing, Sustainable Solutions, and Social Infrastructure

Excluded sectors and activities:

Oppressive Regimes

|

||||||

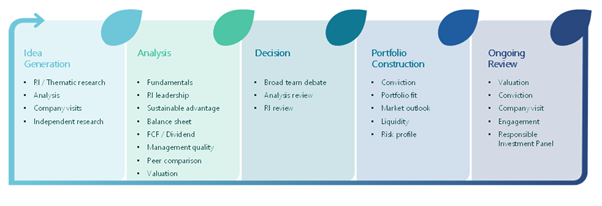

ProcessOur responsible and sustainable criteria form a core part of our investment approach and are integrated into our stock selection and management processes. Our dedicated in-house team of responsible investment (RI) analysts considers each of our investments on the basis of their Environmental, Social and Governance (ESG) credentials and long-term sustainable return potential. We believe that those companies which have a well-developed approach to managing ESG risk are more likely to offer good quality, long-term investment potential. We pride ourselves on our independent thought and analysis and are not afraid to adopt positions which do not conform to conventional thinking or prevailing consensus. We do not have model portfolios or preferred stock lists, preferring to give fund managers the flexibility and responsibility to implement investment strategies that best match the needs of our investors. Finally, our investment process places a strong emphasis on portfolio diversification at all levels, including geographical, sector, company size and investment theme, with the aim of reducing risk. Please see below the summary of the Fund’s investment process:

Stock Selection We look for businesses that are out of favour but intrinsically sound, and where a change in circumstance or economic conditions will bring about a recovery both in company fundamentals and improved investor sentiment, thus leading to superior returns. We actively look to invest in companies which we believe have strong sustainable characteristics and this will then then be confirmed by our robust and comprehensive screening process managed by our Responsible investment team. As value-orientated investors, we are seeking to buy undervalued companies which nonetheless have the ability to generate strong profits and cashflows and to grow these over time. Often taking a contrarian view from the ‘investment’ herd, we seek out-of-favour businesses, with robust balance sheets, and an underappreciated potential to enhance cashflows and create value for long term investors. Identification of potential opportunities starts with a quantitative approach to find companies which appear cheap in terms of forward valuation multiples, which is followed by more in-depth analysis of both quantitative and qualitative factors to ensure the companies are not ‘value traps’, but have strong business franchises, so can maintain and grow these cashflows. Each prospective holding is subject to our Responsible & Sustainable screening process which helps to develop a more holistic view of a company using a wider mosaic of information which informs our understanding of the opportunities and risks associated with each holding. The companies we invest in can be seen to fall into one of three broad buckets:

Our value-orientation naturally draws us to focus on companies on attractive valuation multiplies, although this is far from the only consideration. We also look for companies which have strong market positions, re-invest back into the business (whether that be in terms of growth investment in capital equipment, innovation, brand or people), as well as looking for opportunities to benefit from longer-term structural trends, particularly in terms of sustainable solutions but also in terms of scientific and technological advances. We may use various quantitative tools to screen particular areas of the investment universe once a compelling structural trend has been identified, in order to identify potential valuation anomalies. This may be conducted to evaluate relative valuation of a prospective idea. When assessing potential candidates for the Fund, we place particular importance on three attributes:

These steps are not mutually exclusive, but they help us to determine the investment thesis and whether the valuation is attractive enough to offer enough upside potential to compensate for potential downside risks. The degree of upside that we look for in a new equity investment will vary depending on factors such as market capitalisation, visibility of earnings with preference given the cash returns in the near term, the stability of earnings in different economic and market environments, and the degree of leverage within the business. Fundamental investment analysis and decision-making process Assessment of upside potential Our approach to the fundamental analysis of a company will be tailored to best suit the type of company we are investing in and its present circumstances. However, an emphasis on assessment of the ability of the company to generate high and sustainable cashflows which can be returned to shareholders and the outlook for the company given the prevailing macroeconomic conditions is common across holdings. We believe it is important to remain flexible about valuation techniques; they each have strengths and weaknesses, and the intention is to build a robust framework of information and to avoid simply choosing measures that satisfy confirmation bias.

Assessment of downside risk By investing in companies trading on low valuations, the Fund often takes contrarian positions which go against the prevailing consensus for the outlook for businesses. This could potentially lead to the risk of investment in companies in poor financial health or which are structurally challenged (value traps). To minimise this risk, the investment process includes focused analysis of.

The team believes the extra layer of due diligence provided by the Responsible Investment Team provides potential informational advantages, which is especially important given the Fund invests in companies that have been neglected or priced for poor outcomes. Historical governance analysis may also be reflected in our assessment of the financial health of the company; propensity for off balance sheet leverage or future contingent liabilities. Similarly, the governance and remuneration reports can enable a broader assessment of the underlying drivers and sources of cash generation, capital expenditure requirements. Key KPIs around remuneration framework can provide insight as to how free cash flow will be deployed, i.e. M&A, dividends, buybacks etc. enabling the analyst to undertake a thorough examination of a company’s willingness and ability to pay dividends. More broadly, in considering a company’s management quality, we assess Board independence, tenure, and experience, in order to assess the focus on shareholder value, organisational culture to deliver future potential. The process outlined above will typically involve a meeting or call with management as part of the due diligence process. Quantitative screens typically contain a wide range of metrics in order to get a full picture regarding the source of valuation anomaly, including but not restricted to: fundamental metrics such as free cash flow (FCF) yield, Return on Equity (ROE), Return on Invested Capital (ROIC), Net Debt/EBITDA, and Interest Cover, as well as valuation metrics such as EV/EBITDA, Price to Earnings and Price to Book. It must also be noted that quantitative analysis is only part of the overall due diligence process that goes into identifying prospective investments and typically forms the basis of consensus data gathering. Typically, quantitative screens will not reflect our estimates from our proprietary insights.

Portfolio Construction The Fund’s investment process is primarily driven by bottom up, value orientated, stock picking. The Fund’s intention is to create a well-diversified portfolio in terms of countries, industrial sectors and at an individual stock level consisting of a portfolio of 50-70, With no stock accounting for more than 5% of a fund (and a soft cap which involves not adding to any holding which accounts for more than 3% of the Fund and generally looking to take profits when holdings exceed this amount). We strongly believe in the merits of low portfolio turnover, believing that high trading activity acts as a drag on performance. There is a desire to ensure a broadly diversified portfolio in terms of geographic, industry and sector allocations and whilst there are no set constraints, the Fund is subject to extensive risk modelling to ensure it is not overly exposed to any of these factors. At a higher level we will consider the exposure of the Fund to defensives, cyclicals and financials. Over time the tilt of the portfolio will change depending on our views on financial and economic conditions as well as underlying valuations of the various market segments which will mean the behaviour of the Fund towards differing economic conditions will change over time. At its heart, the positioning of the Fund will be driven by stock picking with areas of the market which offer the best opportunities to invest in companies at low valuations, strong cash flow characteristics and good market positions having the highest weightings. Sell Discipline Each company in the portfolio undergoes regular review with the fund manager making a decision based on the valuation, business fundamentals, economic and financial and investment environment as well as how it sits with the overall portfolio, and whether it should remain. The portfolio is subject to regular review by our CIO and analysis by the investment oversight committee, headed by the Head of Investment Risk Management to ensure that the Fund Manager is not undertaking any excessive or undue concentration, stock specific, sector or country risk. Any previously invested stocks which fail the ongoing screening process will be sold in a timely fashion taking account of market conditions to ensure this is in the best interests of the clients. All holdings must be divested within a 3-month time frame but normally the sells will be carried out in a much more timely fashion. There have been no deviations from this process. |

||||||

Resources, Affiliations & Corporate StrategiesThe five person Responsible Investment (RI) Team is part of the wider Investment Team, and provides the specialist in-house resource for ESG screening, engagement, voting and thought-leadership. All members of the Investment Team are required to have an understanding of responsible and sustainable investing, and to include this into their thinking and analysis for the Responsible & Sustainable & Green fund range. The RI analysis is subject to peer review by the whole team with agreed sign off to ensure quality control and consistency. Our dedicated RI Team biographies are detailed below:

ESG risk exposure is constantly monitored by our data providers, ISS & Sustainalytics, who flag potential violations of global norms. In addition, if any of our holdings breach our screens, we are immediately notified by our data providers and can then review the breach with the ultimate sanction of divestment if we deem it necessary. Furthermore, periodically stocks and instruments held within our funds are reviewed by the RI Team to ensure that they remain suitable, whilst the team monitors any negative news flow, engaging with companies to provide clarity and assess the risk level involved. Our Responsible Investment Team hold overall responsibility of the ESG process. Whilst this involves some input from senior management, we view it as a crucial component of our investment decision-making process vis-à-vis determining a security’s suitability for portfolio inclusion on responsible grounds, that this ownership sits with the RI Team. Our RI team conducts research and analysis from publicly available materials including:

EdenTree plays a leading and longstanding role across multiple organisations. They are signatories, members and subscribers to a number of industry partnerships and initiatives including: Signatory organisations

Collaborative engagement initiatives

EdenTree believes these partnerships signals their commitment to having an active and positive role in the investment community. Collaborations are critical to driving change, whilst learning from expert sources allows them to provide more for their clients. EdenTree also sits on UKSIF’s Analyst Committee, which advises on the development of UKSIF’s knowledge sharing programme on evolving sustainability issues. They also sit on the PRI’s Circular Economy Reference Group, which explores how investors can better integrate the principles of a circular economy into investment processes. EdenTree’s CIO, Charlie Thomas, sits on the IA’s Sustainability and Responsible Investment Committee. Responsible Investment Advisory Panel Overview In addition to the review provided by the RI Team, this team itself has independent oversight from an external advisory panel of senior industry practitioners with expertise in the field of responsible investment. The EdenTree Responsible Investment Advisory Panel (“Panel”) meet three times each year to review the Responsible & Sustainable Fund portfolios, recent investment decisions and to discuss the latest responsible and sustainable research and trends. The purpose of the Panel is to:

The Panel is made up of a number of industry experts, including:

|

||||||

LiteratureRegulatory Notice To obtain further information please speak to your EdenTree representative, visit www.edentreeim.com or call our support team on 0800 011 3821. This document has been prepared by EdenTree Investment Management Limited for Financial Advisors, other intermediaries and other investment professionals only. It is not suitable for private individuals. This document has been produced for information purposes only and as such the views contained herein are not to be taken as advice or recommendation to buy or sell any investment or interest thereto. A full explanation of the characteristics of the investments is given in the Key Investor Information Document (KIID). Any forecast, figures, opinions statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, EdenTree Investment Management’s own at the date of this document. There is no guarantee that any forecast made will come to pass. Please note that the value of an investment and the income from it can fall as well as rise as a result of market and currency fluctuations, you may not get back the amount originally invested. Past performance is not necessarily a guide to future returns. Last amended: 08/02/24 03:30 |

||||||

Important information

This report is for information purposes only and is intended to complement existing services used by UK based financial advisers only. sriServices is not authorised to give investment advice. The information on this site does not in any way constitute advice, recommendation or endorsement of any product or service. Investment decisions should not be based on this information alone. sriServices cannot be held in any way responsible for decisions made or advice offered as a result of using this site.

Whilst we take care to ensure information is as accurate as possible at time of publication we recommend you/financial advisers confirm specific fund details with fund providers. Please see www.sriServices.co.uk for additional information and for our contact details.

© Copyright sriServices 2025

07/10/2025