Fund EcoMarket

the sustainable, responsible and ethical investment information hub

- Newton Ethically Screened Fund for Charities (BNY)

| Fund Name | SRI Style | Product | Region | Asset Type | Launch Date | |

|---|---|---|---|---|---|---|

Newton Ethically Screened Fund for Charities (BNY) |

ESG Plus | Charity fund / trust | Global | Multi Asset | 17/05/2010 | |

Total assets under management: £77829.52 As at: 30/06/25 Contact: Ryan Grey, Sales - Intermediary (UK) ryan.grey@bnymellon.com |

||||||

OverviewDirectly invested to ensure adequate transparency and reassurance to investors that ethical considerations are being addressed across the entire portfolio. A robust exclusionary screen has been developed in response to investor demand. Investments determined to exhibit the Negative Criteria outlined in the Fund’s prospectus are excluded from the investment universe. Newton’s process for making investment decisions follows detailed analysis based on a wide range of financial metrics and research. When making investment decisions, ESG considerations are one component of a variety of fundamental factors analysed, and Newton will make investment decisions that are not based solely on ESG considerations. Newton’s ESG analysis does not apply to certain types of investments, such as cash, cash equivalents, currency positions and particular types of derivatives. |

||||||

FiltersFund informationSustainability - GeneralEncourage more sustainable practices through stewardship Ethical Values Led ExclusionsGambling avoidance policy Alcohol production excluded Pornography avoidance policy Tobacco & related product manufacturers excluded Controversial weapons exclusion Military involvement exclusion Animal testing - excluded except if for medical purposes Human RightsHuman rights policy Child labour exclusion Gilts & SovereignsInvests in gilts / government bonds Banking & FinancialsInvests in banks Predatory lending exclusion Invests in financial instruments issued by banks Invests in insurers Product / Service GovernanceESG integration strategy Asset SizeInvests in small, mid & large cap companies / assets How The Fund/Portfolio WorksSRI / ESG / Ethical policies explained on website Limited / few ethical exclusions Combines norms based exclusions with other SRI criteria Intended Clients & Product OptionsIntended for clients interested in ethical issues Fund management company informationAbout The BusinessResponsible ownership / stewardship policy or strategy (AFM companywide) Boutique / specialist fund management company Vote all* shares at AGMs / EGMs (AFM companywide) Responsible ownership policy for non SRI / sustainable options (AFM companywide) In-house diversity improvement programme (AFM companywide) Integrates ESG factors into all / most research (AFM companywide) ESG / SRI engagement (AFM companywide) Vulnerable client policy on website (AFM companywide) Collaborations & AffiliationsInvestment Association (IA) member PRI signatory UKSIF member Fund EcoMarket partner ResourcesIn-house responsible ownership / voting expertise Employ specialist ESG / SRI / sustainability researchers Use specialist ESG / SRI / sustainability research companies AccreditationsUK Stewardship Code signatory (AFM companywide) Engagement ApproachEngaging on diversity, equality & / or inclusion issues Regularly lead collaborative ESG initiatives (AFM companywide) Engaging on labour / employment issues Engaging on governance issues Engaging on biodiversity / nature issues Engaging on climate change issues Engaging on responsible supply chain issues Engaging on human rights issues Engaging to stop modern slavery Engaging with fossil fuel companies on climate change Engaging to encourage a Just Transition Stewardship escalation policy Climate & Net Zero TransitionCarbon transition plan published (AFM companywide) Encourage carbon / greenhouse gas reduction (AFM companywide) Net Zero - have set a Net Zero target date (AFM companywide) Committed to SBTi / Science Based Targets Initiative Working towards a ‘Net Zero’ commitment (AFM companywide) Net Zero commitment (AFM companywide) TransparencyFull stewardship / responsible ownership policy information available on request Publish full voting record (AFM companywide) Net Zero transition plan publicly available (AFM companywide) Full stewardship / responsible ownership policy information on company website Publish responsible ownership / stewardship report (AFM companywide) |

||||||

Policy |

||||||

Process |

||||||

Resources, Affiliations & Corporate StrategiesNewton has a centralised responsible investment team. This team is the centre of excellence for all matters related to responsible investment, and with its deep functional knowledge of the responsible investment space and how it is evolving, it provides guidance, support and subject-matter expertise to our wider investment team. The responsible investment team, as you can see below, is global in its footprint and diverse in its employee base. The team is organised into three pillars of expertise – stewardship, research and analytics: these specialisations under the responsible investment umbrella allow us to bring further depth and expertise to each of these activities. The team’s compact size enables it to work cohesively and operate as one team. Sustainability research: Subject-matter experts consulting the investment and research teams, driving deep insights on sustainability-related subjects. The team manages Newton’s sustainability standards, definitions and frameworks. Responsible investment analytics: Has strong quantitative and RI data expertise and owns the data ecosystem, creating and managing responsible investment data models, frameworks and tools that support ESG integration and sustainable investing. The team has built an innovative suite of building blocks that can be leveraged to develop scalable solutions to meet specific client requirements. The role of the responsible investment team is to be a support function to the investment teams, to set standards around sustainable investment, and to coordinate and ensure effectiveness around our stewardship efforts. It guides the business around policies and direction of travel for sustainability and stewardship more broadly. The responsible investment team also owns and manages the overall governance systems to ensure we deliver against key codes and commitments including stewardship codes, industry principles such as the UN Principles for Responsible Investment, and industry pledges such as the Net Zero Asset Managers Initiative (NZAMi). Supporting the team, and the wider business, are various external organisations and vendors including ESG service providers, memberships, and internal systems for monitoring and reporting.

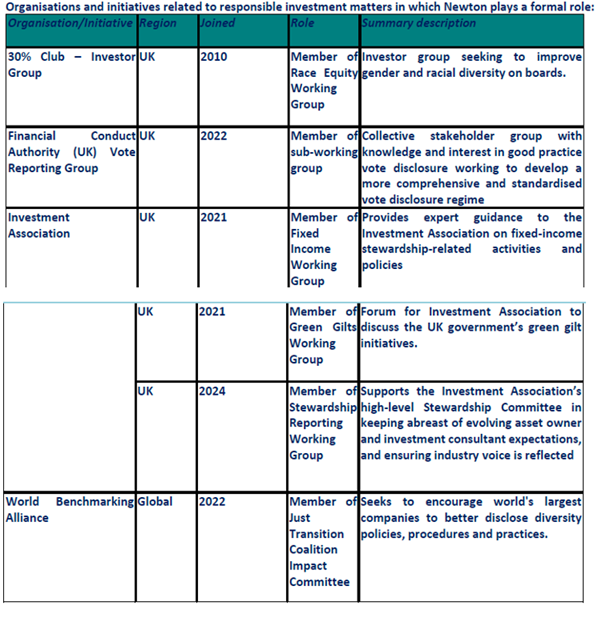

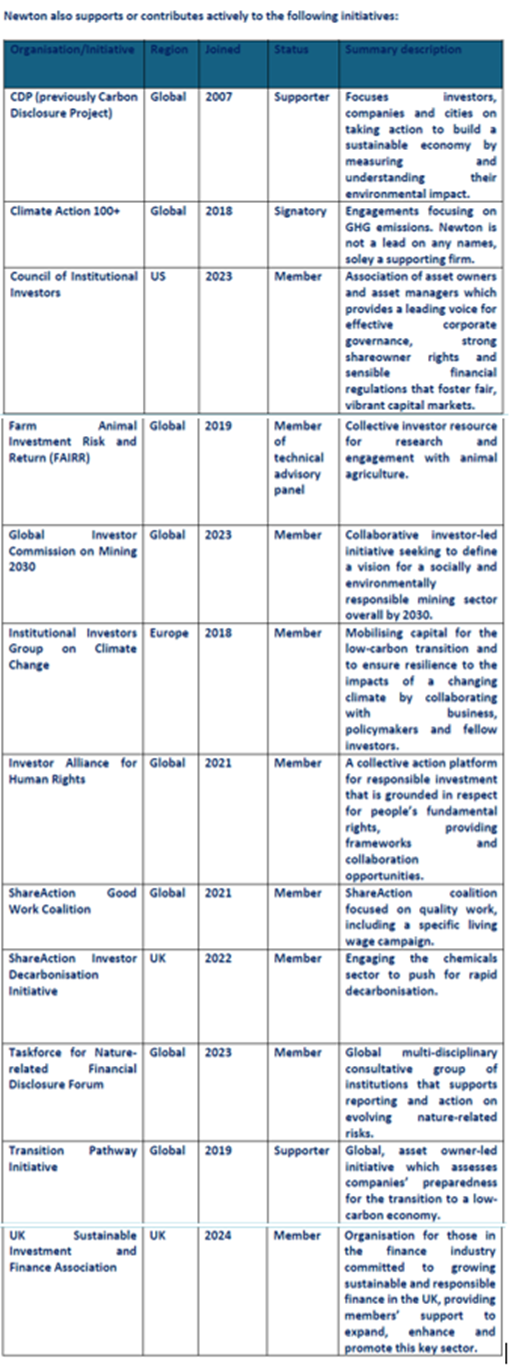

Affiliations Organisations and initiatives related to responsible investment matters in which Newton plays a formal role: *Newton Japan was established as a legal entity in March 2023. Its prior commitment to the Japan Stewardship Code was under its previous structure. ESG Governance Having an effective management and governance framework is an important part of our overall business strategy. As investors, we understand the value of effective leadership and accountability. This is closely linked to the culture of our business, as leadership and accountability have equal importance in Newton’s governance. We have therefore established appropriate governance systems and controls to support our stewardship and RI policy. This policy is reviewed and approved by the Newton Sustainability Committee (NIM and NIMNA), which reports to the Newton Executive Management Committee (NEMC) (to note, the NEMC reports into NIM and NIMNA boards). The policy is also reviewed and approved by the NIMJ Investment Oversight Committee, which reports into the NIMJ Executive Management Committee. The NEMC has overall responsibility for defining Newton’s approach, values and actions across all Newton entities. Two of our operating committees play important roles in relation to our stewardship and RI efforts:

These committees deal with various stewardship and RI aspects on an ad-hoc basis, including any relevant internal audit findings and actions as well as climate-related risk updates from internal groups. Our Board Risk Committee also plays a role in the governance of our RI and stewardship efforts; it acts as an escalation point for any material issues identified through our governance systems and controls. For example, it has previously considered materials related to climate risk. We have also established the Newton Sustainable Investment Forum (SIF) as an oversight group to monitor our strategies with sustainability characteristics. The role of the SIF is to:

|

||||||

LiteratureIMPORTANT INFORMATION Newton manages a variety of investment strategies. How ESG analysis is integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved. ESG can be one of many inputs into the fundamental analysis. Newton will make investment decisions that are not based solely on ESG analysis. Other attributes of an investment may outweigh ESG analysis when making investment decisions. *Newton’ and/or ‘Newton Investment Management’ is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (“NIM”), Newton Investment Management North America LLC (“NIMNA”) and Newton Investment Management Japan Limited ("NIMJ"). Newton’s assets under management include assets collectively managed by NIM, NIMNA and NIMJ. In addition, AUM for Newton includes assets of bank-maintained collective investment funds for which Newton has been appointed sub-advisor, where Newton personnel act as dual officers of affiliated companies and assets of wrap fee account(s) for which Newton provides sub-advisory services to the primary manager of the wrap program. Last amended: 08/08/23 10:37 |

||||||

Important information

This report is for information purposes only and is intended to complement existing services used by UK based financial advisers only. sriServices is not authorised to give investment advice. The information on this site does not in any way constitute advice, recommendation or endorsement of any product or service. Investment decisions should not be based on this information alone. sriServices cannot be held in any way responsible for decisions made or advice offered as a result of using this site.

Whilst we take care to ensure information is as accurate as possible at time of publication we recommend you/financial advisers confirm specific fund details with fund providers. Please see www.sriServices.co.uk for additional information and for our contact details.

© Copyright sriServices 2026

02/25/2026