Fund EcoMarket

the sustainable, responsible and ethical investment information hub

- BNY Mellon Real Return Fund (Responsible) Fund

| Fund Name | SRI Style | Product | Region | Asset Type | Launch Date | |

|---|---|---|---|---|---|---|

BNY Mellon Real Return Fund (Responsible) Fund |

Sustainability Tilt | OEIC | Global | Multi Asset | 24/04/2018 | |

Total assets under management: £77829.52 As at: 30/06/25 Contact: Ryan Grey, Sales - Intermediary (UK) ryan.grey@bnymellon.com |

||||||

OverviewThe Fund seeks to deliver positive returns on a rolling 3-year basis after fees by investing in a portfolio of UK and international securities across a broad range of asset classes. It also aims to deliver positive returns before fees within a range of cash (SONIA (30-day compounded)) on a rolling 3-year basis and cash (SONIA (30-day compounded)) + 4% per annum on a rolling 5-year basis. However, positive returns are not guaranteed and a capital loss may occur. While pursuing its investment objective, the Fund invests a minimum of 70% of its portfolio in securities with sustainability (i.e. positive environmental and/or social) characteristics. |

||||||

FiltersFund informationSustainability - GeneralUN Global Compact linked exclusion policy Transition focus Encourage more sustainable practices through stewardship Sustainability policy Environmental - GeneralLimits exposure to carbon intensive industries Climate Change & EnergyEncourage transition to low carbon through stewardship activity Fracking & tar sands excluded Arctic drilling exclusion Fossil fuel reserves exclusion Clean / renewable energy theme or focus Social / EmploymentMining exclusion Ethical Values Led ExclusionsTobacco & related product manufacturers excluded Pornography avoidance policy Gambling avoidance policy Alcohol production excluded Armaments manufacturers avoided Controversial weapons exclusion Military involvement not excluded Gilts & SovereignsInvests in gilts / government bonds Invests in sovereigns subject to screening criteria Gilts / government bonds - exclude some Banking & FinancialsInvests in banks Invests in financial instruments issued by banks Invests in insurers Governance & ManagementUN sanctions exclusion Avoids companies with poor governance Encourage higher ESG standards through stewardship activity Asset SizeInvests in small, mid & large cap companies / assets How The Fund/Portfolio WorksSRI / ESG / Ethical policies explained on website Balances company 'pros and cons' / best in sector Combines norms based exclusions with other SRI criteria Do not use stock / securities lending Negative selection bias Data led strategy Norms focus Uses unscreened diversifiers to help manage risk Unscreened Assets & CashAssets typically aligned to sustainability objectives 70 - 79% Intended Clients & Product OptionsAvailable via an ISA (OEIC only) Fund management company informationAbout The BusinessResponsible ownership policy for non SRI / sustainable funds (AFM company wide) Integrates ESG factors into all / most (AFM) fund research In-house diversity improvement programme (AFM company wide) ESG / SRI engagement (AFM company wide) Boutique / specialist fund management company Responsible ownership / stewardship policy or strategy (AFM company wide) Vote all* shares at AGMs / EGMs (AFM company wide) Vulnerable client policy on website (AFM company wide) Collaborations & AffiliationsInvestment Association (IA) member PRI signatory UKSIF member Fund EcoMarket partner ResourcesUse specialist ESG / SRI / sustainability research companies Employ specialist ESG / SRI / sustainability researchers In-house responsible ownership / voting expertise AccreditationsUK Stewardship Code signatory (AFM company wide) Engagement ApproachEngaging on climate change issues Engaging on biodiversity / nature issues Engaging on diversity, equality & / or inclusion issues Engaging with fossil fuel companies on climate change Engaging on human rights issues Engaging on governance issues Engaging on responsible supply chain issues Regularly lead collaborative ESG initiatives (AFM company wide) Engaging on labour / employment issues Engaging to stop modern slavery Engaging to encourage a Just Transition Stewardship escalation policy Climate & Net Zero TransitionCommitted to SBTi / Science Based Targets Initiative Working towards a ‘Net Zero’ commitment (AFM company wide) Net Zero - have set a Net Zero target date (AFM company wide) Net Zero commitment (AFM company wide) Encourage carbon / greenhouse gas reduction (AFM company wide) Carbon transition plan published (AFM company wide) TransparencyFull SRI / responsible ownership policy information on company website Net Zero transition plan publicly available (AFM company wide) Full SRI / responsible ownership policy information available on request Publish responsible ownership / stewardship report (AFM company wide) Publish full voting record (AFM company wide) |

||||||

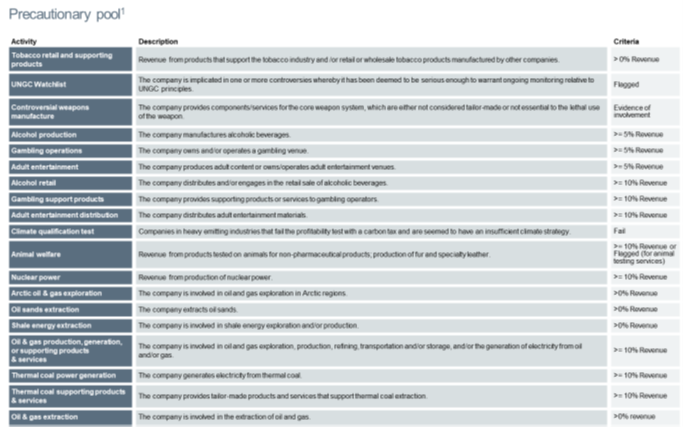

PolicySustainable investment philosophy We consider sustainable investment to be about investing with a clear intent to deliver environmental and/or social outcomes alongside generating a financial return. The strategies that follow the Newton sustainable investment framework seek to balance financial, social and environmental outcomes to support long-term shareholder returns. Sustainable investment framework This framework is focused on two main components: defining what is incompatible with a sustainable universe --‘sustainable investment restrictions’ and defining what constitutes a sustainable investment. The latter rests on an approach that focuses on key sustainable investment themes with underlying sustainable activities and how an investment is connected with this – through alignment or contribution measures. Sustainable investment universe The portfolio manager is responsible for applying the Newton sustainable investment framework and ensuring that the security is eligible following a review which is documented. The review determines whether the investment contributes towards one or more of the Newton sustainable investment themes (sustainable contributors) or demonstrates strong environmental and/or social practices that align with one or more of the Newton sustainable investment themes (sustainable aligners). Sustainable contributors: These are companies that provide solutions (products and services) that address the most pressing environmental or social challenges. Our sustainable investment framework is applied through a series of measures, such as revenues from products relating to Renewable and low-carbon energy sources, resource efficiency, affordable housing, medical technology and healthy eating. As a measure of their contribution, each sustainable contributor must have at least 30% revenue exposure (in aggregate) from one of more of the sustainable activities, as defined in the sustainable investment framework, or have at least 30% capital expenditure (CAPEX) or operational expenditure (OPEX) aligned to the EU Taxonomy. Sustainable aligners: These are companies that manage to a high standard the social and environmental issues relating from their direct operations and supply chains as well as integrate sustainability priorities into their business strategy. This is primarily about the internal management of a company’s operations and supply chain where we seek to invest in leaders or best-in-class industry players. Companies that integrate sustainability into their business strategy have committed explicitly to improving their environmental and social impacts by reducing negative externalities that is expected to lead to a transformation of their business models. The outcome of this mitigation and transformation of the negative externality results in a meaningful positive outcome for society and/or the environment. These two classifications are guided by frameworks, developed, and maintained by the Newton RI team, ensuring robustness and consistency in order to identify the suitable sustainable investment propositions. The overall framework is reviewed regularly and may evolve over time with Newton’s own thinking as well as with regulatory development. Sustainable investment restrictions* The sustainable investment restrictions mainly seek to avoid investments in areas of significant social or environmental harm. These restrictions cannot be overridden. Here we seek to avoid investments involved in areas of high negative externalities, those that cause significant long-term societal harm, investments that have been identified as having severe controversies and/or violating one or more of the ten UN Global Compact Principles covering areas including human rights, labour practices, corruption and the environment. We do not believe that exposure to such activities is aligned with our sustainable investment framework. To identify these companies, we use a combination of external service providers including Bloomberg, ISS, RepRisk, CDP and Factset to inform our decisions. The sustainable investment restrictions are hard coded into the Newton trade process and any potential violations are caught in the pre-trade compliance checks. Revenue threshold parameters applied through these restrictions reflect just one part of our sustainable investment framework – a key part of this process is the additional research and analysis conducted by the investment team.

Note: 1 Some strategies following the Newton Sustainable Investment process may choose to add to these exclusions – but may never subtract. However, please note: revenue threshold parameters reflect just one part of our sustainable investment process – a key part of this process is the additional research and analysis conducted by the investment team. Our process seeks to clearly distinguish between activities that are subject to hard exclusions versus those activities that sustainability portfolio managers may be able to invest in in certain circumstances (precautionary pool). Precautionary pool For areas that have been identified as having controversies or the potential to cause harm (such as fossil fuels other than thermal coal, animal welfare, conventional defence and nuclear power) but are not covered by the sustainable investment restrictions, portfolio managers are alerted, when considering such investments, to review the controversial activity through what is referred to as the 'precautionary pool'. The precautionary pool includes companies that have been flagged in relation to their involvement in heavy-emitting industries, hold exposures to activities that are restricted, but at lower revenue thresholds, and areas such as nuclear power and animal welfare, where there may be nuances in the investment case that are deemed important to be highlighted. The full list of activities caught currently under the precautionary pool is included below:

Note: 1 The RI team maintains a list of companies that are tagged under the ‘precautionary pool’. Portfolio managers are alerted to this pool in the sustainable investment documentation portal (the Newton ‘RI App’). The portfolio managers are encouraged to work with the RI adviser assigned to the portfolio, to ensure that the managers are comfortable that the investment is not in conflict with the objectives of their strategy. Bonds Market participants and credit rating agencies have been placing increasing importance on non-financial factors in determining credit ratings, and understanding default risk on the debt issued by sovereigns. We believe a country’s competitiveness is dependent on the availability and quality of economic, natural, human and institutional capital. Countries that allocate and act as stewards of these capital resources effectively are likely to experience stable long-term growth and show more economic resilience. We evaluate factors such as natural resource depletion, social cohesion and advancement, conflict and institutional strength in order to understand if the returns on offer from sovereign debt are justified given the risks attached. Since we believe that the durability of a sovereign bond relates to a number of factors we seek to gain a holistic view of a country, taking into account the various positive and negative factors. We consider data from a range of sources including the World Bank, Transparency International, IMF, Yale University, Notre Dame Institute and others. We do not apply thresholds when assessing each individual data source, but instead use relative thresholds at the aggregated data level. There are two parts to the calculation – one is the overall score and the other is the momentum. While the score is on a relative basis, momentum is fundamental in nature. All of the indicators are classified into the four capitals mentioned above and then are combined to calculate results at the country level. The country level score and momentum for all countries are categorized into three parts (For Score – Strong, Average and Weak, For Momentum – Positive, Stable and Negative) which then allows for these countries to be allocated into a 3x3 matrix. Each quarter, the model is reviewed by the fixed income and RI specialists to assess whether current affairs have changed our outlook described within the matrix. Those countries rated ‘weak’ and which do not have positive momentum cannot be included in our sustainable investment strategies. Those countries rated ‘average’ (irrespective of momentum) and ‘weak’ with positive momentum can only be included in the sustainable strategies subject to further work being completed by the sovereign specialist and subsequently agreed by the RI team. |

||||||

Process |

||||||

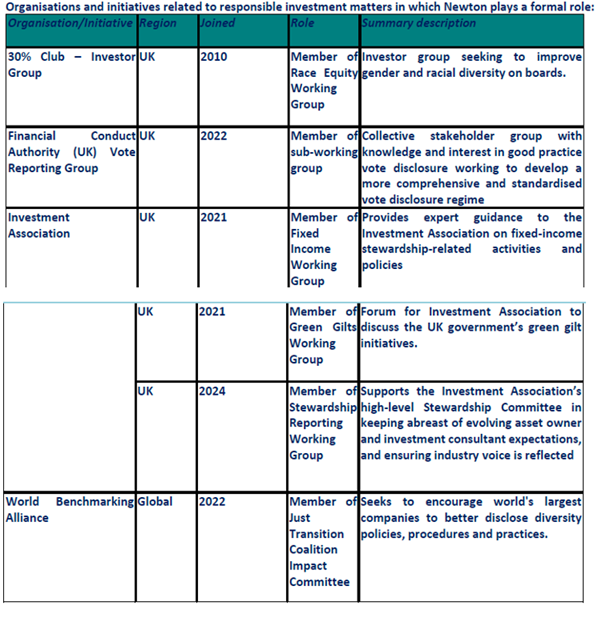

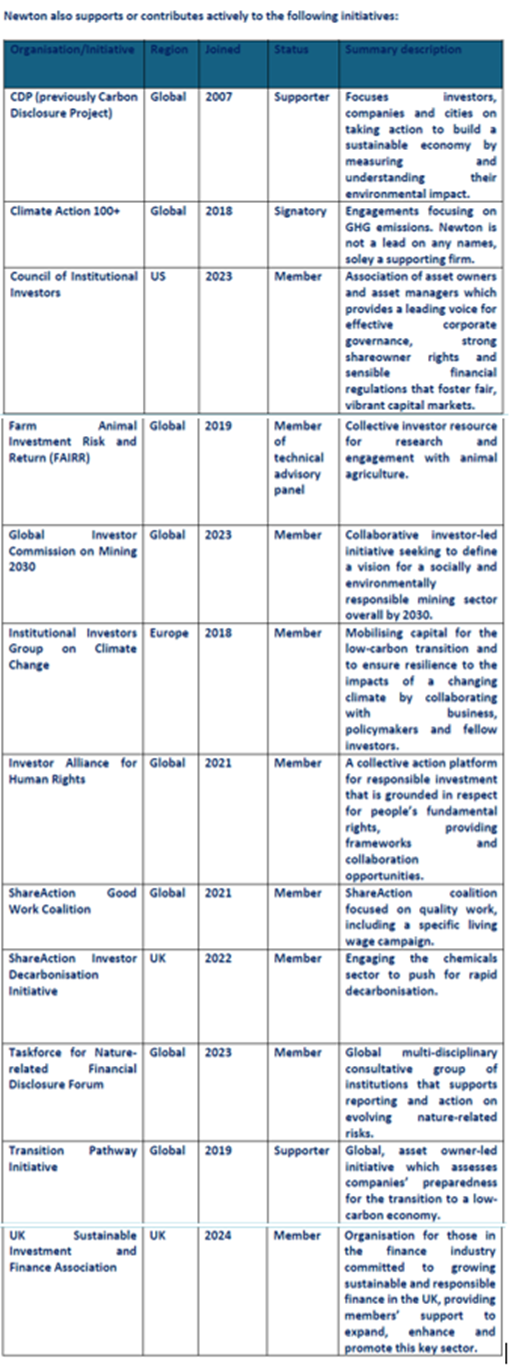

Resources, Affiliations & Corporate StrategiesNewton has a centralised responsible investment team. This team is the centre of excellence for all matters related to responsible investment, and with its deep functional knowledge of the responsible investment space and how it is evolving, it provides guidance, support and subject-matter expertise to our wider investment team. The responsible investment team, as you can see below, is global in its footprint and diverse in its employee base. The team is organised into three pillars of expertise – stewardship, research and analytics: these specialisations under the responsible investment umbrella allow us to bring further depth and expertise to each of these activities. The team’s compact size enables it to work cohesively and operate as one team. Sustainability research: Subject-matter experts consulting the investment and research teams, driving deep insights on sustainability-related subjects. The team manages Newton’s sustainability standards, definitions and frameworks. Responsible investment analytics: Has strong quantitative and RI data expertise and owns the data ecosystem, creating and managing responsible investment data models, frameworks and tools that support ESG integration and sustainable investing. The team has built an innovative suite of building blocks that can be leveraged to develop scalable solutions to meet specific client requirements. The role of the responsible investment team is to be a support function to the investment teams, to set standards around sustainable investment, and to coordinate and ensure effectiveness around our stewardship efforts. It guides the business around policies and direction of travel for sustainability and stewardship more broadly. The responsible investment team also owns and manages the overall governance systems to ensure we deliver against key codes and commitments including stewardship codes, industry principles such as the UN Principles for Responsible Investment, and industry pledges such as the Net Zero Asset Managers Initiative (NZAMi). Supporting the team, and the wider business, are various external organisations and vendors including ESG service providers, memberships, and internal systems for monitoring and reporting.

Affiliations Organisations and initiatives related to responsible investment matters in which Newton plays a formal role: *Newton Japan was established as a legal entity in March 2023. Its prior commitment to the Japan Stewardship Code was under its previous structure. ESG Governance Having an effective management and governance framework is an important part of our overall business strategy. As investors, we understand the value of effective leadership and accountability. This is closely linked to the culture of our business, as leadership and accountability have equal importance in Newton’s governance. We have therefore established appropriate governance systems and controls to support our stewardship and RI policy. This policy is reviewed and approved by the Newton Sustainability Committee (NIM and NIMNA), which reports to the Newton Executive Management Committee (NEMC) (to note, the NEMC reports into NIM and NIMNA boards). The policy is also reviewed and approved by the NIMJ Investment Oversight Committee, which reports into the NIMJ Executive Management Committee. The NEMC has overall responsibility for defining Newton’s approach, values and actions across all Newton entities. Two of our operating committees play important roles in relation to our stewardship and RI efforts:

These committees deal with various stewardship and RI aspects on an ad-hoc basis, including any relevant internal audit findings and actions as well as climate-related risk updates from internal groups. Our Board Risk Committee also plays a role in the governance of our RI and stewardship efforts; it acts as an escalation point for any material issues identified through our governance systems and controls. For example, it has previously considered materials related to climate risk. We have also established the Newton Sustainable Investment Forum (SIF) as an oversight group to monitor our strategies with sustainability characteristics. The role of the SIF is to:

|

||||||

Literature

IMPORTANT INFORMATION Newton manages a variety of investment strategies. How ESG analysis is integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved. ESG can be one of many inputs into the fundamental analysis. Newton will make investment decisions that are not based solely on ESG analysis. Other attributes of an investment may outweigh ESG analysis when making investment decisions. *Newton’ and/or ‘Newton Investment Management’ is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (“NIM”), Newton Investment Management North America LLC (“NIMNA”) and Newton Investment Management Japan Limited ("NIMJ"). Newton’s assets under management include assets collectively managed by NIM, NIMNA and NIMJ. In addition, AUM for Newton includes assets of bank-maintained collective investment funds for which Newton has been appointed sub-advisor, where Newton personnel act as dual officers of affiliated companies and assets of wrap fee account(s) for which Newton provides sub-advisory services to the primary manager of the wrap program. Last amended: 30/07/24 09:59 |

||||||

Important information

This report is for information purposes only and is intended to complement existing services used by UK based financial advisers only. sriServices is not authorised to give investment advice. The information on this site does not in any way constitute advice, recommendation or endorsement of any product or service. Investment decisions should not be based on this information alone. sriServices cannot be held in any way responsible for decisions made or advice offered as a result of using this site.

Whilst we take care to ensure information is as accurate as possible at time of publication we recommend you/financial advisers confirm specific fund details with fund providers. Please see www.sriServices.co.uk for additional information and for our contact details.

© Copyright sriServices 2026

01/09/2026