Fund EcoMarket

the sustainable, responsible and ethical investment information hub

- Royal London Short Term Fixed Income Enhanced Fund

| Fund Name | SRI Style | Product | Region | Asset Type | Launch Date | |

|---|---|---|---|---|---|---|

Royal London Short Term Fixed Income Enhanced Fund |

Limited Exclusions | OEIC | UK | Cash (or =) | 18/05/2015 | |

Fund/Portfolio Size: £1380.78m Total screened & themed / SRI assets: £59860.00 Total assets under management: £177020.00 As at: 30/04/25 |

||||||

OverviewESG integration into cash and short-term fixed income portfolios is still not widely understood. We do this through a four-pillar approach that combines relatively simple actions with more complex, bespoke analysis as we look to maximise our ability to understand and mitigate ESG risks in the portfolios. The first step is an exclusion policy which screens out companies that generate over 10% of revenues from tobacco, armaments, and fossil fuel extractors. An ESG risk assessment is conducted for each security, considering ESG score based on MSCI data, and tenor of exposure. MSCI data is enhanced through an internal framework to derive individual ESG security risk, which can then be aggregated to arrive at a portfolio-wide score. The third stage involves a qualitative assessment which adds an important overlay to a purely quantitative framework. The final stage is ongoing engagement. |

||||||

FiltersFund informationClimate Change & EnergyFossil fuel reserves exclusion Ethical Values Led ExclusionsTobacco & related product manufacturers excluded Armaments manufacturers avoided Controversial weapons exclusion Gilts & SovereignsInvests in gilts / government bonds Invests in sovereigns as an unscreened asset class Banking & FinancialsInvests in banks Financial institutions exclusion Product / Service GovernanceESG integration strategy How The Fund/Portfolio WorksNegative selection bias Use stock / securities lending Intended Clients & Product OptionsAvailable via an ISA (OEIC only) Fund management company informationAbout The BusinessResponsible ownership / stewardship policy or strategy (AFM companywide) ESG / SRI engagement (AFM companywide) Responsible ownership / ESG a key differentiator (AFM companywide) Sustainable property strategy (AFM companywide) Integrates ESG factors into all / most research (AFM companywide) In-house diversity improvement programme (AFM companywide) Vote all* shares at AGMs / EGMs (AFM companywide) Invests in newly listed companies (AFM companywide) Invests in new sustainability linked bond issuances (AFM companywide) Collaborations & AffiliationsPRI signatory UKSIF member Fund EcoMarket partner Investment Association (IA) member ResourcesIn-house responsible ownership / voting expertise Employ specialist ESG / SRI / sustainability researchers Use specialist ESG / SRI / sustainability research companies AccreditationsUK Stewardship Code signatory (AFM companywide) Engagement ApproachRegularly lead collaborative ESG initiatives (AFM companywide) Engaging on climate change issues Engaging with fossil fuel companies on climate change Engaging to encourage responsible mining practices Engaging on biodiversity / nature issues Engaging to encourage a Just Transition Engaging on human rights issues Engaging on labour / employment issues Engaging on diversity, equality & / or inclusion issues Engaging to stop modern slavery Engaging on governance issues Engaging on mental health issues Engaging on responsible supply chain issues Engaging on the responsible use of AI Stewardship escalation policy Company Wide ExclusionsControversial weapons avoidance policy (AFM companywide) Climate & Net Zero TransitionNet Zero commitment (AFM companywide) Voting policy includes net zero targets (AFM companywide) Publish 'CEO owned' Climate Risk policy (AFM companywide) Net Zero - have set a Net Zero target date (AFM companywide) Encourage carbon / greenhouse gas reduction (AFM companywide) ‘Forward Looking Climate Metrics’ published / ITR (AFM companywide) Carbon offsetting – do NOT offset carbon as part of net zero plan (AFM companywide) Working towards a ‘Net Zero’ commitment (AFM companywide) TransparencyPublish responsible ownership / stewardship report (AFM companywide) Full stewardship / responsible ownership policy information on company website Publish full voting record (AFM companywide) Dialshifter statement Full stewardship / responsible ownership policy information available on request |

||||||

PolicyRLAM’s ethical framework combines the avoidance of companies involved in excluded activities with the identification of best of breed companies in permitted sectors. Companies that generate over 10% of their turnover from either one or a combination of the following categories are excluded:

|

||||||

ProcessRLAM’s investment team of fund managers and analysts work in a close and highly collegiate environment designed to encourage the free flow of thoughts and ideas across the team. The nature and size of the team enables new ideas and opportunities to be discussed freely. The close proximity of all members of the team allows agreed decisions to be implemented quickly, ensuring that all portfolios benefit from relevant new ideas with minimal delay. The individual fund managers consult with other team members and credit analysts in on-desk discussions. The Cash and Rates team and the rest of the Fixed Income team are central to the research process. The decisions to trade individual securities are made by the lead fund managers. This process ensures quick implementation of all buy/sell decisions. In addition, individual stocks are reviewed during the weekly off-desk team meeting. All investment decisions must fit within the team’s overall views.

Cash

The funds may invest in covered bonds when thought appropriate by the managers. Issued by financial institutions, these bonds are asset backed, most often by a pool of mortgages. These highly liquid securities are regulated in the UK by the FCA and are exempt from being bailed-in.

Asset allocation

Also, this threshold is deemed to be realistic and appropriate in terms of assessing a company, given that it may not be possible to always pinpoint the exact turnover derived from an excluded activity. This threshold ensures that a minimum of 90% of each holding meets the ethical criteria. |

||||||

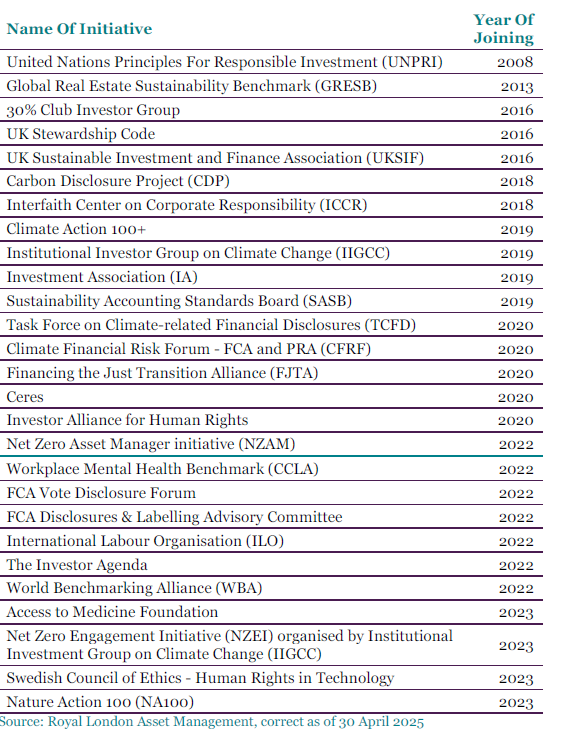

Resources, Affiliations & Corporate StrategiesRoyal London Asset Management’s in-house Responsible Investment (RI) team of 19 professionals is led by Head of Responsible Investment, Ashley Hamilton-Claxton. The RI team works with the investment teams to monitor, assess and analyse ESG factors, vote our shares and engage with companies to encourage better social and environmental outcomes, or better risk management. This team is also responsible for helping to set out our approach and policies around systemic issues such as climate change, providing guidance, feedback and coaching to fund managers and analysts on the latest data, research, policy and industry practices. Governance of Responsible Investment at Royal London Asset Management is integrated at varying levels of the organisation however is led by senior leadership. The Board has ultimate responsibility for setting Royal London Asset Management’s risk appetite and reviewing our strategic risks. Our Chief Investment Officer (CIO) is a regulated Senior Management Function (SMF) and is the Executive team member that is accountable for setting the investment strategy, and overseeing our Responsible Investment function, including our approach to stewardship and climate investment risk. The CIO, with support from the investment teams, updates the Board and monitors responsible investment in line with Royal London Asset Management’s risk tolerance threshold. The CIO is also responsible for ensuring responsible investment, stewardship and climate change risk management is embedded across Royal London Asset Management’s investment strategies. The CIO is a member of Royal London Asset Management’s Executive Committee and also chairs the Investment Committee. Royal London Asset Management is a member of the following initiatives:

|

||||||

Literature. Last amended: 06/01/24 02:36 |

||||||

Important information

This report is for information purposes only and is intended to complement existing services used by UK based financial advisers only. sriServices is not authorised to give investment advice. The information on this site does not in any way constitute advice, recommendation or endorsement of any product or service. Investment decisions should not be based on this information alone. sriServices cannot be held in any way responsible for decisions made or advice offered as a result of using this site.

Whilst we take care to ensure information is as accurate as possible at time of publication we recommend you/financial advisers confirm specific fund details with fund providers. Please see www.sriServices.co.uk for additional information and for our contact details.

© Copyright sriServices 2026

02/10/2026