Fund EcoMarket

the sustainable, responsible and ethical investment information hub

- Ninety One Global Environment Fund

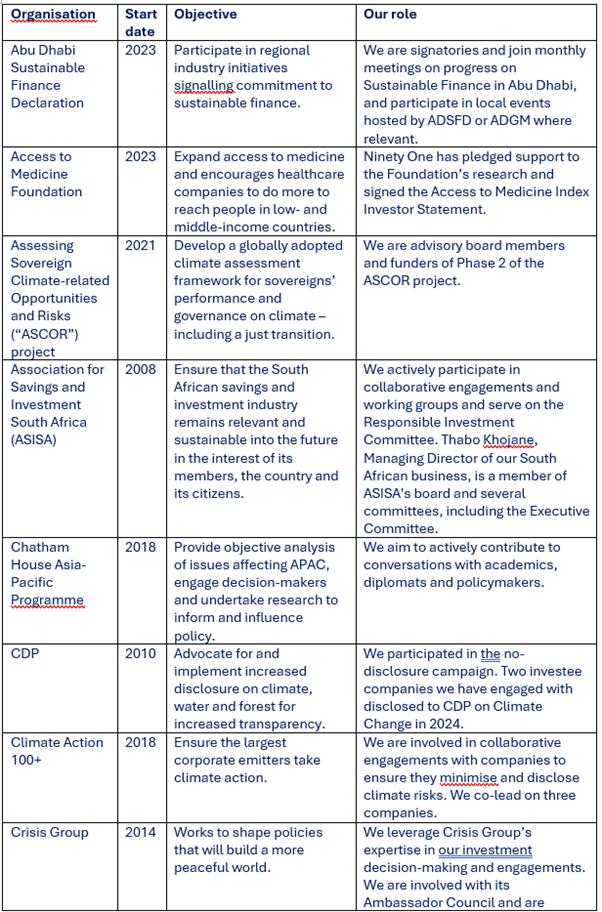

| Fund Name | SRI Style | Product | Region | Asset Type | Launch Date | |

|---|---|---|---|---|---|---|

| Ninety One Global Environment Fund | Environmental Style | OEIC | Global | Equity | 02/12/2019 | |

Fund Size: £2074.00m Total screened & themed / SRI assets: £4024.00 Total Responsible Ownership assets: £126757.00 Total assets under management: £130781.00 As at: 31/03/25 |

||||||

OverviewThe Global Environment Strategy uses a bespoke bottom-up investment process tailored to a diverse universe of global equities. It incorporates proprietary tools, including our environmental/carbon avoided screen and detailed fundamental financial and risk modelling. We also provide transparency through our annual Impact Report, reflecting our commitment to sustainable long-term investing and active engagement. We invest in companies positioned to benefit from sustainable decarbonisation. The strategy is a high-conviction, benchmark-agnostic portfolio of best ideas, managed with a long-term horizon of 5–10 years. We focus on holdings that demonstrate:

By identifying these traits in each holding, we aim to allocate capital to the leaders of the decarbonisation transition - while avoiding those likely to be left behind. This belief also underpins our conviction in maintaining a concentrated portfolio of industry-leading companies. |

||||||

FiltersFund informationSustainability - GeneralEncourage more sustainable practices through stewardship UN Global Compact linked exclusion policy Sustainability policy Report against sustainability objectives Environmental - GeneralWaste management policy or theme Favours cleaner, greener companies Resource efficiency policy or theme Limits exposure to carbon intensive industries Environmental policy Nature & BiodiversityBiodiversity / nature policy Climate Change & EnergyClean / renewable energy theme or focus Energy efficiency theme Fracking and tar sands excluded Coal, oil & / or gas majors excluded Climate change / greenhouse gas emissions policy Encourage transition to low carbon through stewardship activity Require net zero action plan from all/most companies Invests in clean energy / renewables Fossil fuel reserves exclusion Supply chain decarbonisation policy Hydrogen policy or theme Fossil fuel exploration exclusion - direct involvement Social / EmploymentDiversity, equality & inclusion Policy (fund level) Favours companies with strong social policies Ethical Values Led ExclusionsArmaments manufacturers avoided Tobacco and related product manufacturers excluded Tobacco and related products - avoid where revenue > 5% Civilian firearms production exclusion Controversial weapons exclusion Gilts & SovereignsDoes not invest in sovereigns Governance & ManagementAvoids companies with poor governance Encourage board diversity e.g. gender UN sanctions exclusion Fund GovernanceESG integration strategy Asset SizeInvests mostly in large cap companies / assets Over 50% large cap companies Targeted Positive InvestmentsInvests >50% of fund in environmental/social solutions companies Invests >25% of fund in environmental/social solutions companies EU Sustainable Finance Taxonomy holdings 5-25% of fund assets Impact MethodologiesAims to generate positive impacts (or 'outcomes') Measures positive impacts Positive environmental impact theme Described as an ‘impact investment fund’ Invests in environmental solutions companies Over 50% in assets providing environmental or social ‘solutions’ Publish ‘theory of change’ explanation Invests in sustainability / ESG disruptors Aim to deliver positive impacts through engagement How The Fund WorksPositive selection bias Limited / few ethical exclusions Do not use stock / securities lending SRI / ESG / Ethical policies explained on website Unscreened Assets & CashAssets typically aligned to sustainability objectives 70 - 79% Assets typically aligned to sustainability objectives 80 – 89% Assets typically aligned to sustainability objectives > 90% Intended Clients & Product OptionsIntended for clients who want to have a positive impact Intended for investors interested in sustainability Labels & AccreditationsRSMR rated SDR Labelled ACT signatory Fund management company informationAbout The BusinessIntegrates ESG factors into all / most (AFM) fund research ESG / SRI engagement (AFM company wide) Senior management KPIs include environmental goals (AFM company wide) Responsible ownership policy for non SRI funds (AFM company wide) Responsible ownership / stewardship policy or strategy (AFM company wide) In-house diversity improvement programme (AFM company wide) SDG aligned aims / objectives (AFM company wide) Vote all* shares at AGMs / EGMs (AFM company wide) Offer structured intermediary training on sustainable investment Responsible ownership / ESG a key differentiator (AFM company wide) Invests in new sustainability linked bond issuances (AFM company wide) Collaborations & AffiliationsPRI signatory Investment Association (IA) member TNFD forum member (AFM company wide) ResourcesIn-house responsible ownership / voting expertise ESG specialists on all investment desks (AFM company wide) Use specialist ESG / SRI / sustainability research companies Employ specialist ESG / SRI / sustainability researchers AccreditationsUK Stewardship Code signatory (AFM company wide) PRI A+ rated (AFM company wide) Engagement ApproachEngaging on responsible supply chain issues Engaging with fossil fuel companies on climate change Engaging on biodiversity / nature issues Engaging to encourage responsible mining practices Engaging to reduce plastics pollution / waste Engaging on climate change issues Engaging on human rights issues Engaging to encourage a Just Transition Engaging on governance issues Engaging on diversity, equality and / or inclusion issues Engaging on labour / employment issues Regularly lead collaborative ESG initiatives (AFM company wide) Engaging to stop modern slavery Stewardship escalation policy Company Wide ExclusionsControversial weapons avoidance policy (AFM company wide) Climate & Net Zero TransitionNet Zero - have set a Net Zero target date (AFM company wide) Net Zero commitment (AFM company wide) Voting policy includes net zero targets (AFM company wide) Encourage carbon / greenhouse gas reduction (AFM company wide) Carbon transition plan published (AFM company wide) ‘Forward Looking Climate Metrics’ published / ITR (AFM company wide) Carbon offsetting - offset carbon as part of our net zero plan (AFM company wide) In-house carbon / GHG reduction policy (AFM company wide) TransparencyFull SRI / responsible ownership policy information on company website Publish full voting record (AFM company wide) Just Transition policy on website (AFM company wide) Publish responsible ownership / stewardship report (AFM company wide) Sustainability transition plan publicly available (AFM company wide) Paris Alignment plan publicly available (AFM company wide) Net Zero transition plan publicly available (AFM company wide) |

||||||

PolicyThe Global Environment Strategy seeks exposure to themes and companies that will drive the multi-decade process of decarbonisation - the most vital contributor to a sustainable future. To achieve this, we only include companies where we believe the products and services avoid carbon and where we can quantify that carbon is indeed avoided. Our screening process means that to enter the portfolios investment universe a company must have >50% in environmental revenues and quantified carbon avoided, with the environmental revenue classification based on Bloomberg Industry Classification System (BICS). We also exclude any companies with more than 5%* of revenues in Oil, Gas & Coal. In addition to the universe screen we then carry out detailed fundamental analysis to maintain there is a sound environmental thesis, quantifiable carbon avoided and that the majority of the business is directly linked to the energy transition/sustainable decarbonisation. More broadly, ESG and sustainability assessments are incorporated into every stage of our investment process, with a focus within fundamental research on understanding the company's management of its positive and negative externalities across natural, social, human and financial capital. Any ESG or sustainability characteristic of a portfolio company that we deem to be sub-optimal or where there is room for improvement, this becomes an engagement goal. We will not invest in any company where we consider there to be material ESG or sustainability concerns, even if the company otherwise meets the criteria of a decarbonisation leader. * Specifically, we use the following BICs subsectors for this exclusion: Engines & Parts Manufacturing, Exhausts & Emissions Manufacturing, Oil & Gas, Diesel Locomotives Manufacturing, Oil & Gas Infrastructure Construction, Oilfield Chemicals Manufacturing, Coal Mining. This exclusion does not include the Utility sector, which is currently a highly carbon intensive sector but has the greatest potential to ‘avoid’ large amounts of carbon and contribute materially to decarbonisation We believe there are three compelling reasons to allocate to a portfolio of companies that will enable the process of sustainable decarbonisation, outlined below. Climate strategies vary widely across the peer group. Pure-play renewables and alternative energy funds have struggled in the recent negative beta environment for the theme. By focusing on companies with strong competitive advantages, the Global Environment strategy has better preserved capital than these managers. On the other hand, some climate funds are much more broad, and deliver outcomes more similar to MSCI ACWI. The Global Environment strategy sits between these approaches—more diversified than renewables-focused funds but narrower than broad climate strategies. This balance provides strong exposure to decarbonisation while reducing volatility.

Achieving such an allocation requires the ability to firstly rigorously screen for and accurately measure the positive carbon impact of a company, before qualitatively appraising its fundamental characteristics. We only include companies in the universe where we are confident that a company plays an important part in offering environmental products and solutions, and where revenues can be directly associated with the concept of ‘carbon avoided’. The Global Environment Strategy employs a bespoke bottom-up investment process designed specifically for this diverse universe of global equities. The process combines proprietary models, such as our environmental/carbon avoided screen, the idea generation ranking process and our detailed company-level fundamental financial and risk modelling, with our qualitative insights, judgments and analysis. We provide transparency on positions and company engagement through our annual Impact Report. This process reflects our core beliefs of sustainable long-term investing and active engagement. We own companies that we believe will be beneficiaries of sustainable decarbonisation. This is a high conviction concentrated portfolio of best ideas managed to a long-term investment horizon. We seek portfolio holdings that exhibit three characteristics:

|

||||||

ProcessThe Strategy employs a bespoke bottom-up investment process designed specifically for the relevant diverse universe of global equities. The process incorporates proprietary models, such as our environmental/carbon avoided screen and our detailed company-level fundamental financial and risk modelling, but ultimately relies on our qualitative decisions. Our process has been developed over many years of investing in global equity markets with a focus on environmental/carbon screening, fundamental growth, returns based investment analysis with a focus on sustainability and bottom up stock selection. The process includes five clear stages:

During the initial screening stage, we apply a two-part screening process: Step one - Environmental Revenues: Initially, we identify those companies that are driving this 'unprecedented shift in energy systems and transport’. It is important to think not just about the direct beneficiaries of decarbonisation, but the entire related supply chain that needs to be built up. The companies which will benefit from the transition to a low carbon economy will likely sit within sectors including industrials, utilities, energy, technology, materials, chemicals and automotive sectors, which represent almost 80% of the GICS. Our investment framework, created for the transition, encapsulates that there will be winners and losers; for example, as renewable energy grows, fossil electric generation will decline, and we have consequently excluded companies which have revenues that would be significantly eroded by the transition. Step two – Decarbonisation: Once we’ve found companies that will enable the process of sustainable decarbonisation, we need to determine which companies’ products are genuinely avoiding carbon. We do this through measuring carbon risk and carbon impact as explained below:

During this screening stage, we see:

We only include companies in the universe where we believe the products and services avoid carbon and we can quantify that carbon is avoided. The ultimate universe consists of over 1700 companies with a total market cap of US$18 trillion, distributed between the US, China and the rest of the world. It’s worth noting that our carbon reporting is still at an early stage, much of the data is estimated by our external carbon data provider Urgentem along with CDP and believe that engagement to encourage better reporting is vital to the Strategy. Please see our thought paper: ‘Defining the Global Environment Universe’ for further details.

The main source of our idea generation is a screen for companies based on key financial, sustainability and competitive advantage metrics. The metrics chosen derive from decades of investment team and firm-wide experience as well as rigorous back-testing and relevant cross-sector analysis. This screen directs our analyst research which can then lead to further qualitative idea generation. Given that the universe is rapidly-evolving in a disruptive market, we have analysed several sectors that we believe will share similar characteristics. The key attributes we highlight for relevant cross-sector comparison and analysis include:

This spans many sectors where capital intensity meets technology, with autos, IT and infrastructure/utilities the most relevant. We carried out in depth back-testing on these sectors, and our idea generation screen highlights companies who perform best on metrics most correlated with alpha generation and this is where our analysts focus their attention. We have also integrated an internal sustainability indicator into this part of the process. This indicator assesses companies across various sustainability and ESG factors that we've identified as being likely to have a financial impact on a company, with each company appraised relative to its sector. Once a company screens to be included in stage 3 (Fundamental Analysis), we perform our own sustainability analysis of the company. This is an integral part of the investment process as we believe that companies with strong sustainability characteristics and who minimise their negative externalities will outperform over time.

Companies that look most attractive from our idea generation screen are taken through to the next stage of the investment process where the team conducts the fundamental analysis. The first stage of our fundamental analysis process is focused on the company’s business model and whether it fits with our requirement for structural growth, sustainable returns and competitive advantage. At this stage we also carry out our own sustainability analysis by assessing the positive and negative externalities generated by the company. When we are comfortable that the company fulfils our requirement and there are no material sustainability risks, we take it forward to a second, more detailed stage of fundamental analysis. We also conduct detailed fundamental analysis of sub-sectors and technologies exposed to the transition to a low carbon economy. We build sector supply and demand models (e.g., our proprietary global 2 degree model) and undertake thematic research which is presented in our thought pieces “Energy 3.0” which can be found on our website and here. This helps us to inform and stress test our company models. The key areas of our company research are described below: Company Analysis The investment team works through a rigorous checklist for each investment idea. We want to find the best companies in our universe which are intrinsically undervalued. Clean balance sheets and clear business models are a competitive advantage in many parts of this volatile sector. The team conducts fundamental analysis by constructing detailed models. Our technical understanding and experience looking at these industries, combined with access to the best and most granular data, enables us to construct detailed models that allow us to test different assumptions. We build an investment case for each idea and focus on the following key factors: Competitive Advantage Our competitive advantage analysis can be simplified into the key topics shown below:

We use these factors to determine the long-term sustainability of the business in question. In addition, we believe a strong balance sheet and outstanding management are also a competitive advantage and ensure we cover these factors during our fundamental analysis. Intrinsic Value The team conducts full financial and valuation analysis by constructing individual company models to determine the growth, earnings and intrinsic value of the companies under review. Our proprietary equity models are maintained within the team and contain our own forecasts. Research from earlier parts of the process is used and built on here. In undertaking full income statement, cashflow statement and balance sheet analysis we can focus on specific financial metrics which we believe to be the drivers of long-term returns. The output of the equity analysis is a target price for the company across different scenarios. The target price is based on three main components with returns and cash flow being prioritised:

Return profile and growth It is important to note that profitable growth and efficient use of capital is embedded within each of the above calculations. Structural growth and sustainable returns are two key drivers of our stock selection and analysis. We believe growth and returns are key factors in determining a reasonable fair value for any company. We therefore do not claim to be only growth or only value investors, instead we invest in the leading companies within our universe that we believe are intrinsically undervalued. Management, sustainability and engagement Capital allocation decisions and operational performance are important considerations for us when evaluating management. Much of these considerations feed into our competitive advantage and valuation work. We also place huge significance on sustainability factors as highlighted in our initial screens. Sustainability reports and net zero emissions targets are important throughout our fundamental analysis as well as topics featuring in team debates. This fundamental bottom-up research stage of the investment process also includes company meetings and onsite visits where we will focus on all the key factors mentioned above. We will only buy a stock for the portfolio after we have met with company management. When all factors described above score positively for an investment idea, we will add it to our list of best ideas and compare to the existing holdings.

The best ideas generated through stages 1 – 3 of the investment process are used to construct a portfolio in line with the risk constraints. Ideas are presented in weekly investment meetings and are challenged by the investment team. We operate a team-based approach and all team members have input into idea generation and analysis, with the co-portfolio managers having ultimate decision-making responsibility for the portfolio composition. We will compare any new ideas to the current portfolio characteristics across the main inputs of our investment process. The portfolio is constructed bottom-up in a benchmark-agnostic fashion. Positions are weighted according to our target prices, strength of competitive advantage and the contribution to the portfolio's risk. The portfolio is then reviewed at a sub-sector level with regards to overall risk budget, sub-sector risks, stress tests and style analytics metrics. Weightings may then be adjusted accordingly. We use MSCI Barra One for quantitative portfolio risk analysis and optimisation. We will only buy a stock which/when:

Sell Discipline We will revisit a stock if:

Subsequently, stocks are typically sold when:

We meet management and engage with all portfolio companies on a regular basis. Topics of engagement are not only on financial and operational issues, but any material sustainability issues. We have ongoing engagement goals for each company and will report on this engagement and progress in our annual impact report. For example, any company that has sustainability characteristics or externalities which are not best in class, automatically becomes an engagement target. We list the engagement targets for each company, along with the reasons why we believe the company fits in the portfolio and the carbon data in our annual impact report. In our Annual Impact Report, we provide transparency on positions and company engagement, as well as an explanation of why we believe the companies will see structural growth and have a competitive advantage. This report presents significant developments throughout the year, including all environmental metrics for the portfolio and underlying holding as well as engagement goals and progress towards those goals. We are not naïve on where we can and can’t have influence. There are some engagement goals, for example better carbon disclosure where we would hope to have significant progress in the coming years; others, for example improved gender diversity in the workforce, will regrettably take more time, but we believe are still worth discussing. |

||||||

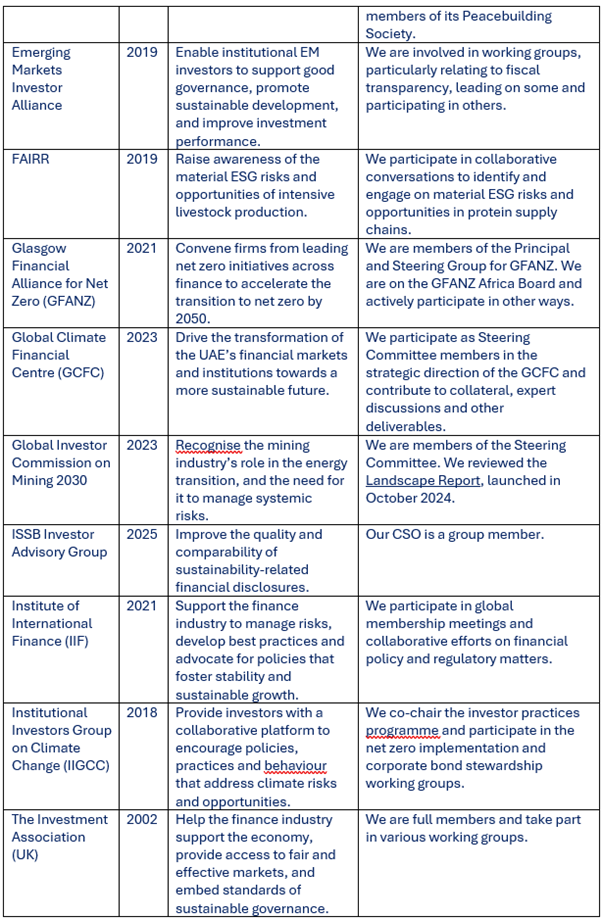

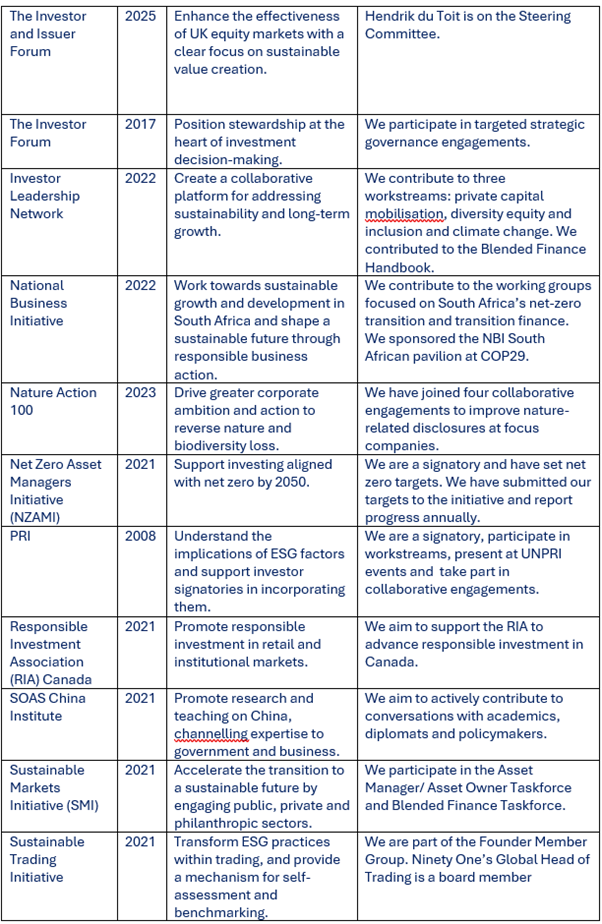

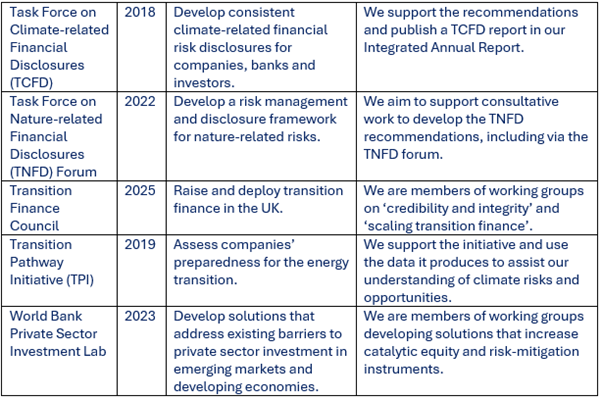

Resources, Affiliations & Corporate StrategiesNinety One operates a fully integrated approach to ESG, sustainability and stewardship. Therefore sustainability knowledge and expertise is held across a number of areas of the business. The Sustainability Committee oversees the sustainability ecosystem in the business. Ninety One’s firm-wide sustainability strategy and initiatives are overseen by the Chief Sustainability Officer, Nazmeera Moola, supported by the central Sustainability team. This includes investment integration, advocacy, corporate transition to net zero and developing and implementing efforts to mobilise dedicated funding for an inclusive and sustainable transition. Compliance

|

||||||

DialshifterThis fund is helping to ‘shift the dial from brown to green’ by… … investing in companies whose growth is driven by sustainable decarbonisation, contributing to positive environmental change. The investment objective of the Strategy is explicitly aligned with its sustainability objective. The strategy's positive impact is measured by carbon avoided. The Strategy employs a bespoke bottom-up investment process designed specifically for this diverse universe of global equities. The process incorporates proprietary models, such as our environmental/carbon avoided screen and our detailed company-level fundamental financial and risk modelling. We provide transparency on positions and company engagement through our annual Impact Report. This process reflects our core beliefs of sustainable long-term investing and active engagement.

|

||||||

Literature

Important information The personal information contained in this document is confidential, and only for the information of the intended recipient. This communication for professional investors and financial advisors only. It is not to be distributed to retail customers who are resident in countries where the Fund is not registered for sale or in any other circumstances where its distribution is not authorised or is unlawful. Please visit www.ninetyone.com/registrations to check registration by country. The information may discuss general market activity or industry trends and is not intended to be relied upon as a forecast, research or investment advice. There is no guarantee that views and opinions expressed will be correct. The investment views, analysis and market opinions expressed may not reflect those of Ninety One as a whole, and different views may be expressed based on different investment objectives. Ninety One has prepared this communication based on internally developed data, public and third party sources. Although we believe the information obtained from public and third party sources to be reliable, we have not independently verified it, and we cannot guarantee its accuracy or completeness (ESG-related data is still at an early stage with considerable variation in estimates and disclosure across companies. Double counting is inherent in all aggregate carbon data). Ninety One’s internal data may not be audited. Ninety One does not provide legal or tax advice. Prospective investors should consult their tax advisors before making tax-related investment decisions. The Funds are sub-fund of the Ninety One Funds Series range (series i - iv) which are incorporated in England and Wales as investment companies with variable capital. Ninety One Fund Managers UK Ltd (registered in England and Wales No. 2392609 and authorised and regulated by the Financial Conduct Authority) is the authorised corporate director of the Ninety One Funds Series range. This communication is not an invitation to make an investment, nor does it constitute an offer for sale. Any decision to invest in the Fund should be made only after reviewing the full offering documentation, including the Key Investor Information Documents (KIID) and Prospectus, which set out the fund specific risks. Fund prices and copies of the Prospectus, annual and semi-annual Report & Accounts, Instruments of Incorporation and the Key Investor Information Documents may be obtained from www.ninetyone.com. Daily transactional data is not available to fund investors. Transparency around transactions costs is available to investors via PRIIPs and MiFID methodologies. THIS INVESTMENT IS NOT FOR SALE TO US PERSONS. Except as otherwise authorised, this information may not be shown, copied, transmitted, or otherwise given to any third party without Ninety One’s prior written consent. © 2025 Ninety One. All rights reserved. Issued by Ninety One, May 2025. Indices Indices are shown for illustrative purposes only, are unmanaged and do not take into account market conditions or the costs associated with investing. Further, the manager’s strategy may deploy investment techniques and instruments not used to generate Index performance. For this reason, the performance of the manager and the Indices are not directly comparable. If applicable MSCI data is sourced from MSCI Inc. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. If applicable FTSE data is sourced from FTSE International Limited (‘FTSE’) © FTSE 2025. Please note a disclaimer applies to FTSE data and can be found at www.ftse.com/products/downloads/FTSE_Wholly_Owned_Non-Partner.pdf Targeted or projected performance returns These are based on Manager’s good faith estimate of the likelihood of the performance of asset classes under current market conditions. There can be no assurances that any investment will generate such returns, that any client or investor will achieve comparable results or that the manager will be able to implement its investment strategy. Actual performance may be adversely affected by a variety of factors, beyond the manager’s control, such as, political, and socio-economic events, adverse changes in the interest rate environment, changes to investment expenses, and a lack of suitable investment opportunities. Accordingly, target returns and expected results may change over time and may differ from previous reports. Additional and supporting information is available upon request. Hypothetical performance results shown are backtested and do not represent the performance of any account, fund or strategy managed by Ninety One but were achieved by means of the retroactive application, certain aspects of which may have been designed with the benefit of hindsight. The hypothetical back-tested performance does not represent the results of actual trading using client assets nor decision-making during the period and does not and is not intended to indicate the past performance or future performance of any account or investment strategy. If actual accounts had been managed throughout the period, ongoing research might have resulted in changes to the strategy which might have altered returns. The actual performance of any account or investment strategy managed by Ninety One will differ, perhaps materially, from the hypothetical back-tested performance results shown herein. Additional and supporting information is available upon request. This communication includes results which are not historical or actual in nature but are hypothetical illustrations involving modelling components and assumptions that are required for purposes of such hypothetical illustrations. No representations are made as to the accuracy of such hypothetical illustrations or that all assumptions relating to such hypothetical illustrations have been considered or stated or that such hypothetical illustrations will be realized. Actual events are difficult to predict and are beyond the Firm’s control. Actual events may be different, perhaps materially, from those assumed. No investor or client of the Firm has actually experienced the hypothetical results presented. Additional and supporting information is available upon request. There is no assurance that the persons referenced herein will continue to be involved with investing assets for the Manager, or that other persons not identified herein will become involved at any time without notice. References to specific and periodic team meetings are not guaranteed to be held or fully attended due to reasonable priority driven circumstances and holidays. Any description or information regarding investment process is provided for illustrative purposes only, may not be fully indicative of any present or future investments and may be changed at the discretion of the manager without notice. References to specific investments, strategies or investment vehicles are for illustrative purposes only and should not be relied upon as a recommendation to purchase or sell such investments or to engage in any particular Strategy. Portfolio data is expected to change and there is no assurance that the actual portfolio will remain as described herein. There is no assurance that the investments presented will be available in the future at the levels presented, with the same characteristics or be available at all. Past performance is no guarantee of future results and has no bearing upon the ability of Manager to construct the illustrative portfolio and implement its investment strategy or investment objective. References to particular investments or strategies are for illustrative purposes only and should not be seen as a buy, sell or hold recommendation. Such references are not a complete list and other positions, strategies, or vehicles may experience results which differ, perhaps materially, from those presented herein due to different investment objectives, guidelines, or market conditions. The securities or investment products mentioned in this document may not have been registered in any jurisdiction. More information is available upon request. Last amended: 22/06/23 10:19 |

||||||

Important information

This report is for information purposes only and is intended to complement existing services used by UK based financial advisers only. sriServices is not authorised to give investment advice. The information on this site does not in any way constitute advice, recommendation or endorsement of any product or service. Investment decisions should not be based on this information alone. sriServices cannot be held in any way responsible for decisions made or advice offered as a result of using this site.

Whilst we take care to ensure information is as accurate as possible at time of publication we recommend you/financial advisers confirm specific fund details with fund providers. Please see www.sriServices.co.uk for additional information and for our contact details.

© Copyright sriServices 2025

07/16/2025