Information received directly from Fund Manager

Last amended date: Jul 2025

|

Please select what you would like to read:

Fund Management Company Information

About The Business

Collaborations & Affiliations

Resources

Accreditations

Engagement Approach

Company Wide Exclusions

Climate & Net Zero Transition

Transparency

Resources, Affiliations & Corporate Strategies:Ninety One operates a fully integrated approach to ESG, sustainability and stewardship. Therefore sustainability knowledge and expertise is held across a number of areas of the business. The Sustainability Committee oversees the sustainability ecosystem in the business. Ninety One’s firm-wide sustainability strategy and initiatives are overseen by the Chief Sustainability Officer, Nazmeera Moola, supported by the central Sustainability team. This includes investment integration, advocacy, corporate transition to net zero and developing and implementing efforts to mobilise dedicated funding for an inclusive and sustainable transition. Compliance

Dialshifter:Our organisation is helping to support the Paris Climate Agreement and the Race to Net Zero by… … thinking about our investments holistically, as entities operating within society, all depending on the natural environment. Only by understanding connections between these can we consistently make the right decisions to preserve and grow assets entrusted to us for future generations. Our focus on sustainable development started with our African roots, particularly our private markets focus (equity, credit and infrastructure), which showed us the role that capital has to play. We believe that ESG considerations should be integrated with all investment processes, across all asset classes. Investing in companies and countries with strong sustainability and ESG performance makes long-term investing sense. |

Ninety One operates a fully integrated approach to ESG, sustainability and stewardship. Therefore sustainability knowledge and expertise is held across a number of areas of the business. The Sustainability Committee oversees the sustainability ecosystem in the business. Ninety One’s firm-wide sustainability strategy and initiatives are overseen by the Chief Sustainability Officer, Nazmeera Moola, supported by the central Sustainability team. This includes investment integration, advocacy, corporate transition to net zero and developing and implementing efforts to mobilise dedicated funding for an inclusive and sustainable transition.

Ultimately, the investment teams have responsibility for managing sustainability risks and opportunities within their investment process through their integration frameworks. We place a big emphasis on ensuring that the investment teams have the appropriate knowledge, insights, data and tools so that the expertise is a truly integrated part of the investment process. The investment teams are supported by dedicated ESG specialists across our Sustainability team and Investment Risk team. We also have further expertise that we can draw upon from the portfolio managers managing our dedicated sustainability strategies, and other sustainability specialists that are dedicated to individual investment teams.

The below provides an overview of the teams, committees and forums with oversight and responsibility for various aspects of sustainability:

Sustainable, Social & Ethics Committee (SS&E)

Oversees compliance with sustainability, social and ethical commitments, targets, and performance.

Reviews sustainability initiatives and implementation across the three pillars of the framework.

Sustainability Committee (SC)

Responsible for the internal oversight of Sustainability and Stewardship, including:

Determining sustainability strategy and monitoring progress on ESG integration, stewardship, advocacy, climate risk, regulation, and other related matters.

Ensuring alignment of focus and integrity throughout the business.

Sustainable Investment Advisory Committee (SIAF)

Responsible for the internal coordination and challenge of investment-related sustainability issues:

Ensuring alignment and compliance of products with sustainability and impact objectives.

Serving as a forum for consultation and discussion on sustainability initiatives, guidelines, and policies.

Sustainability Team

Central custodian of the firm-wide Sustainability strategy, responsible for:

Development of strategy and sustainability and stewardship policies and frameworks.

Promoting best practice ESG integration and stewardship across investment teams.

Coordinating and leading advocacy and firmwide sustainability initiatives.

Providing sustainability expertise and monitoring implementation of sustainability strategy.

Investment Risk Team

Oversight and challenge of firm-wide ESG risk assessment, management, and integration quality.

Management of ESG and climate risk data.

Investment Operations: Proxy Voting

Coordination and execution of the voting process.

Work with the sustainability team to align voting with strategic initiatives.

Investment Teams

Responsible for developing ESG integration frameworks and engagement priorities.

Undertaking ESG analysis, engagement, and voting.

Supporting firmwide initiatives.

Product Development

Manages sustainable product strategy and product development process.

Compliance

Coordinates input on, advises on, and ensures implementation of sustainability-related regulation.

We seek to contribute meaningfully to the conversation on sustainability and to encourage a deeper focus on sustainability-related issues in all of the jurisdictions where we invest, always to the benefit of our clients and their long-term investment outcomes. We may collaborate with other investors as part of an engagement strategy if it can contribute to achieving our engagement objectives and can help address the relevant risks. . Our membership of regional and global organisations facilitates this.

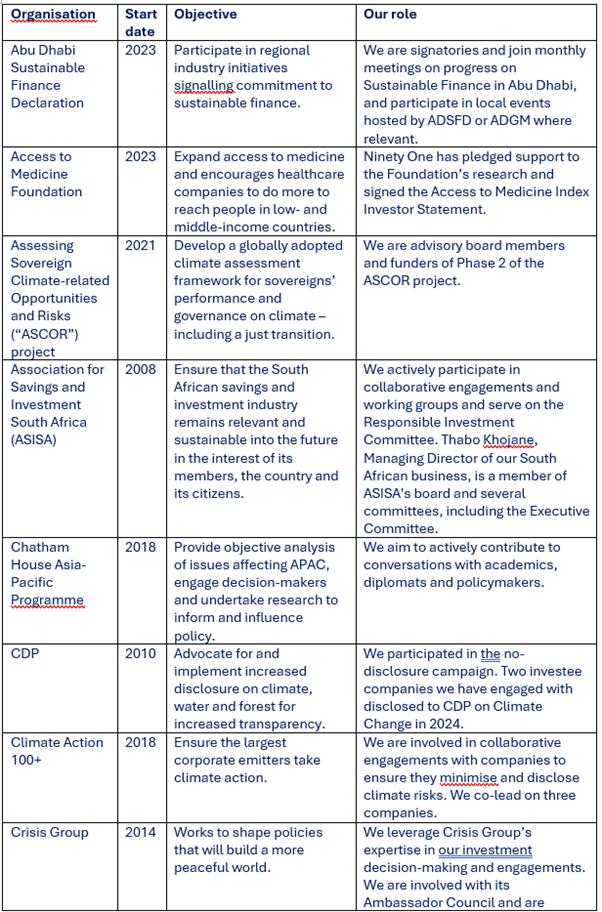

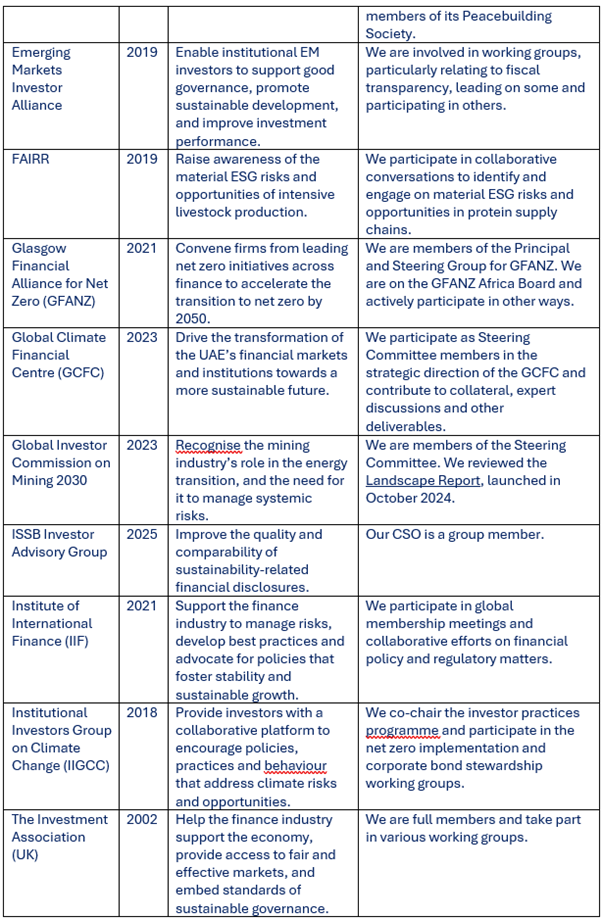

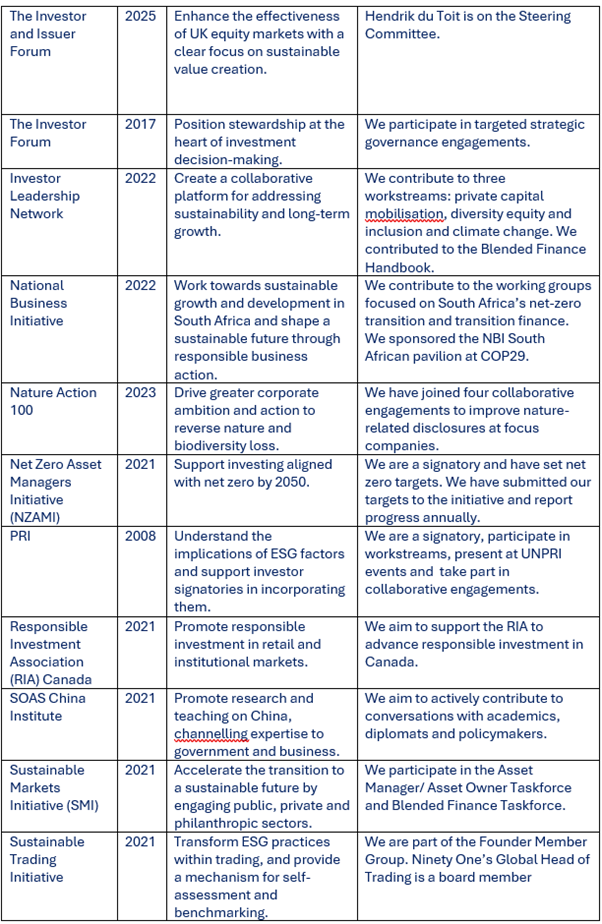

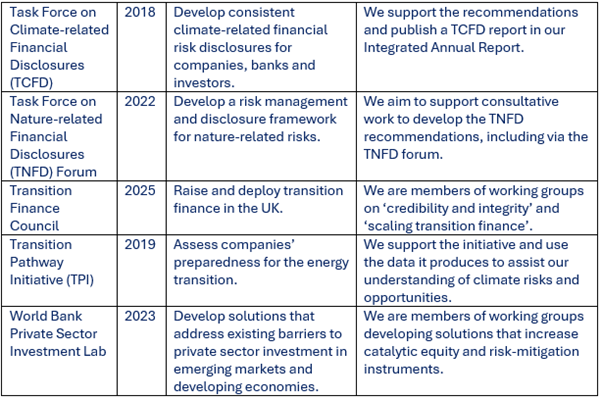

The table below details our firmwide collaborative partnerships and our role:

Our organisation is helping to support the Paris Climate Agreement and the Race to Net Zero by…

… thinking about our investments holistically, as entities operating within society, all depending on the natural environment. Only by understanding connections between these can we consistently make the right decisions to preserve and grow assets entrusted to us for future generations.

Our focus on sustainable development started with our African roots, particularly our private markets focus (equity, credit and infrastructure), which showed us the role that capital has to play.

We believe that ESG considerations should be integrated with all investment processes, across all asset classes. Investing in companies and countries with strong sustainability and ESG performance makes long-term investing sense.

Funds

Disclaimer

Important information

The personal information contained in this document is confidential, and only for the information of the intended recipient.

This communication for professional investors and financial advisors only. It is not to be distributed to retail customers who are resident in countries where the Fund is not registered for sale or in any other circumstances where its distribution is not authorised or is unlawful. Please visit www.ninetyone.com/registrations to check registration by country.

The information may discuss general market activity or industry trends and is not intended to be relied upon as a forecast, research or investment advice. There is no guarantee that views and opinions expressed will be correct. The investment views, analysis and market opinions expressed may not reflect those of Ninety One as a whole, and different views may be expressed based on different investment objectives. Ninety One has prepared this communication based on internally developed data, public and third party sources. Although we believe the information obtained from public and third party sources to be reliable, we have not independently verified it, and we cannot guarantee its accuracy or completeness (ESG-related data is still at an early stage with considerable variation in estimates and disclosure across companies. Double counting is inherent in all aggregate carbon data). Ninety One’s internal data may not be audited. Ninety One does not provide legal or tax advice. Prospective investors should consult their tax advisors before making tax-related investment decisions.

The Funds are sub-fund of the Ninety One Funds Series range (series i - iv) which are incorporated in England and Wales as investment companies with variable capital. Ninety One Fund Managers UK Ltd (registered in England and Wales No. 2392609 and authorised and regulated by the Financial Conduct Authority) is the authorised corporate director of the Ninety One Funds Series range.

This communication is not an invitation to make an investment, nor does it constitute an offer for sale. Any decision to invest in the Fund should be made only after reviewing the full offering documentation, including the Key Investor Information Documents (KIID) and Prospectus, which set out the fund specific risks. Fund prices and copies of the Prospectus, annual and semi-annual Report & Accounts, Instruments of Incorporation and the Key Investor Information Documents may be obtained from www.ninetyone.com.

Daily transactional data is not available to fund investors. Transparency around transactions costs is available to investors via PRIIPs and MiFID methodologies.

THIS INVESTMENT IS NOT FOR SALE TO US PERSONS.

Except as otherwise authorised, this information may not be shown, copied, transmitted, or otherwise given to any third party without Ninety One’s prior written consent. © 2025 Ninety One. All rights reserved. Issued by Ninety One, May 2025.

Indices

Indices are shown for illustrative purposes only, are unmanaged and do not take into account market conditions or the costs associated with investing. Further, the manager’s strategy may deploy investment techniques and instruments not used to generate Index performance. For this reason, the performance of the manager and the Indices are not directly comparable.

If applicable MSCI data is sourced from MSCI Inc. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

If applicable FTSE data is sourced from FTSE International Limited (‘FTSE’) © FTSE 2025. Please note a disclaimer applies to FTSE data and can be found at www.ftse.com/products/downloads/FTSE_Wholly_Owned_Non-Partner.pdf

Targeted or projected performance returns

These are based on Manager’s good faith estimate of the likelihood of the performance of asset classes under current market conditions. There can be no assurances that any investment will generate such returns, that any client or investor will achieve comparable results or that the manager will be able to implement its investment strategy. Actual performance may be adversely affected by a variety of factors, beyond the manager’s control, such as, political, and socio-economic events, adverse changes in the interest rate environment, changes to investment expenses, and a lack of suitable investment opportunities. Accordingly, target returns and expected results may change over time and may differ from previous reports. Additional and supporting information is available upon request.

Hypothetical performance results shown are backtested and do not represent the performance of any account, fund or strategy managed by Ninety One but were achieved by means of the retroactive application, certain aspects of which may have been designed with the benefit of hindsight. The hypothetical back-tested performance does not represent the results of actual trading using client assets nor decision-making during the period and does not and is not intended to indicate the past performance or future performance of any account or investment strategy. If actual accounts had been managed throughout the period, ongoing research might have resulted in changes to the strategy which might have altered returns. The actual performance of any account or investment strategy managed by Ninety One will differ, perhaps materially, from the hypothetical back-tested performance results shown herein. Additional and supporting information is available upon request.

This communication includes results which are not historical or actual in nature but are hypothetical illustrations involving modelling components and assumptions that are required for purposes of such hypothetical illustrations. No representations are made as to the accuracy of such hypothetical illustrations or that all assumptions relating to such hypothetical illustrations have been considered or stated or that such hypothetical illustrations will be realized. Actual events are difficult to predict and are beyond the Firm’s control. Actual events may be different, perhaps materially, from those assumed. No investor or client of the Firm has actually experienced the hypothetical results presented. Additional and supporting information is available upon request.

There is no assurance that the persons referenced herein will continue to be involved with investing assets for the Manager, or that other persons not identified herein will become involved at any time without notice. References to specific and periodic team meetings are not guaranteed to be held or fully attended due to reasonable priority driven circumstances and holidays.

Any description or information regarding investment process is provided for illustrative purposes only, may not be fully indicative of any present or future investments and may be changed at the discretion of the manager without notice. References to specific investments, strategies or investment vehicles are for illustrative purposes only and should not be relied upon as a recommendation to purchase or sell such investments or to engage in any particular Strategy. Portfolio data is expected to change and there is no assurance that the actual portfolio will remain as described herein. There is no assurance that the investments presented will be available in the future at the levels presented, with the same characteristics or be available at all. Past performance is no guarantee of future results and has no bearing upon the ability of Manager to construct the illustrative portfolio and implement its investment strategy or investment objective.

References to particular investments or strategies are for illustrative purposes only and should not be seen as a buy, sell or hold recommendation. Such references are not a complete list and other positions, strategies, or vehicles may experience results which differ, perhaps materially, from those presented herein due to different investment objectives, guidelines, or market conditions. The securities or investment products mentioned in this document may not have been registered in any jurisdiction. More information is available upon request.