ESG: More Than a Protest – Citywire infographic and article

Posted on: March 8th, 2021

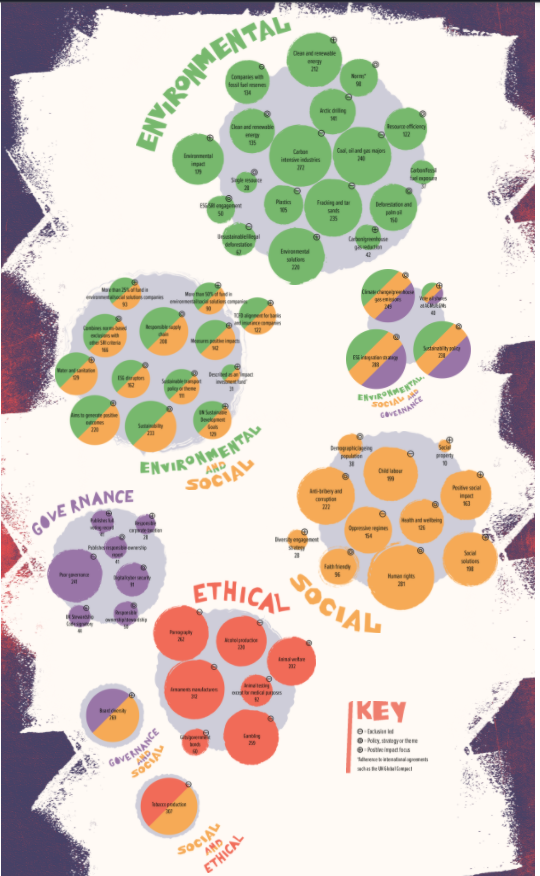

I love this clever infographic New Model Adviser editor William Robins and the Citywire team have created out of a mass of data from our Fund EcoMarket tool…

It illustrates the range of different #ESG & #ethical issues – the number of retail fund options that cover each – and different fund methodologies – all on one image! (See key: Exclusion (-) / Policy, Strategy or Theme (o) / Positive Impact Focus (+) ).

Lots of great articles this week too … finishing off with one from me on the draft (being consulted on) #FCA #sustainableinvestment Principles for retail funds.

Needless to say I am happy to endorse their view that ESG is truly not just a protest!

Direct link to my (FCA principles) article here.

===

You can read the text I submitted to Citywire below:

Developing a more principled approach to sustainable funds

As you will have seen from the infographic, the sustainable investment fund market covers a huge range of issues that can be combined in many different ways.

Some, understandably, see that as a challenge. Others, like myself, welcome the variety – in part as this enables intermediaries to offer more personalised advice to clients – but also because it highlights investors collective power to effect positive change by pulling different levers concurrently.

Having recognised the power of financial markets policymakers are increasingly turning their attention to how to encourage them to help deliver ‘net zero’ swiftly – both by attracting and redirecting investment and by exerting pressure on companies where it is needed.

As a result, there has been a baffling array of international projects, codes, consultations and target setting over recent years. Much is aimed growing ‘solutions’ companies – although encouraging companies to transition away from polluting and unsustainable practices is every bit as important.

The UK remains heavily involved in many of these, including TCFD adoption and IOSCO’s work, however we are yet to finalise whether or how MiFID II and SFDR might apply.

The FCA’s emerging position in retail markets is looking particularly promising, as they have been exploring how to strengthen existing regulatory mechanisms. Their chosen method, which remains ‘work in progress’, is a set of principles that would compliments any future developments – including what ‘matching the EU’s ambition in sustainable finance’ might mean.

The draft Sustainable Investment Principles were first aired by the FCAs Director of Strategy Richard Monks at our ‘SRI Services and Partners Good Money Week event’ in October 2020 – and have been evolving ever since. (A link to the speech is in a blog on Fund EcoMarket – or you can search ‘Building Trust in Sustainable Investment’).

The principles build on the existing requirements to be ‘clear, fair and not misleading’.

They aim to steer fund managers away from ‘greenwashing’ (where environmental credentials are significantly overstated) – whether intentionally or unintentionally – which is damaging most notably both because it risks the misallocation of capital and erodes trust.

The principles took a step forward on the 4th of February when the FCA held a round table event, presenting recent consumer research (which supported the view that there is the potential to mislead clients in this area) and their revised principles.

The themes however remained broadly unchanged. Managers should ensure fund names, objectives, strategies and holdings are aligned – with strategy references being ‘proportionate’ to stock selection and stewardship activity. Fund strategies should, in turn, be communicated to end investors in ways that are ‘accessible’ – both in precontractual regulatory and marketing literature.

Performance against stated ESG (environmental, social and governance) objectives also attract attention – specifically, where funds set KPIs or specify intended ‘real world’ outcomes or impacts – managers should periodically report (to clients) against those aims and objectives. This should include publishing information about methods used and actions taken in pursuit of those aims, quantifying outcomes (as far as is reasonably possible) no matter how big, small, high level or granular. Funds’ use of data forms the final principle. It sets the expectation that firms ensure the data they use, including ESG ratings, is ‘fit for purpose’ and able to be explained in a transparent fashion – including understanding any gaps or limitations.

Based on 25 years specialising in this area I welcome this approach. The principles are neither overly prescriptive or too vague. They position sustainability within existing rules (sustainability is ‘not a bolt on’) and they stand every chance of being relatively future proof. The (draft) wording allow diverse fund strategies to coexist, evolve and improve – as they must. And perhaps best of all – the principles fit on a single side of A4 – meaning that once finalised, they should be able to be implemented swiftly, which is crucial as time is not on our side.

Julia Dreblow

Founding Director of SRI Services and the Fund EcoMarket fund tool

Read more of our blogs on ESG here