FCA Sustainability Disclosure and Labelling Regime published

Posted on: November 28th, 2023

SRI Services is absolutely delighted to welcome the SDR, which is now live.

The information below is our ‘welcome statement’ plus a combination of extracts from the policy statement and our views/opinions and some aspects that financial services professionals should take early note of.

Please note this is for information only and intended to aid conversations about this new development. We are not regulated or authorised to offer advice.

Please see the FCA website for full SDR information (and legal instruments), published 28 November 2023:

===

SRI Services welcomes the publication of SDR…

“This is a really big day. The document has only just been published so I have not fully digested it yet – but from what I have seen the FCA looks to have done a good job making sense of all the feedback we discussed in their DLAG (advisory group) meetings, following the consultation feedback.

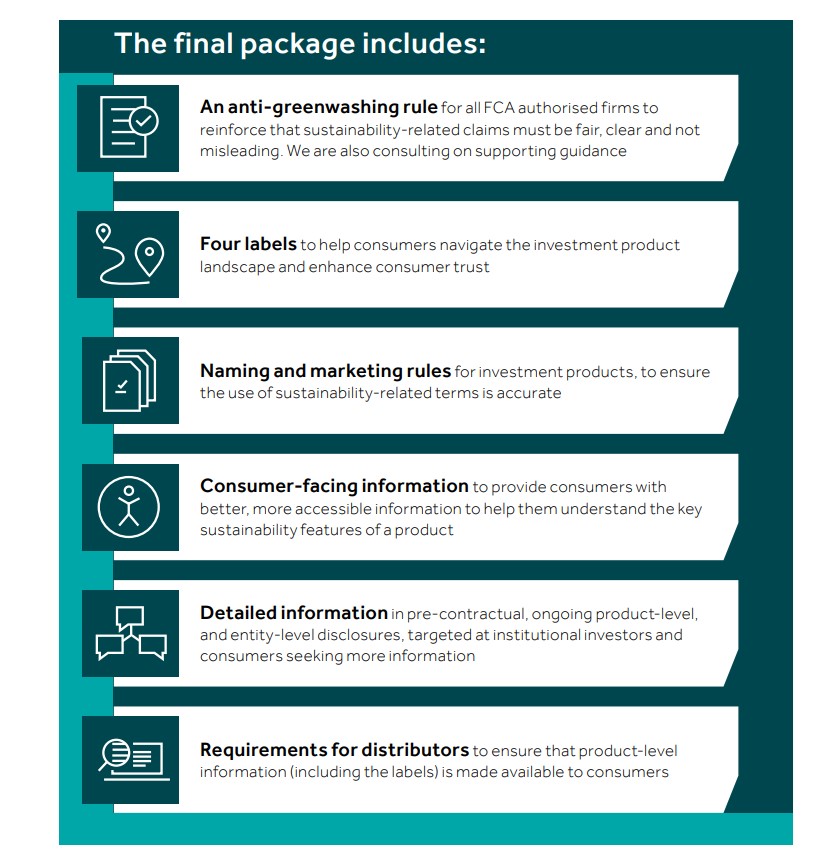

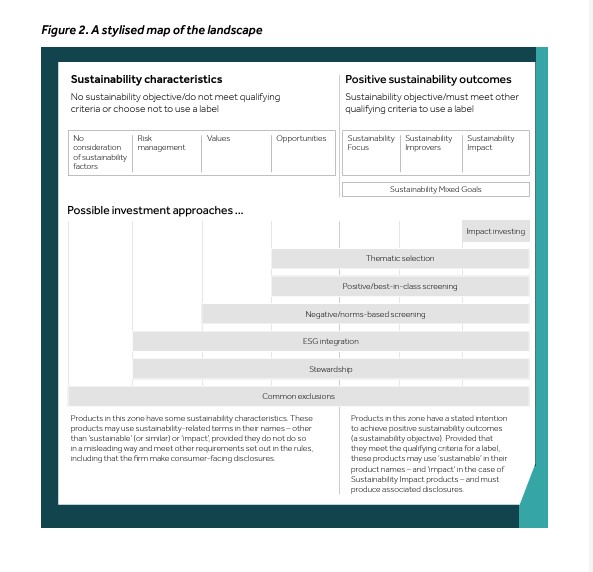

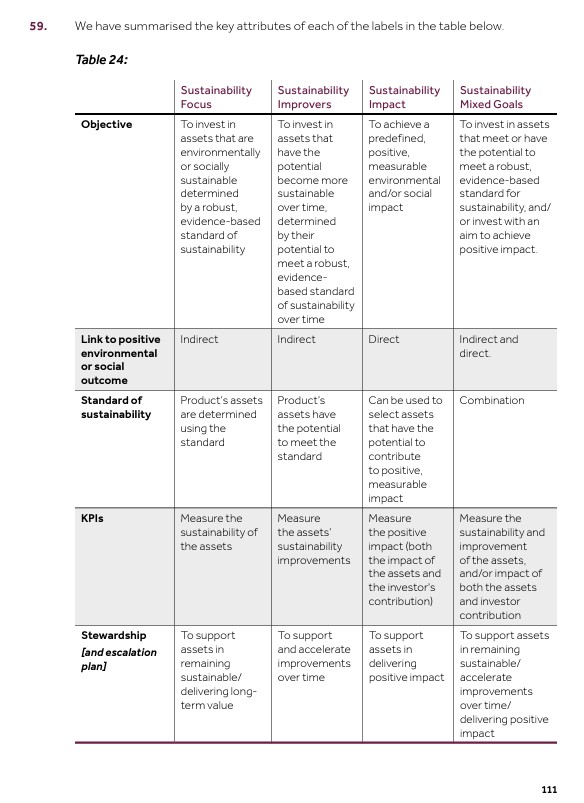

The SDR requirements remain firmly principles based, with some specific requirements articulated where needed. The final paper also includes some significant but welcome changes, such as a shift to four labels (which will help portfolios), and slightly more accommodating naming and marketing rules for funds that do not qualify for the sustainable fund labels, such as (potentially, for example) ethical and ESG integration based funds.

The FCA will continue to work on certain areas. The paper sets out next steps for finalising the greenwash rules, and where we go from here in the advisory portfolios areas. So more will follow. In brief, the starting gun has been fired, we are on our way – but watch this space.”

===

Additional information:

A brief introduction to SDR was included in our newsletter, published on 29 November 2023. View our 29 Nov 2023 Newsletter here.

More recent comment can be found here: What is SDR? article published on 12 March 2024

We have also produced a Brief Introduction to SDR video which talks through the main features of the new rules, indicates a few areas people might like to watch out for, and on the final slides point to how Fund EcoMarket can help intermediaries navigate the topic better.

===

Detailed extracts from policy statements with points we believe to be useful to highlight (15 December 2023):

We aim to update this over time.

DRAFT – Key points for early note and discussion:

Purpose of SDR: flows from UK Green Finance strategy, but focuses on the need to improve (retail) client understanding of sustainable investment options – and therefore helping to deliver better client outcomes

Scope of SDR: Focused on ‘sustainable funds’ but relevant to other funds and communications that talk about ‘environmental’ and ‘social’ issues (to ensure clients are not misled)

Overarching principles… include being ‘clear, fair and not misleading’ (as in Consumer Duty etc)

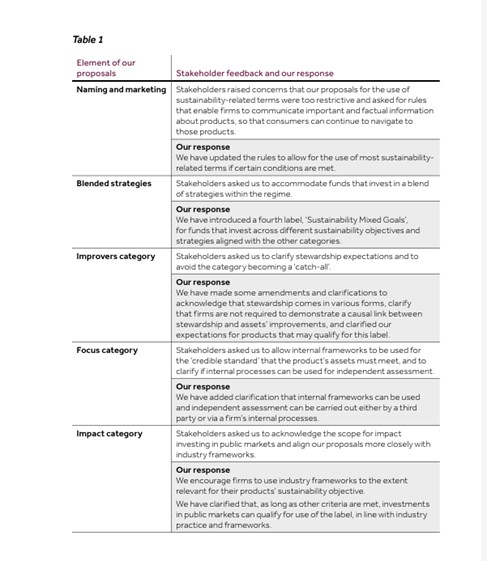

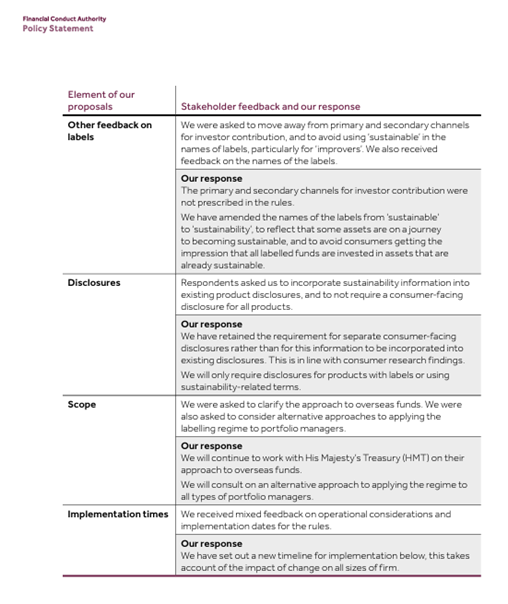

Main changes made since the consultation:

Specific labelling criteria from p105

See Annex 2 p98

Relevant funds will need:

- Objective (to include sustainability)

- Sustainable investment policy and strategy (70%, robust, evidenced… to include articulation of negatives, ‘independent’ assessment, escalation plans p102/3)

- KPIs

- Appropriate resources and governance structure (& info explaining it)

- Stewardship (explain)

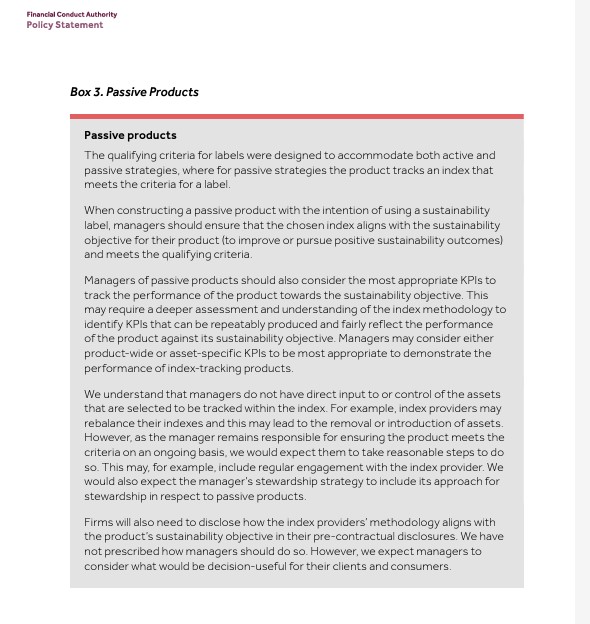

- Index tracking funds to use appropriate index (that ‘matches’ fund objectives)

- & Ongoing reviews of the above

Some points of interest:

- Transparency, credibility and proving you do as you say remain crucial

- Requirement for at least 70% alignment to objectives now applies to all labels

- No assets can contradict objectives*

- Labelled funds to be registered with FCA (online)

- Independent assessment can be internal or external for all labels but must be separate from the investment process

- Impact label – no ‘additionality’ requirement, but need to set out a ‘Theory of Change’

- Annual checking needed eg for literature, appropriateness of label, 70% etc

- Escalation plans for all labels (divestment is not ‘a requirement’)

- Non labelled (NL) funds will need a ‘statement’ if use (environmental and social) sustainability related terms (p115)

Naming and Marketing (p113)

- Labelled and non labelled funds are in scope – ie anything that might mislead clients

- Three protected terms (only): sustainability, sustainable, impact

- Client disclosures must be stand alone and prominent

- 12 monthly reviews

- Entity level reporting to be consistent with TCFD (governance, strategy, risk management, metrics and targets) – can cross refer

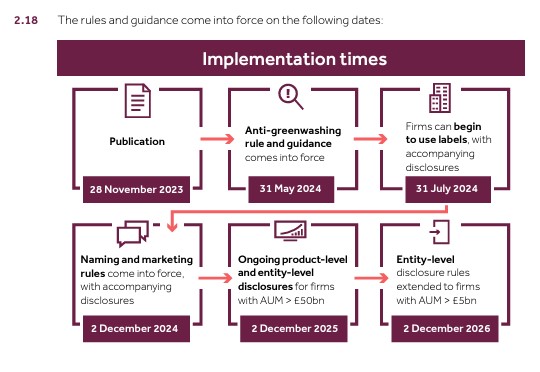

- Links to anti greenwash rules which go live 31 May 2024 (plus additional consultation now live)

p79 Cost Benefit Analysis (CBA) – of note…

Questions / ongoing queries:

The text in [square brackets] indicate our thoughts/responses / suggestions offered during the 15 December meeting.

- Is their a perceived hierarchy in the 4 x SDR labels? ie aspirations to be Sust. Impact, or simply a reflection of what funds already do? [no – the labels are not intended to be hierarchical]

- Do you envisage financial intermediaries filtering the investible fund universe using SDR label(s) as a requirement? As things stand, many ‘responsible’ or ‘ethical’ funds might not achieve one in their current form. [yes, but intermediaries should not only look at labels as clients’ needs are diverse]

- It would be useful to know more about the use of the ‘protected terms’. [The ‘most protected’ terms are ‘sustainable’, ‘sustainability’ and ‘impact’ – see p46 onwards, and eg Annex 2, Appendix 1]

- How might the 30% work in practice? (eg for funds that exclude banks, govvies etc)

- What impact will this have on ethical funds? [nb Fund EcoMarket and RSMR will continue to list and focus on ethical options, but agree this needs exploring further]

- What does this mean for MPS (etc)? [this info will follow]

- The fourth label is good for some areas (eg for multiasset funds, portfolios and DC schemes), but might it be abused?

- How detailed do ‘escalation strategies’ need to be? Should there be one for every individual asset? [our understanding is that this would be probably sensibly be ‘overarching’ but may need to be more specific in places, depending on the strategy]

- Linking this to Consumer Duty ‘Foreseeable Harm’ is great – but could get interesting.

- Trademarked labels…

A big thank you to Stuart Ryan at RSMR who contributed to the ‘pulling together’ of the above notes and aided discussion of this topic at our ‘interactive’ 15 December Teams event.