FCA Financial Lives Survey 2024 – responsible investment highlights

Posted on: May 22nd, 2025

The FCA has just published (May 2025) the findings of its most recent Financial Lives Survey (FLS), from research data collected in 2024.

The 2024 FCA financial lives survey includes analysis of a range of attitudes to sustainable and responsible investment. The report uses the term ‘responsible’.

There are a number of things that jump out from this report for me.

First impressions:

- Public interest in responsible investment appears to be a little lower in 2024 than in 2022, but remains high.

- Across the board, not much as really changed.

- The narrative on some of the slides is unhelpfully negative given high client interest. The data is more useful.

The excerpts below cover some of the numbers that I found most interesting – with a little commentary:

FCA Financial Lives Survey 2024

The 2024 FCA financial lives survey, published in May 2025, explores a range of attitudes to sustainable and responsible investment. Findings include the following.

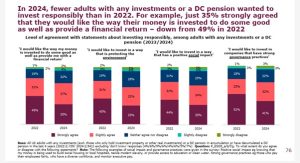

- 72% of adults who already had investments (or a DC scheme) wanted to ‘do some good as well as provide a financial return’. (Slide 76)

- 33% ‘strongly agreed’, an additional 37% ‘slightly agreed’).

- This is a clear majority, but less than the 80% identified in 2022 (which the slide highlights).

- When asked about interest in investing positively to ‘protect the environment’ (65% agreed) ‘have a positive social impact’ (69% agreed) or ‘invest in companies with strong governance practices’ (73% agreed). ie most were in favour, although many were neutral. (Also slide 76) a clear trend emerged:

- Across the board only 7% of respondents expressed disagreement with any of the statements describing positive investment options, whereas 93% of people were either ‘neutral’ or ‘slightly’ or ‘strongly’ across the range of positive investment options in 2024 (down slightly from 95% in 2022)

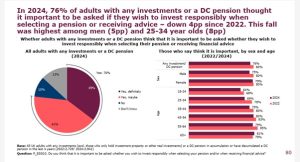

- 76% of adults with any investments or a DC pension thought it was important to be asked if they wish to invest responsibly in 2024. (Slide 80)

- When asked ‘how interested are you in investing in responsible investments in the future?’ 54% of respondents who already had investments or DC schemes, responded positively. This was down from 63% in 2022, but similar to 2020 (57%). (Slide 73)

- By far the biggest decline was amongst respondents aged 18-34. (From 69% in 2022 to 53% in 2024).

- Interests across age groups was relatively equal in 2024 (unlike in 2022), and there was no significant male (54%) female (53%) difference (as in 2022).

- The two most commonly cited reasons why people did not invest responsibly were ‘having too little money’ (22%) and ‘not knowing enough to invest responsibly’ (21%). (Slide 82)

- 58% of adults with any investment were aware of responsible investment (not significantly different from 2022). (slide 72)

Links to FCA data:

- The full research can be found here.

- The ‘Consumer insights’ section which includes information on sustainable and responsible investment is here. (see slides 70-82)

Some thoughts…

To my mind the story remains unchanged from what many of us have been saying for a long while

The majority of people are interested in responsible investing and want to invest to do good – whilst also achieving financial returns.

This highlights the gap between client interest and industry practices.

(The latest Investment Association (IA) research puts the proportion of UK investor funds under management invested in responsible and sustainable funds (both institutional and retail) at 7% in Q1 2025. This is in sharp contrast to the 60-70%+ support indicated in the key questions.)

The level of interest points to a degree of investor resilience to overly negative messaging.

It is not uncommon to read stories about the demise of ESG (which is different from, but not entirely separate from sustainable and responsible investment). It is important to ask why such messages are being communicated.

It remains our hope and expectation that the UK’s SDR should help to address some of the legitimate concerns around poor sustainable investment information – however it is probably too early to see the new rules have impacted this research. Some of the additional FCA slides touched on this area.

With regard to where interest has clearly dropped – there was a big drop amongst younger investors (who were previously outliers) and I suspect that issues such as the cost of living, war, political and economic uncertainty may be more front of mind for some people than they were in 2022. We are living in uncertain times, and some media messaging about environmental issues has been particularly poor recently. The report also does a good job of dispelling stereotypes about differences between age, sex and wealth levels, which are, in my view, too often exaggerated.

This is useful research

Ideally I would have preferred the numbers to have gone up not down, and I dislike some of the narrative on the slides as I fear it may do interested clients a disservice. However I am in no doubt that the data will prove useful over the coming years.

The key takeaways, in my view, is that:

- By far the majority of investors want the way their money is invested ‘to do some good as well as provide a financial return’ (72%)

- Most people (76%) would like to be asked if they are interested in this area when selecting options seeking advice.

These are important messages for the investment, financial advisory and wealth management communities.

Our SRI Stylefinder tool can help financial advisers and wealth managers to get started in conversations with clients .

Our Fund EcoMarket database can help create bespoke portfolios that respond to client’s individual areas of interest, and find funds with SDR labels.

The comments above are based on the following slides (and some experience!):

https://www.fca.org.uk/publication/financial-lives/fls-2024-consumer-investments.pdf