Fund EcoMarket changes – New Styles and Subfund data

Posted on: September 24th, 2020

Over the last six months we’ve been working on a number of pretty major changes to Fund EcoMarket.

App

The first major change, that you may be aware of, was to launch our new, also free to use, App which is available both via Apple and Google App stores (search ‘Fund EcoMarket’).

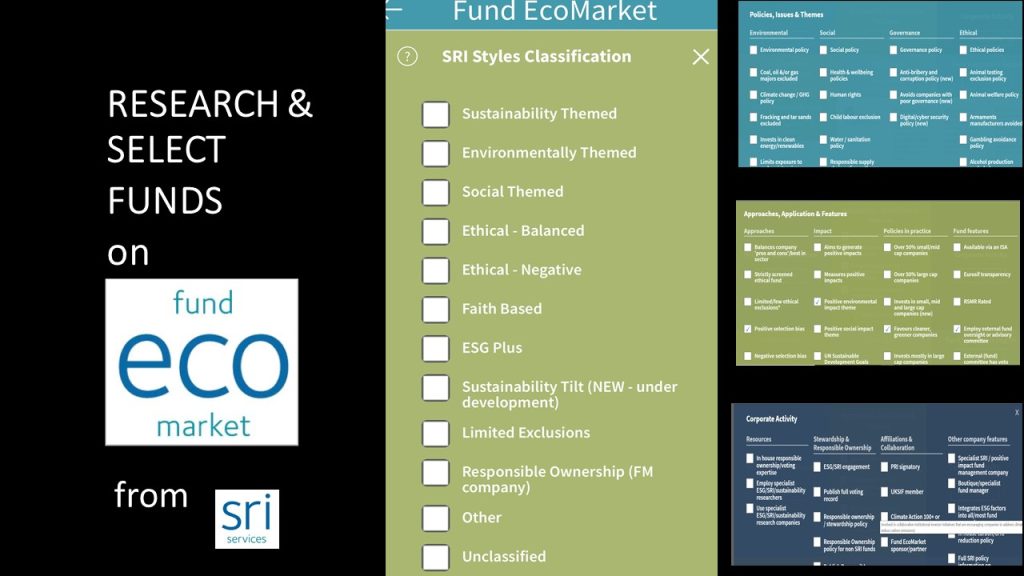

SRI Styles changes

The second major change has been to update our SRI Styles.

This is involved adding a new ‘Sustainability Tilt’ classification for funds which integrate sustainability – but do not use it as a core driver of where they invest. Although similar, these funds differ from ‘Sustainability Themed’ funds – which have a clearer focus on selecting sustainability ‘leaders’ and/or ‘solutions companies’.

This is in addition to the recently added ‘Limited Exclusions’ category – which we use for funds that simply list a small number of areas where they will not invest (typically tobacco and/or armaments companies). Again these funds are similar to but differ from ‘Negative Ethical’ which have a significantly more comprehensive exclusion criteria (and therefore qualify as being ‘ethical funds’).

We have also introduced an ‘Unclassified’ category for funds which we feel unable to classify, normally due to lack of information and a ‘Pending’ classification for funds which we have not yet given an ‘SRI Style’ to.

Part of the reason for making these changes is to help users differentiate between ‘greenwash’ and funds that just happen to be different to what a user might expect.

You can read further about SRI Syles via this link

(Please keep in mind these changes are ‘work in progress’ at the moment. Once complete we will be updating the SRI StyleFinder fact find tool and fact find support documents also so that this all matches up again.)

Fund data being added to sub funds

The third major change has been to redesign the back end of the database so that the information held him ‘primary’ funds – typically OEICs – can be copied across into sub funds which includes life pension and funds held on 3rd party platforms.

Once complete this means our users will be able to search for eg a pension fund that ‘excludes coal, oil and gas majors’ without having to go via teh primary (OEIC) fund listing.

New filter fields for fund sizes, voting and holdings information.

The fourth area of change is the addition of new fields – to make looking for specific information easier. The new fields are: fund size (and related company assets under management size) and url link fields specifically for Voting and Fund holdings information (where supplied).

All of these changes will be on both our website and Fund EcoMarket app.

NB

We are currently working on making these changes – so please keep that in mind when using the site.

We welcome feedback – please do get in touch if you have any questions.

And finally – if you have not done so already you can sign up to our SRI Services & Partners annual Good Money Week event on 21 October here. (Financial Services industry professionals only)