Fund EcoMarket roundup and top 100 searches in 2020

Posted on: January 6th, 2021

Happy New Year…

I very much hope you and yours are well and coping with the situation we find ourselves in once again.

COVID, aside (and that is the last time I will mention it) 2020 was another great year for SRI Services.

This blog is to give you a quick overview of how last year went… including a list of what Fund EcoMarket users searched for most often in 2020, plus some links.

But first it is important to reiterate that our aim remains to do everything we can to help change the way people invest – for the better. For us that means making sure everyone (first and foremost IFAs) has access to high quality, detailed information on sustainable, responsible and ethical investment funds.

We are able to offer this for free thanks to our wonderful partners – so a big thank you to Rathbones, Pictet, Sarasin and Partners, Liontrust, Quilter Cheviot, Unicorn, Foresight, JanusHenderson, M&G, Triodos, Aegon, WHEB, EdenTree, BMO and Aberdeen Standard – and a warm welcome to our newest partners BNY Mellon and Fidelity!

‘External’ activity in 2020

As you may be aware, we work with a range of third party service providers, regularly speak at events (media, industry associations, IFA firms and for our partners) and collaborate with (in various forms) some important industry bodies – notably being an UKSIF director, on TISA committees and speaking regularly with the FCA . We also helped create the new PIMFA ESG Academy (that I was the ‘technical author’ of. In brief – the course is 5 hours of free to members, online, ESG CPD’able training).

Videos

You may like to watch the ESG Mastrclass keynote talk I recorded for Professional Adviser’s ESG Conference in October. The 30 minute session is called ‘The Giant Awakes’ and is a gallop through the massive shifts that are taking place in our sector right now and some practical tips. It is on our YouTube channel here (‘rebranded’ with the PA name removed – see link below).

The most popular video on our YouTube channel last year was, by a country mile, the keynote address given by Richard Monks, FCA Director of Strategy, at our Good Money Week event. Regulation remains a hot topic (and ‘work in progress’) – as you will be aware – but his content remains current. Richard’s presentation is linked here.

Please click ‘Subscribe’ on the channel to be kept informed.

Some key Fund EcoMarket changes in 2020 were:

- populating life and pension fund entries with the information from their corresponding (primary)

OEIC funds so you can search all product types.

OEIC funds so you can search all product types. - splitting the ‘Sustainability’ ‘SRI Style’ Classification on Fund EcoMarket in two – to make fund differences more obvious. Our view remains that understanding what funds actually do remains the central tenet of being able to give sound advice in this area.

- The two classifications are now ‘Sustainability Themed’ (for themed funds where sustainability issues and opportunities are the core focus/purpose of the fund) and ‘Sustainability Tilt’ (for funds that favour companies with higher sustainability standards – but may invest across all or most sectors).

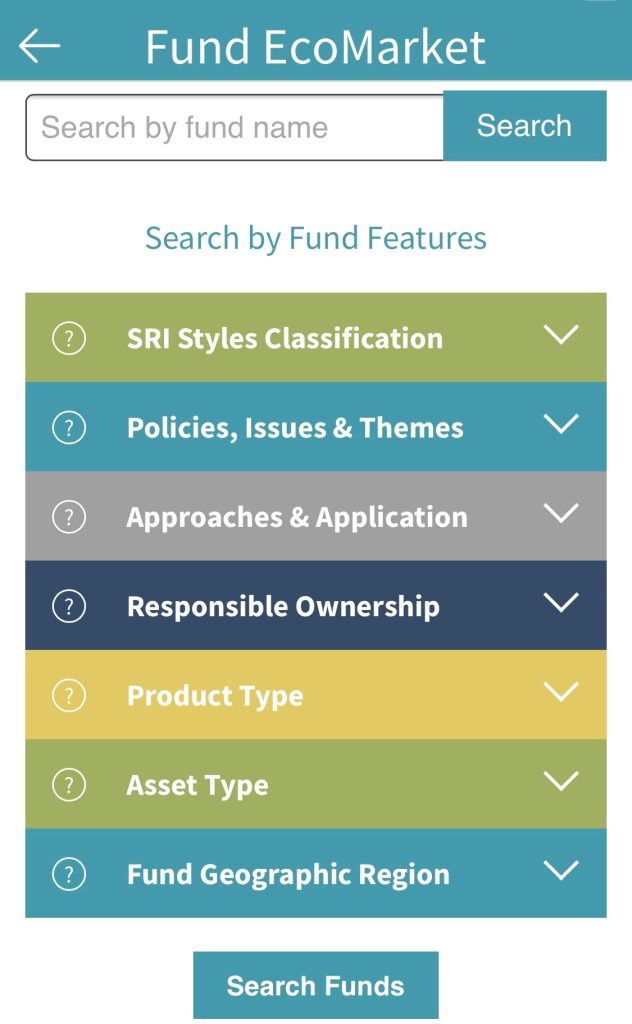

- Creating a new free to use App (search ‘Fund EcoMarket’ via your normal App provider to downlad it).

Website user information 2020

The number of users of our site increased rapidly again last year. The numbers (courtesy of Google Analytics) are below:

- 2020 Unique Users: 17,000 (2019 Total Unique Users – 11,363). This marks an increase of 44.3% from 2019.

- 2020 Sessions: 26,000 (2019 Total sessions – 18,000). This marks an increase of 45.8% from 2019.

- Average user time 4 minutes 40 (broadly unchanged)

Who & when?

We do not have (or want) systems that track exactly who is using Fund EcoMarket, but Google Analytics tells us that in 2020 Fund EcoMarket users were:

- 76% in the UK

- almost all using the site between 8am and 6pm

- 87% accessed the site via desktop computers

… meaning that we are probably getting to our ‘intended audience’ – UK investment professionals (although happy to help other interested people also!)

And finally, below is the 2020 list of the most frequently searched options on Fund EcoMarket. Again this is very diverse, showing the range of information that needs to be brought together to offer advice on this area. Four ‘SRI Styles’ were in the top 15 searches – alongside more generic searches like ‘asset types’. The top individual issue (as previously) was ‘Avoids Coal, Oil and Gas Majors’ (13), with ‘Avoids Armaments’ and ‘Avoids Tobacco’ (16 & 17) not far behind. The highest more positive strategy was ‘Invests in clean energy/renewables’ (at 28).

Top 100 searches carried out Fund EcoMarket during 2020:

| 1. OEIC/Unit Trust |

| 2. Sustainability Themed |

| 3. Equity |

| 4. Global |

| 5. Mixed Asset |

| 6. Environmentally Themed |

| 7. UK |

| 8. Ethical – Balanced |

| 9. Environmental policy |

| 10. Fixed Interest |

| 11. Equity Income |

| 12. Ethical – Negative |

| 13. Coal, oil &/or gas majors excluded |

| 14. Sustainability policy |

| 15. Investment Trust |

| 16. Armaments manufacturers avoided |

| 17. Tobacco production avoided |

| 18. Unclassified |

| 19. Passive Equity |

| 20. Climate change / GHG policy |

| 21. ESG Plus |

| 22. Europe |

| 23. Asia Pacific |

| 24. USA |

| 25. Not Set |

| 26. ETF |

| 27. Emerging Markets |

| 28. Invests in clean energy/renewables |

| 29. Pension |

| 30. Fracking and tar sands excluded |

| 31. SICAV/Offshore* |

| 32. Property |

| 33. Social Themed |

| 34. Europe Ex-UK |

| 35. Animal testing exclusion policy |

| 36. Animal welfare policy |

| 37. Asia Pacific ex Japan |

| 38. Gambling avoidance policy |

| 39. Deforestation / palm oil policy |

| 40. Pornography avoidance policy |

| 41. DFM/Portfolio Planner* |

| 42. Human rights policy |

| 43. Child labour exclusion |

| 44. Europe >50% UK |

| 45. Ethical policies |

| 46. Infrastructure |

| 47. Favours cleaner, greener companies |

| 48. Sustainability themed |

| 49. Limits exposure to carbon intensive industries |

| 50. Responsible Ownership (FM company) |

| 51. Environmental damage and pollution policy |

| 52. Social policy |

| 53. Clean energy themed |

| 54. Not set |

| 55. Positive environmental impact theme |

| 56. Alcohol production excluded |

| 57. Plastics policy / reviewing plastics |

| 58. Indian sub-continent |

| 59. Governance policy |

| 60. Other |

| 61. Arctic drilling exclusion |

| 62. Ethically Balanced |

| 63. Health & wellbeing policies |

| 64. Strictly screened ethical fund |

| 65. Positive selection bias |

| 66. Avoids companies with fossil fuel reserves |

| 67. Nuclear exclusion policy |

| 68. Janus Henderson Global Sustainable Equity |

| 69. Oppressive regimes exclusion policy |

| 70. Negative selection bias |

| 71. Available via an ISA |

| 72. Avoids companies with poor governance |

| 73. Aims to generate positive impacts (or ‘outcomes’) |

| 74. Anti-bribery and corruption policy |

| 75. Rathbone Ethical Bond |

| 76. Sustainable transport policy or theme |

| 77. Faith Based |

| 78. Unsustainable / illegal deforestation exclusion policy |

| 79. Invests in environmental solutions companies |

| 80. Responsible supply chain policy or theme |

| 81. Balances company ‘pros and cons’/best in sector |

| 82. Positive social impact theme |

| 83. Liontrust Sustainable Future Global Growth Fund |

| 84. Hedge |

| 85. Excludes animal testing except for medical purposes |

| 86. Aims to generate positive impacts |

| 87. ESG integration strategy |

| 88. ESG/SRI engagement (company wide) |

| 89. Measures positive impacts |

| 90. Employ specialist ESG/SRI/sustainability researchers |

| 91. Water / sanitation policy |

| 92. Resource efficiency policy or theme |

| 93. FP WHEB Sustainability Fund |

| 94. Life |

| 95. Negative Ethical |

| 96. UN Sustainable Development Goals (SDG) focus |

| 97. In house responsible ownership/voting expertise |

| 98. Liontrust Sustainable Future UK Growth Fund |

| 99. Tobacco avoidance policy (AM company wide) |

| 100.Use specialist ESG/SRI/sustainability research companies |

https://mailchi.mp/732d3f977a5a/sri-services-and-fund-ecomarket-news

OEIC funds so you can search all product types.

OEIC funds so you can search all product types.