HLEG – EU sustainable finance interim report published

Posted on: July 19th, 2017

The EU has recently published its High Level Expert Group (HLEG) Sustainable Finance interim report.

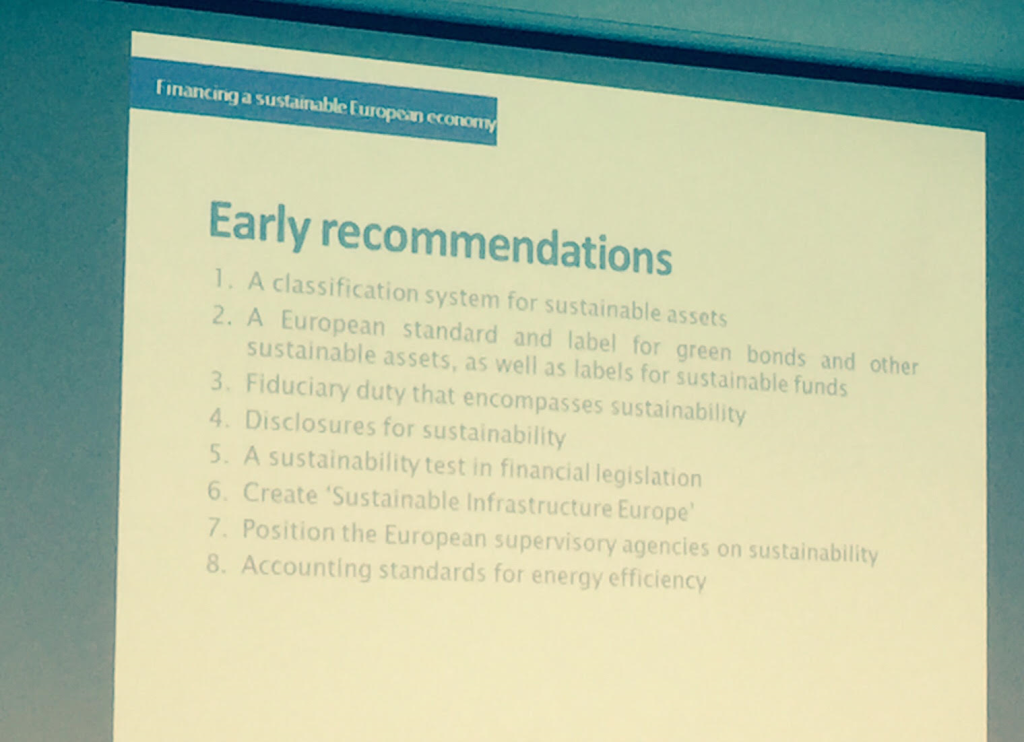

This ambitious and significant report covers issues ranging from financing greener infrastructure to the labelling SRI funds.

Although mainly aimed at institutions the implication is that the final recommendations will also impact individual (retail) investors.

The EU plans to start implementing changes at the start of 2018 – which means that no matter what happens with Brexit this will be relevant to the UK investors.

It is of course not the lightest of holiday reads – but much of the text should chime with UK investors, perhaps because a quarter of the HLEG (effectively the report authors) are from the UK.

If you share my view that we need to get behind (and add our opinions to) this important piece of work in order to help shape a cleaner, greener economy – then please take this opportunity to read the report and respond either directly, or via myself or Fergus at UKSIF. (Fergus.Moffatt@uksif.org)

For links to all relevant information from their website – here.

You can download the full interim report here.

Responses (via this link) were invited from until 20 September.

Julia@sriServices.co.uk

https://ec.europa.eu/info/business-economy-euro/banking-and-finance/sustainable-finance_en