Independent Assessment of UK Climate Risk – report

Posted on: June 17th, 2021

I can’t say I have made it all the way through the third (UK) Climate Change Risk Assessment (CCRA3) report – issued by the Climate Change Committee yesterday just yet – but a read of the executive summary tells us that the UK is a failing to address climate change related risks.

Indeed the report highlights that even on the ‘adaptation’ side of the climate equation (by which we effectively mean protecting ourselves from the damage we have brought on ourselves) the gap between climate related risks – and taking the measures needed to protect ourselves against those risks – is growing.

The following link is to the Climate Change Committee’s CCRA3 website with links to the report, technical information, animations and more.

Or you can access the CCRA3 report directly here:

Independent-Assessment-of-UK-Climate-Risk-Advice-to-Govt-for-CCRA3-CCC

As a brief summary I have copied the key findings of the report below also:

Key findings

The Advice Report provides the Adaptation Committee’s statutory advice to Governments on priorities for the forthcoming national adaptation plans and wider action. It is informed by extensive new evidence gathered for the accompanying Climate Change Risk Assessment (CCRA3) Technical Report. More than 60 risks and opportunities have been identified, fundamental to every aspect of life in the UK covering our natural environment, our health, our homes, the infrastructure on which we rely, and the economy.

- Alarmingly, this new evidence shows that the gap between the level of risk we face and the level of adaptation underway has widened. Adaptation action has failed to keep pace with the worsening reality of climate risk.

- The UK has the capacity and the resources to respond effectively to these risks, but it has not yet done so. Acting now will be cheaper than waiting to deal with the consequences. Government must lead that action.

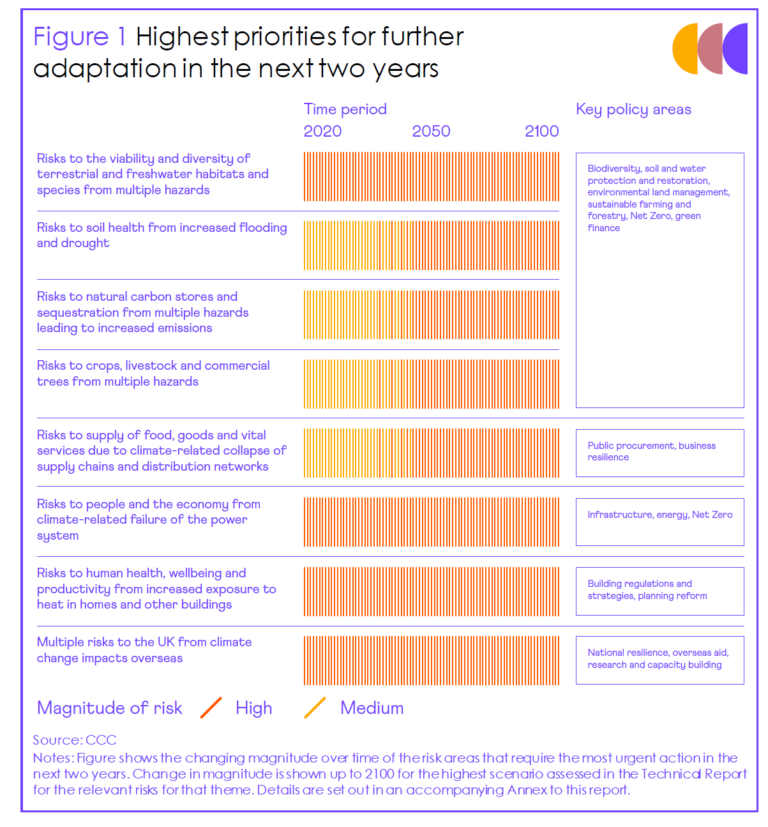

- The Committee identifies eight risk areas that require the most urgent attention in the next two years. They have been selected on the basis of the urgency of additional action, the gap in UK adaptation planning, the opportunity to integrate adaptation into forthcoming policy commitments and the need to avoid locking in poor planning, especially as we recover from the COVID-19 pandemic.

- The Committee also reports on the full set of 61 risks and opportunities. These must be considered in the next set of national National Adaptation Plans, due from 2023.

- The Committee recommends ten principles for good adaptation planning that should form the basis for the next round of national adaptation plans. These are intended to bring adaptation into mainstream consideration by Government and business.