Six Monthly Fund EcoMarket user report – exploring sustainable investment trends.

Posted on: July 13th, 2021

This information relates to Fund EcoMarket user activity from 1 January – to 30 June 2021

Key findings:

- Use of the Fund EcoMarket (retail sustainable investment fund tool) website increased by 15% over the six months to 30 June (from H2 2020), pointing to continued growth in interest in retail ESG and sustainable investment.

- The top 3 searches over this period were ‘OEIC/Unit Trust’, ‘Sustainability Themed’ (an SRI Style) and ‘Equity’.

- As this ‘top 3’ indicate, users continue to search for generic ‘product’ and ‘asset type’ information frequently – alongside sustainability and ESG (environmental, social and governance) requirements. This indicates the importance of intermediaries being able to combine different types of information so that they can offer advice and plan portfolios.

- 6 of our 8 SRI Styles are in the top 50 searches (Sustainability Themed, Environmentally Themed, ESG Plus, Sustainability Tilt, Ethical, Social Themed), indicating the usefulness of our fund segmentation to intermediaries.

- Major sustainability and climate change related filter options remain the most common ‘issues’ related searches. The highest were ‘Climate Change / greenhouse gas emissions policy’ (13th place) and ‘Avoids coal, oil and gas majors’ (17th place).

- Many of the issues that the ESG/SRI community are most focused on are not regularly searched for (eg impact, regulation, stewardship and net zero). There are many possible explanations – including that key message may not be reaching intermediaries yet.

- The total estimated value of the OEIC funds we list is £80 billion. (This may include some double counting and some funds do not supply data).

Data overview

- There were 731 funds listed on Fund EcoMarket at the end of June 2021.

- 341 of these are ‘primary’ funds, of which 200 are OEICs. The others are Investment Trusts, SICAVS, ETFs and NURS funds (not currently all ‘whole of market’).

- The information shown here, including the ‘top 50 searches’ list below, is based on 25,952 ‘events’ (clicks), carried out during 16,000 ‘sessions’, by 10,000 ‘unique users’. (Source – Google Analytics – which tracks clicks on individual filters and fund options). During 2020 (Jan-Dec)Fund EcoMarket had 17,000 unique users who carried out 26,000 searches. Use of the site during 2020 was c45% higher than in 2019.

Largest and most often searched for SRI Styles

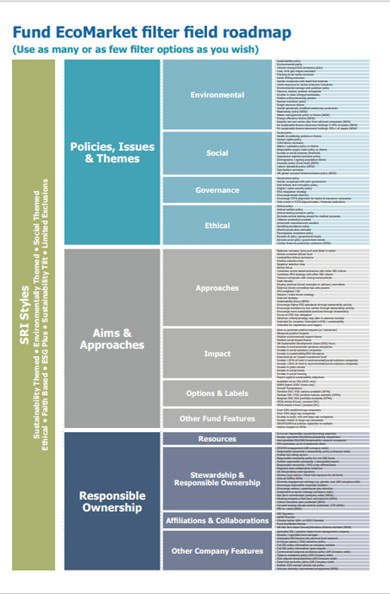

Funds on Fund EcoMarket are split into ‘SRI Styles’, our own classification system, that helps users recognise core fund similarities and differences. We have classified funds by SRI Styles for 10 years and the system is regularly amended to take account of market changes.

The largest and most often searched for ‘SRI Style’ is ‘Sustainability Themed’ which are funds with deep dive sustainability strategies. We classify 96 funds as Sustainability Themed. This filter was the second most popular search option (after ‘OEIC’).

Many Sustainability Themed funds (68) ‘Aim to generate positive impacts and outcomes’ (a filter option). 51 of these also ‘Measure positive impacts’, meaning that 51 Sustainability themed funds meet the two core requirements for being regarded as an ‘impact fund’ – although only 9 of these say their funds are ‘Described as an impact investment fund’. This points to variations in methodologies as well as intentionality (wider aims).

Sustainability Themed funds make up approximately half of the funds that tell us they ‘Aim to deliver positive impacts’ and ‘Measure their positive impacts’ (51/100). The other half are funds classified as Ethical, Social Themed and Environmental Themed – which indicates significant variations in impact related and stock selection strategies.

Environmental Themed funds were the second most searched for SRI Style, raking 6th in the overall searches. This style comprises 47 (primary) funds. Their strategies are highly diverse, ranging from focusing on a single sector to broad based multi asset approaches. Their emphasis on impacts and outcomes also varies.

Ethical funds. During Q1 we changed the classification for ‘Ethical’ funds (41 fund options) – bringing our previous ‘Balanced Ethical’ and ‘Negative Ethical’ classifications together. If the new classification had applied from January ‘Ethical’ would have been the 4th most commonly searched (overall) filter option. Our view is that this continued appeal is most probably the result of a combination of factors – including the typically extensive and thoughtful nature of these strategies, their being well established and developed, and the fact that most now significantly integrate sustainability issues into their methodologies.

The second largest group of funds is ‘ESG Plus’ (54 funds), which ranked 24th in the H1/2021 searches. These are funds where the lead strategy is ESG (environmental, social and governance) risk mitigation and ‘how’ companies operate and are managed today. To achieve this classification the funds must also demonstrate that they are intended for clients with an interest in this area – which means having additional exclusion criteria and/or extensive stewardship activity.

The third largest SRI Style is ‘Sustainability Tilt’ funds (48 funds). This option ranked 30th in user searches. These funds typically ‘overweight’ the companies that manager consider to be ‘more sustainable’ – or in other words – those with more forward looking strategies that reflect the rapidly changing environmental and social landscape. These funds do not typically have extensive exclusions, although they often avoid the most contentious companies such as tobacco and armaments manufacturers. Leading funds tend to have extensive stewardship programmes aimed at encouraging higher sustainability standards. Some hold and engage with major oil companies – encouraging them to transition to more sustainable practices, as seen during the recent ‘voting season’.

See our ‘SRI Styles Directory’ here.

What are users searching for (and not searching for)?

High ranking specific searches of note:

- The highest individual issue search was ‘Climate change / greenhouse gas emissions policy’ at number 13 (up from 23rd place in the second half of last year).

- The next highest issue related search was ‘Coal, oil &/or gas majors excluded’ in 17th place (up from 21st place over the second half of last year).

- ‘Deforestation/ palm oil policy ’ – a key biodiversity issue – remained in 39th place (unchanged from H2 2020).

- Core ‘ethical’ exclusions remained high, indicating that traditional ethical values remain important to many clients. ‘Armaments manufacturers avoided’ and ‘Tobacco production avoided’ remained high – at 21 and 26 respectively. ‘Animal welfare policy’ and ‘Animal testing exclusion policy’ ranked 32 and 35.

- ‘Social Themed’ (SRI Style) ranked 41st – although the highest specific social issue remained ‘Child labour exclusion’ at 47. ‘Human rights policy’ was 52nd. The relatively low ranking of social issues may surprise some given the level of scrutiny social issues have received during the covid pandemic.

Options that ranked lower than we might hope or expect:

The all-important ‘Aims to generate positive impacts (and outcomes)’ just missed this top 50, coming in at 56 – although ‘Invests in clean energy/renewables’, a key ‘positive’ investment strategy – was in 30th place.

The other key means by which investors can (and must) help deliver positive change – through responsible ownership – was not regularly researched. The highest-ranking filter option in that area was ‘Responsible ownership / stewardship policy (company wide)’ which ranked 124th. Although relatively low it is notable that people searched for this as a fund management company wide strategy, rather than as a fund specific feature.

About ‘Net Zero’… We added a number of new filter options at the start of the year so that users would be able to find funds and fund management companies that were focused on achieving ‘Net Zero’ (carbon emissions), the importance of which cannot (and must not) be underestimated.

The fund level filter option ‘Require Net Zero action plan from all/most companies’ ranked 135th. The two Net Zero related fund management company wide options (which are found in the Responsible Ownership filter) – ‘Net Zero commitment’ and ‘Working towards a net zero commitment’ – both ranked around 170th. Each was selected fewer than 50 times. There are 58 primary funds available from fund managers who selected at least one of these.

The also high profile (EU) SFDR Article & & 9 classifications do not appear to have resonated with our users yet. They ranked 617 & 618 respectively, with very few clicks.

(The top 50 searches are listed below, as are the number of funds in each product types – and SRI Style. See appendix.)

Additional thoughts on these findings:

Commenting on these findings SRI Services and Fund EcoMarket founder Julia Dreblow added:

“In this COP26 year – and as temperatures soar in Western Canada – it is more important than ever that the financial services and fund management communities work together to help deliver long overdue progress in areas like climate change and biodiversity loss.

The continued growth of interest in this area is however most welcome. This analysis indicates that finding simpler ways to explain sustainable and ESG options to intermediaries is incredibly useful – although it must be backed by more granular information to avoid potential mis-selling risks.

My hope is that this brief analysis will once again contribute to the conversations that need to happen – and that our tool will continue to encourage openness and transparency that are our primary weapons in the fight against both intentional and unintentional greenwash.

Although I would personally have chosen to put net zero and biodiversity related criteria right at the top, closely followed by human rights and diversity, it is nonetheless hugely heartening to see climate change related options moving ever higher – as that means climate issues are increasingly striking a chord with intermediaries and their clients.

This is good news as we are fast approaching a time when climate risk will really start to hit asset values and I do not want individual investors to be left to pick up the tab.”

About Fund EcoMarket

The purpose of our business is to help change how people invest. The purpose of the Fund EcoMarket tool is to ensure that all intermediaries have easy access to comprehensive information on sustainable, responsible, ethical and ESG fund strategies that they can match to client aims.

Our ‘open to all’ approach means that everyone has the ability to invest in line with their personal opinions, be ‘part of the solution’, and help accelerate the urgently needed shift towards sustainable lifestyles.

Fund EcoMarket is designed for intermediaries but open to all. It is free to use thanks to the support of 19 fund management groups: Rathbones, Liontrust, Pictet, Sarasin & Partners, Triodos, Quilter Cheviot, Unicorn, M&G, Janus Henderson, Aegon, WHEB, Foresight, EdenTree, Aberdeen Standard, BMO, BNY Mellon, Fidelity, Stewart Investors and Jupiter. Partner funds are listed first and display their logos – however we make every effort to include all relevant regulated, retail, onshore funds in order to assist IFAs and other intermediaries.

Fund EcoMarket content and use

Fund EcoMarket was launched in 2011. It has evolved, expanded and developed over the years in line with the market – focusing on what explaining funds do and how they operate. For example, both the ‘ESG Plus’ and ‘Sustainability Tilt’ SRI Styles are relatively new – having been created to help reduce the risk of mis-selling as their strategies need some explaining.

There are currently over 180 filter options showing different ESG/sustainable/ethical characteristics. This range reflects the wide range of client aims, fund strategies and issues that need to be tackled. The site also carries extensive explanatory text and links.

All filter information, text and links (except our SRI Styles classifications) is supplied directly by fund managers in order to ensure the information we present matches fund strategies, policies and aims as closely as possible.

Fund EcoMarket is also available as a (free) App – which, like the website – also has a report generation function to support intermediaries’ due diligence processes.

You are welcome to cite this information quoting ‘SRI Services’ as the source.

Appendices:

Top 50 Fund EcoMarket searches from 1/1/21 to 30/6/21.

| 1. OEIC/Unit Trust |

| 2. Sustainability Themed [SRI Style] |

| 3. Equity |

| 4. Mixed Asset |

| 5. Global |

| 6. Environmentally Themed [SRI Style] |

| 7. UK |

| 8. Sustainability policy |

| 9. Environmental policy |

| 10. Investment Trust |

| 11. Fixed Interest |

| 12. Passive Equity |

| 13. Climate change / greenhouse gas emissions policy |

| 14. Unclassified |

| 15. Ethical [SRI Style] |

| 16. Equity Income |

| 17. Coal, oil &/or gas majors excluded |

| 18. SICAV/Offshore |

| 19. Europe |

| 20. Not Set |

| 21. Armaments manufacturers avoided |

| 22. Asia Pacific |

| 23. ETF |

| 24. ESG Plus [SRI Style] |

| 25. DFM/Portfolio Planner |

| 26. Tobacco production avoided |

| 27. Emerging Markets |

| 28. USA |

| 29. Invests in clean energy/renewables |

| 30. Sustainability Tilt [SRI Style] |

| 31. Ethical (Balanced) [SRI Style – now merged with Ethical] |

| 32. Animal welfare policy |

| 33. Asia Pacific ex Japan |

| 34. Europe Ex-UK |

| 35. Animal testing exclusion policy |

| 36. Ethical policies |

| 37. Europe >50% UK |

| 38. Fracking and tar sands excluded |

| 39. Deforestation / palm oil policy |

| 40. Social Themed [SRI Style] |

| 41. Arctic drilling exclusion |

| 42. Infrastructure |

| 43. Favours cleaner, greener companies |

| 44. Pension |

| 45. Social policy |

| 46. Limits exposure to carbon intensive industries |

| 47. Child labour exclusion |

| 48. Property |

| 49. Avoids companies with fossil fuel reserves |

| 50. Environmental damage and pollution policy |

Total funds in each product group:

| OEIC funds* | 200 |

| Investment Trusts (IT) * | 19 |

| Pension funds (typically sub funds): | 230 |

| SICAVs: * | 94 |

| Life funds: | 109 |

| NURS fund:* | 5 |

| ETFs* | 23 |

| DFM/portfolios listed with details | 15 |

|

*Total primary funds (OEIC, SICAV, ETF, IT, NURS) |

341 |

| Total number of funds on Fund EcoMarket | 731 |

Number of Primary funds classified in each ‘SRI Style’

| Sustainability themed | 96 |

| Environmental theme | 47 |

| Social theme | 17 |

| Ethical | 41 |

| Faith based | 5 |

| ESG plus | 54 |

| Sustainability tilt | 48 |

| Limited exclusions | 22 |

| Other/unclassified/pending | 11 |

For information on our SRI Styles see https://fundecomarket.co.uk/help/sri-styles-directory

Download the Fund EcoMarket brochure here.