SRI Services & Partners Good Money Week event 2021

Posted on: September 18th, 2021

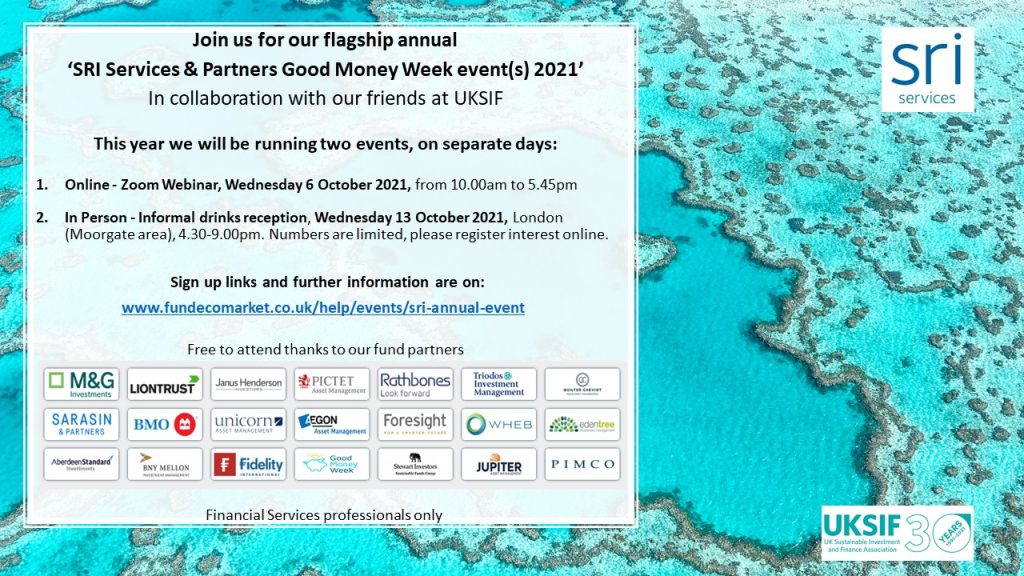

We are delighted to invite you to sign up to our annual event which is being held in two parts this year: an all day Zoom conference on 6 October, and an informal London drinks reception on 13 October.

Sign up links for both events are below.

6 October all day event

10 am – 5.45pm, Zoom

Our annual event is a deep dive conference for financial services intermediaries – intended to build knowledge of sustainable, responsible, ESG and ethical funds.

- The day comprises presentations and panel sessions

- The CISI has approved the event for 6 hours of CPD.

- Our keynote speaker this year (at 11am) is Mark Manning of the FCA.

- The event is free to attend event and open to all financial advisers, financials services intermediaries and related retail financial services professionals.

- Members of the public and individual investors are not able to attend.

Register here to attend our 6 October (Zoom) conference.

Agenda

(Please note timings and details may vary slightly on the day).

10- 10:25 Introduction

- Julia to welcome guests

- Agenda run through & market overview

- SRI Services update

10:30 10.55

- UKSIF – introduction to UKSIF & their work & Good Money Week Update

- CEO James Alexander

11:00 – 11.30 KEYNOTE FCA Mark Manning, Technical Specialist, Sustainable Finance and Stewardship

11:30 – 11.40 Break

11.40 – 12.30 Fund Manager Panel 1

- Diversity, inclusion and equality. Why do ‘people issues’ matter to companies, investors – and beyond? What can we learn from recent events & what does ‘good’ look like?

-

- Miranda Beacham – Aegon Asset Management

- Alex Game – Unicorn Asset Management

- Freddie Woolfe – Jupiter Asset Management

- Kaboo Leung – PIMCO Europe Ltd

- Harriet Parker – Liontrust Asset Management

12.35 – 1.15 Fund Manager Panel 2

- Biodiversity and supply chain management. How can investors ensure they are not effectively responsible for habitat destruction? How do investors manage supply chain issues?

- Jennifer Boscardin-Ching – Pictet Asset Management

- Adam Robbins – Triodos Investment Management

- Mohan Gundu – Stewart Investors

- Neville White – EdenTree Investment Management

13:15 -14:20- Lunch Break

- UKSIF CEO James Alexander in a pre-recorded interview Professor Dasgupta, author of the government’s recent report into biodiversity loss

14:20-15.00 – Fund Manager Panel 3

- Climate change – the facts. A discussion of recent international developments, why ‘net zero’ and +1.5-2 degrees matter and what we can expect from COP26.

-

- Vicki Bakhshi – BMO Asset Management

- Randeep Somel – M&G Investments

- Amarachi Seery – Janus Henderson Investors

- Ben McEwen – Sarasin & Partners

15.05 – 15:45 – Fund Manager Panel 4

- Responding to the climate emergency. Are investors responding with the ‘necessary urgency’? What options are available to investors – large and small? What ‘escalation options’ are available? What do ‘good’ and ‘bad’ look like?

-

- Mark Brennan – Foresight Group

- Lloyd McAllister – BNY Mellon

- David Harrison – Rathbones

- Cornelia Furse – Fidelity International

15:45-16.00 – Break

16.00-16:40 – Fund Manager Panel 5

- New ESG and Sustainability developments – what’s hot and what’s not? An exploration of new industry initiatives and developments aimed at addressing major ESG threats.

- Amanda Young – abrdn

- Caroline Langley – Quilter Cheviot Investment Management

- Seb Beloe – WHEB Asset Management

- Mike Clark – Ario Advisory

16.40 – 17.00 ‘An expert view on ‘What needs to happen’ in the investment world (and how to understand it when it does).’

- Mike Clark, founder Ario Advisory

17.00 – 17.45 Formal close & move to optional breakout room

If you have further questions please contact events@sriServices.co.uk

===

We are also running a drinks reception to celebrate the end of Good Money Week 2021…

13 October London drinks reception

Time: 5.00 – 9.00, London Wall

Format: informal drinks reception.

Free to attend. Financial services professional only.

These events are free to attend thanks to our Fund Manager partners:

Janus Henderson, EdenTree, Rathbones, ASI, M&G, Aegon, Stewart, BNY Mellon, Pictet, Unicorn, Sarasin & Partners, Fidelity, Liontrust, BMO, Triodos, WHEB, Quilter, Jupiter, Foresight & PIMCO

—

To view previous event videos go to our YouTube channel (Please ‘subscribe’) or visit our SRI Services annual events page here

To view upcoming events please visit our events page

To be kept informed please sign up to our newsletter.

The video below has highlights from last year’s Zoom event: