Our ‘SRI Styles’ help you navigate sustainable, responsible and ethical investment funds by highlighting key similarities (and differences)

‘SRI Styles’ are our own, in house, classification system. They group broadly similar fund (and product) options together, based on the issue(s) considered and the approach(es) managers employ.

Our SRI Styles should not be confused with the FCA’s sustainable fund (SDR) labels that became available for use in July 2024.

The FCA’s SDR labelling regime is set out in regulation – see PS23/16.

SDR labelled options are required to meet specific regulatory requirements – and are only (currently) available to UK based funds (see more).

By contrast SRI Styles represent our opinion of a strategy. These are based on information shared by managers, but are nonetheless simply ‘an opinion’.

Our SRI Styles aim to help users recognise the key strategic similarities and differences that are likely to matter most to clients with an interest in sustainability or ethical issues.

There is however significant cross-over between the styles and variation within each style, so they should only be regarded as a starting point.

Many people have specific interests, concerns and requirements, so styles in most instances we suggest they are used in conjunction with the additional filter options on the Fund EcoMarket tool.

The following is a brief description of each style, with links to further information.

See our SDR Support page for opinions on how our SRI Styles may map to the new SDR regime.

‘SRI Styles’ directory and links to individual ‘Styles’ pages

Funds which focus on a specific issue or theme – often alongside screening criteria and engagement:

- Sustainable Style funds focus significantly on (environmental and social) sustainability issues, opportunities and themes when selecting investments. These funds tend to have forward looking strategies, favouring companies and other assets that show ‘sustainability leadership’, are ‘solutions companies’ , or are helping to facilitate the ‘transition’ to more sustainable lifestyles. They may also have ‘ethical’ exclusion criteria and encourage positive change through stewardship activity.

- Environmental Style funds significantly integrate environmental issues into investment strategies. Their focus is often around longer term environmental and resource related issues, risks and opportunities. Some funds are very broad, others focus on a single issue, industry or resource. They may have ‘ethical’ exclusion criteria and also encourage positive change through stewardship activity.

- Social Style funds focus on ‘people issues’, investing in assets that help to address social challenges such as employment, education, housing and other basic necessities of life. Strategies vary, some invest in an individual sector others invest more broadly.

Funds which focus on ‘ethical’ or ‘values based’ issues – normally by employing negative and/or positive screening criteria – typically alongside ESG considerations and engagement activity:

- Ethically Focused funds – focus on ‘values based’ issues almost always alongside considering ESG (environmental, social and governance) and sustainability related issues. These funds set out where they aim to invest and avoid in their published criteria. Some have extensive exclusions others may make more balanced decisions – balancing pros and cons. The most common exclusions are armaments and tobacco. Negative screens often operate alongside positive criteria. Strategies vary. These strategies are often complemented by responsible ownership (stewardship) activity.

- Faith Based funds invest in line with specific religious principles (e.g. Shariah Law)

Strategies that significantly integrate ‘issues’ – but may invest widely across most sectors and/or rely substantially on stewardship activity:

- Sustainability Tilted funds integrate (environmental and social) sustainability considerations into their investment processes, favouring – being ‘overweight’ in – companies the managers believe have higher standards and being ‘underweight’ (invested less in) companies with lower sustainability standards. This means they are likely to invest in almost all types of companies – potentially including assets some clients will view as controversial. They may also have ‘ethical’ exclusion criteria that remove certain companies or asset types. They may also encourage positive change through stewardship activity – to a greater or lesser extent.

- ESG Plus funds have environmental, social and governance risk mitigation strategies, often alongside other strategies which demonstrate the fund is intended for clients with an interest in ESG issues. They may have responsible ownership strategies that encourage higher standards and/or exclusion criteria. These funds may hold assets some clients review as controversial. Strategies vary. See fund entries for further information.

Limited avoidance

- Limited Exclusions is our classification for funds that exclude only a very small proportion of an index or allowable universe – and invest otherwise in a ‘conventional’ fashion. Some funds exclude companies with the worst possible ESG scores, others may avoid a single industry eg tobacco or cluster munitions manufacturers. These funds are significantly different from other SRI Styles as they have a very ‘limited’ impact on stock selection.

Responsible ownership and stewardship activity

- Responsible Ownership information on Fund EcoMarket refers to company wide ‘stewardship’ strategies.

- Responsible ownership characteristics and activities can be searched within the ‘Fund Management Company Information’ filter area.

Additional SRI Styles classifications

The following are used for a small number of funds with the aim of reducing the risk of misleading users. These are not reflected in our StyleFinder fact find tool – the aim of which is to simplify the advice process.

- ‘Other’ is used to flag funds that have a policy or strategy that is aligned to the issues covered by sustainable and/or ethical funds but is substantially different from other funds (e.g. single/niche issue).

- ‘Unclassified’ funds that we have considered but are not confident are intended for clients with a keen interest in ESG, sustainability or ethical issues.

- ‘Pending’ indicates funds that are not yet classified.

Fund Strategies vary, sometimes significantly. Please see individual fund entries for fund specific information.

About Fund EcoMarket listings

The Fund EcoMarket database lists all of the regulated, retail, onshore funds (plus a few related entries) that we are aware of. The listing is therefore (as far as we are aware) ‘whole of market’ for these groups.

A listing on this database does not represent any form of endorsement, recommendation or indication of quality or appropriateness.

We do not list specialist options such as unlisted funds or individual share or bonds.

Please contact us if you have found any omissions or would like to request we alter any of the information we publish.

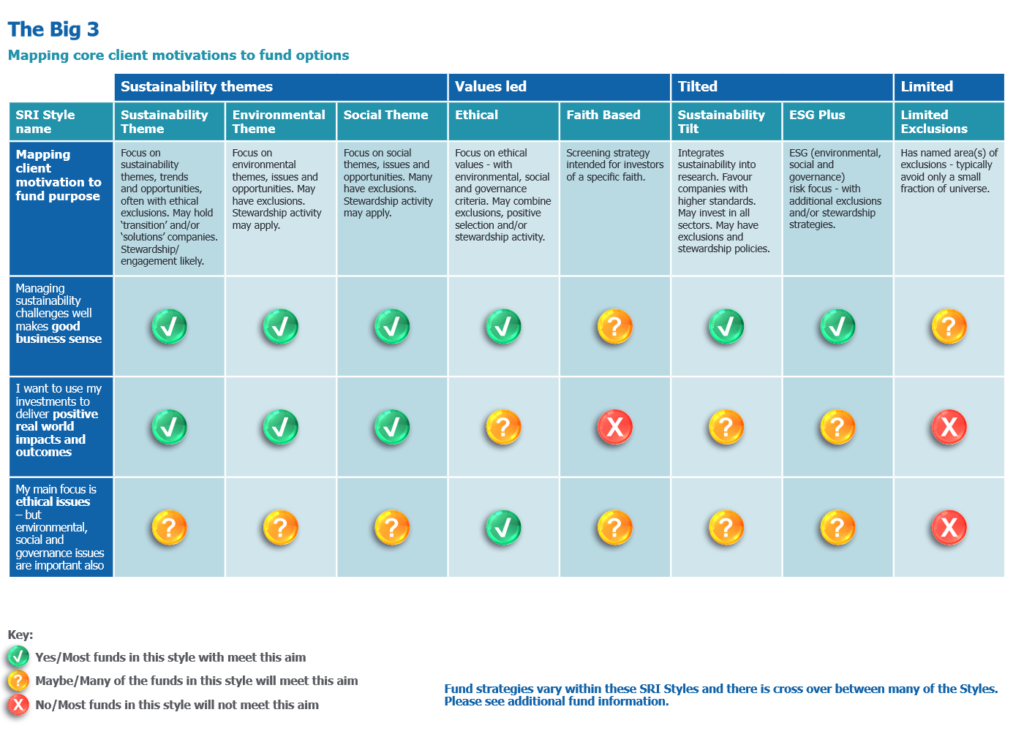

One of the important aspects of this area is the need to recognise that both fund managers and clients aims and opinions vary. The table below maps our SRI Styles to three common ‘motivations’ for investing in this area, to help you get started:

Please note, some of the style names shown below have been updated.

This service is for information only. Please speak with a qualified financial adviser for further information.

We are not regulated, do not offer advice and can not deal directly with individual investors.