Treasury Sub-Committee on Financial Services Regulations (Greenwash: sustainability disclosure requirements)

Posted on: March 16th, 2023

The recent Treasury Sub-Committee on Financial Services Regulations (Greenwash: sustainability disclosure requirements) has generated some headlines that could have been more constructive – and risk playing into the hands of those who were never particularly interested in sustainability.

The meeting was held on 22 February 2023. It started at 2.17pm and ended 4.33pm

The links to the recording are below … take a look to make up your own mind:

Some of my own thoughts include:

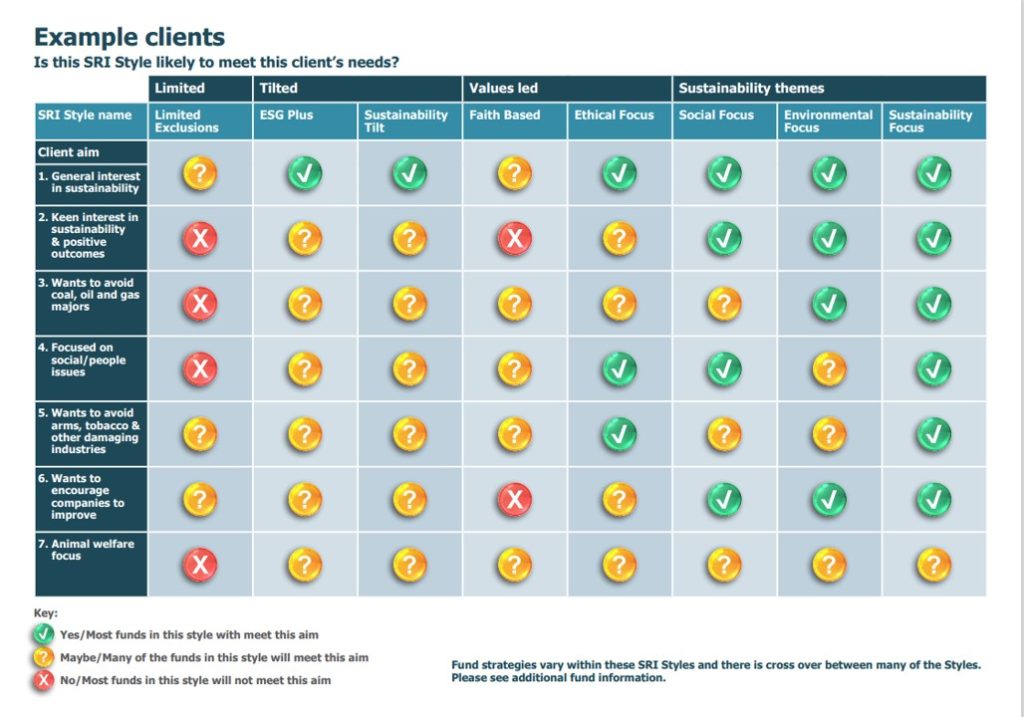

a) Fund strategies vary, as do client views (see image). Variety is beneficial, it guards against bubbles and encourages investors to use different ‘levers’. However, just because a fund is ‘doing something on ESG’ does not mean it is aiming to help to solve sustainability challenges. We must not conflate the two – and at present many of us fear clients are being ‘greenwashed’, which is why we need new rules.

b) There has been a ‘spectrum of sustainability integration’ for many years. When the new regulatory line is drawn some funds will be on one side of it and other funds will be on the other side. Managers of funds that are currently marketed as ESG, sustainable or similar, but decide not go as far as adopting the new rules (when agreed), are likely to look daft and will be swimming against the tide, but that is their choice. These funds should be obliged to explain their position publicly and offer free switches for clients who may be unhappy. Inviting ambulance chasers into this process, whilst tempting, won’t solve the very real problems we face.

c) It would be undesirable and disappointing if many funds that currently say they are ‘serious about sustainability’, or similar, decided not to adopt the new SDR rules. All funds should take sustainability seriously. But the answer is not to lower the bar to ‘keep them in the tent’ (apologies for mixing metaphors). And once fund managers have made their choices intermediaries will be better able to support client needs with confidence. This is no magic wand, but investors have a massive part to play in addressing ‘real world problems’ – and it is time to get on with it.

I’d be very interested to hear views on switching.

Is there any reason why SDR should be a problem beyond some fund managers having to eat humble pie? (They may look daft, but there were no rules previously…)

What happens in other industries when new rules come in?

julia@fundecomarket.co.uk