Schroder Global Sustainable Growth Fund

SRI Style:

Sustainable Style

SDR Labelling:

Sustainability Focus label

Product:

OEIC

Fund Region:

Global

Fund Asset Type:

Equity

Launch Date:

19/01/2021

Last Amended:

Aug 2025

Dialshifter ( ):

):

Fund Size:

£273.87m

(as at: 31/05/2025)

Total Screened Themed SRI Assets:

£80299.00m

(as at: 31/03/2025)

Total Responsible Ownership Assets:

£653712.00m

(as at: 31/03/2025)

Total Assets Under Management:

£758460.00m

(as at: 31/03/2025)

ISIN:

GB00BF781M07, GB00BF781L99, GB00BF782614, GB00BF782507, GB00BF781R51, GB00BF781P38, GB00BF781N14

Contact Us:

Objectives:

The fund aims to provide capital growth in excess of the MSCI All Country World (Net Total Return) Index (after the deduction of fees) over any three to five year period by investing in equities of companies worldwide which the investment manager classifies as sustainable. We believe that only companies demonstrating positive sustainability characteristics, defined as managing the business for the long-term, and recognising their responsibilities to a broad group of stakeholders, will be able to maintain their growth and returns over the long-term.

Sustainable, Responsible

&/or ESG Overview:

We invest in companies that, through the way they are managed and/or the goods and services that they sell, make a positive contribution to the planet (the environment); and/or people (employee wellbeing; customer wellbeing; healthy, inclusive and connected communities; and/or effective and accountable institutions).

Primary fund last amended:

Aug 2025

Information directly from fund manager.

Fund Filters

Sustainability - General

Funds that have policies that consider (environmental and social) sustainability issues. Strategies vary but are likely to consider environmental issues like climate change, carbon emissions, biodiversity loss, resource management, environmental impacts; and social issues like equal opportunities, human rights, labour standards, diversity and adherence to internationally recognised codes. See fund information.

Find funds which substantially focus on sustainability issues

Nature & Biodiversity

Find funds that have policies in place explaining that they avoid companies involved in illegal and/or unsustainable deforestation. This may relate to palm oil, cattle farming or other concerns. Strategies vary. See fund information for further detail.

Climate Change & Energy

Funds that avoid investing in companies with coal, oil and gas reserves. See fund information for further details.

The fund manager excludes companies with direct involvement in fossil fuel exploration (eg coal, oil and gas companies)

Ethical Values Led Exclusions

Companies are excluded if they are involved in any aspect of the production chain for tobacco products, including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Find funds that exclude companies which make controversial weapons such as landmines, cluster munitions and chemical weapons. See fund literature for further information.

Find funds that avoid companies with military contracts of any kind. This may include medical supplies, food, safety equipment, housing, etc. Fund strategies vary. See fund liteterature for more information.

Find funds with a written civilian firearms exclusion policy - meaning that they will not invest in companies that make (or perhaps also sell) handguns made for non-military users.

Find funds that avoid investment in companies involved in the production of alcohol. Strategies vary; some funds allow a small proportion of profits to come from this area. See fund literature for further information.

Find funds that avoid companies with significant involvement in the gambling industry. Some funds may allow a small proportion of profits to come from this area. See fund policy for further details.

Find funds that avoid companies that derive significant income from pornography and related areas. Strategies vary. See fund details for further information.

Banking & Financials

Fund excludes financial services companies with widely criticised, aggressive lending practices where interest rates are typically very high, includes ‘doorstep lending’)

Fund Governance

Environmental, social and governance issues are part of this fund’s reporting of their ‘value’ to clients. AoV reporting is a statutory requirement. Including ESG factors in its calculation is not.

Impact Methodologies

Fund aims to deliver positive environmental and or social impacts (real world benefits) through its engagement with investee assets

How The Fund Works

Find funds that focus on finding and investing in companies with positive / beneficial attributes. This strategy can be applied in addition to exclusion criteria and engagement/stewardship activity.

This fund does not use stock lending for performance or risk purposes.

Labels & Accreditations

Find funds that have chosen to adopt one of the Financial Conduct Authority (FCA) SDR labels. Please note: there are a range of reasons why potentially relevant funds may not use an SDR label eg. adopting a label may be work in progress, the manager may not yet be allowed to do so because of the product type, a manager may feel their fund is insufficiently aligned to SDR requirements. Read fund literature and / or our blogs for further information.

Fund Management Company Information

About The Business

Find fund management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management.

Engagement Approach

Escalation policies describe how a manager will proceed if stewardship / engagement activity is not successful in the short term.

Transparency

Find companies that publish information about their sustainable and responsible investment strategies on their company website.

Find fund management companies that have supplied Dialshifter information. See Dialshifter tab within record for more information.

Sustainable, Responsible &/or ESG Policy:

The fund is actively managed and invests at least 80% of its assets in a concentrated portfolio of equities of companies worldwide. The fund typically holds 30 to 50 companies. The fund may also invest directly or indirectly in other securities (including in other asset classes), countries, regions, industries or currencies, collective investment schemes (including Schroder funds), warrants and money market instruments, and hold cash. The fund may use derivatives with the aim of reducing risk or managing the fund more efficiently.

The fund invests at least 70% of its portfolio in assets that the investment manager classifies as sustainable. A company is considered to be sustainable if it makes a positive contribution to: - Planet. This includes contributions to the environment - such as reducing greenhouse gas (GHG) emissions, which helps slow down climate change. and/or - People. This includes contributions to one or more of the following: - employee wellbeing - such as paying more than living wages or providing training to employees, which supports their professional development and prosperity. - customer wellbeing - such as developing new products and services that improve customers' quality of life, for example medical drugs, therapies, diagnostic tools and healthy food. - healthy, inclusive and connected communities – such as providing access to clean water and sanitation (which promotes good health). - effective and accountable institutions – such as promoting financial stability, which supports people's prosperity and financial security. A company is classified as sustainable if it achieves a positive score in Schroders' systematic model (SustainExTM).

SustainExTM produces an assessment of the company's effect on a defined set of benefits and costs for people and the planet, which are then combined to calculate an overall sustainability score for the company. A company must achieve a positive score to be deemed sustainable. The model is based on in-depth internal research, which has included establishing the relevance of various factors to the sustainability outcomes referred to above. In some exceptional cases, SustainExTM does not provide a fair reflection of a company's contribution to people and/or the planet. The investment manager can refer such companies to Schroders' Sustainable Investment Panel (the Panel), an independent panel of experts. The fund is not permitted to invest in any assets that conflict with the sustainability objective. The investment manager also engages with selected companies held by the fund on sustainability issues. Please see the fund's Consumer Facing Disclosure, available via https://www.schroders.com/en-gb/uk/individual/fund-centre for more details on the investment manager's approach to sustainability.

Process:

Kindly refer to the response provided in the 'Policy' section.

Resources, Affiliations & Corporate Strategies:

Sustainability is fundamental to our investment principles at Schroders and we have an experienced and well-resourced Sustainable Investment team, who are embedded within our Investment function. We are a global team, spread across four regional hubs in London, Paris, Singapore and New York, aiming to ensure that sustainability is embedded through our global investment teams and client functions.

The team is led by Andrew Howard, Global Head of Sustainable Investment. As team head, he oversees our approach to ESG integration, active ownership, our sustainability research and tools, and our reporting and product strategy.

Our central Sustainable Investment team sits alongside investment teams rather than operating in a silo, which facilitates regular dialogue with our analysts and portfolio managers.

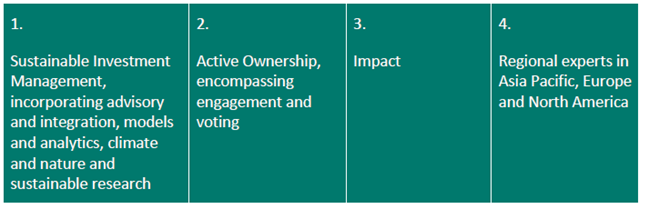

It is organised into four pillars:

We outline their key responsibilities and areas of focus below.

1. Sustainable investment management

Our Advisory and Integration team acts as a central contact point and consultant for a range of stakeholders across the business. This includes advising investment teams on ESG integration best practice; compliance, risk and legal teams on ESG regulation; and working with our regional experts; across Asia Pacific, Europe and North America, as outlined under pillar four.

Our Models and Analytics team is responsible for the maintenance and evolution of our suite of proprietary tools. They are also responsible for ESG data, ensuring we harness sustainability data effectively from both conventional and unconventional sources.

Our Strategy and Research team is responsible for undertaking sustainability research to: inform firmwide strategy and commitments; provide insights for investment teams to analyse sustainability-related risks and opportunities; and provide research-related and technical support for other stakeholders across the firm.

2. Active ownership

Our Engagement team partners with investors to have dialogue with the companies in which we invest, seeking to understand how prepared they are for a changing world and pushing them towards more sustainable practices. The team track the progress of these engagements and hold companies to account.

Our Corporate Governance team is responsible for voting in line with our Voting Policy and Principles.

3. Impact

Our Impact team is responsible for scaling our impact product offering in line with best-practice impact principles. The team works closely with investment desks and is responsible for developing and implementing our impact management and measurement framework, including impact assessment and monitoring at transaction and portfolio level, product development, impact strategy and impact reporting.

4. Regional Expertise

Our Regional Experts based in Asia Pacific, Europe and North America have a deep understanding of local market characteristics and nuances, and are responsible for staying abreast of sustainability-related developments. Our experts work with clients and internal teams to navigate and support clients’ ESG aspirations and challenges, utilising Schroders’ proprietary tools and research to develop investment solutions that meet their needs. They also engage with regulators and industry bodies to shape and support the global sustainable finance agenda. Our regional experts are a critical extension of the central team in London as the firm continues to evolve its global ESG strategy.

We have a number of governance structures in place for decision-making and oversight of our approach to sustainable investment. The Board of Schroders plc (the Board) has collective responsibility for the management, direction and performance of the Group, and is accountable for our overall business strategy. The Group Chief Executive is responsible for proposing the strategy for the Group and for its implementation, supported by the Group’s senior management team and a number of Committees, some of which are noted below.

The Group Sustainability and Impact (GSI) Committee provides advice to the Group Chief Executive on sustainability and impact matters. The Committee considers, reviews and recommends the overall global sustainability and impact strategy, including key initiatives, new commitments and policies for approval. The Global Head of Sustainable Investment and Global Head of Corporate Sustainability are members of the Committee and report to the Board.

The Sustainability Executive Committee (ExCo) develops and oversees the delivery of our Group-level sustainable investment management strategy. The ExCo also advises on the development of our sustainability and impact investment and product frameworks. The ExCo has senior representation from across the business including Investment, Client Group, Wealth Management, Schroders Capital and Corporate Sustainability.

The Group Regulatory Oversight Committee (GROC) oversees the progress of sustainability regulatory change programmes, as well as facilitating the monitoring of emergent sustainability regulations and ensuring we have appropriately determined the impact on our Group sustainability strategy and supporting operations. The GROC receives input on planned or potential sustainability-related regulation from our Public Policy and Compliance teams, which actively engage with relevant regulators, industry trade associations and other bodies in our key markets of the UK and EU. Once the business implications of new legal and regulatory requirements are defined, the relevant sustainability regulations programme workstreams deliver the necessary change to our business operations. The GROC oversees the progress of the programme, including monitoring and mitigating associated risks and issues. Where necessary, risks and key issues from the GROC can be escalated to the Group Risk Committee for resolution.

Certain Schroders entities, businesses and Investment teams also have their own committees which consider their sustainable investment activities. For example, the Private Assets Sustainability and Impact Steering Committee (PA S&I SteerCo) develops and oversees the implementation of the Private Assets Sustainability and Impact strategy. In addition, the Wealth Management Sustainable Investment Committee (WMSIC), a sub-committee of the Wealth Management Investment Committee (WMIC), has delegated responsibility for recommending Wealth Management's Sustainability models, as well as providing investment strategy and direction for client portfolios that are linked to the sustainable models.

Alongside our central Sustainable Investment team, sustainable investing is also overseen and delivered by dedicated teams and expert individuals embedded throughout the firm (including across Investment teams and Client Group functions).

We have a long-standing commitment to support and collaborate with several industry groups, organisations and initiatives to promote well-functioning financial markets.

Our key stakeholders include exchanges, regulators and international and regional trade associations. For example, Schroders is a member of trade bodies such as the Investment Association in the UK, the European Fund and Asset Management Association (EFAMA), the Asia Securities Industry and Financial Markets Association (ASIFMA) in Hong Kong and the Securities Industry and Financial Markets Association (SIFMA) in the US. Through this participation we share our insights to support the development of policy recommendations, share best practice and build coalitions of like-minded market participants to advocate for better functioning markets.

Our activity with policymakers aims to help them ensure that the measures they take support businesses and provide clear direction. By monitoring and influencing regulatory initiatives at their inception, we aim to support the development of a business environment which is conducive to Schroders’ clients’ best interests.

We aim to engage with the regulatory environments in which we are operating and raise awareness on sustainability matters. We believe well-designed regulation is an important cornerstone to promoting healthy markets, and have asked publicly that policy makers support sustainable finance legislation and regulation and deliver on commitments, including around climate mitigation.

We consider this to be key in improving responsible investment standards across sectors, establishing a consistent dialogue with companies, and in promoting the ongoing development and recognition of sustainability and Environmental, Social and Governance (ESG) topics within the investment industry. A full list of organisations and initiatives of which Schroders is a member or signatory is available here (https://www.schroders.com/en/global/individual/corporate-transparency/working-with-policy-makers/memberships/)

SDR Labelling:

Sustainability Focus label

Key Performance Indicators:

The fund maintains a higher overall sustainability score than the MSCI AC World (Net TR) index, based on the Investment Manager’s rating system. This benchmark (which is a broad market index) does not take into account the environmental and/ or social characteristics promoted by the Fund. No reference benchmark has been designated for the purpose of meeting the environmental or social characteristics promoted by the financial product. The sustainability score of the Fund is measured by SustainEx™, Schroders’ proprietary tool that provides an estimate of the potential social and environmental costs and benefits that an issuer may create.

- Consumer Facing Disclosure

SDR Literature:

Fund Holdings

Voting Record

Disclaimer

Important Information

This document is addressed to existing client(s) only. Not for further distribution.

This document contains indicative terms for discussion purposes only and is not intended to provide the sole basis for evaluation of the investment solutions described.

Investment involves risk. Reliance should not be placed on any views or information in the material when taking individual investment and/or strategic decisions.

Any reference to regions/ countries/ sectors/ stocks/ securities is for illustrative purposes only and not a recommendation to buy or sell any financial instruments or adopt a specific investment strategy.

The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations.

Past Performance is not a guide to future performance and may not be repeated.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of investments to fall as well as rise.

Schroders has expressed its own views and opinions in this document and these may change.

Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy.

The data contained in this document has been sourced by Schroders and should be independently verified. Third party data is owned or licenced by the data provider and may not be reproduced, extracted or used for any other purpose without the data provider’s consent. Neither Schroders, nor the data provider, will have any liability in connection with the third-party data.

Issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 1893220 England. Authorised and regulated by the Financial Conduct Authority.

For your security, communications may be recorded or monitored.

Issued in June 2025.

| Fund Name | SRI Style | SDR Labelling | Product | Region | Asset Type | Launch Date | Last Amended |

|

|---|---|---|---|---|---|---|---|---|

Schroder Global Sustainable Growth Fund |

Sustainable Style | Sustainability Focus label | OEIC | Global | Equity | 19/01/2021 | Aug 2025 | |

ObjectivesThe fund aims to provide capital growth in excess of the MSCI All Country World (Net Total Return) Index (after the deduction of fees) over any three to five year period by investing in equities of companies worldwide which the investment manager classifies as sustainable. We believe that only companies demonstrating positive sustainability characteristics, defined as managing the business for the long-term, and recognising their responsibilities to a broad group of stakeholders, will be able to maintain their growth and returns over the long-term.

|

Fund Size: £273.87m (as at: 31/05/2025) Total Screened Themed SRI Assets: £80299.00m (as at: 31/03/2025) Total Responsible Ownership Assets: £653712.00m (as at: 31/03/2025) Total Assets Under Management: £758460.00m (as at: 31/03/2025) ISIN: GB00BF781M07, GB00BF781L99, GB00BF782614, GB00BF782507, GB00BF781R51, GB00BF781P38, GB00BF781N14 Contact Us: sami.arouche@schroders.com |

|||||||

Sustainable, Responsible &/or ESG OverviewWe invest in companies that, through the way they are managed and/or the goods and services that they sell, make a positive contribution to the planet (the environment); and/or people (employee wellbeing; customer wellbeing; healthy, inclusive and connected communities; and/or effective and accountable institutions). |

||||||||

|

Primary fund last amended: Aug 2025 |

||||||||

|

Information received directly from Fund Manager |

||||||||

|

Please select what you would like to read:

Fund FiltersSustainability - General

Sustainability policy

Funds that have policies that consider (environmental and social) sustainability issues. Strategies vary but are likely to consider environmental issues like climate change, carbon emissions, biodiversity loss, resource management, environmental impacts; and social issues like equal opportunities, human rights, labour standards, diversity and adherence to internationally recognised codes. See fund information.

Sustainability focus

Find funds which substantially focus on sustainability issues Nature & Biodiversity

Illegal deforestation exclusion policy

Find funds that have policies in place explaining that they avoid companies involved in illegal and/or unsustainable deforestation. This may relate to palm oil, cattle farming or other concerns. Strategies vary. See fund information for further detail. Climate Change & Energy

Fossil fuel reserves exclusion

Funds that avoid investing in companies with coal, oil and gas reserves. See fund information for further details.

Fossil fuel exploration exclusion - direct involvement

The fund manager excludes companies with direct involvement in fossil fuel exploration (eg coal, oil and gas companies) Ethical Values Led Exclusions

Tobacco and related product manufacturers excluded

Companies are excluded if they are involved in any aspect of the production chain for tobacco products, including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Controversial weapons exclusion

Find funds that exclude companies which make controversial weapons such as landmines, cluster munitions and chemical weapons. See fund literature for further information.

Military involvement exclusion

Find funds that avoid companies with military contracts of any kind. This may include medical supplies, food, safety equipment, housing, etc. Fund strategies vary. See fund liteterature for more information.

Civilian firearms production exclusion

Find funds with a written civilian firearms exclusion policy - meaning that they will not invest in companies that make (or perhaps also sell) handguns made for non-military users.

Alcohol production excluded

Find funds that avoid investment in companies involved in the production of alcohol. Strategies vary; some funds allow a small proportion of profits to come from this area. See fund literature for further information.

Gambling avoidance policy

Find funds that avoid companies with significant involvement in the gambling industry. Some funds may allow a small proportion of profits to come from this area. See fund policy for further details.

Pornography avoidance policy

Find funds that avoid companies that derive significant income from pornography and related areas. Strategies vary. See fund details for further information. Banking & Financials

Predatory lending exclusion

Fund excludes financial services companies with widely criticised, aggressive lending practices where interest rates are typically very high, includes ‘doorstep lending’) Fund Governance

ESG factors included in Assessment of Value (AoV) report

Environmental, social and governance issues are part of this fund’s reporting of their ‘value’ to clients. AoV reporting is a statutory requirement. Including ESG factors in its calculation is not. Impact Methodologies

Aim to deliver positive impacts through engagement

Fund aims to deliver positive environmental and or social impacts (real world benefits) through its engagement with investee assets How The Fund Works

Positive selection bias

Find funds that focus on finding and investing in companies with positive / beneficial attributes. This strategy can be applied in addition to exclusion criteria and engagement/stewardship activity.

Do not use stock / securities lending

This fund does not use stock lending for performance or risk purposes. Labels & Accreditations

SDR Labelled

Find funds that have chosen to adopt one of the Financial Conduct Authority (FCA) SDR labels. Please note: there are a range of reasons why potentially relevant funds may not use an SDR label eg. adopting a label may be work in progress, the manager may not yet be allowed to do so because of the product type, a manager may feel their fund is insufficiently aligned to SDR requirements. Read fund literature and / or our blogs for further information. Fund Management Company InformationAbout The Business

Integrates ESG factors into all / most (AFM) fund research

Find fund management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management. Engagement Approach

Stewardship escalation policy

Escalation policies describe how a manager will proceed if stewardship / engagement activity is not successful in the short term. Transparency

Full SRI / responsible ownership policy information on company website

Find companies that publish information about their sustainable and responsible investment strategies on their company website.

Dialshifter statement

Find fund management companies that have supplied Dialshifter information. See Dialshifter tab within record for more information. Sustainable, Responsible &/or ESG Policy:The fund is actively managed and invests at least 80% of its assets in a concentrated portfolio of equities of companies worldwide. The fund typically holds 30 to 50 companies. The fund may also invest directly or indirectly in other securities (including in other asset classes), countries, regions, industries or currencies, collective investment schemes (including Schroder funds), warrants and money market instruments, and hold cash. The fund may use derivatives with the aim of reducing risk or managing the fund more efficiently. The fund invests at least 70% of its portfolio in assets that the investment manager classifies as sustainable. A company is considered to be sustainable if it makes a positive contribution to: - Planet. This includes contributions to the environment - such as reducing greenhouse gas (GHG) emissions, which helps slow down climate change. and/or - People. This includes contributions to one or more of the following: - employee wellbeing - such as paying more than living wages or providing training to employees, which supports their professional development and prosperity. - customer wellbeing - such as developing new products and services that improve customers' quality of life, for example medical drugs, therapies, diagnostic tools and healthy food. - healthy, inclusive and connected communities – such as providing access to clean water and sanitation (which promotes good health). - effective and accountable institutions – such as promoting financial stability, which supports people's prosperity and financial security. A company is classified as sustainable if it achieves a positive score in Schroders' systematic model (SustainExTM). SustainExTM produces an assessment of the company's effect on a defined set of benefits and costs for people and the planet, which are then combined to calculate an overall sustainability score for the company. A company must achieve a positive score to be deemed sustainable. The model is based on in-depth internal research, which has included establishing the relevance of various factors to the sustainability outcomes referred to above. In some exceptional cases, SustainExTM does not provide a fair reflection of a company's contribution to people and/or the planet. The investment manager can refer such companies to Schroders' Sustainable Investment Panel (the Panel), an independent panel of experts. The fund is not permitted to invest in any assets that conflict with the sustainability objective. The investment manager also engages with selected companies held by the fund on sustainability issues. Please see the fund's Consumer Facing Disclosure, available via https://www.schroders.com/en-gb/uk/individual/fund-centre for more details on the investment manager's approach to sustainability. Process:Kindly refer to the response provided in the 'Policy' section. Resources, Affiliations & Corporate Strategies:Sustainability is fundamental to our investment principles at Schroders and we have an experienced and well-resourced Sustainable Investment team, who are embedded within our Investment function. We are a global team, spread across four regional hubs in London, Paris, Singapore and New York, aiming to ensure that sustainability is embedded through our global investment teams and client functions. Our central Sustainable Investment team sits alongside investment teams rather than operating in a silo, which facilitates regular dialogue with our analysts and portfolio managers. It is organised into four pillars:

We outline their key responsibilities and areas of focus below. 1. Sustainable investment management Our Advisory and Integration team acts as a central contact point and consultant for a range of stakeholders across the business. This includes advising investment teams on ESG integration best practice; compliance, risk and legal teams on ESG regulation; and working with our regional experts; across Asia Pacific, Europe and North America, as outlined under pillar four. Our Models and Analytics team is responsible for the maintenance and evolution of our suite of proprietary tools. They are also responsible for ESG data, ensuring we harness sustainability data effectively from both conventional and unconventional sources. Our Strategy and Research team is responsible for undertaking sustainability research to: inform firmwide strategy and commitments; provide insights for investment teams to analyse sustainability-related risks and opportunities; and provide research-related and technical support for other stakeholders across the firm. 2. Active ownership Our Engagement team partners with investors to have dialogue with the companies in which we invest, seeking to understand how prepared they are for a changing world and pushing them towards more sustainable practices. The team track the progress of these engagements and hold companies to account. Our Corporate Governance team is responsible for voting in line with our Voting Policy and Principles. 3. Impact Our Impact team is responsible for scaling our impact product offering in line with best-practice impact principles. The team works closely with investment desks and is responsible for developing and implementing our impact management and measurement framework, including impact assessment and monitoring at transaction and portfolio level, product development, impact strategy and impact reporting. 4. Regional Expertise Our Regional Experts based in Asia Pacific, Europe and North America have a deep understanding of local market characteristics and nuances, and are responsible for staying abreast of sustainability-related developments. Our experts work with clients and internal teams to navigate and support clients’ ESG aspirations and challenges, utilising Schroders’ proprietary tools and research to develop investment solutions that meet their needs. They also engage with regulators and industry bodies to shape and support the global sustainable finance agenda. Our regional experts are a critical extension of the central team in London as the firm continues to evolve its global ESG strategy. We have a number of governance structures in place for decision-making and oversight of our approach to sustainable investment. The Board of Schroders plc (the Board) has collective responsibility for the management, direction and performance of the Group, and is accountable for our overall business strategy. The Group Chief Executive is responsible for proposing the strategy for the Group and for its implementation, supported by the Group’s senior management team and a number of Committees, some of which are noted below. The Group Sustainability and Impact (GSI) Committee provides advice to the Group Chief Executive on sustainability and impact matters. The Committee considers, reviews and recommends the overall global sustainability and impact strategy, including key initiatives, new commitments and policies for approval. The Global Head of Sustainable Investment and Global Head of Corporate Sustainability are members of the Committee and report to the Board. The Sustainability Executive Committee (ExCo) develops and oversees the delivery of our Group-level sustainable investment management strategy. The ExCo also advises on the development of our sustainability and impact investment and product frameworks. The ExCo has senior representation from across the business including Investment, Client Group, Wealth Management, Schroders Capital and Corporate Sustainability. The Group Regulatory Oversight Committee (GROC) oversees the progress of sustainability regulatory change programmes, as well as facilitating the monitoring of emergent sustainability regulations and ensuring we have appropriately determined the impact on our Group sustainability strategy and supporting operations. The GROC receives input on planned or potential sustainability-related regulation from our Public Policy and Compliance teams, which actively engage with relevant regulators, industry trade associations and other bodies in our key markets of the UK and EU. Once the business implications of new legal and regulatory requirements are defined, the relevant sustainability regulations programme workstreams deliver the necessary change to our business operations. The GROC oversees the progress of the programme, including monitoring and mitigating associated risks and issues. Where necessary, risks and key issues from the GROC can be escalated to the Group Risk Committee for resolution. Certain Schroders entities, businesses and Investment teams also have their own committees which consider their sustainable investment activities. For example, the Private Assets Sustainability and Impact Steering Committee (PA S&I SteerCo) develops and oversees the implementation of the Private Assets Sustainability and Impact strategy. In addition, the Wealth Management Sustainable Investment Committee (WMSIC), a sub-committee of the Wealth Management Investment Committee (WMIC), has delegated responsibility for recommending Wealth Management's Sustainability models, as well as providing investment strategy and direction for client portfolios that are linked to the sustainable models. Alongside our central Sustainable Investment team, sustainable investing is also overseen and delivered by dedicated teams and expert individuals embedded throughout the firm (including across Investment teams and Client Group functions). We have a long-standing commitment to support and collaborate with several industry groups, organisations and initiatives to promote well-functioning financial markets. Our key stakeholders include exchanges, regulators and international and regional trade associations. For example, Schroders is a member of trade bodies such as the Investment Association in the UK, the European Fund and Asset Management Association (EFAMA), the Asia Securities Industry and Financial Markets Association (ASIFMA) in Hong Kong and the Securities Industry and Financial Markets Association (SIFMA) in the US. Through this participation we share our insights to support the development of policy recommendations, share best practice and build coalitions of like-minded market participants to advocate for better functioning markets. Our activity with policymakers aims to help them ensure that the measures they take support businesses and provide clear direction. By monitoring and influencing regulatory initiatives at their inception, we aim to support the development of a business environment which is conducive to Schroders’ clients’ best interests. We aim to engage with the regulatory environments in which we are operating and raise awareness on sustainability matters. We believe well-designed regulation is an important cornerstone to promoting healthy markets, and have asked publicly that policy makers support sustainable finance legislation and regulation and deliver on commitments, including around climate mitigation. Dialshifter (Corporate)Our organisation is helping to support the Paris Climate Agreement and the Race to Net Zero by… … being a signatory to the Science Based Targets Initiative (SBTi), we measure and track the temperature alignment of our investments and have committed to align our financed emissions, across our portfolio companies Scope 1, 2 and 3 GHG emissions, to a 1.5°C world by 2040 across 100% of our investments. We also have an interim target of 2.2°C by 2030 across our portfolio companies Scope 1 and 2 emissions. SDR Labelling:Sustainability Focus label Key Performance Indicators:

The fund maintains a higher overall sustainability score than the MSCI AC World (Net TR) index, based on the Investment Manager’s rating system. This benchmark (which is a broad market index) does not take into account the environmental and/ or social characteristics promoted by the Fund. No reference benchmark has been designated for the purpose of meeting the environmental or social characteristics promoted by the financial product. The sustainability score of the Fund is measured by SustainEx™, Schroders’ proprietary tool that provides an estimate of the potential social and environmental costs and benefits that an issuer may create.

SDR Literature:Fund HoldingsVoting RecordDisclaimerImportant Information This document is addressed to existing client(s) only. Not for further distribution. |

||||||||