Rathbone Greenbank Defensive Growth Portfolio Fund

SRI Style:

Sustainable Style

SDR Labelling:

Sustainability Focus label

Product:

OEIC

Fund Region:

Global

Fund Asset Type:

Multi Asset

Launch Date:

29/03/2021

Last Amended:

Aug 2025

Dialshifter ( ):

):

Fund/Portfolio Size:

£177.40m

(as at: 31/05/2025)

Total Screened Themed SRI Assets:

£2709.20m

(as at: 31/05/2025)

Total Assets Under Management:

£15754.85m

(as at: 31/05/2025)

ISIN:

GB00BMQC6K53, GB00BMQC6L60

Contact Us:

Objectives:

The funds seek to invest in entities whose activities or ways of operating are aligned with sustainable development and therefore support the achievement of the UN Sustainable Development Goals. In particular, we believe that companies displaying strong policies and practices with regard to environmental, social and governance issues are likely to be well-positioned to deliver long-term value creation for investors. The funds avoid entities creating significant negative impacts that are considered to be incompatible with sustainable development.

The funds have non-financial objectives which aim to promote positive environmental and/or social outcomes alongside their financial return objectives. Further information can be found in the Funds Prospectus (from page 103 onwards).

Sustainable, Responsible

&/or ESG Overview:

We meticulously select every holding, ensuring strong investor returns alongside sustainable goals. Your financial future is paramount, so the business case for our investments is as crucial as their positive societal impact. To guarantee integrity, Greenbank has a veto on every investment's eligibility, providing assurance that "doing the right thing" is never compromised for profit.

With these funds, we aim to influence how companies operate, pushing them towards continuous improvement and accountability.

The funds follow a four-step investment process combining the expertise of Rathbones Asset Management and Greenbank:

- ESG risk integration: conducting in depth research to ensure we only invest in companies who are managing their ESG risks appropriately.

- Negative screening: avoiding investments which are incompatible with sustainable development.

- Positive alignment analysis: aligning investments to Greenbank’s eight sustainable development themes which map to the SDGs.

- Stewardship: dialogue through engagement to align with our sustainability criteria.

Primary fund last amended:

Aug 2025

Information directly from fund manager.

Fund Filters

Sustainability - General

Has policies that consider (environmental and social) sustainability issues. Strategies vary but are likely to consider environmental issues like climate change, carbon emissions, biodiversity loss, resource management, environmental impacts; and social issues like equal opportunities, human rights, labour standards, diversity and adherence to internationally recognised codes. See individual entry information.

Has a significant focus on sustainability issues

Aim to encourage higher sustainability standards through responsible ownership / stewardship / engagement / voting activity

Publicly report performance against named sustainability objectives

Environmental - General

Has policies which relate to environmental issues. These will typically set out their stance on issues such as pollution, climate change, resource management, biodiversity loss, carbon emissions, plastics and/or additional environmental impacts. Strategies vary.

Options that limit or 'reduce' their exposure to carbon intensive industries (ie sectors which are major contributors to climate change). Strategies vary.

Nature & Biodiversity

Has a written biodiversity policy or theme typically aimed at supporting, encouraging and improving environmental protection and safeguarding the natural world (sometimes referred to as 'natural capital'). See eg https://www.un.org/en/climatechange/science/climate-issues/biodiversity

Has policies designed to address involvement in irresponsibly managed palm oil or other forms of deforestation (typically exclusion led). Strategies vary.

Avoids assets that are involved in illegal deforestation. This may relate to palm oil, cattle farming or other areas. Strategies vary.

Climate Change & Energy

Has policies (documented strategies that explain their position) on climate change related issues such as greenhouse gas/carbon emissions, net zero, transitioning to lower carbon. Strategies vary.

Avoid investment in major coal, oil and/or gas (extraction) companies. Strategies vary.

Avoid companies involved in fracking and tar sands - which are widely regarded as controversial methods of oil and gas extraction. Strategies vary.

Avoid companies that are involved in extracting oil from the Arctic regions.

Avoid investing in companies / assets with coal, oil and gas reserves. See individual entry information for further details.

Encourage the transition to lower carbon activities through asset selection and / or responsible ownership activity.

Excludes companies and other assets with direct involvement in fossil fuel exploration (eg coal, oil and gas companies)

Will only invest in companies that report greenhouse gas emissions in line with this international reporting framework. See https://www.fsb-tcfd.org/ https ://www.ifrs.org/sustainability/tcfd/

Social / Employment

Has policies which set out their approach to social issues (e.g. human rights, labour standards, equal opportunities, child labour and/or adherence to internationally recognised codes such as the UN Global Compact). Strategies with social policies typically avoid companies with low standards and/or work to encourage higher standards. See fund information for detail.

Has a written diversity policy – where the manager will aim to select companies with a carefully considered, positive employment standards. This may cover a range of issues including gender, ethnicity, disability, beliefs and sexual orientation.

All mining companies excluded

Ethical Values Led Exclusions

Companies are excluded if they are involved in any aspect of the production chain for tobacco products, including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Companies are excluded if they make more than 5% of their revenue from the manufacture, sale or distribution of tobacco products including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Excludes companies which make controversial weapons such as landmines, cluster munitions and chemical weapons.

Avoids companies that manufacture weapons intended specifically for military use. Strategies vary - may or may not included non-strategic military products.

Does Not exclude companies with military contracts - this may include medical supplies, food, safety equipment, housing, technology etc.

Has a written civilian firearms exclusion policy - meaning that they will not invest in companies that make (or perhaps also sell) handguns made for non-military users.

Avoids companies that produce alcohol. Strategies vary; some may allow a small proportion of revenue to come from this area.

Avoids companies with significant involvement in the gambling industry. Some may allow a small proportion of revenues to come from this area.

Find funds that avoid companies that derive significant income from pornography and related areas. Strategies vary.

Has policies that require specific animal welfare standards to be met. These may reference well-known welfare standards (3Rs - Replace, Reduce, Refine) or certification schemes. Strategies vary.

Human Rights

Has policies relating to human rights issues. Typically require companies to demonstrate higher standards, although some managers work to encourage improvements. Investee companies are often judged against internationally agreed norms or standards. Strategies vary.

Has policies that exclude companies or other assets which operate in, or are owned by regimes which are not democratic, or where people may be oppressed. May use eg. Freedom House research. Strategies vary.

Has a policy which excludes assets with involvement in Modern Slavery

Gilts & Sovereigns

Invest in loans issued the government, commonly known as gilts or government bonds. These may or may not be ringfenced for specific projects (see additional options).

Avoids investing in 'some' gilts or government bonds. Strategies vary, but this may relate to avoiding specific countries or particular reasons for bond issuance. 'Green gilts' for example would be likely to be acceptable.

Invest in financial instruments issued by governments, but will only hold those that meet certain environmental and or social criteria. This may, for example mean certain assets are excluded in line with eg Freedom House research. Strategies vary.

Banking & Financials

Can include banks as part of their holdings / portfolio.

May invest in insurance companies.

Governance & Management

Encourage the companies they invest in to have more diverse board structures (e.g. more women on boards)

Aim to encourage higher ESG standards through responsible ownership / stewardship / engagement /voting activity

Product /Service Governance

Find funds that employ an external committee (i.e. not company employees) that has power to veto (i.e. overrule) fund managers stock selection decisions. (This would typically mean the committee can tell the manager of this particular fund not to buy / sell a specific investment when they consider it appropriate to do so.)

Find funds that factor in 'environmental, social and governance' issues as part of their investment decision making process. A focus on 'ESG' typically means a fund is carrying out additional research to help reduce ESG related risks. It does not necessarily mean a focus on sustainability. Strategies vary. See fund literature.

Asset Size

Invests in international entities or bodies with agreed remits that are broadly similar to those that may otherwise be undertaken by individual governments eg the UN

How The Fund/Portfolio Works

Focuses on finding and investing in companies with positive / beneficial attributes. This strategy can be applied in addition to exclusion criteria and engagement/stewardship activity.

Has principle 'ethical approach' to avoid companies by using negative screening criteria. Strategies vary.

Investment selection process uses internationally agreed 'norms' (e.g. United Nations Global Compact - UNGC - or the UN Sustainable Development Goals - SDGs) alongside additional SRI criteria such as positive or negative stock selection policies and/or stewardship strategies.

Invests in assets which have an ESG strategy (which is typically focused on avoiding companies that pose environmental, social or governance related risks) together with additional criteria such as positive and/or negative screens, themes and stewardship strategies.

Publish explanations of their ethical, social and/or environmental policies online (i.e. investment decision making strategies/ buy/sell &/or asset management strategies).

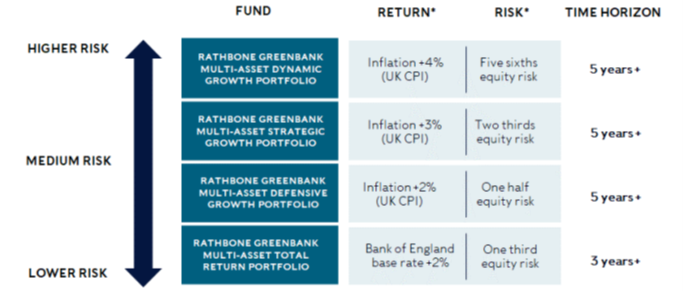

Has different risk options for the same investment strategy

Unscreened Assets & Cash

All assets - except cash - meet the sustainability criteria published in strategy documentation.

Intended Clients & Product Options

Designed to meet the needs of individual investors with an interest in sustainability issues.

Designed for clients who care about ethical and values-based issues, often alongside sustainability issues also.

Available via a tax efficient ISA product wrapper.

Labels & Accreditations

Find options that have chosen to adopt one of the Financial Conduct Authority (FCA) SDR labels. Please note: there are a range of reasons why potentially relevant options may not use an SDR label eg. adopting a label may be work in progress, the manager may not yet be allowed to do so because of the product type, a manager may feel they are insufficiently aligned to SDR requirements.

A voluntary corporate culture standard for investment managers, see https://www.investorsact.com/ - City Hive

Fund Management Company Information

About The Business

Finds fund / asset management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

Find fund / asset management companies that actively encourage higher 'environmental, social and governance' and / or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Find fund / asset managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Find fund / asset managers that consider responsible ownership and ESG to be a key differentiator for their business.

Finds organisations / fund managers that have an in-house (company wide) diversity improvement programme - meaning that they are working to ensure that within their own businesses they employ people from diverse backgrounds - often typically focused on ethnicity and/or sex.

Find fund / asset management companies that encourage the companies they invest in to have strong diversity, race, gender and other equality policies across all assets held, not simply screened or themed SRI/ESG funds. (ie Asset Management company wide).

Fund / asset manager has information on their website that explains how they treat 'vulnerable clients' (as set out in FCA regulation)

Fund / asset management company has investments in bonds designed to meet sustainability requirements - however these assets may not be 'ringfenced' for this purpose. See website for details.

Fund management entity offers unstructured intermediary training on sustainable investment (ie for financial advisers and wealth managers)

Collaborations & Affiliations

Find fund / asset management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

Find fund / asset management companies that are members of UKSIF - the UK Sustainable Investment and Finance association

Find fund / asset management companies that have partnered with Fund EcoMarket - meaning that they are helping to improve access to information on sustainable and responsible investment by paying an annual fee to us which enables us to publish information for free. Partner funds are listed ahead of other funds and have their logos displayed.

A member of the Taskforce for Nature Related Financial Disclosures group which aims to aid risk management and shift money towards nature-positive outcomes.

Fund management entity is a member of the Investment Association https://www.theia.org/

Resources

Find fund / asset management companies that employ people to steer and support fund managers in voting shares at company AGM's and EGMs in ways that are consistent with encouraging higher ESG/sustainability standards.

Find a fund / asset management company that directly employs specialist ESG/SRI/sustainability researchers or analysts. This allows asset managers to discuss environmental, social and governance risks and opportunities directly with companies.

Find fund / asset management companies that makes use of expert external research companies. This can help deliver specialist expertise and means resources are pooled with other investors.

Accreditations

Finds organisations / fund managers that have an A+ PRI rating - meaning they are highly rated according to the 'Principles of Responsible Investment'

Find fund / asset managers that are signatories to the FRC UK Stewardship Code, which sets out a framework for constructive investor / investee relations where managers are encouraged to behave like responsible, typically longer term 'company owners'.

Engagement Approach

Fund / asset manager has stewardship /responsible ownership strategy that is focused on addressing climate change with investee assets.

Fund / asset manager has a stewardship /responsible ownership strategy that involves working with fossil fuel companies on climate change related issues. See fund manager website for details.

Fund / asset manager has stewardship /responsible ownership strategy with involves encouraging investee asset to reduce plastic waste and pollution.

Fund / asset manager has a stewardship / responsible ownership policy that means they are working to encourage more responsible mining practices - where environmental and social issues are properly dealt with by the companies they invest in.

The fund / asset manager has a responsible ownership / stewardship strategy that focuses on biodiversity and nature issues relating to the assets they invest the aim of which will be to reduce harm and or deliver improvement. Strategies vary. https://tnfd.global

Fund / asset manager has a responsible ownership / stewardship strategy which means they are working to encourage the shift to more sustainable business practices in ways that respect and are sensitive to social issues and the impact change has on people effected by the changes that are taking place. https://www.transitionpathwayinitiative.org/ https://transitiontaskforce.net/

Fund / asset manager has responsible ownership / stewardship strategy in place which aims to address human rights issues in investee companies (and potentially their suppliers) with the aim of raising standards

Fund / asset manager has responsible ownership / stewardship strategy in place that aims to improve labour standards for the benefit of employees in investee companies (and potentially their suppliers)

Fund / asset management company has a stewardship strategy in place which involves working to raise diversity, equality and inclusion standards across investee assets

Fund / asset manager is working with the assets they hold to help stamp out modern slavery - where direct or indirect company employees are exploited for business benefits.

Fund / asset managers have stewardship strategies in place that focus on improving governance standards across investee assets

Has a stewardship / responsible ownership strategy that encourages responsible supply chain - ie the managers will discuss environmental, social and governance issues with investee companies with the aim of raising standards

Working to address sustainability, ESG and related concerns around artificial intelligence.

Escalation policies describe how a manager will proceed if stewardship / engagement activity is not successful in the short term.

Company Wide Exclusions

Find fund / asset management companies that avoid investment in fossil fuel companies (e.g. coal, oil and gas) across all of their funds. (and/ or other assets.)

This fund / asset manager has a strategy in place that will lead them to exit direct investments in the coal mining industry. Managers ability to do this may depend on the geographic regions in which they invest.

Climate & Net Zero Transition

Fund / asset management organisations that have pledged to reduce their greenhouse gas emissions to ‘net zero’. Strategies vary - this area is changing rapidly.

This fund / asset management company has set a date by which they plan to achieve net zero greenhouse gas / CO2e emissions.

Find fund / asset management companies that are working with the companies they invest in to encourage reductions in carbon dioxide and other greenhouse gas emissions.

Finds organisations / fund managers that have published ‘forward looking climate metrics’ e.g. 'implied temperature rise' data that are a total of the asset management company's share (% owned) of all the investee company emissions of the assets they manage, as well as their own direct and other indirect emissions.

This fund / asset management company plans to achieve net zero greenhouse gas (CO2e) emissions by reducing their emissions. Calculations and scope vary.

Finds organisations / fund management companies that are in the process of working out how to make a ‘net zero commitment’ - meaning that when that is finalised they will have started the process of reducing their total greenhouse gas emissions to'zero'.

See https://sciencebasedtargets.org/

Transparency

Find fund / asset management companies that publish a report detailing their responsible investment ownership - also known as 'Stewardship' - activity.

Fund / asset management companies that publish a full record of how they vote their shares at AGMs (annual general meetings) and EGMs (extraordinary general meetings). Voting strategies have an important role to play encouraging higher environmental, social and governance standards.

Sustainable, Responsible &/or ESG Policy:

The funds aim to invest in entities whose activities or ways of operating are aligned with sustainable development and which we believe have the potential to support the achievement of the UN Sustainable Development Goals (SDGs). To do this, the sustainable funds take the following approaches:

- Integrating environmental, social and governance (ESG) factors into risk management and stewardship activities.

- Applies negative screening to avoid investments that are failing to effectively manage potential social or environmental harms

- Applies positive screening to identify investments that are aligned to one or more sustainable development themes.

Each asset class requires a separate process for assessing whether it meets the sustainable objectives of the fund. We believe transparency is important in sustainable investing, so we have developed specific criteria that each asset must meet before it can be included in the funds.

All potential investments are put forward by the fund managers, with the team at Greenbank then undertaking the necessary sustainability analysis and making the final decision about its eligibility for inclusion in the funds.

A short summary is provided below of some of the criteria applied to key asset classes. Further details are provided in the Rathbone Greenbank Multi-Asset Portfolios Sustainability Process brochure which is available at Rathbone Greenbank Multi-Asset Portfolios | Rathbones (rathbonesam.com).

Government bonds

Government bonds have historically been an area of debate for sustainable investors because the majority of bond-issuing countries devote some of their budgets to military spending and generate tax revenues from controversial industries such as tobacco and alcohol. However, we believe this needs to be considered alongside the significant positive impact that many governments have on the environment and society. This may be through policies, regulations and subsidies designed to protect the environment, or the significant proportion of spending devoted to education, welfare, healthcare, etc.

Nevertheless, governments are not automatically deemed to be acceptable and, for us to invest in their bonds, they must meet at least three of the following four criteria:

- Civil and political freedom: The country must respect people’s right to political and civil liberty. We use sources such as the Freedom in the World report by the non-governmental organisation Freedom House (freedomhouse.org) to benchmark countries on issues such as electoral process, functioning of government, freedom of expression and belief, rule of law and individual rights.

- Corruption: The country must meet high standards regarding bribery and corruption. We use sources such as Transparency International’s Corruption Perception Index to assess the risk of public sector corruption in different countries.

- Defence: The country must not exceed the global average on military expenditure as a proportion of GDP, calculated on a three-year rolling basis.

- Climate change: The country must be committed to reducing its contribution to climate change. We use sources such as the Climate Change Performance Index and Climate Action Tracker to assess effectiveness of climate change policy, alignment with decarbonisation pathways and progress in reducing emissions.

Equities and corporate bonds

Companies are assessed against a number of positive and negative top-level social and environmental criteria. The team analyse in detail the specific merits of each company’s individual activities and sustainable business practices.

Green, social or sustainability bonds

Green bonds, social bonds, sustainability bonds, or similar bonds where the proceeds are used to support specified environmental or social objectives, may be eligible for inclusion in the fund. Each is subject to the usual sustainability criteria applied to the issuer. If the corporate issuer itself does not pass our positive and negative screens, a bond may still be approved for inclusion in the fund on the merits of how the bond’s proceeds will be used, rather than the issuer’s principal activity. When analysing a ring-fenced bond against our criteria, we will look at:

- The issuer’s green/social financing framework and whether an independent second party opinion on this has been sought (what the proceeds of the bond can be used for).

- The processes in place to govern ongoing management of proceeds from the bond (how certain can we be that the money will be used as intended).

- Full transparency on the use of proceeds through regular reporting, ideally with third party verification and reporting on impact in addition to allocation of funds (what was the money used for and what benefit did it create).

- Whether the funding is transformational for the issuer or part of ‘business as usual’ with a green/social label (would the activity have occurred anyway?).

The exclusions and negative screens

The funds apply screening criteria to avoid investing in companies creating significant negative impacts that are considered to be incompatible with sustainable development.

The funds shall exclude companies in breach of specific criteria related to one or more of the following:

- Alcohol

- Animal welfare: animal testing

- Animal welfare: fur

- Animal welfare: intensive livestock farming

- Armaments

- Climate change

- Employment

- Environment

- Gambling

- Human rights

- Nuclear power

- Pornography

- Tobacco

The positive sustainability criteria

We believe that companies displaying strong policies and practices with regard to environmental, social and governance issues are likely to be well-positioned to deliver long-term value creation for investors.

In order to qualify for inclusion in the funds, companies that pass the negative screen must also display leading or well-developed business practices and policies (operational alignment), and/or allocate capital towards the provision of products or services aligned with sustainable development (activity alignment).

In September 2015, the UN launched the SDGs. These comprise 17 goals, with 169 underlying targets that aim to ‘end poverty, protect the planet and ensure prosperity for all’ by 2030. The SDGs provide a comprehensive framework for international action on the many social and environmental challenges facing the world.

Greenbank have mapped the SDGs to a set of eight sustainable development categories and a number of underlying sub-categories. These categories ultimately align with the same ambitions as the SDGs, but focus on the areas most relevant to companies. We use these categories to determine how successful individual companies are at translating aspirations into tangible results.

- Energy and climate: Support decarbonisation aligned to the goals of the Paris Agreement on climate change.

- Habitats and ecosystems: Preserve and enhance natural systems by encouraging companies to have a net positive impact on biodiversity.

- Resource efficiency: Promote a circular economy that supports sustainable levels of consumption.

- Inclusive economies: Promote an equitable economy in which there is expanded opportunity for shared prosperity.

- Decent work: Ensure proper emphasis on the quality of jobs being created and maintained alongside their quantity.

- Innovation and infrastructure: Support infrastructure that is fit to achieve broader planetary and societal goals.

- Resilient institutions: Strengthen well-functioning institutions that protect the rule of law and fundamental rights.

- Health and wellbeing: Ensure companies do not undermine the health of their beneficiaries and encourage improved health outcomes.

Operational alignment

Our focus is on three principal areas of operations: employment, environment and human rights. If a company is to be aligned to one of the eight categories based on operational alignment, it must display positive action which is well developed and leading across one or more of these areas.

Activity alignment

We analyse whether companies have significant involvement in the provision of products or services aligned with sustainable development. Essentially, we are asking whether companies are allocating capital in alignment with any of the SDGs, and if this practice is central to their business models.

Process:

The funds follow a four-step investment process combining the expertise of Rathbones Asset Management and Greenbank:

- ESG risk integration: conducting in depth research to ensure we only invest in companies who are managing their ESG risks appropriately.

- Negative screening: avoiding investments which are incompatible with sustainable development.

- Positive alignment analysis: aligning investments to Greenbank’s eight sustainable development themes which map to the SDGs.

- Stewardship: dialogue through engagement to align with our sustainability criteria.

Our investment team look to identify material ESG risks in their investment analysis. This enables us to uncover any potential ESG risks or identify any potential ESG opportunities a company may have, before deciding whether or not we believe those factors could be financially material to that particular company and therefore affect our investment decision. We only consider material ESG factors in our investment process. When assessing whether an ESG factor is material to a particular company we consider (1) Probability: how likely it is to affect the financial or operating performance of the company (2) Impact: how large would the impact be on the financial or operating performance of the company if the ESG issue occurred.

There is not one exhaustive list of the types of ESG issues we may integrate into our analysis (and these will likely differ depending on the sector and region the company operates in) however some examples of the types of ESG factors we may look at include:

Environmental

This covers matters relating to the quality and functioning of the natural environment including:

- Climate change and carbon emissions

- Air and water pollution

- Biodiversity

- Deforestation

- Energy efficiency

- Waste management

- Water scarcity

Social

This focuses on the rights, well-being and interests of people and communities including:

- Customer satisfaction

- Data protection and privacy

- Gender and diversity

- Employee engagement

- Community relations

- Human rights

- Labour standards

Governance

This relates to the governance of companies and other investment vehicles including:

- Board composition

- Audit committee structure

- Bribery and corruption

- Executive compensation

- Lobbying

- Political contributions

- Whistleblower schemes

After the fund managers have identified material ESG risks in their investment analysis and assessed the potential impact of these on companies before making an investment decision, all assets in the fund are then scrutinised against pre-determined sustainability criteria by Greenbank Investments’ (Greenbank) Ethical Sustainable and Impact ESI Research team, which maintains a proprietary database of in-depth profiles on companies and countries. The criteria have been designed to exclude entities whose activities or behaviours hinder sustainable development and identify those that are delivering benefits for society and the environment.

New investments that are considered suitable for the funds are investigated as requested by the fund managers and subjected to the team’s screening process. The team looks to update all of its in-depth company profiles on a 12-18 month cycle. A full review of the fund’s eligible investment universe will be carried out an annual basis ahead of a formal annual review meeting.

The fund’s holdings are monitored regularly, and reviewed in the light of any relevant news, merger and acquisition activity or findings from ongoing analysis. As new governments are elected, or companies change their activities, merge with others or develop new policies and practices, their sustainability credentials may alter. The Greenbank ESI Research team works closely with the fund managers to highlight changes in sustainability performance and ensure that the funds only hold approved investments.

Divestment on sustainability grounds is likely to be uncommon, as investments we hold are unlikely to change their ‘spots’ overnight. If the activities of a company change, such that it is no longer suitable for the funds, the fund managers would normally seek to sell the holding within three to six months.

Finally, stewardship forms an essential part of our approach to responsible investment. Stewardship is a crucial fourth leg to the process and involves the participation of both the fund managers and a dedicated corporate governance team when scrutinising policies and management teams.

Our full sustainability criteria can be found in the Rathbone Greenbank Multi-Asset Portfolios Sustainability Process brochure which is available on the Fund EcoMarket and Rathbones Asset Management websites.

ESG data

The Multi-Asset team source ESG data from several vendors in order to support the fund manager’s ESG integration work. The team utilises resources including:

- MSCI ESG ratings and research: measures a company’s resilience to long-term, financially relevant ESG risks and opportunities

- Sustainalytics ESG risk ratings and research: measures the magnitude of a company’s unmanaged ESG risks

- Industry ESG conferences and company meetings: provide information on both sector-wide and company specific ESG or sustainability issues

- ESG research/comments from internal and third-party analysts: provide additional insight into any relevant ESG issues affecting potential investment opportunities

- Weekly sustainability news flow: provides weekly news on material sustainability issues and topics across our multi asset holdings

To apply the sustainability criteria, the ESI Research team use MSCI ESG Manager as a tool to help identify which companies we need to screen out of our portfolios for not meeting our exclusionary criteria. The screening tool looks at companies’ revenue exposure or ESG score to different areas we screen out and flags if there is a breach.

In addition to the reporting outputs from companies themselves, the Greenbank team uses a variety of sources, including reports and publications from industry groups, non-governmental organisations, sell-side analysts, external research bodies and specialist responsible investment publications, to arrive at a balanced view of companies’ overall performance. Some examples of sources of information include the Workforce Disclosure Initiative, Access to Medicine Index, Access to Nutrition Initiative and CDP (Carbon Disclosure Project). Since June 2015, the team has also subscribed to MSCI ESG Manager to reinforce this process, utilising tools such as their SDG alignment tool, as an initial starting point for their analysis in some cases. Greenbank also conducts research into wider topics such as climate change, clean energy, human rights, community investment and employee welfare and utilises this research when conducting the sustainability screening for the funds.

Regarding government bonds, Greenbank has access to a variety of sources but primarily uses Freedom House’s ‘Freedom in the World’ Report, Transparency International’s Corruption Perception Index, military spend data from the Stockholm International Peace Institute, the Climate Change Performance Index and the Climate Action Tracker for their assessment.

For sustainability bonds, Greenbank will also take into consideration whether the financing framework is aligned to an external standard, which can include, but is not limited to, the International Capital Market Association’s Green Bond Principles and the Climate Bonds Initiative’s Climate Bonds Standard and Certification Scheme.

Resources, Affiliations & Corporate Strategies:

The fund uses the services of Greenbank Investments’ in-house Ethical, Sustainable & Impact (ESI) Research Team to carry out its ESG research. This team is part of the wider Rathbones group but is independent from Rathbones Asset Management, ensuring that ethical screening decisions are independent from the investment team. This team has access to a variety of third party ESG research to assist with their research, including subscribing to MSCI’s ESG Manager and has access to its ESG Controversies and ESG Ratings tools. These are used as an adjunct to the team’s in-house research rather than relied on in their raw form.

The investment team also have access to a variety of external third party ESG research providers to assist with their credit analysis including MSCI, Sustainalytics and Fitch.

Greenbank Investments’ ESI Research Team

Greenbank Investments’ specialist Ethical, Sustainable and Impact (ESI) Research Team conduct ethical research and apply the fund’s ethical screening criteria. The team at Greenbank have been at the forefront of developments in the ethical investment industry since 1992, launching one of the first bespoke ethical portfolio services in 1997. The fund’s ethical and sustainability framework and methodology have been developed with Greenbank, utilising their many years’ experience of managing private client portfolios as well as providing screening services for the other Rathbones’ sustainable funds (including Rathbone Greenbank Multi-Asset Portfolio funds, the Rathbone Greenbank Global Sustainability Fund and the Rathbone Greenbank Global Sustainable Bond Fund).

Kate Elliot is Head of Greenbank Research, which comprises:

- Sophie Lawrence - Stewardship and Engagement Lead

- Kai Johns - Senior Ethical, Sustainable and Impact Researcher

- Charlie Young - Ethical, Sustainable and Impact Researcher

- Lauren O’Leary - Ethical, Sustainable and Impact Researcher

- Caitlin Westlake - Assistant Ethical, Sustainable and Impact Researcher

For biographies for the team please visit the Our People page on the Rathbones website.

Rathbones Stewardship team

The Rathbones Group Stewardship team is led by Matt Crossman (Stewardship Director) and comprises:

- Archie Pearson - Stewardship Lead

- Philippa Bliss –Stewardship Lead

- Sonia Amrat-Nath – Stewardship Lead

- Tilia Astell - ESG & Stewardship Analyst

- Kazuki Shaw - ESG & Stewardship Analyst

In addition to this, Jenny Foster is an Engagement Analyst for Rathbones Asset Management, working with all of the fund managers to deliver Rathbone Asset Management's engagement strategy and lead direct engagements with companies.

ESG affiliations and memberships

Rathbones Group is a member of PIMFA and UK Finance. They participate in and are members of or signatories to:

- UK Stewardship Code

- PRI

- CDP

- IIGCC

- Climate Action 100+

- Living Wage employer

- The Workplace Wellbeing Charter

- The FTSE Women Leaders Review

- The Parker Review

- Signatories to UN Global Compact

- Signatories to Women in Finance Charter

- Listed on FTSE4Good

- Net Zero Asset Managers Initiative

- Inclusive Companies

- UKSIF

Please see the Rathbones website for further details

Greenbank (Rathbones’ specialist sustainable investment division) partners with many different members of the responsible investment community. These are shown below:

- Ecumenical Council for Corporate Responsibility (ECCR)

- The Food Foundation

- Access to Medicine Index

- Access to Nutrition Initiative

- Finance for Biodiversity

- Business Benchmark on Farm Animal Welfare (BBFAW)

- Long-term Investors in People’s Health – ShareAction

- FAIRR

- CCLA Mental Health Investor Coalition

- Business Coalition for a Global Plastics Treaty

- Investor Coalition on Food Policy

Please see the Greenbank Investments website for further details at: Partnerships | Greenbank

SDR Labelling:

Sustainability Focus label

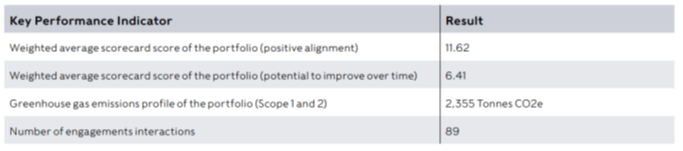

Key Performance Indicators:

Sustainability Metrics

The fund measures and reports its sustainability performance annually, using a set of core key performance indicators (KPIs) to track progress. These metrics include the weighted average scorecard score of the portfolio, disaggregated between assets that meet the fund’s higher threshold of positive alignment with the non-financial objectives, and assets that credibly have the potential to improve over time. Additional metrics include the greenhouse gas emissions profile of the portfolio, and the number of engagements undertaken to improve corporate sustainability practices.

The funds aim to increase the weighted average score of the ‘improvers’ portion of the portfolio by 10% over three years and by 25% over five years.

Quarterly cross-checks against third-party data provide an additional layer of validation, ensuring the accuracy and integrity of the fund’s sustainability performance.

Key Performance Indicator

Rathbone Greenbank Defensive Growth Portfolio Fund:

Source: Rathbones, 28 February 2025

The fund also discloses thematic engagements and their outcomes, providing transparency on how stewardship activities contribute to the overall sustainability objective.

- Consumer Facing Disclosure

SDR Literature:

Literature

Disclaimer

The information contained in this document is for use by investment advisers and is not intended for circulation to private clients or the general public.

Past performance should not be seen as an indication of future performance. The value of investments and the income from them may go down as well as up and you may not get back your original investment.

Rathbones Asset Management is authorised and regulated by the Financial Conduct Authority and Rathbones Asset Management is a member of the Investment Association.

Rathbones Asset Management Limited: Registered address 30 Gresham Street, London, EC2V 7QN.

Registered No. 02376568 - A Member of the Rathbone Group.

| Fund Name | SRI Style | SDR Labelling | Product | Region | Asset Type | Launch Date | Last Amended |

|

|---|---|---|---|---|---|---|---|---|

Rathbone Greenbank Defensive Growth Portfolio Fund |

Sustainable Style | Sustainability Focus label | OEIC | Global | Multi Asset | 29/03/2021 | Aug 2025 | |

Objectives

The funds seek to invest in entities whose activities or ways of operating are aligned with sustainable development and therefore support the achievement of the UN Sustainable Development Goals. In particular, we believe that companies displaying strong policies and practices with regard to environmental, social and governance issues are likely to be well-positioned to deliver long-term value creation for investors. The funds avoid entities creating significant negative impacts that are considered to be incompatible with sustainable development. |

Fund/Portfolio Size: £177.40m (as at: 31/05/2025) Total Screened Themed SRI Assets: £2709.20m (as at: 31/05/2025) Total Assets Under Management: £15754.85m (as at: 31/05/2025) ISIN: GB00BMQC6K53, GB00BMQC6L60 Contact Us: ram@rathbones.com |

|||||||

Sustainable, Responsible &/or ESG OverviewWe meticulously select every holding, ensuring strong investor returns alongside sustainable goals. Your financial future is paramount, so the business case for our investments is as crucial as their positive societal impact. To guarantee integrity, Greenbank has a veto on every investment's eligibility, providing assurance that "doing the right thing" is never compromised for profit.

|

||||||||

|

Primary fund last amended: Aug 2025 |

||||||||

|

Information received directly from Fund Manager |

||||||||

|

Please select what you would like to read:

Fund FiltersSustainability - General

Sustainability policy

Has policies that consider (environmental and social) sustainability issues. Strategies vary but are likely to consider environmental issues like climate change, carbon emissions, biodiversity loss, resource management, environmental impacts; and social issues like equal opportunities, human rights, labour standards, diversity and adherence to internationally recognised codes. See individual entry information.

Sustainability focus

Has a significant focus on sustainability issues

Encourage more sustainable practices through stewardship

Aim to encourage higher sustainability standards through responsible ownership / stewardship / engagement / voting activity

Report against sustainability objectives

Publicly report performance against named sustainability objectives Environmental - General

Environmental policy

Has policies which relate to environmental issues. These will typically set out their stance on issues such as pollution, climate change, resource management, biodiversity loss, carbon emissions, plastics and/or additional environmental impacts. Strategies vary.

Limits exposure to carbon intensive industries

Options that limit or 'reduce' their exposure to carbon intensive industries (ie sectors which are major contributors to climate change). Strategies vary. Nature & Biodiversity

Biodiversity / nature policy

Has a written biodiversity policy or theme typically aimed at supporting, encouraging and improving environmental protection and safeguarding the natural world (sometimes referred to as 'natural capital'). See eg https://www.un.org/en/climatechange/science/climate-issues/biodiversity

Deforestation / palm oil policy

Has policies designed to address involvement in irresponsibly managed palm oil or other forms of deforestation (typically exclusion led). Strategies vary.

Illegal deforestation exclusion policy

Avoids assets that are involved in illegal deforestation. This may relate to palm oil, cattle farming or other areas. Strategies vary. Climate Change & Energy

Climate change / greenhouse gas emissions policy

Has policies (documented strategies that explain their position) on climate change related issues such as greenhouse gas/carbon emissions, net zero, transitioning to lower carbon. Strategies vary.

Coal, oil & / or gas majors excluded

Avoid investment in major coal, oil and/or gas (extraction) companies. Strategies vary.

Fracking and tar sands excluded

Avoid companies involved in fracking and tar sands - which are widely regarded as controversial methods of oil and gas extraction. Strategies vary.

Arctic drilling exclusion

Avoid companies that are involved in extracting oil from the Arctic regions.

Fossil fuel reserves exclusion

Avoid investing in companies / assets with coal, oil and gas reserves. See individual entry information for further details.

Encourage transition to low carbon through stewardship activity

Encourage the transition to lower carbon activities through asset selection and / or responsible ownership activity.

Fossil fuel exploration exclusion - direct involvement

Excludes companies and other assets with direct involvement in fossil fuel exploration (eg coal, oil and gas companies)

TCFD / IFRS reporting requirement

Will only invest in companies that report greenhouse gas emissions in line with this international reporting framework. See https://www.fsb-tcfd.org/ https ://www.ifrs.org/sustainability/tcfd/ Social / Employment

Social policy

Has policies which set out their approach to social issues (e.g. human rights, labour standards, equal opportunities, child labour and/or adherence to internationally recognised codes such as the UN Global Compact). Strategies with social policies typically avoid companies with low standards and/or work to encourage higher standards. See fund information for detail.

Diversity, equality & inclusion Policy (product level)

Has a written diversity policy – where the manager will aim to select companies with a carefully considered, positive employment standards. This may cover a range of issues including gender, ethnicity, disability, beliefs and sexual orientation.

Mining exclusion

All mining companies excluded Ethical Values Led Exclusions

Tobacco and related product manufacturers excluded

Companies are excluded if they are involved in any aspect of the production chain for tobacco products, including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Tobacco and related products - avoid where revenue > 5%

Companies are excluded if they make more than 5% of their revenue from the manufacture, sale or distribution of tobacco products including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Controversial weapons exclusion

Excludes companies which make controversial weapons such as landmines, cluster munitions and chemical weapons.

Armaments manufacturers avoided

Avoids companies that manufacture weapons intended specifically for military use. Strategies vary - may or may not included non-strategic military products.

Military involvement not excluded

Does Not exclude companies with military contracts - this may include medical supplies, food, safety equipment, housing, technology etc.

Civilian firearms production exclusion

Has a written civilian firearms exclusion policy - meaning that they will not invest in companies that make (or perhaps also sell) handguns made for non-military users.

Alcohol production excluded

Avoids companies that produce alcohol. Strategies vary; some may allow a small proportion of revenue to come from this area.

Gambling avoidance policy

Avoids companies with significant involvement in the gambling industry. Some may allow a small proportion of revenues to come from this area.

Pornography avoidance policy

Find funds that avoid companies that derive significant income from pornography and related areas. Strategies vary.

Animal welfare policy

Has policies that require specific animal welfare standards to be met. These may reference well-known welfare standards (3Rs - Replace, Reduce, Refine) or certification schemes. Strategies vary. Human Rights

Human rights policy

Has policies relating to human rights issues. Typically require companies to demonstrate higher standards, although some managers work to encourage improvements. Investee companies are often judged against internationally agreed norms or standards. Strategies vary.

Oppressive regimes (not free or democratic) exclusion policy

Has policies that exclude companies or other assets which operate in, or are owned by regimes which are not democratic, or where people may be oppressed. May use eg. Freedom House research. Strategies vary.

Modern slavery exclusion policy

Has a policy which excludes assets with involvement in Modern Slavery Gilts & Sovereigns

Invests in gilts / government bonds

Invest in loans issued the government, commonly known as gilts or government bonds. These may or may not be ringfenced for specific projects (see additional options).

Gilts / government bonds - exclude some

Avoids investing in 'some' gilts or government bonds. Strategies vary, but this may relate to avoiding specific countries or particular reasons for bond issuance. 'Green gilts' for example would be likely to be acceptable.

Invests in sovereigns subject to screening criteria

Invest in financial instruments issued by governments, but will only hold those that meet certain environmental and or social criteria. This may, for example mean certain assets are excluded in line with eg Freedom House research. Strategies vary. Banking & Financials

Invests in banks

Can include banks as part of their holdings / portfolio.

Invests in insurers

May invest in insurance companies. Governance & Management

Encourage board diversity e.g. gender

Encourage the companies they invest in to have more diverse board structures (e.g. more women on boards)

Encourage higher ESG standards through stewardship activity

Aim to encourage higher ESG standards through responsible ownership / stewardship / engagement /voting activity Product /Service Governance

External (fund/service) committee has veto powers

Find funds that employ an external committee (i.e. not company employees) that has power to veto (i.e. overrule) fund managers stock selection decisions. (This would typically mean the committee can tell the manager of this particular fund not to buy / sell a specific investment when they consider it appropriate to do so.)

ESG integration strategy

Find funds that factor in 'environmental, social and governance' issues as part of their investment decision making process. A focus on 'ESG' typically means a fund is carrying out additional research to help reduce ESG related risks. It does not necessarily mean a focus on sustainability. Strategies vary. See fund literature. Asset Size

Invest in supranationals

Invests in international entities or bodies with agreed remits that are broadly similar to those that may otherwise be undertaken by individual governments eg the UN How The Fund/Portfolio Works

Positive selection bias

Focuses on finding and investing in companies with positive / beneficial attributes. This strategy can be applied in addition to exclusion criteria and engagement/stewardship activity.

Negative selection bias

Has principle 'ethical approach' to avoid companies by using negative screening criteria. Strategies vary.

Combines norms based exclusions with other SRI criteria

Investment selection process uses internationally agreed 'norms' (e.g. United Nations Global Compact - UNGC - or the UN Sustainable Development Goals - SDGs) alongside additional SRI criteria such as positive or negative stock selection policies and/or stewardship strategies.

Combines ESG strategy with other SRI criteria

Invests in assets which have an ESG strategy (which is typically focused on avoiding companies that pose environmental, social or governance related risks) together with additional criteria such as positive and/or negative screens, themes and stewardship strategies.

SRI / ESG / Ethical policies explained on website

Publish explanations of their ethical, social and/or environmental policies online (i.e. investment decision making strategies/ buy/sell &/or asset management strategies).

Different risk options of this strategy are available

Has different risk options for the same investment strategy Unscreened Assets & Cash

All assets (except cash) meet published sustainability criteria

All assets - except cash - meet the sustainability criteria published in strategy documentation. Intended Clients & Product Options

Intended for investors interested in sustainability

Designed to meet the needs of individual investors with an interest in sustainability issues.

Intended for clients interested in ethical issues

Designed for clients who care about ethical and values-based issues, often alongside sustainability issues also.

Available via an ISA (OEIC only)

Available via a tax efficient ISA product wrapper. Labels & Accreditations

SDR Labelled

Find options that have chosen to adopt one of the Financial Conduct Authority (FCA) SDR labels. Please note: there are a range of reasons why potentially relevant options may not use an SDR label eg. adopting a label may be work in progress, the manager may not yet be allowed to do so because of the product type, a manager may feel they are insufficiently aligned to SDR requirements.

ACT signatory

A voluntary corporate culture standard for investment managers, see https://www.investorsact.com/ - City Hive Fund Management Company InformationAbout The Business

Responsible ownership / stewardship policy or strategy (AFM company wide)

Finds fund / asset management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

ESG / SRI engagement (AFM company wide)

Find fund / asset management companies that actively encourage higher 'environmental, social and governance' and / or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Vote all* shares at AGMs / EGMs (AFM company wide)

Find fund / asset managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Responsible ownership / ESG a key differentiator (AFM company wide)

Find fund / asset managers that consider responsible ownership and ESG to be a key differentiator for their business.

In-house diversity improvement programme (AFM company wide)

Finds organisations / fund managers that have an in-house (company wide) diversity improvement programme - meaning that they are working to ensure that within their own businesses they employ people from diverse backgrounds - often typically focused on ethnicity and/or sex.

Diversity, equality & inclusion engagement policy (AFM company wide)

Find fund / asset management companies that encourage the companies they invest in to have strong diversity, race, gender and other equality policies across all assets held, not simply screened or themed SRI/ESG funds. (ie Asset Management company wide).

Vulnerable client policy on website (AFM company wide)

Fund / asset manager has information on their website that explains how they treat 'vulnerable clients' (as set out in FCA regulation)

Invests in new sustainability linked bond issuances (AFM company wide)

Fund / asset management company has investments in bonds designed to meet sustainability requirements - however these assets may not be 'ringfenced' for this purpose. See website for details.

Offer unstructured intermediary sustainable investment training

Fund management entity offers unstructured intermediary training on sustainable investment (ie for financial advisers and wealth managers) Collaborations & Affiliations

PRI signatory

Find fund / asset management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

UKSIF member

Find fund / asset management companies that are members of UKSIF - the UK Sustainable Investment and Finance association

Fund EcoMarket partner

Find fund / asset management companies that have partnered with Fund EcoMarket - meaning that they are helping to improve access to information on sustainable and responsible investment by paying an annual fee to us which enables us to publish information for free. Partner funds are listed ahead of other funds and have their logos displayed.

TNFD forum member (AFM company wide)

A member of the Taskforce for Nature Related Financial Disclosures group which aims to aid risk management and shift money towards nature-positive outcomes.

Investment Association (IA) member

Fund management entity is a member of the Investment Association https://www.theia.org/ Resources

In-house responsible ownership / voting expertise

Find fund / asset management companies that employ people to steer and support fund managers in voting shares at company AGM's and EGMs in ways that are consistent with encouraging higher ESG/sustainability standards.

Employ specialist ESG / SRI / sustainability researchers

Find a fund / asset management company that directly employs specialist ESG/SRI/sustainability researchers or analysts. This allows asset managers to discuss environmental, social and governance risks and opportunities directly with companies.

Use specialist ESG / SRI / sustainability research companies

Find fund / asset management companies that makes use of expert external research companies. This can help deliver specialist expertise and means resources are pooled with other investors. Accreditations

PRI A+ rated (AFM company wide)

Finds organisations / fund managers that have an A+ PRI rating - meaning they are highly rated according to the 'Principles of Responsible Investment'

UK Stewardship Code signatory (AFM company wide)

Find fund / asset managers that are signatories to the FRC UK Stewardship Code, which sets out a framework for constructive investor / investee relations where managers are encouraged to behave like responsible, typically longer term 'company owners'. Engagement Approach

Engaging on climate change issues

Fund / asset manager has stewardship /responsible ownership strategy that is focused on addressing climate change with investee assets.

Engaging with fossil fuel companies on climate change

Fund / asset manager has a stewardship /responsible ownership strategy that involves working with fossil fuel companies on climate change related issues. See fund manager website for details.

Engaging to reduce plastics pollution / waste

Fund / asset manager has stewardship /responsible ownership strategy with involves encouraging investee asset to reduce plastic waste and pollution.

Engaging to encourage responsible mining practices

Fund / asset manager has a stewardship / responsible ownership policy that means they are working to encourage more responsible mining practices - where environmental and social issues are properly dealt with by the companies they invest in.

Engaging on biodiversity / nature issues

The fund / asset manager has a responsible ownership / stewardship strategy that focuses on biodiversity and nature issues relating to the assets they invest the aim of which will be to reduce harm and or deliver improvement. Strategies vary. https://tnfd.global

Engaging to encourage a Just Transition

Fund / asset manager has a responsible ownership / stewardship strategy which means they are working to encourage the shift to more sustainable business practices in ways that respect and are sensitive to social issues and the impact change has on people effected by the changes that are taking place. https://www.transitionpathwayinitiative.org/ https://transitiontaskforce.net/

Engaging on human rights issues

Fund / asset manager has responsible ownership / stewardship strategy in place which aims to address human rights issues in investee companies (and potentially their suppliers) with the aim of raising standards

Engaging on labour / employment issues

Fund / asset manager has responsible ownership / stewardship strategy in place that aims to improve labour standards for the benefit of employees in investee companies (and potentially their suppliers)

Engaging on diversity, equality and / or inclusion issues

Fund / asset management company has a stewardship strategy in place which involves working to raise diversity, equality and inclusion standards across investee assets

Engaging to stop modern slavery

Fund / asset manager is working with the assets they hold to help stamp out modern slavery - where direct or indirect company employees are exploited for business benefits.

Engaging on governance issues

Fund / asset managers have stewardship strategies in place that focus on improving governance standards across investee assets

Engaging on responsible supply chain issues

Has a stewardship / responsible ownership strategy that encourages responsible supply chain - ie the managers will discuss environmental, social and governance issues with investee companies with the aim of raising standards

Engaging on the responsible use of AI

Working to address sustainability, ESG and related concerns around artificial intelligence.

Stewardship escalation policy

Escalation policies describe how a manager will proceed if stewardship / engagement activity is not successful in the short term. Company Wide Exclusions

Fossil fuel exclusion policy (AFM company wide)

Find fund / asset management companies that avoid investment in fossil fuel companies (e.g. coal, oil and gas) across all of their funds. (and/ or other assets.)

Coal divestment policy (AFM company wide)

This fund / asset manager has a strategy in place that will lead them to exit direct investments in the coal mining industry. Managers ability to do this may depend on the geographic regions in which they invest. Climate & Net Zero Transition

Net Zero commitment (AFM company wide)

Fund / asset management organisations that have pledged to reduce their greenhouse gas emissions to ‘net zero’. Strategies vary - this area is changing rapidly.

Net Zero - have set a Net Zero target date (AFM company wide)

This fund / asset management company has set a date by which they plan to achieve net zero greenhouse gas / CO2e emissions.

Encourage carbon / greenhouse gas reduction (AFM company wide)

Find fund / asset management companies that are working with the companies they invest in to encourage reductions in carbon dioxide and other greenhouse gas emissions.

‘Forward Looking Climate Metrics’ published / ITR (AFM company wide)

Finds organisations / fund managers that have published ‘forward looking climate metrics’ e.g. 'implied temperature rise' data that are a total of the asset management company's share (% owned) of all the investee company emissions of the assets they manage, as well as their own direct and other indirect emissions.

Carbon offsetting – do NOT offset carbon as part of net zero plan (AFM company wide)

This fund / asset management company plans to achieve net zero greenhouse gas (CO2e) emissions by reducing their emissions. Calculations and scope vary.

Working towards a ‘Net Zero’ commitment (AFM company wide)

Finds organisations / fund management companies that are in the process of working out how to make a ‘net zero commitment’ - meaning that when that is finalised they will have started the process of reducing their total greenhouse gas emissions to'zero'.

Committed to SBTi / Science Based Targets Initiative

See https://sciencebasedtargets.org/ Transparency

Publish responsible ownership / stewardship report (AFM company wide)

Find fund / asset management companies that publish a report detailing their responsible investment ownership - also known as 'Stewardship' - activity.

Publish full voting record (AFM company wide)

Fund / asset management companies that publish a full record of how they vote their shares at AGMs (annual general meetings) and EGMs (extraordinary general meetings). Voting strategies have an important role to play encouraging higher environmental, social and governance standards. Sustainable, Responsible &/or ESG Policy:The funds aim to invest in entities whose activities or ways of operating are aligned with sustainable development and which we believe have the potential to support the achievement of the UN Sustainable Development Goals (SDGs). To do this, the sustainable funds take the following approaches:

Each asset class requires a separate process for assessing whether it meets the sustainable objectives of the fund. We believe transparency is important in sustainable investing, so we have developed specific criteria that each asset must meet before it can be included in the funds. All potential investments are put forward by the fund managers, with the team at Greenbank then undertaking the necessary sustainability analysis and making the final decision about its eligibility for inclusion in the funds. A short summary is provided below of some of the criteria applied to key asset classes. Further details are provided in the Rathbone Greenbank Multi-Asset Portfolios Sustainability Process brochure which is available at Rathbone Greenbank Multi-Asset Portfolios | Rathbones (rathbonesam.com). Government bonds Government bonds have historically been an area of debate for sustainable investors because the majority of bond-issuing countries devote some of their budgets to military spending and generate tax revenues from controversial industries such as tobacco and alcohol. However, we believe this needs to be considered alongside the significant positive impact that many governments have on the environment and society. This may be through policies, regulations and subsidies designed to protect the environment, or the significant proportion of spending devoted to education, welfare, healthcare, etc. Nevertheless, governments are not automatically deemed to be acceptable and, for us to invest in their bonds, they must meet at least three of the following four criteria:

Equities and corporate bonds Companies are assessed against a number of positive and negative top-level social and environmental criteria. The team analyse in detail the specific merits of each company’s individual activities and sustainable business practices. Green, social or sustainability bonds Green bonds, social bonds, sustainability bonds, or similar bonds where the proceeds are used to support specified environmental or social objectives, may be eligible for inclusion in the fund. Each is subject to the usual sustainability criteria applied to the issuer. If the corporate issuer itself does not pass our positive and negative screens, a bond may still be approved for inclusion in the fund on the merits of how the bond’s proceeds will be used, rather than the issuer’s principal activity. When analysing a ring-fenced bond against our criteria, we will look at:

The exclusions and negative screens The funds apply screening criteria to avoid investing in companies creating significant negative impacts that are considered to be incompatible with sustainable development. The funds shall exclude companies in breach of specific criteria related to one or more of the following:

The positive sustainability criteria We believe that companies displaying strong policies and practices with regard to environmental, social and governance issues are likely to be well-positioned to deliver long-term value creation for investors. In order to qualify for inclusion in the funds, companies that pass the negative screen must also display leading or well-developed business practices and policies (operational alignment), and/or allocate capital towards the provision of products or services aligned with sustainable development (activity alignment). In September 2015, the UN launched the SDGs. These comprise 17 goals, with 169 underlying targets that aim to ‘end poverty, protect the planet and ensure prosperity for all’ by 2030. The SDGs provide a comprehensive framework for international action on the many social and environmental challenges facing the world. Greenbank have mapped the SDGs to a set of eight sustainable development categories and a number of underlying sub-categories. These categories ultimately align with the same ambitions as the SDGs, but focus on the areas most relevant to companies. We use these categories to determine how successful individual companies are at translating aspirations into tangible results.

Operational alignment Our focus is on three principal areas of operations: employment, environment and human rights. If a company is to be aligned to one of the eight categories based on operational alignment, it must display positive action which is well developed and leading across one or more of these areas. Activity alignment We analyse whether companies have significant involvement in the provision of products or services aligned with sustainable development. Essentially, we are asking whether companies are allocating capital in alignment with any of the SDGs, and if this practice is central to their business models. Process:The funds follow a four-step investment process combining the expertise of Rathbones Asset Management and Greenbank:

Our investment team look to identify material ESG risks in their investment analysis. This enables us to uncover any potential ESG risks or identify any potential ESG opportunities a company may have, before deciding whether or not we believe those factors could be financially material to that particular company and therefore affect our investment decision. We only consider material ESG factors in our investment process. When assessing whether an ESG factor is material to a particular company we consider (1) Probability: how likely it is to affect the financial or operating performance of the company (2) Impact: how large would the impact be on the financial or operating performance of the company if the ESG issue occurred. There is not one exhaustive list of the types of ESG issues we may integrate into our analysis (and these will likely differ depending on the sector and region the company operates in) however some examples of the types of ESG factors we may look at include: Environmental

Social

Governance

After the fund managers have identified material ESG risks in their investment analysis and assessed the potential impact of these on companies before making an investment decision, all assets in the fund are then scrutinised against pre-determined sustainability criteria by Greenbank Investments’ (Greenbank) Ethical Sustainable and Impact ESI Research team, which maintains a proprietary database of in-depth profiles on companies and countries. The criteria have been designed to exclude entities whose activities or behaviours hinder sustainable development and identify those that are delivering benefits for society and the environment. New investments that are considered suitable for the funds are investigated as requested by the fund managers and subjected to the team’s screening process. The team looks to update all of its in-depth company profiles on a 12-18 month cycle. A full review of the fund’s eligible investment universe will be carried out an annual basis ahead of a formal annual review meeting. The fund’s holdings are monitored regularly, and reviewed in the light of any relevant news, merger and acquisition activity or findings from ongoing analysis. As new governments are elected, or companies change their activities, merge with others or develop new policies and practices, their sustainability credentials may alter. The Greenbank ESI Research team works closely with the fund managers to highlight changes in sustainability performance and ensure that the funds only hold approved investments. Divestment on sustainability grounds is likely to be uncommon, as investments we hold are unlikely to change their ‘spots’ overnight. If the activities of a company change, such that it is no longer suitable for the funds, the fund managers would normally seek to sell the holding within three to six months. Finally, stewardship forms an essential part of our approach to responsible investment. Stewardship is a crucial fourth leg to the process and involves the participation of both the fund managers and a dedicated corporate governance team when scrutinising policies and management teams. Our full sustainability criteria can be found in the Rathbone Greenbank Multi-Asset Portfolios Sustainability Process brochure which is available on the Fund EcoMarket and Rathbones Asset Management websites. ESG data The Multi-Asset team source ESG data from several vendors in order to support the fund manager’s ESG integration work. The team utilises resources including: