Schroder Global Sustainable Value Equity Fund

SRI Style:

Sustainability Tilt

SDR Labelling:

Sustainability Focus label

Product:

OEIC

Fund Region:

Global

Fund Asset Type:

Equity

Launch Date:

30/06/2004

Last Amended:

Aug 0025

Dialshifter ( ):

):

Fund/Portfolio Size:

£1057.85m

(as at: 31/05/2025)

Total Screened Themed SRI Assets:

£80299.00m

(as at: 31/03/2025)

Total Responsible Ownership Assets:

£653712.00m

(as at: 31/03/2025)

Total Assets Under Management:

£758460.00m

(as at: 31/03/2025)

ISIN:

GB00BF783V38, GB00BF783W45, GB00B01BZQ27, GB00B019KQ13, GB00BJRSTJ16, GB00BJRSTK21

Contact Us:

Objectives:

The fund aims to provide capital growth in excess of the MSCI World (Net Total Return) Index (after fees have been deducted) over a three to five year period by investing in equities of companies worldwide with 'Value' characteristics which the investment manager classifies as sustainable. These are companies that, through the way they are managed and/or the goods and services that they sell, make a positive contribution to the Planet (the environment); and/or People (employee wellbeing; customer wellbeing; healthy, inclusive and connected communities; and/or effective and accountable institutions).

Sustainable, Responsible

&/or ESG Overview:

Schroder Global Sustainable Value offers unwavering value exposure with laser-sharp focus on sustainability leaders and active engagement.

The strategy offers clients the Schroder Global Value Team’s tried and tested value approach with investment in companies that have a positive societal benefit as measured by our proprietary tool and are in our view industry leading in sustainability. The team explicitly only invest in undervalued sustainability leaders. These are companies that must have positive societal benefits for society and the environment. The team engage with every company in the portfolio to improve sustainability outcomes over time.

This unique approach proves that you can invest in sustainability leaders without sacrificing valuation. The Global Sustainable sector is heavily biased towards Growth, and this strategy provides genuine style diversification. Sustainability and Value are a compelling combination, and investors really can have the best of both worlds.

Primary fund last amended:

Aug 0025

Information directly from fund manager.

Fund Filters

Sustainability - General

Has policies that consider (environmental and social) sustainability issues. Strategies vary but are likely to consider environmental issues like climate change, carbon emissions, biodiversity loss, resource management, environmental impacts; and social issues like equal opportunities, human rights, labour standards, diversity and adherence to internationally recognised codes. See individual entry information.

Aim to encourage higher sustainability standards through responsible ownership / stewardship / engagement / voting activity

Publicly report performance against named sustainability objectives

Environmental - General

Has policies which relate to environmental issues. These will typically set out their stance on issues such as pollution, climate change, resource management, biodiversity loss, carbon emissions, plastics and/or additional environmental impacts. Strategies vary.

Options that limit or 'reduce' their exposure to carbon intensive industries (ie sectors which are major contributors to climate change). Strategies vary.

Aims to invest in companies with strong or market leading environmental policies and practices. Strategies vary. See individual entry information for more detail.

Nature & Biodiversity

Avoids assets that are involved in illegal deforestation. This may relate to palm oil, cattle farming or other areas. Strategies vary.

Climate Change & Energy

Avoid investment in major coal, oil and/or gas (extraction) companies. Strategies vary.

Encourage the transition to lower carbon activities through asset selection and / or responsible ownership activity.

Will only invest in companies that report greenhouse gas emissions in line with this international reporting framework. See https://www.fsb-tcfd.org/ https ://www.ifrs.org/sustainability/tcfd/

Ethical Values Led Exclusions

Companies are excluded if they make more than 5% of their revenue from the manufacture, sale or distribution of tobacco products including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Excludes companies which make controversial weapons such as landmines, cluster munitions and chemical weapons.

Avoids companies that manufacture weapons intended specifically for military use. Strategies vary - may or may not include non-strategic military products.

Does Not exclude manufacturers of products intended for use in armaments and weapons. So may invest in them

Does Not exclude companies with military contracts - this may include medical supplies, food, safety equipment, housing, technology etc.

Avoids companies with significant involvement in the gambling industry. Some may allow a small proportion of revenues to come from this area.

Avoids companies that derive significant income from pornography and related areas. Strategies vary.

Gilts & Sovereigns

Does not invest in / excludes 'sovereigns' - debt issued by governments. See eg https://www.investopedia.com/terms/s/sovereign-debt.asp

Banking & Financials

Can include banks as part of their holdings / portfolio.

May invest in insurance companies.

Governance & Management

Has policies that relate to corporate governance issues such as board structure, executive remuneration, bribery and/or corporate corruption. These funds will typically avoid companies with poor practices. Strategies vary.

Avoids investing in companies with poor governance practices.(e.g. board structure, management practices etc.) Views may however vary on what counts as 'poor' practices - and funds may not immediately divest as they may prefer to work to encourage higher standards.

Exclude companies that are subject to United Nations sanctions. See eg https://main.un.org/securitycouncil/en/content/un-sc-consolidated-list

Encourage the companies they invest in to have more diverse board structures (e.g. more women on boards)

Aim to encourage higher ESG standards through responsible ownership / stewardship / engagement /voting activity

Product / Service Governance

Find fund / asset managers that factor in 'environmental, social and governance' issues as part of their investment decision making process. A focus on 'ESG' typically means a fund is carrying out additional research to help reduce ESG related risks. It does not necessarily mean a focus on sustainability. Strategies vary. See fund literature.

Environmental, social and governance issues are part of this fund’s reporting of their ‘value’ to clients. AoV reporting is a statutory requirement. Including ESG factors in its calculation is not.

Asset Size

Invests in a combination of small, medium and larger (potentially multinational) companies / assets.

How The Fund/Portfolio Works

Has principle 'ethical approach' to avoid companies by using negative screening criteria. Strategies vary.

Has principle approach to apply positive or negative ethical, social and / or environmental screens. Strictly screened investments are likely to exclude more companies than other related options. Strategies vary.

Invest more heavily in assets which have higher ESG ratings/standards or scores and less heavily in companies with lower ESG ratings. Where this is central to the strategy you should expect assets in most sectors. Strategies vary.

Makes stock selection (and ongoing management) decisions based on ESG data or company ratings (normally supplied by third parties) rather than focusing on what individual companies do, how they operate or their plans for the future

Aims to avoid companies that do significant harm. This originates from the EU’s sustainable finance ‘DNSH’ (do no significant harm) work, which is not necessarily used by UK investors.

Investment selection process uses internationally agreed 'norms' (e.g. United Nations Global Compact - UNGC - or the UN Sustainable Development Goals - SDGs) alongside additional SRI criteria such as positive or negative stock selection policies and/or stewardship strategies.

Invests in assets which have an ESG strategy (which is typically focused on avoiding companies that pose environmental, social or governance related risks) together with additional criteria such as positive and/or negative screens, themes and stewardship strategies.

Considers both the 'positive' and 'negative' aspects of company behaviour and makes balanced, considered decisions as part of their investment approach. May apply to a range of different issues and policy areas.

Does not use stock lending for performance or risk purposes.

Unscreened Assets & Cash

Holds between 70-79% of assets which align to the sustainability objectives; which are not being held purely for risk management purposes, such as derivatives and cash equivalent assets.

Only invests in cash to aid the practical management (buying and selling) of assets and so do not use additional financial instruments.

Intended Clients & Product Options

Designed to meet the needs of individual investors with an interest in sustainability issues.

Designed for clients who care about ethical and values-based issues, often alongside sustainability issues also.

Available via a tax efficient ISA product wrapper.

Labels & Accreditations

Find options that have chosen to adopt one of the Financial Conduct Authority (FCA) SDR labels. Please note: there are a range of reasons why potentially relevant options may not use an SDR label eg. adopting a label may be work in progress, the manager may not yet be allowed to do so because of the product type, a manager may feel they are insufficiently aligned to SDR requirements.

A voluntary corporate culture standard for investment managers, see https://www.investorsact.com/ - City Hive

Fund Management Company Information

About The Business

Finds fund / asset management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

Find fund / asset management companies that actively encourage higher 'environmental, social and governance' and / or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Find fund / asset managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Find fund / asset managers that consider responsible ownership and ESG to be a key differentiator for their business.

Find fund / asset management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management.

Collaborations & Affiliations

Find fund / asset management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

Find fund / asset management companies that are members of UKSIF - the UK Sustainable Investment and Finance association

Find fund / asset management companies that have partnered with Fund EcoMarket - meaning that they are helping to improve access to information on sustainable and responsible investment by paying an annual fee to us which enables us to publish information for free. Partner funds are listed ahead of other funds and have their logos displayed.

A member of the Taskforce for Nature Related Financial Disclosures group which aims to aid risk management and shift money towards nature-positive outcomes.

Fund management entity is a member of the Investment Association https://www.theia.org/

Engagement Approach

Fund / asset manager has stewardship /responsible ownership strategy that is focused on addressing climate change with investee assets.

Fund / asset manager is working with the assets they hold to help stamp out modern slavery - where direct or indirect company employees are exploited for business benefits.

Escalation policies describe how a manager will proceed if stewardship / engagement activity is not successful in the short term.

Transparency

Find fund / asset management companies that publish information about their sustainable and responsible investment strategies on their company website.

Find fund / asset management companies that have supplied Dialshifter information. See Dialshifter tab within record for more information.

Sustainable, Responsible &/or ESG Policy:

The fund is actively managed and invests at least 80% of its assets in a concentrated range of equity and equity related securities of companies worldwide that have certain ‘Value’ characteristics. Value is assessed by looking at indicators such as cash flows, dividends and earnings to identify securities which the manager believes have been undervalued by the market. The fund typically holds 30 to 70 companies. The fund may also invest directly or indirectly in other securities (including in other asset classes), countries, regions, industries or currencies, collective investment schemes (including Schroder funds), warrants and money market instruments, and hold cash. The fund may use derivatives with the aim of reducing risk or managing the fund more efficiently.

The fund invests at least 70% of its portfolio in assets that the investment manager classifies as sustainable. A company is considered to be sustainable if it makes a positive contribution to: – Planet. This includes contributions to the environment - such as reducing greenhouse gas (GHG) emissions, which helps slow down climate change. and/or – People. This includes contributions to one or more of the following: – employee wellbeing - such as paying more than living wages or providing training to employees, which supports their professional development and prosperity. – customer wellbeing - such as developing new products and services that improve customers’ quality of life, for example medical drugs, therapies, diagnostic tools and healthy food. – healthy, inclusive and connected communities – such as providing access to clean water and sanitation (which promotes good health). – effective and accountable institutions – such as promoting financial stability, which supports people’s prosperity and financial security.

Process:

A company is classified as sustainable if it achieves a positive score in Schroders’ systematic model (SustainExTM). SustainExTM produces an assessment of the company’s effect on a defined set of benefits and costs for people and the planet, which are then combined to calculate an overall sustainability score for the company. A company must achieve a positive score to be deemed sustainable. The model is based on in-depth internal research, which has included establishing the relevance of various factors to the sustainability outcomes referred to above. In some exceptional cases, SustainExTM does not provide a fair reflection of a company’s contribution to people and/or the planet. The investment manager can refer such companies to Schroders’ Sustainable Investment Panel (the Panel), an independent panel of experts. The Panel reviews additional robust evidence provided by the investment manager to determine whether, if such evidence was available to SustainExTM, the company would achieve a positive score. This could be relevant where SustainExTM does not capture an area of positive contribution – such as where a company produces a particularly sustainable product whose importance to people or the planet is not fully captured by the company’s overall score. Alternatively, it could be relevant where the investment manager is able to supply additional data to enhance a calculation – such as where a company does not publish details of employee salaries, but the investment manager is able to obtain or more accurately estimate this from other sources.

For this fund, the investment manager will also assess whether potential investments are “ESG Leaders”. This process is separate to the assessment of whether a company meets the fund’s sustainability objective (as described above), and is not relevant in determining whether the fund has invested at least 70% of its assets in line with that objective. The ESG Leaders assessment determines whether a company provides an overall benefit to society and is best in-class versus industry peers in its approach to sustainability. ESG leadership is assessed holistically by: (1) assessing the quality of the company’s relationship with key stakeholders such as employees, communities, suppliers, customers and regulators; (2) analysing a range of sustainability-related materials including company disclosures and sustainability analysis carried out by third party experts; and (3) avoiding companies with a MSCI ESG score lower than ‘A’ in order to help avoid exposure to material ESG risks. A company must be classified as an ESG leader to be eligible for investment. The ESG Leaders assessment uses a broad range of data sources, including Schroders’ systematic models, third party sustainability rating data and company disclosures.

Resources, Affiliations & Corporate Strategies:

Sustainability is fundamental to our investment principles at Schroders and we have an experienced and well-resourced Sustainable Investment team, who are embedded within our Investment function. We are a global team, spread across four regional hubs in London, Paris, Singapore and New York, aiming to ensure that sustainability is embedded through our global investment teams and client functions.

The team is led by Andrew Howard, Global Head of Sustainable Investment. As team head, he oversees our approach to ESG integration, active ownership, our sustainability research and tools, and our reporting and product strategy.

Our central Sustainable Investment team sits alongside investment teams rather than operating in a silo, which facilitates regular dialogue with our analysts and portfolio managers.

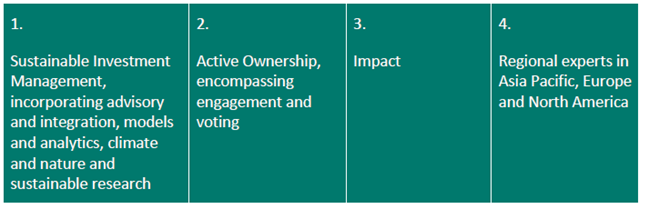

It is organised into four pillars:

We outline their key responsibilities and areas of focus below.

1. Sustainable investment management

Our Advisory and Integration team acts as a central contact point and consultant for a range of stakeholders across the business. This includes advising investment teams on ESG integration best practice; compliance, risk and legal teams on ESG regulation; and working with our regional experts; across Asia Pacific, Europe and North America, as outlined under pillar four.

Our Models and Analytics team is responsible for the maintenance and evolution of our suite of proprietary tools. They are also responsible for ESG data, ensuring we harness sustainability data effectively from both conventional and unconventional sources.

Our Strategy and Research team is responsible for undertaking sustainability research to: inform firmwide strategy and commitments; provide insights for investment teams to analyse sustainability-related risks and opportunities; and provide research-related and technical support for other stakeholders across the firm.

2. Active ownership

Our Engagement team partners with investors to have dialogue with the companies in which we invest, seeking to understand how prepared they are for a changing world and pushing them towards more sustainable practices. The team track the progress of these engagements and hold companies to account.

Our Corporate Governance team is responsible for voting in line with our Voting Policy and Principles.

3. Impact

Our Impact team is responsible for scaling our impact product offering in line with best-practice impact principles. The team works closely with investment desks and is responsible for developing and implementing our impact management and measurement framework, including impact assessment and monitoring at transaction and portfolio level, product development, impact strategy and impact reporting.

4. Regional Expertise

Our Regional Experts based in Asia Pacific, Europe and North America have a deep understanding of local market characteristics and nuances, and are responsible for staying abreast of sustainability-related developments. Our experts work with clients and internal teams to navigate and support clients’ ESG aspirations and challenges, utilising Schroders’ proprietary tools and research to develop investment solutions that meet their needs. They also engage with regulators and industry bodies to shape and support the global sustainable finance agenda. Our regional experts are a critical extension of the central team in London as the firm continues to evolve its global ESG strategy.

We have a number of governance structures in place for decision-making and oversight of our approach to sustainable investment. The Board of Schroders plc (the Board) has collective responsibility for the management, direction and performance of the Group, and is accountable for our overall business strategy. The Group Chief Executive is responsible for proposing the strategy for the Group and for its implementation, supported by the Group’s senior management team and a number of Committees, some of which are noted below.

The Group Sustainability and Impact (GSI) Committee provides advice to the Group Chief Executive on sustainability and impact matters. The Committee considers, reviews and recommends the overall global sustainability and impact strategy, including key initiatives, new commitments and policies for approval. The Global Head of Sustainable Investment and Global Head of Corporate Sustainability are members of the Committee and report to the Board.

The Sustainability Executive Committee (ExCo) develops and oversees the delivery of our Group-level sustainable investment management strategy. The ExCo also advises on the development of our sustainability and impact investment and product frameworks. The ExCo has senior representation from across the business including Investment, Client Group, Wealth Management, Schroders Capital and Corporate Sustainability.

The Group Regulatory Oversight Committee (GROC) oversees the progress of sustainability regulatory change programmes, as well as facilitating the monitoring of emergent sustainability regulations and ensuring we have appropriately determined the impact on our Group sustainability strategy and supporting operations. The GROC receives input on planned or potential sustainability-related regulation from our Public Policy and Compliance teams, which actively engage with relevant regulators, industry trade associations and other bodies in our key markets of the UK and EU. Once the business implications of new legal and regulatory requirements are defined, the relevant sustainability regulations programme workstreams deliver the necessary change to our business operations. The GROC oversees the progress of the programme, including monitoring and mitigating associated risks and issues. Where necessary, risks and key issues from the GROC can be escalated to the Group Risk Committee for resolution.

Certain Schroders entities, businesses and Investment teams also have their own committees which consider their sustainable investment activities. For example, the Private Assets Sustainability and Impact Steering Committee (PA S&I SteerCo) develops and oversees the implementation of the Private Assets Sustainability and Impact strategy. In addition, the Wealth Management Sustainable Investment Committee (WMSIC), a sub-committee of the Wealth Management Investment Committee (WMIC), has delegated responsibility for recommending Wealth Management's Sustainability models, as well as providing investment strategy and direction for client portfolios that are linked to the sustainable models.

Alongside our central Sustainable Investment team, sustainable investing is also overseen and delivered by dedicated teams and expert individuals embedded throughout the firm (including across Investment teams and Client Group functions).

We have a long-standing commitment to support and collaborate with several industry groups, organisations and initiatives to promote well-functioning financial markets.

Our key stakeholders include exchanges, regulators and international and regional trade associations. For example, Schroders is a member of trade bodies such as the Investment Association in the UK, the European Fund and Asset Management Association (EFAMA), the Asia Securities Industry and Financial Markets Association (ASIFMA) in Hong Kong and the Securities Industry and Financial Markets Association (SIFMA) in the US. Through this participation we share our insights to support the development of policy recommendations, share best practice and build coalitions of like-minded market participants to advocate for better functioning markets.

Our activity with policymakers aims to help them ensure that the measures they take support businesses and provide clear direction. By monitoring and influencing regulatory initiatives at their inception, we aim to support the development of a business environment which is conducive to Schroders’ clients’ best interests.

We aim to engage with the regulatory environments in which we are operating and raise awareness on sustainability matters. We believe well-designed regulation is an important cornerstone to promoting healthy markets, and have asked publicly that policy makers support sustainable finance legislation and regulation and deliver on commitments, including around climate mitigation.

We consider this to be key in improving responsible investment standards across sectors, establishing a consistent dialogue with companies, and in promoting the ongoing development and recognition of sustainability and Environmental, Social and Governance (ESG) topics within the investment industry. A full list of organisations and initiatives of which Schroders is a member or signatory is available here (https://www.schroders.com/en/global/individual/corporate-transparency/working-with-policy-makers/memberships/)

Dialshifter

This fund is helping to ‘shift the dial from brown to green’ by…

…investing in undervalued sustainable leaders in global equities. These are companies Schroders Global Value team identify as having a positive societal benefit as measured by our proprietary tool and are in our view industry leading in sustainability, these are companies that must have net positive societal benefits for society and/or the environment and be best-in-class versus peers. They combine ethical screening to avoid significant exposure to fossil fuels, weapons, alcohol, gambling, adult entertainment, or tobacco with their independent fundamental research to select true sustainable leaders. Engagement for progress is critical and the team engage with every company in the portfolio to improve sustainability outcomes over time.

SDR Labelling:

Sustainability Focus label

Key Performance Indicators:

Funds using a Sustainability Label must set KPIs that demonstrate whether the fund is achieving its sustainability objective over time. This section sets out the relevant KPIs for the fund. The investment manager uses KPIs to assess whether the fund is meeting its sustainability objective. Within SustainExTM, each metric has certain KPI(s) that are used, for example:

- GHG emissions (tonnes of CO2 equivalent)

- Energy created from renewable energy (GWh)

- Total water withdrawal (cubic meters)

- Total waste generated (tonnes)

- Health & Safety: Accident rates

- Health & Safety: Fatalities (number of employees and contractors)

- Dollar value of community donations

- Dollar value of employee training

- Emissions which degrade air quality (tonnes of NOx, SOx, VOCs)

A company’s performance against these KPIs is used to calculate its overall SustainEx™ score, which is monitored on an ongoing basis to ensure that investments remain aligned with the sustainability objective. The manager also reports on the KPIs below, which aim to illustrate whether the Fund has invested in companies that the investment manager assessed as providing a positive contribution to people and/or the planet during the previous reporting period. The reporting frequency will usually be 12 months, but may be longer in respect of the first year that the Fund applies a Sustainability Label, and shorter for the second:

Overall sustainability score of the Fund

The overall sustainability score is based on Schroders’ systematic model, SustainEx™, as described under “How does the investment manager identify sustainable companies?” above. The investment manager calculates SustainEx™ scores for all companies in the fund to arrive at the total Fund score. The overall score is a measure of the fund’s sustainability performance relative to the benchmark stated in its investment objective. The benchmark is representative of the investment universe of the Fund before its sustainability criteria have been applied, so comparing the sustainability scores of the Fund and the benchmark provides an indication of the effect of the fund’s sustainable investment strategy.

Overall planet score of the Fund

The planet score is also calculated using SustainEx™, and represents the fund’s environmental performance

relative to its benchmark, as described above.

Overall people score of the Fund

The people score is also calculated using SustainEx™, and represents the fund’s social performance relative to its benchmark, as described above

Percentage of investments that are sustainable

A fund that uses the Sustainability Focus label must ensure that at least 70% of its portfolio is invested in assets that are environmentally and/or socially sustainable. This KPI illustrates the actual percentage of the Fund made up of sustainable companies, as determined by the assessment described under “How does the investment manager identify sustainable companies?” above.

Investments that are classified as sustainable based on Panel review

As described above, where a company does not achieve a positive SustainExTM score, the investment manager can ask the Panel to review additional evidence to determine whether, if such evidence was available to SustainExTM, the company would achieve a positive score. This KPI illustrates the Fund's exposure to companies which achieved a positive score through this Panel process.

- Consumer Facing Disclosure

- Fund Factsheet

SDR Literature:

Literature

Fund Holdings

Voting Record

Disclaimer

Important Information

This document is addressed to existing client(s) only. Not for further distribution.

This document contains indicative terms for discussion purposes only and is not intended to provide the sole basis for evaluation of the investment solutions described.

Investment involves risk. Reliance should not be placed on any views or information in the material when taking individual investment and/or strategic decisions.

Any reference to regions/ countries/ sectors/ stocks/ securities is for illustrative purposes only and not a recommendation to buy or sell any financial instruments or adopt a specific investment strategy.

The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations.

Past Performance is not a guide to future performance and may not be repeated.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of investments to fall as well as rise.

Schroders has expressed its own views and opinions in this document and these may change.

Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy.

Schroders uses SustainEx™ to estimate the net social and environmental “cost” or “benefit” of an investment portfolio having regard to certain sustainability measures in comparison to a product’s benchmark where relevant. It does this using third party data as well as Schroders own estimates and assumptions and the outcome may differ from other sustainability tools and measures.

The data contained in this document has been sourced by Schroders and should be independently verified. Third party data is owned or licenced by the data provider and may not be reproduced, extracted or used for any other purpose without the data provider’s consent. Neither Schroders, nor the data provider, will have any liability in connection with the third-party data.

Issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 1893220 England. Authorised and regulated by the Financial Conduct Authority.

For your security, communications may be recorded or monitored.

Issued in June 2025. 06344.

| Fund Name | SRI Style | SDR Labelling | Product | Region | Asset Type | Launch Date | Last Amended |

|

|---|---|---|---|---|---|---|---|---|

Schroder Global Sustainable Value Equity Fund |

Sustainability Tilt | Sustainability Focus label | OEIC | Global | Equity | 30/06/2004 | Aug 0025 | |

ObjectivesThe fund aims to provide capital growth in excess of the MSCI World (Net Total Return) Index (after fees have been deducted) over a three to five year period by investing in equities of companies worldwide with 'Value' characteristics which the investment manager classifies as sustainable. These are companies that, through the way they are managed and/or the goods and services that they sell, make a positive contribution to the Planet (the environment); and/or People (employee wellbeing; customer wellbeing; healthy, inclusive and connected communities; and/or effective and accountable institutions). |

Fund/Portfolio Size: £1057.85m (as at: 31/05/2025) Total Screened Themed SRI Assets: £80299.00m (as at: 31/03/2025) Total Responsible Ownership Assets: £653712.00m (as at: 31/03/2025) Total Assets Under Management: £758460.00m (as at: 31/03/2025) ISIN: GB00BF783V38, GB00BF783W45, GB00B01BZQ27, GB00B019KQ13, GB00BJRSTJ16, GB00BJRSTK21 Contact Us: sami.arouche@schroders.com |

|||||||

Sustainable, Responsible &/or ESG OverviewSchroder Global Sustainable Value offers unwavering value exposure with laser-sharp focus on sustainability leaders and active engagement. The strategy offers clients the Schroder Global Value Team’s tried and tested value approach with investment in companies that have a positive societal benefit as measured by our proprietary tool and are in our view industry leading in sustainability. The team explicitly only invest in undervalued sustainability leaders. These are companies that must have positive societal benefits for society and the environment. The team engage with every company in the portfolio to improve sustainability outcomes over time. This unique approach proves that you can invest in sustainability leaders without sacrificing valuation. The Global Sustainable sector is heavily biased towards Growth, and this strategy provides genuine style diversification. Sustainability and Value are a compelling combination, and investors really can have the best of both worlds. |

||||||||

|

Primary fund last amended: Aug 0025 |

||||||||

|

Information received directly from Fund Manager |

||||||||

|

Please select what you would like to read:

Fund FiltersSustainability - General

Sustainability policy

Has policies that consider (environmental and social) sustainability issues. Strategies vary but are likely to consider environmental issues like climate change, carbon emissions, biodiversity loss, resource management, environmental impacts; and social issues like equal opportunities, human rights, labour standards, diversity and adherence to internationally recognised codes. See individual entry information.

Encourage more sustainable practices through stewardship

Aim to encourage higher sustainability standards through responsible ownership / stewardship / engagement / voting activity

Report against sustainability objectives

Publicly report performance against named sustainability objectives Environmental - General

Environmental policy

Has policies which relate to environmental issues. These will typically set out their stance on issues such as pollution, climate change, resource management, biodiversity loss, carbon emissions, plastics and/or additional environmental impacts. Strategies vary.

Limits exposure to carbon intensive industries

Options that limit or 'reduce' their exposure to carbon intensive industries (ie sectors which are major contributors to climate change). Strategies vary.

Favours cleaner, greener companies

Aims to invest in companies with strong or market leading environmental policies and practices. Strategies vary. See individual entry information for more detail. Nature & Biodiversity

Illegal deforestation exclusion policy

Avoids assets that are involved in illegal deforestation. This may relate to palm oil, cattle farming or other areas. Strategies vary. Climate Change & Energy

Coal, oil & / or gas majors excluded

Avoid investment in major coal, oil and/or gas (extraction) companies. Strategies vary.

Encourage transition to low carbon through stewardship activity

Encourage the transition to lower carbon activities through asset selection and / or responsible ownership activity.

TCFD / IFRS reporting requirement

Will only invest in companies that report greenhouse gas emissions in line with this international reporting framework. See https://www.fsb-tcfd.org/ https ://www.ifrs.org/sustainability/tcfd/ Ethical Values Led Exclusions

Tobacco & related products - avoid where revenue > 5%

Companies are excluded if they make more than 5% of their revenue from the manufacture, sale or distribution of tobacco products including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Controversial weapons exclusion

Excludes companies which make controversial weapons such as landmines, cluster munitions and chemical weapons.

Armaments manufacturers avoided

Avoids companies that manufacture weapons intended specifically for military use. Strategies vary - may or may not include non-strategic military products.

Armaments manufacturers not excluded

Does Not exclude manufacturers of products intended for use in armaments and weapons. So may invest in them

Military involvement not excluded

Does Not exclude companies with military contracts - this may include medical supplies, food, safety equipment, housing, technology etc.

Gambling avoidance policy

Avoids companies with significant involvement in the gambling industry. Some may allow a small proportion of revenues to come from this area.

Pornography avoidance policy

Avoids companies that derive significant income from pornography and related areas. Strategies vary. Gilts & Sovereigns

Does not invest in sovereigns

Does not invest in / excludes 'sovereigns' - debt issued by governments. See eg https://www.investopedia.com/terms/s/sovereign-debt.asp Banking & Financials

Invests in banks

Can include banks as part of their holdings / portfolio.

Invests in insurers

May invest in insurance companies. Governance & Management

Governance policy

Has policies that relate to corporate governance issues such as board structure, executive remuneration, bribery and/or corporate corruption. These funds will typically avoid companies with poor practices. Strategies vary.

Avoids companies with poor governance

Avoids investing in companies with poor governance practices.(e.g. board structure, management practices etc.) Views may however vary on what counts as 'poor' practices - and funds may not immediately divest as they may prefer to work to encourage higher standards.

UN sanctions exclusion

Exclude companies that are subject to United Nations sanctions. See eg https://main.un.org/securitycouncil/en/content/un-sc-consolidated-list

Encourage board diversity e.g. gender

Encourage the companies they invest in to have more diverse board structures (e.g. more women on boards)

Encourage higher ESG standards through stewardship activity

Aim to encourage higher ESG standards through responsible ownership / stewardship / engagement /voting activity Product / Service Governance

ESG integration strategy

Find fund / asset managers that factor in 'environmental, social and governance' issues as part of their investment decision making process. A focus on 'ESG' typically means a fund is carrying out additional research to help reduce ESG related risks. It does not necessarily mean a focus on sustainability. Strategies vary. See fund literature.

ESG factors included in Assessment of Value (AoV) report

Environmental, social and governance issues are part of this fund’s reporting of their ‘value’ to clients. AoV reporting is a statutory requirement. Including ESG factors in its calculation is not. Asset Size

Invests in small, mid & large cap companies / assets

Invests in a combination of small, medium and larger (potentially multinational) companies / assets. How The Fund/Portfolio Works

Negative selection bias

Has principle 'ethical approach' to avoid companies by using negative screening criteria. Strategies vary.

Strictly screened ethical investment

Has principle approach to apply positive or negative ethical, social and / or environmental screens. Strictly screened investments are likely to exclude more companies than other related options. Strategies vary.

ESG weighted / tilt

Invest more heavily in assets which have higher ESG ratings/standards or scores and less heavily in companies with lower ESG ratings. Where this is central to the strategy you should expect assets in most sectors. Strategies vary.

Data led strategy

Makes stock selection (and ongoing management) decisions based on ESG data or company ratings (normally supplied by third parties) rather than focusing on what individual companies do, how they operate or their plans for the future

Significant harm exclusion

Aims to avoid companies that do significant harm. This originates from the EU’s sustainable finance ‘DNSH’ (do no significant harm) work, which is not necessarily used by UK investors.

Combines norms based exclusions with other SRI criteria

Investment selection process uses internationally agreed 'norms' (e.g. United Nations Global Compact - UNGC - or the UN Sustainable Development Goals - SDGs) alongside additional SRI criteria such as positive or negative stock selection policies and/or stewardship strategies.

Combines ESG strategy with other SRI criteria

Invests in assets which have an ESG strategy (which is typically focused on avoiding companies that pose environmental, social or governance related risks) together with additional criteria such as positive and/or negative screens, themes and stewardship strategies.

Balances company 'pros and cons' / best in sector

Considers both the 'positive' and 'negative' aspects of company behaviour and makes balanced, considered decisions as part of their investment approach. May apply to a range of different issues and policy areas.

Do not use stock / securities lending

Does not use stock lending for performance or risk purposes. Unscreened Assets & Cash

Assets typically aligned to sustainability objectives 70 - 79%

Holds between 70-79% of assets which align to the sustainability objectives; which are not being held purely for risk management purposes, such as derivatives and cash equivalent assets.

No ‘diversifiers’ used other than cash

Only invests in cash to aid the practical management (buying and selling) of assets and so do not use additional financial instruments. Intended Clients & Product Options

Intended for investors interested in sustainability

Designed to meet the needs of individual investors with an interest in sustainability issues.

Intended for clients interested in ethical issues

Designed for clients who care about ethical and values-based issues, often alongside sustainability issues also.

Available via an ISA (OEIC only)

Available via a tax efficient ISA product wrapper. Labels & Accreditations

SDR Labelled

Find options that have chosen to adopt one of the Financial Conduct Authority (FCA) SDR labels. Please note: there are a range of reasons why potentially relevant options may not use an SDR label eg. adopting a label may be work in progress, the manager may not yet be allowed to do so because of the product type, a manager may feel they are insufficiently aligned to SDR requirements.

ACT signatory

A voluntary corporate culture standard for investment managers, see https://www.investorsact.com/ - City Hive Fund Management Company InformationAbout The Business

Responsible ownership / stewardship policy or strategy (AFM company wide)

Finds fund / asset management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

ESG / SRI engagement (AFM company wide)

Find fund / asset management companies that actively encourage higher 'environmental, social and governance' and / or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Vote all* shares at AGMs / EGMs (AFM company wide)

Find fund / asset managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Responsible ownership / ESG a key differentiator (AFM company wide)

Find fund / asset managers that consider responsible ownership and ESG to be a key differentiator for their business.

Integrates ESG factors into all / most (AFM) fund research

Find fund / asset management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management. Collaborations & Affiliations

PRI signatory

Find fund / asset management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

UKSIF member

Find fund / asset management companies that are members of UKSIF - the UK Sustainable Investment and Finance association

Fund EcoMarket partner

Find fund / asset management companies that have partnered with Fund EcoMarket - meaning that they are helping to improve access to information on sustainable and responsible investment by paying an annual fee to us which enables us to publish information for free. Partner funds are listed ahead of other funds and have their logos displayed.

TNFD forum member (AFM company wide)

A member of the Taskforce for Nature Related Financial Disclosures group which aims to aid risk management and shift money towards nature-positive outcomes.

Investment Association (IA) member

Fund management entity is a member of the Investment Association https://www.theia.org/ Engagement Approach

Engaging on climate change issues

Fund / asset manager has stewardship /responsible ownership strategy that is focused on addressing climate change with investee assets.

Engaging to stop modern slavery

Fund / asset manager is working with the assets they hold to help stamp out modern slavery - where direct or indirect company employees are exploited for business benefits.

Stewardship escalation policy

Escalation policies describe how a manager will proceed if stewardship / engagement activity is not successful in the short term. Transparency

Full SRI / responsible ownership policy information on company website

Find fund / asset management companies that publish information about their sustainable and responsible investment strategies on their company website.

Dialshifter statement

Find fund / asset management companies that have supplied Dialshifter information. See Dialshifter tab within record for more information. Sustainable, Responsible &/or ESG Policy:The fund is actively managed and invests at least 80% of its assets in a concentrated range of equity and equity related securities of companies worldwide that have certain ‘Value’ characteristics. Value is assessed by looking at indicators such as cash flows, dividends and earnings to identify securities which the manager believes have been undervalued by the market. The fund typically holds 30 to 70 companies. The fund may also invest directly or indirectly in other securities (including in other asset classes), countries, regions, industries or currencies, collective investment schemes (including Schroder funds), warrants and money market instruments, and hold cash. The fund may use derivatives with the aim of reducing risk or managing the fund more efficiently. The fund invests at least 70% of its portfolio in assets that the investment manager classifies as sustainable. A company is considered to be sustainable if it makes a positive contribution to: – Planet. This includes contributions to the environment - such as reducing greenhouse gas (GHG) emissions, which helps slow down climate change. and/or – People. This includes contributions to one or more of the following: – employee wellbeing - such as paying more than living wages or providing training to employees, which supports their professional development and prosperity. – customer wellbeing - such as developing new products and services that improve customers’ quality of life, for example medical drugs, therapies, diagnostic tools and healthy food. – healthy, inclusive and connected communities – such as providing access to clean water and sanitation (which promotes good health). – effective and accountable institutions – such as promoting financial stability, which supports people’s prosperity and financial security. Process:A company is classified as sustainable if it achieves a positive score in Schroders’ systematic model (SustainExTM). SustainExTM produces an assessment of the company’s effect on a defined set of benefits and costs for people and the planet, which are then combined to calculate an overall sustainability score for the company. A company must achieve a positive score to be deemed sustainable. The model is based on in-depth internal research, which has included establishing the relevance of various factors to the sustainability outcomes referred to above. In some exceptional cases, SustainExTM does not provide a fair reflection of a company’s contribution to people and/or the planet. The investment manager can refer such companies to Schroders’ Sustainable Investment Panel (the Panel), an independent panel of experts. The Panel reviews additional robust evidence provided by the investment manager to determine whether, if such evidence was available to SustainExTM, the company would achieve a positive score. This could be relevant where SustainExTM does not capture an area of positive contribution – such as where a company produces a particularly sustainable product whose importance to people or the planet is not fully captured by the company’s overall score. Alternatively, it could be relevant where the investment manager is able to supply additional data to enhance a calculation – such as where a company does not publish details of employee salaries, but the investment manager is able to obtain or more accurately estimate this from other sources. For this fund, the investment manager will also assess whether potential investments are “ESG Leaders”. This process is separate to the assessment of whether a company meets the fund’s sustainability objective (as described above), and is not relevant in determining whether the fund has invested at least 70% of its assets in line with that objective. The ESG Leaders assessment determines whether a company provides an overall benefit to society and is best in-class versus industry peers in its approach to sustainability. ESG leadership is assessed holistically by: (1) assessing the quality of the company’s relationship with key stakeholders such as employees, communities, suppliers, customers and regulators; (2) analysing a range of sustainability-related materials including company disclosures and sustainability analysis carried out by third party experts; and (3) avoiding companies with a MSCI ESG score lower than ‘A’ in order to help avoid exposure to material ESG risks. A company must be classified as an ESG leader to be eligible for investment. The ESG Leaders assessment uses a broad range of data sources, including Schroders’ systematic models, third party sustainability rating data and company disclosures. Resources, Affiliations & Corporate Strategies:Sustainability is fundamental to our investment principles at Schroders and we have an experienced and well-resourced Sustainable Investment team, who are embedded within our Investment function. We are a global team, spread across four regional hubs in London, Paris, Singapore and New York, aiming to ensure that sustainability is embedded through our global investment teams and client functions. Our central Sustainable Investment team sits alongside investment teams rather than operating in a silo, which facilitates regular dialogue with our analysts and portfolio managers. It is organised into four pillars:

We outline their key responsibilities and areas of focus below. 1. Sustainable investment management Our Advisory and Integration team acts as a central contact point and consultant for a range of stakeholders across the business. This includes advising investment teams on ESG integration best practice; compliance, risk and legal teams on ESG regulation; and working with our regional experts; across Asia Pacific, Europe and North America, as outlined under pillar four. Our Models and Analytics team is responsible for the maintenance and evolution of our suite of proprietary tools. They are also responsible for ESG data, ensuring we harness sustainability data effectively from both conventional and unconventional sources. Our Strategy and Research team is responsible for undertaking sustainability research to: inform firmwide strategy and commitments; provide insights for investment teams to analyse sustainability-related risks and opportunities; and provide research-related and technical support for other stakeholders across the firm. 2. Active ownership Our Engagement team partners with investors to have dialogue with the companies in which we invest, seeking to understand how prepared they are for a changing world and pushing them towards more sustainable practices. The team track the progress of these engagements and hold companies to account. Our Corporate Governance team is responsible for voting in line with our Voting Policy and Principles. 3. Impact Our Impact team is responsible for scaling our impact product offering in line with best-practice impact principles. The team works closely with investment desks and is responsible for developing and implementing our impact management and measurement framework, including impact assessment and monitoring at transaction and portfolio level, product development, impact strategy and impact reporting. 4. Regional Expertise Our Regional Experts based in Asia Pacific, Europe and North America have a deep understanding of local market characteristics and nuances, and are responsible for staying abreast of sustainability-related developments. Our experts work with clients and internal teams to navigate and support clients’ ESG aspirations and challenges, utilising Schroders’ proprietary tools and research to develop investment solutions that meet their needs. They also engage with regulators and industry bodies to shape and support the global sustainable finance agenda. Our regional experts are a critical extension of the central team in London as the firm continues to evolve its global ESG strategy. We have a number of governance structures in place for decision-making and oversight of our approach to sustainable investment. The Board of Schroders plc (the Board) has collective responsibility for the management, direction and performance of the Group, and is accountable for our overall business strategy. The Group Chief Executive is responsible for proposing the strategy for the Group and for its implementation, supported by the Group’s senior management team and a number of Committees, some of which are noted below. The Group Sustainability and Impact (GSI) Committee provides advice to the Group Chief Executive on sustainability and impact matters. The Committee considers, reviews and recommends the overall global sustainability and impact strategy, including key initiatives, new commitments and policies for approval. The Global Head of Sustainable Investment and Global Head of Corporate Sustainability are members of the Committee and report to the Board. The Sustainability Executive Committee (ExCo) develops and oversees the delivery of our Group-level sustainable investment management strategy. The ExCo also advises on the development of our sustainability and impact investment and product frameworks. The ExCo has senior representation from across the business including Investment, Client Group, Wealth Management, Schroders Capital and Corporate Sustainability. The Group Regulatory Oversight Committee (GROC) oversees the progress of sustainability regulatory change programmes, as well as facilitating the monitoring of emergent sustainability regulations and ensuring we have appropriately determined the impact on our Group sustainability strategy and supporting operations. The GROC receives input on planned or potential sustainability-related regulation from our Public Policy and Compliance teams, which actively engage with relevant regulators, industry trade associations and other bodies in our key markets of the UK and EU. Once the business implications of new legal and regulatory requirements are defined, the relevant sustainability regulations programme workstreams deliver the necessary change to our business operations. The GROC oversees the progress of the programme, including monitoring and mitigating associated risks and issues. Where necessary, risks and key issues from the GROC can be escalated to the Group Risk Committee for resolution. Certain Schroders entities, businesses and Investment teams also have their own committees which consider their sustainable investment activities. For example, the Private Assets Sustainability and Impact Steering Committee (PA S&I SteerCo) develops and oversees the implementation of the Private Assets Sustainability and Impact strategy. In addition, the Wealth Management Sustainable Investment Committee (WMSIC), a sub-committee of the Wealth Management Investment Committee (WMIC), has delegated responsibility for recommending Wealth Management's Sustainability models, as well as providing investment strategy and direction for client portfolios that are linked to the sustainable models. Alongside our central Sustainable Investment team, sustainable investing is also overseen and delivered by dedicated teams and expert individuals embedded throughout the firm (including across Investment teams and Client Group functions). We have a long-standing commitment to support and collaborate with several industry groups, organisations and initiatives to promote well-functioning financial markets. Our key stakeholders include exchanges, regulators and international and regional trade associations. For example, Schroders is a member of trade bodies such as the Investment Association in the UK, the European Fund and Asset Management Association (EFAMA), the Asia Securities Industry and Financial Markets Association (ASIFMA) in Hong Kong and the Securities Industry and Financial Markets Association (SIFMA) in the US. Through this participation we share our insights to support the development of policy recommendations, share best practice and build coalitions of like-minded market participants to advocate for better functioning markets. Our activity with policymakers aims to help them ensure that the measures they take support businesses and provide clear direction. By monitoring and influencing regulatory initiatives at their inception, we aim to support the development of a business environment which is conducive to Schroders’ clients’ best interests. We aim to engage with the regulatory environments in which we are operating and raise awareness on sustainability matters. We believe well-designed regulation is an important cornerstone to promoting healthy markets, and have asked publicly that policy makers support sustainable finance legislation and regulation and deliver on commitments, including around climate mitigation. Dialshifter (Fund)This fund is helping to ‘shift the dial from brown to green’ by… …investing in undervalued sustainable leaders in global equities. These are companies Schroders Global Value team identify as having a positive societal benefit as measured by our proprietary tool and are in our view industry leading in sustainability, these are companies that must have net positive societal benefits for society and/or the environment and be best-in-class versus peers. They combine ethical screening to avoid significant exposure to fossil fuels, weapons, alcohol, gambling, adult entertainment, or tobacco with their independent fundamental research to select true sustainable leaders. Engagement for progress is critical and the team engage with every company in the portfolio to improve sustainability outcomes over time. Dialshifter (Corporate)Our organisation is helping to support the Paris Climate Agreement and the Race to Net Zero by… … being a signatory to the Science Based Targets Initiative (SBTi), we measure and track the temperature alignment of our investments and have committed to align our financed emissions, across our portfolio companies Scope 1, 2 and 3 GHG emissions, to a 1.5°C world by 2040 across 100% of our investments. We also have an interim target of 2.2°C by 2030 across our portfolio companies Scope 1 and 2 emissions. SDR Labelling:Sustainability Focus label Key Performance Indicators:

Funds using a Sustainability Label must set KPIs that demonstrate whether the fund is achieving its sustainability objective over time. This section sets out the relevant KPIs for the fund. The investment manager uses KPIs to assess whether the fund is meeting its sustainability objective. Within SustainExTM, each metric has certain KPI(s) that are used, for example:

A company’s performance against these KPIs is used to calculate its overall SustainEx™ score, which is monitored on an ongoing basis to ensure that investments remain aligned with the sustainability objective. The manager also reports on the KPIs below, which aim to illustrate whether the Fund has invested in companies that the investment manager assessed as providing a positive contribution to people and/or the planet during the previous reporting period. The reporting frequency will usually be 12 months, but may be longer in respect of the first year that the Fund applies a Sustainability Label, and shorter for the second: Overall sustainability score of the Fund The overall sustainability score is based on Schroders’ systematic model, SustainEx™, as described under “How does the investment manager identify sustainable companies?” above. The investment manager calculates SustainEx™ scores for all companies in the fund to arrive at the total Fund score. The overall score is a measure of the fund’s sustainability performance relative to the benchmark stated in its investment objective. The benchmark is representative of the investment universe of the Fund before its sustainability criteria have been applied, so comparing the sustainability scores of the Fund and the benchmark provides an indication of the effect of the fund’s sustainable investment strategy. Overall planet score of the Fund The planet score is also calculated using SustainEx™, and represents the fund’s environmental performance Overall people score of the Fund The people score is also calculated using SustainEx™, and represents the fund’s social performance relative to its benchmark, as described above Percentage of investments that are sustainable A fund that uses the Sustainability Focus label must ensure that at least 70% of its portfolio is invested in assets that are environmentally and/or socially sustainable. This KPI illustrates the actual percentage of the Fund made up of sustainable companies, as determined by the assessment described under “How does the investment manager identify sustainable companies?” above. Investments that are classified as sustainable based on Panel review As described above, where a company does not achieve a positive SustainExTM score, the investment manager can ask the Panel to review additional evidence to determine whether, if such evidence was available to SustainExTM, the company would achieve a positive score. This KPI illustrates the Fund's exposure to companies which achieved a positive score through this Panel process.

SDR Literature:LiteratureFund HoldingsVoting RecordDisclaimerImportant Information |

||||||||