Edentree Green Future Fund

SRI Style:

Environmental Style

SDR Labelling:

Sustainability Impact label

Product:

OEIC

Fund Region:

Global

Fund Asset Type:

Equity

Launch Date:

24/01/2022

Last Amended:

Jun 2025

Dialshifter ( ):

):

Fund/Portfolio Size:

£37.01m

(as at: 30/04/2025)

Total Screened Themed SRI Assets:

£1638.79m

(as at: 30/04/2025)

Total Responsible Ownership Assets:

£1403.01m

(as at: 30/04/2025)

Total Assets Under Management:

£3041.81m

(as at: 30/04/2025)

ISIN:

GB00BP5FBP60, GB00BP5FBQ77

Contact Us:

Objectives:

The financial objective of the fund is to provide capital growth over 5 years or more, with an income and sustainability objective is to support a reduction in the level of greenhouse gas emissions, measured in tonnes of CO2e avoided on an annual basis, through the Fund’s investment in, and engagement with, companies whose products and services provide climate change solutions.

Sustainable, Responsible

&/or ESG Overview:

The Fund’s focus on companies providing solutions to climate change means that its choice of companies for investment is limited to a subset of the stock market and may result in periods of difference in the Fund’s performance compared to its indicative benchmark. We consider the Fund’s impact and financial goals to be complementary and are not looking to compromise on either or deliver concessionary financial returns. This Sustainability Goal combines with the Fund’s Financial Goal (as mentioned above) to form the overall Investment Objective.

We expect the Fund to contribute to a reduction in greenhouse gas emissions through its asset contribution and investor contribution, as detailed in next response.

Primary fund last amended:

Jun 2025

Information directly from fund manager.

Fund Filters

Sustainability - General

Has policies that consider (environmental and social) sustainability issues. Strategies vary but are likely to consider environmental issues like climate change, carbon emissions, biodiversity loss, resource management, environmental impacts; and social issues like equal opportunities, human rights, labour standards, diversity and adherence to internationally recognised codes. See individual entry information.

Has a significant focus on sustainability issues

Has documented policies or thematic investment approaches supporting investment in more sustainable, greener transport methods. These will typically set out a preference for companies that run, enable or support more sustainable methods of transport.

Aim to encourage higher sustainability standards through responsible ownership / stewardship / engagement / voting activity

Use the UN Global Compact to inform or help direct where they can or cannot invest. Will typically not invest in companies with significant breaches (low standards) - strategies vary. (The UNGC covers a wide range of issues - search 'UNGC'). See https://unglobalcompact.org/

Aim to support the shift to a sustainable future. See eg https://www.transitionpathwayinitiative.org/

Has a theme or investment strand focused on the shift to a circular economy - where products are reused and recycled not incinerated or dumped. See eg https://www.ellenmacarthurfoundation.org/topics/circular-economy-introduction/overview

Environmental - General

Has policies which relate to environmental issues. These will typically set out their stance on issues such as pollution, climate change, resource management, biodiversity loss, carbon emissions, plastics and/or additional environmental impacts. Strategies vary.

Options that limit or 'reduce' their exposure to carbon intensive industries (ie sectors which are major contributors to climate change). Strategies vary.

Has documented policies explaining the approach to environmental damage and pollution. Strategies vary.

Has a policy or theme that relates to managing natural resources more efficiently. Strategies vary. See individual entry information.

Aims to invest in companies with strong or market leading environmental policies and practices. Strategies vary. See individual entry information for more detail.

Has a written policy or theme focused on waste management - typically to support or encouraging higher levels of recycling and better efficiency / reducing waste. Strategies vary.

Nature & Biodiversity

Has a written biodiversity policy or theme typically aimed at supporting, encouraging and improving environmental protection and safeguarding the natural world (sometimes referred to as 'natural capital'). See eg https://www.un.org/en/climatechange/science/climate-issues/biodiversity

A significant focus on investments that aim to protect, improve and / or restore natural habitat.

Has policies designed to address involvement in irresponsibly managed palm oil or other forms of deforestation (typically exclusion led). Strategies vary.

Avoids assets that are involved in illegal deforestation. This may relate to palm oil, cattle farming or other areas. Strategies vary.

Has a responsible palm oil policy - typically likely to divert investment away from poor practices.

Has a sustainable fisheries policy that will inform where they can and cannot invest.

Has a policy which sets out their expectations for how investee assets should manage their use of water - likely to focus on high users.

Climate Change & Energy

Has policies (documented strategies that explain their position) on climate change related issues such as greenhouse gas/carbon emissions, net zero, transitioning to lower carbon. Strategies vary.

Avoid investment in major coal, oil and/or gas (extraction) companies. Strategies vary.

Avoid companies involved in fracking and tar sands - which are widely regarded as controversial methods of oil and gas extraction. Strategies vary.

Avoid companies that are involved in extracting oil from the Arctic regions.

Avoid investing in companies / assets with coal, oil and gas reserves. See individual entry information for further details.

Invest (or may invest) in clean / renewable energy companies and other assets. The proportion directly or indirectly invested in renewable energy may vary over time.

Encourage the transition to lower carbon activities through asset selection and / or responsible ownership activity.

Has an energy efficiency theme - typically meaning that the manager is focused on investing in organisations that manage - or help others to manage - energy use more carefully and less wastefully - and so reduce greenhouse gas emissions.

Invest in renewable energy companies and / or companies where renewable energy is a significant part of their business. Strategies vary.

Has a policy which describes the avoidance or limited investment in the nuclear industry. Strategies vary.

Has a supply chain decarbonisation policy which sets out their position on the need to reduce carbon emissions.

Excludes companies and other assets with direct involvement in fossil fuel exploration (eg coal, oil and gas companies)

Aims to ensure holdings will reduce their greenhouse gas emissions in line with targets set at COP21 in Paris. The core aim is to help achieve ‘net zero emissions by 2050’ and a ‘maximum global temperature increase of +1.5 to +2 degrees above preindustrial levels’. Strategies and opinions vary.

Requires all, or most of, the assets they invest in to have a ‘net zero action plan’ - describing how they will reduce their greenhouse gas emissions.

Social / Employment

Has policies which set out their approach to social issues (e.g. human rights, labour standards, equal opportunities, child labour and/or adherence to internationally recognised codes such as the UN Global Compact). Strategies with social policies typically avoid companies with low standards and/or work to encourage higher standards. See fund information for detail.

Has a labour standards policy - likely to mean they will invest in / favour companies that have higher employment related standards and avoid those with low standards. Strategies vary. See eg https://www.ilo.org/international-labour-standards

Aims to invest in assets with high social values - this may include strong human rights, labour standards and equal opportunities or safety related practices.

Has policies or themes that set out their approach to health and wellbeing issues, typically aims to invest in companies with high standards - or encourage high standards.

Has a written diversity policy – where the manager will aim to select companies with a carefully considered, positive employment standards. This may cover a range of issues including gender, ethnicity, disability, beliefs and sexual orientation.

All mining companies excluded

Has a policy aimed at protecting vulnerable workers such as those on zero hour / informal contracts working in the gig economy

Ethical Values Led Exclusions

Companies are excluded if they make more than 5% of their revenue from the manufacture, sale or distribution of tobacco products including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Excludes companies which make controversial weapons such as landmines, cluster munitions and chemical weapons.

Avoids companies that manufacture weapons intended specifically for military use. Strategies vary - may or may not included non-strategic military products.

Avoids companies with military contracts. This may include medical supplies, food, safety equipment, housing, technology etc

Has a written civilian firearms exclusion policy - meaning that they will not invest in companies that make (or perhaps also sell) handguns made for non-military users.

Avoids companies that produce alcohol. Strategies vary; some may allow a small proportion of revenue to come from this area.

Avoids companies with significant involvement in the gambling industry. Some may allow a small proportion of revenues to come from this area.

Find funds that avoid companies that derive significant income from pornography and related areas. Strategies vary.

Has policies that require specific animal welfare standards to be met. These may reference well-known welfare standards (3Rs - Replace, Reduce, Refine) or certification schemes. Strategies vary.

Avoids companies that test their products on animals for purposes other than medical benefit (e.g. for cosmetics). Strategies vary.

Human Rights

Has policies relating to human rights issues. Typically require companies to demonstrate higher standards, although some managers work to encourage improvements. Investee companies are often judged against internationally agreed norms or standards. Strategies vary.

Has policies to avoid companies that employ children.

Has policies that exclude companies or other assets which operate in, or are owned by regimes which are not democratic, or where people may be oppressed. May use eg. Freedom House research. Strategies vary.

Has policies or a theme that relates to the responsible management of supply chains. These may relate to employment issues, notably people employed by their suppliers, as well as the sourcing of materials and products.

Has a policy which excludes assets with involvement in Modern Slavery

Meeting Peoples' Basic Needs

Have policies or themes that set out the position on investment in the water sector and/or sanitation. Strategies vary.

Healthcare and or medical theme or area of investment - may have a single or many themes

Has a policy on ‘antimicrobial resistance’ - which is when organisms that cause infection can survive treatment - which is commonly associated with the overuse of antibiotics in factory farming.

Banking & Financials

Can include banks as part of their holdings / portfolio.

Invest in banks and other financial institutions that implement the Task Force on Climate Related Financial Disclosures recommendations on climate change related financial disclosures - which aim to help financial markets measure and respond to climate risk.

Avoids banks that have a large part of their loan book (or other assets) invested in fossil fuels companies - particular coal, oil and gas.

Avoids investing in insurance companies that insure major fossil fuels companies – particularly coal, oil and gas. Strategies (eg definition of ‘major’) vary.

May invest in insurance companies.

Governance & Management

Has policies that relate to corporate governance issues such as board structure, executive remuneration, bribery and/or corporate corruption. These funds will typically avoid companies with poor practices. Strategies vary.

Avoids investing in companies with poor governance practices.(e.g. board structure, management practices etc.) Views may however vary on what counts as 'poor' practices - and funds may not immediately divest as they may prefer to work to encourage higher standards.

Exclude companies that are subject to United Nations sanctions. See eg https://main.un.org/securitycouncil/en/content/un-sc-consolidated-list

Has policies explaining how managers will respond to assets / companies that do not comply with relevant anti-bribery and anti-corruption standards or laws. Strategies vary; options include stewardship/ engagement and divestment - or a combination.

Encourage the companies they invest in to have more diverse board structures (e.g. more women on boards)

Encourage the banks and insurance companies they invest in to publish climate change related financial information - as set out by the Task Force on Climate Related Financial Disclosures (with the aim of helping investors measure and respond to climate risk).

Aim to encourage higher ESG standards through responsible ownership / stewardship / engagement /voting activity

Requires the companies they invest in to report on climate risks that are relevant to their business in their report and accounts

Product /Service Governance

Find funds that factor in 'environmental, social and governance' issues as part of their investment decision making process. A focus on 'ESG' typically means a fund is carrying out additional research to help reduce ESG related risks. It does not necessarily mean a focus on sustainability. Strategies vary. See fund literature.

Environmental, social and governance issues are part of this fund’s reporting of their ‘value’ to clients. AoV reporting is a statutory requirement. Including ESG factors in its calculation is not.

Asset Size

Invests in a combination of small, medium and larger (potentially multinational) companies.

Targeted Positive Investments

Invests >25% of their capital in companies where a major part of their business is focused on helping to address environmental or social challenges.

Invests >50% of their capital in companies where a major part of their business is focused on helping to address environmental or social challenges.

Impact Methodologies

Specifically sets out to help deliver positive environmental impacts, benefits or 'real world' outcomes.

Specifically states that they aim to deliver positive social (i.e. people related) impacts and/or outcomes.

Directs investment towards companies where a major part of their business is about solving environmental challenges. e.g. companies helping to address climate change.

Invest in companies where a major part of their business is specifically aimed at helping to address social challenges. e.g. companies helping to address poverty.

Specifically sets out to invest in companies that are regarded as 'disrupting' existing business practices - typically through the development of innovative (sustainability aware) products and/or practices.

Aims to deliver positive environmental and or social impacts (real world benefits) through its engagement with investee assets

Policy explains the ways in which the manager believes things need to change in order to deliver a more sustainable future, which they are working to help achieve.

How The Fund/Portfolio Works

Focuses on finding and investing in companies with positive / beneficial attributes. This strategy can be applied in addition to exclusion criteria and engagement/stewardship activity.

Has principle 'ethical approach' to avoid companies by using negative screening criteria. Strategies vary.

Has principle approach to apply positive or negative ethical, social and / or environmental screens. Strictly screened investments are likely to exclude more companies than other related options. Strategies vary.

Invest more heavily in assets which have higher ESG ratings/standards or scores and less heavily in companies with lower ESG ratings. Where this is central to the strategy you should expect assets in most sectors. Strategies vary.

Aims to avoid companies that do significant harm. This originates from the EU’s sustainable finance ‘DNSH’ (do no significant harm) work, which is not necessarily used by UK investors.

Investment selection process uses internationally agreed 'norms' (e.g. United Nations Global Compact - UNGC - or the UN Sustainable Development Goals - SDGs) alongside additional SRI criteria such as positive or negative stock selection policies and/or stewardship strategies.

Invests in assets which have an ESG strategy (which is typically focused on avoiding companies that pose environmental, social or governance related risks) together with additional criteria such as positive and/or negative screens, themes and stewardship strategies.

Focuses on the careful management of environmental, social and governance (ESG) related risks - typically by avoiding or being underweight in companies seen as posing major risks in these areas (i.e. not necessarily by using themes, exclusions etc).

Publish explanations of their ethical, social and/or environmental policies online (i.e. investment decision making strategies/ buy/sell &/or asset management strategies).

Does not use stock lending for performance or risk purposes.

Unscreened Assets & Cash

Holds between 70-79% of assets which align to the sustainability objectives; which are not being held purely for risk management purposes, such as derivatives and cash equivalent assets.

Holds between 80-89% of assets which align to the sustainability objectives; which are not being held purely for risk management purposes, such as derivatives and cash equivalent assets.

All assets - except cash - meet the sustainability criteria published in strategy documentation.

Intended Clients & Product Options

Finds funds designed to meet the needs of individual investors with an interest in sustainability issues.

Find funds designed for clients who care about ethical and values-based issues, often alongside sustainability issues also.

Find funds that are available via a tax efficient ISA product wrapper.

Labels & Accreditations

Find funds that have chosen to adopt one of the Financial Conduct Authority (FCA) SDR labels. Please note: there are a range of reasons why potentially relevant funds may not use an SDR label eg. adopting a label may be work in progress, the manager may not yet be allowed to do so because of the product type, a manager may feel their fund is insufficiently aligned to SDR requirements. Read fund literature and / or our blogs for further information.

A voluntary corporate culture standard for investment managers, see https://www.investorsact.com/ - City Hive

Fund Management Company Information

About The Business

Find fund management companies that are smaller or specialise in particular areas - notably, ideally ESG related. Strategies vary.

Finds fund management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

Find fund management companies that actively encourage higher 'environmental, social and governance' and/or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Find fund managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Find fund managers that consider responsible ownership and ESG to be a key differentiator for their business.

Find fund management companies that take sustainability criteria into account when selecting and/or managing all of their property / real estate investments.

The leadership team of this asset manager have performance targets linked to environmental goals.

Find fund management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management.

Finds organisations / fund managers that have an in-house (company wide) diversity improvement programme - meaning that they are working to ensure that within their own businesses they employ people from diverse backgrounds - often typically focused on ethnicity and/or sex.

Find fund management companies that encourage the companies they invest in to have strong diversity, race, gender and other equality policies across all assets held, not simply screened or themed SRI/ESG funds. (ie Asset Management company wide).

Asset manager has information on their website that explains how they treat 'vulnerable clients' (as set out in FCA regulation)

This asset management company invests in companies which have recently listed on a stock exchange (which is important as it can help grow new businesses).

Asset management company has investments in bonds designed to meet sustainability requirements - however these assets may not be 'ringfenced' for this purpose. See fund manager website for details.

Fund management entity offers unstructured intermediary training on sustainable investment (ie for financial advisers and wealth managers)

Fund management entity offers unstructured intermediary training on sustainable investment (ie for financial advisers and wealth managers)

Collaborations & Affiliations

Find fund management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

Find fund management companies that are members of UKSIF - the UK Sustainable Investment and Finance association

Find fund management companies that have partnered with Fund EcoMarket - meaning that they are helping to improve access to information on sustainable and responsible investment by paying an annual fee to us which enables us to publish information for free. Partner funds are listed ahead of other funds and have their logos displayed.

Fund management entity is a member of the Investment Association https://www.theia.org/

Resources

Find fund management companies that employ people to steer and support fund managers in voting shares at company AGM's and EGMs in ways that are consistent with encouraging higher ESG/sustainability standards.

Find a fund management company that directly employs specialist ESG/SRI/sustainability researchers or analysts. This allows asset managers to discuss environmental, social and governance risks and opportunities directly with companies.

Find fund management companies that makes use of expert external research companies. This can help deliver specialist expertise and means resources are pooled with other investors.

Accreditations

Finds organisations / fund managers that have an A+ PRI rating - meaning they are highly rated according to the 'Principles of Responsible Investment'

Find fund managers that are signatories to the FRC UK Stewardship Code, which sets out a framework for constructive investor / investee relations where fund managers are encouraged to behave like responsible, typically longer term 'company owners'.

Engagement Approach

Find fund management companies that regularly initiate or run industry wide (collaborative) investor projects aimed at raising environmental, social and governance standards amongst investee companies.

Find fund management companies that are working with the companies they invest in to encourage more responsible corporate taxation.

Fund manager has stewardship /responsible ownership strategy that is focused on addressing climate change with investee assets.

Asset manager has a stewardship /responsible ownership strategy that involves working with fossil fuel companies on climate change related issues. See fund manager website for details.

Asset manager has stewardship /responsible ownership strategy with involves encouraging investee asset to reduce plastic waste and pollution.

The asset manager has a responsible ownership / stewardship strategy that focuses on biodiversity and nature issues relating to the assets they invest the aim of which will be to reduce harm and or deliver improvement. Strategies vary. https://tnfd.global

Asset manager has a responsible ownership / stewardship strategy which means they are working to encourage the shift to more sustainable business practices in ways that respect and are sensitive to social issues and the impact change has on people effected by the changes that are taking place. https://www.transitionpathwayinitiative.org/ https://transitiontaskforce.net/

Asset manager has responsible ownership / stewardship strategy in place which aims to address human rights issues in investee companies (and potentially their suppliers) with the aim of raising standards

Asset manager has responsible ownership / stewardship strategy in place that aims to improve labour standards for the benefit of employees in investee companies (and potentially their suppliers)

Asset management company has a stewardship strategy in place which involves working to raise diversity, equality and inclusion standards across investee assets

working with the assets they hold to help stamp out modern slavery - where direct or indirect company employees are exploited for business benefits.

Fund managers have stewardship strategies in place that focus on improving governance standards across investee assets

Has a stewardship / responsible ownership strategy that encourages responsible supply chain - ie the managers will discuss environmental, social and governance issues with investee companies with the aim of raising standards

Working to address sustainability, ESG and related concerns around artificial intelligence.

Escalation policies describe how a manager will proceed if stewardship / engagement activity is not successful in the short term.

Company Wide Exclusions

Find fund management companies (not funds) that avoid investment in 'controversial weapons' across all of their funds and other investment vehicles.

Find fund management companies that avoid investment in fossil fuel companies (e.g. coal, oil and gas) across all of their funds. (and/ or other assets.)

This asset manager excludes direct investment in the coal mining industry. Managers ability to do this may depend on the geographic regions in which they invest.

Asset management company excludes companies with fossil fuel reserves across all assets/funds

Climate & Net Zero Transition

Fund management organisations that have pledged to reduce their greenhouse gas emissions to ‘net zero’. Strategies vary - this area is changing rapidly.

Fund manager AGM / EGM voting strategy has processes in place that mean they will normally be expected to vote in a way that will encourage the transition to net zero greenhouse gas emissions.

This asset management company has set a date by which they plan to achieve net zero greenhouse gas / CO2e emissions.

Find fund management companies that are working with the companies they invest in to encourage reductions in carbon dioxide and other greenhouse gas emissions.

Finds organisations / fund managers that have published ‘forward looking climate metrics’ e.g. 'implied temperature rise' data that are a total of the asset management company's share (% owned) of all the investee company emissions of the assets they manage, as well as their own direct and other indirect emissions.

See https://sciencebasedtargets.org/

Transparency

Find fund management companies that publish a report detailing their responsible investment ownership - also known as 'Stewardship' - activity.

Find companies that publish information about their sustainable and responsible investment strategies on their company website.

Find fund management companies that will supply information about their sustainable and responsible investment activity on request.

Fund management companies that publish a full record of how they vote their shares at AGMs (annual general meetings) and EGMs (extraordinary general meetings). Voting strategies have an important role to play encouraging higher environmental, social and governance standards.

Find fund management companies that have supplied Dialshifter information. See Dialshifter tab within record for more information.

Comments

Please note:

- Tobacco and related products - avoid where revenue > 5% - exclusion is technically 10% on tobacco, not 5%. In practise we don’t hold any companies between 5-10% of revenue.

Sustainable, Responsible &/or ESG Policy:

Sustainability Approach

We expect the Fund to contribute to a reduction in greenhouse gas emissions through its asset contribution and investor contribution, as detailed below.

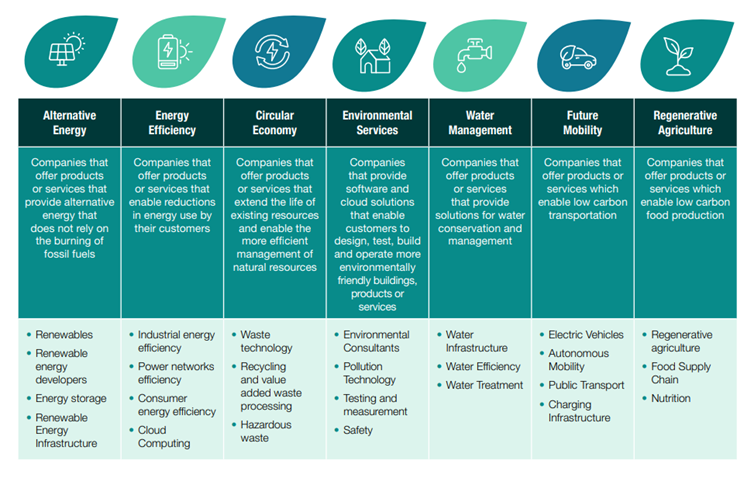

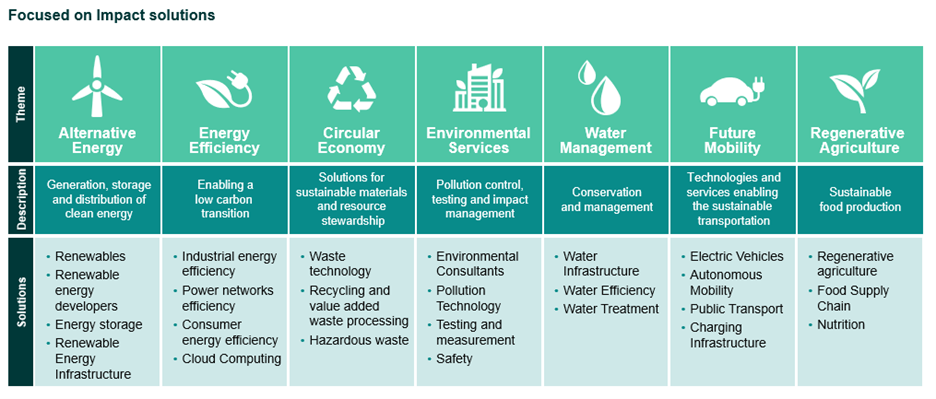

Asset activities (Asset Contribution to the Fund’s Impact): directing capital to companies which are providing solutions to climate change across seven core themes.

Engagement activities (Investor Contribution to the Fund’s Impact):

EdenTree will engage with companies held in the portfolio to increase provision of climate solutions and avoid potentially negative outcomes. Our engagement activities seek to increase the greenhouse gas emissions reductions delivered by a company via two types of engagement:

- Increase positive impacts: This type of engagement activity seeks to increase the company’s delivery of positive impact

- Decrease potential negative impacts: This type of engagement activity seeks to decrease the investee company’s potential negative impacts.

The Fund invests at least 80% in the shares of listed companies globally. Up to 20% of the Fund may be invested in other assets deemed economically appropriate to meet the Fund’s objective. These investments will be held for diversification and risk management purposes. At least 70% of the assets of the Fund will be selected in accordance with the Sustainability Approach. Up to 30% of the Fund may be invested in other assets that do not meet the Sustainability Approach but will not conflict with the Fund’s sustainability objective.

The Fund seeks to avoid investment in areas which we consider fundamentally misaligned with the Sustainability Goal. The Fund will not invest in companies which have a material involvement (10% or more) in alcohol and tobacco production, weapon production, gambling, publication of violent or explicit materials, oppressive regimes, companies using animals to test cosmetic or household products, intensive farming, fossil fuel exploration and production and high interest lending.

Process:

At EdenTree, we believe that detailed fundamental analysis and proprietary research are prerequisites for successful stock selection within global equity markets. Therefore, as a team, we spend a considerable amount of time discussing and modelling transformative sustainability trends, consuming academic and industry research, as well as engaging with companies and key business stakeholders. This mix of top-down and bottom-up proprietary analysis has led to the construction of a Green Future Investment Universe, consisting of those companies that are making an active contribution to the multi-trillion-dollar environmental solutions value chain.

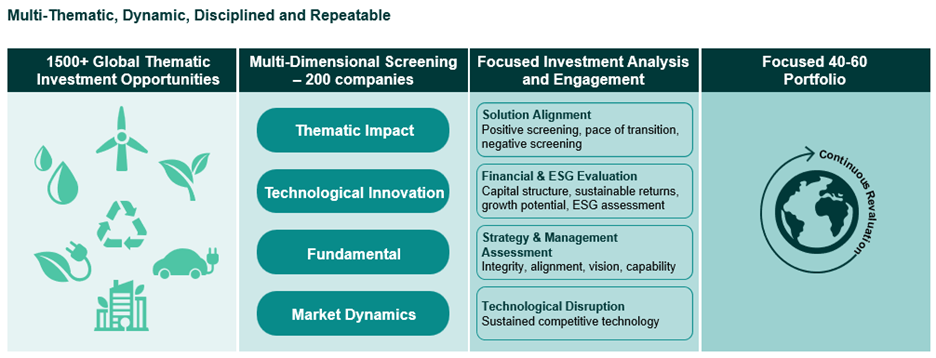

The Green Future Investment Universe is central to the strategy’s investment process and ensures that the investment process is multi-thematic, dynamic, disciplined, and repeatable. The investment process has been shaped over 20 years, through multiple economic and innovation cycles. The investment process is considered through 4 stages: Sourcing, evaluation, investment analysis and revaluation.

Sourcing

EdenTree has developed a global thematic investment opportunities database of over 1,500 companies globally. This represents the core source from which investment ideas can be generated. The database is constantly evolving as new environmental solutions emerge, new companies list on public markets, or indeed as existing listed entities transition into environmental solution providers.

Evaluating

From the Green Future database the investment managers seek to evaluate an active pool of around 200 companies. The evaluation process considers 4 principle pivots. Namely; seeking investments around a specific solution (Thematic), investments which have a specific innovation of technology pathway (Innovation), investments which have strong fundamental returns or potential returns (Fundamental) and finally appreciating wider market dynamics and source potential under-appreciated investments (Market Dynamics).

Investment Analysis

We hold to the belief that long-term returns are more likely to be achieved by investing responsibly in sustainable businesses and therefore seek to find companies that generate returns without future detriment to the environment and society. In order to achieve this, we consider both the financial and responsible aspects in detail to form a comprehensive view of companies, their risks and opportunities. This includes considered analysis of investment solution alignment, the ability of the company to sustain and enhance a competitive advantage over the long-term, financial analysis of the investment (notably the ability of investments to generate sustainable returns alongside capital structure), and a comprehensive assessment of the management team (notably their skill, track record and commitment to a sustainable future). All with the goal of identifying the best opportunities to deliver long-term returns for our clients.

We look for companies that offer strong solutions attributes – coupled with “green at reasonable price” characteristics, and ones that provide solutions to address long-term thematic global issues.

The Fund style is that of blended approach, seeking to incorporate companies within a lifecycle analysis framework namely.

- Pioneering – earlier stage but high disruptive potential through their products of service.

- Inflecting – rapid deployment of proven technologies responding to market growth.

- Sustaining – mature technologies with established market positions with the capacity to generate sustainable positive cashflows and commonly return cash to shareholders.

The outcome of the investment process ensures multiple thematic exposures, across a variety of market capitalisations and global distribution of investment. Exposures are determined by our investment selection over asset allocation.

Revaluation

On-going revaluation of investments is a critical aspect of the Green Future Fund. This requires understanding whether the investment remains aligned with our Green Future Framework, as well as how market and policy developments, technology change, and strategic and management shifts might affect our forecasted investment outcomes. These factors, alongside broader economic outcomes, can lead us to alter our proprietary forecasts, thus impacting our expected intrinsic value of our investments. Regular analysis, engagement with management and key stakeholders, and markets appreciation form an important part of this on-going due diligence process.

Resources, Affiliations & Corporate Strategies:

The five person Responsible Investment (RI) Team is part of the wider Investment Team, and provides the specialist in-house resource for ESG screening, engagement, voting and thought-leadership. All members of the Investment Team are required to have an understanding of responsible and sustainable investing, and to include this into their thinking and analysis for the Responsible & Sustainable & Green fund range. The RI analysis is subject to peer review by the whole team with agreed sign off to ensure quality control and consistency. Our dedicated RI Team biographies are detailed below:

- Carlota Esguevillas, Head of Responsible Investment – Prior to joining the firm, Carlota worked for a leading sustainability consultancy advising global companies on their ESG strategies and disclosures. She holds a First-Class Honours BA in Geography from Oxford University, a master’s certificate with distinction in Business & Human Rights from Bergen University, and the Investment Management Certificate (IMC). She is also a member of the UK Sustainable Investment and Finance Association’s (UKSIF) Industry Development Committee.

- Amelia Gaston, Senior Responsible Investment Analyst – Amelia holds a BA in Geography from Durham University and previously worked as a Responsible Investment Analyst at LGPS Central, one of the UK Pension Pools. Amelia holds the Investment Management Certificate (IMC) and CFA Certificate in ESG Investing. She leads EdenTree’s work on climate and environmental issues.

- Hayley Grafton, Senior Responsible Investment Analyst – Hayley leads on the firm's approach to corporate governance and proxy voting. She holds the Investment Management Certificate (IMC), and is a member of the StePs (Stewardship Professionals) Association. Previously, Hayley worked at Mercer, where she focused on the firm's stewardship approach and activity across portfolio funds in her role as a Sustainable Investment Specialist.

- Cordelia Dower-Tylee, Responsible Investment Analyst – Cordelia holds an MA in History from the University of Edinburgh, and a Certificate in Sustainable Finance from the University of Cambridge. She has previously worked with the International Water Management Institute and has experience in a green-focused corporate advisory firm. She leads EdenTree’s environmental work, with an emphasis on water, and supports the company’s work on governance.

- Aaron Cox, Impact Strategist – Aaron joined EdenTree in June 2022 and is Impact Strategist within the Responsible Investment Team. Prior to joining EdenTree, Aaron had roles at First State Investments (now First Sentier), Jupiter and Majedie and as a writer and researcher with a focus on ESG and sustainable investing. He started his career as a derivatives broker in Sydney. Aaron has a BA in English from the University of New South Wales, Post Grad Certificate in Environmental Economics from SOAS and Certificate in Sustainable Investing from Harvard Business School. He is currently undertaking a post graduate research project at Birmingham University on computational linguistic methods to identify sustainability stretch goal tensions and the risk of greenwashing and corporate misbehaviour.

ESG risk exposure is constantly monitored by our data providers, ISS & Sustainalytics, who flag potential violations of global norms. In addition, if any of our holdings breach our screens, we are immediately notified by our data providers and can then review the breach with the ultimate sanction of divestment if we deem it necessary. Furthermore, periodically stocks and instruments held within our funds are reviewed by the RI Team to ensure that they remain suitable, whilst the team monitors any negative news flow, engaging with companies to provide clarity and assess the risk level involved.

Our Responsible Investment Team hold overall responsibility of the ESG process. Whilst this involves some input from senior management, we view it as a crucial component of our investment decision-making process vis-à-vis determining a security’s suitability for portfolio inclusion on responsible grounds, that this ownership sits with the RI Team.

Our RI team conducts research and analysis from publicly available materials including:

- Company literature (annual reports, websites and sustainability reports)

- Industry or trade body publications and websites

- Non-governmental organisations (NGO) reports and websites e.g. Banktrack

- Government and academic research

- Investor benchmark initiatives

EdenTree plays a leading and longstanding role across multiple organisations. They are signatories, members and subscribers to a number of industry partnerships and initiatives including:

Signatory organisations

- Principles of Responsible Investing (PRI);

- UK Sustainable Investment & Finance Association (UKSIF);

- Global Impact Investing Network;

- UK Stewardship Code FRC;

- Institutional Investors Group on Climate Change (IIGCC);

- Farm Animal Investment Risk & Return (FAIRR);

- Financing a Just Transition Alliance;

- World Benchmarking Alliance;

- Access to Nutrition Initiative;

- Access to Medicine Initiative;

Collaborative engagement initiatives

- PRI Advance Human Rights - Human Rights;

- IIGCC Banks Working Group - Climate Change;

- CDP (formerly Carbon Disclosure Project);

- Climate Action 100+ - Climate Change;

- Nature Action 100+ - Biodiversity;

- Investor Action Group on Anti-Microbial Resistance - Water & AMR;

- Valuing Water Initiative - Water;

- Investor Initiative on Hazardous Chemicals - Water & Chemicals;

- Microfibre pollution initiative - Plastics Pollution;

- 30% Club Investor Group - Diversity;

- WBA – Digital Inclusion Group - Digital rights;

- Good Work Coalition - Good work;

- Votes Against Slavery - Modern slavery

- Find it, Fix it, Prevent it initiative on modern slavery

EdenTree believes these partnerships signals their commitment to having an active and positive role in the investment community. Collaborations are critical to driving change, whilst learning from expert sources allows them to provide more for their clients. EdenTree also sits on UKSIF’s Analyst Committee, which advises on the development of UKSIF’s knowledge sharing programme on evolving sustainability issues. They also sit on the PRI’s Circular Economy Reference Group, which explores how investors can better integrate the principles of a circular economy into investment processes. EdenTree’s CIO, Charlie Thomas, sits on the IA’s Sustainability and Responsible Investment Committee.

Responsible Investment Advisory Panel Overview

In addition to the review provided by the RI Team, this team itself has independent oversight from an external advisory panel of senior industry practitioners with expertise in the field of responsible investment. The EdenTree Responsible Investment Advisory Panel (“Panel”) meet three times each year to review the Responsible & Sustainable Fund portfolios, recent investment decisions and to discuss the latest responsible and sustainable research and trends.

The purpose of the Panel is to:

- Help to ensure that the EdenTree Responsible & Sustainable range of funds meet the stated aims and objectives.

- Provide advice in the formulation of policy in the light of changing social and environmental issues. The Panel will provide advice to the RI Team including:

- Advising on emerging issues or topics relevant to RI criteria.

- Provide advice and guidance on individual companies or sectors, and engagement work.

The Panel is made up of a number of industry experts, including:

- Will Oulton – Panel Chair, (former Head of RI at First Sentier)

- Mike Barry – Former Director of Sustainable Business

- Verity Mitchell - Independent Consultant, (former Director of Utilities for HSBC Global Research)

- Julian Parrott – Client Member, Ethical Futures

- Sue Round – Chair of EdenTree Investment Management ACD Board and former CEO

- Annette Ferguson – Independent Consultant (former Head of Sustainable Business at Vodafone)

- Paul Simpson OBE – Strategic Advisor (former CEO of CDP).

Dialshifter

This fund is helping to ‘shift the dial from brown to green’ by…

The core philosophy for the EdenTree Green Future Fund is that the true value of the planet’s natural capital is inappropriately priced within traditional market conventions, leading to the widespread abuse of natural resources and excessive pollution. As society becomes increasingly aligned with the protection of our natural capital, we believe that those competitively advantaged business models that are focused on improving the resource efficiency of the global economy (both in the solutions they provide and the operations they oversee) will be able to deliver greater levels of demand and higher returns on capital over the long-term.

The strategy targets capital appreciation by investing in those companies developing solutions to address the world’s environmental challenges, while also supporting the acceleration towards a more sustainable future through our engagement and stewardship practices.

Furthermore, the strategy seeks to invest in companies that make a substantial active contribution to solving environmental challenges, rather than companies that are purely focusing on minimising the environmental impact of their own operations. This is an important distinction and forms the basis of our “Green Future Investment Framework” of listed companies, which captures investment opportunities across all sectors, all market cap tiers and across all regions within the public equity market. The strategy distils this investment set into seven environmental-focused investment verticals, which are detailed below, along with the framework exposures:

SDR Labelling:

Sustainability Impact label

Key Performance Indicators:

The fund adopted the SDR “Sustainability Impact” label and the fund invests mainly in solutions to sustainability problems, with an aim to achieve a positive impact for people or the planet.

The Fund measures its impact via one primary Key Performance Indicator (KPI), which reflects the Fund’s aim to support a reduction in the level of greenhouse gas emissions through the Fund’s investment in, and engagement with, companies whose products and services provide climate change solutions and is measured in terms of the quantity of harmful emissions (tCO2 e) avoided. At a minimum, we expect each of the Fund’s assets to contribute positively towards the Fund level KPI, which is set out in the Fund’s Theory of Change which links asset and investment activities to the positive outcome the Fund seeks to achieve.

In addition, we measure three theme-specific sustainability metrics, which we will report in the Fund’s Annual Sustainability Report. These include:

- Renewable energy installed capacity (MW) - the amount of electricity a generator can produce when running at full operation.

- Renewable energy generated (MWh) - the amount of electricity generated by a power plant.

- Water saved/treated/provided (litres) - the volume of water that is treated/saved/provided by a company’s products and services.

Literature

Voting Record

Disclaimer

Regulatory Notice

To obtain further information please speak to your EdenTree representative, visit www.edentreeim.com or call our support team on 0800 011 3821. This document has been prepared by EdenTree Investment Management Limited for Financial Advisors, other intermediaries and other investment professionals only. It is not suitable for private individuals.

This document has been produced for information purposes only and as such the views contained herein are not to be taken as advice or recommendation to buy or sell any investment or interest thereto. A full explanation of the characteristics of the investments is given in the Key Investor Information Document (KIID). Any forecast, figures, opinions statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, EdenTree Investment Management’s own at the date of this document. There is no guarantee that any forecast made will come to pass. Please note that the value of an investment and the income from it can fall as well as rise as a result of market and currency fluctuations, you may not get back the amount originally invested. Past performance is not necessarily a guide to future returns.

| Fund Name | SRI Style | SDR Labelling | Product | Region | Asset Type | Launch Date | Last Amended |

|

|---|---|---|---|---|---|---|---|---|

Edentree Green Future Fund |

Environmental Style | Sustainability Impact label | OEIC | Global | Equity | 24/01/2022 | Jun 2025 | |

ObjectivesThe financial objective of the fund is to provide capital growth over 5 years or more, with an income and sustainability objective is to support a reduction in the level of greenhouse gas emissions, measured in tonnes of CO2e avoided on an annual basis, through the Fund’s investment in, and engagement with, companies whose products and services provide climate change solutions. |

Fund/Portfolio Size: £37.01m (as at: 30/04/2025) Total Screened Themed SRI Assets: £1638.79m (as at: 30/04/2025) Total Responsible Ownership Assets: £1403.01m (as at: 30/04/2025) Total Assets Under Management: £3041.81m (as at: 30/04/2025) ISIN: GB00BP5FBP60, GB00BP5FBQ77 Contact Us: Clare.Setchfield@edentreeim.com |

|||||||

Sustainable, Responsible &/or ESG OverviewThe Fund’s focus on companies providing solutions to climate change means that its choice of companies for investment is limited to a subset of the stock market and may result in periods of difference in the Fund’s performance compared to its indicative benchmark. We consider the Fund’s impact and financial goals to be complementary and are not looking to compromise on either or deliver concessionary financial returns. This Sustainability Goal combines with the Fund’s Financial Goal (as mentioned above) to form the overall Investment Objective. We expect the Fund to contribute to a reduction in greenhouse gas emissions through its asset contribution and investor contribution, as detailed in next response. |

||||||||

|

Primary fund last amended: Jun 2025 |

||||||||

|

Information received directly from Fund Manager |

||||||||

|

Please select what you would like to read:

Fund FiltersSustainability - General

Sustainability policy

Has policies that consider (environmental and social) sustainability issues. Strategies vary but are likely to consider environmental issues like climate change, carbon emissions, biodiversity loss, resource management, environmental impacts; and social issues like equal opportunities, human rights, labour standards, diversity and adherence to internationally recognised codes. See individual entry information.

Sustainability focus

Has a significant focus on sustainability issues

Sustainable transport policy or theme

Has documented policies or thematic investment approaches supporting investment in more sustainable, greener transport methods. These will typically set out a preference for companies that run, enable or support more sustainable methods of transport.

Encourage more sustainable practices through stewardship

Aim to encourage higher sustainability standards through responsible ownership / stewardship / engagement / voting activity

UN Global Compact linked exclusion policy

Use the UN Global Compact to inform or help direct where they can or cannot invest. Will typically not invest in companies with significant breaches (low standards) - strategies vary. (The UNGC covers a wide range of issues - search 'UNGC'). See https://unglobalcompact.org/

Transition focus

Aim to support the shift to a sustainable future. See eg https://www.transitionpathwayinitiative.org/

Circular economy theme

Has a theme or investment strand focused on the shift to a circular economy - where products are reused and recycled not incinerated or dumped. See eg https://www.ellenmacarthurfoundation.org/topics/circular-economy-introduction/overview Environmental - General

Environmental policy

Has policies which relate to environmental issues. These will typically set out their stance on issues such as pollution, climate change, resource management, biodiversity loss, carbon emissions, plastics and/or additional environmental impacts. Strategies vary.

Limits exposure to carbon intensive industries

Options that limit or 'reduce' their exposure to carbon intensive industries (ie sectors which are major contributors to climate change). Strategies vary.

Environmental damage and pollution policy

Has documented policies explaining the approach to environmental damage and pollution. Strategies vary.

Resource efficiency policy or theme

Has a policy or theme that relates to managing natural resources more efficiently. Strategies vary. See individual entry information.

Favours cleaner, greener companies

Aims to invest in companies with strong or market leading environmental policies and practices. Strategies vary. See individual entry information for more detail.

Waste management policy or theme

Has a written policy or theme focused on waste management - typically to support or encouraging higher levels of recycling and better efficiency / reducing waste. Strategies vary. Nature & Biodiversity

Biodiversity / nature policy

Has a written biodiversity policy or theme typically aimed at supporting, encouraging and improving environmental protection and safeguarding the natural world (sometimes referred to as 'natural capital'). See eg https://www.un.org/en/climatechange/science/climate-issues/biodiversity

Nature / biodiversity based solutions theme

A significant focus on investments that aim to protect, improve and / or restore natural habitat.

Deforestation / palm oil policy

Has policies designed to address involvement in irresponsibly managed palm oil or other forms of deforestation (typically exclusion led). Strategies vary.

Illegal deforestation exclusion policy

Avoids assets that are involved in illegal deforestation. This may relate to palm oil, cattle farming or other areas. Strategies vary.

Responsible palm oil policy

Has a responsible palm oil policy - typically likely to divert investment away from poor practices.

Sustainable fisheries policy

Has a sustainable fisheries policy that will inform where they can and cannot invest.

Water stewardship policy

Has a policy which sets out their expectations for how investee assets should manage their use of water - likely to focus on high users. Climate Change & Energy

Climate change / greenhouse gas emissions policy

Has policies (documented strategies that explain their position) on climate change related issues such as greenhouse gas/carbon emissions, net zero, transitioning to lower carbon. Strategies vary.

Coal, oil & / or gas majors excluded

Avoid investment in major coal, oil and/or gas (extraction) companies. Strategies vary.

Fracking and tar sands excluded

Avoid companies involved in fracking and tar sands - which are widely regarded as controversial methods of oil and gas extraction. Strategies vary.

Arctic drilling exclusion

Avoid companies that are involved in extracting oil from the Arctic regions.

Fossil fuel reserves exclusion

Avoid investing in companies / assets with coal, oil and gas reserves. See individual entry information for further details.

Clean / renewable energy theme or focus

Invest (or may invest) in clean / renewable energy companies and other assets. The proportion directly or indirectly invested in renewable energy may vary over time.

Encourage transition to low carbon through stewardship activity

Encourage the transition to lower carbon activities through asset selection and / or responsible ownership activity.

Energy efficiency theme

Has an energy efficiency theme - typically meaning that the manager is focused on investing in organisations that manage - or help others to manage - energy use more carefully and less wastefully - and so reduce greenhouse gas emissions.

Invests in clean energy / renewables

Invest in renewable energy companies and / or companies where renewable energy is a significant part of their business. Strategies vary.

Nuclear exclusion policy

Has a policy which describes the avoidance or limited investment in the nuclear industry. Strategies vary.

Supply chain decarbonisation policy

Has a supply chain decarbonisation policy which sets out their position on the need to reduce carbon emissions.

Fossil fuel exploration exclusion - direct involvement

Excludes companies and other assets with direct involvement in fossil fuel exploration (eg coal, oil and gas companies)

Paris aligned strategy

Aims to ensure holdings will reduce their greenhouse gas emissions in line with targets set at COP21 in Paris. The core aim is to help achieve ‘net zero emissions by 2050’ and a ‘maximum global temperature increase of +1.5 to +2 degrees above preindustrial levels’. Strategies and opinions vary.

Require net zero action plan from all/most companies

Requires all, or most of, the assets they invest in to have a ‘net zero action plan’ - describing how they will reduce their greenhouse gas emissions. Social / Employment

Social policy

Has policies which set out their approach to social issues (e.g. human rights, labour standards, equal opportunities, child labour and/or adherence to internationally recognised codes such as the UN Global Compact). Strategies with social policies typically avoid companies with low standards and/or work to encourage higher standards. See fund information for detail.

Labour standards policy

Has a labour standards policy - likely to mean they will invest in / favour companies that have higher employment related standards and avoid those with low standards. Strategies vary. See eg https://www.ilo.org/international-labour-standards

Favours companies with strong social policies

Aims to invest in assets with high social values - this may include strong human rights, labour standards and equal opportunities or safety related practices.

Health & wellbeing policies or theme

Has policies or themes that set out their approach to health and wellbeing issues, typically aims to invest in companies with high standards - or encourage high standards.

Diversity, equality & inclusion Policy (product level)

Has a written diversity policy – where the manager will aim to select companies with a carefully considered, positive employment standards. This may cover a range of issues including gender, ethnicity, disability, beliefs and sexual orientation.

Mining exclusion

All mining companies excluded

Vulnerable / gig workers protection policy

Has a policy aimed at protecting vulnerable workers such as those on zero hour / informal contracts working in the gig economy Ethical Values Led Exclusions

Tobacco and related products - avoid where revenue > 5%

Companies are excluded if they make more than 5% of their revenue from the manufacture, sale or distribution of tobacco products including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Controversial weapons exclusion

Excludes companies which make controversial weapons such as landmines, cluster munitions and chemical weapons.

Armaments manufacturers avoided

Avoids companies that manufacture weapons intended specifically for military use. Strategies vary - may or may not included non-strategic military products.

Military involvement exclusion

Avoids companies with military contracts. This may include medical supplies, food, safety equipment, housing, technology etc

Civilian firearms production exclusion

Has a written civilian firearms exclusion policy - meaning that they will not invest in companies that make (or perhaps also sell) handguns made for non-military users.

Alcohol production excluded

Avoids companies that produce alcohol. Strategies vary; some may allow a small proportion of revenue to come from this area.

Gambling avoidance policy

Avoids companies with significant involvement in the gambling industry. Some may allow a small proportion of revenues to come from this area.

Pornography avoidance policy

Find funds that avoid companies that derive significant income from pornography and related areas. Strategies vary.

Animal welfare policy

Has policies that require specific animal welfare standards to be met. These may reference well-known welfare standards (3Rs - Replace, Reduce, Refine) or certification schemes. Strategies vary.

Animal testing - excluded except if for medical purposes

Avoids companies that test their products on animals for purposes other than medical benefit (e.g. for cosmetics). Strategies vary. Human Rights

Human rights policy

Has policies relating to human rights issues. Typically require companies to demonstrate higher standards, although some managers work to encourage improvements. Investee companies are often judged against internationally agreed norms or standards. Strategies vary.

Child labour exclusion

Has policies to avoid companies that employ children.

Oppressive regimes (not free or democratic) exclusion policy

Has policies that exclude companies or other assets which operate in, or are owned by regimes which are not democratic, or where people may be oppressed. May use eg. Freedom House research. Strategies vary.

Responsible supply chain policy or theme

Has policies or a theme that relates to the responsible management of supply chains. These may relate to employment issues, notably people employed by their suppliers, as well as the sourcing of materials and products.

Modern slavery exclusion policy

Has a policy which excludes assets with involvement in Modern Slavery Meeting Peoples' Basic Needs

Water / sanitation policy or theme

Have policies or themes that set out the position on investment in the water sector and/or sanitation. Strategies vary.

Healthcare / medical theme

Healthcare and or medical theme or area of investment - may have a single or many themes

Antimicrobial resistance policy

Has a policy on ‘antimicrobial resistance’ - which is when organisms that cause infection can survive treatment - which is commonly associated with the overuse of antibiotics in factory farming. Banking & Financials

Invests in banks

Can include banks as part of their holdings / portfolio.

Only invest in TCFD (ISSB) aligned banks / financial institutions

Invest in banks and other financial institutions that implement the Task Force on Climate Related Financial Disclosures recommendations on climate change related financial disclosures - which aim to help financial markets measure and respond to climate risk.

Exclude banks with significant fossil fuel investments

Avoids banks that have a large part of their loan book (or other assets) invested in fossil fuels companies - particular coal, oil and gas.

Exclude insurers of major fossil fuel companies

Avoids investing in insurance companies that insure major fossil fuels companies – particularly coal, oil and gas. Strategies (eg definition of ‘major’) vary.

Invests in insurers

May invest in insurance companies. Governance & Management

Governance policy

Has policies that relate to corporate governance issues such as board structure, executive remuneration, bribery and/or corporate corruption. These funds will typically avoid companies with poor practices. Strategies vary.

Avoids companies with poor governance

Avoids investing in companies with poor governance practices.(e.g. board structure, management practices etc.) Views may however vary on what counts as 'poor' practices - and funds may not immediately divest as they may prefer to work to encourage higher standards.

UN sanctions exclusion

Exclude companies that are subject to United Nations sanctions. See eg https://main.un.org/securitycouncil/en/content/un-sc-consolidated-list

Anti-bribery and corruption policy

Has policies explaining how managers will respond to assets / companies that do not comply with relevant anti-bribery and anti-corruption standards or laws. Strategies vary; options include stewardship/ engagement and divestment - or a combination.

Encourage board diversity e.g. gender

Encourage the companies they invest in to have more diverse board structures (e.g. more women on boards)

Encourage TCFD alignment for banks & insurance companies

Encourage the banks and insurance companies they invest in to publish climate change related financial information - as set out by the Task Force on Climate Related Financial Disclosures (with the aim of helping investors measure and respond to climate risk).

Encourage higher ESG standards through stewardship activity

Aim to encourage higher ESG standards through responsible ownership / stewardship / engagement /voting activity

Require investee companies to report climate risk in R&A

Requires the companies they invest in to report on climate risks that are relevant to their business in their report and accounts Product /Service Governance

ESG integration strategy

Find funds that factor in 'environmental, social and governance' issues as part of their investment decision making process. A focus on 'ESG' typically means a fund is carrying out additional research to help reduce ESG related risks. It does not necessarily mean a focus on sustainability. Strategies vary. See fund literature.

ESG factors included in Assessment of Value (AoV) report

Environmental, social and governance issues are part of this fund’s reporting of their ‘value’ to clients. AoV reporting is a statutory requirement. Including ESG factors in its calculation is not. Asset Size

Invests in small, mid and large cap companies / assets

Invests in a combination of small, medium and larger (potentially multinational) companies. Targeted Positive Investments

Invests >25% in environmental/social solutions companies

Invests >25% of their capital in companies where a major part of their business is focused on helping to address environmental or social challenges.

Invests >50% of fund in environmental/social solutions companies

Invests >50% of their capital in companies where a major part of their business is focused on helping to address environmental or social challenges. Impact Methodologies

Positive environmental impact theme

Specifically sets out to help deliver positive environmental impacts, benefits or 'real world' outcomes.

Positive social impact theme

Specifically states that they aim to deliver positive social (i.e. people related) impacts and/or outcomes.

Invests in environmental solutions companies

Directs investment towards companies where a major part of their business is about solving environmental challenges. e.g. companies helping to address climate change.

Invests in social solutions companies

Invest in companies where a major part of their business is specifically aimed at helping to address social challenges. e.g. companies helping to address poverty.

Invests in sustainability / ESG disruptors

Specifically sets out to invest in companies that are regarded as 'disrupting' existing business practices - typically through the development of innovative (sustainability aware) products and/or practices.

Aim to deliver positive impacts through engagement

Aims to deliver positive environmental and or social impacts (real world benefits) through its engagement with investee assets

Publish ‘theory of change’ explanation

Policy explains the ways in which the manager believes things need to change in order to deliver a more sustainable future, which they are working to help achieve. How The Fund/Portfolio Works

Positive selection bias

Focuses on finding and investing in companies with positive / beneficial attributes. This strategy can be applied in addition to exclusion criteria and engagement/stewardship activity.

Negative selection bias

Has principle 'ethical approach' to avoid companies by using negative screening criteria. Strategies vary.

Strictly screened ethical investment

Has principle approach to apply positive or negative ethical, social and / or environmental screens. Strictly screened investments are likely to exclude more companies than other related options. Strategies vary.

ESG weighted / tilt

Invest more heavily in assets which have higher ESG ratings/standards or scores and less heavily in companies with lower ESG ratings. Where this is central to the strategy you should expect assets in most sectors. Strategies vary.

Significant harm exclusion

Aims to avoid companies that do significant harm. This originates from the EU’s sustainable finance ‘DNSH’ (do no significant harm) work, which is not necessarily used by UK investors.

Combines norms based exclusions with other SRI criteria

Investment selection process uses internationally agreed 'norms' (e.g. United Nations Global Compact - UNGC - or the UN Sustainable Development Goals - SDGs) alongside additional SRI criteria such as positive or negative stock selection policies and/or stewardship strategies.

Combines ESG strategy with other SRI criteria

Invests in assets which have an ESG strategy (which is typically focused on avoiding companies that pose environmental, social or governance related risks) together with additional criteria such as positive and/or negative screens, themes and stewardship strategies.

Focus on ESG risk mitigation

Focuses on the careful management of environmental, social and governance (ESG) related risks - typically by avoiding or being underweight in companies seen as posing major risks in these areas (i.e. not necessarily by using themes, exclusions etc).

SRI / ESG / Ethical policies explained on website

Publish explanations of their ethical, social and/or environmental policies online (i.e. investment decision making strategies/ buy/sell &/or asset management strategies).

Do not use stock / securities lending

Does not use stock lending for performance or risk purposes. Unscreened Assets & Cash

Assets typically aligned to sustainability objectives 70 - 79%

Holds between 70-79% of assets which align to the sustainability objectives; which are not being held purely for risk management purposes, such as derivatives and cash equivalent assets.

Assets typically aligned to sustainability objectives 80 – 89%

Holds between 80-89% of assets which align to the sustainability objectives; which are not being held purely for risk management purposes, such as derivatives and cash equivalent assets.

All assets (except cash) meet published sustainability criteria

All assets - except cash - meet the sustainability criteria published in strategy documentation. Intended Clients & Product Options

Intended for investors interested in sustainability

Finds funds designed to meet the needs of individual investors with an interest in sustainability issues.

Intended for clients interested in ethical issues

Find funds designed for clients who care about ethical and values-based issues, often alongside sustainability issues also.

Available via an ISA (OEIC only)

Find funds that are available via a tax efficient ISA product wrapper. Labels & Accreditations

SDR Labelled

Find funds that have chosen to adopt one of the Financial Conduct Authority (FCA) SDR labels. Please note: there are a range of reasons why potentially relevant funds may not use an SDR label eg. adopting a label may be work in progress, the manager may not yet be allowed to do so because of the product type, a manager may feel their fund is insufficiently aligned to SDR requirements. Read fund literature and / or our blogs for further information.

ACT signatory

A voluntary corporate culture standard for investment managers, see https://www.investorsact.com/ - City Hive Fund Management Company InformationAbout The Business

Boutique / specialist fund management company

Find fund management companies that are smaller or specialise in particular areas - notably, ideally ESG related. Strategies vary.

Responsible ownership / stewardship policy or strategy (AFM company wide)

Finds fund management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

ESG / SRI engagement (AFM company wide)

Find fund management companies that actively encourage higher 'environmental, social and governance' and/or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Vote all* shares at AGMs / EGMs (AFM company wide)

Find fund managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Responsible ownership / ESG a key differentiator (AFM company wide)

Find fund managers that consider responsible ownership and ESG to be a key differentiator for their business.

Sustainable property strategy (AFM company wide)

Find fund management companies that take sustainability criteria into account when selecting and/or managing all of their property / real estate investments.

Senior management KPIs include environmental goals (AFM company wide)

The leadership team of this asset manager have performance targets linked to environmental goals.

Integrates ESG factors into all / most (AFM) fund research

Find fund management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management.

In-house diversity improvement programme (AFM company wide)

Finds organisations / fund managers that have an in-house (company wide) diversity improvement programme - meaning that they are working to ensure that within their own businesses they employ people from diverse backgrounds - often typically focused on ethnicity and/or sex.

Diversity, equality & inclusion engagement policy (AFM company wide)

Find fund management companies that encourage the companies they invest in to have strong diversity, race, gender and other equality policies across all assets held, not simply screened or themed SRI/ESG funds. (ie Asset Management company wide).

Vulnerable client policy on website (AFM company wide)

Asset manager has information on their website that explains how they treat 'vulnerable clients' (as set out in FCA regulation)

Invests in newly listed companies (AFM company wide)

This asset management company invests in companies which have recently listed on a stock exchange (which is important as it can help grow new businesses).

Invests in new sustainability linked bond issuances (AFM company wide)

Asset management company has investments in bonds designed to meet sustainability requirements - however these assets may not be 'ringfenced' for this purpose. See fund manager website for details.

Offer structured intermediary training on sustainable investment

Fund management entity offers unstructured intermediary training on sustainable investment (ie for financial advisers and wealth managers)

Offer unstructured intermediary sustainable investment training

Fund management entity offers unstructured intermediary training on sustainable investment (ie for financial advisers and wealth managers) Collaborations & Affiliations

PRI signatory

Find fund management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

UKSIF member

Find fund management companies that are members of UKSIF - the UK Sustainable Investment and Finance association

Fund EcoMarket partner

Find fund management companies that have partnered with Fund EcoMarket - meaning that they are helping to improve access to information on sustainable and responsible investment by paying an annual fee to us which enables us to publish information for free. Partner funds are listed ahead of other funds and have their logos displayed.

Investment Association (IA) member

Fund management entity is a member of the Investment Association https://www.theia.org/ Resources

In-house responsible ownership / voting expertise

Find fund management companies that employ people to steer and support fund managers in voting shares at company AGM's and EGMs in ways that are consistent with encouraging higher ESG/sustainability standards.

Employ specialist ESG / SRI / sustainability researchers