L&G GBP Corporate Bond Screened UCITS ETF

SRI Style:

Limited Exclusions

SDR Labelling:

Not eligible to use label

Product:

ETF

Fund Region:

Global

Fund Asset Type:

Fixed Interest

Launch Date:

09/12/2020

Last Amended:

Aug 2025

Dialshifter ( ):

):

Fund/Portfolio Size:

£164.20m

(as at: 23/06/2025)

Total Screened Themed SRI Assets:

£424600.00m

(as at: 31/12/2024)

Total Responsible Ownership Assets:

£1117672.56m

(as at: 31/12/2024)

Total Assets Under Management:

£1117672.56m

(as at: 31/12/2024)

ISIN:

IE00BLRPQM83

Contact Us:

Objectives:

The L&G GBP Corporate Bond Screened UCITS ETF (the "ETF") aims to track the performance of the J.P. Morgan GCI ESG Investment Grade GBP Custom Maturity Index (the “Index”).

Sustainable, Responsible

&/or ESG Overview:

The L&G GBP ESG GBP Corporate Bond UCITS ETF aims to provide exposure to the Pound Sterling-denominated investment grade corporate bond market.

The Fund promotes a range of environmental and social characteristics which are met by tracking the Index. Further information on how such characteristics are met by the Fund can be found in the Fund Supplement.

Primary fund last amended:

Aug 2025

Information directly from fund manager.

Fund Filters

Sustainability - General

Has policies that consider (environmental and social) sustainability issues. Strategies vary but are likely to consider environmental issues like climate change, carbon emissions, biodiversity loss, resource management, environmental impacts; and social issues like equal opportunities, human rights, labour standards, diversity and adherence to internationally recognised codes. See individual entry information.

Has a significant focus on sustainability issues

Use the UN Global Compact to inform or help direct where they can or cannot invest. Will typically not invest in companies with significant breaches (low standards) - strategies vary. (The UNGC covers a wide range of issues - search 'UNGC'). See https://unglobalcompact.org/

Environmental - General

Options that limit or 'reduce' their exposure to carbon intensive industries (ie sectors which are major contributors to climate change). Strategies vary.

Climate Change & Energy

Avoid investment in major coal, oil and/or gas (extraction) companies. Strategies vary.

Avoid companies involved in fracking and tar sands - which are widely regarded as controversial methods of oil and gas extraction. Strategies vary.

Ethical Values Led Exclusions

Companies are excluded if they are involved in any aspect of the production chain for tobacco products, including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Companies are excluded if they make more than 5% of their revenue from the manufacture, sale or distribution of tobacco products including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Excludes companies which make controversial weapons such as landmines, cluster munitions and chemical weapons.

Avoids companies that manufacture weapons intended specifically for military use. Strategies vary - may or may not included non-strategic military products.

Has a written civilian firearms exclusion policy - meaning that they will not invest in companies that make (or perhaps also sell) handguns made for non-military users.

Human Rights

Has policies relating to human rights issues. Typically require companies to demonstrate higher standards, although some managers work to encourage improvements. Investee companies are often judged against internationally agreed norms or standards. Strategies vary.

Governance & Management

Avoids investing in companies with poor governance practices.(e.g. board structure, management practices etc.) Views may however vary on what counts as 'poor' practices - and funds may not immediately divest as they may prefer to work to encourage higher standards.

Exclude companies that are subject to United Nations sanctions. See eg https://main.un.org/securitycouncil/en/content/un-sc-consolidated-list

Aim to encourage higher ESG standards through responsible ownership / stewardship / engagement /voting activity

Impact Methodologies

Fund aims to deliver positive environmental and or social impacts (real world benefits) through its engagement with investee assets

How The Fund Works

Find funds where their main 'ethical approach' is to avoid companies by using negative screening criteria. Read fund literature for further information.

Find funds that invest more heavily in those that have higher ESG ratings/standards or scores and less heavily in companies with lower ESG ratings. Where this is central to a fund's strategy you should expect it to invest in most sectors. Strategies vary.

Find funds that use an investment index to direct where they can invest. Fund strategies and indices vary. See fund details and index used.

Aims to avoid companies that do significant harm. This originates from the EU’s sustainable finance ‘DNSH’ (do no significant harm) work, which is not necessarily used by UK investors.

Find funds that have published explanations of their ethical, social and/or environmental policies online (i.e. fund decision making strategies/ buy/sell &/or asset management strategies).

See fund information for different risk options of this fund strategy

Unscreened Assets & Cash

The percentage of assets held within the fund that match the fund’s sustainability objectives and are not being held purely for risk management purposes, such as derivatives and cash equivalent assets.

The percentage of assets held within the fund that match the fund’s sustainability objectives and are not being held purely for risk management purposes, such as derivatives and cash equivalent assets.

The percentage of assets held within the fund that match the fund’s sustainability objectives and are not being held purely for risk management purposes, such as derivatives and cash equivalent assets

Intended Clients & Product Options

Finds funds designed to meet the needs of individual investors with an interest in sustainability issues.

Labels & Accreditations

Finds funds classified under Article 8 of the EU’s SFDR (Sustainable Finance Disclosure Requirements). Article 8 of the SFDR is a set of requirements that apply to financial products that 'promote' environmental or social characteristics with high governance also. These rules do not currently apply to UK funds so many managers may leave this field blank.

Fund Management Company Information

About The Business

Finds fund management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

Find fund management companies that actively encourage higher 'environmental, social and governance' and/or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Find fund managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Find fund managers that consider responsible ownership and ESG to be a key differentiator for their business.

Find fund management companies that take sustainability criteria into account when selecting and/or managing all of their property / real estate investments.

The leadership team of this asset manager have performance targets linked to environmental goals.

Find funds run by fund managers that apply Responsible ownership or 'Stewardship' policies to all or most of their investment assets. This means active involvement (e.g. voting, dialogue) with the companies they invest in across funds (not normally limited to ethical or SRI options.) Read fund literature for further information.

Find fund management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management.

Finds organisations / fund managers that have an in-house (company wide) diversity improvement programme - meaning that they are working to ensure that within their own businesses they employ people from diverse backgrounds - often typically focused on ethnicity and/or sex.

Find fund management companies that encourage the companies they invest in to have strong diversity, race, gender and other equality policies across all assets held, not simply screened or themed SRI/ESG funds. (ie Asset Management company wide).

This asset management company invests in companies which have recently listed on a stock exchange (which is important as it can help grow new businesses).

Asset management company has investments in bonds designed to meet sustainability requirements - however these assets may not be 'ringfenced' for this purpose. See fund manager website for details.

Collaborations & Affiliations

Find fund management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

A member of the Taskforce for Nature Related Financial Disclosures group which aims to aid risk management and shift money towards nature-positive outcomes.

Fund management entity is a member of the Investment Association https://www.theia.org/

Resources

Find fund management companies that employ people to steer and support fund managers in voting shares at company AGM's and EGMs in ways that are consistent with encouraging higher ESG/sustainability standards.

Find a fund management company that directly employs specialist ESG/SRI/sustainability researchers or analysts. This allows asset managers to discuss environmental, social and governance risks and opportunities directly with companies.

Find fund management companies that makes use of expert external research companies. This can help deliver specialist expertise and means resources are pooled with other investors.

Finds organisations / fund managers that have one or more ESG/sustainability experts on all investment teams or 'desks' (all asset types)

Accreditations

Find fund managers that are signatories to the FRC UK Stewardship Code, which sets out a framework for constructive investor / investee relations where fund managers are encouraged to behave like responsible, typically longer term 'company owners'.

Engagement Approach

Find fund management companies that regularly initiate or run industry wide (collaborative) investor projects aimed at raising environmental, social and governance standards amongst investee companies.

Fund manager has stewardship /responsible ownership strategy that is focused on addressing climate change with investee assets.

Asset manager has a stewardship /responsible ownership strategy that involves working with fossil fuel companies on climate change related issues. See fund manager website for details.

Asset manager has stewardship /responsible ownership strategy with involves encouraging investee asset to reduce plastic waste and pollution.

Asset manager has a stewardship / responsible ownership policy that means they are working to encourage more responsible mining practices - where environmental and social issues are properly dealt with by the companies they invest in.

The asset manager has a responsible ownership / stewardship strategy that focuses on biodiversity and nature issues relating to the assets they invest the aim of which will be to reduce harm and or deliver improvement. Strategies vary. https://tnfd.global

Asset manager has a responsible ownership / stewardship strategy which means they are working to encourage the shift to more sustainable business practices in ways that respect and are sensitive to social issues and the impact change has on people effected by the changes that are taking place. https://www.transitionpathwayinitiative.org/ https://transitiontaskforce.net/

Asset manager has responsible ownership / stewardship strategy in place which aims to address human rights issues in investee companies (and potentially their suppliers) with the aim of raising standards

Asset manager has responsible ownership / stewardship strategy in place that aims to improve labour standards for the benefit of employees in investee companies (and potentially their suppliers)

Asset management company has a stewardship strategy in place which involves working to raise diversity, equality and inclusion standards across investee assets

working with the assets they hold to help stamp out modern slavery - where direct or indirect company employees are exploited for business benefits.

Fund managers have stewardship strategies in place that focus on improving governance standards across investee assets

Escalation policies describe how a manager will proceed if stewardship / engagement activity is not successful in the short term.

Company Wide Exclusions

Find fund management companies (not funds) that avoid investment in 'controversial weapons' across all of their funds and other investment vehicles.

Find funds / fund managers that are reviewing, or have reviewed, their exposure to carbon intensive industries including (but not only) mining, oil and gas companies. (Typically with reference to climate change.)

This asset manager excludes direct investment in the coal mining industry. Managers ability to do this may depend on the geographic regions in which they invest.

Climate & Net Zero Transition

Fund management organisations that have pledged to reduce their greenhouse gas emissions to ‘net zero’. Strategies vary - this area is changing rapidly.

This asset management company has set a date by which they plan to achieve net zero greenhouse gas / CO2e emissions.

Find fund management companies that are working with the companies they invest in to encourage reductions in carbon dioxide and other greenhouse gas emissions.

Finds organisations / fund managers that have a company wide carbon transition plan - meaning that they have plotted a path to how they will move away from activities that produce or use carbon based energy sources (that emit greenhouse gases) towards clean, alternative, renewable energy sources.

This asset management company plans to achieve net zero greenhouse gas (CO2e) emissions by reducing their emissions. Calculations and scope vary.

Find fund management companies that are working to reduce their own (fund management company) carbon/greenhouse gas emissions.

Finds organisations / fund management companies that are in the process of working out how to make a ‘net zero commitment’ - meaning that when that is finalised they will have started the process of reducing their total greenhouse gas emissions to'zero'.

See https://sciencebasedtargets.org/

Transparency

Find fund management companies that publish a report detailing their responsible investment ownership - also known as 'Stewardship' - activity.

Find companies that publish information about their sustainable and responsible investment strategies on their company website.

Find fund management companies that will supply information about their sustainable and responsible investment activity on request.

Fund management companies that publish a full record of how they vote their shares at AGMs (annual general meetings) and EGMs (extraordinary general meetings). Voting strategies have an important role to play encouraging higher environmental, social and governance standards.

This asset management company has published a plan that explains how they are going to achieve net zero greenhouse gas / CO2e emissions.

Find fund management companies that have supplied Dialshifter information. See Dialshifter tab within record for more information.

Sustainable, Responsible &/or ESG Policy:

The L&G GBP Corporate Bond Screened UCITS ETF (the "ETF") aims to track the performance of the J.P. Morgan GCI ESG Investment Grade GBP Custom Maturity Index (the “Index”). The Fund promotes a range of environmental and social characteristics which are met by tracking the Index.

The Index tracks Sterling-denominated investment grade corporate bonds across developed and emerging market issuers. The index applies an ESG scoring and screening methodology to tilt toward issuers ranked higher on ESG criteria and green bond issues, and to underweight and exclude issuers that rank lower.

The Fund follows the following sustainability-related investment strategy by tracking the Index that applies:

J.P. Morgan ESG Exclusions:

The Index

- excludes issuers with revenue from thermal coal, oil sands, , controversial weapons tobacco and weapons sectors,

- excludes issuers not in compliance with the United Nations Global Compact principles, as determined by the Index provider’s methodology, and

- excludes issuers with J.P. Morgan (JESG) scores less than 20, these issuers are not eligible for index re-inclusion for 12 months.

J.P. Morgan ESG Score:

The Index positively tilts towards issuers ranked higher on ESG criteria and underweights lower ranking issuers. The Index applies JESG issuer scores to adjust the market value of index constituents from the baseline index. JESG issuer scores are a 0-100 percentile rank calculated based on normalized raw ESG scores from third-party research providers, including Sustainalytics and RepRisk. An issuer’s finalized JESG score incorporates a 3-month rolling average. Quasi-Sovereign issuers with no coverage from either third-party research provider default to their sovereign JESG score. The JESG scores are divided into five bands that are used to scale each issue’s baseline index market value, with the band rebalance occurring on a quarterly basis.

JESG Score Bands Scalar

- Band 1: Score > 80 1.00

- Band 2: 60 < Score <= 80 0.80

- Band 3: 40 < Score <= 60 0.60

- Band 4: 20 < Score <= 40 0.40

- Band 5: Score <= 20 0.00

Issuers in Band 5 will be excluded from the index and will not be eligible for twelve months. If an instrument is categorized as a “green bond” by the Climate Bonds Initiative, the security will receive a one-band upgrade. Green bonds upgrades may happen intra quarter. Green bonds by issuers already in Band 1 will not receive any further upgrades.

Additionally, the Index incorporates positive screening techniques whereby ‘green’ bonds (bonds which are created to fund projects that have positive environmental and/ or climate benefits) of the same issuer are prioritised by the Index.

Further information on the index methodology can be found at: https://www.jpmorgan.com/insights/research/index-research/composition-docs

Additionally, the Fund considers principal adverse impacts on sustainability factors and LGIM has identified a subset of the adverse sustainability indicators that are relevant to the Fund’s investments. The Fund considers principal adverse impacts, identified using the below listed sustainability indicators, through the implementation of the Fund’s ESG investment strategy.

- PAI 1: GHG emissions

- PAI 2: Carbon footprint

- PAI 3: GHG intensity of companies

- PAI 4: Exposure to fossil fuel companies

- PAI 5: Share of non-renewable energy

- PAI 7: Activities negatively affecting biodiversity-sensitive areas

- PAI 8: Emissions to water

- PAI 10: Companies violating UNGC/OECD

- PAI 14: Controversial weapons

Process:

L&G has developed a proprietary research tool called Active ESG View which brings together granular quantitative and qualitative ESG inputs. Active ESG View primarily uses third-party data from multiple different vendors which includes hundreds of ESG metrics (including data on carbon emissions, water and waste, environmental policies and controls, labour, health and safety, bribery and corruption) spanning 64 specific sectors and/or sub-sectors from a number of ESG data providers.

The quantitative inputs consist of two components:

- an ESG score calculated in Active ESG View which evaluates and scores issuers from an environmental, social and governance perspective, and

- a screening of investee companies in respect of their involvement in certain products and services, and certain controversies and violations of norms and standards. This screening, directly or indirectly, maps to some of the adverse sustainability indicators set out in Table 1 of Annex I of the Level 2 Measures.

L&G sets minimum thresholds for both of these components in Active ESG View. These are then supplemented by LGIM’s qualitative assessment of the sustainability risks and opportunities relating to the relevant issuer. This qualitative assessment is performed by the Global Research and Engagement Groups (“GREGs”) which bring together representatives from LGIM’s investment and investment stewardship teams across regions and asset classes. Where issuers fail to meet either of the components of the quantitative assessment, and the GREGs have reviewed and agreed with the assessment through qualitative analysis, L&G will seek to limit the Fund’s aggregate exposure to such issuers relative to their weights in the Benchmark Index.

The sustainability indicator that will be used in relation to the attainment of the environmental and social characteristics relating to this process will measure the aggregate overweight exposure to issuers that are not aligned with L&G’s requirements for ESG factor evaluation compared to such issuers' weight in the Benchmark Index.

Resources, Affiliations & Corporate Strategies:

As of December 2024, there are c.100 L&G - Asset Management (L&G) employees with roles dedicated to ESG, some of which are outlined in more detail below.

Responsible Investment and Investment Stewardship team

- Amelia Tan was appointed Head of Responsible Investment & Stewardship for Legal and General’s Asset Management division in January 2025, having joined in 2022 as Head of Responsible Investment Strategy. In this role, she is responsible for engagement with publicly listed investee companies globally across all of the firm’s assets under management as well as responsible investment processes and products of the public market’s investment teams. She coordinates the strategy for responsible investing in the Asset Management division and is responsible for regulatory and policy engagement regarding environmental, social, governance and responsible investment matters.

- The Investment Stewardship team is responsible for developing and carrying out L&G’s investment stewardship and active ownership activities. The team comprises subject matter experts across our global investment stewardship themes and is organised in a matrix of thematic and sector coverage.

- There are 24 people in our global Investment Stewardship team (as at 31 December 2024). The team includes those located in the US, Japan and Singapore, the latter two led by Aina Fukuda and Trista Chen, respectively.

- The Responsible Investing Strategy team, comprising three colleagues, works with investment teams to integrate responsible investing insights into investment process across asset classes and investment styles. Additionally, the team also looks to innovate on responsible investing products and solutions, with the focus on positioning and ensuring that we are market-leading, credible and consistent.

Climate Solutions team

- Nick Stansbury, Head of Climate Solutions, leads our energy transition approach and is one of our most prominent spokespeople on this topic.

- The Climate Solutions team, which has a total of eight team members, has created a bespoke, detailed and investor-focused model to facilitate construction of fully independent energy scenarios. The framework uses in excess of 10 million data variables to model the energy system. The model, L&G’s Destination@Risk, is now helping to inform our long-term investment decisions and develop dynamic pathways for the energy system.

ESG Distribution

- Laura Brown, Head of Public Markets Distribution, is supported by two further colleagues who are dedicated to ESG and supporting clients in meeting their sustainability and responsible investing objectives.

Real Assets

- L&G’s Real Assets teamhas 11 dedicated ESG experts working across the range of private credit and real estate strategies that we manage. This team is led Shuen Chan, Head of Responsible Investment and Sustainability.

Product Development and Strategy

- Rachel Ahlquistis focused on developing and shaping the strategic direction of the pooled product range with respect to Responsible Investment features. This includes specific focus on product launch or amendment work with more advanced ESG features.

Global Research and Engagement Group (GREGs)

Further to those with roles dedicated to ESG, our Global Research and Engagement Groups (GREGs) bring together representatives from the Investment and Investment Stewardship teams across regions and asset classes. The GREGs enable L&G to connect top-down macro and thematic views with bottom-up analysis of corporate and sector fundamentals to understand the materiality of sustainability risks and opportunities and prioritise them accordingly. Combining the capabilities of the Investment and Investment Stewardship teams also enables L&G to scale and coordinate our engagement efforts with companies at board and executive management levels, across all asset class and investment styles. C.40 research analysts contribute to our GREGs, researching into structural industry changes and risks, and identifying key themes and engagement topics across nine sectors.

Please see L&G Attachment 1 - ESG Memberships and Collaboration for details on list of related affiliations and memberships.

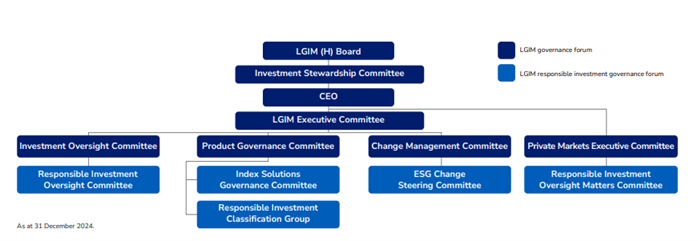

Please find the team organisation chart below.

See also: L&G ESG Memberships & Collaborations.docx

SDR Labelling:

Not eligible to use label

Literature

Fund Holdings

Voting Record

Disclaimer

This communication is not a financial promotion and is intended for Professional Clients, Qualified Investors, companies and pension trustees and should not be relied upon by retail customers, pension scheme members, employees, or any other persons.

This document has been prepared by Legal & General Investment Management Limited and/or its affiliates ('L&G', ‘we’ or ‘us’). The information in this document is the property and/or confidential information of L&G and may not be reproduced in whole or in part or distributed or disclosed by you to any other person without the prior written consent of L&G. Not for distribution to any person resident in any jurisdiction where such distribution would be contrary to local law or regulation.

No party shall have any right of action against L&G in relation to the accuracy or completeness of the information in this document. The information and views expressed in this document are believed to be accurate and complete as at the date of publication, but they should not be relied upon and may be subject to change without notice. We are under no obligation to update or amend the information in this document. Where this document contains third party data, we cannot guarantee the accuracy, completeness or reliability of such data and we accept no responsibility or liability whatsoever in respect of such data.

No part of this document should be construed as providing investment advice, and L&G does not accept any liability for any decisions based on this document.

Legal and General Assurance (Pensions Management) Limited. Registered in England and Wales No. 01006112. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, No. 202202.

LGIM Real Assets (Operator) Limited. Registered in England and Wales, No. 05522016. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No. 447041. Please note that while LGIM Real Assets (Operator) Limited is regulated by the Financial Conduct Authority, it may conduct certain activities that are unregulated.

Legal & General (Unit Trust Managers) Limited. Registered in England and Wales No. 01009418. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No. 119273.

Issued by Legal & General Investment Management Ltd in the UK. Registered in England and Wales No. 02091894. Registered office: One Coleman Street, London EC2R 5AA. Authorised and regulated by the Financial Conduct Authority.

| Fund Name | SRI Style | SDR Labelling | Product | Region | Asset Type | Launch Date | Last Amended |

|

|---|---|---|---|---|---|---|---|---|

L&G GBP Corporate Bond Screened UCITS ETF |

Limited Exclusions | Not eligible to use label | ETF | Global | Fixed Interest | 09/12/2020 | Aug 2025 | |

ObjectivesThe L&G GBP Corporate Bond Screened UCITS ETF (the "ETF") aims to track the performance of the J.P. Morgan GCI ESG Investment Grade GBP Custom Maturity Index (the “Index”).

|

Fund/Portfolio Size: £164.20m (as at: 23/06/2025) Total Screened Themed SRI Assets: £424600.00m (as at: 31/12/2024) Total Responsible Ownership Assets: £1117672.56m (as at: 31/12/2024) Total Assets Under Management: £1117672.56m (as at: 31/12/2024) ISIN: IE00BLRPQM83 Contact Us: fundsales@lgim.com |

|||||||

Sustainable, Responsible &/or ESG OverviewThe L&G GBP ESG GBP Corporate Bond UCITS ETF aims to provide exposure to the Pound Sterling-denominated investment grade corporate bond market. The Fund promotes a range of environmental and social characteristics which are met by tracking the Index. Further information on how such characteristics are met by the Fund can be found in the Fund Supplement. |

||||||||

|

Primary fund last amended: Aug 2025 |

||||||||

|

Information received directly from Fund Manager |

||||||||

|

Please select what you would like to read:

Fund FiltersSustainability - General

Sustainability policy

Has policies that consider (environmental and social) sustainability issues. Strategies vary but are likely to consider environmental issues like climate change, carbon emissions, biodiversity loss, resource management, environmental impacts; and social issues like equal opportunities, human rights, labour standards, diversity and adherence to internationally recognised codes. See individual entry information.

Sustainability focus

Has a significant focus on sustainability issues

UN Global Compact linked exclusion policy

Use the UN Global Compact to inform or help direct where they can or cannot invest. Will typically not invest in companies with significant breaches (low standards) - strategies vary. (The UNGC covers a wide range of issues - search 'UNGC'). See https://unglobalcompact.org/ Environmental - General

Limits exposure to carbon intensive industries

Options that limit or 'reduce' their exposure to carbon intensive industries (ie sectors which are major contributors to climate change). Strategies vary. Climate Change & Energy

Coal, oil & / or gas majors excluded

Avoid investment in major coal, oil and/or gas (extraction) companies. Strategies vary.

Fracking and tar sands excluded

Avoid companies involved in fracking and tar sands - which are widely regarded as controversial methods of oil and gas extraction. Strategies vary. Ethical Values Led Exclusions

Tobacco and related product manufacturers excluded

Companies are excluded if they are involved in any aspect of the production chain for tobacco products, including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Tobacco and related products - avoid where revenue > 5%

Companies are excluded if they make more than 5% of their revenue from the manufacture, sale or distribution of tobacco products including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Controversial weapons exclusion

Excludes companies which make controversial weapons such as landmines, cluster munitions and chemical weapons.

Armaments manufacturers avoided

Avoids companies that manufacture weapons intended specifically for military use. Strategies vary - may or may not included non-strategic military products.

Civilian firearms production exclusion

Has a written civilian firearms exclusion policy - meaning that they will not invest in companies that make (or perhaps also sell) handguns made for non-military users. Human Rights

Human rights policy

Has policies relating to human rights issues. Typically require companies to demonstrate higher standards, although some managers work to encourage improvements. Investee companies are often judged against internationally agreed norms or standards. Strategies vary. Governance & Management

Avoids companies with poor governance

Avoids investing in companies with poor governance practices.(e.g. board structure, management practices etc.) Views may however vary on what counts as 'poor' practices - and funds may not immediately divest as they may prefer to work to encourage higher standards.

UN sanctions exclusion

Exclude companies that are subject to United Nations sanctions. See eg https://main.un.org/securitycouncil/en/content/un-sc-consolidated-list

Encourage higher ESG standards through stewardship activity

Aim to encourage higher ESG standards through responsible ownership / stewardship / engagement /voting activity Impact Methodologies

Aim to deliver positive impacts through engagement

Fund aims to deliver positive environmental and or social impacts (real world benefits) through its engagement with investee assets How The Fund Works

Negative selection bias

Find funds where their main 'ethical approach' is to avoid companies by using negative screening criteria. Read fund literature for further information.

ESG weighted / tilt

Find funds that invest more heavily in those that have higher ESG ratings/standards or scores and less heavily in companies with lower ESG ratings. Where this is central to a fund's strategy you should expect it to invest in most sectors. Strategies vary.

Passive / index driven strategy

Find funds that use an investment index to direct where they can invest. Fund strategies and indices vary. See fund details and index used.

Significant harm exclusion

Aims to avoid companies that do significant harm. This originates from the EU’s sustainable finance ‘DNSH’ (do no significant harm) work, which is not necessarily used by UK investors.

SRI / ESG / Ethical policies explained on website

Find funds that have published explanations of their ethical, social and/or environmental policies online (i.e. fund decision making strategies/ buy/sell &/or asset management strategies).

Different risk options of this strategy are available

See fund information for different risk options of this fund strategy Unscreened Assets & Cash

Assets typically aligned to sustainability objectives 70 - 79%

The percentage of assets held within the fund that match the fund’s sustainability objectives and are not being held purely for risk management purposes, such as derivatives and cash equivalent assets.

Assets typically aligned to sustainability objectives 80 – 89%

The percentage of assets held within the fund that match the fund’s sustainability objectives and are not being held purely for risk management purposes, such as derivatives and cash equivalent assets.

Assets typically aligned to sustainability objectives > 90%

The percentage of assets held within the fund that match the fund’s sustainability objectives and are not being held purely for risk management purposes, such as derivatives and cash equivalent assets Intended Clients & Product Options

Intended for investors interested in sustainability

Finds funds designed to meet the needs of individual investors with an interest in sustainability issues. Labels & Accreditations

SFDR Article 8 fund / product (EU)

Finds funds classified under Article 8 of the EU’s SFDR (Sustainable Finance Disclosure Requirements). Article 8 of the SFDR is a set of requirements that apply to financial products that 'promote' environmental or social characteristics with high governance also. These rules do not currently apply to UK funds so many managers may leave this field blank. Fund Management Company InformationAbout The Business

Responsible ownership / stewardship policy or strategy (AFM company wide)

Finds fund management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

ESG / SRI engagement (AFM company wide)

Find fund management companies that actively encourage higher 'environmental, social and governance' and/or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Vote all* shares at AGMs / EGMs (AFM company wide)

Find fund managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Responsible ownership / ESG a key differentiator (AFM company wide)

Find fund managers that consider responsible ownership and ESG to be a key differentiator for their business.

Sustainable property strategy (AFM company wide)

Find fund management companies that take sustainability criteria into account when selecting and/or managing all of their property / real estate investments.

Senior management KPIs include environmental goals (AFM company wide)

The leadership team of this asset manager have performance targets linked to environmental goals.

Responsible ownership policy for non SRI funds (AFM company wide)

Find funds run by fund managers that apply Responsible ownership or 'Stewardship' policies to all or most of their investment assets. This means active involvement (e.g. voting, dialogue) with the companies they invest in across funds (not normally limited to ethical or SRI options.) Read fund literature for further information.

Integrates ESG factors into all / most (AFM) fund research

Find fund management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management.

In-house diversity improvement programme (AFM company wide)

Finds organisations / fund managers that have an in-house (company wide) diversity improvement programme - meaning that they are working to ensure that within their own businesses they employ people from diverse backgrounds - often typically focused on ethnicity and/or sex.

Diversity, equality & inclusion engagement policy (AFM company wide)

Find fund management companies that encourage the companies they invest in to have strong diversity, race, gender and other equality policies across all assets held, not simply screened or themed SRI/ESG funds. (ie Asset Management company wide).

Invests in newly listed companies (AFM company wide)

This asset management company invests in companies which have recently listed on a stock exchange (which is important as it can help grow new businesses).

Invests in new sustainability linked bond issuances (AFM company wide)

Asset management company has investments in bonds designed to meet sustainability requirements - however these assets may not be 'ringfenced' for this purpose. See fund manager website for details. Collaborations & Affiliations

PRI signatory

Find fund management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

TNFD forum member (AFM company wide)

A member of the Taskforce for Nature Related Financial Disclosures group which aims to aid risk management and shift money towards nature-positive outcomes.

Investment Association (IA) member

Fund management entity is a member of the Investment Association https://www.theia.org/ Resources

In-house responsible ownership / voting expertise

Find fund management companies that employ people to steer and support fund managers in voting shares at company AGM's and EGMs in ways that are consistent with encouraging higher ESG/sustainability standards.

Employ specialist ESG / SRI / sustainability researchers

Find a fund management company that directly employs specialist ESG/SRI/sustainability researchers or analysts. This allows asset managers to discuss environmental, social and governance risks and opportunities directly with companies.

Use specialist ESG / SRI / sustainability research companies

Find fund management companies that makes use of expert external research companies. This can help deliver specialist expertise and means resources are pooled with other investors.

ESG specialists on all investment desks (AFM company wide)

Finds organisations / fund managers that have one or more ESG/sustainability experts on all investment teams or 'desks' (all asset types) Accreditations

UK Stewardship Code signatory (AFM company wide)

Find fund managers that are signatories to the FRC UK Stewardship Code, which sets out a framework for constructive investor / investee relations where fund managers are encouraged to behave like responsible, typically longer term 'company owners'. Engagement Approach

Regularly lead collaborative ESG initiatives (AFM company wide)

Find fund management companies that regularly initiate or run industry wide (collaborative) investor projects aimed at raising environmental, social and governance standards amongst investee companies.

Engaging on climate change issues

Fund manager has stewardship /responsible ownership strategy that is focused on addressing climate change with investee assets.

Engaging with fossil fuel companies on climate change

Asset manager has a stewardship /responsible ownership strategy that involves working with fossil fuel companies on climate change related issues. See fund manager website for details.

Engaging to reduce plastics pollution / waste

Asset manager has stewardship /responsible ownership strategy with involves encouraging investee asset to reduce plastic waste and pollution.

Engaging to encourage responsible mining practices

Asset manager has a stewardship / responsible ownership policy that means they are working to encourage more responsible mining practices - where environmental and social issues are properly dealt with by the companies they invest in.

Engaging on biodiversity / nature issues

The asset manager has a responsible ownership / stewardship strategy that focuses on biodiversity and nature issues relating to the assets they invest the aim of which will be to reduce harm and or deliver improvement. Strategies vary. https://tnfd.global

Engaging to encourage a Just Transition

Asset manager has a responsible ownership / stewardship strategy which means they are working to encourage the shift to more sustainable business practices in ways that respect and are sensitive to social issues and the impact change has on people effected by the changes that are taking place. https://www.transitionpathwayinitiative.org/ https://transitiontaskforce.net/

Engaging on human rights issues

Asset manager has responsible ownership / stewardship strategy in place which aims to address human rights issues in investee companies (and potentially their suppliers) with the aim of raising standards

Engaging on labour / employment issues

Asset manager has responsible ownership / stewardship strategy in place that aims to improve labour standards for the benefit of employees in investee companies (and potentially their suppliers)

Engaging on diversity, equality and / or inclusion issues

Asset management company has a stewardship strategy in place which involves working to raise diversity, equality and inclusion standards across investee assets

Engaging to stop modern slavery

working with the assets they hold to help stamp out modern slavery - where direct or indirect company employees are exploited for business benefits.

Engaging on governance issues

Fund managers have stewardship strategies in place that focus on improving governance standards across investee assets

Stewardship escalation policy

Escalation policies describe how a manager will proceed if stewardship / engagement activity is not successful in the short term. Company Wide Exclusions

Controversial weapons avoidance policy (AFM company wide)

Find fund management companies (not funds) that avoid investment in 'controversial weapons' across all of their funds and other investment vehicles.

Review(ing) carbon / fossil fuel exposure for all funds (AFM company wide)

Find funds / fund managers that are reviewing, or have reviewed, their exposure to carbon intensive industries including (but not only) mining, oil and gas companies. (Typically with reference to climate change.)

Coal exclusion policy (group wide coal mining exclusion policy)

This asset manager excludes direct investment in the coal mining industry. Managers ability to do this may depend on the geographic regions in which they invest. Climate & Net Zero Transition

Net Zero commitment (AFM company wide)

Fund management organisations that have pledged to reduce their greenhouse gas emissions to ‘net zero’. Strategies vary - this area is changing rapidly.

Net Zero - have set a Net Zero target date (AFM company wide)

This asset management company has set a date by which they plan to achieve net zero greenhouse gas / CO2e emissions.

Encourage carbon / greenhouse gas reduction (AFM company wide)

Find fund management companies that are working with the companies they invest in to encourage reductions in carbon dioxide and other greenhouse gas emissions.

Carbon transition plan published (AFM company wide)

Finds organisations / fund managers that have a company wide carbon transition plan - meaning that they have plotted a path to how they will move away from activities that produce or use carbon based energy sources (that emit greenhouse gases) towards clean, alternative, renewable energy sources.

Carbon offsetting – do NOT offset carbon as part of net zero plan (AFM company wide)

This asset management company plans to achieve net zero greenhouse gas (CO2e) emissions by reducing their emissions. Calculations and scope vary.

In-house carbon / GHG reduction policy (AFM company wide)

Find fund management companies that are working to reduce their own (fund management company) carbon/greenhouse gas emissions.

Working towards a ‘Net Zero’ commitment (AFM company wide)

Finds organisations / fund management companies that are in the process of working out how to make a ‘net zero commitment’ - meaning that when that is finalised they will have started the process of reducing their total greenhouse gas emissions to'zero'.

Committed to SBTi / Science Based Targets Initiative

See https://sciencebasedtargets.org/ Transparency

Publish responsible ownership / stewardship report (AFM company wide)

Find fund management companies that publish a report detailing their responsible investment ownership - also known as 'Stewardship' - activity.

Full SRI / responsible ownership policy information on company website

Find companies that publish information about their sustainable and responsible investment strategies on their company website.

Full SRI / responsible ownership policy information available on request

Find fund management companies that will supply information about their sustainable and responsible investment activity on request.

Publish full voting record (AFM company wide)

Fund management companies that publish a full record of how they vote their shares at AGMs (annual general meetings) and EGMs (extraordinary general meetings). Voting strategies have an important role to play encouraging higher environmental, social and governance standards.

Net Zero transition plan publicly available (AFM company wide)

This asset management company has published a plan that explains how they are going to achieve net zero greenhouse gas / CO2e emissions.

Dialshifter statement

Find fund management companies that have supplied Dialshifter information. See Dialshifter tab within record for more information. Sustainable, Responsible &/or ESG Policy:The L&G GBP Corporate Bond Screened UCITS ETF (the "ETF") aims to track the performance of the J.P. Morgan GCI ESG Investment Grade GBP Custom Maturity Index (the “Index”). The Fund promotes a range of environmental and social characteristics which are met by tracking the Index. The Index tracks Sterling-denominated investment grade corporate bonds across developed and emerging market issuers. The index applies an ESG scoring and screening methodology to tilt toward issuers ranked higher on ESG criteria and green bond issues, and to underweight and exclude issuers that rank lower. The Fund follows the following sustainability-related investment strategy by tracking the Index that applies: J.P. Morgan ESG Exclusions: The Index

J.P. Morgan ESG Score: The Index positively tilts towards issuers ranked higher on ESG criteria and underweights lower ranking issuers. The Index applies JESG issuer scores to adjust the market value of index constituents from the baseline index. JESG issuer scores are a 0-100 percentile rank calculated based on normalized raw ESG scores from third-party research providers, including Sustainalytics and RepRisk. An issuer’s finalized JESG score incorporates a 3-month rolling average. Quasi-Sovereign issuers with no coverage from either third-party research provider default to their sovereign JESG score. The JESG scores are divided into five bands that are used to scale each issue’s baseline index market value, with the band rebalance occurring on a quarterly basis. JESG Score Bands Scalar

Issuers in Band 5 will be excluded from the index and will not be eligible for twelve months. If an instrument is categorized as a “green bond” by the Climate Bonds Initiative, the security will receive a one-band upgrade. Green bonds upgrades may happen intra quarter. Green bonds by issuers already in Band 1 will not receive any further upgrades. Additionally, the Index incorporates positive screening techniques whereby ‘green’ bonds (bonds which are created to fund projects that have positive environmental and/ or climate benefits) of the same issuer are prioritised by the Index. Further information on the index methodology can be found at: https://www.jpmorgan.com/insights/research/index-research/composition-docs Additionally, the Fund considers principal adverse impacts on sustainability factors and LGIM has identified a subset of the adverse sustainability indicators that are relevant to the Fund’s investments. The Fund considers principal adverse impacts, identified using the below listed sustainability indicators, through the implementation of the Fund’s ESG investment strategy.

Process:L&G has developed a proprietary research tool called Active ESG View which brings together granular quantitative and qualitative ESG inputs. Active ESG View primarily uses third-party data from multiple different vendors which includes hundreds of ESG metrics (including data on carbon emissions, water and waste, environmental policies and controls, labour, health and safety, bribery and corruption) spanning 64 specific sectors and/or sub-sectors from a number of ESG data providers. The quantitative inputs consist of two components:

L&G sets minimum thresholds for both of these components in Active ESG View. These are then supplemented by LGIM’s qualitative assessment of the sustainability risks and opportunities relating to the relevant issuer. This qualitative assessment is performed by the Global Research and Engagement Groups (“GREGs”) which bring together representatives from LGIM’s investment and investment stewardship teams across regions and asset classes. Where issuers fail to meet either of the components of the quantitative assessment, and the GREGs have reviewed and agreed with the assessment through qualitative analysis, L&G will seek to limit the Fund’s aggregate exposure to such issuers relative to their weights in the Benchmark Index. The sustainability indicator that will be used in relation to the attainment of the environmental and social characteristics relating to this process will measure the aggregate overweight exposure to issuers that are not aligned with L&G’s requirements for ESG factor evaluation compared to such issuers' weight in the Benchmark Index. Resources, Affiliations & Corporate Strategies:As of December 2024, there are c.100 L&G - Asset Management (L&G) employees with roles dedicated to ESG, some of which are outlined in more detail below. Responsible Investment and Investment Stewardship team

Climate Solutions team

ESG Distribution

Real Assets

Product Development and Strategy

Global Research and Engagement Group (GREGs) Further to those with roles dedicated to ESG, our Global Research and Engagement Groups (GREGs) bring together representatives from the Investment and Investment Stewardship teams across regions and asset classes. The GREGs enable L&G to connect top-down macro and thematic views with bottom-up analysis of corporate and sector fundamentals to understand the materiality of sustainability risks and opportunities and prioritise them accordingly. Combining the capabilities of the Investment and Investment Stewardship teams also enables L&G to scale and coordinate our engagement efforts with companies at board and executive management levels, across all asset class and investment styles. C.40 research analysts contribute to our GREGs, researching into structural industry changes and risks, and identifying key themes and engagement topics across nine sectors. Please see L&G Attachment 1 - ESG Memberships and Collaboration for details on list of related affiliations and memberships. Please find the team organisation chart below.

See also: L&G ESG Memberships & Collaborations.docx

Dialshifter (Corporate)Our organisation is helping to support the Paris Climate Agreement and the Race to Net Zero by… At L&G’s Asset Management division, we take our role in addressing climate change very seriously. We have a duty of looking to mitigate long-term risks and seize emerging opportunities and are a company that is acting today in our clients’ long-term interests. As a founding signatory to the Net Zero Asset Manager Initiative (NZAMI), we have committed to support the goal of net zero greenhouse gas (GHG) emissions by 2050, in line with global efforts to limit warming to 1.5°C. We have committed to work in partnership with our clients to reach net-zero GHG emissions by 2050 or sooner across all assets under management (AUM). SDR Labelling:Not eligible to use label LiteratureFund HoldingsVoting RecordDisclaimerThis communication is not a financial promotion and is intended for Professional Clients, Qualified Investors, companies and pension trustees and should not be relied upon by retail customers, pension scheme members, employees, or any other persons. This document has been prepared by Legal & General Investment Management Limited and/or its affiliates ('L&G', ‘we’ or ‘us’). The information in this document is the property and/or confidential information of L&G and may not be reproduced in whole or in part or distributed or disclosed by you to any other person without the prior written consent of L&G. Not for distribution to any person resident in any jurisdiction where such distribution would be contrary to local law or regulation. No party shall have any right of action against L&G in relation to the accuracy or completeness of the information in this document. The information and views expressed in this document are believed to be accurate and complete as at the date of publication, but they should not be relied upon and may be subject to change without notice. We are under no obligation to update or amend the information in this document. Where this document contains third party data, we cannot guarantee the accuracy, completeness or reliability of such data and we accept no responsibility or liability whatsoever in respect of such data. No part of this document should be construed as providing investment advice, and L&G does not accept any liability for any decisions based on this document. Legal and General Assurance (Pensions Management) Limited. Registered in England and Wales No. 01006112. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, No. 202202. LGIM Real Assets (Operator) Limited. Registered in England and Wales, No. 05522016. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No. 447041. Please note that while LGIM Real Assets (Operator) Limited is regulated by the Financial Conduct Authority, it may conduct certain activities that are unregulated. Legal & General (Unit Trust Managers) Limited. Registered in England and Wales No. 01009418. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No. 119273. Issued by Legal & General Investment Management Ltd in the UK. Registered in England and Wales No. 02091894. Registered office: One Coleman Street, London EC2R 5AA. Authorised and regulated by the Financial Conduct Authority. |

||||||||