OMR Schroder Sustainable Future Multi-Asset Pn

SRI Style:

Sustainability Tilt

SDR Labelling:

-

Product:

Pension

Fund Region:

Global

Fund Asset Type:

Multi Asset

Launch Date:

01/11/2019

Last Amended:

Aug 2025

Dialshifter ( ):

):

Fund Size:

£0.13m

(as at: 30/09/2021)

ISIN:

GB00BF95SD99, GB00BF95SC82

Objectives:

The fund aims to provide capital growth and income of the ICE BofA Sterling 3- Month Government Bill Index plus 3.5% per annum (before fees have been deducted*) over a five to seven year period by investing in a diversified range of assets and markets worldwide which the investment manager deems to be: (1) low carbon investments – companies or countries that are operating at a greenhouse gas (GHG) intensity below the level required to meet net zero GHG emissions by 2050 (net zero), based on their most recently reported or estimated emissions. This portion of the fund is aligned with the “Sustainability Focus” label requirements; or (2) decarbonising investments – companies or countries that have the potential to reduce their GHG intensity below the level required to meet net zero, based on the targets those issuers have publicly committed to and/or evidence of previous emissions reductions. This portion of the fund is aligned with the “Sustainability Improvers” label requirements. The fund aims to achieve this with a target average annual volatility (a measure of how much the fund's returns may vary over a year) over a five to seven year period of between 50% to 67% of that of global stock markets (represented by the MSCI All Country World GBP hedged index). This financial return cannot be guaranteed and could change according to prevailing market conditions. Your capital is at risk. *For the target return after fees for each unit class please visit the Schroders website https://www.schroders.com/en/uk/private-investor/investing-with- us/historical-ongoing-charges/

Sustainable, Responsible

&/or ESG Overview:

The fund aims to provide capital growth and income of the ICE BofA Sterling 3-Month Government Bill Index plus 3.5% per annum (before fees have been deducted*) over a five to seven year period by investing in a diversified range of assets and markets worldwide which the Investment Manager deems to be:

- low carbon investments – companies or countries that are operating at a greenhouse gas (GHG) intensity below the level required to meet net zero GHG emissions by 2050 (net zero), based on their most recently reported or estimated emissions. This portion of the Fund is aligned with the “Sustainability Focus” label requirements.

or - decarbonising investments – companies or countries that have the potential to reduce their GHG intensity below the level required to meet net zero, based on the targets those issuers have publicly committed to and/or evidence of previous emissions reductions. This portion of the fund is aligned with the “Sustainability Improvers” label requirements.

Primary fund last amended:

Aug 2025

Information directly from fund manager.

Fund Filters

Sustainability - General

Funds that have policies that consider (environmental and social) sustainability issues. Strategies vary but are likely to consider environmental issues like climate change, carbon emissions, biodiversity loss, resource management, environmental impacts; and social issues like equal opportunities, human rights, labour standards, diversity and adherence to internationally recognised codes. See fund information.

Find funds which substantially focus on sustainability issues

A core element of these funds aim to encourage higher sustainability standards across business practices through responsible ownership / stewardship / engagement / voting activity

Find funds that publicly report their performance against specifically named sustainability objectives (in addition to reporting their financial performance)

Environmental - General

Funds that have policies which relate to environmental issues. These will typically set out the fund's stance on issues such as pollution, climate change, resource management, biodiversity loss, carbon emissions, plastics and/or additional environmental impacts. Strategies vary. See fund information for further information.

Climate Change & Energy

Funds that have policies (documented strategies that explain their position on) climate change related issues such as greenhouse gas/carbon emissions, net zero, transitioning to lower carbon. Strategies vary. Read fund details for further information.

Funds that avoid investing in major coal, oil and/or gas (extraction) companies. Funds vary: some may exclude all companies that extract oil. Others may have exposure to oil extraction via more diversified energy companies. See fund literature to confirm details.

Funds that avoid investing in companies with coal, oil and gas reserves. See fund information for further details.

A core element of these funds will aim to encourage the transition to lower carbon activities through responsible ownership / stewardship / engagement / voting activity

Will only invest in companies that report greenhouse gas emissions reduction strategies in line with the framework set out the by the Taskforce for Climate Related Financial Disclosure, which is increasingly becoming mandatory. See https://www.fsb-tcfd.org/ https ://www.ifrs.org/sustainability/tcfd/

Ethical Values Led Exclusions

Find funds that exclude companies which make controversial weapons such as landmines, cluster munitions and chemical weapons. See fund literature for further information.

Gilts & Sovereigns

Find funds that invest in loans issued the government, commonly known as gilts or government bonds. These may or may not be ringfenced for specific projects (see additional options). See fund literature for any selection criteria.

Governance & Management

Find funds that aim to avoid investing in companies with poor governance practices.(e.g. board structure, management practices etc.) Views may however vary on what counts as 'poor' practices - and funds may not immediately divest as they may prefer to work to encourage higher standards. See fund literature for further information.

Fund managers encourage the companies they invest in to have more diverse board structures (e.g. more women on boards)

A core element of these funds will aim to encourage higher ESG standards through responsible ownership / stewardship / engagement /voting activity

Fund Governance

Find funds that factor in 'environmental, social and governance' issues as part of their investment decision making process. A focus on 'ESG' typically means a fund is carrying out additional research to help reduce ESG related risks. It does not necessarily mean a focus on sustainability. Strategies vary. See fund literature.

Environmental, social and governance issues are part of this fund’s reporting of their ‘value’ to clients. AoV reporting is a statutory requirement. Including ESG factors in its calculation is not.

Asset Size

Find a fund that invests in a combination of small, medium and larger (potentially multinational)companies.

Targeted Positive Investments

Find funds that invest >25% of their capital towards companies where a major part of their business is focused on helping to address environmental or social challenges.

Find funds that invest >50% of their capital in companies where a major part of their business is focused on helping to address environmental or social challenges.

Impact Methodologies

Funds that aim to help or support the delivery of positive social or environmental impacts (or societal/real world outcomes) by investing in companies they regard as beneficial to people and / or the planet. Strategies vary. See fund literature for further information.

Funds that aim to measure the positive real world environmental and / or social benefits that are associated with their investment strategy. Funds that aim to deliver positive impacts and measure those impacts may be referred to as 'impact funds' - although impact measurement is not restricted to impact funds. Strategies vary. See fund information.

Fund aims to deliver positive environmental and or social impacts (real world benefits) through its engagement with investee assets

How The Fund Works

Find funds that focus on finding and investing in companies with positive / beneficial attributes. This strategy can be applied in addition to exclusion criteria and engagement/stewardship activity.

Find funds where their main 'ethical approach' is to avoid companies by using negative screening criteria. Read fund literature for further information.

Aims to avoid companies that do significant harm. This originates from the EU’s sustainable finance ‘DNSH’ (do no significant harm) work, which is not necessarily used by UK investors.

Find funds that make significant use of internationally agreed 'norms' (e.g. United Nations Global Compact - UNGC - or the UN Sustainable Development Goals - SDGs) as part of their investment selection process alongside additional SRI criteria such as positive or negative stock selection policies and/or stewardship strategies.

Fund invests in assets that have not passed its usual sustainability criteria or screening standards in order to help manage investment risk. This may be limited or significant. See literature.

This fund has changed its mandate. It was previously not an ESG/sustainable fund. The information published here shows the upgraded fund strategy.

This fund does not use stock lending for performance or risk purposes.

Unscreened Assets & Cash

The percentage of assets held within the fund that match the fund’s sustainability objectives and are not being held purely for risk management purposes, such as derivatives and cash equivalent assets.

Intended Clients & Product Options

Finds funds designed to meet the needs of individual investors with an interest in sustainability issues.

Fund Management Company Information

About The Business

Find fund management companies (or subsidiaries) that specialise in - or focus entirely on - investing in assets that are helping to deliver positive environmental and / or social impacts.

Finds fund management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

Find fund management companies that actively encourage higher 'environmental, social and governance' and/or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Find fund managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Find fund managers that consider responsible ownership and ESG to be a key differentiator for their business.

Find fund management companies that take sustainability criteria into account when selecting and/or managing all of their property / real estate investments.

The leadership team of this asset manager have performance targets linked to environmental goals.

Find fund management companies that aim to align all their investments (across all funds) to help meet the aims of the UN Sustainable Development Goals.

Find funds run by fund managers that apply Responsible ownership or 'Stewardship' policies to all or most of their investment assets. This means active involvement (e.g. voting, dialogue) with the companies they invest in across funds (not normally limited to ethical or SRI options.) Read fund literature for further information.

Find fund management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management.

Finds organisations / fund managers that have an in-house (company wide) diversity improvement programme - meaning that they are working to ensure that within their own businesses they employ people from diverse backgrounds - often typically focused on ethnicity and/or sex.

Find fund management companies that encourage the companies they invest in to have strong diversity, race, gender and other equality policies across all assets held, not simply screened or themed SRI/ESG funds. (ie Asset Management company wide).

This asset management company invests in companies which have recently listed on a stock exchange (which is important as it can help grow new businesses).

Asset management company has investments in bonds designed to meet sustainability requirements - however these assets may not be 'ringfenced' for this purpose. See fund manager website for details.

Fund management entity offers unstructured intermediary training on sustainable investment (ie for financial advisers and wealth managers)

Fund management entity offers unstructured intermediary training on sustainable investment (ie for financial advisers and wealth managers)

Collaborations & Affiliations

Find fund management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

This asset manager has signed up to the UNEP (United Nations Environment Program) program which aims to encourage more responsible banking practices – focused on environmental and social issues.

Fund management entity is a member of the Investment Association https://www.theia.org/

Resources

Find fund management companies that employ people to steer and support fund managers in voting shares at company AGM's and EGMs in ways that are consistent with encouraging higher ESG/sustainability standards.

Find a fund management company that directly employs specialist ESG/SRI/sustainability researchers or analysts. This allows asset managers to discuss environmental, social and governance risks and opportunities directly with companies.

Find fund management companies that makes use of expert external research companies. This can help deliver specialist expertise and means resources are pooled with other investors.

Finds organisations / fund managers that have one or more ESG/sustainability experts on all investment teams or 'desks' (all asset types)

Accreditations

Finds organisations / fund managers that have an A+ PRI rating - meaning they are highly rated according to the 'Principles of Responsible Investment'

Find fund managers that are signatories to the FRC UK Stewardship Code, which sets out a framework for constructive investor / investee relations where fund managers are encouraged to behave like responsible, typically longer term 'company owners'.

Engagement Approach

Find fund management companies that regularly initiate or run industry wide (collaborative) investor projects aimed at raising environmental, social and governance standards amongst investee companies.

Find fund management companies that are working with the companies they invest in to encourage more responsible corporate taxation.

Fund manager has stewardship /responsible ownership strategy that is focused on addressing climate change with investee assets.

Asset manager has a stewardship /responsible ownership strategy that involves working with fossil fuel companies on climate change related issues. See fund manager website for details.

Asset manager has stewardship /responsible ownership strategy with involves encouraging investee asset to reduce plastic waste and pollution.

Asset manager has a stewardship / responsible ownership policy that means they are working to encourage more responsible mining practices - where environmental and social issues are properly dealt with by the companies they invest in.

The asset manager has a responsible ownership / stewardship strategy that focuses on biodiversity and nature issues relating to the assets they invest the aim of which will be to reduce harm and or deliver improvement. Strategies vary. https://tnfd.global

Asset manager has a responsible ownership / stewardship strategy which means they are working to encourage the shift to more sustainable business practices in ways that respect and are sensitive to social issues and the impact change has on people effected by the changes that are taking place. https://www.transitionpathwayinitiative.org/ https://transitiontaskforce.net/

Asset manager has responsible ownership / stewardship strategy in place which aims to address human rights issues in investee companies (and potentially their suppliers) with the aim of raising standards

Asset manager has responsible ownership / stewardship strategy in place that aims to improve labour standards for the benefit of employees in investee companies (and potentially their suppliers)

Asset management company has a stewardship strategy in place which involves working to raise diversity, equality and inclusion standards across investee assets

Fund managers have stewardship strategies in place that focus on improving governance standards across investee assets

Asset manager has stewardship strategy in place which involves discussing mental health issues with investee companies - with the aim of raising standards

Has a stewardship / responsible ownership strategy that encourages responsible supply chain - ie the managers will discuss environmental, social and governance issues with investee companies with the aim of raising standards

Escalation policies describe how a manager will proceed if stewardship / engagement activity is not successful in the short term.

Company Wide Exclusions

Find fund management companies (not funds) that avoid investment in 'controversial weapons' across all of their funds and other investment vehicles.

Find funds / fund managers that are reviewing, or have reviewed, their exposure to carbon intensive industries including (but not only) mining, oil and gas companies. (Typically with reference to climate change.)

Climate & Net Zero Transition

Fund management organisations that have pledged to reduce their greenhouse gas emissions to ‘net zero’. Strategies vary - this area is changing rapidly.

Fund manager AGM / EGM voting strategy has processes in place that mean they will normally be expected to vote in a way that will encourage the transition to net zero greenhouse gas emissions.

Find fund management companies that have published a Climate Risk policy or statement that is signed / owned by their Chief Executive.

This asset management company has set a date by which they plan to achieve net zero greenhouse gas / CO2e emissions.

Find fund management companies that are working with the companies they invest in to encourage reductions in carbon dioxide and other greenhouse gas emissions.

Finds organisations / fund managers that have a company wide carbon transition plan - meaning that they have plotted a path to how they will move away from activities that produce or use carbon based energy sources (that emit greenhouse gases) towards clean, alternative, renewable energy sources.

Finds organisations / fund managers that have published ‘forward looking climate metrics’ e.g. 'implied temperature rise' data that are a total of the asset management company's share (% owned) of all the investee company emissions of the assets they manage, as well as their own direct and other indirect emissions.

Find fund management companies that are working to reduce their own (fund management company) carbon/greenhouse gas emissions.

Finds organisations / fund management companies that are in the process of working out how to make a ‘net zero commitment’ - meaning that when that is finalised they will have started the process of reducing their total greenhouse gas emissions to'zero'.

See https://sciencebasedtargets.org/

Transparency

Find fund management companies that publish a report detailing their responsible investment ownership - also known as 'Stewardship' - activity.

Find companies that publish information about their sustainable and responsible investment strategies on their company website.

Fund management companies that publish a full record of how they vote their shares at AGMs (annual general meetings) and EGMs (extraordinary general meetings). Voting strategies have an important role to play encouraging higher environmental, social and governance standards.

This asset management company has published a plan that explains how they are to become a sustainable business - without significant negative environmental or social impacts.

This asset management company has published a plan that explains how they will align to the climate change commitments made at the Paris Climate Talks, COP21.

This asset management company has published a plan that explains how they are going to achieve net zero greenhouse gas / CO2e emissions.

Find fund management companies that have supplied Dialshifter information. See Dialshifter tab within record for more information.

Sustainable, Responsible &/or ESG Policy:

The fund invests at least 70% of its portfolio in assets which the Investment Manager deems to be either:

1) Low carbon investments – these are companies or countries which are operating at a GHG intensity below the level required to meet net zero GHG emissions by 2050, in line with the EU Technical Expert Group (TEG) on Sustainable Finance’s recommendation2 that the global economy should decrease emissions by 7% per year (which equates to approximately a 90% reduction from 2020 levels to 2050).

Companies whose GHG intensity is 90% lower than the average intensity of their industry group in 2020 are therefore classified as low carbon. Countries are classified as low carbon if their GHG intensity is 90% below 2020 levels. GHG intensity is calculated using scope 1 and 2 emissions divided by a company’s sales (tonnes of carbon equivalent per $1 million of sales), or a country’s nominal gross domestic product (tonnes of carbon equivalent per $1 million of nominal GDP). The calculation is based on the most recent reported data available (or where an issuer has not reported emissions data, estimated data may be used).

2) Decarbonising investments – these are companies or countries that have the potential to achieve a GHG intensity below the level required to meet net zero, based on the targets those companies or governments have publicly committed to or evidence of previous emission reductions. A company can demonstrate this potential by meeting at least one of the following criteria: – The company has set targets to reduce scope 1 and 2 emissions in the mid-term (5-15 years) or long-term (>15 years), which translate to a company temperature alignment score of less than 2.5°C based on an industry standard methodology (the CDP-WWF Temperature Scoring Methodology). – The company has publicly committed to develop science-based emissions reduction targets and submit these to the Science Based Targets Initiative (SBTi) for validation within two years of their commitment. – The company has a downwards trend in scope 1 and 2 emissions intensity over the past six years. – The company’s trend in scope 1 and 2 emissions intensity over the past six years is lower (i.e. it is decarbonising faster) than its respective industry group average trend over the same period. – The company’s scope 1 and 2 emissions intensity, based on the most recently reported or estimated emissions, is below the level required for its relevant industry group to be in line with a 2°C pathway. A country can demonstrate this potential if its government has publicly committed to mid-term (5-15 years) or longterm (>15 years) emissions reduction targets that are in line with achieving net zero, based on those countries having established “net zero” or equivalent national emissions reduction targets in the public Net Zero Tracker database, or similar other sources. Absolute emissions measure the total amount of emissions of the issuer, while emissions intensity measures emissions relative to an issuer's revenue. Scope 1 and 2 emissions come from an issuer's direct activities and indirect energy consumption.

1 With effect from 1 April, Schroder Dynamic Multi Asset Fund changed its name to Schroder Sustainable Future Multi-Asset Fund and changed its investment objective and policy.

Please note that the assessments above do not include scope 3 emissions, which means that indirect emissions from an issuer’s value chain are not taken into account.

By investing in companies and countries that are operating at a greenhouse gas (GHG) intensity below the level required to meet net zero (or those that have the potential to achieve this over time), the Fund aims to helps them continue to contribute to the positive sustainability outcome of reducing GHG emissions and therefore slowing global warming. The fund’s holdings in such investments may also allow the Investment Manager, through engagement, to encourage them to set better emissions reduction targets and to further reduce their GHG emissions in practice.

Process:

Within Multi-Asset Investments, we consider ESG factors when making investment decisions. Our approach to sustainability considers both a top-down view when allocating to asset classes and a bottom-up view when selecting securities. As shown in Figure 1, ESG factors are embedded throughout our investment process, from research and asset allocation, through to portfolio construction and portfolio implementation. From a bottom-up perspective, we delegate security selection to the underlying desks as we allocate to funds across Schroders. Every desk has their own sustainability accreditation document, which is independently reviewed by the ESG Advisory and Integration team. We rely on the fact that the desk is accredited under the Schroders framework to be confident that ESG factors are being integrated into the investment process of the funds that we hold. When allocating to a Schroders fund, the multi-asset investment team may invite the desk to present at the monthly portfolio manager meeting, where they would do a deep dive into their strategies. The teams can also do their own analysis using tools such as Aladdin to look for style, sector or regional biases and have access to proprietary sustainability tools to see if the funds are complimentary to the gap they are looking to fill in portfolios.

Figure 1: Embedding ESG into our multi-asset process

Source: Schroders. Environmental, Social & Governance (ESG) Integration means that certain ESG risks were considered in the evaluation of the investments made in the portfolio in line with clients’ priorities. This is not a sustainable product for the purposes of the FCA rules. Information is provided solely on investor request and may not be used in a promotional context.

Below we have summarised each stage in more detail:

Research: One of the challenges of capitalism has always been the existence of negative externalities which occur when production or consumption impose external costs on third parties outside of the market for which no appropriate compensation is paid. This causes social costs to exceed private costs. There is a renewed sense of urgency on this front because of the very real challenge posed by climate change and because the pandemic accentuated the gap between the “haves” and the “have-nots”. We believe that, as these ESG factors are being increasingly considered by our governments, they are likely to have an impact on the investment environment in which we operate.

From a top-down perspective, the foundation for all Multi-Asset investments is the research carried out by the Strategic Investment Group - Multi-Asset (SIGMA). We have adopted a risk-premia based approach for multi-asset research, investment and risk management. Our research effort is organised into six risk premia groups (equities, term, credit, commodities, currency, and private assets). The aim of the groups is to utilise both quantitative and qualitative approaches to assess opportunities within each risk premium and come up with a medium-term return view for that premium.

When determining their views, the research groups also use a cross-asset framework considering a number of factors, the primary ones being cyclical, valuation and momentum. This framework is the responsibility of the cross-asset research group, which using these factors, provides a suite of clear, consistent models and qualitative considerations to provide insight on the relative attractiveness of asset classes. The risk premia teams consider political, regulatory, social and positioning trends such as globalisation, geopolitical risks and other macroeconomic factors that correlate with environmental, social and governance factors. These could result in negative externalities (impacts on society) being internalised in the performance of companies and markets.

Once a month, the risk premia groups and cross-asset team meet formally to discuss their research at SIGMA and review their asset class scores. While this meeting is scheduled to occur monthly, teams may amend the score of any of their risk premia intra-month if a major event occurs which has a significant impact on them.

Figure 2: Global Research Platform

Source: Schroders. *Strategic Investment Group Multi-Asset. Sectors and securities mentioned are for illustrative purposes only and should not be viewed as a recommendation to buy/sell.

Asset allocation and portfolio construction:

Asset allocation: The Global Asset Allocation Committee (GAAC) is responsible for asset allocations views across multi-asset portfolios. The GAAC meets monthly and is comprised of five senior multi-asset fund managers. Our process is primarily qualitative, with each member of the GAAC responsible for identifying valuation and thematic anomalies over a 3 to 12 month time horizon that can be implemented as active asset allocation positions within portfolios. These trade ideas can be expressed as pair trades, i.e. where we believe one asset will outperform another. The pair trade is, therefore, to buy the preferred asset and to sell the less favoured. In order for any trade idea to be accepted, it must be proposed by one member, seconded by another, have a strong rationale and have profit and stop loss limits. Consequently, each position has two names backing it and, crucially, the performance of each trade forms a part of each proposer’s and seconder’s annual assessment and compensation. Figure 3 illustrates the framework surrounding the GAAC idea generation process.

Figure 3: Global Asset Allocation Committee (GAAC) idea generation process

Source: Schroders, for illustrative purposes only.

Using the output of the investment meetings (SIGMA and GAAC) the fund managers decide the overall asset allocation. Critical to the success of a multi-asset portfolio is a deep understanding of risk and the impact of combining the underlying components. We express our current level of conviction by ranking each asset in order to construct the portfolio. Our starting point is to rank assets from 1 to 4, 1 being our most preferred, 4 our least. We find this process to be a more effective way of expressing conviction than using short term return forecasts. The fund managers use our proprietary portfolio construction system to derive the optimal set of capital weights expected to meet return and risk objectives, while being sufficiently flexible to adapt to different market environments.

Importantly, from an ESG perspective, we use long term asset class return and risk forecasts adjusted for the impact of climate change in our optimisation process. We have a three-step approach adjusting for the physical costs, transition costs and stranded assets. The first step is a focus on what happens to output as temperatures rise, which we will refer to as the ‘physical cost’ of climate change. The second considers the economic impact of steps taken to mitigate those temperature increases, or the ‘transition cost’. This second step is slightly more complicated, in that there are a range of possible transition scenarios. Finally, we adjust for the effects of stranded assets. This is where we take account of the losses incurred where oil and other carbon-based forms of energy have to be written off, as it is no longer possible to make use of them, such that they are left in the ground.

Portfolio Implementation:

In implementing our views, we aim to be as efficient as possible, combining passive and active approaches to achieve a superior access to the underlying risk premia at reasonable fees. We have access to an outstanding range of Schroders funds, plus the ability to include external funds where we deem appropriate.

At this stage, if investing in an internal Schroders fund, we ensure we understand their approach to ESG and how they demonstrate their impact on people and planet. As previously mentioned, every desk has their own sustainability accreditation document, which is independently reviewed by the ESG Advisory and Integration team. We rely on the fact that the desk is accredited under the Schroders framework to be confident that ESG factors are being integrated into the investment process of the funds that we hold. Furthermore, we believe successful investing is intrinsically linked to identifying, understanding and incorporating the effects of ESG trends and for this reason many of our portfolios allocate to sustainable strategies. A few examples are included in section 4.

Where possible, from a strategic core multi-asset portfolio perspective, we prioritise physical investments, allowing us to make meaningful use of the most potent sustainability tools available, which differs by asset class. The three core sustainability levers for change we use are: 1. Active ownership; 2. Use of proceeds and provision of capital; 3. Direct outward impact. Figure 5 outlines each sustainability lever for change.

We believe active ownership through engagement and voting is the most potent sustainability lever for physically invested equities. Active engagement is also a lever used by credit investors, however we believe the use of proceeds and provision of capital is the most powerful sustainability lever for fixed income investing. The third lever - ‘direct outward impact’ - is used by strategies delivering financial returns through investments that contribute to societal or environmental goals or strategies intend to generate a positive & measurable societal or environmental impact, alongside financial returns.

Figure 4: Portfolio implementation - sustainability levers for change

Source: Schroders, for illustrative purposes only.

From a portfolio implementation bottom-up stance, security selection and active ownership play a key role:

Security selection: The Multi-Asset Investment team is integrated with Schroders’ global resources, drawing on the expertise of specialist equity, fixed income and alternative security selection teams. We have access to extensive alpha generation capabilities across our equity fixed income and alternative sustainable investment strategies.

Active ownership: Effective and responsible active ownership has long been part of our fundamental approach to investment at Schroders, and is performed by the underlying security selection and Sustainable Investment teams (not by Multi-Asset). We recognise that companies play a critical role in societies and are heavily exposed to changes in those societies and the natural environment. We believe by engaging with companies and their management we can improve our understanding of the issues they face and their approaches to managing them, helping us to protect or enhance the value of our investments. The overriding principle governing our approach to voting is to act in line with our fiduciary responsibilities. We aim to support the management of the companies we invest in; however, we will oppose management if we believe that it is in the best interests of our clients.

A key part of our multi-asset approach is our engagement with underlying security selection managers to understand and ensure sustainability risk and opportunities are managed. For more information on our approach to active ownership, please refer to question 3.

ESG Measurement: We are able to measure and monitor our multi-asset portfolios using a number of proprietary sustainability tools such as SustainEx™.

Our proprietary tool, SustainEx™, scientifically combines measures of both the harm companies can do and the good they can bring to arrive at an aggregate measure of each firm’s social and environmental impact, allowing investors to target their ESG investments effectively. It quantifies the extent to which companies are in credit or deficit with the societies to which they belong, and the risks they face if the costs they externalise are pushed into companies’ own costs. SustainEx™ helps us to measure the potential exposure to ESG risks at the portfolio level. In addition to SustainEx™, we have several proprietary sustainability tools to assess the investment implications of ESG factors at the top-down asset allocation level and the bottom-up security selection level.

Resources, Affiliations & Corporate Strategies:

Sustainability is fundamental to our investment principles at Schroders and we have an experienced and well-resourced Sustainable Investment team, who are embedded within our Investment function. We are a global team, spread across four regional hubs in London, Paris, Singapore and New York, aiming to ensure that sustainability is embedded through our global investment teams and client functions.

The team is led by Andrew Howard, Global Head of Sustainable Investment. As team head, he oversees our approach to ESG integration, active ownership, our sustainability research and tools, and our reporting and product strategy.

Our central Sustainable Investment team sits alongside investment teams rather than operating in a silo, which facilitates regular dialogue with our analysts and portfolio managers.

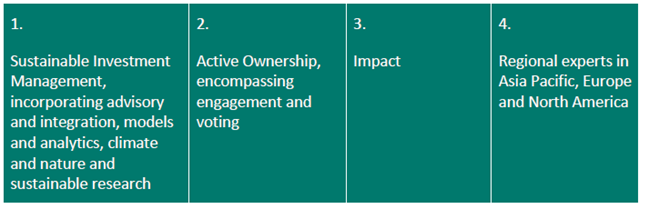

It is organised into four pillars:

We outline their key responsibilities and areas of focus below.

1. Sustainable investment management

Our Advisory and Integration team acts as a central contact point and consultant for a range of stakeholders across the business. This includes advising investment teams on ESG integration best practice; compliance, risk and legal teams on ESG regulation; and working with our regional experts; across Asia Pacific, Europe and North America, as outlined under pillar four.

Our Models and Analytics team is responsible for the maintenance and evolution of our suite of proprietary tools. They are also responsible for ESG data, ensuring we harness sustainability data effectively from both conventional and unconventional sources.

Our Strategy and Research team is responsible for undertaking sustainability research to: inform firmwide strategy and commitments; provide insights for investment teams to analyse sustainability-related risks and opportunities; and provide research-related and technical support for other stakeholders across the firm.

2. Active ownership

Our Engagement team partners with investors to have dialogue with the companies in which we invest, seeking to understand how prepared they are for a changing world and pushing them towards more sustainable practices. The team track the progress of these engagements and hold companies to account.

Our Corporate Governance team is responsible for voting in line with our Voting Policy and Principles.

3. Impact

Our Impact team is responsible for scaling our impact product offering in line with best-practice impact principles. The team works closely with investment desks and is responsible for developing and implementing our impact management and measurement framework, including impact assessment and monitoring at transaction and portfolio level, product development, impact strategy and impact reporting.

4. Regional Expertise

Our Regional Experts based in Asia Pacific, Europe and North America have a deep understanding of local market characteristics and nuances, and are responsible for staying abreast of sustainability-related developments. Our experts work with clients and internal teams to navigate and support clients’ ESG aspirations and challenges, utilising Schroders’ proprietary tools and research to develop investment solutions that meet their needs. They also engage with regulators and industry bodies to shape and support the global sustainable finance agenda. Our regional experts are a critical extension of the central team in London as the firm continues to evolve its global ESG strategy.

We have a number of governance structures in place for decision-making and oversight of our approach to sustainable investment. The Board of Schroders plc (the Board) has collective responsibility for the management, direction and performance of the Group, and is accountable for our overall business strategy. The Group Chief Executive is responsible for proposing the strategy for the Group and for its implementation, supported by the Group’s senior management team and a number of Committees, some of which are noted below.

The Group Sustainability and Impact (GSI) Committee provides advice to the Group Chief Executive on sustainability and impact matters. The Committee considers, reviews and recommends the overall global sustainability and impact strategy, including key initiatives, new commitments and policies for approval. The Global Head of Sustainable Investment and Global Head of Corporate Sustainability are members of the Committee and report to the Board.

The Sustainability Executive Committee (ExCo) develops and oversees the delivery of our Group-level sustainable investment management strategy. The ExCo also advises on the development of our sustainability and impact investment and product frameworks. The ExCo has senior representation from across the business including Investment, Client Group, Wealth Management, Schroders Capital and Corporate Sustainability.

The Group Regulatory Oversight Committee (GROC) oversees the progress of sustainability regulatory change programmes, as well as facilitating the monitoring of emergent sustainability regulations and ensuring we have appropriately determined the impact on our Group sustainability strategy and supporting operations. The GROC receives input on planned or potential sustainability-related regulation from our Public Policy and Compliance teams, which actively engage with relevant regulators, industry trade associations and other bodies in our key markets of the UK and EU. Once the business implications of new legal and regulatory requirements are defined, the relevant sustainability regulations programme workstreams deliver the necessary change to our business operations. The GROC oversees the progress of the programme, including monitoring and mitigating associated risks and issues. Where necessary, risks and key issues from the GROC can be escalated to the Group Risk Committee for resolution.

Certain Schroders entities, businesses and Investment teams also have their own committees which consider their sustainable investment activities. For example, the Private Assets Sustainability and Impact Steering Committee (PA S&I SteerCo) develops and oversees the implementation of the Private Assets Sustainability and Impact strategy. In addition, the Wealth Management Sustainable Investment Committee (WMSIC), a sub-committee of the Wealth Management Investment Committee (WMIC), has delegated responsibility for recommending Wealth Management's Sustainability models, as well as providing investment strategy and direction for client portfolios that are linked to the sustainable models.

Alongside our central Sustainable Investment team, sustainable investing is also overseen and delivered by dedicated teams and expert individuals embedded throughout the firm (including across Investment teams and Client Group functions).

We have a long-standing commitment to support and collaborate with several industry groups, organisations and initiatives to promote well-functioning financial markets.

Our key stakeholders include exchanges, regulators and international and regional trade associations. For example, Schroders is a member of trade bodies such as the Investment Association in the UK, the European Fund and Asset Management Association (EFAMA), the Asia Securities Industry and Financial Markets Association (ASIFMA) in Hong Kong and the Securities Industry and Financial Markets Association (SIFMA) in the US. Through this participation we share our insights to support the development of policy recommendations, share best practice and build coalitions of like-minded market participants to advocate for better functioning markets.

Our activity with policymakers aims to help them ensure that the measures they take support businesses and provide clear direction. By monitoring and influencing regulatory initiatives at their inception, we aim to support the development of a business environment which is conducive to Schroders’ clients’ best interests.

We aim to engage with the regulatory environments in which we are operating and raise awareness on sustainability matters. We believe well-designed regulation is an important cornerstone to promoting healthy markets, and have asked publicly that policy makers support sustainable finance legislation and regulation and deliver on commitments, including around climate mitigation.

We consider this to be key in improving responsible investment standards across sectors, establishing a consistent dialogue with companies, and in promoting the ongoing development and recognition of sustainability and Environmental, Social and Governance (ESG) topics within the investment industry. A full list of organisations and initiatives of which Schroders is a member or signatory is available here (https://www.schroders.com/en/global/individual/corporate-transparency/working-with-policy-makers/memberships/)

Literature

Fund Holdings

Voting Record

Disclaimer

Important Information

This document is addressed to existing client(s) only. Not for further distribution.

This document contains indicative terms for discussion purposes only and is not intended to provide the sole basis for evaluation of the investment solutions described.

Investment involves risk. Reliance should not be placed on any views or information in the material when taking individual investment and/or strategic decisions.

Any reference to regions/ countries/ sectors/ stocks/ securities is for illustrative purposes only and not a recommendation to buy or sell any financial instruments or adopt a specific investment strategy.

The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations.

Past Performance is not a guide to future performance and may not be repeated.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of investments to fall as well as rise.

Schroders has expressed its own views and opinions in this document and these may change.

Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy.

Schroders uses SustainEx™ to estimate the net social and environmental “cost” or “benefit” of an investment portfolio having regard to certain sustainability measures in comparison to a product’s benchmark where relevant. It does this using third party data as well as Schroders own estimates and assumptions and the outcome may differ from other sustainability tools and measures.

The data contained in this document has been sourced by Schroders and should be independently verified. Third party data is owned or licenced by the data provider and may not be reproduced, extracted or used for any other purpose without the data provider’s consent. Neither Schroders, nor the data provider, will have any liability in connection with the third-party data.

Issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 1893220 England. Authorised and regulated by the Financial Conduct Authority.

For your security, communications may be recorded or monitored.

Issued in June 2025. 06348.

| Fund Name | SRI Style | SDR Labelling | Product | Region | Asset Type | Launch Date | Last Amended |

|

|---|---|---|---|---|---|---|---|---|

OMR Schroder Sustainable Future Multi-Asset Pn |

Sustainability Tilt | - | Pension | Global | Multi Asset | 01/11/2019 | Aug 2025 | |

ObjectivesThe fund aims to provide capital growth and income of the ICE BofA Sterling 3- Month Government Bill Index plus 3.5% per annum (before fees have been deducted*) over a five to seven year period by investing in a diversified range of assets and markets worldwide which the investment manager deems to be: (1) low carbon investments – companies or countries that are operating at a greenhouse gas (GHG) intensity below the level required to meet net zero GHG emissions by 2050 (net zero), based on their most recently reported or estimated emissions. This portion of the fund is aligned with the “Sustainability Focus” label requirements; or (2) decarbonising investments – companies or countries that have the potential to reduce their GHG intensity below the level required to meet net zero, based on the targets those issuers have publicly committed to and/or evidence of previous emissions reductions. This portion of the fund is aligned with the “Sustainability Improvers” label requirements. The fund aims to achieve this with a target average annual volatility (a measure of how much the fund's returns may vary over a year) over a five to seven year period of between 50% to 67% of that of global stock markets (represented by the MSCI All Country World GBP hedged index). This financial return cannot be guaranteed and could change according to prevailing market conditions. Your capital is at risk. *For the target return after fees for each unit class please visit the Schroders website https://www.schroders.com/en/uk/private-investor/investing-with- us/historical-ongoing-charges/

|

Fund Size: £0.13m (as at: 30/09/2021) ISIN: GB00BF95SD99, GB00BF95SC82 |

|||||||

Sustainable, Responsible &/or ESG OverviewThis product is linked to the "Schroder Sustainable Future Multi-Asset" fund. The following information refers to the primary fund. The fund aims to provide capital growth and income of the ICE BofA Sterling 3-Month Government Bill Index plus 3.5% per annum (before fees have been deducted*) over a five to seven year period by investing in a diversified range of assets and markets worldwide which the Investment Manager deems to be:

|

||||||||

|

Primary fund last amended: Aug 2025 |

||||||||

|

Information received directly from Fund Manager |

||||||||

|

Please select what you would like to read:

Fund FiltersSustainability - General

Sustainability policy

Funds that have policies that consider (environmental and social) sustainability issues. Strategies vary but are likely to consider environmental issues like climate change, carbon emissions, biodiversity loss, resource management, environmental impacts; and social issues like equal opportunities, human rights, labour standards, diversity and adherence to internationally recognised codes. See fund information.

Sustainability focus

Find funds which substantially focus on sustainability issues

Encourage more sustainable practices through stewardship

A core element of these funds aim to encourage higher sustainability standards across business practices through responsible ownership / stewardship / engagement / voting activity

Report against sustainability objectives

Find funds that publicly report their performance against specifically named sustainability objectives (in addition to reporting their financial performance) Environmental - General

Environmental policy

Funds that have policies which relate to environmental issues. These will typically set out the fund's stance on issues such as pollution, climate change, resource management, biodiversity loss, carbon emissions, plastics and/or additional environmental impacts. Strategies vary. See fund information for further information. Climate Change & Energy

Climate change / greenhouse gas emissions policy

Funds that have policies (documented strategies that explain their position on) climate change related issues such as greenhouse gas/carbon emissions, net zero, transitioning to lower carbon. Strategies vary. Read fund details for further information.

Coal, oil & / or gas majors excluded

Funds that avoid investing in major coal, oil and/or gas (extraction) companies. Funds vary: some may exclude all companies that extract oil. Others may have exposure to oil extraction via more diversified energy companies. See fund literature to confirm details.

Fossil fuel reserves exclusion

Funds that avoid investing in companies with coal, oil and gas reserves. See fund information for further details.

Encourage transition to low carbon through stewardship activity

A core element of these funds will aim to encourage the transition to lower carbon activities through responsible ownership / stewardship / engagement / voting activity

TCFD reporting requirement (Becoming IFRS)

Will only invest in companies that report greenhouse gas emissions reduction strategies in line with the framework set out the by the Taskforce for Climate Related Financial Disclosure, which is increasingly becoming mandatory. See https://www.fsb-tcfd.org/ https ://www.ifrs.org/sustainability/tcfd/ Ethical Values Led Exclusions

Controversial weapons exclusion

Find funds that exclude companies which make controversial weapons such as landmines, cluster munitions and chemical weapons. See fund literature for further information. Gilts & Sovereigns

Invests in gilts / government bonds

Find funds that invest in loans issued the government, commonly known as gilts or government bonds. These may or may not be ringfenced for specific projects (see additional options). See fund literature for any selection criteria. Governance & Management

Avoids companies with poor governance

Find funds that aim to avoid investing in companies with poor governance practices.(e.g. board structure, management practices etc.) Views may however vary on what counts as 'poor' practices - and funds may not immediately divest as they may prefer to work to encourage higher standards. See fund literature for further information.

Encourage board diversity e.g. gender

Fund managers encourage the companies they invest in to have more diverse board structures (e.g. more women on boards)

Encourage higher ESG standards through stewardship activity

A core element of these funds will aim to encourage higher ESG standards through responsible ownership / stewardship / engagement /voting activity Fund Governance

ESG integration strategy

Find funds that factor in 'environmental, social and governance' issues as part of their investment decision making process. A focus on 'ESG' typically means a fund is carrying out additional research to help reduce ESG related risks. It does not necessarily mean a focus on sustainability. Strategies vary. See fund literature.

ESG factors included in Assessment of Value (AoV) report

Environmental, social and governance issues are part of this fund’s reporting of their ‘value’ to clients. AoV reporting is a statutory requirement. Including ESG factors in its calculation is not. Asset Size

Invests in small, mid and large cap companies / assets

Find a fund that invests in a combination of small, medium and larger (potentially multinational)companies. Targeted Positive Investments

Invests >25% of fund in environmental/social solutions companies

Find funds that invest >25% of their capital towards companies where a major part of their business is focused on helping to address environmental or social challenges.

Invests >50% of fund in environmental/social solutions companies

Find funds that invest >50% of their capital in companies where a major part of their business is focused on helping to address environmental or social challenges. Impact Methodologies

Aims to generate positive impacts (or 'outcomes')

Funds that aim to help or support the delivery of positive social or environmental impacts (or societal/real world outcomes) by investing in companies they regard as beneficial to people and / or the planet. Strategies vary. See fund literature for further information.

Measures positive impacts

Funds that aim to measure the positive real world environmental and / or social benefits that are associated with their investment strategy. Funds that aim to deliver positive impacts and measure those impacts may be referred to as 'impact funds' - although impact measurement is not restricted to impact funds. Strategies vary. See fund information.

Aim to deliver positive impacts through engagement

Fund aims to deliver positive environmental and or social impacts (real world benefits) through its engagement with investee assets How The Fund Works

Positive selection bias

Find funds that focus on finding and investing in companies with positive / beneficial attributes. This strategy can be applied in addition to exclusion criteria and engagement/stewardship activity.

Negative selection bias

Find funds where their main 'ethical approach' is to avoid companies by using negative screening criteria. Read fund literature for further information.

Significant harm exclusion

Aims to avoid companies that do significant harm. This originates from the EU’s sustainable finance ‘DNSH’ (do no significant harm) work, which is not necessarily used by UK investors.

Combines norms based exclusions with other SRI criteria

Find funds that make significant use of internationally agreed 'norms' (e.g. United Nations Global Compact - UNGC - or the UN Sustainable Development Goals - SDGs) as part of their investment selection process alongside additional SRI criteria such as positive or negative stock selection policies and/or stewardship strategies.

Fund uses unscreened ‘diversifiers’ to help manage risk

Fund invests in assets that have not passed its usual sustainability criteria or screening standards in order to help manage investment risk. This may be limited or significant. See literature.

Converted from ‘non ESG’ strategy

This fund has changed its mandate. It was previously not an ESG/sustainable fund. The information published here shows the upgraded fund strategy.

Do not use stock / securities lending

This fund does not use stock lending for performance or risk purposes. Unscreened Assets & Cash

Assets typically aligned to sustainability objectives 70 - 79%

The percentage of assets held within the fund that match the fund’s sustainability objectives and are not being held purely for risk management purposes, such as derivatives and cash equivalent assets. Intended Clients & Product Options

Intended for investors interested in sustainability

Finds funds designed to meet the needs of individual investors with an interest in sustainability issues. Fund Management Company InformationAbout The Business

Specialist positive impact fund management company

Find fund management companies (or subsidiaries) that specialise in - or focus entirely on - investing in assets that are helping to deliver positive environmental and / or social impacts.

Responsible ownership / stewardship policy or strategy (AFM company wide)

Finds fund management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

ESG / SRI engagement (AFM company wide)

Find fund management companies that actively encourage higher 'environmental, social and governance' and/or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Vote all* shares at AGMs / EGMs (AFM company wide)

Find fund managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Responsible ownership / ESG a key differentiator (AFM company wide)

Find fund managers that consider responsible ownership and ESG to be a key differentiator for their business.

Sustainable property strategy (AFM company wide)

Find fund management companies that take sustainability criteria into account when selecting and/or managing all of their property / real estate investments.

Senior management KPIs include environmental goals (AFM company wide)

The leadership team of this asset manager have performance targets linked to environmental goals.

SDG aligned aims / objectives (AFM company wide)

Find fund management companies that aim to align all their investments (across all funds) to help meet the aims of the UN Sustainable Development Goals.

Responsible ownership policy for non SRI funds (AFM company wide)

Find funds run by fund managers that apply Responsible ownership or 'Stewardship' policies to all or most of their investment assets. This means active involvement (e.g. voting, dialogue) with the companies they invest in across funds (not normally limited to ethical or SRI options.) Read fund literature for further information.

Integrates ESG factors into all / most (AFM) fund research

Find fund management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management.

In-house diversity improvement programme (AFM company wide)

Finds organisations / fund managers that have an in-house (company wide) diversity improvement programme - meaning that they are working to ensure that within their own businesses they employ people from diverse backgrounds - often typically focused on ethnicity and/or sex.

Diversity, equality & inclusion engagement policy (AFM company wide)

Find fund management companies that encourage the companies they invest in to have strong diversity, race, gender and other equality policies across all assets held, not simply screened or themed SRI/ESG funds. (ie Asset Management company wide).

Invests in newly listed companies (AFM company wide)

This asset management company invests in companies which have recently listed on a stock exchange (which is important as it can help grow new businesses).

Invests in new sustainability linked bond issuances (AFM company wide)

Asset management company has investments in bonds designed to meet sustainability requirements - however these assets may not be 'ringfenced' for this purpose. See fund manager website for details.

Offer structured intermediary training on sustainable investment

Fund management entity offers unstructured intermediary training on sustainable investment (ie for financial advisers and wealth managers)

Offer unstructured intermediary sustainable investment training

Fund management entity offers unstructured intermediary training on sustainable investment (ie for financial advisers and wealth managers) Collaborations & Affiliations

PRI signatory

Find fund management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

UN Principles of Responsible Banking framework signatory-co wide

This asset manager has signed up to the UNEP (United Nations Environment Program) program which aims to encourage more responsible banking practices – focused on environmental and social issues.

Investment Association (IA) member

Fund management entity is a member of the Investment Association https://www.theia.org/ Resources

In-house responsible ownership / voting expertise

Find fund management companies that employ people to steer and support fund managers in voting shares at company AGM's and EGMs in ways that are consistent with encouraging higher ESG/sustainability standards.

Employ specialist ESG / SRI / sustainability researchers

Find a fund management company that directly employs specialist ESG/SRI/sustainability researchers or analysts. This allows asset managers to discuss environmental, social and governance risks and opportunities directly with companies.

Use specialist ESG / SRI / sustainability research companies

Find fund management companies that makes use of expert external research companies. This can help deliver specialist expertise and means resources are pooled with other investors.

ESG specialists on all investment desks (AFM company wide)

Finds organisations / fund managers that have one or more ESG/sustainability experts on all investment teams or 'desks' (all asset types) Accreditations

PRI A+ rated (AFM company wide)

Finds organisations / fund managers that have an A+ PRI rating - meaning they are highly rated according to the 'Principles of Responsible Investment'

UK Stewardship Code signatory (AFM company wide)

Find fund managers that are signatories to the FRC UK Stewardship Code, which sets out a framework for constructive investor / investee relations where fund managers are encouraged to behave like responsible, typically longer term 'company owners'. Engagement Approach

Regularly lead collaborative ESG initiatives (AFM company wide)

Find fund management companies that regularly initiate or run industry wide (collaborative) investor projects aimed at raising environmental, social and governance standards amongst investee companies.

Encourage responsible corporate taxation (AFM company wide)

Find fund management companies that are working with the companies they invest in to encourage more responsible corporate taxation.

Engaging on climate change issues

Fund manager has stewardship /responsible ownership strategy that is focused on addressing climate change with investee assets.

Engaging with fossil fuel companies on climate change

Asset manager has a stewardship /responsible ownership strategy that involves working with fossil fuel companies on climate change related issues. See fund manager website for details.

Engaging to reduce plastics pollution / waste

Asset manager has stewardship /responsible ownership strategy with involves encouraging investee asset to reduce plastic waste and pollution.

Engaging to encourage responsible mining practices

Asset manager has a stewardship / responsible ownership policy that means they are working to encourage more responsible mining practices - where environmental and social issues are properly dealt with by the companies they invest in.

Engaging on biodiversity / nature issues

The asset manager has a responsible ownership / stewardship strategy that focuses on biodiversity and nature issues relating to the assets they invest the aim of which will be to reduce harm and or deliver improvement. Strategies vary. https://tnfd.global

Engaging to encourage a Just Transition

Asset manager has a responsible ownership / stewardship strategy which means they are working to encourage the shift to more sustainable business practices in ways that respect and are sensitive to social issues and the impact change has on people effected by the changes that are taking place. https://www.transitionpathwayinitiative.org/ https://transitiontaskforce.net/

Engaging on human rights issues

Asset manager has responsible ownership / stewardship strategy in place which aims to address human rights issues in investee companies (and potentially their suppliers) with the aim of raising standards

Engaging on labour / employment issues

Asset manager has responsible ownership / stewardship strategy in place that aims to improve labour standards for the benefit of employees in investee companies (and potentially their suppliers)

Engaging on diversity, equality and / or inclusion issues

Asset management company has a stewardship strategy in place which involves working to raise diversity, equality and inclusion standards across investee assets

Engaging on governance issues

Fund managers have stewardship strategies in place that focus on improving governance standards across investee assets

Engaging on mental health issues

Asset manager has stewardship strategy in place which involves discussing mental health issues with investee companies - with the aim of raising standards

Engaging on responsible supply chain issues

Has a stewardship / responsible ownership strategy that encourages responsible supply chain - ie the managers will discuss environmental, social and governance issues with investee companies with the aim of raising standards

Stewardship escalation policy

Escalation policies describe how a manager will proceed if stewardship / engagement activity is not successful in the short term. Company Wide Exclusions

Controversial weapons avoidance policy (AFM company wide)

Find fund management companies (not funds) that avoid investment in 'controversial weapons' across all of their funds and other investment vehicles.

Review(ing) carbon / fossil fuel exposure for all funds (AFM company wide)

Find funds / fund managers that are reviewing, or have reviewed, their exposure to carbon intensive industries including (but not only) mining, oil and gas companies. (Typically with reference to climate change.) Climate & Net Zero Transition

Net Zero commitment (AFM company wide)

Fund management organisations that have pledged to reduce their greenhouse gas emissions to ‘net zero’. Strategies vary - this area is changing rapidly.

Voting policy includes net zero targets (AFM company wide)

Fund manager AGM / EGM voting strategy has processes in place that mean they will normally be expected to vote in a way that will encourage the transition to net zero greenhouse gas emissions.

Publish 'CEO owned' Climate Risk policy (AFM company wide)

Find fund management companies that have published a Climate Risk policy or statement that is signed / owned by their Chief Executive.

Net Zero - have set a Net Zero target date (AFM company wide)

This asset management company has set a date by which they plan to achieve net zero greenhouse gas / CO2e emissions.

Encourage carbon / greenhouse gas reduction (AFM company wide)

Find fund management companies that are working with the companies they invest in to encourage reductions in carbon dioxide and other greenhouse gas emissions.

Carbon transition plan published (AFM company wide)

Finds organisations / fund managers that have a company wide carbon transition plan - meaning that they have plotted a path to how they will move away from activities that produce or use carbon based energy sources (that emit greenhouse gases) towards clean, alternative, renewable energy sources.

‘Forward Looking Climate Metrics’ published / ITR (AFM company wide)

Finds organisations / fund managers that have published ‘forward looking climate metrics’ e.g. 'implied temperature rise' data that are a total of the asset management company's share (% owned) of all the investee company emissions of the assets they manage, as well as their own direct and other indirect emissions.

In-house carbon / GHG reduction policy (AFM company wide)

Find fund management companies that are working to reduce their own (fund management company) carbon/greenhouse gas emissions.

Working towards a ‘Net Zero’ commitment (AFM company wide)

Finds organisations / fund management companies that are in the process of working out how to make a ‘net zero commitment’ - meaning that when that is finalised they will have started the process of reducing their total greenhouse gas emissions to'zero'.

Committed to SBTi / Science Based Targets Initiative

See https://sciencebasedtargets.org/ Transparency

Publish responsible ownership / stewardship report (AFM company wide)

Find fund management companies that publish a report detailing their responsible investment ownership - also known as 'Stewardship' - activity.

Full SRI / responsible ownership policy information on company website

Find companies that publish information about their sustainable and responsible investment strategies on their company website.

Publish full voting record (AFM company wide)

Fund management companies that publish a full record of how they vote their shares at AGMs (annual general meetings) and EGMs (extraordinary general meetings). Voting strategies have an important role to play encouraging higher environmental, social and governance standards.

Sustainability transition plan publicly available (AFM company wide)

This asset management company has published a plan that explains how they are to become a sustainable business - without significant negative environmental or social impacts.

Paris Alignment plan publicly available (AFM company wide)

This asset management company has published a plan that explains how they will align to the climate change commitments made at the Paris Climate Talks, COP21.

Net Zero transition plan publicly available (AFM company wide)

This asset management company has published a plan that explains how they are going to achieve net zero greenhouse gas / CO2e emissions.

Dialshifter statement