Phoenix Wealth Schroder European Climate Transition Pn

SRI Style:

Sustainability Tilt

SDR Labelling:

-

Product:

Pension

Fund Region:

Europe

Fund Asset Type:

Equity

Launch Date:

31/03/2014

Last Amended:

Aug 2025

Dialshifter ( ):

):

Fund Size:

£0.10m

(as at: 30/11/2024)

ISIN:

GB00BK35BJ72, GB00BK35BK87, GB00BK35BL94

Contact Us:

Objectives:

The fund aims to provide capital growth in excess of the FTSE World Series Europe ex UK (Gross Total Return) Index (after fees have been deducted) over a three to five year period by investing in equities of European companies, excluding the UK, which have the potential to achieve net zero greenhouse gas (“GHG”) emissions by 2050. Such companies support decarbonisation and therefore contribute to the goal of limiting global warming to no more than 1.5˚C above pre-industrial levels.

By investing in companies that the investment manager determines to have the potential to achieve net zero GHG emissions by 2050, the fund aims to helps them continue to contribute to the positive sustainability outcome of reducing GHG emissions and therefore slowing global warming. Achieving net zero helps prevent the buildup of greenhouse gases, which in turn reduces the risk of both acute and chronic climate events such as extreme weather, sea-level rise, and disruptions to ecosystems.

Sustainable, Responsible

&/or ESG Overview:

The fund manager invests in companies that have the potential to achieve net zero GHG emissions by 2050 (“decarbonising investments”). Net zero GHG means that the amount of GHG emissions emitted into the atmosphere by a company is balanced by the amount removed. To qualify as a decarbonising investment, a company needs to have a temperature alignment of no more than 1.5˚C based on evidence of previous emissions reductions. This means that the company's expected emissions reductions are consistent with limiting global warming to 1.5 degrees C above pre-industrial levels. The manager has repeatable process for identifying these companies.

The fund may also invest up to 30% of its assets in companies that are not deemed to be decarbonising investments, but have a company-reported emissions reduction target aligned with a temperature of no more than 1.5˚C.

Primary fund last amended:

Aug 2025

Information directly from fund manager.

Fund Filters

Sustainability - General

A core element of these funds aim to encourage higher sustainability standards across business practices through responsible ownership / stewardship / engagement / voting activity

Find funds that use the UN Global Compact to inform or help direct where they can or cannot invest and will typically not invest in companies with significant breaches (low standards) - although strategies vary. (The UNGC covers a wide range of issues - search 'UNGC'). See https://unglobalcompact.org/

Find funds that publicly report their performance against specifically named sustainability objectives (in addition to reporting their financial performance)

Environmental - General

Funds that have policies which relate to environmental issues. These will typically set out the fund's stance on issues such as pollution, climate change, resource management, biodiversity loss, carbon emissions, plastics and/or additional environmental impacts. Strategies vary. See fund information for further information.

Funds that limit or 'reduce' their exposure to carbon intensive industries (ie sectors which are major contributors to climate change. Funds vary - some funds may be 'underweight' in this area which means they may have some investment in highly carbon intensive areas. Funds of this kind may choose companies they consider to be 'best in sector' and encourage ever higher standards. Strategies vary. See fund information for further details.

Funds that have written policies explaining the approach they take when companies damage the environment or are significant polluters. Funds of this kind may work with companies to encourage higher standards, or exclude companies - sometimes dependent on the situation. Strategies vary. See fund information for further detail.

Funds that aim to invest in companies with strong or market leading environmental policies and practices. Strategies vary - in particular the balance between 'financial' aspects and environmental benefits. Some may invest substantially in solutions or 'positive impact' companies - others may invest in more conventional companies providing certain environmental criteria are met. See fund information for further detail.

Climate Change & Energy

A core element of these funds will aim to encourage the transition to lower carbon activities through responsible ownership / stewardship / engagement / voting activity

This fund has a strategy that aims ensure its holdings will gradually reduce their greenhouse gas emissions in line with targets set at COP21 in Paris. The ultimate aim is to achieve ‘net zero emissions by 2050’ and a ‘maximum global temperature increase of +1.5 to +2 degrees above preindustrial levels’. Strategies and opinions vary. Read fund information.

Find funds that require all, or almost all, of the companies it invests in to have a ‘net zero action plan’ - meaning that the companies they invest in have worked out how they will, over time, reduce their total carbon (and other greenhouse gas) emissions to nil.

Will only invest in companies that report greenhouse gas emissions reduction strategies in line with the framework set out the by the Taskforce for Climate Related Financial Disclosure, which is increasingly becoming mandatory. See https://www.fsb-tcfd.org/ https ://www.ifrs.org/sustainability/tcfd/

Ethical Values Led Exclusions

Companies are excluded if they are involved in any aspect of the production chain for tobacco products, including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Companies are excluded if they make more than 5% of their revenue from the manufacture, sale or distribution of tobacco products including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Find funds that exclude companies which make controversial weapons such as landmines, cluster munitions and chemical weapons. See fund literature for further information.

Find funds that avoid companies that manufacture products intended specifically for military use. Fund strategies vary - particularly with regard to non-strategic military products. See fund literature for fund specific details.

Find funds which have a policy that excludes manufacturers of products designed for use in armaments and weapons. See fund literature for more information.

Find funds that do not exclude companies with military contracts - this may include medical supplies, food, safety equioment, housing, etc. See fund literature for further information.

Find funds with a written civilian firearms exclusion policy - meaning that they will not invest in companies that make (or perhaps also sell) handguns made for non-military users.

Find funds that avoid companies with significant involvement in the gambling industry. Some funds may allow a small proportion of profits to come from this area. See fund policy for further details.

Find funds that avoid companies that derive significant income from pornography and related areas. Strategies vary. See fund details for further information.

Gilts & Sovereigns

Find funds that do not invest in / exclude 'sovereigns' - debt issued by governments. See eg https://www.investopedia.com/terms/s/sovereign-debt.asp

Banking & Financials

Find funds that include banks as part of their holdings / portfolio.

Funds that do or may invest in insurance companies.

Governance & Management

Find funds that aim to avoid investing in companies with poor governance practices.(e.g. board structure, management practices etc.) Views may however vary on what counts as 'poor' practices - and funds may not immediately divest as they may prefer to work to encourage higher standards. See fund literature for further information.

Fund managers encourage the companies they invest in to have more diverse board structures (e.g. more women on boards)

Find fund managers that encourage the banks and insurance companies they invest in to publish climate change related financial information - as set out by the Task Force on Climate Related Financial Disclosures (with the aim of helping investors measure and respond to climate risk).

A core element of these funds will aim to encourage higher ESG standards through responsible ownership / stewardship / engagement /voting activity

Fund Governance

Find funds that factor in 'environmental, social and governance' issues as part of their investment decision making process. A focus on 'ESG' typically means a fund is carrying out additional research to help reduce ESG related risks. It does not necessarily mean a focus on sustainability. Strategies vary. See fund literature.

Environmental, social and governance issues are part of this fund’s reporting of their ‘value’ to clients. AoV reporting is a statutory requirement. Including ESG factors in its calculation is not.

Impact Methodologies

Find funds that specifically set out to help deliver positive environmental impacts, benefits or 'real world' outcomes.

Find funds that direct investment towards companies where a major part of their business is about solving environmental challenges. e.g. companies helping to address climate change.

Fund aims to deliver positive environmental and or social impacts (real world benefits) through its engagement with investee assets

How The Fund Works

Find funds that make significant use of internationally agreed 'norms' (e.g. United Nations Global Compact - UNGC - or the UN Sustainable Development Goals - SDGs) as part of their investment selection process alongside additional SRI criteria such as positive or negative stock selection policies and/or stewardship strategies.

This fund does not use stock lending for performance or risk purposes.

Unscreened Assets & Cash

Fund that only invest in cash to aid the practical management (buying and selling) of assets. These funds do not use additional financial instruments.

Intended Clients & Product Options

Finds funds designed to meet the needs of individual investors with an interest in sustainability issues.

Find funds designed for clients who care about ethical and values-based issues, often alongside sustainability issues also.

Find funds that are available via a tax efficient ISA product wrapper.

Fund Management Company Information

About The Business

Finds fund management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

Find fund management companies that actively encourage higher 'environmental, social and governance' and/or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Find fund managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Find fund managers that consider responsible ownership and ESG to be a key differentiator for their business.

Collaborations & Affiliations

Find fund management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

Find fund management companies that are members of UKSIF - the UK Sustainable Investment and Finance association

A member of the Taskforce for Nature Related Financial Disclosures group which aims to aid risk management and shift money towards nature-positive outcomes.

Fund management entity is a member of the Investment Association https://www.theia.org/

Engagement Approach

working with the assets they hold to help stamp out modern slavery - where direct or indirect company employees are exploited for business benefits.

Sustainable, Responsible &/or ESG Policy:

To qualify as a decarbonising investment, a company needs to have a temperature alignment of no more than 1.5˚C based on evidence of previous emissions reductions. This means that the company's expected emissions reductions are consistent with limiting global warming to 1.5˚C above preindustrial levels. To calculate a company's temperature alignment, the investment manager uses emissions data from a third party provider and company reports to produce four data sets (using a reference year of 2019, or the first reported year thereafter), and calculate the trend in emissions reduction for each:

- Absolute emissions (based on Scope 1 and 2 emissions data)

- Absolute emissions (based on Scope 1, 2 and 3 emissions data)

- Emissions intensity (based on Scope 1 and 2 emissions data relative to annual revenue in USD)

- Emissions intensity (based on Scope 1, 2 and 3 emissions data relative to annual revenue in USD)

Absolute emissions measure the total amount of emissions of the company, while intensity measures emissions relative to a company's revenue. Scope 1 and 2 emissions come from a company's direct activities and indirect energy consumption, while Scope 3 emissions are indirect emissions from the company's value chain. The investment manager then uses an industry-standard methodology (the CDP-WWF Temperature Scoring Methodology) to calculate the company's temperature alignment based on the data set with the greatest emissions reduction trend. If a company's temperature alignment is 1.5˚C or less, the company is deemed to be a decarbonising investment.

Process:

The target sustainability outcome for the Fund is net zero GHG emissions by 2050. The standard of sustainability for the Fund (meaning the measure of whether a company has the potential to achieve the target outcome over time) is the CDP-WWF Temperature Scoring Methodology, which is used to assess whether a company has a long-term temperature alignment of no more than 1.5 ˚C by 2050, based on evidence of previous emissions reductions. This temperature alignment demonstrates that companies support net zero GHG emissions by 2050. The CDP-WWF Temperature Scoring Methodology is based on data issued by a third party data provider, or where data is missing, this can be sourced directly from company reports. Only data reported by companies is used to ensure accuracy and to support engagement.

Resources, Affiliations & Corporate Strategies:

Sustainability is fundamental to our investment principles at Schroders and we have an experienced and well-resourced Sustainable Investment team, who are embedded within our Investment function. We are a global team, spread across four regional hubs in London, Paris, Singapore and New York, aiming to ensure that sustainability is embedded through our global investment teams and client functions.

The team is led by Andrew Howard, Global Head of Sustainable Investment. As team head, he oversees our approach to ESG integration, active ownership, our sustainability research and tools, and our reporting and product strategy.

Our central Sustainable Investment team sits alongside investment teams rather than operating in a silo, which facilitates regular dialogue with our analysts and portfolio managers.

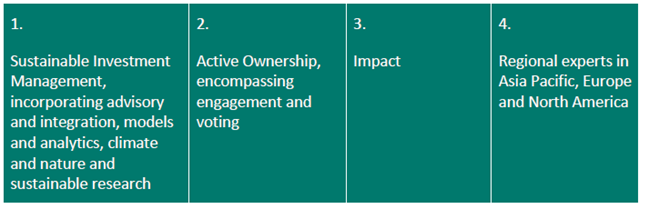

It is organised into four pillars:

We outline their key responsibilities and areas of focus below.

1. Sustainable investment management

Our Advisory and Integration team acts as a central contact point and consultant for a range of stakeholders across the business. This includes advising investment teams on ESG integration best practice; compliance, risk and legal teams on ESG regulation; and working with our regional experts; across Asia Pacific, Europe and North America, as outlined under pillar four.

Our Models and Analytics team is responsible for the maintenance and evolution of our suite of proprietary tools. They are also responsible for ESG data, ensuring we harness sustainability data effectively from both conventional and unconventional sources.

Our Strategy and Research team is responsible for undertaking sustainability research to: inform firmwide strategy and commitments; provide insights for investment teams to analyse sustainability-related risks and opportunities; and provide research-related and technical support for other stakeholders across the firm.

2. Active ownership

Our Engagement team partners with investors to have dialogue with the companies in which we invest, seeking to understand how prepared they are for a changing world and pushing them towards more sustainable practices. The team track the progress of these engagements and hold companies to account.

Our Corporate Governance team is responsible for voting in line with our Voting Policy and Principles.

3. Impact

Our Impact team is responsible for scaling our impact product offering in line with best-practice impact principles. The team works closely with investment desks and is responsible for developing and implementing our impact management and measurement framework, including impact assessment and monitoring at transaction and portfolio level, product development, impact strategy and impact reporting.

4. Regional Expertise

Our Regional Experts based in Asia Pacific, Europe and North America have a deep understanding of local market characteristics and nuances, and are responsible for staying abreast of sustainability-related developments. Our experts work with clients and internal teams to navigate and support clients’ ESG aspirations and challenges, utilising Schroders’ proprietary tools and research to develop investment solutions that meet their needs. They also engage with regulators and industry bodies to shape and support the global sustainable finance agenda. Our regional experts are a critical extension of the central team in London as the firm continues to evolve its global ESG strategy.

We have a number of governance structures in place for decision-making and oversight of our approach to sustainable investment. The Board of Schroders plc (the Board) has collective responsibility for the management, direction and performance of the Group, and is accountable for our overall business strategy. The Group Chief Executive is responsible for proposing the strategy for the Group and for its implementation, supported by the Group’s senior management team and a number of Committees, some of which are noted below.

The Group Sustainability and Impact (GSI) Committee provides advice to the Group Chief Executive on sustainability and impact matters. The Committee considers, reviews and recommends the overall global sustainability and impact strategy, including key initiatives, new commitments and policies for approval. The Global Head of Sustainable Investment and Global Head of Corporate Sustainability are members of the Committee and report to the Board.

The Sustainability Executive Committee (ExCo) develops and oversees the delivery of our Group-level sustainable investment management strategy. The ExCo also advises on the development of our sustainability and impact investment and product frameworks. The ExCo has senior representation from across the business including Investment, Client Group, Wealth Management, Schroders Capital and Corporate Sustainability.

The Group Regulatory Oversight Committee (GROC) oversees the progress of sustainability regulatory change programmes, as well as facilitating the monitoring of emergent sustainability regulations and ensuring we have appropriately determined the impact on our Group sustainability strategy and supporting operations. The GROC receives input on planned or potential sustainability-related regulation from our Public Policy and Compliance teams, which actively engage with relevant regulators, industry trade associations and other bodies in our key markets of the UK and EU. Once the business implications of new legal and regulatory requirements are defined, the relevant sustainability regulations programme workstreams deliver the necessary change to our business operations. The GROC oversees the progress of the programme, including monitoring and mitigating associated risks and issues. Where necessary, risks and key issues from the GROC can be escalated to the Group Risk Committee for resolution.

Certain Schroders entities, businesses and Investment teams also have their own committees which consider their sustainable investment activities. For example, the Private Assets Sustainability and Impact Steering Committee (PA S&I SteerCo) develops and oversees the implementation of the Private Assets Sustainability and Impact strategy. In addition, the Wealth Management Sustainable Investment Committee (WMSIC), a sub-committee of the Wealth Management Investment Committee (WMIC), has delegated responsibility for recommending Wealth Management's Sustainability models, as well as providing investment strategy and direction for client portfolios that are linked to the sustainable models.

Alongside our central Sustainable Investment team, sustainable investing is also overseen and delivered by dedicated teams and expert individuals embedded throughout the firm (including across Investment teams and Client Group functions).

We have a long-standing commitment to support and collaborate with several industry groups, organisations and initiatives to promote well-functioning financial markets.

Our key stakeholders include exchanges, regulators and international and regional trade associations. For example, Schroders is a member of trade bodies such as the Investment Association in the UK, the European Fund and Asset Management Association (EFAMA), the Asia Securities Industry and Financial Markets Association (ASIFMA) in Hong Kong and the Securities Industry and Financial Markets Association (SIFMA) in the US. Through this participation we share our insights to support the development of policy recommendations, share best practice and build coalitions of like-minded market participants to advocate for better functioning markets.

Our activity with policymakers aims to help them ensure that the measures they take support businesses and provide clear direction. By monitoring and influencing regulatory initiatives at their inception, we aim to support the development of a business environment which is conducive to Schroders’ clients’ best interests.

We aim to engage with the regulatory environments in which we are operating and raise awareness on sustainability matters. We believe well-designed regulation is an important cornerstone to promoting healthy markets, and have asked publicly that policy makers support sustainable finance legislation and regulation and deliver on commitments, including around climate mitigation.

We consider this to be key in improving responsible investment standards across sectors, establishing a consistent dialogue with companies, and in promoting the ongoing development and recognition of sustainability and Environmental, Social and Governance (ESG) topics within the investment industry. A full list of organisations and initiatives of which Schroders is a member or signatory is available here (https://www.schroders.com/en/global/individual/corporate-transparency/working-with-policy-makers/memberships/)

Literature

Fund Holdings

Voting Record

Disclaimer

Important Information

This document is addressed to existing client(s) only. Not for further distribution.

This document contains indicative terms for discussion purposes only and is not intended to provide the sole basis for evaluation of the investment solutions described.

Investment involves risk. Reliance should not be placed on any views or information in the material when taking individual investment and/or strategic decisions.

Any reference to regions/ countries/ sectors/ stocks/ securities is for illustrative purposes only and not a recommendation to buy or sell any financial instruments or adopt a specific investment strategy.

The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations.

Past Performance is not a guide to future performance and may not be repeated.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of investments to fall as well as rise.

Schroders has expressed its own views and opinions in this document and these may change.

Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy.

The data contained in this document has been sourced by Schroders and should be independently verified. Third party data is owned or licenced by the data provider and may not be reproduced, extracted or used for any other purpose without the data provider’s consent. Neither Schroders, nor the data provider, will have any liability in connection with the third-party data.

Issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 1893220 England. Authorised and regulated by the Financial Conduct Authority.

For your security, communications may be recorded or monitored.

Issued in June 2025. 06340.

| Fund Name | SRI Style | SDR Labelling | Product | Region | Asset Type | Launch Date | Last Amended |

|

|---|---|---|---|---|---|---|---|---|

Phoenix Wealth Schroder European Climate Transition Pn |

Sustainability Tilt | - | Pension | Europe | Equity | 31/03/2014 | Aug 2025 | |

ObjectivesThe fund aims to provide capital growth in excess of the FTSE World Series Europe ex UK (Gross Total Return) Index (after fees have been deducted) over a three to five year period by investing in equities of European companies, excluding the UK, which have the potential to achieve net zero greenhouse gas (“GHG”) emissions by 2050. Such companies support decarbonisation and therefore contribute to the goal of limiting global warming to no more than 1.5˚C above pre-industrial levels. By investing in companies that the investment manager determines to have the potential to achieve net zero GHG emissions by 2050, the fund aims to helps them continue to contribute to the positive sustainability outcome of reducing GHG emissions and therefore slowing global warming. Achieving net zero helps prevent the buildup of greenhouse gases, which in turn reduces the risk of both acute and chronic climate events such as extreme weather, sea-level rise, and disruptions to ecosystems. |

Fund Size: £0.10m (as at: 30/11/2024) ISIN: GB00BK35BJ72, GB00BK35BK87, GB00BK35BL94 Contact Us: sami.arouche@schroders.com |

|||||||

Sustainable, Responsible &/or ESG OverviewThis product is linked to the "Schroder European Climate Transition" fund. The following information refers to the primary fund. The fund manager invests in companies that have the potential to achieve net zero GHG emissions by 2050 (“decarbonising investments”). Net zero GHG means that the amount of GHG emissions emitted into the atmosphere by a company is balanced by the amount removed. To qualify as a decarbonising investment, a company needs to have a temperature alignment of no more than 1.5˚C based on evidence of previous emissions reductions. This means that the company's expected emissions reductions are consistent with limiting global warming to 1.5 degrees C above pre-industrial levels. The manager has repeatable process for identifying these companies. The fund may also invest up to 30% of its assets in companies that are not deemed to be decarbonising investments, but have a company-reported emissions reduction target aligned with a temperature of no more than 1.5˚C. |

||||||||

|

Primary fund last amended: Aug 2025 |

||||||||

|

Information received directly from Fund Manager |

||||||||

|

Please select what you would like to read:

Fund FiltersSustainability - General

Encourage more sustainable practices through stewardship

A core element of these funds aim to encourage higher sustainability standards across business practices through responsible ownership / stewardship / engagement / voting activity

UN Global Compact linked exclusion policy

Find funds that use the UN Global Compact to inform or help direct where they can or cannot invest and will typically not invest in companies with significant breaches (low standards) - although strategies vary. (The UNGC covers a wide range of issues - search 'UNGC'). See https://unglobalcompact.org/

Report against sustainability objectives

Find funds that publicly report their performance against specifically named sustainability objectives (in addition to reporting their financial performance) Environmental - General

Environmental policy

Funds that have policies which relate to environmental issues. These will typically set out the fund's stance on issues such as pollution, climate change, resource management, biodiversity loss, carbon emissions, plastics and/or additional environmental impacts. Strategies vary. See fund information for further information.

Limits exposure to carbon intensive industries

Funds that limit or 'reduce' their exposure to carbon intensive industries (ie sectors which are major contributors to climate change. Funds vary - some funds may be 'underweight' in this area which means they may have some investment in highly carbon intensive areas. Funds of this kind may choose companies they consider to be 'best in sector' and encourage ever higher standards. Strategies vary. See fund information for further details.

Environmental damage and pollution policy

Funds that have written policies explaining the approach they take when companies damage the environment or are significant polluters. Funds of this kind may work with companies to encourage higher standards, or exclude companies - sometimes dependent on the situation. Strategies vary. See fund information for further detail.

Favours cleaner, greener companies

Funds that aim to invest in companies with strong or market leading environmental policies and practices. Strategies vary - in particular the balance between 'financial' aspects and environmental benefits. Some may invest substantially in solutions or 'positive impact' companies - others may invest in more conventional companies providing certain environmental criteria are met. See fund information for further detail. Climate Change & Energy

Encourage transition to low carbon through stewardship activity

A core element of these funds will aim to encourage the transition to lower carbon activities through responsible ownership / stewardship / engagement / voting activity

Paris aligned fund strategy

This fund has a strategy that aims ensure its holdings will gradually reduce their greenhouse gas emissions in line with targets set at COP21 in Paris. The ultimate aim is to achieve ‘net zero emissions by 2050’ and a ‘maximum global temperature increase of +1.5 to +2 degrees above preindustrial levels’. Strategies and opinions vary. Read fund information.

Require net zero action plan from all/most companies

Find funds that require all, or almost all, of the companies it invests in to have a ‘net zero action plan’ - meaning that the companies they invest in have worked out how they will, over time, reduce their total carbon (and other greenhouse gas) emissions to nil.

TCFD reporting requirement (Becoming IFRS)

Will only invest in companies that report greenhouse gas emissions reduction strategies in line with the framework set out the by the Taskforce for Climate Related Financial Disclosure, which is increasingly becoming mandatory. See https://www.fsb-tcfd.org/ https ://www.ifrs.org/sustainability/tcfd/ Ethical Values Led Exclusions

Tobacco and related product manufacturers excluded

Companies are excluded if they are involved in any aspect of the production chain for tobacco products, including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Tobacco and related products - avoid where revenue > 5%

Companies are excluded if they make more than 5% of their revenue from the manufacture, sale or distribution of tobacco products including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Controversial weapons exclusion

Find funds that exclude companies which make controversial weapons such as landmines, cluster munitions and chemical weapons. See fund literature for further information.

Armaments manufacturers avoided

Find funds that avoid companies that manufacture products intended specifically for military use. Fund strategies vary - particularly with regard to non-strategic military products. See fund literature for fund specific details.

Armaments manufacturers not excluded

Find funds which have a policy that excludes manufacturers of products designed for use in armaments and weapons. See fund literature for more information.

Military involvement not excluded

Find funds that do not exclude companies with military contracts - this may include medical supplies, food, safety equioment, housing, etc. See fund literature for further information.

Civilian firearms production exclusion

Find funds with a written civilian firearms exclusion policy - meaning that they will not invest in companies that make (or perhaps also sell) handguns made for non-military users.

Gambling avoidance policy

Find funds that avoid companies with significant involvement in the gambling industry. Some funds may allow a small proportion of profits to come from this area. See fund policy for further details.

Pornography avoidance policy

Find funds that avoid companies that derive significant income from pornography and related areas. Strategies vary. See fund details for further information. Gilts & Sovereigns

Does not invest in sovereigns

Find funds that do not invest in / exclude 'sovereigns' - debt issued by governments. See eg https://www.investopedia.com/terms/s/sovereign-debt.asp Banking & Financials

Invests in banks

Find funds that include banks as part of their holdings / portfolio.

Invests in insurers

Funds that do or may invest in insurance companies. Governance & Management

Avoids companies with poor governance

Find funds that aim to avoid investing in companies with poor governance practices.(e.g. board structure, management practices etc.) Views may however vary on what counts as 'poor' practices - and funds may not immediately divest as they may prefer to work to encourage higher standards. See fund literature for further information.

Encourage board diversity e.g. gender

Fund managers encourage the companies they invest in to have more diverse board structures (e.g. more women on boards)

Encourage TCFD alignment for banks & insurance companies

Find fund managers that encourage the banks and insurance companies they invest in to publish climate change related financial information - as set out by the Task Force on Climate Related Financial Disclosures (with the aim of helping investors measure and respond to climate risk).

Encourage higher ESG standards through stewardship activity

A core element of these funds will aim to encourage higher ESG standards through responsible ownership / stewardship / engagement /voting activity Fund Governance

ESG integration strategy

Find funds that factor in 'environmental, social and governance' issues as part of their investment decision making process. A focus on 'ESG' typically means a fund is carrying out additional research to help reduce ESG related risks. It does not necessarily mean a focus on sustainability. Strategies vary. See fund literature.

ESG factors included in Assessment of Value (AoV) report

Environmental, social and governance issues are part of this fund’s reporting of their ‘value’ to clients. AoV reporting is a statutory requirement. Including ESG factors in its calculation is not. Impact Methodologies

Positive environmental impact theme

Find funds that specifically set out to help deliver positive environmental impacts, benefits or 'real world' outcomes.

Invests in environmental solutions companies

Find funds that direct investment towards companies where a major part of their business is about solving environmental challenges. e.g. companies helping to address climate change.

Aim to deliver positive impacts through engagement

Fund aims to deliver positive environmental and or social impacts (real world benefits) through its engagement with investee assets How The Fund Works

Combines norms based exclusions with other SRI criteria

Find funds that make significant use of internationally agreed 'norms' (e.g. United Nations Global Compact - UNGC - or the UN Sustainable Development Goals - SDGs) as part of their investment selection process alongside additional SRI criteria such as positive or negative stock selection policies and/or stewardship strategies.

Do not use stock / securities lending

This fund does not use stock lending for performance or risk purposes. Unscreened Assets & Cash

No ‘diversifiers’ used other than cash

Fund that only invest in cash to aid the practical management (buying and selling) of assets. These funds do not use additional financial instruments. Intended Clients & Product Options

Intended for investors interested in sustainability

Finds funds designed to meet the needs of individual investors with an interest in sustainability issues.

Intended for clients interested in ethical issues

Find funds designed for clients who care about ethical and values-based issues, often alongside sustainability issues also.

Available via an ISA (OEIC only)

Find funds that are available via a tax efficient ISA product wrapper. Fund Management Company InformationAbout The Business

Responsible ownership / stewardship policy or strategy (AFM company wide)

Finds fund management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

ESG / SRI engagement (AFM company wide)

Find fund management companies that actively encourage higher 'environmental, social and governance' and/or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Vote all* shares at AGMs / EGMs (AFM company wide)

Find fund managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Responsible ownership / ESG a key differentiator (AFM company wide)

Find fund managers that consider responsible ownership and ESG to be a key differentiator for their business. Collaborations & Affiliations

PRI signatory

Find fund management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

UKSIF member

Find fund management companies that are members of UKSIF - the UK Sustainable Investment and Finance association

TNFD forum member (AFM company wide)

A member of the Taskforce for Nature Related Financial Disclosures group which aims to aid risk management and shift money towards nature-positive outcomes.

Investment Association (IA) member

Fund management entity is a member of the Investment Association https://www.theia.org/ Engagement Approach

Engaging to stop modern slavery

working with the assets they hold to help stamp out modern slavery - where direct or indirect company employees are exploited for business benefits. Sustainable, Responsible &/or ESG Policy:To qualify as a decarbonising investment, a company needs to have a temperature alignment of no more than 1.5˚C based on evidence of previous emissions reductions. This means that the company's expected emissions reductions are consistent with limiting global warming to 1.5˚C above preindustrial levels. To calculate a company's temperature alignment, the investment manager uses emissions data from a third party provider and company reports to produce four data sets (using a reference year of 2019, or the first reported year thereafter), and calculate the trend in emissions reduction for each:

Absolute emissions measure the total amount of emissions of the company, while intensity measures emissions relative to a company's revenue. Scope 1 and 2 emissions come from a company's direct activities and indirect energy consumption, while Scope 3 emissions are indirect emissions from the company's value chain. The investment manager then uses an industry-standard methodology (the CDP-WWF Temperature Scoring Methodology) to calculate the company's temperature alignment based on the data set with the greatest emissions reduction trend. If a company's temperature alignment is 1.5˚C or less, the company is deemed to be a decarbonising investment. Process:The target sustainability outcome for the Fund is net zero GHG emissions by 2050. The standard of sustainability for the Fund (meaning the measure of whether a company has the potential to achieve the target outcome over time) is the CDP-WWF Temperature Scoring Methodology, which is used to assess whether a company has a long-term temperature alignment of no more than 1.5 ˚C by 2050, based on evidence of previous emissions reductions. This temperature alignment demonstrates that companies support net zero GHG emissions by 2050. The CDP-WWF Temperature Scoring Methodology is based on data issued by a third party data provider, or where data is missing, this can be sourced directly from company reports. Only data reported by companies is used to ensure accuracy and to support engagement. Resources, Affiliations & Corporate Strategies:Sustainability is fundamental to our investment principles at Schroders and we have an experienced and well-resourced Sustainable Investment team, who are embedded within our Investment function. We are a global team, spread across four regional hubs in London, Paris, Singapore and New York, aiming to ensure that sustainability is embedded through our global investment teams and client functions. Our central Sustainable Investment team sits alongside investment teams rather than operating in a silo, which facilitates regular dialogue with our analysts and portfolio managers. It is organised into four pillars:

We outline their key responsibilities and areas of focus below. 1. Sustainable investment management Our Advisory and Integration team acts as a central contact point and consultant for a range of stakeholders across the business. This includes advising investment teams on ESG integration best practice; compliance, risk and legal teams on ESG regulation; and working with our regional experts; across Asia Pacific, Europe and North America, as outlined under pillar four. Our Models and Analytics team is responsible for the maintenance and evolution of our suite of proprietary tools. They are also responsible for ESG data, ensuring we harness sustainability data effectively from both conventional and unconventional sources. Our Strategy and Research team is responsible for undertaking sustainability research to: inform firmwide strategy and commitments; provide insights for investment teams to analyse sustainability-related risks and opportunities; and provide research-related and technical support for other stakeholders across the firm. 2. Active ownership Our Engagement team partners with investors to have dialogue with the companies in which we invest, seeking to understand how prepared they are for a changing world and pushing them towards more sustainable practices. The team track the progress of these engagements and hold companies to account. Our Corporate Governance team is responsible for voting in line with our Voting Policy and Principles. 3. Impact Our Impact team is responsible for scaling our impact product offering in line with best-practice impact principles. The team works closely with investment desks and is responsible for developing and implementing our impact management and measurement framework, including impact assessment and monitoring at transaction and portfolio level, product development, impact strategy and impact reporting. 4. Regional Expertise Our Regional Experts based in Asia Pacific, Europe and North America have a deep understanding of local market characteristics and nuances, and are responsible for staying abreast of sustainability-related developments. Our experts work with clients and internal teams to navigate and support clients’ ESG aspirations and challenges, utilising Schroders’ proprietary tools and research to develop investment solutions that meet their needs. They also engage with regulators and industry bodies to shape and support the global sustainable finance agenda. Our regional experts are a critical extension of the central team in London as the firm continues to evolve its global ESG strategy. We have a number of governance structures in place for decision-making and oversight of our approach to sustainable investment. The Board of Schroders plc (the Board) has collective responsibility for the management, direction and performance of the Group, and is accountable for our overall business strategy. The Group Chief Executive is responsible for proposing the strategy for the Group and for its implementation, supported by the Group’s senior management team and a number of Committees, some of which are noted below. The Group Sustainability and Impact (GSI) Committee provides advice to the Group Chief Executive on sustainability and impact matters. The Committee considers, reviews and recommends the overall global sustainability and impact strategy, including key initiatives, new commitments and policies for approval. The Global Head of Sustainable Investment and Global Head of Corporate Sustainability are members of the Committee and report to the Board. The Sustainability Executive Committee (ExCo) develops and oversees the delivery of our Group-level sustainable investment management strategy. The ExCo also advises on the development of our sustainability and impact investment and product frameworks. The ExCo has senior representation from across the business including Investment, Client Group, Wealth Management, Schroders Capital and Corporate Sustainability. The Group Regulatory Oversight Committee (GROC) oversees the progress of sustainability regulatory change programmes, as well as facilitating the monitoring of emergent sustainability regulations and ensuring we have appropriately determined the impact on our Group sustainability strategy and supporting operations. The GROC receives input on planned or potential sustainability-related regulation from our Public Policy and Compliance teams, which actively engage with relevant regulators, industry trade associations and other bodies in our key markets of the UK and EU. Once the business implications of new legal and regulatory requirements are defined, the relevant sustainability regulations programme workstreams deliver the necessary change to our business operations. The GROC oversees the progress of the programme, including monitoring and mitigating associated risks and issues. Where necessary, risks and key issues from the GROC can be escalated to the Group Risk Committee for resolution. Certain Schroders entities, businesses and Investment teams also have their own committees which consider their sustainable investment activities. For example, the Private Assets Sustainability and Impact Steering Committee (PA S&I SteerCo) develops and oversees the implementation of the Private Assets Sustainability and Impact strategy. In addition, the Wealth Management Sustainable Investment Committee (WMSIC), a sub-committee of the Wealth Management Investment Committee (WMIC), has delegated responsibility for recommending Wealth Management's Sustainability models, as well as providing investment strategy and direction for client portfolios that are linked to the sustainable models. Alongside our central Sustainable Investment team, sustainable investing is also overseen and delivered by dedicated teams and expert individuals embedded throughout the firm (including across Investment teams and Client Group functions). We have a long-standing commitment to support and collaborate with several industry groups, organisations and initiatives to promote well-functioning financial markets. Our key stakeholders include exchanges, regulators and international and regional trade associations. For example, Schroders is a member of trade bodies such as the Investment Association in the UK, the European Fund and Asset Management Association (EFAMA), the Asia Securities Industry and Financial Markets Association (ASIFMA) in Hong Kong and the Securities Industry and Financial Markets Association (SIFMA) in the US. Through this participation we share our insights to support the development of policy recommendations, share best practice and build coalitions of like-minded market participants to advocate for better functioning markets. Our activity with policymakers aims to help them ensure that the measures they take support businesses and provide clear direction. By monitoring and influencing regulatory initiatives at their inception, we aim to support the development of a business environment which is conducive to Schroders’ clients’ best interests. We aim to engage with the regulatory environments in which we are operating and raise awareness on sustainability matters. We believe well-designed regulation is an important cornerstone to promoting healthy markets, and have asked publicly that policy makers support sustainable finance legislation and regulation and deliver on commitments, including around climate mitigation. LiteratureFund HoldingsVoting RecordDisclaimerImportant Information This document is addressed to existing client(s) only. Not for further distribution. |

||||||||