Impax Global Social Leaders Fund

SRI Style:

Social Style

SDR Labelling:

Not eligible to use label (out of scope)

Product:

SICAV/Overseas

Fund Region:

Global

Fund Asset Type:

Equity

Launch Date:

19/12/2023

Last Amended:

Sep 2025

Dialshifter ( ):

):

Fund/Portfolio Size:

£12.60m

(as at: 31/03/2025)

Total Screened Themed SRI Assets:

£25332.00m

(as at: 31/03/2025)

Total Assets Under Management:

£25332.00m

(as at: 31/03/2025)

ISIN:

IE0008C8W7Z6, IE0006JCJGB8, IE0007D6Y842, IE000B3ZUCL8, IE0002OPDCG0, IE000KXZX349, IE0000ZB1O31, IE0007B0F168

Contact Us:

Objectives:

The Impax Global Social Leaders Fund seeks to generate long-term capital growth. The strategy aims to enable investors to benefit from a portfolio of companies that provide products and services benefitting from long-term secular trends shaping society. Investments are made in companies which have 20% or more of their underlying revenue generated by providing products and services to improve quality of life, broaden economic participation, and meet basic needs. A quantitative framework also defines the investable universe for this strategy by identifying businesses which show indications of strong corporate culture correlated with stock price outperformance, including low employee turnover, gender-diverse leadership and inclusive business practices.

Sustainable, Responsible

&/or ESG Overview:

Impax believes that the growth opportunities from long-term societal secular trends such as ageing populations, rising middle class in emerging markets, increased incidence of chronic disease, urbanization, and financial inclusivity, are being underestimated by the market.

Impax believes companies with inclusive, innovative, and equitable cultures outperform over time; however, the market typically ignores culture in favour of more easily valued metrics.

The investment process has been built to exploit these market inefficiencies, which arise predominantly due to the short-term thinking of most market participants, to drive long-term outperformance compared to a broad benchmark (MSCI ACWI).

Primary fund last amended:

Sep 2025

Information directly from fund manager.

Fund Filters

Sustainability - General

Has policies that consider (environmental and social) sustainability issues. Strategies vary but are likely to consider environmental issues like climate change, carbon emissions, biodiversity loss, resource management, environmental impacts; and social issues like equal opportunities, human rights, labour standards, diversity and adherence to internationally recognised codes. See individual entry information.

Has a significant focus on sustainability issues

Has documented policies or thematic investment approaches supporting investment in more sustainable, greener transport methods. These will typically set out a preference for companies that run, enable or support more sustainable methods of transport.

Aim to encourage higher sustainability standards through responsible ownership / stewardship / engagement / voting activity

Use the UN Global Compact to inform or help direct where they can or cannot invest. Will typically not invest in companies with significant breaches (low standards) - strategies vary. (The UNGC covers a wide range of issues - search 'UNGC'). See https://unglobalcompact.org/

Publicly report performance against named sustainability objectives

Has a theme or investment strand focused on the shift to a circular economy - where products are reused and recycled not incinerated or dumped. See eg https://www.ellenmacarthurfoundation.org/topics/circular-economy-introduction/overview

Environmental - General

Has policies which relate to environmental issues. These will typically set out their stance on issues such as pollution, climate change, resource management, biodiversity loss, carbon emissions, plastics and/or additional environmental impacts. Strategies vary.

Has a policy or theme that relates to managing natural resources more efficiently. Strategies vary. See individual entry information.

Aims to invest in companies with strong or market leading environmental policies and practices. Strategies vary. See individual entry information for more detail.

Nature & Biodiversity

Has a written biodiversity policy or theme typically aimed at supporting, encouraging and improving environmental protection and safeguarding the natural world (sometimes referred to as 'natural capital'). See eg https://www.un.org/en/climatechange/science/climate-issues/biodiversity

Climate Change & Energy

Has policies (documented strategies that explain their position) on climate change related issues such as greenhouse gas/carbon emissions, net zero, transitioning to lower carbon. Strategies vary.

Avoid investment in major coal, oil and/or gas (extraction) companies. Strategies vary.

Avoid companies involved in fracking and tar sands - which are widely regarded as controversial methods of oil and gas extraction. Strategies vary.

Avoid companies that are involved in extracting oil from the Arctic regions.

Encourage the transition to lower carbon activities through asset selection and / or responsible ownership activity.

Has an energy efficiency theme - typically meaning that the manager is focused on investing in organisations that manage - or help others to manage - energy use more carefully and less wastefully - and so reduce greenhouse gas emissions.

Invest in renewable energy companies and / or companies where renewable energy is a significant part of their business. Strategies vary.

Has a policy which describes the avoidance or limited investment in the nuclear industry. Strategies vary.

Excludes companies and other assets with direct involvement in fossil fuel exploration (eg coal, oil and gas companies)

Requires all, or most of, the assets they invest in to have a ‘net zero action plan’ - describing how they will reduce their greenhouse gas emissions.

Will only invest in companies that report greenhouse gas emissions in line with this international reporting framework. See https://www.fsb-tcfd.org/ https ://www.ifrs.org/sustainability/tcfd/

Social / Employment

Aims to invest in assets with high social values - this may include strong human rights, labour standards and equal opportunities or safety related practices.

Has policies or themes that set out their approach to health and wellbeing issues, typically aims to invest in companies with high standards - or encourage high standards.

Ethical Values Led Exclusions

Companies are excluded if they make more than 5% of their revenue from the manufacture, sale or distribution of tobacco products including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Excludes companies which make controversial weapons such as landmines, cluster munitions and chemical weapons.

Human Rights

Has policies relating to human rights issues. Typically require companies to demonstrate higher standards, although some managers work to encourage improvements. Investee companies are often judged against internationally agreed norms or standards. Strategies vary.

Has policies to avoid companies that employ children.

Has policies that exclude companies or other assets which operate in, or are owned by regimes which are not democratic, or where people may be oppressed. May use eg. Freedom House research. Strategies vary.

Has a policy which excludes assets with involvement in Modern Slavery

Meeting Peoples' Basic Needs

Focuses on (ie directs a significant proportion of its investment towards) green infrastructure, eg the clean energy supply chain.

Has a responsible food production or agriculture theme or strand of investment. May have a single or many themes.

Healthcare and or medical theme or area of investment - may have a single or many themes

Gilts & Sovereigns

Does not invest in / excludes 'sovereigns' - debt issued by governments. See eg https://www.investopedia.com/terms/s/sovereign-debt.asp

Governance & Management

Exclude companies that are subject to United Nations sanctions. See eg https://main.un.org/securitycouncil/en/content/un-sc-consolidated-list

Encourage the companies they invest in to have more diverse board structures (e.g. more women on boards)

Aim to encourage higher ESG standards through responsible ownership / stewardship / engagement /voting activity

Impact Methodologies

Specifically states that they aim to deliver positive social (i.e. people related) impacts and/or outcomes.

Invest in companies where a major part of their business is specifically aimed at helping to address social challenges. e.g. companies helping to address poverty.

Policy explains the ways in which the manager believes things need to change in order to deliver a more sustainable future, which they are working to help achieve.

How The Fund/Portfolio Works

Aims to avoid companies that do significant harm. This originates from the EU’s sustainable finance ‘DNSH’ (do no significant harm) work, which is not necessarily used by UK investors.

Invests in assets which can be 'mapped' (reviewed) their investment selection and management strategies to identify which of the UN Sustainable Development Goals (SDGs) the fund is helping to address.

Investment selection process uses internationally agreed 'norms' (e.g. United Nations Global Compact - UNGC - or the UN Sustainable Development Goals - SDGs) alongside additional SRI criteria such as positive or negative stock selection policies and/or stewardship strategies.

Focuses on the careful management of environmental, social and governance (ESG) related risks - typically by avoiding or being underweight in companies seen as posing major risks in these areas (i.e. not necessarily by using themes, exclusions etc).

Publish explanations of their ethical, social and/or environmental policies online (i.e. investment decision making strategies/ buy/sell &/or asset management strategies).

Does not use stock lending for performance or risk purposes.

Unscreened Assets & Cash

Holds between 70-79% of assets which align to the sustainability objectives; which are not being held purely for risk management purposes, such as derivatives and cash equivalent assets.

Holds between 80-89% of assets which align to the sustainability objectives; which are not being held purely for risk management purposes, such as derivatives and cash equivalent assets.

Holds at least 90% of assets which align to the sustainability objectives; which are not being held purely for risk management purposes, such as derivatives and cash equivalent assets.

Only invests in cash to aid the practical management (buying and selling) of assets and so do not use additional financial instruments.

Intended Clients & Product Options

Designed to meet the needs of individual investors with an interest in sustainability issues.

Designed for clients who care about ethical and values-based issues, often alongside sustainability issues also.

Labels & Accreditations

Find options classified under Article 9 of the EU’s SFDR (Sustainable Finance Disclosure Requirements). Article 9 of the SFDR applies to financial products that have sustainable investment 'objectives' - including emissions reduction objectives. (These may currently be referred to as 'impact' funds or aiming to deliver clear, specific positive outcomes.) These rules do not currently apply in the UK so product managers may leave this field blank.

Fund Management Company Information

About The Business

Find fund management companies that are smaller or specialise in particular areas - notably, ideally ESG related. Strategies vary.

Find fund management companies (or subsidiaries) that specialise in - or focus entirely on - investing in assets that are helping to deliver positive environmental and / or social impacts.

Finds fund management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

Find fund management companies that actively encourage higher 'environmental, social and governance' and/or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Find fund managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Find fund managers that consider responsible ownership and ESG to be a key differentiator for their business.

The leadership team of this asset manager have performance targets linked to environmental goals.

Find fund management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management.

Finds organisations / fund managers that have an in-house (company wide) diversity improvement programme - meaning that they are working to ensure that within their own businesses they employ people from diverse backgrounds - often typically focused on ethnicity and/or sex.

Find fund management companies that encourage the companies they invest in to have strong diversity, race, gender and other equality policies across all assets held, not simply screened or themed SRI/ESG funds. (ie Asset Management company wide).

Asset management company has investments in bonds designed to meet sustainability requirements - however these assets may not be 'ringfenced' for this purpose. See fund manager website for details.

Collaborations & Affiliations

Find fund management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

Find fund management companies that are members of UKSIF - the UK Sustainable Investment and Finance association

A member of the Taskforce for Nature Related Financial Disclosures group which aims to aid risk management and shift money towards nature-positive outcomes.

Fund management entity is a member of the Investment Association https://www.theia.org/

Resources

Find fund management companies that employ people to steer and support fund managers in voting shares at company AGM's and EGMs in ways that are consistent with encouraging higher ESG/sustainability standards.

Find a fund management company that directly employs specialist ESG/SRI/sustainability researchers or analysts. This allows asset managers to discuss environmental, social and governance risks and opportunities directly with companies.

Find fund management companies that makes use of expert external research companies. This can help deliver specialist expertise and means resources are pooled with other investors.

Finds organisations / fund managers that have one or more ESG/sustainability experts on all investment teams or 'desks' (all asset types)

Accreditations

Finds organisations / fund managers that have an A+ PRI rating - meaning they are highly rated according to the 'Principles of Responsible Investment'

Find fund managers that are signatories to the FRC UK Stewardship Code, which sets out a framework for constructive investor / investee relations where fund managers are encouraged to behave like responsible, typically longer term 'company owners'.

Engagement Approach

Find fund management companies that regularly initiate or run industry wide (collaborative) investor projects aimed at raising environmental, social and governance standards amongst investee companies.

Find fund management companies that are working with the companies they invest in to encourage more responsible corporate taxation.

Fund manager has stewardship /responsible ownership strategy that is focused on addressing climate change with investee assets.

Asset manager has a stewardship /responsible ownership strategy that involves working with fossil fuel companies on climate change related issues. See fund manager website for details.

Asset manager has stewardship /responsible ownership strategy with involves encouraging investee asset to reduce plastic waste and pollution.

The asset manager has a responsible ownership / stewardship strategy that focuses on biodiversity and nature issues relating to the assets they invest the aim of which will be to reduce harm and or deliver improvement. Strategies vary. https://tnfd.global

Asset manager has a responsible ownership / stewardship strategy which means they are working to encourage the shift to more sustainable business practices in ways that respect and are sensitive to social issues and the impact change has on people effected by the changes that are taking place. https://www.transitionpathwayinitiative.org/ https://transitiontaskforce.net/

Asset manager has responsible ownership / stewardship strategy in place which aims to address human rights issues in investee companies (and potentially their suppliers) with the aim of raising standards

Asset manager has responsible ownership / stewardship strategy in place that aims to improve labour standards for the benefit of employees in investee companies (and potentially their suppliers)

Asset management company has a stewardship strategy in place which involves working to raise diversity, equality and inclusion standards across investee assets

working with the assets they hold to help stamp out modern slavery - where direct or indirect company employees are exploited for business benefits.

Fund managers have stewardship strategies in place that focus on improving governance standards across investee assets

Asset manager has stewardship strategy in place which involves discussing mental health issues with investee companies - with the aim of raising standards

Has a stewardship / responsible ownership strategy that encourages responsible supply chain - ie the managers will discuss environmental, social and governance issues with investee companies with the aim of raising standards

Working to address sustainability, ESG and related concerns around artificial intelligence.

Escalation policies describe how a manager will proceed if stewardship / engagement activity is not successful in the short term.

Company Wide Exclusions

Find fund management companies (not funds) that avoid investment in 'controversial weapons' across all of their funds and other investment vehicles.

Find funds / fund managers that are reviewing, or have reviewed, their exposure to carbon intensive industries including (but not only) mining, oil and gas companies. (Typically with reference to climate change.)

Climate & Net Zero Transition

Fund management organisations that have pledged to reduce their greenhouse gas emissions to ‘net zero’. Strategies vary - this area is changing rapidly.

Fund manager AGM / EGM voting strategy has processes in place that mean they will normally be expected to vote in a way that will encourage the transition to net zero greenhouse gas emissions.

This asset management company has set a date by which they plan to achieve net zero greenhouse gas / CO2e emissions.

Find fund management companies that are working with the companies they invest in to encourage reductions in carbon dioxide and other greenhouse gas emissions.

Finds organisations / fund managers that have a company wide carbon transition plan - meaning that they have plotted a path to how they will move away from activities that produce or use carbon based energy sources (that emit greenhouse gases) towards clean, alternative, renewable energy sources.

Finds organisations / fund managers that have published ‘forward looking climate metrics’ e.g. 'implied temperature rise' data that are a total of the asset management company's share (% owned) of all the investee company emissions of the assets they manage, as well as their own direct and other indirect emissions.

This asset management company plans to achieve net zero greenhouse gas (CO2e) emissions by reducing their emissions. Calculations and scope vary.

Find fund management companies that are working to reduce their own (fund management company) carbon/greenhouse gas emissions.

Finds organisations / fund management companies that are in the process of working out how to make a ‘net zero commitment’ - meaning that when that is finalised they will have started the process of reducing their total greenhouse gas emissions to'zero'.

Transparency

Find fund management companies that publish a report detailing their responsible investment ownership - also known as 'Stewardship' - activity.

Find companies that publish information about their sustainable and responsible investment strategies on their company website.

Fund management companies that publish a full record of how they vote their shares at AGMs (annual general meetings) and EGMs (extraordinary general meetings). Voting strategies have an important role to play encouraging higher environmental, social and governance standards.

This asset management company has published a plan that explains how they will align to the climate change commitments made at the Paris Climate Talks, COP21.

This asset management company has published a plan that explains how they are going to achieve net zero greenhouse gas / CO2e emissions.

Find fund management companies that have supplied Dialshifter information. See Dialshifter tab within record for more information.

Sustainable, Responsible &/or ESG Policy:

All of Impax Asset Managements’ investments are aligned to the transition to a more sustainable economy. Activities with lower sustainability risks and higher opportunities are set to benefit from a transition to a more sustainable, low-carbon economy and are well positioned for the long-term. They are less at risk of disruption from new technologies, changing consumer preferences or legislation. These well-positioned areas of the economy are sought and prioritised for investment across the Manager’s listed investment strategies.

ESG-analysis is an integral part of the Manager’s investment process. All investee companies must meet financial and environmental, social and governance (“ESG”) criteria before entering the Fund’s universe of investable companies. The investment team members of the Investment Manager are responsible for integrating ESG analysis into the investment process. Through screening, the Investment Manager intends to avoid companies involved in significant controversies that violate global norms related to human rights, labour, environment and corruption, and through ESG analysis, the Investment Manager conducts a detailed, proprietary ESG analysis of new investee companies considered for the investable universe and reviews the ESG analysis on a periodic basis.

Stewardship through active ESG engagement and proxy voting are important parts of the investment process. They enable monitoring of the investee companies more effectively and aim at further enhancing the structures, processes and disclosures of the companies. Impax Asset Management takes into account relevant regulations when considering the approach to sustainability and ESG, especially as it relates to reporting and disclosures.

Further details on how sustainability risks are integrated into the investment decision making process for the Fund are provided in the Investment Manager’s ESG Policy, available on the Investment Manager’s website at www.impaxam.com.

The full ESG Sub-Policy can be found on the Investment Manager’s website impax-esg-sub-policy.pdf (impaxam.com)

Process:

Idea generation - Identifying interesting companies

The investable universe represents Impax’s intellectual property, and is managed internally through a robust process. Creation of the universe for this strategy leverages two proprietary tools, and companies must meet both criteria to be included.

Impax Social taxonomy:

Impax developed a clear and robust taxonomy to identify companies which have generated 20% or more of their underlying revenue by providing products and services to improve quality of life, broaden economic participation, and meet basic need

The investment teams analyse available social behavioural data across multiple sources, including in-house research and third-party providers, to evaluate every company in the MSCI ACWI universe utilising these seven culture indicators. Companies are scored from 0-100, with 0 being the lowest score and 100 being the highest score. Data is neutralised for market capitalisation where appropriate, adjusted for regional differences and is combined into a single scoring output. The lowest scoring quintile is removed from the investment universe.

Companies are scored from 0-100, with 0 being the lowest score and 100 being the highest score. Data is neutralised for market capitalisation where appropriate, adjusted for regional differences and is combined into a single scoring output. The lowest scoring quintile is removed from the investment universe. The results highlight meaningful excess returns for companies with high corporate culture indicator scores.

These scores are supplemented with Impax’s fundamental and ESG research.

Resources, Affiliations & Corporate Strategies:

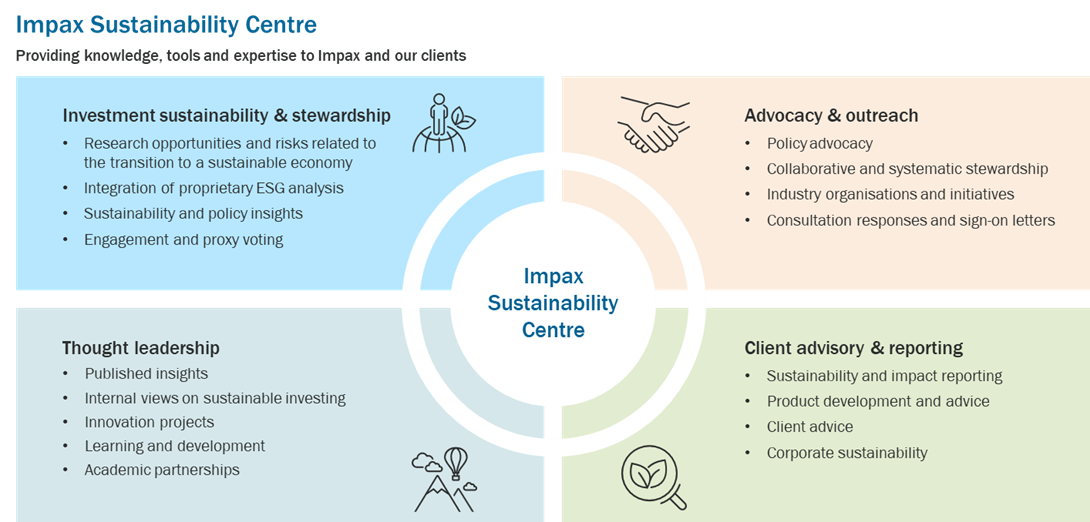

The Sustainability Centre:

The Sustainability Centre (SC) acts as Impax’s centre of excellence providing services, tools and knowledge on investing in the transition to a more sustainable global economy (TSE). The SC allows Impax to meet the growing expectations of clients, regulators and other stakeholders. It also enables Impax to focus on the rapidly expanding range and depth of sustainability issues that require the Firm’s attention. The SC is led by Co-Heads Lisa Beauvilain (Global Head of Sustainability & Stewardship) and Chris Dodwell (Global Head of Policy & Advocacy) who share management responsibilities and report directly into Impax’s CEO.

Sustainability continues to be fully integrated within Impax’s investment process. Bringing the functions of the existing Sustainability & Stewardship and Policy & Advocacy teams into a single unit provides:

- further integration of policy insights into the Impax Investment process

- a joined-up approach to planning, delivery and reporting of engagement work with companies and policymakers

- Increased focus and resources for the development of thought leadership, both in terms of integrating insights into Impax’s investment process and sharing them externally

- further development of research partnerships with clients, academics, and other stakeholders

- an enhanced approach to sustainability training and development for Impax staff, including for the investment team

- team structure provides clarity, accountability, and scalability, while enabling specialization and flexibility

The Sustainability Centre team:

The Sustainability Centre is a centre of excellence, providing services, knowledge, tools and expertise on investing in the transition to a more sustainable economy across the four pillars as outlined below:

- Pillar 1 - Investment sustainability & stewardship

Through this pillar, the SC provides leadership, advice and oversight of investment-related sustainability research, thematic and sustainable universe development, impact measurement, development of proprietary tools and methodologies, management of the fundamental and systematic ESG analysis and processes, and stewardship work including proxy voting and company-specific and thematic engagement, as well as policy insights for the investment process. The SC provides advice, coordination and peer review of ESG-analysis and company-specific engagement which are fully integrated in Impax’s investment process and owned by the lead analysts of the companies.

- Pillar 2 – Advocacy & outreach

The focus of this pillar is to support policy makers who are working to create enabling environments that will accelerate the transition to a more sustainable economy. Impax is active across a range of channels, from traditional reactive approaches such as working through industry associations, responding to consultations, and participating in issue-specific initiatives and sign-on letters - to more innovative pro-active interventions such as publishing Impax’s perspectives and commentaries, funding research, piloting new approaches, partnering with clients, and bilateral discussions with policy makers. Impax’s efforts around “systematic stewardship” fall under this pillar. Systemic stewardship combines company thematic engagement and policy advocacy as levers for accelerated change.

- Pillar 3 – Thought leadership

Through this pillar, the SC delivers thought-leadership content that supports the investment process, as well as content produced for external audiences. The SC’s thought leadership output provides Impax’s house view on important and evolving topics, supports research partnerships with academia and clients, and provides Impax’s firm-wide sustainability training and development.

- Pillar 4 – Client advisory and reporting

Under the fourth pillar, the SC advises on sustainability in Impax’s product development, sustainable finance regulatory responses, and reporting, including the metrics and methodologies used by the client advisory and reporting working group. The SC develops Impax’s firm-wide sustainability policies and is responsible for providing sustainability expertise and insights to Impax’s clients.

Sustainability Centre leadership

The leadership within the Sustainability Centre team has specific responsibilities as described below.

- Lisa Beauvilain, Global Head of Sustainability & Stewardship, Co-Head of the Sustainability Centre – responsible for pillars one and four

- Chris Dodwell, Global Head of Policy and Advocacy, Co-Head of the Sustainability Centre - responsible for pillars two and three

- David Loehwing, Head of Sustainability & Stewardship, North America – responsible for oversight and development of Impax’s ESG-related methodologies, frameworks, and analytics

- Heather Smith, Head of Stewardship – responsible for implementing Impax’s company engagement and voting strategy, including development of themes, metrics, and reporting

- Julie Gorte, Ph.D., Senior Vice President, Sustainable Investing – responsible for Impax’s systematic engagement efforts and actively participates in policy advocacy in the US and in working groups with many of Impax’s membership organisations

- Miriam Benarey, Head of Sustainability Client Advisory – leading on developing partnerships with our clients to address key sustainability themes, providing expertise on sustainability in the investment process and the sustainable finance regulatory landscape, as well as co-chairing Impax’s Beyond Financial Returns (BFR) Group

- Nana Li, Head of Sustainability & Stewardship, Asia-Pacific – responsible for sustainability research, thought leadership, and engagement in the Asia-Pacific region

- Paolo Macri, Sustainable Investment Research – responsible for oversight and development of thematic universes and taxonomies, related data and impact measurement and reporting methodology

- Shahbano Soomro, Deputy Head of Policy and Advocacy - responsible for providing policy insights into the investment process

Memberships:

Key collective responsible Investment (RI) initiatives of which Impax is a signatory/member:

- Compliance with the UN Global Compact principles (including human rights, labour rights, environment, and anti-corruption) is a normative investment requirement for Impax. The Impax investible universe is screened for adherence to the UN Global Compact principles. An external research provider is used to support this screening activity. The underlying research provides assessments covering the UN’s Global Compact Principles, International Labour Organization’s (ILO) Conventions, OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights (UNGPs).

- Net Zero Asset Managers Initiative (NZAM). Impax joined the Net Zero Asset Managers Initiative in October 2021 and made its Initial Target Disclosure in November 2022.

- UK Stewardship Code. Impax has been a signatory of the Financial Reporting Council’s UK Stewardship Code since 2011. The code aims to enhance the quality of engagement between institutional investors and companies to help improve long-term returns to shareholders and the efficient exercise of governance responsibilities.

- Principles for Responsible Investment (PRI). Impax has been a signatory of the PRI since 2008. The PRI aims to help investors integrate ESG considerations into investment decision making and supports sharing best practice in active ownership.

- Task Force on Climate-related Financial Disclosures (TCFD). Impax has been a signatory of the TCFD recommendations since 2017. The TCFD develops voluntary, consistent climate-related financial risk disclosures for companies providing information to investors, lenders, insurers and other stakeholders.

- Task Force on Nature-related Financial Disclosures (TNFD). Impax has been actively involved in the preparatory work for the TNFD as a member of the informal working group and is now continuing its support through the TNFD Forum, focusing on the development of decision-useful metrics for assessing nature-related risks and opportunities. Impax will continue to participate in discussions around management and disclosure standards on nature-related risks.

Other key collective RI investment groups of which Impax is a signatory/member:

- CDP

- Institutional Investors Group on Climate Change

- Regional Climate Change e.g., IIGCC, AIGCC, or Ceres

- Investor Network on Climate Risk

- Regional Responsible Investment or Sustainable Finance e.g., RIAA, UKSIF, USSIF

- Climate Action 100+

- Corporate Governance Networks

- 30% club or 40:40 Vision or ILPA D&I Initiative

- The Global Impact Investing Network (GIIN)

- FAIRR Initiative

Stewardship:

Engagement is fully integrated in our investment process for listed equities and fixed income. Engagement is used both to mitigate risk and to enhance value and investment opportunities. Engagement allows us to:

- Manage risks by proactively identifying and mitigating issues

- Enhance company/issuer analysis; how companies/issuers respond to engagement is informative of their character

- Strengthen investee companies/issuers over time; improving quality, processes, transparency and resilience

Engagements are conducted as part of our regular meetings with company management teams, or through additional conference calls, meetings, email exchanges or as part of joint communications with the investment community. In cases where engagements are not progressing as anticipated, Impax may utilise escalation processes, which include seeking meetings with alternative contacts at investee companies, including board directors, seeking engagement with other shareholders, industry organisations, standard-setters or regulators, as well as filing or co-filing shareholder resolutions.

Collaborative engagements may be prioritised in cases where an issue is being escalated or where outreach may particularly benefit from a larger group of shareholder involvement. Collaborative engagements are conducted across various, material sustainability issues and specific sectors and companies. Impax does not participate in collaborative engagements that could be interpreted as investors acting in concert.

Impax Investment Committee meetings have a monthly standing agenda item to continuously inform and discuss stewardship issues across the investment team. Members of the Sustainability Centre regularly attend Portfolio Review Meetings to discuss company-specific stewardship priorities and issues at the portfolio and strategy-level with lead analysts and portfolio managers.

Types of Engagement

Impax’s stewardship work can be divided into the following types:

Bottom-up company- and issuer-specific engagement

As part of our ongoing, proprietary company and issuer-level ESG analysis, we identify company- and issuer-specific matters and risks and actively engage regarding these matters as part of monitoring and managing risks. We prioritise engagement with investee companies where we have identified more significant risk issues and/or have larger positions. In addition to risk management, bottom-up company specific engagement is also intended to enhance company value and improve the structures, processes and disclosures of investee companies.

Responsibilities: The lead analysts for the investee companies and issuers are responsible for bottom-up company engagement, with the Sustainability Centre assisting with coordination, preparation and research.

Proxy voting driven engagement

Proxy voting is predominantly related to governance issues such as the election of directors, board structures and management remuneration, but we also express our views on diversity, climate and material sustainability risk management. When Impax has voted against a significant resolution for companies in our active equity strategies, we reach out to the companies to explain our voting rationale and the enhancements we would like to see. We are also in dialogue with companies throughout the year to discuss and comment on proposed governance structures, sustainability processes and disclosures by companies. Impax can also initiate or support shareholder proposals at annual shareholder meetings to encourage greater corporate transparency around a company’s most significant environmental or social risks based on its sector and activities.

Responsibilities: In executing our proxy votes, Impax uses a peer review process, where one Sustainability Centre team member instructs votes and another team member verifies and executes the votes. For resolutions related to financial transactions, including share issuance and M&A or for more contested or controversial resolutions, the Sustainability Centre will engage with the company lead analyst.

Top-down thematic engagement

Every year we assess and outline our thematic engagement priorities. These priorities are based on market developments and emerging sustainability issues that are relevant and material for our companies and issuers. Where possible, we use specific performance data related to the engagement themes, as well as the overall ownership in the companies, as parameters for prioritising companies and issuers for thematic engagements. Companies of all sizes are engaged, including larger companies, with the aim of promoting best practices throughout an industry peer group.

Our engagement themes are often of a long-term nature and do not necessarily change annually.

Engagement themes for 2025:

- Climate

- Net-zero transition planning

- Increasing resilience to physical climate risks

- Nature

- Nature-related dependencies and impacts

- People

- Corporate Culture

- Human rights

- Corporate Governance

- Board composition and structure

- Executive compensation

- Sustainability reporting and assurance

Responsibilities: The lead analysts for the investee companies and issuers are part of thematic company engagements, but the work is driven and coordinated by the Sustainability Centre and its Head of Stewardship, with a lead for each engagement theme or topic.

Systematic engagement

Impax has identified critical and often hard-to-engage areas, with barriers to progress. To remove these impediments, we use ‘systematic engagement,’ which combines company engagement and policy advocacy with the aim of shaping companies’ practices through regulatory or policy change. These areas often cover topics that companies may prefer not to disclose and are not mandatory, such as geolocation data for strategic company assets, but that investors need in order to fully understand companies’ operations and risks.

Responsibilities: One member of the Impax Sustainability Centre is responsible for leading and coordinating the systematic engagement work, bringing together our company engagements and policy advocacy work. Company and issuer lead analysts are involved in these meetings as relevant.

For more information please see: impax-stewardship-policy.pdf

SDR Labelling:

Not eligible to use label (out of scope)

Literature

Voting Record

Disclaimer

This document (the “Document”) contains information that has been provided at the specific request of the intended recipient and is for discussion purposes only. This Document has been issued by Impax Asset Management (“Impax”) which means one of the following entities depending on the location of the recipient:

- For recipients based outside the European Economic Area (the “EEA”): Impax Asset Management Limited (FRN 197008) and/or Impax Asset Management (AIFM) Limited (FRN 613534) which are authorised and regulated by the Financial Conduct Authority.

- For recipients based inside the EEA: Impax Asset Management (Ireland) Limited which is authorised and regulated by the Central Bank of Ireland (Reference No: C186651).

The information and any opinions contained in this Document have been compiled in good faith, but no representation or warranty, express or implied, is made to their accuracy, completeness or correctness. Impax, its officers, employees, representatives and agents expressly advise that they shall not be liable in any respect whatsoever for any loss or damage, whether direct, indirect, consequential or otherwise however arising (whether in negligence or otherwise) out of or in connection with the contents of or any omissions from this Document. The information in the Document has not been independently verified and is subject at all times to the conditions, caveats and limitations described in the Document. All opinions, projections and estimates constitute the judgment of Impax as of the date of the Document and are subject to change without notice.

This Document does not constitute an offer to sell, purchase, subscribe for or otherwise invest in units or shares of any fund managed by Impax. It may not be relied upon as constituting any form of investment advice and prospective investors are advised to ensure that they obtain appropriate independent professional advice before making any investment. This information is in no way indicative of how the strategy will perform and is not intended as a statement as to the likelihood of Impax achieving particular results in the future. Past performance of a strategy is no guarantee as to its performance in the future. This Document is not an advertisement and is not intended for public use or distribution.

The information contained in the Document is not investment, tax, accounting or legal advice and does not take into consideration the investment objectives, financial situation or particular needs of the recipient. Investing entails certain risks, including the possible loss of the entire principal amount invested. The recipient of this Document should seek its own financial, tax, accounting and legal advice in connection with any proposed investment.

The Document is strictly confidential and is only intended for the intended recipient(s) and must not be forwarded by such intended recipient to anyone else. It must not be copied, reproduced or distributed in whole or in part at any time. The Document may contain proprietary information and any further confidential information made available to the recipient must be held in complete confidence and documents containing such information may not be reproduced, used or disclosed without the prior written consent of Impax.

The Document is not intended to be distributed in any jurisdiction where such distribution is not permitted by the local law.

EEA – The Document is only being made available to and is only directed at persons in member states of the EEA who are professionals, defined as Eligible Counterparties, or Professional Clients, as defined by the applicable jurisdiction. Under no circumstances should any information contained in this document be regarded as an offer or solicitation to deal in investments in any jurisdiction.

UK – The Document is only being made available to and is only directed at persons in the United Kingdom who are professionals, defined as Eligible Counterparties, or Professional Clients, within the meaning of the rules of the Financial Conduct Authority. Under no circumstances should any information contained in this Document be regarded as an offer or solicitation to deal in investments in any jurisdiction. In the United Kingdom, this material is a financial promotion and has been approved by Impax Asset Management Limited OR Impax Asset Management (AIFM) Limited, which is authorised and regulated in the United Kingdom by the Financial Conduct Authority.

Australia – This Document has been prepared and is being made available by Impax Asset Management Limited. Impax Asset Management Limited is exempt from the requirement to hold an Australian financial services license in respect of the financial services it provides to wholesale investors in Australia and is regulated by the Financial Conduct Authority of the United Kingdom under the laws of the United Kingdom which differ from Australian laws. This document is only to be made available to 'wholesale investors' under the Corporations Act 2001 (Cth) receiving this document in Australia. Impax Asset Management Limited is exempt from the requirement to hold an Australian financial services license by operation of ASIC Class Order 03/1099: UK FCA regulated financial service providers, as modified by ASIC Corporations (Repeal and Transitional) Instrument 2016/396.

Impax is trademark of Impax Asset Management Group Plc. Impax is a registered trademark in the UK, EU, US, Hong Kong, Canada, Japan and Australia. © Impax Asset Management LLC, Impax Asset Management Limited and/or Impax Asset Management (Ireland) Limited. All rights reserved.

Impax Asset Management makes its investment and related decisions pursuant to its independently determined policies and practices that seek to serve the risk management objectives and interests of its investors. Any and all engagement by Impax Asset Management with issuers and other market participants on sustainability issues are pursuant to, and consistent with, those independently determined policies and practices.

*CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

| Fund Name | SRI Style | SDR Labelling | Product | Region | Asset Type | Launch Date | Last Amended |

|

|---|---|---|---|---|---|---|---|---|

Impax Global Social Leaders Fund |

Social Style | Not eligible to use label (out of scope) | SICAV/Overseas | Global | Equity | 19/12/2023 | Sep 2025 | |

ObjectivesThe Impax Global Social Leaders Fund seeks to generate long-term capital growth. The strategy aims to enable investors to benefit from a portfolio of companies that provide products and services benefitting from long-term secular trends shaping society. Investments are made in companies which have 20% or more of their underlying revenue generated by providing products and services to improve quality of life, broaden economic participation, and meet basic needs. A quantitative framework also defines the investable universe for this strategy by identifying businesses which show indications of strong corporate culture correlated with stock price outperformance, including low employee turnover, gender-diverse leadership and inclusive business practices. |

Fund/Portfolio Size: £12.60m (as at: 31/03/2025) Total Screened Themed SRI Assets: £25332.00m (as at: 31/03/2025) Total Assets Under Management: £25332.00m (as at: 31/03/2025) ISIN: IE0008C8W7Z6, IE0006JCJGB8, IE0007D6Y842, IE000B3ZUCL8, IE0002OPDCG0, IE000KXZX349, IE0000ZB1O31, IE0007B0F168 Contact Us: clientservices@impaxam.com |

|||||||

Sustainable, Responsible &/or ESG OverviewImpax believes that the growth opportunities from long-term societal secular trends such as ageing populations, rising middle class in emerging markets, increased incidence of chronic disease, urbanization, and financial inclusivity, are being underestimated by the market. Impax believes companies with inclusive, innovative, and equitable cultures outperform over time; however, the market typically ignores culture in favour of more easily valued metrics. The investment process has been built to exploit these market inefficiencies, which arise predominantly due to the short-term thinking of most market participants, to drive long-term outperformance compared to a broad benchmark (MSCI ACWI). |

||||||||

|

Primary fund last amended: Sep 2025 |

||||||||

|

Information received directly from Fund Manager |

||||||||

|

Please select what you would like to read:

Fund FiltersSustainability - General

Sustainability policy

Has policies that consider (environmental and social) sustainability issues. Strategies vary but are likely to consider environmental issues like climate change, carbon emissions, biodiversity loss, resource management, environmental impacts; and social issues like equal opportunities, human rights, labour standards, diversity and adherence to internationally recognised codes. See individual entry information.

Sustainability focus

Has a significant focus on sustainability issues

Sustainable transport policy or theme

Has documented policies or thematic investment approaches supporting investment in more sustainable, greener transport methods. These will typically set out a preference for companies that run, enable or support more sustainable methods of transport.

Encourage more sustainable practices through stewardship

Aim to encourage higher sustainability standards through responsible ownership / stewardship / engagement / voting activity

UN Global Compact linked exclusion policy

Use the UN Global Compact to inform or help direct where they can or cannot invest. Will typically not invest in companies with significant breaches (low standards) - strategies vary. (The UNGC covers a wide range of issues - search 'UNGC'). See https://unglobalcompact.org/

Report against sustainability objectives

Publicly report performance against named sustainability objectives

Circular economy theme

Has a theme or investment strand focused on the shift to a circular economy - where products are reused and recycled not incinerated or dumped. See eg https://www.ellenmacarthurfoundation.org/topics/circular-economy-introduction/overview Environmental - General

Environmental policy

Has policies which relate to environmental issues. These will typically set out their stance on issues such as pollution, climate change, resource management, biodiversity loss, carbon emissions, plastics and/or additional environmental impacts. Strategies vary.

Resource efficiency policy or theme

Has a policy or theme that relates to managing natural resources more efficiently. Strategies vary. See individual entry information.

Favours cleaner, greener companies

Aims to invest in companies with strong or market leading environmental policies and practices. Strategies vary. See individual entry information for more detail. Nature & Biodiversity

Biodiversity / nature policy

Has a written biodiversity policy or theme typically aimed at supporting, encouraging and improving environmental protection and safeguarding the natural world (sometimes referred to as 'natural capital'). See eg https://www.un.org/en/climatechange/science/climate-issues/biodiversity Climate Change & Energy

Climate change / greenhouse gas emissions policy

Has policies (documented strategies that explain their position) on climate change related issues such as greenhouse gas/carbon emissions, net zero, transitioning to lower carbon. Strategies vary.

Coal, oil & / or gas majors excluded

Avoid investment in major coal, oil and/or gas (extraction) companies. Strategies vary.

Fracking and tar sands excluded

Avoid companies involved in fracking and tar sands - which are widely regarded as controversial methods of oil and gas extraction. Strategies vary.

Arctic drilling exclusion

Avoid companies that are involved in extracting oil from the Arctic regions.

Encourage transition to low carbon through stewardship activity

Encourage the transition to lower carbon activities through asset selection and / or responsible ownership activity.

Energy efficiency theme

Has an energy efficiency theme - typically meaning that the manager is focused on investing in organisations that manage - or help others to manage - energy use more carefully and less wastefully - and so reduce greenhouse gas emissions.

Invests in clean energy / renewables

Invest in renewable energy companies and / or companies where renewable energy is a significant part of their business. Strategies vary.

Nuclear exclusion policy

Has a policy which describes the avoidance or limited investment in the nuclear industry. Strategies vary.

Fossil fuel exploration exclusion - direct involvement

Excludes companies and other assets with direct involvement in fossil fuel exploration (eg coal, oil and gas companies)

Require net zero action plan from all/most companies

Requires all, or most of, the assets they invest in to have a ‘net zero action plan’ - describing how they will reduce their greenhouse gas emissions.

TCFD / IFRS reporting requirement

Will only invest in companies that report greenhouse gas emissions in line with this international reporting framework. See https://www.fsb-tcfd.org/ https ://www.ifrs.org/sustainability/tcfd/ Social / Employment

Favours companies with strong social policies

Aims to invest in assets with high social values - this may include strong human rights, labour standards and equal opportunities or safety related practices.

Health & wellbeing policies or theme

Has policies or themes that set out their approach to health and wellbeing issues, typically aims to invest in companies with high standards - or encourage high standards. Ethical Values Led Exclusions

Tobacco and related products - avoid where revenue > 5%

Companies are excluded if they make more than 5% of their revenue from the manufacture, sale or distribution of tobacco products including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Controversial weapons exclusion

Excludes companies which make controversial weapons such as landmines, cluster munitions and chemical weapons. Human Rights

Human rights policy

Has policies relating to human rights issues. Typically require companies to demonstrate higher standards, although some managers work to encourage improvements. Investee companies are often judged against internationally agreed norms or standards. Strategies vary.

Child labour exclusion

Has policies to avoid companies that employ children.

Oppressive regimes (not free or democratic) exclusion policy

Has policies that exclude companies or other assets which operate in, or are owned by regimes which are not democratic, or where people may be oppressed. May use eg. Freedom House research. Strategies vary.

Modern slavery exclusion policy

Has a policy which excludes assets with involvement in Modern Slavery Meeting Peoples' Basic Needs

Green infrastructure focus

Focuses on (ie directs a significant proportion of its investment towards) green infrastructure, eg the clean energy supply chain.

Responsible food production or agriculture theme

Has a responsible food production or agriculture theme or strand of investment. May have a single or many themes.

Healthcare / medical theme

Healthcare and or medical theme or area of investment - may have a single or many themes Gilts & Sovereigns

Does not invest in sovereigns

Does not invest in / excludes 'sovereigns' - debt issued by governments. See eg https://www.investopedia.com/terms/s/sovereign-debt.asp Governance & Management

UN sanctions exclusion

Exclude companies that are subject to United Nations sanctions. See eg https://main.un.org/securitycouncil/en/content/un-sc-consolidated-list

Encourage board diversity e.g. gender

Encourage the companies they invest in to have more diverse board structures (e.g. more women on boards)

Encourage higher ESG standards through stewardship activity

Aim to encourage higher ESG standards through responsible ownership / stewardship / engagement /voting activity Impact Methodologies

Positive social impact theme

Specifically states that they aim to deliver positive social (i.e. people related) impacts and/or outcomes.

Invests in social solutions companies

Invest in companies where a major part of their business is specifically aimed at helping to address social challenges. e.g. companies helping to address poverty.

Publish ‘theory of change’ explanation

Policy explains the ways in which the manager believes things need to change in order to deliver a more sustainable future, which they are working to help achieve. How The Fund/Portfolio Works

Significant harm exclusion

Aims to avoid companies that do significant harm. This originates from the EU’s sustainable finance ‘DNSH’ (do no significant harm) work, which is not necessarily used by UK investors.

Assets mapped to SDGs

Invests in assets which can be 'mapped' (reviewed) their investment selection and management strategies to identify which of the UN Sustainable Development Goals (SDGs) the fund is helping to address.

Combines norms based exclusions with other SRI criteria

Investment selection process uses internationally agreed 'norms' (e.g. United Nations Global Compact - UNGC - or the UN Sustainable Development Goals - SDGs) alongside additional SRI criteria such as positive or negative stock selection policies and/or stewardship strategies.

Focus on ESG risk mitigation

Focuses on the careful management of environmental, social and governance (ESG) related risks - typically by avoiding or being underweight in companies seen as posing major risks in these areas (i.e. not necessarily by using themes, exclusions etc).

SRI / ESG / Ethical policies explained on website

Publish explanations of their ethical, social and/or environmental policies online (i.e. investment decision making strategies/ buy/sell &/or asset management strategies).

Do not use stock / securities lending

Does not use stock lending for performance or risk purposes. Unscreened Assets & Cash

Assets typically aligned to sustainability objectives 70 - 79%

Holds between 70-79% of assets which align to the sustainability objectives; which are not being held purely for risk management purposes, such as derivatives and cash equivalent assets.

Assets typically aligned to sustainability objectives 80 – 89%

Holds between 80-89% of assets which align to the sustainability objectives; which are not being held purely for risk management purposes, such as derivatives and cash equivalent assets.

Assets typically aligned to sustainability objectives > 90%

Holds at least 90% of assets which align to the sustainability objectives; which are not being held purely for risk management purposes, such as derivatives and cash equivalent assets.

No ‘diversifiers’ used other than cash

Only invests in cash to aid the practical management (buying and selling) of assets and so do not use additional financial instruments. Intended Clients & Product Options

Intended for investors interested in sustainability

Designed to meet the needs of individual investors with an interest in sustainability issues.

Intended for clients interested in ethical issues

Designed for clients who care about ethical and values-based issues, often alongside sustainability issues also. Labels & Accreditations

SFDR Article 9 fund / product (EU)

Find options classified under Article 9 of the EU’s SFDR (Sustainable Finance Disclosure Requirements). Article 9 of the SFDR applies to financial products that have sustainable investment 'objectives' - including emissions reduction objectives. (These may currently be referred to as 'impact' funds or aiming to deliver clear, specific positive outcomes.) These rules do not currently apply in the UK so product managers may leave this field blank. Fund Management Company InformationAbout The Business

Boutique / specialist fund management company

Find fund management companies that are smaller or specialise in particular areas - notably, ideally ESG related. Strategies vary.

Specialist positive impact fund management company

Find fund management companies (or subsidiaries) that specialise in - or focus entirely on - investing in assets that are helping to deliver positive environmental and / or social impacts.

Responsible ownership / stewardship policy or strategy (AFM company wide)

Finds fund management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

ESG / SRI engagement (AFM company wide)

Find fund management companies that actively encourage higher 'environmental, social and governance' and/or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Vote all* shares at AGMs / EGMs (AFM company wide)

Find fund managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Responsible ownership / ESG a key differentiator (AFM company wide)

Find fund managers that consider responsible ownership and ESG to be a key differentiator for their business.

Senior management KPIs include environmental goals (AFM company wide)

The leadership team of this asset manager have performance targets linked to environmental goals.

Integrates ESG factors into all / most (AFM) fund research

Find fund management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management.

In-house diversity improvement programme (AFM company wide)

Finds organisations / fund managers that have an in-house (company wide) diversity improvement programme - meaning that they are working to ensure that within their own businesses they employ people from diverse backgrounds - often typically focused on ethnicity and/or sex.

Diversity, equality & inclusion engagement policy (AFM company wide)

Find fund management companies that encourage the companies they invest in to have strong diversity, race, gender and other equality policies across all assets held, not simply screened or themed SRI/ESG funds. (ie Asset Management company wide).

Invests in new sustainability linked bond issuances (AFM company wide)

Asset management company has investments in bonds designed to meet sustainability requirements - however these assets may not be 'ringfenced' for this purpose. See fund manager website for details. Collaborations & Affiliations

PRI signatory

Find fund management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

UKSIF member

Find fund management companies that are members of UKSIF - the UK Sustainable Investment and Finance association

TNFD forum member (AFM company wide)

A member of the Taskforce for Nature Related Financial Disclosures group which aims to aid risk management and shift money towards nature-positive outcomes.

Investment Association (IA) member

Fund management entity is a member of the Investment Association https://www.theia.org/ Resources

In-house responsible ownership / voting expertise

Find fund management companies that employ people to steer and support fund managers in voting shares at company AGM's and EGMs in ways that are consistent with encouraging higher ESG/sustainability standards.

Employ specialist ESG / SRI / sustainability researchers

Find a fund management company that directly employs specialist ESG/SRI/sustainability researchers or analysts. This allows asset managers to discuss environmental, social and governance risks and opportunities directly with companies.

Use specialist ESG / SRI / sustainability research companies

Find fund management companies that makes use of expert external research companies. This can help deliver specialist expertise and means resources are pooled with other investors.

ESG specialists on all investment desks (AFM company wide)

Finds organisations / fund managers that have one or more ESG/sustainability experts on all investment teams or 'desks' (all asset types) Accreditations

PRI A+ rated (AFM company wide)

Finds organisations / fund managers that have an A+ PRI rating - meaning they are highly rated according to the 'Principles of Responsible Investment'

UK Stewardship Code signatory (AFM company wide)

Find fund managers that are signatories to the FRC UK Stewardship Code, which sets out a framework for constructive investor / investee relations where fund managers are encouraged to behave like responsible, typically longer term 'company owners'. Engagement Approach

Regularly lead collaborative ESG initiatives (AFM company wide)

Find fund management companies that regularly initiate or run industry wide (collaborative) investor projects aimed at raising environmental, social and governance standards amongst investee companies.

Encourage responsible corporate taxation (AFM company wide)

Find fund management companies that are working with the companies they invest in to encourage more responsible corporate taxation.

Engaging on climate change issues

Fund manager has stewardship /responsible ownership strategy that is focused on addressing climate change with investee assets.

Engaging with fossil fuel companies on climate change

Asset manager has a stewardship /responsible ownership strategy that involves working with fossil fuel companies on climate change related issues. See fund manager website for details.

Engaging to reduce plastics pollution / waste

Asset manager has stewardship /responsible ownership strategy with involves encouraging investee asset to reduce plastic waste and pollution.

Engaging on biodiversity / nature issues

The asset manager has a responsible ownership / stewardship strategy that focuses on biodiversity and nature issues relating to the assets they invest the aim of which will be to reduce harm and or deliver improvement. Strategies vary. https://tnfd.global

Engaging to encourage a Just Transition

Asset manager has a responsible ownership / stewardship strategy which means they are working to encourage the shift to more sustainable business practices in ways that respect and are sensitive to social issues and the impact change has on people effected by the changes that are taking place. https://www.transitionpathwayinitiative.org/ https://transitiontaskforce.net/

Engaging on human rights issues

Asset manager has responsible ownership / stewardship strategy in place which aims to address human rights issues in investee companies (and potentially their suppliers) with the aim of raising standards

Engaging on labour / employment issues

Asset manager has responsible ownership / stewardship strategy in place that aims to improve labour standards for the benefit of employees in investee companies (and potentially their suppliers)

Engaging on diversity, equality and / or inclusion issues

Asset management company has a stewardship strategy in place which involves working to raise diversity, equality and inclusion standards across investee assets

Engaging to stop modern slavery

working with the assets they hold to help stamp out modern slavery - where direct or indirect company employees are exploited for business benefits.

Engaging on governance issues

Fund managers have stewardship strategies in place that focus on improving governance standards across investee assets

Engaging on mental health issues

Asset manager has stewardship strategy in place which involves discussing mental health issues with investee companies - with the aim of raising standards

Engaging on responsible supply chain issues

Has a stewardship / responsible ownership strategy that encourages responsible supply chain - ie the managers will discuss environmental, social and governance issues with investee companies with the aim of raising standards

Engaging on the responsible use of AI

Working to address sustainability, ESG and related concerns around artificial intelligence.

Stewardship escalation policy

Escalation policies describe how a manager will proceed if stewardship / engagement activity is not successful in the short term. Company Wide Exclusions

Controversial weapons avoidance policy (AFM company wide)

Find fund management companies (not funds) that avoid investment in 'controversial weapons' across all of their funds and other investment vehicles.

Review(ing) carbon / fossil fuel exposure for all funds (AFM company wide)

Find funds / fund managers that are reviewing, or have reviewed, their exposure to carbon intensive industries including (but not only) mining, oil and gas companies. (Typically with reference to climate change.) Climate & Net Zero Transition

Net Zero commitment (AFM company wide)

Fund management organisations that have pledged to reduce their greenhouse gas emissions to ‘net zero’. Strategies vary - this area is changing rapidly.

Voting policy includes net zero targets (AFM company wide)

Fund manager AGM / EGM voting strategy has processes in place that mean they will normally be expected to vote in a way that will encourage the transition to net zero greenhouse gas emissions.

Net Zero - have set a Net Zero target date (AFM company wide)

This asset management company has set a date by which they plan to achieve net zero greenhouse gas / CO2e emissions.

Encourage carbon / greenhouse gas reduction (AFM company wide)

Find fund management companies that are working with the companies they invest in to encourage reductions in carbon dioxide and other greenhouse gas emissions.

Carbon transition plan published (AFM company wide)

Finds organisations / fund managers that have a company wide carbon transition plan - meaning that they have plotted a path to how they will move away from activities that produce or use carbon based energy sources (that emit greenhouse gases) towards clean, alternative, renewable energy sources.

‘Forward Looking Climate Metrics’ published / ITR (AFM company wide)

Finds organisations / fund managers that have published ‘forward looking climate metrics’ e.g. 'implied temperature rise' data that are a total of the asset management company's share (% owned) of all the investee company emissions of the assets they manage, as well as their own direct and other indirect emissions.

Carbon offsetting – do NOT offset carbon as part of net zero plan (AFM company wide)

This asset management company plans to achieve net zero greenhouse gas (CO2e) emissions by reducing their emissions. Calculations and scope vary.

In-house carbon / GHG reduction policy (AFM company wide)

Find fund management companies that are working to reduce their own (fund management company) carbon/greenhouse gas emissions.

Working towards a ‘Net Zero’ commitment (AFM company wide)

Finds organisations / fund management companies that are in the process of working out how to make a ‘net zero commitment’ - meaning that when that is finalised they will have started the process of reducing their total greenhouse gas emissions to'zero'. Transparency

Publish responsible ownership / stewardship report (AFM company wide)

Find fund management companies that publish a report detailing their responsible investment ownership - also known as 'Stewardship' - activity.

Full SRI / responsible ownership policy information on company website

Find companies that publish information about their sustainable and responsible investment strategies on their company website.

Publish full voting record (AFM company wide)

Fund management companies that publish a full record of how they vote their shares at AGMs (annual general meetings) and EGMs (extraordinary general meetings). Voting strategies have an important role to play encouraging higher environmental, social and governance standards.

Paris Alignment plan publicly available (AFM company wide)

This asset management company has published a plan that explains how they will align to the climate change commitments made at the Paris Climate Talks, COP21.

Net Zero transition plan publicly available (AFM company wide)

This asset management company has published a plan that explains how they are going to achieve net zero greenhouse gas / CO2e emissions.

Dialshifter statement