Janus Henderson Global Responsible Managed Fund

SRI Style:

Ethical Style

SDR Labelling:

Unlabelled with sustainable characteristics

Product:

OEIC

Fund Region:

Global

Fund Asset Type:

Multi Asset

Launch Date:

24/10/2000

Last Amended:

Jun 2025

Dialshifter ( ):

):

Fund Size:

£531.95m

(as at: 31/03/2025)

Total Screened Themed SRI Assets:

£5960.22m

(as at: 31/03/2025)

Total Responsible Ownership Assets:

£240849.95m

(as at: 31/03/2025)

Total Assets Under Management:

£289122.57m

(as at: 31/03/2025)

ISIN:

GB00B4LMJ388, GB0031833402, GB00BJ0LFW26, GB0034219989

Objectives:

This Fund does not have a UK sustainable investment label as it does not have a specific Sustainability Goal, but it does include environmental and social factors in its investment process in a binding manner beyond the integration of financially material sustainability risks. For further information please refer to the consumer facing disclosure here.

The Fund aims to provide capital growth over the long term (5 years or more). For more details on the Fund’s investment objectives please refer to the Fund’s website here.

As an additional means of assessing the performance of the Fund, its Composite Index (50% MSCI World ex UK, 25% FTSE All-Share Index, 12.5% Bloomberg Barclays Global Aggregate Corporate Unhedged GBP, and 12.5% Bloomberg Barclays Sterling Aggregate Unhedged GBP), which is broadly representative of the mix of assets to which the Fund is typically exposed may also provide a useful comparator.

Sustainable, Responsible

&/or ESG Overview:

The Fund seeks a responsible approach to investing in the shares and bonds of global companies by incorporating environmental, social, and governance (ESG) factors in investment decisions and by avoiding companies, through the application of exclusionary screens (in some cases subject to thresholds), that the investment manager considers to be involved in business activities and behaviours that may be environmentally and/ or socially harmful.

The investment manager seeks to identify companies with attractive long-term business models offering the potential for good capital returns over the long term. The equity element of the Fund consists of one underlying allocation of UK equities and one underlying allocation of global equities. The allocation of global equities will invest in companies that derive at least 50% of their revenues from products and services that are considered by the investment manager as contributing to positive environmental or social change and thereby have an impact on the development of a sustainable global economy.

Primary fund last amended:

Jun 2025

Information directly from fund manager.

Fund Filters

Sustainability - General

Find funds that use the UN Global Compact to inform or help direct where they can or cannot invest and will typically not invest in companies with significant breaches (low standards) - although strategies vary. (The UNGC covers a wide range of issues - search 'UNGC'). See https://unglobalcompact.org/

Environmental - General

Funds that limit or 'reduce' their exposure to carbon intensive industries (ie sectors which are major contributors to climate change. Funds vary - some funds may be 'underweight' in this area which means they may have some investment in highly carbon intensive areas. Funds of this kind may choose companies they consider to be 'best in sector' and encourage ever higher standards. Strategies vary. See fund information for further details.

Funds that have written policies explaining the approach they take when companies damage the environment or are significant polluters. Funds of this kind may work with companies to encourage higher standards, or exclude companies - sometimes dependent on the situation. Strategies vary. See fund information for further detail.

Climate Change & Energy

Funds that have policies (documented strategies that explain their position on) climate change related issues such as greenhouse gas/carbon emissions, net zero, transitioning to lower carbon. Strategies vary. Read fund details for further information.

Funds that avoid investing in major coal, oil and/or gas (extraction) companies. Funds vary: some may exclude all companies that extract oil. Others may have exposure to oil extraction via more diversified energy companies. See fund literature to confirm details.

Funds that avoid companies involved in fracking and tar sands - which are widely regarded as controversial methods of oil and gas extraction. Strategies vary. See fund information for further information.

Funds that avoid investing in companies with coal, oil and gas reserves. See fund information for further details.

A core element of these funds will aim to encourage the transition to lower carbon activities through responsible ownership / stewardship / engagement / voting activity

Find funds that have policies which say they avoid or limit their investment in the nuclear industry. Strategies vary. See fund information for further detail.

The fund manager excludes companies with direct involvement in fossil fuel exploration (eg coal, oil and gas companies)

The fund manager excludes companies with indirect involvement in fossil fuel exploration. For example they would be expected to exclude banks and insurance companies that are effectively enabling new coal, oil and or gas reserves to be discovered and in due course extracted through the provision of necessary finance or services.

Will only invest in companies that report greenhouse gas emissions reduction strategies in line with the framework set out the by the Taskforce for Climate Related Financial Disclosure, which is increasingly becoming mandatory. See https://www.fsb-tcfd.org/ https ://www.ifrs.org/sustainability/tcfd/

Social / Employment

Find funds that have a labour standards policy - which can be expected to mean that the fund will invest in / favour companies that have higher standards in this area - although fund strategies can vary significantly (as with all policy areas). See eg https://www.ilo.org/international-labour-standards

All mining companies excluded

Ethical Values Led Exclusions

Companies are excluded if they are involved in any aspect of the production chain for tobacco products, including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Companies are excluded if they make more than 5% of their revenue from the manufacture, sale or distribution of tobacco products including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Find funds that exclude companies which make controversial weapons such as landmines, cluster munitions and chemical weapons. See fund literature for further information.

Find funds that avoid companies that manufacture products intended specifically for military use. Fund strategies vary - particularly with regard to non-strategic military products. See fund literature for fund specific details.

Find funds with a written civilian firearms exclusion policy - meaning that they will not invest in companies that make (or perhaps also sell) handguns made for non-military users.

Find funds that avoid investment in companies involved in the production of alcohol. Strategies vary; some funds allow a small proportion of profits to come from this area. See fund literature for further information.

Find funds that avoid companies with significant involvement in the gambling industry. Some funds may allow a small proportion of profits to come from this area. See fund policy for further details.

Find funds that avoid companies that derive significant income from pornography and related areas. Strategies vary. See fund details for further information.

Find funds that avoid companies that test their products on animals for purposes other than medical benefit (e.g. for cosmetics). Strategies vary. See fund literature for further information.

Human Rights

Find funds that have policies relating to human rights issues. Funds of this kind typically require companies to demonstrate higher standards, although some fund managers work to encourage improvements. Investee companies are often judged against internationally agreed norms or standards. Strategies vary. See fund information for further detail.

Find funds that have policies in place to ensure they do not invest in companies that employ children.

Find funds with policies that exclude companies or other assets where regimes are not democratic, or where people may be oppressed. May use eg. Freedom House research. Strategies vary. See fund literature for further information.

Gilts & Sovereigns

Find funds that invest in loans issued the government, commonly known as gilts or government bonds. These may or may not be ringfenced for specific projects (see additional options). See fund literature for any selection criteria.

Find funds that avoid investing in 'some' gilts or government bonds. Strategies vary, but this may relate to avoiding specific countries or particular reasons for bond issuance. 'Green gilts' for example would be likely to be acceptable. See fund literature for further information.

Find funds that invest in financial instruments issued by governments, but will only hold those that meet certain environmental and or social criteria. This may, for example mean certain assets are excluded in line with eg Freedom House research. Strategies vary, see fund literature for more information.

Banking & Financials

Find funds that include banks as part of their holdings / portfolio.

Finds funds that include financial instruments (cash, derivatives and / or foreign exchange) issued by banks. See fund literature for further information as strategies vary.

Funds that do or may invest in insurance companies.

Governance & Management

Find fund options that have policies that relate to corporate governance issues such as board structure, executive remuneration, bribery and/or corporate corruption. These funds will typically avoid companies with poor practices. Strategies vary. See fund literature for further information.

Find funds that aim to avoid investing in companies with poor governance practices.(e.g. board structure, management practices etc.) Views may however vary on what counts as 'poor' practices - and funds may not immediately divest as they may prefer to work to encourage higher standards. See fund literature for further information.

Exclude companies that are subject to United Nations sanctions. See eg https://main.un.org/securitycouncil/en/content/un-sc-consolidated-list

Find funds that have policies explaining how managers will respond to assets / companies that do not comply with relevant anti-bribery and anti-corruption standards or laws. Strategies vary; options include stewardship/ engagement and divestment - or a combination. See fund literature for further information.

Fund managers encourage the companies they invest in to have more diverse board structures (e.g. more women on boards)

A core element of these funds will aim to encourage higher ESG standards through responsible ownership / stewardship / engagement /voting activity

Fund Governance

Find funds that factor in 'environmental, social and governance' issues as part of their investment decision making process. A focus on 'ESG' typically means a fund is carrying out additional research to help reduce ESG related risks. It does not necessarily mean a focus on sustainability. Strategies vary. See fund literature.

Asset Size

Find a fund that invests in a combination of small, medium and larger (potentially multinational)companies.

International entities or bodies with agreed remits that are broadly similar to those that may otherwise be undertaken by individual governments eg the UN

Targeted Positive Investments

Find funds that invest >25% of their capital towards companies where a major part of their business is focused on helping to address environmental or social challenges.

Find funds that invest >50% of their capital in companies where a major part of their business is focused on helping to address environmental or social challenges.

Impact Methodologies

Find funds that direct investment towards companies where a major part of their business is about solving environmental challenges. e.g. companies helping to address climate change.

Find funds that invest in companies where a major part of their business is specifically aimed at helping to address social challenges. e.g. companies helping to address poverty.

Fund aims to deliver positive environmental and or social impacts (real world benefits) through its engagement with investee assets

50% of fund assets are regarded by the fund manager as being significantly focused on providing solutions to environmental or social challenges. Strategies vary.

How The Fund Works

Find funds that focus on finding and investing in companies with positive / beneficial attributes. This strategy can be applied in addition to exclusion criteria and engagement/stewardship activity.

Find funds where their main 'ethical approach' is to avoid companies by using negative screening criteria. Read fund literature for further information.

Find funds that invest more heavily in those that have higher ESG ratings/standards or scores and less heavily in companies with lower ESG ratings. Where this is central to a fund's strategy you should expect it to invest in most sectors. Strategies vary.

Aims to avoid companies that do significant harm. This originates from the EU’s sustainable finance ‘DNSH’ (do no significant harm) work, which is not necessarily used by UK investors.

Find funds that make significant use of internationally agreed 'norms' (e.g. United Nations Global Compact - UNGC - or the UN Sustainable Development Goals - SDGs) as part of their investment selection process alongside additional SRI criteria such as positive or negative stock selection policies and/or stewardship strategies.

Find funds that have an ESG strategy (which is typically focused on avoiding companies that pose environmental, social or governance related risks) with additional criteria such as positive and/or negative screens, themes and stewardship strategies.

Find funds that use internationally agreed standards, conventions and 'norms' to help direct where the fund can and cannot invest (e.g. the UN Global Compact, UN Sustainable Development Goals). Read fund literature for further information.

A major focus of these funds is the careful management of environmental, social and governance (ESG) related risks - typically by avoiding or being underweight in companies seen as posing major risks in these areas (i.e. not necessarily by using themes, exclusions etc).

Find funds that have published explanations of their ethical, social and/or environmental policies online (i.e. fund decision making strategies/ buy/sell &/or asset management strategies).

This fund does not use stock lending for performance or risk purposes.

Unscreened Assets & Cash

The percentage of assets held within the fund that match the fund’s sustainability objectives and are not being held purely for risk management purposes, such as derivatives and cash equivalent assets.

The percentage of assets held within the fund that match the fund’s sustainability objectives and are not being held purely for risk management purposes, such as derivatives and cash equivalent assets.

The percentage of assets held within the fund that match the fund’s sustainability objectives and are not being held purely for risk management purposes, such as derivatives and cash equivalent assets

Intended Clients & Product Options

Finds funds designed to meet the needs of individual investors with an interest in sustainability issues.

Find funds designed for clients who care about ethical and values-based issues, often alongside sustainability issues also.

Find funds that are available via a tax efficient ISA product wrapper.

Fund Management Company Information

About The Business

Finds fund management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

Find fund management companies that actively encourage higher 'environmental, social and governance' and/or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Find fund managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Find fund managers that consider responsible ownership and ESG to be a key differentiator for their business.

The leadership team of this asset manager have performance targets linked to environmental goals.

Find funds run by fund managers that apply Responsible ownership or 'Stewardship' policies to all or most of their investment assets. This means active involvement (e.g. voting, dialogue) with the companies they invest in across funds (not normally limited to ethical or SRI options.) Read fund literature for further information.

Find fund management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management.

Finds organisations / fund managers that have an in-house (company wide) diversity improvement programme - meaning that they are working to ensure that within their own businesses they employ people from diverse backgrounds - often typically focused on ethnicity and/or sex.

This asset management company invests in companies which have recently listed on a stock exchange (which is important as it can help grow new businesses).

Fund management entity offers unstructured intermediary training on sustainable investment (ie for financial advisers and wealth managers)

Fund management entity offers unstructured intermediary training on sustainable investment (ie for financial advisers and wealth managers)

Collaborations & Affiliations

Find fund management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

Find fund management companies that are members of UKSIF - the UK Sustainable Investment and Finance association

A member of the Taskforce for Nature Related Financial Disclosures group which aims to aid risk management and shift money towards nature-positive outcomes.

Fund management entity is a member of the Investment Association https://www.theia.org/

Resources

Find fund management companies that employ people to steer and support fund managers in voting shares at company AGM's and EGMs in ways that are consistent with encouraging higher ESG/sustainability standards.

Find a fund management company that directly employs specialist ESG/SRI/sustainability researchers or analysts. This allows asset managers to discuss environmental, social and governance risks and opportunities directly with companies.

Find fund management companies that makes use of expert external research companies. This can help deliver specialist expertise and means resources are pooled with other investors.

Accreditations

Find fund managers that are signatories to the FRC UK Stewardship Code, which sets out a framework for constructive investor / investee relations where fund managers are encouraged to behave like responsible, typically longer term 'company owners'.

Engagement Approach

Find fund management companies that regularly initiate or run industry wide (collaborative) investor projects aimed at raising environmental, social and governance standards amongst investee companies.

Find fund management companies that are working with the companies they invest in to encourage more responsible corporate taxation.

Fund manager has stewardship /responsible ownership strategy that is focused on addressing climate change with investee assets.

Asset manager has stewardship /responsible ownership strategy with involves encouraging investee asset to reduce plastic waste and pollution.

Asset manager has a stewardship / responsible ownership policy that means they are working to encourage more responsible mining practices - where environmental and social issues are properly dealt with by the companies they invest in.

The asset manager has a responsible ownership / stewardship strategy that focuses on biodiversity and nature issues relating to the assets they invest the aim of which will be to reduce harm and or deliver improvement. Strategies vary. https://tnfd.global

Asset manager has responsible ownership / stewardship strategy in place which aims to address human rights issues in investee companies (and potentially their suppliers) with the aim of raising standards

Asset manager has responsible ownership / stewardship strategy in place that aims to improve labour standards for the benefit of employees in investee companies (and potentially their suppliers)

Asset management company has a stewardship strategy in place which involves working to raise diversity, equality and inclusion standards across investee assets

working with the assets they hold to help stamp out modern slavery - where direct or indirect company employees are exploited for business benefits.

Fund managers have stewardship strategies in place that focus on improving governance standards across investee assets

Has a stewardship / responsible ownership strategy that encourages responsible supply chain - ie the managers will discuss environmental, social and governance issues with investee companies with the aim of raising standards

Working to address sustainability, ESG and related concerns around artificial intelligence.

Company Wide Exclusions

Find fund management companies (not funds) that avoid investment in 'controversial weapons' across all of their funds and other investment vehicles.

Find funds / fund managers that are reviewing, or have reviewed, their exposure to carbon intensive industries including (but not only) mining, oil and gas companies. (Typically with reference to climate change.)

Climate & Net Zero Transition

Find fund management companies that are working with the companies they invest in to encourage reductions in carbon dioxide and other greenhouse gas emissions.

This asset management company plans to achieve net zero greenhouse gas (CO2e) emissions with the help of a scheme that will lock away an amount of carbon that is equivalent to the company’s own emissions – so that the end result is ‘net zero’. Calculations and scope vary.

Find fund management companies that are working to reduce their own (fund management company) carbon/greenhouse gas emissions.

Transparency

Find fund management companies that publish a report detailing their responsible investment ownership - also known as 'Stewardship' - activity.

Find companies that publish information about their sustainable and responsible investment strategies on their company website.

Find fund management companies that will supply information about their sustainable and responsible investment activity on request.

Fund management companies that publish a full record of how they vote their shares at AGMs (annual general meetings) and EGMs (extraordinary general meetings). Voting strategies have an important role to play encouraging higher environmental, social and governance standards.

Comments

Please note:

Invests in sovereigns subject to screening criteria - The Fund invests in G7 sovereigns only.

Invests in financial instruments issued by banks - We invest in corporate bonds issued by banks.

Positive selection bias - For Global sub-portfolios only.

Sustainable, Responsible &/or ESG Policy:

Head of Global Sustainable Equities Hamish Chamberlayne, CFA, Andrew Jones, James Briggs, ACA, CFA, and Brad Smith are the co-portfolio managers of the Fund. The Fund consists of three sub-portfolios: global equities managed by Hamish, UK equities managed by Andrew, and a fixed income sub-portfolio managed by James and Brad.

The portfolio management team work closely with the broader Global Sustainable Equities Team and with the firm’s Responsible Investment and Governance Team, part of the central Responsibility Team.

The Responsible Investment and Governance Team focuses on ESG data analysis and research, governance, ESG company and thematic engagement, proxy voting and advisory services that serves as a resource for all our investment desks. The team delivers ESG training, support on developing frameworks to identify financial material ESG issues, planning and conducting engagements, supporting research on ESG issues that can impact cash flows or valuation, and advising on proxy voting.

Key differentiators

Diversified multi-asset portfolio with an attractive risk-return profile and clear exclusionary criteria

The Global Responsible Managed Fund provides clients with exposure to a blend of equities and bonds that is diversified in terms of geography, sectors, themes, and style. The Fund operates a three sub-portfolio approach covering global equities, UK equities and fixed income. This mix of assets gives the Fund the potential to outperform in a variety of market conditions and is an option for clients not wanting full exposure to equity market volatility.

Environmental & social avoidance criteria and ESG investment framework

Since inception, the Fund has applied strict avoidance criteria to avoid companies involved in business activities that may be environmentally and/or socially harmful. ESG considerations are integral to the investment philosophy and process, from universe definition and idea generation through to fundamental analysis, engagement, and portfolio management. For more information on the Fund’s most material and quantifiable ESG key performance indicators (KPIs) please refer to the Fund’s latest Annual ESG Report - Annual ESG, Sustainability and Climate Report.

Low carbon characteristics

As a result of the Fund’s responsible investment approach, the Fund’s carbon characteristics, such as carbon footprint and carbon intensity, will be lower than if this approach was not applied.

Diversified by style and theme

The global equity sub-portfolio provides investors with exposure to the global growth characteristics and positive investment themes of the Janus Henderson Global Sustainable Equity strategy (the “strategy’). The UK equity sub-portfolio provides exposure to the UK Responsible Income strategy with a focus on free cash flow generation, dividend yield and, dividend growth within a valuation framework. Finally, the fixed income sub-portfolio helps dampen the Fund’s volatility and offers exposure to themes such as social housing and infrastructure that are harder to access through public equity markets.

Long history of sustainable investing with a highly experienced investment team

Janus Henderson Investors (“Janus Henderson” or the “firm” or “JHI”) has a long and successful track record in the consistent application of a sustainability framework – the first sustainable strategy was launched in 1991 and Andrew and Hamish have been involved in the management of this Fund since 2012 and 2013 respectively. The Fund itself is over 20 years old with a strong track record of producing attractive risk adjusted returns for clients*.

*Past performance does not predict future returns.

The Fund consists of three investment sub-portfolios: global equities, UK equities, and fixed income.

The global equities sub-portfolio provides investors with exposure to the global growth characteristics and positive investment themes of the Janus Henderson Global Sustainable Equity strategy. The UK equities sub-portfolio meanwhile delivers an attractive dividend yield with a focus on free cash flow generation and valuation. Finally, exposure to fixed income helps dampen the Fund’s volatility. The result is a Fund that can outperform in a variety of market conditions and offers clients compelling risk-return characteristics, an attractive option for those not wanting full exposure to equity market volatility.

The investment approach of the Fund is primarily one of bottom-up security selection, operated within the ESG investment framework and avoidance criteria parameters of the Fund*.

* This strategy integrates ESG but does not pursue a sustainable investment strategy or have a sustainable investment objective or otherwise take ESG factors into account in a binding manner. ESG integration is the practice of incorporating material environmental, social and governance (ESG) information or insights in a non-binding manner alongside traditional measures into the investment decision process to improve long-term financial outcomes of portfolios. ESG related research is one of many factors considered within the investment process and in this material we seek to show why it is financially relevant.

Each of the sub-portfolios initially start with determining the investment universe where we seek to avoid businesses that have products or operations directly associated with the following exclusionary criteria:

Environmental and social avoidance criteria (1)

- Alcohol - We avoid companies involved in the production and sale of alcoholic drinks.

- Animal testing - We avoid companies that manufacture vitamins, cosmetics, soaps, or toiletries unless they make it clear that their products and ingredients are not animal tested. We allow animal testing for medical purposes only where the company employs best practices in accordance with the ‘3Rs’ policy of refinement, reduction, and replacement (2)

- Armaments - We avoid companies involved in the direct production or sale of weapons. We will not invest in companies involved in the direct production of land mines, cluster munitions, biological/chemical weapons, and nuclear weapons (3)

- Chemicals of concern - We avoid companies which manufacture or sell chemicals, or products containing chemicals, subject to bans or severe restrictions in major markets around the world. This includes ozone-depleting substances micro beads, persistent organic pollutants, and the manufacture of any other substances banned or restricted under international conventions.

- Fossil fuel extraction & refining - We avoid companies engaged in the extraction and refining of coal, oil, and gas.

- Fossil fuel power generation - We avoid companies engaged in fossil fuel power generation; however, investment in companies generating power from natural gas may be allowed in cases where the company’s strategy involves a transition to renewable energy power generation (4). In the case of labelled bonds, we may consider bonds issued by companies engaged in fossil fuel power generation where there is no association with tar sands, oil shale, fracking, or a predominant reliance on thermal coal power generation, and where there is a credible plan for transition to net zero or renewable energy.

- Fur - We avoid companies involved in the sale or manufacture of animal fur products.

- Gambling - We avoid companies with activities related to gambling.

- Genetic engineering - We avoid companies involved in the deliberate release of genetically modified organisms (eg, animals or plants). Investment in companies where genetic technologies are used for medical or industrial applications may be acceptable providing high environmental and social standards can be demonstrated. Companies that use or sell products that make use of such technologies may be acceptable providing genetically modified organism (GMO) ingredients that are clearly labelled.

- Nuclear power - We avoid companies that are involved in the uranium fuel cycle, treat radioactive waste, or supply specialist nuclear related equipment or services for constructing or running nuclear plant or facilities.

- Pornography - We avoid companies that are involved in producing or distributing pornography and adult entertainment materials or services.

- Tobacco - We avoid companies that engage in activities related to the production and sale of tobacco products.

Source: Janus Henson Investors.

(1) We also seek to avoid companies operating in contentious industries which have a high degree of negative environmental or social impact unless the company is taking action to mitigate negative impacts. Examples of contentious industries include cement, mining, and timber.

(2) 3 ’R’s: Refine experiments to ensure suffering is minimised. Reduce the number of animals to a minimum. Replace animals with alternative techniques.

(3) As a firm wide policy we exclude companies involved in controversial weapons.

(4) Transitioning companies are companies whose strategy involves a transitioning to renewables energy power generation and with a carbon intensity aligned with the scenario of restricting global warming to two degrees above pre-industrial levels. Where carbon intensity cannot be determined, there is a 10% threshold for energy production from natural gas.

In addition to the avoidance criteria, all holdings in the Fund are compliant with the UN Global Compact Principles and the Organisation for Economic Co-operation and Development (OECD) Guidelines for Multinational Enterprises (5). The UN Global Compact’s ten principles cover human rights, the International Labour Organisation’s declaration on workers’ rights, corruption, and environmental pollution, while the OECD guidelines cover a range of issues to including but not limited to employment, bribery, disclosure, and competition.

(5) The OECD Guidelines for Multinational Enterprises are recommendations addressed by governments to multinational enterprises operating in or from adhering countries. They provide non-binding principles and standards for responsible business conduct in a global context consistent with applicable laws and internationally recognised standards.

Government bond criteria

The Fund will only invest in G7 government debt.

De minimis limits

In order to minimise exposure to business activities and behaviours that may be environmentally and/or socially harmful, the Fund seeks to avoid businesses that have products or operations directly associated with the certain criteria, subject to de minimis limits.

Where possible, we will seek to achieve zero exposure in respect of the avoidance criteria. However, there may be instances when we will apply a de minimis limit. A de minimis limit is a threshold above which investment will not be made and relates to the scope of a company’s business activity; the limit may be quantitative (eg, expressed as a percentage of a company’s revenues) or may involve a more qualitative assessment. De minimis limits exist because sometimes avoiding an industry entirely may not be feasible given the complex nature of business operations.

In such instances, we will invest in a company only if we are satisfied that the ‘avoided’ activity forms a small part of the company’s business, and when our research shows that the company manages the activity in line with best practice.

When the activity relates to a company’s revenues, we use a 10% threshold, unless otherwise stated. When the activity relates to a company’s operations, we will seek to gain comfort that the company is taking action to improve its performance or is managing it in an exemplary fashion. Any company with a persistent record of misconduct will be excluded unless there is clear evidence of significant progress.

The Fund may invest in companies that would be excluded by the screens described above if the investment manager believes, based on its own research, and as approved by its ESG Oversight Committee, that the third-party data used to apply the exclusions is insufficient or inaccurate. Exclusionary screens are applied to direct investments (excluding government bonds) using third-party data at the point of investment and are monitored on a continuous basis. If an investment becomes ineligible based on exclusionary screens it will be divested within 90 days.

Janus Henderson has appointed specialist companies, MSCI and Vigeo EIRIS, to provide the environmental and social avoidance criteria screening of potential investments. An investee company must pass these screens or be approved by the ESG Oversight Committee to be eligible for the Fund.

ESG investment framework

Assessment of the risks and opportunities stemming from environmental, social, and governance (ESG) issues forms part of our investment due diligence. We believe that companies with effective management strategies to address material ESG issues are more likely to reliably generate shareholder value.

As part of our analysis, we identify and prioritise the issues we deem to be the most financially material to the investment case. These vary from company to company according to the sector and industry. We define materiality as the potential of an issue to significantly impact the short- or long-term financial performance of a company. We look at whether a company is willing or able to manage and mitigate its material ESG issues / factors, how it performs in its peer groups, its exposure to controversies and its approach to climate change. We also consider other issues that have the potential to effect impact stakeholder groups beyond the shareholder, such as society, the environment, and the world around it. Factors that may be considered include but are not limited to:

Identifying companies with good governance practices is fundamental to our investment process. We take factors such as the alignment of interests between shareholders and management, the strength of relations with stakeholders, and the management of environmental and social risks all as evidence of good governance practices.

At the Fund level, we monitor quantitative data on carbon emissions and climate scenario analysis. We also assess qualitative factors such as whether companies are measuring and reporting carbon emissions and whether they have set targets to manage these. As a result, and given the Fund’s exclusion of high emitting sectors, it is expected that the Fund’s carbon characteristics, as measured by third party provider MSCI, will be lower than if this approach was not applied.

We make use of both internal resources and external research and data providers. Internal resources comprise specialist sustainability analysts within various investment teams and Janus Henderson’s central Responsibility Team. Our principle external ESG data provider is MSCI, however, we also use several other ESG research providers including Sustainalytics, ISS, and Vigeo EIRIS.

As mentioned earlier, the Fund is actively managed with reference to the IA Mixed Investment 40–85% Shares sector average.

Process:

Investment approach

The three sub-portfolios have the following approaches:

Global equities

The global equities sub-portfolio is managed using the same investment approach as Janus Henderson's Global Sustainable Equity strategy which applies ‘positive selection criteria’. This investment approach seeks to invest in businesses that have products or services that contribute to positive environmental or social change and thereby have an impact on the development of a sustainable global economy, whilst avoiding companies that potentially have a negative impact on the development of a sustainable global economy. Examples of themes identified include efficiency, cleaner energy, water management, environmental services, sustainable transport, sustainable property & finance, safety, quality of life, knowledge & technology, and health.

Idea generation

Our approach to idea generation is based on a bottom-up search for high quality investment ideas. Every investment in the portfolio starts as an individual company idea which can be generated via a number of different teams and is then subject to our structured evaluation framework.

The four pillars of our sustainability-driven investment strategy

We see four key elements to an investment approach based on sustainability. Often there are conflicts between environmental and social sustainability, and our approach seeks to address this by using both positive and negative (avoidance) investment criteria and considering both the products and operations of a business. Company engagement and active portfolio management are essential features of any true sustainable investment strategy.

There are four pillars to our sustainable investment process which incorporates both positive and negative selection criteria and includes both product and operational impact analysis. It is through this rigorous and repeatable stock-selection process that we believe we add value to our clients.

- Thematic revenue alignment: ten sustainable development themes guide idea generation and identify long-term investment opportunities.

- Avoidance criteria: we will not invest in activities that contribute to environmental or social harm. This also helps us avoid industries most likely to be disrupted.

- ‘Triple bottom-line’ framework: fundamental research evaluates how companies focus on profits, people, and the planet in equal measure.

- Active management and engagement: we construct a differentiated portfolio with typically high active share (>85%). Collaborative, continuous, and collective engagement is a key aspect of our process.

Positive investment themes

The team believes that the defining investment issue of our time will be transitioning to a low carbon and sustainable economy, while maintaining the levels of productivity necessary to deliver the goods and services that an ageing and growing population requires. Derived from these four megatrends, we identify ten environmental and social sustainable development themes. Examples of these themes the investment manager has identified include clean energy, efficiency, environmental services, sustainable transport, water management, knowledge and technology, health, safety, safety, sustainable property and finance and quality of life. For a company to be eligible for the portfolio at least 50% of its revenues will be aligned with at least one of these sustainable development themes.

Fundamental and valuation analysis

The team have a rigorous process the fundamental research process which is looking at both ESG factors and also financial factors in an integrated fashion. The team ultimately analyses every company on the basis of the ‘3Ps’ of their ‘triple bottom line’ framework: how they generate Profits, how they impact People; and how they impact the Planet.

The team seeks to identify businesses with long-term compounding characteristics, and with optionality upside, which are trading at discounts to their intrinsic value. Typically, the team looks for companies with the ability to generate and compound long-term free cash flows, where the equity market is currently under-valuing those. There is a specific focus to the financial analysis that the team does to identify intrinsic value.

The team looks for:

- The potential for multi-year revenue compounding

- A culture of innovation, that in turn drives that upside optionality

- Durable business models

- Greater predictability of revenues

- Consistency of margins and cash flows

- Strong balance sheets

Active portfolio construction and risk management

Every stock selected for the portfolio must fit at least one theme; but for the purposes of portfolio construction, there is no forced distribution of themes. Portfolio construction is driven by stock selection, with each stock assessed within the disciplined analytical framework. The portfolio is constructed with the aim of generating attractive excess returns, but with a good level of overall risk diversification. The intention is to construct a high-conviction portfolio with high active share against the benchmark.

UK equities

The UK equities sub-portfolio is managed using the same investment approach as Janus Henderson's UK Responsible Income strategy. The strategy is actively managed with reference to the FTSE All Share Index, which is broadly representative of the companies in which it may invest. It seeks to identify UK companies, with attractive long-term business models offering the potential for good dividend growth and capital returns over the long term.

Idea generation

The strategy takes a bottom-up stock selection investment approach. The fundamental positions of companies are examined, and an evaluation made of whether they are well placed to generate good cash flow to ensure that dividends may be sustained and increased over time.

The strategy typically outperforms when markets are driven by a focus on valuation and the strength of underlying businesses in terms of their ability to pay a dividend, grow the dividend, maintain a robust balance sheet, and generate good levels of cashflow.

Once the avoidance criteria have been applied, fundamental analysis is then carried out on securities. The portfolio manager aims to understand what will drive a company’s earnings and profitability over the long term, and then assesses how the market currently values the company relative to its potential. As part of this fundamental analysis the portfolio manager will consider the effect of material ESG issues on the long-term attractiveness of companies.

Fundamental analysis

There are four key sections the portfolio manager focuses on:

- Defensible competitive position

- Aligned management behaviour

- Affordable investment requirements

- Sustainable returns

Valuation analysis

The bottom-up stock selection process is grounded in fundamental analysis that aims to gain a clear understanding of specific companies and their markets, together with a valuation discipline that encompasses a wide range of valuation techniques. Rather than applying a prescribed valuation metric, the portfolio manager uses relative and absolute valuation measures that are relevant to each company’s business and the industry or sector in which they operate.

As well as dividend yield, other factors such as dividend growth, free cash flow yield, cash flow growth, balance sheet strength, and profitability-based metrics such as price/earnings ratios are also considered. The portfolio manager will also consider metrics such as Net Asset Value, EV/Sales, and EV/EBITDA. There is a strong emphasis on identifying companies that have good and growing levels of free cash flow with the aim of identifying stocks with the potential for income growth and capital returns. Robust balance sheets are also favoured within the process.

While fundamental analysis may suggest a company has good prospects, the valuation discipline focuses on assessing whether a company is attractively priced. This valuation-driven approach favours temporarily unpopular stocks, resulting in a moderately contrarian portfolio.

ESG investment framework

Analysing ESG issues is an important part of the analysis of a company’s business fundamentals. Environmental factors consider a company’s impact on the environment, social factors consider the way businesses treat and value people, and governance factors focus on corporate policies and how companies are governed. We believe companies with sound governance practices and strong stakeholder relations, that manage relevant environmental and social risks responsibly, have a greater propensity to create long-term value for shareholders. Key ESG issues considered as part of the investment process include corporate governance, human capital and diversity, climate change, controversies, disclosure, transparency, and business ethics.

Active portfolio construction and risk management

The portfolio is constructed on a conviction-weighted basis whereby the weights of individual stocks are driven by company-specific analysis and the income objectives of the strategy without regard to the weightings in the performance benchmark. The liquidity of a stock will be considered when determining position size.

In constructing the portfolio, the portfolio manager is able to draw on the resources of the Janus Henderson Investment Risk Team to assess the likely impact of portfolio reorganisations in terms of risk and return, and to ensure that individual positions reflect the portfolio manager’s level of conviction in each company. The portfolio has held between 60 to 75 securities historically. The typical investment horizon would be 3 to 5 years.

Fixed income ESG integration

Our approach to ESG integration seeks to maximise our analytical strengths. At its heart is a forward-looking approach as our primary consideration is to identify value and avoid unwanted risk. ESG factors can have a material impact on credit outcomes, which is why we believe they are an important consideration within our decision-making. We place importance on an issuer’s willingness to improve and seek to corroborate what companies say with evidence of action. Outside of certain areas (eg, cluster munitions) we typically avoid blanket exclusions unless requested within bespoke ESG-segregated mandates. The investment team can share and access issuer-level and portfolio-level ESG information through our proprietary ESG data and analytics tool ESG Explore (ESGX). Many of the climate metrics include those identified as best-practice by the Task Force on Climate Related Financial Disclosures and the Partnership for Carbon Accounting.

Rating model

Fixed Income ESG rating spectrum

Our ratings model is a four-step process. Each step is important as we combine third-party ESG data with our own research and analysis. The forward-looking assessment provides a qualitative overlay to the earlier quantitative metrics to arrive at a final ESG rating for a corporate issuer.

Sector assessment: top-down view of material ESG issues at sector level

Company baseline score: bottom-up, data-drive and leveraging third-party data

Forward-looking assessment: subjective analyst views from timely and dynamic ratings

JHI ESG rating: final proprietary sector-agnostic rating

Incorporation within overall credit recommendation

Our proprietary ESG ratings are reflected in our data analytics tool Quantum, which is utilised by our investment teams as well as in ESG Explore, our in-house ESG research database.

The ESG rating allows for sufficient differentiation to be meaningful when integrating financially-material ESG into our decision-making. For example, for a security with a high ESG risk (marked as Red), we expect a greater risk premium to be incorporated into the overall relative value assessment. Analysts leverage insights from ESG Explore (see over) and their engagements (see over) to refine the ESG ratings, which then influence the broader credit recommendations. The overall credit recommendations are formulated by considering industry insights, fundamental analysis (e.g. balance sheet strategy, cash flow generation, management analysis), market dynamics, valuations, ESG and quantitative analysis to develop trade ideas. These trade ideas are then shared with the portfolio managers who determine the overall allocation of the portfolio.

Fixed income engagement

Stewardship and a commitment to good governance is an integral part of Janus Henderson’s active approach to investment management. The primary route for engagement is the regular meetings analysts and portfolio managers have with the issuers in which they invest, of which we hold thousands each year. Meetings can incorporate a wide range of topics, including strategy, capital allocation, performance, risk, management succession, board composition, corporate governance and environmental and social issues. We classify engagements as either:

- Engagement for insight. The goal is to understand an issuer’s ESG strategy and actions and incorporate this into our decision-making.

- Engagement for action. These are outcome-oriented, where we encourage issuers to take decisions that we believe are in the best long-term interests of bondholders.

Thematic engagements are chosen based on their relevance and potential to enhance understanding of financially material ESG factors within sectors. Top-down themes reflect client interests and key market and societal ESG trends, such as decarbonisation, water scarcity, decent work (diversity, equity and inclusion) and business ethics. This is typically cross-collaborative with equity colleagues and aligned with the Responsible Investment and Governance (RI&G) Team. Credit analysts additionally based on bottom-up considerations, triggered by their ongoing credit analysis.

ESG Explore (ESGX) / investment team ESG data

ESGX allows our investment teams to access issuer-level and portfolio-level ESG information. Many of the climate metrics include those identified as best-practice by the Task Force on Climate Related Financial Disclosures and the Partnership for Carbon Accounting.

Collaboration with the central Responsibility Team

The integrated ESG approach to our investment decisions is further enhanced by collaboration with the central Responsibility Team, which comprises four pillars:

Credit analysts in our Global Credit Research Team partner with RI&G analysts to work on joint engagement and leverage their ESG research. This can help generate ideas, increase transparency around ESG risks and challenge portfolio positioning.

We recognise that ESG is evolving, which is why regular ESG forums and the ESG Research Working Group continuously work to review and strengthen our processes, ensuring we adopt best practices and successfully integrate financially- material ESG factors into our decision-making process.

Asset allocation

The Fund’s alpha generation is primarily generated by bottom-up stock and bond selection from the three underlying sub-portfolios. However, the asset allocation between equities and fixed income is also reviewed at regular asset allocation (AA) meetings with the Fund’s asset class exposure monitored relative to the IA mixed investment 40 to 85% shares sector peer group average. The purpose of the AA meeting is to ensure there is appropriate risk exposure across the Fund’s asset classes, while also identifying any areas that are over or under valued with the aim of ensuring capital is appropriately allocated. These meetings are attended by the portfolio managers and chaired by Jane Shoemake, the Client Portfolio Manager for the Fund.

The Fund’s asset allocation is based on an assessment of the bottom-up opportunity set in each asset class alongside top-down macroeconomic analysis. The team utilise third-party macro research in addition to the asset allocation expertise of the London-based Multi-Asset Team and the Denver-based Balanced Team. These inputs all help inform the asset allocation discussion and determine the relative value of bonds in comparison to equities.

The team consider several top-down macro-economic leading indicators alongside bond market signals, including the shape of the yield curve, interest rate expectations, central bank monetary policy and any recent significant changes. Asset class valuations (both absolute and relative) are also considered with relative yield seen as a useful valuation indicator.

The extent of bottom-up investment opportunities identified by the respective portfolio managers also feeds into the asset allocation decision making process. For the allocation between UK and international equities, Hamish and Andrew consider both bottom-up and top-down factors, including a range of relative valuation metrics, earnings and dividend growth forecasts, macro-economic data, and investment opportunities at the stock level.

Asset allocation decisions are not limited to being made at the scheduled bi-monthly asset allocation meetings but can also be acted upon more frequently as market opportunities arise. Ultimate decision-making authority resides with the four Fund managers and no AA change will be made unless there is complete agreement.

The portfolio managers ensure there is appropriate risk exposure across the Fund’s asset classes, while also identifying any areas that are over or under valued with the aim of ensuring capital is appropriately allocated.

Asset allocation constraints

Beyond the IA sector criteria, there are no minimum or maximum asset class weight constraints although the Fund will typically not have more than 10% of its AUM in cash. Additionally, the Fund will typically not exceed +/- 10% weighting vs the peer group benchmark in either the global, UK or fixed income sub-portfolios. The portfolio will also generally be at least 60% invested in equities unless a material change in the risk/reward of equities versus fixed income securities is identified which may prompt a temporary increase in the fixed income allocation.

Within the fixed income sub-portfolio, the allocation between government bonds and corporate bonds, and investment grade and high yield, is driven by the output from the monthly credit team meetings and their risk budgeting process which ultimately decides the beta and duration management for the sub-portfolio. The duration of the fixed income sub-portfolio will usually be within +/-2.5 years of the fixed income comparator benchmark (50% Bloomberg Barclays Global Aggregate Corporate Unhedged £ and 50% Bloomberg Barclays Sterling Aggregate Unhedged £).

Cash

The IA mixed investment 40 to 85% shares sector includes a weighting to cash and the Fund’s allocation to cash is considered as part of the asset allocation discussion.

Derivatives

The portfolio managers may use derivatives to reduce risk or to manage the Fund more efficiently.

Sell discipline

Equity holdings may be sold for several reasons:

- Impairment of the long-term investment thesis – if there is a change, either at the regulatory, industry or company level, which undermines the ability of the company to grow over time.

- Breach of avoidance criteria – if the company, either as a result of an acquisition or internal business development, becomes involved in an activity that transgresses the avoidance criteria.

- Deteriorating or unresolved operational ESG issues – the team seek to invest in companies which demonstrate high and improving standards in respect of the management of operational ESG factors because this underpins the ability of the company to grow over time.

- A new idea offers a more compelling risk/reward opportunity.

Fixed income holdings may be sold for the following reasons:

- Change in the portfolio manager’s / credit analyst’s view on a security.

- Performance - relative to sector / peers.

- Threshold loss tolerance level (bps) exceeded - at either the security or Fund/strategy level

- Breach of avoidance criteria

Engagement

Company engagement forms an important part of the investment process. The team take an active approach to communicating their views to companies and seeking improvements in performance. The types of engagement include:

- Collaborative engagement: coming together with a group of other institutional investors to engage with companies on a range of ESG issues.

- Continuous engagement: working with companies on ESG issues that have long-duration and do not result in immediate outcomes.

- Collective engagement: bringing together ideas and resources from a diverse range of stakeholders from outside the organisation to engage with companies on key issues.

Our analysis of the portfolio against key ESG performance indicators helps us identify topics for engagement, together with the controversies, scientific advances and actions taken by companies. These topics for engagement are not fixed and are subject to change depending on the activities of the company and their materiality.

Janus Henderson’s Proxy Voting Policy and Procedures document, which can be found on www.janushenderson.com, sets out the firm’s proxy voting policy.

Ultimate voting authority rests with the portfolio manager of each sub-portfolio, who is responsible for ensuring that votes are exercised in the best interests of clients, with ESG factors an important consideration where relevant. The portfolio managers are supported by the central Responsible Investment and Governance team, who work closely with investment teams to help analyse voting-related issues. With regards to voting and company engagement, the portfolio manager considers certain core principles such as disclosure, transparency, board composition, shareholder rights, audit and internal controls, and remuneration. A key element of the approach to proxy voting is to support these principles and practices and foster the long-term interests of shareholders.

Given the Fund’s responsible investment process incorporates environment, social, and governance factors in investment decisions, there will be relatively few shareholder proposals on ESG issues for the companies held in the Fund. We aim to support shareholder proposals on ESG factors for portfolio holdings following our approach to voting and engagement outlined within this document.

The Fund’s Quarterly Voting and Engagement Report can be found on www.janushenderson.com.

ESG risk management

ESG monitoring is fully integrated into Janus Henderson’s risk reporting and review processes for the Fund.

Regular MSCI ESG reports are available to portfolio managers. These reports identify the companies with the highest risk ratings with respect to overall ESG issues, significant changes in ESG ratings, controversy risk, governance risks and the portfolio’s carbon footprint relative to the relevant benchmark. These reports also provide an ESG quality score which measures the ability of the underlying holdings to manage key medium to long term risks and opportunities that arise from ESG factors. These ratings are supplemented with Janus Henderson research and analysis as well as engagements with companies when appropriate.

These reports are discussed at ESG meetings with the Responsible Investment and Governance team where the focus is on identifying areas for further engagement both at a theme and company specific level.

The portfolio is subject to regular reviews of its exposure to ESG risks as part of Janus Henderson’s formal risk oversight process. The team use numerous ESG data systems including Sustainalytics, MSCI, ISS, Bloomberg, RepRisk to flag exposure to controversies.

Risk management

Portfolios are subject to independent reviews on an on-going basis, with regular management and internal monitoring controls implemented at various levels:

- Compliance with investment/trading restrictions are monitored by the compliance system, Charles River Development (CRD).

- Portfolio risk is independently monitored by the Investment Risk Team, who aim to meet every portfolio manager at least once a quarter on a rolling basis.

- Portfolio performance and consistency is peer reviewed by senior personnel, including the Global Co-Heads of Equities. Performance and risk statistics are formally reviewed by the Board monthly.

For further details, please refer to the link – Janus Henderson Global Responsible Managed Fund_Investment Principles.

Resources, Affiliations & Corporate Strategies:

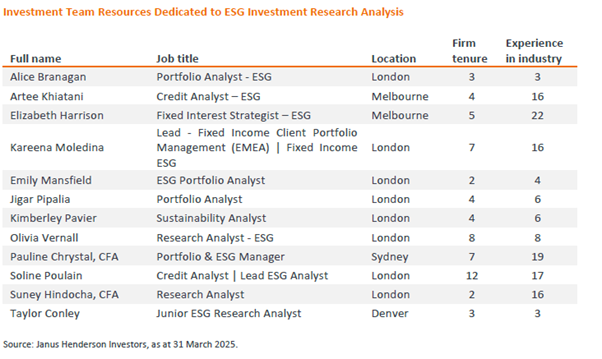

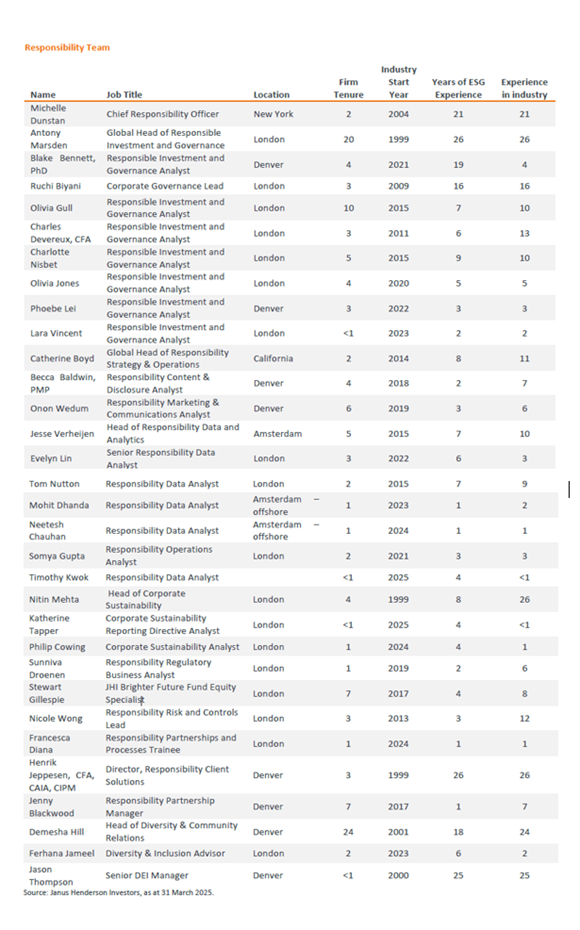

As at 31 March 2025, Janus Henderson has 32 Responsibility Team resources. This centralised team are our ESG subject-matter experts who partner with our investment teams on ESG. On our investment teams, we have 12 dedicated ESG experts embedded within numerous investment teams. Additionally, we have 18 portfolio managers* on Janus Henderson’s Brighter Future (ESG-focused) Funds. Our portfolio managers are further supported by our central research functions and/or investment team analysts.

Source: Janus Henderson Investors, as at 31 March 2025.

*Portfolio managers manage multiple strategies, so may not be fully dedicated to ESG-focused products. Note: the methodology to calculate this data has changed and previously included portfolio managers who manage ESG-integrated funds rather than ESG-labelled products.

Our approach to Responsibility

Janus Henderson has a three-pronged approach to Responsibility.

- The first is our own corporate responsibility. Our commitment to responsibility extends to our corporate practices, embodying the principle that ‘Responsibility starts at home.’ We need to ensure our own policies and practices reflect what our stakeholders demand. At a corporate level, behaving responsibly impacts our people, our culture, and our choices with the ultimate aim of investing in a brighter future for our clients. We leverage our influence to responsibly deliver value to our clients, employees, shareholders, and the wider community.

- The second is ESG integration. At an investment level, we integrate financially material ESG factors into our analysis and processes for most of our actively managed strategies, as appropriate, to help us identify opportunities and risks and to drive the long-term value of the companies in which we invest.

- The third is our JHI Brighter Future Funds. For those clients who want to invest for a purpose beyond risk and return, we have and continue to build our suite of ESG-focused strategies that go above and beyond integration to have ESG considerations at their core alongside the primary financial objective.

Responsible Investment Policy overview and Integration

Janus Henderson’s has had a Responsible Investment Policy since approximately 2001, referring to the legal Henderson policy established at this time. In 2023, we implemented our revised Responsible Investment Policy, which sets out our approach to Responsible Investing and ESG Governance and Oversight.

As an active manager, integrating financially material ESG factors into our investment decision-making and ownership practices is fundamental to delivering the results our clients seek from us. Financially material ESG considerations are a key component of the investment processes employed by our investment teams for most of our actively managed strategies. Our investment teams operate and are structured in ways most suited to their respective asset classes. Aside from expectations outlined within our Responsible Investment Policy, the precise approach to and depth of ESG integration is down to the discretion and judgement of our investment teams, who apply their differentiated perspectives, insight and experience to identify sustainable business practices that can generate long-term value for investors. While the evaluation of our implementation of ESG criteria is carried out at the strategy level, our central Responsibility Team supports each team in their ESG integration with data, tools, stewardship, and ESG research.

Engagement and stewardship approach

Engagement and stewardship are integral and natural parts of our long-term, active approach to investment management. We believe engagement is vital to understanding and promoting practices that position the companies and issuers we invest in for future financial success.

Our investment teams often partner with our central Responsibility Team on engagements with company management teams. We prefer an engagement-focused approach to a firm-level exclusion or divestment policy for companies and issuers where we have identified financially material ESG risks. We believe this approach is best for maximising risk-adjusted returns for our clients.

We have a wide range of engagement themes and topics chosen by individual investment teams or the Responsible Investment and Governance Team, which is part of the broader Responsibility Team. These range from longstanding engagement themes such as climate change and diversity, equity & inclusion, to biodiversity, human capital and culture, health and wellbeing, and sustainable corporate governance.

Most products and services offered by a company or issuer play necessary roles for the global economy – including sectors with higher carbon emissions such as energy, industrials, materials, and utilities. Rather than ignoring companies or issuers in these sectors through automatic exclusion or divestment, engagement leads to two benefits:

- Insight: Knowledge gained through engagements with companies or issuers can be leveraged in the investment process to better inform our research, financial modeling, and investment decisions. Engaging for insight helps us assess the magnitude of any potential risk, how well a company or issuer is managing that risk, and the potential impact on that company or issuer’s financial outcomes.

- Outcomes: Where a company or issuer may be ignoring or not managing a financially material ESG risk, engaging for outcomes can encourage that company or issuer to adopt policies or practices that will address that risk and better position it for the future.

Engagement with the company or issuer’s management or board of directors directly link the ESG consideration to why we believe addressing it makes them a better company, leading to improved cash flows, valuations, cost of capital, or credit ratings. In 2024, we conducted a total of 716 engagement discussions – 666 for insight and 50 for outcomes.

Stewardship is an integral and natural part of Janus Henderson’s long-term, active approach to investment management. We believe that strong ownership practices such as management engagement can help protect and enhance long-term shareholder value.

We support a number of stewardship codes, such as the UK Stewardship Code, and broader initiatives around the world including the UN-supported Principles for Responsible Investment (PRI). We are pleased that the PRI has recognised the significant progress we’ve made in advancing our responsible investment capabilities over the last three years and maintained our high scores in our latest assessment through June 2024. We also continue to remain a signatory to the Financial Reporting Council’s UK Stewardship Code, regarded as a benchmark in investment stewardship.

Our commitment to clients

Janus Henderson understands responsible investing continues to evolve and mature. We are committed to maintaining an open dialogue with our clients, shareholders, employees, industry groups, and regional regulators to ensure we continue to meet their expectations and hold true to our values as a steward of our clients’ capital. This includes listening to client needs and developing new products to meet changing requirements. It also means actively sharing the views of our managers on how they see financially material ESG issues reshaping the investment landscape and where the risks and opportunities lie. The Janus Henderson website provides access to manager insights as well as our Responsibility policies, voting records and annual reports.

Janus Henderson Investors Brighter Future Funds

Many of Janus Henderson’s clients want to invest for a purpose beyond risk and return and, to meet the needs of these clients, we’ve developed our JHI Brighter Future Funds, a suite of ESG-focused portfolios that go above and beyond integration to have ESG at their core alongside the primary financial objective.

ESG-focused portfolios

Across the industry, there are many different approaches to managing ESG-focused portfolios. We consider the following strategies:

ESG leaders

Invest in companies that excel in managing ESG risks or taking advantage of financially material ESG opportunities.

ESG improvers and transitioners

Invest in companies that are actively enacting positive change in their own operations to address financially material ESG issues.

ESG solutions or enablers

Invest in companies that offer products and services that are essential to addressing financially material ESG issues.

Firm-wide exclusions policy

Except as noted below, the firmwide exclusions generally apply to all Janus Henderson Funds and discretionary segregated mandates. They do not apply to index and certain other derivatives or passive portfolios (including ETFs) intended to track a benchmark.

Issuers excluded

A direct manufacturer of and / or minority shareholding of 20% or greater in a manufacturer of:

- Cluster munitions

- Anti-personnel mines

- Chemical weapons

- Biological weapons

Classification of issuers is primarily based on activity identification fields supplied by our third-party ESG data providers. This classification maybe subject to an investment research override, following approval by the ESG Oversight Committee (ESGOC), in cases where sufficient evidence exists that the third-party field is not accurate or appropriate.

In any scenario where a portfolio position is identified as not meeting this exclusion criteria for any reason (legacy holding, transition holding, etc.) the portfolio manager shall generally be granted 90 days to review or challenge classification of the issuer if appropriate. After this period, in the event an investment research override is not granted, divestment is required under normal market trading circumstances.

Cannabis related issuers

To ensure Janus Henderson complies with regional legal and regulatory obligations ‘Cannabis-Related Issuers’ (CRI) may be excluded where an issuer’s revenue from cannabis related activities is understood to constitute more than 5% of their total revenue. A permissibility assessment is undertaken that gives consideration to various factors, including, without limitation:

- Domicile of Janus Henderson Fund;

- Domicile of Janus Henderson Fund Manager, including any sub-delegations;

- Domicile of the CRI; and

- Type of cannabis business operation, product, or activity conducted by the CRI.

Exceptions investing in CRI more broadly may be permitted following request to, and approval from, the ESGOC. All exceptions to this Policy requirement must be suitably documented with the accompanying rational.

Responsibility Team

The central Responsibility Team (the “team”) is a specialised in-house group focused on ESG data analysis and research, governance, ESG company and thematic engagement, and proxy voting and advisory services that serves as a resource for all our investment desks. They play a leading role in working with investment desks to enhance their ESG integration processes and externally leading our active participation in numerous responsibility initiatives. Fundamental, bottom-up research has been at the core of our investment process for more than 45 years and this partnership leads to enhanced research and decision-making by marrying the sector and industry expertise of the investment teams with the responsibility skills of the Responsibility Team.

In December 2022, we appointed Michelle Dunstan, an experienced leader in Responsibility strategy and responsible investing, as Chief Responsibility Officer (CRO) to oversee our Responsibility strategy. To emphasise the importance of our responsibility efforts and embed them across our entire firm, the CRO reports directly to the CEO, provides quarterly reports to our Board of Directors on established metrics and targets, and sits on the firm’s Strategic Leadership Team.

In 2024, we continued to add specialist resources to our central Responsibility Team to better align resourcing with our strategic priorities. As of year-end 2024 the Responsibility Team has 28 dedicated team members working as responsibility subject matter experts partnering with investment teams and firmwide colleagues. The team sits on the investment floor and is easily accessible to investment professionals. The Responsibility Team is centred around four focus areas:

Our Responsibility Strategy and Operations pillar supports our investment and non-investment teams in four areas -ESG Data and Analytics, Content and Learning (including the development of training, reports, client responses, external communications, and ESG thought leadership), Regulations and Risk (collaborating with Regulatory, Risk, Compliance, and Legal on relevant regulatory requirements / disclosures), and Corporate Sustainability (development and support of our corporate environmental strategy and execution).

Our Responsible Investment and Governance pillar provides direct support to our investment teams. The focus of this partnership is on equipping and supporting our analysts and portfolio managers to do what they do best: research industries and securities to select the most attractive candidates for inclusion in our portfolios. Our team will partner with the investment teams to deliver ESG training, support on developing frameworks to identify financial material ESG risks and considerations, planning and conducting engagements, supporting research on issues that can impact cash flows or valuation, and advising on proxy voting.

Our Responsibility Client Solutions pillar focuses on partnering with our product, distribution, and investment teams to enhance existing portfolios and deliver new portfolios to clients across varying levels of responsibility needs, from robust integration to ESG-focused strategies. They also partner with investment desks to continuously evolve our integration capabilities, including developing and refining integration frameworks that inform research, stewardship, and portfolio construction. Furthermore, the team also contributes to thought leadership content and conducts training on various responsibility topics.