Royal London Ethical Bond

SRI Style:

Ethical Style

SDR Labelling:

Unlabelled - promotes sustainable characteristics (Has CFD)

Product:

OEIC

Fund Region:

UK

Fund Asset Type:

Fixed Interest

Launch Date:

31/01/2007

Last Amended:

Aug 2025

Dialshifter ( ):

):

Fund/Portfolio Size:

£1141.44m

(as at: 30/04/2025)

Total Screened Themed SRI Assets:

£59860.00m

(as at: 30/04/2025)

Total Assets Under Management:

£177020.00m

(as at: 31/03/2025)

ISIN:

GB00BJ4KSX76, GB00BJ4KSY83, GB00BMY4CR20, GB00BJ4KSZ90

Contact Us:

Objectives:

The fund integrates the assessment of environmental, social, and governance (ESG) risks into the investment decision making process in order to help mitigate ESG risks and/or identify opportunities for investors. In addition to identifying and managing ESG risks, Royal London Asset Management’s Ethical Bond Fund applies an additional layer to its process – ethical bond screening. This process identifies bonds which meet predetermined ethical criteria, excluding from investment in the fund bonds which fall short of these requirements. Full details of the exclusions can be found at www.rlam.com

Sustainable, Responsible

&/or ESG Overview:

Our ethical investment process begins with screening for eligible investments, which is conducted by our in-house team of experienced experts using specialist research from MSCI ESG Research and Glass Lewis, using a bespoke approach to assessing ESG from a credit perspective. Our ethical framework combines the avoidance of companies involved in excluded activities with the identification of and evaluation of ESG risk. Companies that generate over 10% of their turnover from any one or a combination of alcohol, armaments, gambling, tobacco, pornography, or fossil fuels are excluded, whilst the screening process also identifies companies that have the opportunity to make a positive impact. Companies with inappropriate/ inadequate policies or systems in environment, human rights, or animal testing are also excluded.

Primary fund last amended:

Aug 2025

Information directly from fund manager.

Fund Filters

Environmental - General

Has policies which relate to environmental issues. These will typically set out their stance on issues such as pollution, climate change, resource management, biodiversity loss, carbon emissions, plastics and/or additional environmental impacts. Strategies vary.

Has documented policies explaining the approach to environmental damage and pollution. Strategies vary.

Climate Change & Energy

Avoid investment in major coal, oil and/or gas (extraction) companies. Strategies vary.

Avoid companies involved in fracking and tar sands - which are widely regarded as controversial methods of oil and gas extraction. Strategies vary.

Avoid investing in companies / assets with coal, oil and gas reserves. See individual entry information for further details.

Invest in renewable energy companies and / or companies where renewable energy is a significant part of their business. Strategies vary.

Excludes companies and other assets with direct involvement in fossil fuel exploration (eg coal, oil and gas companies)

Social / Employment

Has policies which set out their approach to social issues (e.g. human rights, labour standards, equal opportunities, child labour and/or adherence to internationally recognised codes such as the UN Global Compact). Strategies with social policies typically avoid companies with low standards and/or work to encourage higher standards. See fund information for detail.

Ethical Values Led Exclusions

Has policies that set out their position on ethical or 'personal values' based issues. Strategies vary.

Companies are excluded if they are involved in any aspect of the production chain for tobacco products, including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Excludes companies which make controversial weapons such as landmines, cluster munitions and chemical weapons.

Avoids companies that manufacture weapons intended specifically for military use. Strategies vary - may or may not include non-strategic military products.

Does Not exclude manufacturers of products intended for use in armaments and weapons. So may invest in them

Avoids companies that produce alcohol. Strategies vary; some may allow a small proportion of revenue to come from this area.

Avoids companies with significant involvement in the gambling industry. Some may allow a small proportion of revenues to come from this area.

Avoids companies that derive significant income from pornography and related areas. Strategies vary.

Avoids companies that test their products on animals for purposes other than medical benefit (e.g. for cosmetics). Strategies vary.

Meeting Peoples' Basic Needs

Have investments in social housing or similar assets.

Gilts & Sovereigns

Invest in loans issued the government, commonly known as gilts or government bonds. These may or may not be ringfenced for specific projects (see additional options).

Invests in financial instruments issued by governments, typically for risk reasons, but do not screen them for environmental and social characteristics.

Banking & Financials

Can include banks as part of their holdings / portfolio.

Invests in financial instruments (cash, derivatives and / or foreign exchange) issued by banks. Strategies vary.

Product / Service Governance

Find fund / asset managers that factor in 'environmental, social and governance' issues as part of their investment decision making process. A focus on 'ESG' typically means a fund is carrying out additional research to help reduce ESG related risks. It does not necessarily mean a focus on sustainability. Strategies vary. See fund literature.

Asset Size

Invests in international entities or bodies with agreed remits that are broadly similar to those that may otherwise be undertaken by individual governments eg the UN

How The Fund/Portfolio Works

Has principle 'ethical approach' to avoid companies by using negative screening criteria. Strategies vary.

Aims to avoid companies that do significant harm. This originates from the EU’s sustainable finance ‘DNSH’ (do no significant harm) work, which is not necessarily used by UK investors.

Publish explanations of their ethical, social and/or environmental policies online (i.e. investment decision making strategies/ buy/sell &/or asset management strategies).

Uses specialist strategies to aid performance which involve ‘lending’ assets to others at specific points in time.

Intended Clients & Product Options

Designed for clients who care about ethical and values-based issues, often alongside sustainability issues also.

Available via a tax efficient ISA product wrapper.

Labels & Accreditations

Find options that are rated by research agency 'Rayner Spencer Mills Research' (awarded 'RSMR Rated' status). Contact RSMR for further information.

Fund Management Company Information

About The Business

Finds fund / asset management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

Find fund / asset management companies that actively encourage higher 'environmental, social and governance' and / or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Find fund / asset managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Find fund / asset managers that consider responsible ownership and ESG to be a key differentiator for their business.

Find fund / asset management companies that take sustainability criteria into account when selecting and/or managing all of their property / real estate investments.

Find fund / asset management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management.

Finds organisations / fund managers that have an in-house (company wide) diversity improvement programme - meaning that they are working to ensure that within their own businesses they employ people from diverse backgrounds - often typically focused on ethnicity and/or sex.

This fund / asset management company invests in companies which have recently listed on a stock exchange (which is important as it can help grow new businesses).

Fund / asset management company has investments in bonds designed to meet sustainability requirements - however these assets may not be 'ringfenced' for this purpose. See website for details.

Collaborations & Affiliations

Find fund / asset management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

Find fund / asset management companies that are members of UKSIF - the UK Sustainable Investment and Finance association

Find fund / asset management companies that have partnered with Fund EcoMarket - meaning that they are helping to improve access to information on sustainable and responsible investment by paying an annual fee to us which enables us to publish information for free. Partner funds are listed ahead of other funds and have their logos displayed.

Fund management entity is a member of the Investment Association https://www.theia.org/

Resources

Find fund / asset management companies that employ people to steer and support fund managers in voting shares at company AGM's and EGMs in ways that are consistent with encouraging higher ESG/sustainability standards.

Find a fund / asset management company that directly employs specialist ESG/SRI/sustainability researchers or analysts. This allows asset managers to discuss environmental, social and governance risks and opportunities directly with companies.

Find fund / asset management companies that makes use of expert external research companies. This can help deliver specialist expertise and means resources are pooled with other investors.

Accreditations

Find fund / asset managers that are signatories to the FRC UK Stewardship Code, which sets out a framework for constructive investor / investee relations where managers are encouraged to behave like responsible, typically longer term 'company owners'.

Engagement Approach

Find fund / asset management companies that regularly initiate or run industry wide (collaborative) investor projects aimed at raising environmental, social and governance standards amongst investee companies.

Fund / asset manager has stewardship /responsible ownership strategy that is focused on addressing climate change with investee assets.

Fund / asset manager has a stewardship /responsible ownership strategy that involves working with fossil fuel companies on climate change related issues. See fund manager website for details.

Fund / asset manager has a stewardship / responsible ownership policy that means they are working to encourage more responsible mining practices - where environmental and social issues are properly dealt with by the companies they invest in.

The fund / asset manager has a responsible ownership / stewardship strategy that focuses on biodiversity and nature issues relating to the assets they invest the aim of which will be to reduce harm and or deliver improvement. Strategies vary. https://tnfd.global

Fund / asset manager has a responsible ownership / stewardship strategy which means they are working to encourage the shift to more sustainable business practices in ways that respect and are sensitive to social issues and the impact change has on people effected by the changes that are taking place. https://www.transitionpathwayinitiative.org/ https://transitiontaskforce.net/

Fund / asset manager has responsible ownership / stewardship strategy in place which aims to address human rights issues in investee companies (and potentially their suppliers) with the aim of raising standards

Fund / asset manager has responsible ownership / stewardship strategy in place that aims to improve labour standards for the benefit of employees in investee companies (and potentially their suppliers)

Fund / asset management company has a stewardship strategy in place which involves working to raise diversity, equality and inclusion standards across investee assets

Fund / asset manager is working with the assets they hold to help stamp out modern slavery - where direct or indirect company employees are exploited for business benefits.

Fund / asset managers have stewardship strategies in place that focus on improving governance standards across investee assets

Fund / asset manager has stewardship strategy in place which involves discussing mental health issues with investee companies - with the aim of raising standards

Has a stewardship / responsible ownership strategy that encourages responsible supply chain - ie the managers will discuss environmental, social and governance issues with investee companies with the aim of raising standards

Working to address sustainability, ESG and related concerns around artificial intelligence.

Escalation policies describe how a manager will proceed if stewardship / engagement activity is not successful in the short term.

Company Wide Exclusions

Find fund / asset management companies (not funds) that avoid investment in 'controversial weapons' across all of their funds and other investment vehicles.

Climate & Net Zero Transition

Fund / asset management organisations that have pledged to reduce their greenhouse gas emissions to ‘net zero’. Strategies vary - this area is changing rapidly.

Fund / asset manager AGM / EGM voting strategy has processes in place that mean they will normally be expected to vote in a way that will encourage the transition to net zero greenhouse gas emissions.

Find fund / asset management companies that have published a Climate Risk policy or statement that is signed / owned by their Chief Executive.

This fund / asset management company has set a date by which they plan to achieve net zero greenhouse gas / CO2e emissions.

Find fund / asset management companies that are working with the companies they invest in to encourage reductions in carbon dioxide and other greenhouse gas emissions.

Finds organisations / fund managers that have published ‘forward looking climate metrics’ e.g. 'implied temperature rise' data that are a total of the asset management company's share (% owned) of all the investee company emissions of the assets they manage, as well as their own direct and other indirect emissions.

This fund / asset management company plans to achieve net zero greenhouse gas (CO2e) emissions by reducing their emissions. Calculations and scope vary.

Finds organisations / fund management companies that are in the process of working out how to make a ‘net zero commitment’ - meaning that when that is finalised they will have started the process of reducing their total greenhouse gas emissions to 'zero'.

Transparency

Find fund / asset management companies that publish a report detailing their responsible investment ownership - also known as 'Stewardship' - activity.

Find fund / asset management companies that publish information about their sustainable and responsible investment strategies on their company website.

Find fund / asset management companies that will supply information about their sustainable and responsible investment activity on request.

Fund / asset management companies that publish a full record of how they vote their shares at AGMs (annual general meetings) and EGMs (extraordinary general meetings). Voting strategies have an important role to play encouraging higher environmental, social and governance standards.

Find fund / asset management companies that have supplied Dialshifter information. See Dialshifter tab within record for more information.

Sustainable, Responsible &/or ESG Policy:

Companies that generate over 10% of their turnover from any one or a combination of the following five categories are excluded:

- Alcohol: Brewing, distilling or selling alcoholic drinks

- Armaments: Manufacturing armaments or nuclear weapons, or associated strategic products

- Gambling Operating betting shops, casinos or amusement arcades

- Tobacco Growing, processing or selling tobacco products

- Pornography Providing adult entertainment services

The screening process also identifies companies that have the opportunity to make a positive impact. Companies with inappropriate or inadequate policies or systems in the following areas are also excluded:

- Environment Companies with a high environmental impact and no evidence of appropriate environmental management systems

- Human rights Companies in strategic sectors operating in countries of concern with no evidence of policies or systems to manage human rights risks

- Animal testing Companies that test cosmetics on animals or provide animal testing services. Our Ethical Bond fund additionally excludes companies that test household products, other products (excluding medicines) and their ingredients on animals.

Process:

RLAM has established and maintained a commendable reputation over the last two decades as a high quality, active fixed income manager. Our long-standing philosophy and process have been central to our success and consistent record of outperformance.

The three objectives of RLAM’s credit process are:

- To exploit market inefficiencies and identify mis-priced credit risk – based on a belief that the market undervalues genuine credit enhancements, over-values more superficial credit characteristics and that the methodologies employed by rating agencies are too narrow and rigid;

- To ensure appropriate research coverage to identify and manage specific risks in portfolios; this leads to a high exposure to secured debt; and

- To ensure our funds’ are diversified without significant sector or issuer concentrations

The central pillars of our investment approach which enable us to achieve these objectives are:

1. A targeted allocation of resource

- Focuses primary research (financial modelling and the derivation of financial data) on untapped and under-researched areas; targeting of primary research will be a function of both the opportunity to add value (scale, profile and third party coverage of an issuer) and potential financial risk. The nature of our universe, with a high proportion of large cap issuers, releases our analysts to focus primary analysis on genuine market inefficiencies

- Never duplicates third party research if it cannot be enhanced.

- Never delegates the final evaluation; whether information is being internally or externally derived, given our very different philosophical approach to valuation, we will never delegate the final decision as to whether a bond is selected in our portfolios.

2. A focus on sustainability of opening lender position

- We are aware that volatility is damaging for providers of fixed capital and the risk profile of credit is asymmetric (bonds have capped upside – they do not participate in the profit growth of a company – but full exposure to capital loss).

- We focus on fundamental factors that genuinely impact creditors.

- We place most emphasis on the highest conviction characteristics of corporate bonds e.g. covenants, structure and security.

3. Encouraging a collegiate approach to research

- Team-wide decision making; maintaining a team of experienced credit specialists with contrasting and complementary knowledge and skills, sharing a common philosophy and incentives.

- Overlapped sector coverage (ABS and unsecured); this ensures analysts have a more rounded sense of valuation to bring to their discussions with the rest of the team and increases team-wide scrutiny.

- Dynamic interaction and prompt evaluation; maintaining an appropriate team size that avoids unnecessary bureaucracy and fragmented decision making.

While issuer type will determine the specific nature of the research undertaken and the balance of the analysis, RLAM has a long established framework for evaluating ‘overall’ credit risk. At the heart of this approach is producing ‘relevant’ corporate analysis. We do not over-emphasise short-term trends or news flow and do not produce research simply to demonstrate the breadth of our capabilities. We feel this merely adds to the mountain of research that is already produced externally across large swathes of a credit market that is dominated by large issuers. It does mean focusing on how we can add value through our research and a consideration of factors that are relevant to long-term lenders rather than traders.

Our focus is on creating robust portfolios that will deliver long-term returns in a low risk way. The core of our approach is therefore to concentrate upon the most reliable sources of outperformance.

- Sector and security selection: Our philosophy is to look where others are not looking as the best way of creating diversified and robust credit portfolios. This means emphasis on bond covenant analysis and attention to the security offered by a particular bond.

- Duration: Positioning is a key determinant of performance. We manage the duration of the portfolio to reflect our views on long-term interest rates. Our style is to back our views but to ensure that the scale of the duration position is appropriate.

- Asset allocation: This can be a source of outperformance; we are prepared to be different from the consensus.

- Yield curve: Positioning will be used to enhance return. We undertake various yield curve trades within the different segments of the portfolio while controlling overall duration.

Over the longer term, we believe that sector and security selection will be the most important component of outperformance and that the contribution to performance of other factors will vary depending on market conditions.

By emphasising a longer term investment horizon, RLAM seeks to ensure that our clients we are adequately paid for overall credit risk without an assumed safety net of constant liquidity. However, we also believe that our tested philosophy and processes, combined with an efficient team structure, provides an exceptionally solid foundation to exploit short-term valuation anomalies when these present themselves. This is very distinct from an overall strategy that is dependent on lower conviction trading to generate sustainable returns.

.

Ethical overlay

Our ethical investment process begins with screening for eligible investments, which is conducted by our in-house team of experts using specialist research from MSCI ESG Research and Glass Lewis. Our in-house team has extensive knowledge of environmental, social and governance (ESG) issues and has created a bespoke approach to assessing ESG from a credit perspective. RLAM’s ethical framework combines the avoidance of companies involved in excluded activities with the identification of best of breed companies in permitted sectors and integration of material ESG issues into investment decision-making.

Companies that generate over 10% of their turnover from any one or a combination of the following five categories are excluded:

- Alcohol Brewing, distilling or selling alcoholic drinks

- Armaments Manufacturing armaments or nuclear weapons, or associated strategic products

- Gambling Operating betting shops, casinos or amusement arcades

- Tobacco Growing, processing or selling tobacco products

- Pornography Providing adult entertainment services

The screening process also identifies companies that have the opportunity to make a positive impact. Companies with inappropriate or inadequate policies or systems in the following areas are also excluded:

- Environment Companies with a high environmental impact and no evidence of appropriate environmental management systems

- Human rights Companies in strategic sectors operating in countries of concern with no evidence of policies or systems to manage human rights risks

- Animal testing Companies that test cosmetics on animals or provide animal testing services. Our Ethical Bond fund additionally excludes companies that test household products, other products (excluding medicines) and their ingredients on animals.

We integrate ESG into our credit analysis as we principally see ourselves as long-term lenders of our clients’ money rather than short-term traders of bonds. The sustainability of our lending position is, therefore, critical and we tailor our approach both to the specifics of fixed income investing, reflecting the asymmetric nature of credit risk, as well as the particular characteristics of each issuer. We prioritise research on sectors where we feel there is most ESG risk and/or limited third party ESG research.

Overall credit risk identification is enhanced through dynamic interaction between our RI and credit analysts, whilst mitigation of observable risks, through bond structure, pricing and portfolio construction, is the responsibility of our credit specialists.

We use ESG data to inform our opinions, but are aware of the limitations of third party data. ESG risk is nuanced and its impact on credit risk will be materially impacted by the specific nature of the bonds we purchase (structure, credit enhancements etc.). We prefer to create bespoke ESG analysis that is debt specific to support our decisions. However, we recognise clients’ needs to provide accessible ESG data for reporting and regulatory purposes. Given our dissatisfaction with third party ESG data, which is often incorrect/incomplete and distant from the economic reality of how we lend, we are in the process of developing proprietary ESG ratings.

We buy external ESG data from MSCI, Trucost, SASB and RepRisk. We have built up a significant library of proprietary ESG data and insights on more debt-centric, but often high impact, issuers such as water utilities, social housing, infrastructure companies, and MBS. Our ESG ratings will incorporate these insights, co-created by the RI and credit teams, ensuring our data is tailored to fixed income.

Resources, Affiliations & Corporate Strategies:

Royal London Asset Management’s in-house Responsible Investment (RI) team of 19 professionals is led by Head of Responsible Investment, Ashley Hamilton-Claxton. The RI team works with the investment teams to monitor, assess and analyse ESG factors, vote our shares and engage with companies to encourage better social and environmental outcomes, or better risk management. This team is also responsible for helping to set out our approach and policies around systemic issues such as climate change, providing guidance, feedback and coaching to fund managers and analysts on the latest data, research, policy and industry practices.

Governance of Responsible Investment at Royal London Asset Management is integrated at varying levels of the organisation however is led by senior leadership. The Board has ultimate responsibility for setting Royal London Asset Management’s risk appetite and reviewing our strategic risks. Our Chief Investment Officer (CIO) is a regulated Senior Management Function (SMF) and is the Executive team member that is accountable for setting the investment strategy, and overseeing our Responsible Investment function, including our approach to stewardship and climate investment risk. The CIO, with support from the investment teams, updates the Board and monitors responsible investment in line with Royal London Asset Management’s risk tolerance threshold. The CIO is also responsible for ensuring responsible investment, stewardship and climate change risk management is embedded across Royal London Asset Management’s investment strategies. The CIO is a member of Royal London Asset Management’s Executive Committee and also chairs the Investment Committee.

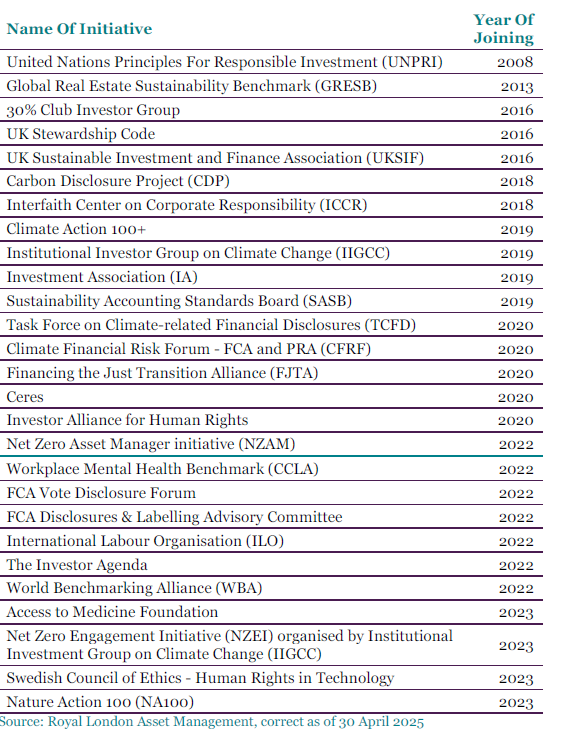

Royal London Asset Management is a member of the following initiatives:

SDR Labelling:

Unlabelled - promotes sustainable characteristics (Has CFD)

- Consumer Facing Disclosure

SDR Literature:

Literature

Voting Record

Disclaimer

.

| Fund Name | SRI Style | SDR Labelling | Product | Region | Asset Type | Launch Date | Last Amended |

|

|---|---|---|---|---|---|---|---|---|

Royal London Ethical Bond |

Ethical Style | Unlabelled - promotes sustainable characteristics (Has CFD) | OEIC | UK | Fixed Interest | 31/01/2007 | Aug 2025 | |

ObjectivesThe fund integrates the assessment of environmental, social, and governance (ESG) risks into the investment decision making process in order to help mitigate ESG risks and/or identify opportunities for investors. In addition to identifying and managing ESG risks, Royal London Asset Management’s Ethical Bond Fund applies an additional layer to its process – ethical bond screening. This process identifies bonds which meet predetermined ethical criteria, excluding from investment in the fund bonds which fall short of these requirements. Full details of the exclusions can be found at www.rlam.com |

Fund/Portfolio Size: £1141.44m (as at: 30/04/2025) Total Screened Themed SRI Assets: £59860.00m (as at: 30/04/2025) Total Assets Under Management: £177020.00m (as at: 31/03/2025) ISIN: GB00BJ4KSX76, GB00BJ4KSY83, GB00BMY4CR20, GB00BJ4KSZ90 Contact Us: bdsupport@RLAM.co.uk |

|||||||

Sustainable, Responsible &/or ESG OverviewOur ethical investment process begins with screening for eligible investments, which is conducted by our in-house team of experienced experts using specialist research from MSCI ESG Research and Glass Lewis, using a bespoke approach to assessing ESG from a credit perspective. Our ethical framework combines the avoidance of companies involved in excluded activities with the identification of and evaluation of ESG risk. Companies that generate over 10% of their turnover from any one or a combination of alcohol, armaments, gambling, tobacco, pornography, or fossil fuels are excluded, whilst the screening process also identifies companies that have the opportunity to make a positive impact. Companies with inappropriate/ inadequate policies or systems in environment, human rights, or animal testing are also excluded. |

||||||||

|

Primary fund last amended: Aug 2025 |

||||||||

|

Information received directly from Fund Manager |

||||||||

|

Please select what you would like to read:

Fund FiltersEnvironmental - General

Environmental policy

Has policies which relate to environmental issues. These will typically set out their stance on issues such as pollution, climate change, resource management, biodiversity loss, carbon emissions, plastics and/or additional environmental impacts. Strategies vary.

Environmental damage & pollution policy

Has documented policies explaining the approach to environmental damage and pollution. Strategies vary. Climate Change & Energy

Coal, oil & / or gas majors excluded

Avoid investment in major coal, oil and/or gas (extraction) companies. Strategies vary.

Fracking & tar sands excluded

Avoid companies involved in fracking and tar sands - which are widely regarded as controversial methods of oil and gas extraction. Strategies vary.

Fossil fuel reserves exclusion

Avoid investing in companies / assets with coal, oil and gas reserves. See individual entry information for further details.

Invests in clean energy / renewables

Invest in renewable energy companies and / or companies where renewable energy is a significant part of their business. Strategies vary.

Fossil fuel exploration exclusion - direct involvement

Excludes companies and other assets with direct involvement in fossil fuel exploration (eg coal, oil and gas companies) Social / Employment

Social policy

Has policies which set out their approach to social issues (e.g. human rights, labour standards, equal opportunities, child labour and/or adherence to internationally recognised codes such as the UN Global Compact). Strategies with social policies typically avoid companies with low standards and/or work to encourage higher standards. See fund information for detail. Ethical Values Led Exclusions

Ethical policies

Has policies that set out their position on ethical or 'personal values' based issues. Strategies vary.

Tobacco & related product manufacturers excluded

Companies are excluded if they are involved in any aspect of the production chain for tobacco products, including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Controversial weapons exclusion

Excludes companies which make controversial weapons such as landmines, cluster munitions and chemical weapons.

Armaments manufacturers avoided

Avoids companies that manufacture weapons intended specifically for military use. Strategies vary - may or may not include non-strategic military products.

Armaments manufacturers not excluded

Does Not exclude manufacturers of products intended for use in armaments and weapons. So may invest in them

Alcohol production excluded

Avoids companies that produce alcohol. Strategies vary; some may allow a small proportion of revenue to come from this area.

Gambling avoidance policy

Avoids companies with significant involvement in the gambling industry. Some may allow a small proportion of revenues to come from this area.

Pornography avoidance policy

Avoids companies that derive significant income from pornography and related areas. Strategies vary.

Animal testing - excluded except if for medical purposes

Avoids companies that test their products on animals for purposes other than medical benefit (e.g. for cosmetics). Strategies vary. Meeting Peoples' Basic Needs

Invests > 5% in social housing

Have investments in social housing or similar assets. Gilts & Sovereigns

Invests in gilts / government bonds

Invest in loans issued the government, commonly known as gilts or government bonds. These may or may not be ringfenced for specific projects (see additional options).

Invests in sovereigns as an unscreened asset class

Invests in financial instruments issued by governments, typically for risk reasons, but do not screen them for environmental and social characteristics. Banking & Financials

Invests in banks

Can include banks as part of their holdings / portfolio.

Invests in financial instruments issued by banks

Invests in financial instruments (cash, derivatives and / or foreign exchange) issued by banks. Strategies vary. Product / Service Governance

ESG integration strategy

Find fund / asset managers that factor in 'environmental, social and governance' issues as part of their investment decision making process. A focus on 'ESG' typically means a fund is carrying out additional research to help reduce ESG related risks. It does not necessarily mean a focus on sustainability. Strategies vary. See fund literature. Asset Size

Invest in supranationals

Invests in international entities or bodies with agreed remits that are broadly similar to those that may otherwise be undertaken by individual governments eg the UN How The Fund/Portfolio Works

Negative selection bias

Has principle 'ethical approach' to avoid companies by using negative screening criteria. Strategies vary.

Significant harm exclusion

Aims to avoid companies that do significant harm. This originates from the EU’s sustainable finance ‘DNSH’ (do no significant harm) work, which is not necessarily used by UK investors.

SRI / ESG / Ethical policies explained on website

Publish explanations of their ethical, social and/or environmental policies online (i.e. investment decision making strategies/ buy/sell &/or asset management strategies).

Use stock / securities lending

Uses specialist strategies to aid performance which involve ‘lending’ assets to others at specific points in time. Intended Clients & Product Options

Intended for clients interested in ethical issues

Designed for clients who care about ethical and values-based issues, often alongside sustainability issues also.

Available via an ISA (OEIC only)

Available via a tax efficient ISA product wrapper. Labels & Accreditations

RSMR rated

Find options that are rated by research agency 'Rayner Spencer Mills Research' (awarded 'RSMR Rated' status). Contact RSMR for further information. Fund Management Company InformationAbout The Business

Responsible ownership / stewardship policy or strategy (AFM company wide)

Finds fund / asset management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

ESG / SRI engagement (AFM company wide)

Find fund / asset management companies that actively encourage higher 'environmental, social and governance' and / or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Vote all* shares at AGMs / EGMs (AFM company wide)

Find fund / asset managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Responsible ownership / ESG a key differentiator (AFM company wide)

Find fund / asset managers that consider responsible ownership and ESG to be a key differentiator for their business.

Sustainable property strategy (AFM company wide)

Find fund / asset management companies that take sustainability criteria into account when selecting and/or managing all of their property / real estate investments.

Integrates ESG factors into all / most (AFM) fund research

Find fund / asset management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management.

In-house diversity improvement programme (AFM company wide)

Finds organisations / fund managers that have an in-house (company wide) diversity improvement programme - meaning that they are working to ensure that within their own businesses they employ people from diverse backgrounds - often typically focused on ethnicity and/or sex.

Invests in newly listed companies (AFM company wide)

This fund / asset management company invests in companies which have recently listed on a stock exchange (which is important as it can help grow new businesses).

Invests in new sustainability linked bond issuances (AFM company wide)

Fund / asset management company has investments in bonds designed to meet sustainability requirements - however these assets may not be 'ringfenced' for this purpose. See website for details. Collaborations & Affiliations

PRI signatory

Find fund / asset management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

UKSIF member

Find fund / asset management companies that are members of UKSIF - the UK Sustainable Investment and Finance association

Fund EcoMarket partner

Find fund / asset management companies that have partnered with Fund EcoMarket - meaning that they are helping to improve access to information on sustainable and responsible investment by paying an annual fee to us which enables us to publish information for free. Partner funds are listed ahead of other funds and have their logos displayed.

Investment Association (IA) member

Fund management entity is a member of the Investment Association https://www.theia.org/ Resources

In-house responsible ownership / voting expertise

Find fund / asset management companies that employ people to steer and support fund managers in voting shares at company AGM's and EGMs in ways that are consistent with encouraging higher ESG/sustainability standards.

Employ specialist ESG / SRI / sustainability researchers

Find a fund / asset management company that directly employs specialist ESG/SRI/sustainability researchers or analysts. This allows asset managers to discuss environmental, social and governance risks and opportunities directly with companies.

Use specialist ESG / SRI / sustainability research companies

Find fund / asset management companies that makes use of expert external research companies. This can help deliver specialist expertise and means resources are pooled with other investors. Accreditations

UK Stewardship Code signatory (AFM company wide)

Find fund / asset managers that are signatories to the FRC UK Stewardship Code, which sets out a framework for constructive investor / investee relations where managers are encouraged to behave like responsible, typically longer term 'company owners'. Engagement Approach

Regularly lead collaborative ESG initiatives (AFM company wide)

Find fund / asset management companies that regularly initiate or run industry wide (collaborative) investor projects aimed at raising environmental, social and governance standards amongst investee companies.

Engaging on climate change issues

Fund / asset manager has stewardship /responsible ownership strategy that is focused on addressing climate change with investee assets.

Engaging with fossil fuel companies on climate change

Fund / asset manager has a stewardship /responsible ownership strategy that involves working with fossil fuel companies on climate change related issues. See fund manager website for details.

Engaging to encourage responsible mining practices

Fund / asset manager has a stewardship / responsible ownership policy that means they are working to encourage more responsible mining practices - where environmental and social issues are properly dealt with by the companies they invest in.

Engaging on biodiversity / nature issues

The fund / asset manager has a responsible ownership / stewardship strategy that focuses on biodiversity and nature issues relating to the assets they invest the aim of which will be to reduce harm and or deliver improvement. Strategies vary. https://tnfd.global

Engaging to encourage a Just Transition

Fund / asset manager has a responsible ownership / stewardship strategy which means they are working to encourage the shift to more sustainable business practices in ways that respect and are sensitive to social issues and the impact change has on people effected by the changes that are taking place. https://www.transitionpathwayinitiative.org/ https://transitiontaskforce.net/

Engaging on human rights issues

Fund / asset manager has responsible ownership / stewardship strategy in place which aims to address human rights issues in investee companies (and potentially their suppliers) with the aim of raising standards

Engaging on labour / employment issues

Fund / asset manager has responsible ownership / stewardship strategy in place that aims to improve labour standards for the benefit of employees in investee companies (and potentially their suppliers)

Engaging on diversity, equality & / or inclusion issues

Fund / asset management company has a stewardship strategy in place which involves working to raise diversity, equality and inclusion standards across investee assets

Engaging to stop modern slavery

Fund / asset manager is working with the assets they hold to help stamp out modern slavery - where direct or indirect company employees are exploited for business benefits.

Engaging on governance issues

Fund / asset managers have stewardship strategies in place that focus on improving governance standards across investee assets

Engaging on mental health issues

Fund / asset manager has stewardship strategy in place which involves discussing mental health issues with investee companies - with the aim of raising standards

Engaging on responsible supply chain issues

Has a stewardship / responsible ownership strategy that encourages responsible supply chain - ie the managers will discuss environmental, social and governance issues with investee companies with the aim of raising standards

Engaging on the responsible use of AI

Working to address sustainability, ESG and related concerns around artificial intelligence.

Stewardship escalation policy

Escalation policies describe how a manager will proceed if stewardship / engagement activity is not successful in the short term. Company Wide Exclusions

Controversial weapons avoidance policy (AFM company wide)

Find fund / asset management companies (not funds) that avoid investment in 'controversial weapons' across all of their funds and other investment vehicles. Climate & Net Zero Transition

Net Zero commitment (AFM company wide)

Fund / asset management organisations that have pledged to reduce their greenhouse gas emissions to ‘net zero’. Strategies vary - this area is changing rapidly.

Voting policy includes net zero targets (AFM company wide)

Fund / asset manager AGM / EGM voting strategy has processes in place that mean they will normally be expected to vote in a way that will encourage the transition to net zero greenhouse gas emissions.

Publish 'CEO owned' Climate Risk policy (AFM company wide)

Find fund / asset management companies that have published a Climate Risk policy or statement that is signed / owned by their Chief Executive.

Net Zero - have set a Net Zero target date (AFM company wide)

This fund / asset management company has set a date by which they plan to achieve net zero greenhouse gas / CO2e emissions.

Encourage carbon / greenhouse gas reduction (AFM company wide)

Find fund / asset management companies that are working with the companies they invest in to encourage reductions in carbon dioxide and other greenhouse gas emissions.

‘Forward Looking Climate Metrics’ published / ITR (AFM company wide)

Finds organisations / fund managers that have published ‘forward looking climate metrics’ e.g. 'implied temperature rise' data that are a total of the asset management company's share (% owned) of all the investee company emissions of the assets they manage, as well as their own direct and other indirect emissions.

Carbon offsetting – do NOT offset carbon as part of net zero plan (AFM company wide)

This fund / asset management company plans to achieve net zero greenhouse gas (CO2e) emissions by reducing their emissions. Calculations and scope vary.

Working towards a ‘Net Zero’ commitment (AFM company wide)

Finds organisations / fund management companies that are in the process of working out how to make a ‘net zero commitment’ - meaning that when that is finalised they will have started the process of reducing their total greenhouse gas emissions to 'zero'. Transparency

Publish responsible ownership / stewardship report (AFM company wide)

Find fund / asset management companies that publish a report detailing their responsible investment ownership - also known as 'Stewardship' - activity.

Full SRI / responsible ownership policy information on company website

Find fund / asset management companies that publish information about their sustainable and responsible investment strategies on their company website.

Full SRI / responsible ownership policy information available on request

Find fund / asset management companies that will supply information about their sustainable and responsible investment activity on request.

Publish full voting record (AFM company wide)

Fund / asset management companies that publish a full record of how they vote their shares at AGMs (annual general meetings) and EGMs (extraordinary general meetings). Voting strategies have an important role to play encouraging higher environmental, social and governance standards.

Dialshifter statement

Find fund / asset management companies that have supplied Dialshifter information. See Dialshifter tab within record for more information. Sustainable, Responsible &/or ESG Policy:Companies that generate over 10% of their turnover from any one or a combination of the following five categories are excluded:

Process:RLAM has established and maintained a commendable reputation over the last two decades as a high quality, active fixed income manager. Our long-standing philosophy and process have been central to our success and consistent record of outperformance.

2. A focus on sustainability of opening lender position

3. Encouraging a collegiate approach to research

Over the longer term, we believe that sector and security selection will be the most important component of outperformance and that the contribution to performance of other factors will vary depending on market conditions.

. Ethical overlay Our ethical investment process begins with screening for eligible investments, which is conducted by our in-house team of experts using specialist research from MSCI ESG Research and Glass Lewis. Our in-house team has extensive knowledge of environmental, social and governance (ESG) issues and has created a bespoke approach to assessing ESG from a credit perspective. RLAM’s ethical framework combines the avoidance of companies involved in excluded activities with the identification of best of breed companies in permitted sectors and integration of material ESG issues into investment decision-making.

The screening process also identifies companies that have the opportunity to make a positive impact. Companies with inappropriate or inadequate policies or systems in the following areas are also excluded:

We integrate ESG into our credit analysis as we principally see ourselves as long-term lenders of our clients’ money rather than short-term traders of bonds. The sustainability of our lending position is, therefore, critical and we tailor our approach both to the specifics of fixed income investing, reflecting the asymmetric nature of credit risk, as well as the particular characteristics of each issuer. We prioritise research on sectors where we feel there is most ESG risk and/or limited third party ESG research.

Resources, Affiliations & Corporate Strategies:Royal London Asset Management’s in-house Responsible Investment (RI) team of 19 professionals is led by Head of Responsible Investment, Ashley Hamilton-Claxton. The RI team works with the investment teams to monitor, assess and analyse ESG factors, vote our shares and engage with companies to encourage better social and environmental outcomes, or better risk management. This team is also responsible for helping to set out our approach and policies around systemic issues such as climate change, providing guidance, feedback and coaching to fund managers and analysts on the latest data, research, policy and industry practices. Governance of Responsible Investment at Royal London Asset Management is integrated at varying levels of the organisation however is led by senior leadership. The Board has ultimate responsibility for setting Royal London Asset Management’s risk appetite and reviewing our strategic risks. Our Chief Investment Officer (CIO) is a regulated Senior Management Function (SMF) and is the Executive team member that is accountable for setting the investment strategy, and overseeing our Responsible Investment function, including our approach to stewardship and climate investment risk. The CIO, with support from the investment teams, updates the Board and monitors responsible investment in line with Royal London Asset Management’s risk tolerance threshold. The CIO is also responsible for ensuring responsible investment, stewardship and climate change risk management is embedded across Royal London Asset Management’s investment strategies. The CIO is a member of Royal London Asset Management’s Executive Committee and also chairs the Investment Committee. Royal London Asset Management is a member of the following initiatives:

Dialshifter (Corporate)Our organisation is helping to support the Paris Climate Agreement and the Race to Net Zero by… Net Zero Commitment Summary By 2030, Royal London Asset Management aims to engage issuers representing 70% of financed emissions, encouraging science-based targets (e.g., SBTi) and climate transition plans. This firm-level commitment is transparently reported and does not apply to all RLAM funds—please refer to individual fund prospectuses. The focus is on real-economy decarbonisation through engagement, not divestment. RLAM supports decarbonising portfolio companies and collaborates with segregated clients who have net zero goals. This commitment assumes supportive government action and alignment with RLAM’s fiduciary duties. SDR Labelling:Unlabelled - promotes sustainable characteristics (Has CFD)

SDR Literature:LiteratureVoting RecordDisclaimer. |

||||||||