7IM Responsible Balanced Fund

SRI Style:

Sustainable Style

SDR Labelling:

Unlabelled with sustainable characteristics

Product:

OEIC

Fund Region:

Global

Fund Asset Type:

Multi Asset

Launch Date:

02/02/2007

Last Amended:

Jun 2025

Dialshifter ( ):

):

Fund/Portfolio Size:

£117.00m

(as at: 30/04/2025)

Total Screened Themed SRI Assets:

£137.00m

(as at: 31/05/2024)

Total Responsible Ownership Assets:

£72.10m

(as at: 31/03/2024)

Total Assets Under Management:

£21067.00m

(as at: 31/05/2024)

ISIN:

GB00B1LBFW55, GB00B1LBFV49, GB00B1LBFZ86, GB00B1LBG003, GB00B1LBG227, GB00B1LBG110, GB00BJBPWR79, GB00BJBPWS86

Contact Us:

Objectives:

The fund aims to provide a balance of income and capital growth.

Sustainable, Responsible

&/or ESG Overview:

The fund will invest at least 70% of its value in collective investment vehicles and other assets that demonstrate sustainability characteristics using the two stages described briefly below. The fund assesses ESG factors in determining what assets to invest in. For company shares, corporate bonds and other funds, the fund employs a two-stage process. The first stage is excluding any investments that are being considered by the fund from certain sectors or business areas. The maximum revenue limit for any company is 10%. The second stage applies a positive selection process to judge whether an investment has sustainability characteristics. When selecting companies and third-party funds, the fund applies its sustainability approach along with key metrics, which are fully described in the Prospectus. The inputs together measure: Environmental issues, Human capital issues, and Social capital issues.

Primary fund last amended:

Jun 2025

Information directly from fund manager.

Fund Filters

Sustainability - General

Funds that have policies that consider (environmental and social) sustainability issues. Strategies vary but are likely to consider environmental issues like climate change, carbon emissions, biodiversity loss, resource management, environmental impacts; and social issues like equal opportunities, human rights, labour standards, diversity and adherence to internationally recognised codes. See fund information.

Find funds which substantially focus on sustainability issues

Find funds that have documented policies or thematic investment approaches relating to investment in more sustainable, greener transport methods. These will typically set out a preference for companies that run, enable or support more sustainable methods of transport. See fund information for further detail.

A core element of these funds aim to encourage higher sustainability standards across business practices through responsible ownership / stewardship / engagement / voting activity

The delivery of the shift to a sustainable future is a core feature of this fund and its investment strategy. See eg https://www.transitionpathwayinitiative.org/

Nature & Biodiversity

Find funds that aim to avoid investing in companies that produce genetically modified seeds or crops. (This does not typically include avoiding companies such as supermarkets). See fund literature for further information.

Climate Change & Energy

A core element of these funds will aim to encourage the transition to lower carbon activities through responsible ownership / stewardship / engagement / voting activity

Funds that hold companies in the clean energy and renewable energy sectors (at the time research was supplied). Fund strategies vary, in particular the proportion of investment in these areas may vary significantly. Check fund literature for details.

Ethical Values Led Exclusions

Find funds that have policies that set out their position on ethical or 'personal values' based issues. Strategies vary. See fund information for further detail.

Companies are excluded if they are involved in any aspect of the production chain for tobacco products, including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Find funds that exclude companies which make controversial weapons such as landmines, cluster munitions and chemical weapons. See fund literature for further information.

Find funds that avoid companies that manufacture products intended specifically for military use. Fund strategies vary - particularly with regard to non-strategic military products. See fund literature for fund specific details.

Find funds with a written civilian firearms exclusion policy - meaning that they will not invest in companies that make (or perhaps also sell) handguns made for non-military users.

Find funds that avoid investment in companies involved in the production of alcohol. Strategies vary; some funds allow a small proportion of profits to come from this area. See fund literature for further information.

Find funds that avoid companies with significant involvement in the gambling industry. Some funds may allow a small proportion of profits to come from this area. See fund policy for further details.

Find funds that avoid companies that derive significant income from pornography and related areas. Strategies vary. See fund details for further information.

Meeting Peoples' Basic Needs

Find funds with a thematic investment approach focusing on the ‘silver economy’ - in particular (typically) the issues and opportunities presented by changing demographics. This could include finance, healthcare and medicines and/ or longevity science to extend lifespans. Strategies vary. See fund literature for further information.

Healthcare and or medical theme or area of investment - the fund may have a single theme or many themes

Gilts & Sovereigns

Find funds that invest in loans issued the government, commonly known as gilts or government bonds. These may or may not be ringfenced for specific projects (see additional options). See fund literature for any selection criteria.

Find funds that invest in financial instruments issued by governments, typically for risk reasons, but do not screen them for environmental and social characteristics. See fund literature for more information.

Banking & Financials

Find funds that include banks as part of their holdings / portfolio.

Finds funds that include financial instruments (cash, derivatives and / or foreign exchange) issued by banks. See fund literature for further information as strategies vary.

Governance & Management

A core element of these funds will aim to encourage higher ESG standards through responsible ownership / stewardship / engagement /voting activity

Fund Governance

Find funds that factor in 'environmental, social and governance' issues as part of their investment decision making process. A focus on 'ESG' typically means a fund is carrying out additional research to help reduce ESG related risks. It does not necessarily mean a focus on sustainability. Strategies vary. See fund literature.

Asset Size

Find a fund that invests in a combination of small, medium and larger (potentially multinational)companies.

Targeted Positive Investments

Invests in loan stock that is exclusively used to finance environmental and social projects. See ICMA Sustainable Bond Guidelines.

Invests in loan stock that is supporting or enabling the shift towards a cleaner, more sustainable future. Strategies vary significantly and may or may not be linked to specific outcomes.

Impact Methodologies

Find funds that specifically set out to help deliver positive environmental impacts, benefits or 'real world' outcomes.

Find funds that specifically state that they aim to deliver positive social (i.e. people related) impacts and/or outcomes.

Fund aims to deliver positive environmental and or social impacts (real world benefits) through its engagement with investee assets

How The Fund Works

Find funds that focus on finding and investing in companies with positive / beneficial attributes. This strategy can be applied in addition to exclusion criteria and engagement/stewardship activity.

Find funds where their main 'ethical approach' is to avoid companies by using negative screening criteria. Read fund literature for further information.

Find funds where their main approach is to apply positive or negative ethical, social and / or environmental screens. Strictly screened funds are likely to exclude more companies than other related fund options. See fund literature for further information.

Find funds that make significant use of internationally agreed 'norms' (e.g. United Nations Global Compact - UNGC - or the UN Sustainable Development Goals - SDGs) as part of their investment selection process alongside additional SRI criteria such as positive or negative stock selection policies and/or stewardship strategies.

Find funds that have an ESG strategy (which is typically focused on avoiding companies that pose environmental, social or governance related risks) with additional criteria such as positive and/or negative screens, themes and stewardship strategies.

Intended Clients & Product Options

Finds funds designed to meet the needs of individual investors with an interest in sustainability issues.

Find funds designed for clients who care about ethical and values-based issues, often alongside sustainability issues also.

Finds funds designed to meet the needs of individual investors with an interest in ‘Impact investment funds’ which help or support the delivery of positive social or environmental impacts (or societal/real world outcomes) by investing in companies they regard as beneficial to people and / or the planet. Strategies vary. See fund literature for further information.

Only applicable for DFM’s & portfolio providers. Finds those that offer an SRI / ESG portfolio option

Fund Management Company Information

About The Business

Finds fund management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

Find fund management companies that actively encourage higher 'environmental, social and governance' and/or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Find fund management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management.

Collaborations & Affiliations

Find fund management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

Accreditations

Find fund managers that are signatories to the FRC UK Stewardship Code, which sets out a framework for constructive investor / investee relations where fund managers are encouraged to behave like responsible, typically longer term 'company owners'.

Engagement Approach

Asset manager has a stewardship /responsible ownership strategy that involves working with fossil fuel companies on climate change related issues. See fund manager website for details.

Escalation policies describe how a manager will proceed if stewardship / engagement activity is not successful in the short term.

Company Wide Exclusions

Find fund management companies (not funds) that avoid investment in 'controversial weapons' across all of their funds and other investment vehicles.

Climate & Net Zero Transition

Find fund management companies that are working with the companies they invest in to encourage reductions in carbon dioxide and other greenhouse gas emissions.

This asset management company plans to achieve net zero greenhouse gas (CO2e) emissions with the help of a scheme that will lock away an amount of carbon that is equivalent to the company’s own emissions – so that the end result is ‘net zero’. Calculations and scope vary.

Find fund management companies that are working to reduce their own (fund management company) carbon/greenhouse gas emissions.

Transparency

Find fund management companies that publish a report detailing their responsible investment ownership - also known as 'Stewardship' - activity.

Find companies that publish information about their sustainable and responsible investment strategies on their company website.

Find fund management companies that will supply information about their sustainable and responsible investment activity on request.

Fund management companies that publish a full record of how they vote their shares at AGMs (annual general meetings) and EGMs (extraordinary general meetings). Voting strategies have an important role to play encouraging higher environmental, social and governance standards.

Sustainable, Responsible &/or ESG Policy:

The 7IM Responsible Balanced Fund is an actively managed fund with a balanced risk profile, invested in a range of global equities, bonds and funds managed within a sustainable investment framework. The investment strategy for the fund encompasses detailed screening for sustainability using both negative screening to exclude investments which are significantly involved in unacceptable business areas and positive selection process to select investments with sustainable characteristics as set out in the prospectus. The Fund assesses environmental, social and governance (ESG) factors in determining what assets to invest in. For company shares, corporate bonds and other funds, the Fund employs a two-stage process. The inputs together measure:

- Environmental issues, including supporting and managing climate change mitigation (i.e. reduction of greenhouse gases) and adaptation, waste and water management or land management;

- Human capital issues, including fair labour practices, health and safety practices or supply chain management; and

- Social capital issues, including access to healthcare or finance, privacy and data security or consumer protection

We will invest at least 70% of the fund's value in collective investment vehicles and other assets that demonstrate sustainability characteristics.

Key sustainability metrics can be found in the latest CFD: https://www.7im.co.uk/media/kmgfb01b/7im-responsible-balanced-fund-consumer-facing-disclosure.pdf

Process:

- Negative screening

We apply specific exclusions on company shares, corporate bonds and other funds to keep exposure to controversial activities to a minimum. These controversial activities are outlined below:

- Adult entertainment

- Alcohol

- Armaments

- Gambling

- Genetically modified organisms (GMOs) in agriculture

- Nuclear power generation

- Tobacco

In respect of company shares and corporate bonds, the maximum revenue limit for any company is 10%. In respect of investments in other funds, there may be differences in the revenue limits. Further details are provided in Section 4. In any event, we limit the total exposure to companies linked to the excluded activities to 1%. If the aggregate portfolio exposure to the exclusions outlined above breaches this 1% tolerance, we will resolve any issue as soon as is practicably possible. Further details of the exclusion list are provided in Section 4.

- Positive selection

The Positive Selection Process further defines how the Fund can select company shares, corporate bonds and other funds that are considered to have sustainability characteristics. The process assesses the management of the following issues: • Environmental issues, including supporting and managing climate change mitigation (i.e. reduction of greenhouse gases) and adaptation, waste and water management or land management; • Human capital issues, including fair labour practices, health and safety practices or supply chain management; and • Social capital issues, including access to healthcare or finance, privacy and data security or consumer protection.

For investments in company shares:

For companies to be considered as having sustainable characteristics, they must meet at least one of the following considerations:

- a key issue score that is above the global equity index “average”; or

- a carbon intensity that is below the global equity index “average”.

For investments in collective investment vehicles:

For third-party funds to be considered as having sustainability characteristics, they must demonstrate the following:

- having a key issue score that is above the global equity index “average”; or

- having a carbon intensity below the global equity index “average”; and

- complies with at least one of the following criteria for selection:

- the fund must systematically integrate ESG factors into investment decisions, or

- the fund must analyse ESG materiality before and after investment decisions, or

- the fund must act as good stewards and implement responsible investment and engagement practices.

The purpose of the fund selection process at 7IM from an ESG perspective is to identify an investment that has the people, process and expertise in place to invest sustainably. We explain this below and use a number of third-party data tools to validate this due diligence.

- We screen the asset class universe for funds which follow a sustainable benchmark or systematically integrate ESG factors into investment decisions

- We screen these investments based on size, date of launch and key performance metrics

- We meet with managers to discuss how they integrate ESG into their investment process, firm culture and how they engage with companies that they are invested in

- We then do a deep dive into their investment process, how they generate value and how they manage risks.

When conducting due diligence for investment in a new fund, we follow a rigorous review process whereby the investment manager and the sector specialist with responsibility for the asset class at 7IM meet the fund managers of the fund. At that point, we explore the fund investment process and philosophy, strength of the team managing the fund, years of experience, etc., research resources, risk analysis and performance attribution. Post-investment, the performance is monitored fortnightly, using style-adjusted benchmarks at our Portfolio Management Committee. We also meet with the managers at least once a year, or on an ad hoc basis if there is an issue that needs to be explored.

- Government Bonds Selection Process

We assess government bonds on a periodic basis through a country level ESG analysis which entails consideration of governmental policies relating to social and environmental issues and overall governance. The analysis is composed of three publicly available indices covering country-level ESG factors.

- Exclusions

The intention when looking for company shares, corporate bonds, and collective investment schemes managed by third parties is to keep exposure to controversial activities to a minimum. These controversial activities are outlined below. During the due diligence process, we ask what exclusions the manager applies and at what thresholds these are enforced. We also try to understand how these have changed over time and what activities they are planning to exclude in the future. Using a third-party data provider, we screen the underlying fund holdings for the following activities using the thresholds below:

The underlying exclusion policies for each third-party fund are unlikely to be the same, meaning there may be residual exposure that breaches the thresholds above. We will only invest in other funds where we judge that this will not be in conflict with the Fund’s objective, investment policy and strategy. In any event, the Fund’s total exposure to companies linked to the excluded activities set out above is limited to 1%. If aggregate portfolio exposure to the exclusions outlined above breaches this 1% tolerance, the Manager will resolve any issue as soon as is practicably possible following its identification in accordance with its ongoing monitoring and stewardship processes.

Resources, Affiliations & Corporate Strategies:

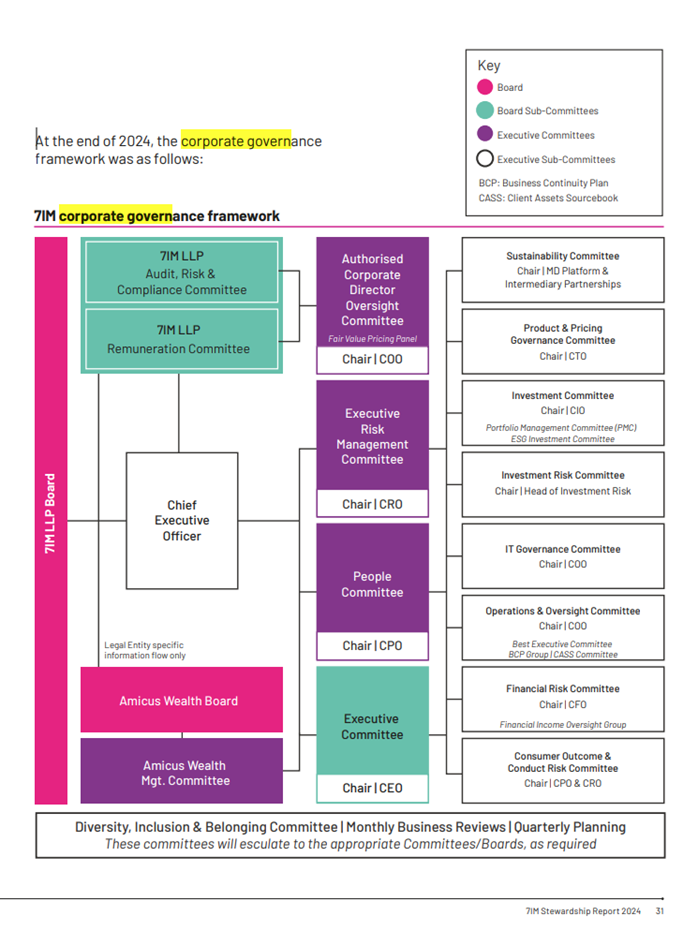

At the end of 2024, the corporate governance framework was as follows:

Stewardship and Responsible Investing

7IM underwent ownership and senior leadership changes over the course of 2023 and this was finalised in early 2024. Ontario Teachers’ Pension Plan Board (“Ontario Teachers’” or “OTPP”) has acquired a majority stake in 7IM, from Caledonia Investments plc (“Caledonia”). The strong cultural alignment between the two entities under our updated ownership structure has reinforced our dedication to responsible business practices and facilitate positive outcomes for clients. A key focus for us is to strengthen the functions of committees to ensure the full integration of ESG considerations across the business and investments. Revisions to sustainability governance within 7IM were approved and implemented in early 2024. The below highlights the structure of our Sustainability Committee as of December 2024. The Sustainability Committee was set up in 2020 and reports to the 7IM ExCo. The objective of the Committee remains the same. The Committee is held accountable for pulling together and embedding our commitments within our culture and related groups and activity and includes people from across the whole business.

The Committee comprises of the Committee Chair and representatives from the following:

- Investment Management team;

- People and Culture team;

- Charity Committee;

- Risk and Compliance team;

- Operations team;

- Finance team;

- Client Experience and Transformation team;

- Private Client team;

- Intermediary team;

- Partners Wealth Management; and

- Platform team.

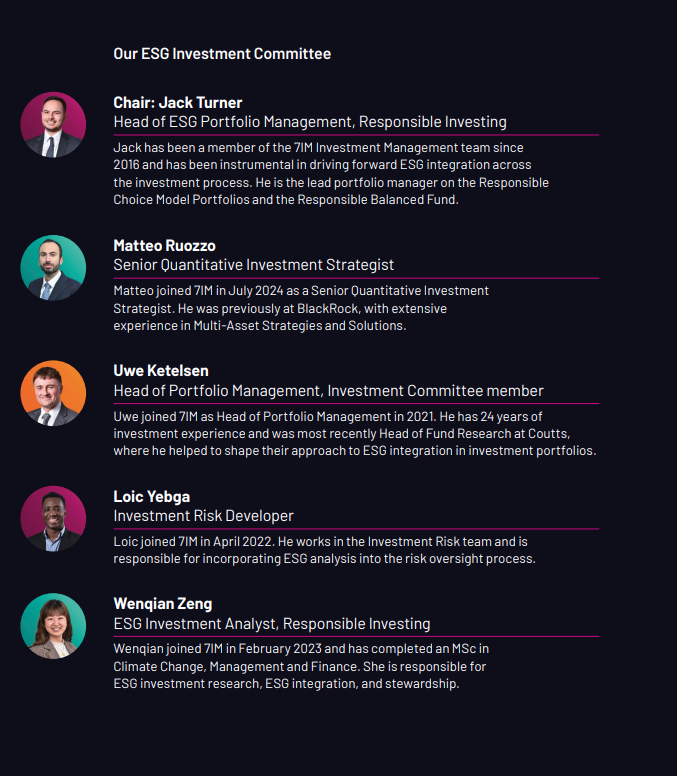

The Sustainability Committee is chaired by Russell Lancaster (Managing Director, Platform & Intermediary Partnerships, ExCo member). The Sustainability Committee’s responsibilities include: i) to act as guardian of the 7IM Stewardship Code and the Sustainability Framework; ii) to review and recommend changes to 7IM’s sustainability strategy and policy, to ensure that standards of business behaviour are up to date and reflect best practice; iii) to introduce to 7IM best practice thinking and ongoing awareness of global developments in sustainability and Corporate Social Responsibility (CSR); and iv) to make sure the 7IM culture is respected and advanced across the firm. Through 2024, we refined 7IM’s Sustainability Framework & Strategy, explained further on p. 33. Investment stewardship and ESG integration at 7IM are managed by the ESG Investment Committee, also set up in 2020. It reports to the Sustainability Committee and to the Investment Committee, which is the senior decision-making body for all 7IM’s investments and is ultimately responsible for investment performance. The ESG Investment Committee is based in the Investment Management team and has five members. It includes representatives from every stage of the investment process at 7IM: Strategic Asset Allocation, Tactical Asset Allocation, Portfolio Management and Investment Risk. A member of the Investment Committee also sits on the ESG Investment Committee.

Stewardship governance

We reviewed and upgraded our stewardship governance framework in 2020 to support 7IM’s stewardship more effectively and explicitly. At the corporate level, as noted earlier, the Sustainability Committee is responsible for stewardship and related issues. The Sustainability Committee is chaired by a member of ExCo. At the investment level, the ESG Investment Committee ensures full integration of stewardship through our investment processes, overseen by the Investment Committee. As discussed in our previous report, much thought went into the design of 7IM’s current governance structure and the underlying processes. We believe they support our targets and ambitions with regard to stewardship in two ways. First, the roles and responsibilities of these two committees have been formalised. Second, stewardship metrics have been incorporated into the objectives and reviews of the key people involved. We continue to monitor our stewardship governance to ensure it remains fit for purpose and adequately covers both 7IM’s stewardship objectives and the full suite of potential harms to which it and our clients are exposed. Enhancements were made to the Risk Management Framework and systems to support key risk management processes, explained in our 2022 and 2023 Stewardship Report with further information later on in this year’s Stewardship report.

SDR Labelling:

Unlabelled with sustainable characteristics

- Consumer Facing Disclosure

SDR Literature:

Literature

Fund Holdings

Voting Record

| Fund Name | SRI Style | SDR Labelling | Product | Region | Asset Type | Launch Date | Last Amended |

|

|---|---|---|---|---|---|---|---|---|

7IM Responsible Balanced Fund |

Sustainable Style | Unlabelled with sustainable characteristics | OEIC | Global | Multi Asset | 02/02/2007 | Jun 2025 | |

ObjectivesThe fund aims to provide a balance of income and capital growth.

|

Fund/Portfolio Size: £117.00m (as at: 30/04/2025) Total Screened Themed SRI Assets: £137.00m (as at: 31/05/2024) Total Responsible Ownership Assets: £72.10m (as at: 31/03/2024) Total Assets Under Management: £21067.00m (as at: 31/05/2024) ISIN: GB00B1LBFW55, GB00B1LBFV49, GB00B1LBFZ86, GB00B1LBG003, GB00B1LBG227, GB00B1LBG110, GB00BJBPWR79, GB00BJBPWS86 Contact Us: Investmentsolutions@7im.co.uk |

|||||||

Sustainable, Responsible &/or ESG OverviewThe fund will invest at least 70% of its value in collective investment vehicles and other assets that demonstrate sustainability characteristics using the two stages described briefly below. The fund assesses ESG factors in determining what assets to invest in. For company shares, corporate bonds and other funds, the fund employs a two-stage process. The first stage is excluding any investments that are being considered by the fund from certain sectors or business areas. The maximum revenue limit for any company is 10%. The second stage applies a positive selection process to judge whether an investment has sustainability characteristics. When selecting companies and third-party funds, the fund applies its sustainability approach along with key metrics, which are fully described in the Prospectus. The inputs together measure: Environmental issues, Human capital issues, and Social capital issues. |

||||||||

|

Primary fund last amended: Jun 2025 |

||||||||

|

Information received directly from Fund Manager |

||||||||

|

Please select what you would like to read:

Fund FiltersSustainability - General

Sustainability policy

Funds that have policies that consider (environmental and social) sustainability issues. Strategies vary but are likely to consider environmental issues like climate change, carbon emissions, biodiversity loss, resource management, environmental impacts; and social issues like equal opportunities, human rights, labour standards, diversity and adherence to internationally recognised codes. See fund information.

Sustainability focus

Find funds which substantially focus on sustainability issues

Sustainable transport policy or theme

Find funds that have documented policies or thematic investment approaches relating to investment in more sustainable, greener transport methods. These will typically set out a preference for companies that run, enable or support more sustainable methods of transport. See fund information for further detail.

Encourage more sustainable practices through stewardship

A core element of these funds aim to encourage higher sustainability standards across business practices through responsible ownership / stewardship / engagement / voting activity

Transition focus

The delivery of the shift to a sustainable future is a core feature of this fund and its investment strategy. See eg https://www.transitionpathwayinitiative.org/ Nature & Biodiversity

Avoids genetically modified seeds/crop production

Find funds that aim to avoid investing in companies that produce genetically modified seeds or crops. (This does not typically include avoiding companies such as supermarkets). See fund literature for further information. Climate Change & Energy

Encourage transition to low carbon through stewardship activity

A core element of these funds will aim to encourage the transition to lower carbon activities through responsible ownership / stewardship / engagement / voting activity

Invests in clean energy / renewables

Funds that hold companies in the clean energy and renewable energy sectors (at the time research was supplied). Fund strategies vary, in particular the proportion of investment in these areas may vary significantly. Check fund literature for details. Ethical Values Led Exclusions

Ethical policies

Find funds that have policies that set out their position on ethical or 'personal values' based issues. Strategies vary. See fund information for further detail.

Tobacco and related product manufacturers excluded

Companies are excluded if they are involved in any aspect of the production chain for tobacco products, including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Controversial weapons exclusion

Find funds that exclude companies which make controversial weapons such as landmines, cluster munitions and chemical weapons. See fund literature for further information.

Armaments manufacturers avoided

Find funds that avoid companies that manufacture products intended specifically for military use. Fund strategies vary - particularly with regard to non-strategic military products. See fund literature for fund specific details.

Civilian firearms production exclusion

Find funds with a written civilian firearms exclusion policy - meaning that they will not invest in companies that make (or perhaps also sell) handguns made for non-military users.

Alcohol production excluded

Find funds that avoid investment in companies involved in the production of alcohol. Strategies vary; some funds allow a small proportion of profits to come from this area. See fund literature for further information.

Gambling avoidance policy

Find funds that avoid companies with significant involvement in the gambling industry. Some funds may allow a small proportion of profits to come from this area. See fund policy for further details.

Pornography avoidance policy

Find funds that avoid companies that derive significant income from pornography and related areas. Strategies vary. See fund details for further information. Meeting Peoples' Basic Needs

Demographic / ageing population theme

Find funds with a thematic investment approach focusing on the ‘silver economy’ - in particular (typically) the issues and opportunities presented by changing demographics. This could include finance, healthcare and medicines and/ or longevity science to extend lifespans. Strategies vary. See fund literature for further information.

Healthcare / medical theme

Healthcare and or medical theme or area of investment - the fund may have a single theme or many themes Gilts & Sovereigns

Invests in gilts / government bonds

Find funds that invest in loans issued the government, commonly known as gilts or government bonds. These may or may not be ringfenced for specific projects (see additional options). See fund literature for any selection criteria.

Invests in sovereigns as an unscreened asset class

Find funds that invest in financial instruments issued by governments, typically for risk reasons, but do not screen them for environmental and social characteristics. See fund literature for more information. Banking & Financials

Invests in banks

Find funds that include banks as part of their holdings / portfolio.

Invests in financial instruments issued by banks

Finds funds that include financial instruments (cash, derivatives and / or foreign exchange) issued by banks. See fund literature for further information as strategies vary. Governance & Management

Encourage higher ESG standards through stewardship activity

A core element of these funds will aim to encourage higher ESG standards through responsible ownership / stewardship / engagement /voting activity Fund Governance

ESG integration strategy

Find funds that factor in 'environmental, social and governance' issues as part of their investment decision making process. A focus on 'ESG' typically means a fund is carrying out additional research to help reduce ESG related risks. It does not necessarily mean a focus on sustainability. Strategies vary. See fund literature. Asset Size

Invests in small, mid and large cap companies / assets

Find a fund that invests in a combination of small, medium and larger (potentially multinational)companies. Targeted Positive Investments

Invests > 5% in sustainable bonds

Invests in loan stock that is exclusively used to finance environmental and social projects. See ICMA Sustainable Bond Guidelines.

Invest > 5% in transition bonds

Invests in loan stock that is supporting or enabling the shift towards a cleaner, more sustainable future. Strategies vary significantly and may or may not be linked to specific outcomes. Impact Methodologies

Positive environmental impact theme

Find funds that specifically set out to help deliver positive environmental impacts, benefits or 'real world' outcomes.

Positive social impact theme

Find funds that specifically state that they aim to deliver positive social (i.e. people related) impacts and/or outcomes.

Aim to deliver positive impacts through engagement

Fund aims to deliver positive environmental and or social impacts (real world benefits) through its engagement with investee assets How The Fund Works

Positive selection bias

Find funds that focus on finding and investing in companies with positive / beneficial attributes. This strategy can be applied in addition to exclusion criteria and engagement/stewardship activity.

Negative selection bias

Find funds where their main 'ethical approach' is to avoid companies by using negative screening criteria. Read fund literature for further information.

Strictly screened ethical fund

Find funds where their main approach is to apply positive or negative ethical, social and / or environmental screens. Strictly screened funds are likely to exclude more companies than other related fund options. See fund literature for further information.

Combines norms based exclusions with other SRI criteria

Find funds that make significant use of internationally agreed 'norms' (e.g. United Nations Global Compact - UNGC - or the UN Sustainable Development Goals - SDGs) as part of their investment selection process alongside additional SRI criteria such as positive or negative stock selection policies and/or stewardship strategies.

Combines ESG strategy with other SRI criteria

Find funds that have an ESG strategy (which is typically focused on avoiding companies that pose environmental, social or governance related risks) with additional criteria such as positive and/or negative screens, themes and stewardship strategies. Intended Clients & Product Options

Intended for investors interested in sustainability

Finds funds designed to meet the needs of individual investors with an interest in sustainability issues.

Intended for clients interested in ethical issues

Find funds designed for clients who care about ethical and values-based issues, often alongside sustainability issues also.

Intended for clients who want to have a positive impact

Finds funds designed to meet the needs of individual investors with an interest in ‘Impact investment funds’ which help or support the delivery of positive social or environmental impacts (or societal/real world outcomes) by investing in companies they regard as beneficial to people and / or the planet. Strategies vary. See fund literature for further information.

Portfolio SRI / ESG options available (DFMs)

Only applicable for DFM’s & portfolio providers. Finds those that offer an SRI / ESG portfolio option Fund Management Company InformationAbout The Business

Responsible ownership / stewardship policy or strategy (AFM company wide)

Finds fund management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

ESG / SRI engagement (AFM company wide)

Find fund management companies that actively encourage higher 'environmental, social and governance' and/or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Integrates ESG factors into all / most (AFM) fund research

Find fund management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management. Collaborations & Affiliations

PRI signatory

Find fund management companies that have signed up to the UN backed 'Principles of Responsible Investment'. Accreditations

UK Stewardship Code signatory (AFM company wide)

Find fund managers that are signatories to the FRC UK Stewardship Code, which sets out a framework for constructive investor / investee relations where fund managers are encouraged to behave like responsible, typically longer term 'company owners'. Engagement Approach

Engaging with fossil fuel companies on climate change

Asset manager has a stewardship /responsible ownership strategy that involves working with fossil fuel companies on climate change related issues. See fund manager website for details.

Stewardship escalation policy

Escalation policies describe how a manager will proceed if stewardship / engagement activity is not successful in the short term. Company Wide Exclusions

Controversial weapons avoidance policy (AFM company wide)

Find fund management companies (not funds) that avoid investment in 'controversial weapons' across all of their funds and other investment vehicles. Climate & Net Zero Transition

Encourage carbon / greenhouse gas reduction (AFM company wide)

Find fund management companies that are working with the companies they invest in to encourage reductions in carbon dioxide and other greenhouse gas emissions.

Carbon offsetting - offset carbon as part of our net zero plan (AFM company wide)

This asset management company plans to achieve net zero greenhouse gas (CO2e) emissions with the help of a scheme that will lock away an amount of carbon that is equivalent to the company’s own emissions – so that the end result is ‘net zero’. Calculations and scope vary.

In-house carbon / GHG reduction policy (AFM company wide)

Find fund management companies that are working to reduce their own (fund management company) carbon/greenhouse gas emissions. Transparency

Publish responsible ownership / stewardship report (AFM company wide)

Find fund management companies that publish a report detailing their responsible investment ownership - also known as 'Stewardship' - activity.

Full SRI / responsible ownership policy information on company website

Find companies that publish information about their sustainable and responsible investment strategies on their company website.

Full SRI / responsible ownership policy information available on request

Find fund management companies that will supply information about their sustainable and responsible investment activity on request.

Publish full voting record (AFM company wide)

Fund management companies that publish a full record of how they vote their shares at AGMs (annual general meetings) and EGMs (extraordinary general meetings). Voting strategies have an important role to play encouraging higher environmental, social and governance standards. Sustainable, Responsible &/or ESG Policy:The 7IM Responsible Balanced Fund is an actively managed fund with a balanced risk profile, invested in a range of global equities, bonds and funds managed within a sustainable investment framework. The investment strategy for the fund encompasses detailed screening for sustainability using both negative screening to exclude investments which are significantly involved in unacceptable business areas and positive selection process to select investments with sustainable characteristics as set out in the prospectus. The Fund assesses environmental, social and governance (ESG) factors in determining what assets to invest in. For company shares, corporate bonds and other funds, the Fund employs a two-stage process. The inputs together measure:

We will invest at least 70% of the fund's value in collective investment vehicles and other assets that demonstrate sustainability characteristics. Key sustainability metrics can be found in the latest CFD: https://www.7im.co.uk/media/kmgfb01b/7im-responsible-balanced-fund-consumer-facing-disclosure.pdf Process:

We apply specific exclusions on company shares, corporate bonds and other funds to keep exposure to controversial activities to a minimum. These controversial activities are outlined below:

In respect of company shares and corporate bonds, the maximum revenue limit for any company is 10%. In respect of investments in other funds, there may be differences in the revenue limits. Further details are provided in Section 4. In any event, we limit the total exposure to companies linked to the excluded activities to 1%. If the aggregate portfolio exposure to the exclusions outlined above breaches this 1% tolerance, we will resolve any issue as soon as is practicably possible. Further details of the exclusion list are provided in Section 4.

The Positive Selection Process further defines how the Fund can select company shares, corporate bonds and other funds that are considered to have sustainability characteristics. The process assesses the management of the following issues: • Environmental issues, including supporting and managing climate change mitigation (i.e. reduction of greenhouse gases) and adaptation, waste and water management or land management; • Human capital issues, including fair labour practices, health and safety practices or supply chain management; and • Social capital issues, including access to healthcare or finance, privacy and data security or consumer protection. For investments in company shares: For companies to be considered as having sustainable characteristics, they must meet at least one of the following considerations:

For investments in collective investment vehicles: For third-party funds to be considered as having sustainability characteristics, they must demonstrate the following:

The purpose of the fund selection process at 7IM from an ESG perspective is to identify an investment that has the people, process and expertise in place to invest sustainably. We explain this below and use a number of third-party data tools to validate this due diligence.

When conducting due diligence for investment in a new fund, we follow a rigorous review process whereby the investment manager and the sector specialist with responsibility for the asset class at 7IM meet the fund managers of the fund. At that point, we explore the fund investment process and philosophy, strength of the team managing the fund, years of experience, etc., research resources, risk analysis and performance attribution. Post-investment, the performance is monitored fortnightly, using style-adjusted benchmarks at our Portfolio Management Committee. We also meet with the managers at least once a year, or on an ad hoc basis if there is an issue that needs to be explored.

We assess government bonds on a periodic basis through a country level ESG analysis which entails consideration of governmental policies relating to social and environmental issues and overall governance. The analysis is composed of three publicly available indices covering country-level ESG factors.

The intention when looking for company shares, corporate bonds, and collective investment schemes managed by third parties is to keep exposure to controversial activities to a minimum. These controversial activities are outlined below. During the due diligence process, we ask what exclusions the manager applies and at what thresholds these are enforced. We also try to understand how these have changed over time and what activities they are planning to exclude in the future. Using a third-party data provider, we screen the underlying fund holdings for the following activities using the thresholds below:

The underlying exclusion policies for each third-party fund are unlikely to be the same, meaning there may be residual exposure that breaches the thresholds above. We will only invest in other funds where we judge that this will not be in conflict with the Fund’s objective, investment policy and strategy. In any event, the Fund’s total exposure to companies linked to the excluded activities set out above is limited to 1%. If aggregate portfolio exposure to the exclusions outlined above breaches this 1% tolerance, the Manager will resolve any issue as soon as is practicably possible following its identification in accordance with its ongoing monitoring and stewardship processes. Resources, Affiliations & Corporate Strategies:At the end of 2024, the corporate governance framework was as follows:

Stewardship and Responsible Investing 7IM underwent ownership and senior leadership changes over the course of 2023 and this was finalised in early 2024. Ontario Teachers’ Pension Plan Board (“Ontario Teachers’” or “OTPP”) has acquired a majority stake in 7IM, from Caledonia Investments plc (“Caledonia”). The strong cultural alignment between the two entities under our updated ownership structure has reinforced our dedication to responsible business practices and facilitate positive outcomes for clients. A key focus for us is to strengthen the functions of committees to ensure the full integration of ESG considerations across the business and investments. Revisions to sustainability governance within 7IM were approved and implemented in early 2024. The below highlights the structure of our Sustainability Committee as of December 2024. The Sustainability Committee was set up in 2020 and reports to the 7IM ExCo. The objective of the Committee remains the same. The Committee is held accountable for pulling together and embedding our commitments within our culture and related groups and activity and includes people from across the whole business. The Committee comprises of the Committee Chair and representatives from the following:

The Sustainability Committee is chaired by Russell Lancaster (Managing Director, Platform & Intermediary Partnerships, ExCo member). The Sustainability Committee’s responsibilities include: i) to act as guardian of the 7IM Stewardship Code and the Sustainability Framework; ii) to review and recommend changes to 7IM’s sustainability strategy and policy, to ensure that standards of business behaviour are up to date and reflect best practice; iii) to introduce to 7IM best practice thinking and ongoing awareness of global developments in sustainability and Corporate Social Responsibility (CSR); and iv) to make sure the 7IM culture is respected and advanced across the firm. Through 2024, we refined 7IM’s Sustainability Framework & Strategy, explained further on p. 33. Investment stewardship and ESG integration at 7IM are managed by the ESG Investment Committee, also set up in 2020. It reports to the Sustainability Committee and to the Investment Committee, which is the senior decision-making body for all 7IM’s investments and is ultimately responsible for investment performance. The ESG Investment Committee is based in the Investment Management team and has five members. It includes representatives from every stage of the investment process at 7IM: Strategic Asset Allocation, Tactical Asset Allocation, Portfolio Management and Investment Risk. A member of the Investment Committee also sits on the ESG Investment Committee.

Stewardship governance We reviewed and upgraded our stewardship governance framework in 2020 to support 7IM’s stewardship more effectively and explicitly. At the corporate level, as noted earlier, the Sustainability Committee is responsible for stewardship and related issues. The Sustainability Committee is chaired by a member of ExCo. At the investment level, the ESG Investment Committee ensures full integration of stewardship through our investment processes, overseen by the Investment Committee. As discussed in our previous report, much thought went into the design of 7IM’s current governance structure and the underlying processes. We believe they support our targets and ambitions with regard to stewardship in two ways. First, the roles and responsibilities of these two committees have been formalised. Second, stewardship metrics have been incorporated into the objectives and reviews of the key people involved. We continue to monitor our stewardship governance to ensure it remains fit for purpose and adequately covers both 7IM’s stewardship objectives and the full suite of potential harms to which it and our clients are exposed. Enhancements were made to the Risk Management Framework and systems to support key risk management processes, explained in our 2022 and 2023 Stewardship Report with further information later on in this year’s Stewardship report. SDR Labelling:Unlabelled with sustainable characteristics

SDR Literature:LiteratureFund HoldingsVoting Record |

||||||||