Newton Ethically Screened Fund for Charities (BNY)

SRI Style:

ESG Plus

SDR Labelling:

Other

Product:

Charity fund / trust

Fund Region:

Global

Fund Asset Type:

Multi Asset

Launch Date:

17/05/2010

Last Amended:

Sep 2025

Dialshifter ( ):

):

Fund/Portfolio Size:

£54.36m

(as at: 30/06/2025)

Total Assets Under Management:

£77829.52m

(as at: 30/06/2025)

ISIN:

GB00B4VV6B25, GB00BKRVRY86, GB00BKRVS015, GB00BKRVRZ93

Contact Us:

Objectives:

The Fund aims to achieve a balance between capital growth and income for investors which are Charities, over the long term (five years or more).

The Fund is not considered to have sustainability characteristics and does not have a sustainable objective.

Sustainable, Responsible

&/or ESG Overview:

Directly invested to ensure adequate transparency and reassurance to investors that ethical considerations are being addressed across the entire portfolio. A robust exclusionary screen has been developed in response to investor demand. Investments determined to exhibit the Negative Criteria outlined in the Fund’s prospectus are excluded from the investment universe.

Newton’s process for making investment decisions follows detailed analysis based on a wide range of financial metrics and research. When making investment decisions, ESG considerations are one component of a variety of fundamental factors analysed, and Newton will make investment decisions that are not based solely on ESG considerations. Newton’s ESG analysis does not apply to certain types of investments, such as cash, cash equivalents, currency positions and particular types of derivatives.

Primary fund last amended:

Sep 2025

Information directly from fund manager.

Fund Filters

Sustainability - General

Aim to encourage higher sustainability standards through responsible ownership / stewardship / engagement / voting activity

Ethical Values Led Exclusions

Companies are excluded if they are involved in any aspect of the production chain for tobacco products, including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Excludes companies which make controversial weapons such as landmines, cluster munitions and chemical weapons.

Avoids companies with military contracts. This may include medical supplies, food, safety equipment, housing, technology etc

Avoids companies that produce alcohol. Strategies vary; some may allow a small proportion of revenue to come from this area.

Avoids companies with significant involvement in the gambling industry. Some may allow a small proportion of revenues to come from this area.

Avoids companies that derive significant income from pornography and related areas. Strategies vary.

Avoids companies that test their products on animals for purposes other than medical benefit (e.g. for cosmetics). Strategies vary.

Human Rights

Has policies relating to human rights issues. Typically require companies to demonstrate higher standards, although some managers work to encourage improvements. Investee companies are often judged against internationally agreed norms or standards. Strategies vary.

Has policies to avoid companies that employ children.

Gilts & Sovereigns

Invest in loans issued the government, commonly known as gilts or government bonds. These may or may not be ringfenced for specific projects (see additional options).

Banking & Financials

Can include banks as part of their holdings / portfolio.

Excludes financial services companies with widely criticised, aggressive lending practices where interest rates are typically very high, (eg ‘doorstep lending’)

Invests in financial instruments (cash, derivatives and / or foreign exchange) issued by banks. Strategies vary.

May invest in insurance companies.

Product / Service Governance

Find fund / asset managers that factor in 'environmental, social and governance' issues as part of their investment decision making process. A focus on 'ESG' typically means a fund is carrying out additional research to help reduce ESG related risks. It does not necessarily mean a focus on sustainability. Strategies vary. See fund literature.

Asset Size

Invests in a combination of small, medium and larger (potentially multinational) companies / assets.

How The Fund/Portfolio Works

Has some exclusions - typically for example excludes tobacco or companies that breach commonly adopted standards or norms such as the UN Global Compact.

Investment selection process uses internationally agreed 'norms' (e.g. United Nations Global Compact - UNGC - or the UN Sustainable Development Goals - SDGs) alongside additional SRI criteria such as positive or negative stock selection policies and/or stewardship strategies.

Publish explanations of their ethical, social and/or environmental policies online (i.e. investment decision making strategies/ buy/sell &/or asset management strategies).

Intended Clients & Product Options

Designed for clients who care about ethical and values-based issues, often alongside sustainability issues also.

Fund Management Company Information

About The Business

Find fund / asset management companies that are smaller or specialise in particular areas - notably, ideally ESG related. Strategies vary.

Finds fund / asset management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

Find fund / asset management companies that actively encourage higher 'environmental, social and governance' and / or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Find fund / asset managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Find options run by managers that apply Responsible ownership or 'Stewardship' policies to all or most of their investment assets. This means active involvement (e.g. voting, dialogue) with the companies across all or most funds, products and services.

Find fund / asset management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management.

Finds organisations / fund managers that have an in-house (company wide) diversity improvement programme - meaning that they are working to ensure that within their own businesses they employ people from diverse backgrounds - often typically focused on ethnicity and/or sex.

Fund / asset manager has information on their website that explains how they treat 'vulnerable clients' (as set out in FCA regulation)

Collaborations & Affiliations

Find fund / asset management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

Find fund / asset management companies that are members of UKSIF - the UK Sustainable Investment and Finance association

Find fund / asset management companies that have partnered with Fund EcoMarket - meaning that they are helping to improve access to information on sustainable and responsible investment by paying an annual fee to us which enables us to publish information for free. Partner funds are listed ahead of other funds and have their logos displayed.

Fund management entity is a member of the Investment Association https://www.theia.org/

Resources

Find fund / asset management companies that employ people to steer and support fund managers in voting shares at company AGM's and EGMs in ways that are consistent with encouraging higher ESG/sustainability standards.

Find a fund / asset management company that directly employs specialist ESG/SRI/sustainability researchers or analysts. This allows asset managers to discuss environmental, social and governance risks and opportunities directly with companies.

Find fund / asset management companies that makes use of expert external research companies. This can help deliver specialist expertise and means resources are pooled with other investors.

Accreditations

Find fund / asset managers that are signatories to the FRC UK Stewardship Code, which sets out a framework for constructive investor / investee relations where managers are encouraged to behave like responsible, typically longer term 'company owners'.

Engagement Approach

Find fund / asset management companies that regularly initiate or run industry wide (collaborative) investor projects aimed at raising environmental, social and governance standards amongst investee companies.

Fund / asset manager has stewardship /responsible ownership strategy that is focused on addressing climate change with investee assets.

Fund / asset manager has a stewardship /responsible ownership strategy that involves working with fossil fuel companies on climate change related issues. See fund manager website for details.

The fund / asset manager has a responsible ownership / stewardship strategy that focuses on biodiversity and nature issues relating to the assets they invest the aim of which will be to reduce harm and or deliver improvement. Strategies vary. https://tnfd.global

Fund / asset manager has a responsible ownership / stewardship strategy which means they are working to encourage the shift to more sustainable business practices in ways that respect and are sensitive to social issues and the impact change has on people effected by the changes that are taking place. https://www.transitionpathwayinitiative.org/ https://transitiontaskforce.net/

Fund / asset manager has responsible ownership / stewardship strategy in place which aims to address human rights issues in investee companies (and potentially their suppliers) with the aim of raising standards

Fund / asset manager has responsible ownership / stewardship strategy in place that aims to improve labour standards for the benefit of employees in investee companies (and potentially their suppliers)

Fund / asset management company has a stewardship strategy in place which involves working to raise diversity, equality and inclusion standards across investee assets

Fund / asset manager is working with the assets they hold to help stamp out modern slavery - where direct or indirect company employees are exploited for business benefits.

Fund / asset managers have stewardship strategies in place that focus on improving governance standards across investee assets

Has a stewardship / responsible ownership strategy that encourages responsible supply chain - ie the managers will discuss environmental, social and governance issues with investee companies with the aim of raising standards

Escalation policies describe how a manager will proceed if stewardship / engagement activity is not successful in the short term.

Climate & Net Zero Transition

Fund / asset management organisations that have pledged to reduce their greenhouse gas emissions to ‘net zero’. Strategies vary - this area is changing rapidly.

This fund / asset management company has set a date by which they plan to achieve net zero greenhouse gas / CO2e emissions.

Find fund / asset management companies that are working with the companies they invest in to encourage reductions in carbon dioxide and other greenhouse gas emissions.

Finds organisations / fund managers that have a company wide carbon transition plan - meaning that they have plotted a path to how they will move away from activities that produce or use carbon based energy sources (that emit greenhouse gases) towards clean, alternative, renewable energy sources.

Finds organisations / fund management companies that are in the process of working out how to make a ‘net zero commitment’ - meaning that when that is finalised they will have started the process of reducing their total greenhouse gas emissions to 'zero'.

See https://sciencebasedtargets.org/

Transparency

Find fund / asset management companies that publish a report detailing their responsible investment ownership - also known as 'Stewardship' - activity.

Find fund / asset management companies that publish information about their sustainable and responsible investment strategies on their company website.

Find fund / asset management companies that will supply information about their sustainable and responsible investment activity on request.

Fund / asset management companies that publish a full record of how they vote their shares at AGMs (annual general meetings) and EGMs (extraordinary general meetings). Voting strategies have an important role to play encouraging higher environmental, social and governance standards.

This fund / asset management company has published a plan that explains how they are going to achieve net zero greenhouse gas / CO2e emissions.

Resources, Affiliations & Corporate Strategies:

Newton has a centralised responsible investment team. This team is the centre of excellence for all matters related to responsible investment, and with its deep functional knowledge of the responsible investment space and how it is evolving, it provides guidance, support and subject-matter expertise to our wider investment team. The responsible investment team, as you can see below, is global in its footprint and diverse in its employee base. The team is organised into three pillars of expertise – stewardship, research and analytics: these specialisations under the responsible investment umbrella allow us to bring further depth and expertise to each of these activities. The team’s compact size enables it to work cohesively and operate as one team.

Stewardship: Oversees the firm’s engagement framework and advocacy initiatives, focusing its efforts on meaningful outcomes for clients, and also undertakes the firm’s proxy voting activities. Provides subject-matter expertise to the investment team on governance risks and evolving expectations.

Sustainability research: Subject-matter experts consulting the investment and research teams, driving deep insights on sustainability-related subjects. The team manages Newton’s sustainability standards, definitions and frameworks.

Responsible investment analytics: Has strong quantitative and RI data expertise and owns the data ecosystem, creating and managing responsible investment data models, frameworks and tools that support ESG integration and sustainable investing. The team has built an innovative suite of building blocks that can be leveraged to develop scalable solutions to meet specific client requirements.

The role of the responsible investment team is to be a support function to the investment teams, to set standards around sustainable investment, and to coordinate and ensure effectiveness around our stewardship efforts. It guides the business around policies and direction of travel for sustainability and stewardship more broadly. The responsible investment team also owns and manages the overall governance systems to ensure we deliver against key codes and commitments including stewardship codes, industry principles such as the UN Principles for Responsible Investment, and industry pledges such as the Net Zero Asset Managers Initiative (NZAMi).

Supporting the team, and the wider business, are various external organisations and vendors including ESG service providers, memberships, and internal systems for monitoring and reporting.

Affiliations

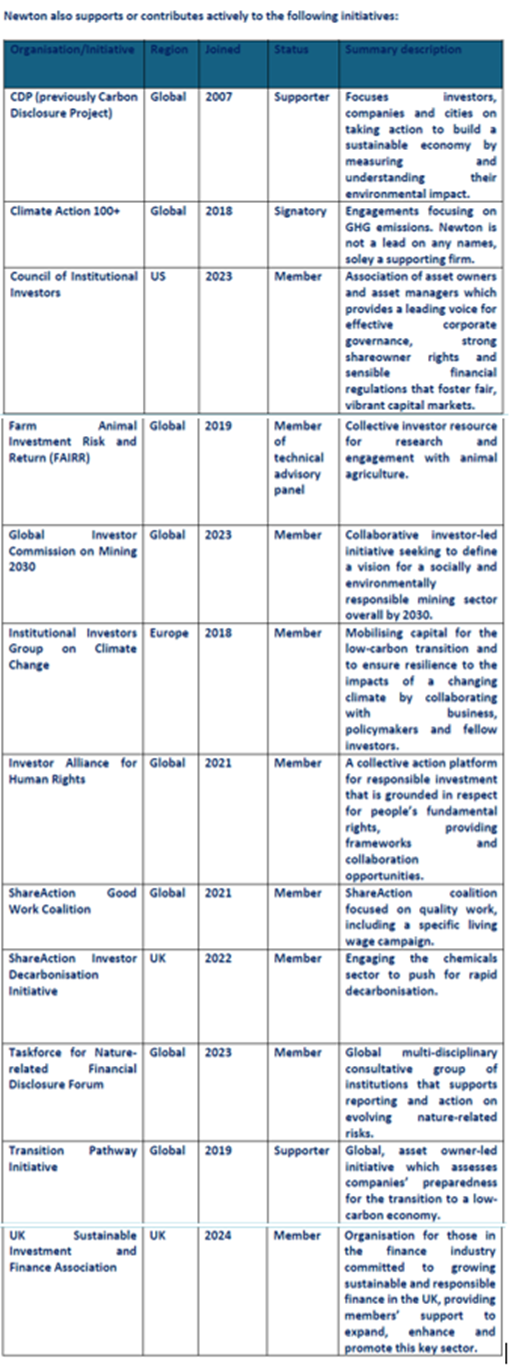

As investors and an intermediary in the financial system we play an important role in providing investors with access to investment solutions, and that with this comes an inherent responsibility to do what is right on behalf of our clients, as well as wider asset owners and stakeholders in the financial system. Our advocacy focus involves supporting or seeking to influence various issues and areas for the long-term interest of our clients and Newton.

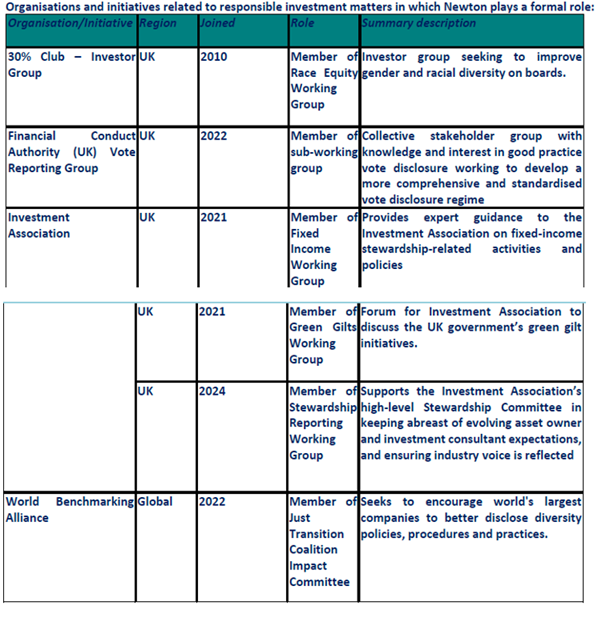

Organisations and initiatives related to responsible investment matters in which Newton plays a formal role:

*Newton Japan was established as a legal entity in March 2023. Its prior commitment to the Japan Stewardship Code was under its previous structure.

ESG Governance

Having an effective management and governance framework is an important part of our overall business strategy. As investors, we understand the value of effective leadership and accountability. This is closely linked to the culture of our business, as leadership and accountability have equal importance in Newton’s governance. We have therefore established appropriate governance systems and controls to support our stewardship and RI policy. This policy is reviewed and approved by the Newton Sustainability Committee (NIM and NIMNA), which reports to the Newton Executive Management Committee (NEMC) (to note, the NEMC reports into NIM and NIMNA boards). The policy is also reviewed and approved by the NIMJ Investment Oversight Committee, which reports into the NIMJ Executive Management Committee. The NEMC has overall responsibility for defining Newton’s approach, values and actions across all Newton entities.

Two of our operating committees play important roles in relation to our stewardship and RI efforts:

- Newton Sustainability Committee – oversees all aspects relating to stewardship and RI at NIM and NIMNA, including our investments, direct impacts and engagement with communities, and engagement with the wider market (advocacy) regarding RI and stewardship matters.

- Newton Risk and Compliance Committee – supported by the Newton Conflicts of Interest Committee and the Emerging Risks Working Group.

These committees deal with various stewardship and RI aspects on an ad-hoc basis, including any relevant internal audit findings and actions as well as climate-related risk updates from internal groups.

Our Board Risk Committee also plays a role in the governance of our RI and stewardship efforts; it acts as an escalation point for any material issues identified through our governance systems and controls. For example, it has previously considered materials related to climate risk. We have also established the Newton Sustainable Investment Forum (SIF) as an oversight group to monitor our strategies with sustainability characteristics.

The role of the SIF is to:

- Foster debate by bringing together a wider set of Newton investment team members focusing on sustainability, including sustainability portfolio managers and RI team members

- Provide support by educating, training and sharing knowledge and insights among the investment team.

Literature

Disclaimer

IMPORTANT INFORMATION

Past performance is not a guide to future performance.

The value of investments can fall. Investors may not get back the amount invested.

Income from investments may vary and is not guaranteed.

For Professional Clients only.

Provided solely for use by Fund Ecomarket.

BNY, BNY Mellon and Bank of New York Mellon are the corporate brands of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally.

Issued in the United Kingdom by BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1118580. Authorised and regulated by the Financial Conduct Authority.

Newton global assets under management (AUM) is the combined total assets under management of Newton Investment Management Limited (‘NIM’), Newton Investment Management North America LLC (‘NIMNA’) and Newton Investment Management Japan Limited (‘NIMJ’).

Returns may increase or decrease as a result of currency fluctuations.

Costs incurred when purchasing, holding, converting or selling any investment, will impact returns.

Costs may increase or decrease as a result of currency and exchange rate fluctuations.

Newton manages a variety of investment strategies. How ESG analysis is integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved. ESG can be one of many inputs into the fundamental analysis. Newton will make investment decisions that are not based solely on ESG analysis. Other attributes of an investment may outweigh ESG analysis when making investment decisions.

*Newton’ and/or ‘Newton Investment Management’ is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (“NIM”), Newton Investment Management North America LLC (“NIMNA”) and Newton Investment Management Japan Limited ("NIMJ").

Newton’s assets under management include assets collectively managed by NIM, NIMNA and NIMJ. In addition, AUM for Newton includes assets of bank-maintained collective investment funds for which Newton has been appointed sub-advisor, where Newton personnel act as dual officers of affiliated companies and assets of wrap fee account(s) for which Newton provides sub-advisory services to the primary manager of the wrap program.

| Fund Name | SRI Style | SDR Labelling | Product | Region | Asset Type | Launch Date | Last Amended |

|

|---|---|---|---|---|---|---|---|---|

Newton Ethically Screened Fund for Charities (BNY) |

ESG Plus | Other | Charity fund / trust | Global | Multi Asset | 17/05/2010 | Sep 2025 | |

ObjectivesThe Fund aims to achieve a balance between capital growth and income for investors which are Charities, over the long term (five years or more). |

Fund/Portfolio Size: £54.36m (as at: 30/06/2025) Total Assets Under Management: £77829.52m (as at: 30/06/2025) ISIN: GB00B4VV6B25, GB00BKRVRY86, GB00BKRVS015, GB00BKRVRZ93 Contact Us: salessupport@bny.com |

|||||||

|

Primary fund last amended: Sep 2025 |

||||||||

|

Information received directly from Fund Manager |

||||||||

|

Please select what you would like to read:

Fund FiltersSustainability - General

Encourage more sustainable practices through stewardship

Aim to encourage higher sustainability standards through responsible ownership / stewardship / engagement / voting activity Ethical Values Led Exclusions

Tobacco & related product manufacturers excluded

Companies are excluded if they are involved in any aspect of the production chain for tobacco products, including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Controversial weapons exclusion

Excludes companies which make controversial weapons such as landmines, cluster munitions and chemical weapons.

Military involvement exclusion

Avoids companies with military contracts. This may include medical supplies, food, safety equipment, housing, technology etc

Alcohol production excluded

Avoids companies that produce alcohol. Strategies vary; some may allow a small proportion of revenue to come from this area.

Gambling avoidance policy

Avoids companies with significant involvement in the gambling industry. Some may allow a small proportion of revenues to come from this area.

Pornography avoidance policy

Avoids companies that derive significant income from pornography and related areas. Strategies vary.

Animal testing - excluded except if for medical purposes

Avoids companies that test their products on animals for purposes other than medical benefit (e.g. for cosmetics). Strategies vary. Human Rights

Human rights policy

Has policies relating to human rights issues. Typically require companies to demonstrate higher standards, although some managers work to encourage improvements. Investee companies are often judged against internationally agreed norms or standards. Strategies vary.

Child labour exclusion

Has policies to avoid companies that employ children. Gilts & Sovereigns

Invests in gilts / government bonds

Invest in loans issued the government, commonly known as gilts or government bonds. These may or may not be ringfenced for specific projects (see additional options). Banking & Financials

Invests in banks

Can include banks as part of their holdings / portfolio.

Predatory lending exclusion

Excludes financial services companies with widely criticised, aggressive lending practices where interest rates are typically very high, (eg ‘doorstep lending’)

Invests in financial instruments issued by banks

Invests in financial instruments (cash, derivatives and / or foreign exchange) issued by banks. Strategies vary.

Invests in insurers

May invest in insurance companies. Product / Service Governance

ESG integration strategy

Find fund / asset managers that factor in 'environmental, social and governance' issues as part of their investment decision making process. A focus on 'ESG' typically means a fund is carrying out additional research to help reduce ESG related risks. It does not necessarily mean a focus on sustainability. Strategies vary. See fund literature. Asset Size

Invests in small, mid & large cap companies / assets

Invests in a combination of small, medium and larger (potentially multinational) companies / assets. How The Fund/Portfolio Works

Limited / few ethical exclusions

Has some exclusions - typically for example excludes tobacco or companies that breach commonly adopted standards or norms such as the UN Global Compact.

Combines norms based exclusions with other SRI criteria

Investment selection process uses internationally agreed 'norms' (e.g. United Nations Global Compact - UNGC - or the UN Sustainable Development Goals - SDGs) alongside additional SRI criteria such as positive or negative stock selection policies and/or stewardship strategies.

SRI / ESG / Ethical policies explained on website

Publish explanations of their ethical, social and/or environmental policies online (i.e. investment decision making strategies/ buy/sell &/or asset management strategies). Intended Clients & Product Options

Intended for clients interested in ethical issues

Designed for clients who care about ethical and values-based issues, often alongside sustainability issues also. Fund Management Company InformationAbout The Business

Boutique / specialist fund management company

Find fund / asset management companies that are smaller or specialise in particular areas - notably, ideally ESG related. Strategies vary.

Responsible ownership / stewardship policy or strategy (AFM companywide)

Finds fund / asset management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

ESG / SRI engagement (AFM companywide)

Find fund / asset management companies that actively encourage higher 'environmental, social and governance' and / or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Vote all* shares at AGMs / EGMs (AFM companywide)

Find fund / asset managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Responsible ownership policy for non SRI / sustainable options (AFM companywide)

Find options run by managers that apply Responsible ownership or 'Stewardship' policies to all or most of their investment assets. This means active involvement (e.g. voting, dialogue) with the companies across all or most funds, products and services.

Integrates ESG factors into all / most research (AFM companywide)

Find fund / asset management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management.

In-house diversity improvement programme (AFM companywide)

Finds organisations / fund managers that have an in-house (company wide) diversity improvement programme - meaning that they are working to ensure that within their own businesses they employ people from diverse backgrounds - often typically focused on ethnicity and/or sex.

Vulnerable client policy on website (AFM companywide)

Fund / asset manager has information on their website that explains how they treat 'vulnerable clients' (as set out in FCA regulation) Collaborations & Affiliations

PRI signatory

Find fund / asset management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

UKSIF member

Find fund / asset management companies that are members of UKSIF - the UK Sustainable Investment and Finance association

Fund EcoMarket partner

Find fund / asset management companies that have partnered with Fund EcoMarket - meaning that they are helping to improve access to information on sustainable and responsible investment by paying an annual fee to us which enables us to publish information for free. Partner funds are listed ahead of other funds and have their logos displayed.

Investment Association (IA) member

Fund management entity is a member of the Investment Association https://www.theia.org/ Resources

In-house responsible ownership / voting expertise

Find fund / asset management companies that employ people to steer and support fund managers in voting shares at company AGM's and EGMs in ways that are consistent with encouraging higher ESG/sustainability standards.

Employ specialist ESG / SRI / sustainability researchers

Find a fund / asset management company that directly employs specialist ESG/SRI/sustainability researchers or analysts. This allows asset managers to discuss environmental, social and governance risks and opportunities directly with companies.

Use specialist ESG / SRI / sustainability research companies

Find fund / asset management companies that makes use of expert external research companies. This can help deliver specialist expertise and means resources are pooled with other investors. Accreditations

UK Stewardship Code signatory (AFM companywide)

Find fund / asset managers that are signatories to the FRC UK Stewardship Code, which sets out a framework for constructive investor / investee relations where managers are encouraged to behave like responsible, typically longer term 'company owners'. Engagement Approach

Regularly lead collaborative ESG initiatives (AFM companywide)

Find fund / asset management companies that regularly initiate or run industry wide (collaborative) investor projects aimed at raising environmental, social and governance standards amongst investee companies.

Engaging on climate change issues

Fund / asset manager has stewardship /responsible ownership strategy that is focused on addressing climate change with investee assets.

Engaging with fossil fuel companies on climate change

Fund / asset manager has a stewardship /responsible ownership strategy that involves working with fossil fuel companies on climate change related issues. See fund manager website for details.

Engaging on biodiversity / nature issues

The fund / asset manager has a responsible ownership / stewardship strategy that focuses on biodiversity and nature issues relating to the assets they invest the aim of which will be to reduce harm and or deliver improvement. Strategies vary. https://tnfd.global

Engaging to encourage a Just Transition

Fund / asset manager has a responsible ownership / stewardship strategy which means they are working to encourage the shift to more sustainable business practices in ways that respect and are sensitive to social issues and the impact change has on people effected by the changes that are taking place. https://www.transitionpathwayinitiative.org/ https://transitiontaskforce.net/

Engaging on human rights issues

Fund / asset manager has responsible ownership / stewardship strategy in place which aims to address human rights issues in investee companies (and potentially their suppliers) with the aim of raising standards

Engaging on labour / employment issues

Fund / asset manager has responsible ownership / stewardship strategy in place that aims to improve labour standards for the benefit of employees in investee companies (and potentially their suppliers)

Engaging on diversity, equality & / or inclusion issues

Fund / asset management company has a stewardship strategy in place which involves working to raise diversity, equality and inclusion standards across investee assets

Engaging to stop modern slavery

Fund / asset manager is working with the assets they hold to help stamp out modern slavery - where direct or indirect company employees are exploited for business benefits.

Engaging on governance issues

Fund / asset managers have stewardship strategies in place that focus on improving governance standards across investee assets

Engaging on responsible supply chain issues

Has a stewardship / responsible ownership strategy that encourages responsible supply chain - ie the managers will discuss environmental, social and governance issues with investee companies with the aim of raising standards

Stewardship escalation policy

Escalation policies describe how a manager will proceed if stewardship / engagement activity is not successful in the short term. Climate & Net Zero Transition

Net Zero commitment (AFM companywide)

Fund / asset management organisations that have pledged to reduce their greenhouse gas emissions to ‘net zero’. Strategies vary - this area is changing rapidly.

Net Zero - have set a Net Zero target date (AFM companywide)

This fund / asset management company has set a date by which they plan to achieve net zero greenhouse gas / CO2e emissions.

Encourage carbon / greenhouse gas reduction (AFM companywide)

Find fund / asset management companies that are working with the companies they invest in to encourage reductions in carbon dioxide and other greenhouse gas emissions.

Carbon transition plan published (AFM companywide)

Finds organisations / fund managers that have a company wide carbon transition plan - meaning that they have plotted a path to how they will move away from activities that produce or use carbon based energy sources (that emit greenhouse gases) towards clean, alternative, renewable energy sources.

Working towards a ‘Net Zero’ commitment (AFM companywide)

Finds organisations / fund management companies that are in the process of working out how to make a ‘net zero commitment’ - meaning that when that is finalised they will have started the process of reducing their total greenhouse gas emissions to 'zero'.

Committed to SBTi / Science Based Targets Initiative

See https://sciencebasedtargets.org/ Transparency

Publish responsible ownership / stewardship report (AFM companywide)

Find fund / asset management companies that publish a report detailing their responsible investment ownership - also known as 'Stewardship' - activity.

Full stewardship / responsible ownership policy information on company website

Find fund / asset management companies that publish information about their sustainable and responsible investment strategies on their company website.

Full stewardship / responsible ownership policy information available on request

Find fund / asset management companies that will supply information about their sustainable and responsible investment activity on request.

Publish full voting record (AFM companywide)

Fund / asset management companies that publish a full record of how they vote their shares at AGMs (annual general meetings) and EGMs (extraordinary general meetings). Voting strategies have an important role to play encouraging higher environmental, social and governance standards.

Net Zero transition plan publicly available (AFM companywide)

This fund / asset management company has published a plan that explains how they are going to achieve net zero greenhouse gas / CO2e emissions. Resources, Affiliations & Corporate Strategies:Newton has a centralised responsible investment team. This team is the centre of excellence for all matters related to responsible investment, and with its deep functional knowledge of the responsible investment space and how it is evolving, it provides guidance, support and subject-matter expertise to our wider investment team. The responsible investment team, as you can see below, is global in its footprint and diverse in its employee base. The team is organised into three pillars of expertise – stewardship, research and analytics: these specialisations under the responsible investment umbrella allow us to bring further depth and expertise to each of these activities. The team’s compact size enables it to work cohesively and operate as one team. Sustainability research: Subject-matter experts consulting the investment and research teams, driving deep insights on sustainability-related subjects. The team manages Newton’s sustainability standards, definitions and frameworks. Responsible investment analytics: Has strong quantitative and RI data expertise and owns the data ecosystem, creating and managing responsible investment data models, frameworks and tools that support ESG integration and sustainable investing. The team has built an innovative suite of building blocks that can be leveraged to develop scalable solutions to meet specific client requirements. The role of the responsible investment team is to be a support function to the investment teams, to set standards around sustainable investment, and to coordinate and ensure effectiveness around our stewardship efforts. It guides the business around policies and direction of travel for sustainability and stewardship more broadly. The responsible investment team also owns and manages the overall governance systems to ensure we deliver against key codes and commitments including stewardship codes, industry principles such as the UN Principles for Responsible Investment, and industry pledges such as the Net Zero Asset Managers Initiative (NZAMi). Supporting the team, and the wider business, are various external organisations and vendors including ESG service providers, memberships, and internal systems for monitoring and reporting.

Affiliations Organisations and initiatives related to responsible investment matters in which Newton plays a formal role: *Newton Japan was established as a legal entity in March 2023. Its prior commitment to the Japan Stewardship Code was under its previous structure. ESG Governance Having an effective management and governance framework is an important part of our overall business strategy. As investors, we understand the value of effective leadership and accountability. This is closely linked to the culture of our business, as leadership and accountability have equal importance in Newton’s governance. We have therefore established appropriate governance systems and controls to support our stewardship and RI policy. This policy is reviewed and approved by the Newton Sustainability Committee (NIM and NIMNA), which reports to the Newton Executive Management Committee (NEMC) (to note, the NEMC reports into NIM and NIMNA boards). The policy is also reviewed and approved by the NIMJ Investment Oversight Committee, which reports into the NIMJ Executive Management Committee. The NEMC has overall responsibility for defining Newton’s approach, values and actions across all Newton entities. Two of our operating committees play important roles in relation to our stewardship and RI efforts:

These committees deal with various stewardship and RI aspects on an ad-hoc basis, including any relevant internal audit findings and actions as well as climate-related risk updates from internal groups. Our Board Risk Committee also plays a role in the governance of our RI and stewardship efforts; it acts as an escalation point for any material issues identified through our governance systems and controls. For example, it has previously considered materials related to climate risk. We have also established the Newton Sustainable Investment Forum (SIF) as an oversight group to monitor our strategies with sustainability characteristics. The role of the SIF is to:

LiteratureDisclaimerIMPORTANT INFORMATION Newton manages a variety of investment strategies. How ESG analysis is integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved. ESG can be one of many inputs into the fundamental analysis. Newton will make investment decisions that are not based solely on ESG analysis. Other attributes of an investment may outweigh ESG analysis when making investment decisions. *Newton’ and/or ‘Newton Investment Management’ is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (“NIM”), Newton Investment Management North America LLC (“NIMNA”) and Newton Investment Management Japan Limited ("NIMJ"). Newton’s assets under management include assets collectively managed by NIM, NIMNA and NIMJ. In addition, AUM for Newton includes assets of bank-maintained collective investment funds for which Newton has been appointed sub-advisor, where Newton personnel act as dual officers of affiliated companies and assets of wrap fee account(s) for which Newton provides sub-advisory services to the primary manager of the wrap program. |

||||||||