LV= L&G Future World ESG Screened and Selected Multi-Index 4 Pn

SRI Style:

Sustainability Tilt

SDR Labelling:

-

Product:

Pension

Fund Region:

Global

Fund Asset Type:

Multi Asset

Launch Date:

18/11/2019

Last Amended:

Aug 2025

Dialshifter ( ):

):

Fund/Portfolio Size:

£1.27m

(as at: 31/07/2025)

ISIN:

GB00BJDQL483

Objectives:

The Fund’s objective is to provide a combination of growth and income within a pre-determined risk profile. The Fund’s potential gains and losses are likely to be constrained by the aim to stay within the risk profile. The Fund also aims to explicitly incorporate social, environmental and governance considerations into the investment strategy at both portfolio and security level.

Sustainable, Responsible

&/or ESG Overview:

The fund is a multi-asset fund which primarily invests in internal L&G products from a wide array of asset classes. Its asset allocation is managed actively, and it targets Dynamic Planner risk level 4.

The Fund belongs to the Future World product range which represents the Manager's conviction and framework for responsible investing. Within our Future World ESG Multi-Index funds, we integrate ESG by utilising the three ‘E’s of ESG integration – Enforce – Enhance – Engage – within our Future World building blocks: We first Enforce our Future World Protection List Methodology. We then look to Enhance the ESG profile by tilting towards those companies or issuers with higher ESG score in ESG index funds or using Active View to consider ESG credentials in our active funds. Finally, we Engage. Through our approach to investment stewardship, we seek to improve companies’ standards by engaging with them and using our voice.

Primary fund last amended:

Aug 2025

Information directly from fund manager.

Fund Filters

Sustainability - General

Has policies that consider (environmental and social) sustainability issues. Strategies vary but are likely to consider environmental issues like climate change, carbon emissions, biodiversity loss, resource management, environmental impacts; and social issues like equal opportunities, human rights, labour standards, diversity and adherence to internationally recognised codes. See individual entry information.

Has a significant focus on sustainability issues

Aim to encourage higher sustainability standards through responsible ownership / stewardship / engagement / voting activity

Use the UN Global Compact to inform or help direct where they can or cannot invest. Will typically not invest in companies with significant breaches (low standards) - strategies vary. (The UNGC covers a wide range of issues - search 'UNGC'). See https://unglobalcompact.org/

Aim to invest (and manage assets) in ways that help to address all or some of the UN's Sustainable Development Goals (SDGs). See https://sdgs.un.org/goals).

Aim to support the shift to a sustainable future. See eg https://www.transitionpathwayinitiative.org/

Has a strategy on - and may focus investment on sustainability issues in the property sector - they may eg use GRESB / BREEAM scores to inform investment decisions.

Environmental - General

Has policies which relate to environmental issues. These will typically set out their stance on issues such as pollution, climate change, resource management, biodiversity loss, carbon emissions, plastics and/or additional environmental impacts. Strategies vary.

Options that limit or 'reduce' their exposure to carbon intensive industries (ie sectors which are major contributors to climate change). Strategies vary.

Aims to invest in companies with strong or market leading environmental policies and practices. Strategies vary. See individual entry information for more detail.

Nature & Biodiversity

Has a written biodiversity policy or theme typically aimed at supporting, encouraging and improving environmental protection and safeguarding the natural world (sometimes referred to as 'natural capital'). See eg https://www.un.org/en/climatechange/science/climate-issues/biodiversity

Has a significant focus on investment in nature and biodiversity related opportunities

Has policies designed to address involvement in irresponsibly managed palm oil or other forms of deforestation (typically exclusion led). Strategies vary.

Climate Change & Energy

Has policies (documented strategies that explain their position) on climate change related issues such as greenhouse gas/carbon emissions, net zero, transitioning to lower carbon. Strategies vary.

Avoid investment in major coal, oil and/or gas (extraction) companies. Strategies vary.

Avoid companies involved in fracking and tar sands - which are widely regarded as controversial methods of oil and gas extraction. Strategies vary.

Encourage the transition to lower carbon activities through asset selection and / or responsible ownership activity.

Invest in renewable energy companies and / or companies where renewable energy is a significant part of their business. Strategies vary.

Excludes companies and other assets with direct involvement in fossil fuel exploration (eg coal, oil and gas companies)

Social / Employment

Has policies which set out their approach to social issues (e.g. human rights, labour standards, equal opportunities, child labour and/or adherence to internationally recognised codes such as the UN Global Compact). Strategies with social policies typically avoid companies with low standards and/or work to encourage higher standards. See fund information for detail.

Has a labour standards policy - likely to mean they will invest in / favour companies that have higher employment related standards and avoid those with low standards. Strategies vary. See eg https://www.ilo.org/international-labour-standards

Aims to invest in assets with high social values - this may include strong human rights, labour standards and equal opportunities or safety related practices.

Ethical Values Led Exclusions

Companies are excluded if they are involved in any aspect of the production chain for tobacco products, including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Companies are excluded if they make more than 5% of their revenue from the manufacture, sale or distribution of tobacco products including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Avoids companies that manufacture weapons intended specifically for military use. Strategies vary - may or may not included non-strategic military products.

Has a written civilian firearms exclusion policy - meaning that they will not invest in companies that make (or perhaps also sell) handguns made for non-military users.

Human Rights

Has policies relating to human rights issues. Typically require companies to demonstrate higher standards, although some managers work to encourage improvements. Investee companies are often judged against internationally agreed norms or standards. Strategies vary.

Has policies to avoid companies that employ children.

Has policies that exclude companies or other assets which operate in, or are owned by regimes which are not democratic, or where people may be oppressed. May use eg. Freedom House research. Strategies vary.

Has policies or a theme that relates to the responsible management of supply chains. These may relate to employment issues, notably people employed by their suppliers, as well as the sourcing of materials and products.

Meeting Peoples' Basic Needs

Invest in social housing property freeholds. Strategies vary.

Focuses on (ie directs a significant proportion of its investment towards) green infrastructure, eg the clean energy supply chain.

Gilts & Sovereigns

Invest in loans issued the government, commonly known as gilts or government bonds. These may or may not be ringfenced for specific projects (see additional options).

Invest in financial instruments issued by governments, but will only hold those that meet certain environmental and or social criteria. This may, for example mean certain assets are excluded in line with eg Freedom House research. Strategies vary.

Banking & Financials

Can include banks as part of their holdings / portfolio.

Invests in financial instruments (cash, derivatives and / or foreign exchange) issued by banks. Strategies vary.

May invest in insurance companies.

Governance & Management

Has policies that relate to corporate governance issues such as board structure, executive remuneration, bribery and/or corporate corruption. These funds will typically avoid companies with poor practices. Strategies vary.

Avoids investing in companies with poor governance practices.(e.g. board structure, management practices etc.) Views may however vary on what counts as 'poor' practices - and funds may not immediately divest as they may prefer to work to encourage higher standards.

Has policies explaining how managers will respond to assets / companies that do not comply with relevant anti-bribery and anti-corruption standards or laws. Strategies vary; options include stewardship/ engagement and divestment - or a combination.

Encourage the banks and insurance companies they invest in to publish climate change related financial information - as set out by the Task Force on Climate Related Financial Disclosures (with the aim of helping investors measure and respond to climate risk).

Product /Service Governance

Find funds that have an external committee that helps steer or advise fund managers on SRI policy or strategy related issues. These people may be paid for their time but are not employees of the fund manager.

Find funds that factor in 'environmental, social and governance' issues as part of their investment decision making process. A focus on 'ESG' typically means a fund is carrying out additional research to help reduce ESG related risks. It does not necessarily mean a focus on sustainability. Strategies vary. See fund literature.

Asset Size

Invests in a combination of small, medium and larger (potentially multinational) companies.

Invests in international entities or bodies with agreed remits that are broadly similar to those that may otherwise be undertaken by individual governments eg the UN

Targeted Positive Investments

Invests in loan stock that is exclusively used to finance environmental and social projects. See ICMA Sustainable Bond Guidelines.

Impact Methodologies

Aims to deliver positive environmental and or social impacts (real world benefits) through its engagement with investee assets

How The Fund/Portfolio Works

Focuses on finding and investing in companies with positive / beneficial attributes. This strategy can be applied in addition to exclusion criteria and engagement/stewardship activity.

Has principle 'ethical approach' to avoid companies by using negative screening criteria. Strategies vary.

Has some exclusions - typically for example excludes tobacco or companies that breach commonly adopted standards or norms such as the UN Global Compact.

Invest more heavily in assets which have higher ESG ratings/standards or scores and less heavily in companies with lower ESG ratings. Where this is central to the strategy you should expect assets in most sectors. Strategies vary.

Makes stock selection (and ongoing management) decisions based on ESG data or company ratings (normally supplied by third parties) rather than focusing on what individual companies do, how they operate or their plans for the future

Only uses an investment index to direct where they can invest. Fund strategies and indices vary.

Investment selection process uses internationally agreed 'norms' (e.g. United Nations Global Compact - UNGC - or the UN Sustainable Development Goals - SDGs) alongside additional SRI criteria such as positive or negative stock selection policies and/or stewardship strategies.

Invests in assets which have an ESG strategy (which is typically focused on avoiding companies that pose environmental, social or governance related risks) together with additional criteria such as positive and/or negative screens, themes and stewardship strategies.

Considers both the 'positive' and 'negative' aspects of company behaviour and makes balanced, considered decisions as part of their investment approach. May apply to a range of different issues and policy areas.

Focuses on the careful management of environmental, social and governance (ESG) related risks - typically by avoiding or being underweight in companies seen as posing major risks in these areas (i.e. not necessarily by using themes, exclusions etc).

Publish explanations of their ethical, social and/or environmental policies online (i.e. investment decision making strategies/ buy/sell &/or asset management strategies).

Has different risk options for the same investment strategy

Uses specialist strategies to aid performance which involve ‘lending’ assets to others at specific points in time.

Intended Clients & Product Options

Finds funds designed to meet the needs of individual investors with an interest in sustainability issues.

Find funds that are available via a tax efficient ISA product wrapper.

Fund Management Company Information

About The Business

Finds fund management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

Find fund management companies that actively encourage higher 'environmental, social and governance' and/or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Find fund managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Find fund managers that consider responsible ownership and ESG to be a key differentiator for their business.

Find fund management companies that take sustainability criteria into account when selecting and/or managing all of their property / real estate investments.

Find fund management companies that aim to align all their investments (across all funds) to help meet the aims of the UN Sustainable Development Goals.

Find funds run by fund managers that apply Responsible ownership or 'Stewardship' policies to all or most of their investment assets. This means active involvement (e.g. voting, dialogue) with the companies they invest in across funds (not normally limited to ethical or SRI options.) Read fund literature for further information.

Find fund management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management.

Finds organisations / fund managers that have an in-house (company wide) diversity improvement programme - meaning that they are working to ensure that within their own businesses they employ people from diverse backgrounds - often typically focused on ethnicity and/or sex.

Find fund management companies that encourage the companies they invest in to have strong diversity, race, gender and other equality policies across all assets held, not simply screened or themed SRI/ESG funds. (ie Asset Management company wide).

This asset management company invests in companies which have recently listed on a stock exchange (which is important as it can help grow new businesses).

Asset management company has investments in bonds designed to meet sustainability requirements - however these assets may not be 'ringfenced' for this purpose. See fund manager website for details.

Collaborations & Affiliations

Find fund management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

A member of the Taskforce for Nature Related Financial Disclosures group which aims to aid risk management and shift money towards nature-positive outcomes.

Resources

Find fund management companies that employ people to steer and support fund managers in voting shares at company AGM's and EGMs in ways that are consistent with encouraging higher ESG/sustainability standards.

Find a fund management company that directly employs specialist ESG/SRI/sustainability researchers or analysts. This allows asset managers to discuss environmental, social and governance risks and opportunities directly with companies.

Find fund management companies that makes use of expert external research companies. This can help deliver specialist expertise and means resources are pooled with other investors.

Finds organisations / fund managers that have one or more ESG/sustainability experts on all investment teams or 'desks' (all asset types)

Accreditations

Finds organisations / fund managers that have an A+ PRI rating - meaning they are highly rated according to the 'Principles of Responsible Investment'

Engagement Approach

Find fund management companies that regularly initiate or run industry wide (collaborative) investor projects aimed at raising environmental, social and governance standards amongst investee companies.

Find fund management companies that are working with the companies they invest in to encourage more responsible corporate taxation.

Fund manager has stewardship /responsible ownership strategy that is focused on addressing climate change with investee assets.

Asset manager has a stewardship /responsible ownership strategy that involves working with fossil fuel companies on climate change related issues. See fund manager website for details.

Asset manager has stewardship /responsible ownership strategy with involves encouraging investee asset to reduce plastic waste and pollution.

Asset manager has a stewardship / responsible ownership policy that means they are working to encourage more responsible mining practices - where environmental and social issues are properly dealt with by the companies they invest in.

The asset manager has a responsible ownership / stewardship strategy that focuses on biodiversity and nature issues relating to the assets they invest the aim of which will be to reduce harm and or deliver improvement. Strategies vary. https://tnfd.global

Asset manager has a responsible ownership / stewardship strategy which means they are working to encourage the shift to more sustainable business practices in ways that respect and are sensitive to social issues and the impact change has on people effected by the changes that are taking place. https://www.transitionpathwayinitiative.org/ https://transitiontaskforce.net/

Asset manager has responsible ownership / stewardship strategy in place which aims to address human rights issues in investee companies (and potentially their suppliers) with the aim of raising standards

Asset manager has responsible ownership / stewardship strategy in place that aims to improve labour standards for the benefit of employees in investee companies (and potentially their suppliers)

Asset management company has a stewardship strategy in place which involves working to raise diversity, equality and inclusion standards across investee assets

working with the assets they hold to help stamp out modern slavery - where direct or indirect company employees are exploited for business benefits.

Fund managers have stewardship strategies in place that focus on improving governance standards across investee assets

Has a stewardship / responsible ownership strategy that encourages responsible supply chain - ie the managers will discuss environmental, social and governance issues with investee companies with the aim of raising standards

Working to address sustainability, ESG and related concerns around artificial intelligence.

Company Wide Exclusions

Find fund management companies (not funds) that avoid investment in 'controversial weapons' across all of their funds and other investment vehicles.

Find fund management companies that avoid investment in fossil fuel companies (e.g. coal, oil and gas) across all of their funds. (and/ or other assets.)

Find funds / fund managers that are reviewing, or have reviewed, their exposure to carbon intensive industries including (but not only) mining, oil and gas companies. (Typically with reference to climate change.)

This asset manager has a strategy in place that will lead them to exit direct investments in the coal mining industry. Managers ability to do this may depend on the geographic regions in which they invest.

This asset manager excludes direct investment in the coal mining industry. Managers ability to do this may depend on the geographic regions in which they invest.

Climate & Net Zero Transition

Fund management organisations that have pledged to reduce their greenhouse gas emissions to ‘net zero’. Strategies vary - this area is changing rapidly.

Fund manager AGM / EGM voting strategy has processes in place that mean they will normally be expected to vote in a way that will encourage the transition to net zero greenhouse gas emissions.

Find fund management companies that have published a Climate Risk policy or statement that is signed / owned by their Chief Executive.

This asset management company has set a date by which they plan to achieve net zero greenhouse gas / CO2e emissions.

Find fund management companies that are working with the companies they invest in to encourage reductions in carbon dioxide and other greenhouse gas emissions.

Finds organisations / fund managers that have a company wide carbon transition plan - meaning that they have plotted a path to how they will move away from activities that produce or use carbon based energy sources (that emit greenhouse gases) towards clean, alternative, renewable energy sources.

Finds organisations / fund managers that have published ‘forward looking climate metrics’ e.g. 'implied temperature rise' data that are a total of the asset management company's share (% owned) of all the investee company emissions of the assets they manage, as well as their own direct and other indirect emissions.

This asset management company plans to achieve net zero greenhouse gas (CO2e) emissions by reducing their emissions. Calculations and scope vary.

Find fund management companies that are working to reduce their own (fund management company) carbon/greenhouse gas emissions.

Finds organisations / fund management companies that are in the process of working out how to make a ‘net zero commitment’ - meaning that when that is finalised they will have started the process of reducing their total greenhouse gas emissions to'zero'.

See https://sciencebasedtargets.org/

Transparency

Find fund management companies that publish a report detailing their responsible investment ownership - also known as 'Stewardship' - activity.

Find companies that publish information about their sustainable and responsible investment strategies on their company website.

Find fund management companies that will supply information about their sustainable and responsible investment activity on request.

This asset management company has published information on their website about the delivery of a 'just transition' - ie the delivery of the necessary shift to a sustainable future that takes full account of social implications - how change effects people. See eg https://www.unepfi.org/social-issues/just-transition/ or LSE Grantham

Fund management companies that publish a full record of how they vote their shares at AGMs (annual general meetings) and EGMs (extraordinary general meetings). Voting strategies have an important role to play encouraging higher environmental, social and governance standards.

This asset management company has published a plan that explains how they are to become a sustainable business - without significant negative environmental or social impacts.

This asset management company has published a plan that explains how they will align to the climate change commitments made at the Paris Climate Talks, COP21.

This asset management company has published a plan that explains how they are going to achieve net zero greenhouse gas / CO2e emissions.

Sustainable, Responsible &/or ESG Policy:

These funds aim to invest at least 75% in ESG Assets (please see the Prospectus for the detailed definitions of the types of ESG Assets we invest in), and we utilise the three ‘E’s of ESG integration – Enforce – Enhance – Engage – within the Future World index building blocks:

We first Enforce our Future World Protection List Methodology. Although L&G prioritises company engagement over exclusions, when combined with engagement and voting, targeted exclusions can also be a very powerful tool.

We then look to Enhance the ESG profile by tilting towards those companies or issuers with higher ESG score in ESG index funds or using Active View to consider ESG credentials in our active funds.

Finally, we Engage. Through our approach to investment stewardship, we seek to improve companies’ standards by engaging with them and using our voice.

Please see below for further details.

Enforce

The following aspects are incorporated as an initial exclusion policy in defining the investable universe for our core equity building blocks. The standards set here are based on our L&G Future World Protection list; a set of exclusions based on companies who fail to meet either globally accepted principles of business practice, or whose business is incompatible with a low-carbon transition.

- Companies that derive more than 20% of their revenues from Thermal Coal mining, power generation or oil Sands

- Manufacturers of controversial weapons

- Perennial violators of the United Nations Global Compact (UNGC).

- We also extend this list with two additional exclusions across equity unit trusts that we hold in the fund:

- companies that derive more than 10% of their revenues from the production or retail of tobacco products

- companies that derive more than 10% of their revenue from military weapon system manufacturing and

- companies that derive more than 5% of their revenue from assault weapons.

Enhance

We then look to Enhance the ESG profile of the fund through a number of mechanisms:

ESG tilts: we have developed a rules-based and transparent methodology by which to score companies against ESG metrics which generates the L&G ESG Score. We developed the scores with the aim of improving market standards globally, while monitoring ESG developments across our entire investment universe. This proprietary scoring framework is the foundation of our Future World Index funds range. The L&G ESG Score aligns with how we engage with, and vote on, the companies in which we invest. To facilitate this process, we publish the scores and explain the metrics on which they are based.

Our methodology is based on a transparent framework to assess companies, in order to avoid creating an investment 'black box' and enhance the role of investors to reward and penalise companies based on clear and consistent global standards. Our score comprises 34 ESG data points that measure companies against what we believe are global minimum standards and were selected based on three guiding principles. Each of the 34 data points are assessed and scored, creating a sub-score at the theme level. Individual themes are then aggregated to form the environmental, social, governance and transparency scores. Please refer to the L&G ESG Score methodology for further information.

We implement the score within the Future World ESG Multi-Index funds by tilting towards companies that have higher ESG scores and away from those with lower scores. In addition, the scores enable us to incentivise companies to improve their ESG profile through a transparent methodology. We also use ESG Active View to consider ESG credentials in our active funds.

Targeted self-decarbonisation: the equity indices behind our core equity building blocks are designed to glide towards a 2050 net zero target, initially reducing emissions by 50% relative to market index and will structurally reduce by 7% annually.

Engage

L&G engages on behalf of all our clients’ assets, and represents all clients in carrying out voting, engagement and advocacy activities in order to protect and enhance asset values over the long term and speak with one voice in our discussions with companies. Our Investment Stewardship team is not afraid to express its views, voting every share with one voice, without abstentions. We never abstain unless it is technically impossible for us to vote. In 2023, L&G cast roughly 149,000 votes and engaged with 2,050 companies.

We have participated in longstanding direct and collective engagement with policymakers on climate, including associations such as the PRI, CA100+, IIGCC, TCFD, and TPI.

We note that the carbon footprint of the portfolio is important to you; we also believe that climate is an incredibly important topic. As part of our longstanding engagement programme, the Climate Impact Pledge, we hold over 5000 companies across 20 climate-critical sectors accountable on their climate ambitions and disclosures through our votes and targeted divestment decisions.

The fund invests at least 75% in collective investment schemes. Hence, the integration of environmental, social and governance considerations in the fund will primarily occur on the level of the collective investment schemes which we will use to populate our asset allocation.

The choice of underlying building blocks has a material impact on the aggregate ESG score and the carbon metrics of our core equity and credit allocation relative to a composite comparator of market-cap weighted indices.

We regularly monitor and publish these metrics on a monthly basis to assess the portfolio’s exposure to climate risk and carbon footprint. This is done on a complete look-through basis using underlying scores and carbon metrics for individual companies.

Process:

The ESG policy and process for the fund is described in the previous section. Our ESG Score and ESG Active View (which utilises its own separate ESG score) is described as follows:

ESG Score

We have developed a rules-based and transparent methodology by which to score companies against ESG metrics. The ESG Score aligns with how we engage with, and vote on, the companies in which we invest. To facilitate this process, we publish the scores and explain the metrics on which they are based.

Our methodology is based on a transparent framework to assess companies, in order to avoid creating an investment 'black box' and enhance the role of investors to reward and penalise companies based on clear and consistent standards. Our score comprises 32 data points that measure companies against what we believe are global minimum standards and were selected based on three guiding principles.

- Available - Are companies in the investable universe reporting this information?

- Quantifiable - Is the information available in a numerical format to be included in the scores?

- Reliable - Is the data reported regularly to allow for comparison amongst all the relevant companies?

Each of the 32 data points are assessed and scored, creating a sub-score at the theme level. Individual themes are then aggregated to form the environmental, social, governance and transparency scores.

External data sources used are HSBC, Refinitiv, ISS and Influence Map, as set out in the methodology document.

ESG Active View

L&G has developed a proprietary research tool called Active ESG View which brings together granular quantitative and qualitative ESG inputs. Active ESG View primarily uses third-party data from multiple different vendors which includes hundreds of ESG metrics (including data on carbon emissions, water and waste, environmental policies and controls, labour, health and safety, bribery and corruption) spanning 64 specific sectors and/or sub-sectors from a number of ESG data providers.

The quantitative inputs consist of two components:

- an ESG score calculated in Active ESG View which evaluates and scores issuers from an environmental, social and governance perspective, and

- a screening of investee companies in respect of their involvement in certain products and services, and certain controversies and violations of norms and standards. This screening, directly or indirectly, maps to some of the adverse sustainability indicators set out in Table 1 of Annex I of the Level 2 Measures.

L&G sets minimum thresholds for both of these components in Active ESG View. These are then supplemented by L&G’s qualitative assessment of the sustainability risks and opportunities relating to the relevant issuer. This qualitative assessment is performed by the Global Research and Engagement Groups (“GREGs”) which bring together representatives from L&G’s investment and investment stewardship teams across regions and asset classes. Where issuers fail to meet either of the components of the quantitative assessment, and the GREGs have reviewed and agreed with the assessment through qualitative analysis, L&G will seek to limit the Fund’s aggregate exposure to such issuers relative to their weights in the Benchmark Index.

The sustainability indicator that will be used in relation to the attainment of the environmental and social characteristics relating to this process will measure the aggregate overweight exposure to issuers that are not aligned with L&G’s requirements for ESG factor evaluation compared to such issuers' weight in the Benchmark Index.

Resources, Affiliations & Corporate Strategies:

As of December 2024, there are c.100 L&G - Asset Management (L&G) employees with roles dedicated to ESG, some of which are outlined in more detail below.

Responsible Investment and Investment Stewardship team

- Amelia Tan was appointed Head of Responsible Investment & Stewardship for Legal and General’s Asset Management division in January 2025, having joined in 2022 as Head of Responsible Investment Strategy. In this role, she is responsible for engagement with publicly listed investee companies globally across all of the firm’s assets under management as well as responsible investment processes and products of the public market’s investment teams. She coordinates the strategy for responsible investing in the Asset Management division and is responsible for regulatory and policy engagement regarding environmental, social, governance and responsible investment matters.

- The Investment Stewardship team is responsible for developing and carrying out L&G’s investment stewardship and active ownership activities. The team comprises subject matter experts across our global investment stewardship themes and is organised in a matrix of thematic and sector coverage.

- There are 24 people in our global Investment Stewardship team (as at 31 December 2024). The team includes those located in the US, Japan and Singapore, the latter two led by Aina Fukuda and Trista Chen, respectively.

- The Responsible Investing Strategy team, comprising three colleagues, works with investment teams to integrate responsible investing insights into investment process across asset classes and investment styles. Additionally, the team also looks to innovate on responsible investing products and solutions, with the focus on positioning and ensuring that we are market-leading, credible and consistent.

Climate Solutions team

- Nick Stansbury, Head of Climate Solutions, leads our energy transition approach and is one of our most prominent spokespeople on this topic.

- The Climate Solutions team, which has a total of eight team members, has created a bespoke, detailed and investor-focused model to facilitate construction of fully independent energy scenarios. The framework uses in excess of 10 million data variables to model the energy system. The model, L&G’s Destination@Risk, is now helping to inform our long-term investment decisions and develop dynamic pathways for the energy system.

ESG Distribution

- Laura Brown, Head of Public Markets Distribution, is supported by two further colleagues who are dedicated to ESG and supporting clients in meeting their sustainability and responsible investing objectives.

Real Assets

- L&G’s Real Assets teamhas 11 dedicated ESG experts working across the range of private credit and real estate strategies that we manage. This team is led Shuen Chan, Head of Responsible Investment and Sustainability.

Product Development and Strategy

- Rachel Ahlquistis focused on developing and shaping the strategic direction of the pooled product range with respect to Responsible Investment features. This includes specific focus on product launch or amendment work with more advanced ESG features.

Global Research and Engagement Group (GREGs)

Further to those with roles dedicated to ESG, our Global Research and Engagement Groups (GREGs) bring together representatives from the Investment and Investment Stewardship teams across regions and asset classes. The GREGs enable L&G to connect top-down macro and thematic views with bottom-up analysis of corporate and sector fundamentals to understand the materiality of sustainability risks and opportunities and prioritise them accordingly. Combining the capabilities of the Investment and Investment Stewardship teams also enables L&G to scale and coordinate our engagement efforts with companies at board and executive management levels, across all asset class and investment styles. C.40 research analysts contribute to our GREGs, researching into structural industry changes and risks, and identifying key themes and engagement topics across nine sectors.

Please see L&G Attachment 1 - ESG Memberships and Collaboration for details on list of related affiliations and memberships.

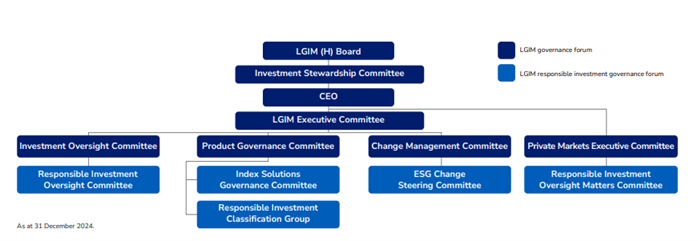

Please find the team organisation chart below.

See also: L&G ESG Memberships & Collaborations.docx

Literature

Fund Holdings

Voting Record

Disclaimer

This communication is not a financial promotion and is intended for Professional Clients, Qualified Investors, companies and pension trustees and should not be relied upon by retail customers, pension scheme members, employees, or any other persons.

This document has been prepared by Legal & General Investment Management Limited and/or its affiliates ('L&G', ‘we’ or ‘us’). The information in this document is the property and/or confidential information of L&G and may not be reproduced in whole or in part or distributed or disclosed by you to any other person without the prior written consent of L&G. Not for distribution to any person resident in any jurisdiction where such distribution would be contrary to local law or regulation.

No party shall have any right of action against L&G in relation to the accuracy or completeness of the information in this document. The information and views expressed in this document are believed to be accurate and complete as at the date of publication, but they should not be relied upon and may be subject to change without notice. We are under no obligation to update or amend the information in this document. Where this document contains third party data, we cannot guarantee the accuracy, completeness or reliability of such data and we accept no responsibility or liability whatsoever in respect of such data.

No part of this document should be construed as providing investment advice, and L&G does not accept any liability for any decisions based on this document.

Legal and General Assurance (Pensions Management) Limited. Registered in England and Wales No. 01006112. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, No. 202202.

LGIM Real Assets (Operator) Limited. Registered in England and Wales, No. 05522016. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No. 447041. Please note that while LGIM Real Assets (Operator) Limited is regulated by the Financial Conduct Authority, it may conduct certain activities that are unregulated.

Legal & General (Unit Trust Managers) Limited. Registered in England and Wales No. 01009418. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No. 119273.

Issued by Legal & General Investment Management Ltd in the UK. Registered in England and Wales No. 02091894. Registered office: One Coleman Street, London EC2R 5AA. Authorised and regulated by the Financial Conduct Authority.

| Fund Name | SRI Style | SDR Labelling | Product | Region | Asset Type | Launch Date | Last Amended |

|

|---|---|---|---|---|---|---|---|---|

LV= L&G Future World ESG Screened and Selected Multi-Index 4 Pn |

Sustainability Tilt | - | Pension | Global | Multi Asset | 18/11/2019 | Aug 2025 | |

ObjectivesThe Fund’s objective is to provide a combination of growth and income within a pre-determined risk profile. The Fund’s potential gains and losses are likely to be constrained by the aim to stay within the risk profile. The Fund also aims to explicitly incorporate social, environmental and governance considerations into the investment strategy at both portfolio and security level.

|

Fund/Portfolio Size: £1.27m (as at: 31/07/2025) ISIN: GB00BJDQL483 |

|||||||

Sustainable, Responsible &/or ESG OverviewThis product is linked to the "Legal & General Future World ESG Screened and Selected Multi-Index 4" fund. The following information refers to the primary fund.

The fund is a multi-asset fund which primarily invests in internal L&G products from a wide array of asset classes. Its asset allocation is managed actively, and it targets Dynamic Planner risk level 4. The Fund belongs to the Future World product range which represents the Manager's conviction and framework for responsible investing. Within our Future World ESG Multi-Index funds, we integrate ESG by utilising the three ‘E’s of ESG integration – Enforce – Enhance – Engage – within our Future World building blocks: We first Enforce our Future World Protection List Methodology. We then look to Enhance the ESG profile by tilting towards those companies or issuers with higher ESG score in ESG index funds or using Active View to consider ESG credentials in our active funds. Finally, we Engage. Through our approach to investment stewardship, we seek to improve companies’ standards by engaging with them and using our voice. |

||||||||

|

Primary fund last amended: Aug 2025 |

||||||||

|

Information received directly from Fund Manager |

||||||||

|

Please select what you would like to read:

Fund FiltersSustainability - General

Sustainability policy

Has policies that consider (environmental and social) sustainability issues. Strategies vary but are likely to consider environmental issues like climate change, carbon emissions, biodiversity loss, resource management, environmental impacts; and social issues like equal opportunities, human rights, labour standards, diversity and adherence to internationally recognised codes. See individual entry information.

Sustainability focus

Has a significant focus on sustainability issues

Encourage more sustainable practices through stewardship

Aim to encourage higher sustainability standards through responsible ownership / stewardship / engagement / voting activity

UN Global Compact linked exclusion policy

Use the UN Global Compact to inform or help direct where they can or cannot invest. Will typically not invest in companies with significant breaches (low standards) - strategies vary. (The UNGC covers a wide range of issues - search 'UNGC'). See https://unglobalcompact.org/

UN Sustainable Development Goals (SDG) focus

Aim to invest (and manage assets) in ways that help to address all or some of the UN's Sustainable Development Goals (SDGs). See https://sdgs.un.org/goals).

Transition focus

Aim to support the shift to a sustainable future. See eg https://www.transitionpathwayinitiative.org/

Green / Sustainable property strategy

Has a strategy on - and may focus investment on sustainability issues in the property sector - they may eg use GRESB / BREEAM scores to inform investment decisions. Environmental - General

Environmental policy

Has policies which relate to environmental issues. These will typically set out their stance on issues such as pollution, climate change, resource management, biodiversity loss, carbon emissions, plastics and/or additional environmental impacts. Strategies vary.

Limits exposure to carbon intensive industries

Options that limit or 'reduce' their exposure to carbon intensive industries (ie sectors which are major contributors to climate change). Strategies vary.

Favours cleaner, greener companies

Aims to invest in companies with strong or market leading environmental policies and practices. Strategies vary. See individual entry information for more detail. Nature & Biodiversity

Biodiversity / nature policy

Has a written biodiversity policy or theme typically aimed at supporting, encouraging and improving environmental protection and safeguarding the natural world (sometimes referred to as 'natural capital'). See eg https://www.un.org/en/climatechange/science/climate-issues/biodiversity

Nature / biodiversity focus

Has a significant focus on investment in nature and biodiversity related opportunities

Deforestation / palm oil policy

Has policies designed to address involvement in irresponsibly managed palm oil or other forms of deforestation (typically exclusion led). Strategies vary. Climate Change & Energy

Climate change / greenhouse gas emissions policy

Has policies (documented strategies that explain their position) on climate change related issues such as greenhouse gas/carbon emissions, net zero, transitioning to lower carbon. Strategies vary.

Coal, oil & / or gas majors excluded

Avoid investment in major coal, oil and/or gas (extraction) companies. Strategies vary.

Fracking and tar sands excluded

Avoid companies involved in fracking and tar sands - which are widely regarded as controversial methods of oil and gas extraction. Strategies vary.

Encourage transition to low carbon through stewardship activity

Encourage the transition to lower carbon activities through asset selection and / or responsible ownership activity.

Invests in clean energy / renewables

Invest in renewable energy companies and / or companies where renewable energy is a significant part of their business. Strategies vary.

Fossil fuel exploration exclusion - direct involvement

Excludes companies and other assets with direct involvement in fossil fuel exploration (eg coal, oil and gas companies) Social / Employment

Social policy

Has policies which set out their approach to social issues (e.g. human rights, labour standards, equal opportunities, child labour and/or adherence to internationally recognised codes such as the UN Global Compact). Strategies with social policies typically avoid companies with low standards and/or work to encourage higher standards. See fund information for detail.

Labour standards policy

Has a labour standards policy - likely to mean they will invest in / favour companies that have higher employment related standards and avoid those with low standards. Strategies vary. See eg https://www.ilo.org/international-labour-standards

Favours companies with strong social policies

Aims to invest in assets with high social values - this may include strong human rights, labour standards and equal opportunities or safety related practices. Ethical Values Led Exclusions

Tobacco and related product manufacturers excluded

Companies are excluded if they are involved in any aspect of the production chain for tobacco products, including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Tobacco and related products - avoid where revenue > 5%

Companies are excluded if they make more than 5% of their revenue from the manufacture, sale or distribution of tobacco products including cigarettes, vaping, e-cigarettes, chewing tobacco and cigars.

Armaments manufacturers avoided

Avoids companies that manufacture weapons intended specifically for military use. Strategies vary - may or may not included non-strategic military products.

Civilian firearms production exclusion

Has a written civilian firearms exclusion policy - meaning that they will not invest in companies that make (or perhaps also sell) handguns made for non-military users. Human Rights

Human rights policy

Has policies relating to human rights issues. Typically require companies to demonstrate higher standards, although some managers work to encourage improvements. Investee companies are often judged against internationally agreed norms or standards. Strategies vary.

Child labour exclusion

Has policies to avoid companies that employ children.

Oppressive regimes (not free or democratic) exclusion policy

Has policies that exclude companies or other assets which operate in, or are owned by regimes which are not democratic, or where people may be oppressed. May use eg. Freedom House research. Strategies vary.

Responsible supply chain policy or theme

Has policies or a theme that relates to the responsible management of supply chains. These may relate to employment issues, notably people employed by their suppliers, as well as the sourcing of materials and products. Meeting Peoples' Basic Needs

Invests in social property (freehold)

Invest in social housing property freeholds. Strategies vary.

Green infrastructure focus

Focuses on (ie directs a significant proportion of its investment towards) green infrastructure, eg the clean energy supply chain. Gilts & Sovereigns

Invests in gilts / government bonds

Invest in loans issued the government, commonly known as gilts or government bonds. These may or may not be ringfenced for specific projects (see additional options).

Invests in sovereigns subject to screening criteria

Invest in financial instruments issued by governments, but will only hold those that meet certain environmental and or social criteria. This may, for example mean certain assets are excluded in line with eg Freedom House research. Strategies vary. Banking & Financials

Invests in banks

Can include banks as part of their holdings / portfolio.

Invests in financial instruments issued by banks

Invests in financial instruments (cash, derivatives and / or foreign exchange) issued by banks. Strategies vary.

Invests in insurers

May invest in insurance companies. Governance & Management

Governance policy

Has policies that relate to corporate governance issues such as board structure, executive remuneration, bribery and/or corporate corruption. These funds will typically avoid companies with poor practices. Strategies vary.

Avoids companies with poor governance

Avoids investing in companies with poor governance practices.(e.g. board structure, management practices etc.) Views may however vary on what counts as 'poor' practices - and funds may not immediately divest as they may prefer to work to encourage higher standards.

Anti-bribery and corruption policy

Has policies explaining how managers will respond to assets / companies that do not comply with relevant anti-bribery and anti-corruption standards or laws. Strategies vary; options include stewardship/ engagement and divestment - or a combination.

Encourage TCFD alignment for banks & insurance companies

Encourage the banks and insurance companies they invest in to publish climate change related financial information - as set out by the Task Force on Climate Related Financial Disclosures (with the aim of helping investors measure and respond to climate risk). Product /Service Governance

External oversight/advisory committee (fund/service)

Find funds that have an external committee that helps steer or advise fund managers on SRI policy or strategy related issues. These people may be paid for their time but are not employees of the fund manager.

ESG integration strategy

Find funds that factor in 'environmental, social and governance' issues as part of their investment decision making process. A focus on 'ESG' typically means a fund is carrying out additional research to help reduce ESG related risks. It does not necessarily mean a focus on sustainability. Strategies vary. See fund literature. Asset Size

Invests in small, mid and large cap companies / assets

Invests in a combination of small, medium and larger (potentially multinational) companies.

Invest in supranationals

Invests in international entities or bodies with agreed remits that are broadly similar to those that may otherwise be undertaken by individual governments eg the UN Targeted Positive Investments

Invests > 5% in sustainable bonds

Invests in loan stock that is exclusively used to finance environmental and social projects. See ICMA Sustainable Bond Guidelines. Impact Methodologies

Aim to deliver positive impacts through engagement

Aims to deliver positive environmental and or social impacts (real world benefits) through its engagement with investee assets How The Fund/Portfolio Works

Positive selection bias

Focuses on finding and investing in companies with positive / beneficial attributes. This strategy can be applied in addition to exclusion criteria and engagement/stewardship activity.

Negative selection bias

Has principle 'ethical approach' to avoid companies by using negative screening criteria. Strategies vary.

Limited / few ethical exclusions

Has some exclusions - typically for example excludes tobacco or companies that breach commonly adopted standards or norms such as the UN Global Compact.

ESG weighted / tilt

Invest more heavily in assets which have higher ESG ratings/standards or scores and less heavily in companies with lower ESG ratings. Where this is central to the strategy you should expect assets in most sectors. Strategies vary.

Data led strategy

Makes stock selection (and ongoing management) decisions based on ESG data or company ratings (normally supplied by third parties) rather than focusing on what individual companies do, how they operate or their plans for the future

Passive / index driven strategy

Only uses an investment index to direct where they can invest. Fund strategies and indices vary.

Combines norms based exclusions with other SRI criteria

Investment selection process uses internationally agreed 'norms' (e.g. United Nations Global Compact - UNGC - or the UN Sustainable Development Goals - SDGs) alongside additional SRI criteria such as positive or negative stock selection policies and/or stewardship strategies.

Combines ESG strategy with other SRI criteria

Invests in assets which have an ESG strategy (which is typically focused on avoiding companies that pose environmental, social or governance related risks) together with additional criteria such as positive and/or negative screens, themes and stewardship strategies.

Balances company 'pros and cons' / best in sector

Considers both the 'positive' and 'negative' aspects of company behaviour and makes balanced, considered decisions as part of their investment approach. May apply to a range of different issues and policy areas.

Focus on ESG risk mitigation

Focuses on the careful management of environmental, social and governance (ESG) related risks - typically by avoiding or being underweight in companies seen as posing major risks in these areas (i.e. not necessarily by using themes, exclusions etc).

SRI / ESG / Ethical policies explained on website

Publish explanations of their ethical, social and/or environmental policies online (i.e. investment decision making strategies/ buy/sell &/or asset management strategies).

Different risk options of this strategy are available

Has different risk options for the same investment strategy

Use stock / securities lending

Uses specialist strategies to aid performance which involve ‘lending’ assets to others at specific points in time. Intended Clients & Product Options

Intended for investors interested in sustainability

Finds funds designed to meet the needs of individual investors with an interest in sustainability issues.

Available via an ISA (OEIC only)

Find funds that are available via a tax efficient ISA product wrapper. Fund Management Company InformationAbout The Business

Responsible ownership / stewardship policy or strategy (AFM company wide)

Finds fund management companies that have a published company wide stewardship, engagement and / or responsible ownership policy or strategy that covers all investments. Stewardship typically involves encouraging higher ESG standards through voting and dialogue.

ESG / SRI engagement (AFM company wide)

Find fund management companies that actively encourage higher 'environmental, social and governance' and/or 'sustainable and responsible investment' practices across investee companies - typically where the aim is to encourage positive change that is aligned with the best interests of investors. Strategies vary. See additional information and options.

Vote all* shares at AGMs / EGMs (AFM company wide)

Find fund managers that vote all* the shares they own at Annual General Meetings and Extraordinary General Meetings. A commitment to voting shares is a key indicator of 'responsible share ownership' demonstrating their support for or disagreement with management policy. (*situations can legitimately, occasionally occur where voting proves impossible, but in principle all shares should be voted.)

Responsible ownership / ESG a key differentiator (AFM company wide)

Find fund managers that consider responsible ownership and ESG to be a key differentiator for their business.

Sustainable property strategy (AFM company wide)

Find fund management companies that take sustainability criteria into account when selecting and/or managing all of their property / real estate investments.

SDG aligned aims / objectives (AFM company wide)

Find fund management companies that aim to align all their investments (across all funds) to help meet the aims of the UN Sustainable Development Goals.

Responsible ownership policy for non SRI funds (AFM company wide)

Find funds run by fund managers that apply Responsible ownership or 'Stewardship' policies to all or most of their investment assets. This means active involvement (e.g. voting, dialogue) with the companies they invest in across funds (not normally limited to ethical or SRI options.) Read fund literature for further information.

Integrates ESG factors into all / most (AFM) fund research

Find fund management companies that consider environmental, social and governance (ESG) issues when deciding whether or not to invest in a company for all / almost all of their funds and other assets. This is increasingly seen as part of sound risk management.

In-house diversity improvement programme (AFM company wide)

Finds organisations / fund managers that have an in-house (company wide) diversity improvement programme - meaning that they are working to ensure that within their own businesses they employ people from diverse backgrounds - often typically focused on ethnicity and/or sex.

Diversity, equality & inclusion engagement policy (AFM company wide)

Find fund management companies that encourage the companies they invest in to have strong diversity, race, gender and other equality policies across all assets held, not simply screened or themed SRI/ESG funds. (ie Asset Management company wide).

Invests in newly listed companies (AFM company wide)

This asset management company invests in companies which have recently listed on a stock exchange (which is important as it can help grow new businesses).

Invests in new sustainability linked bond issuances (AFM company wide)

Asset management company has investments in bonds designed to meet sustainability requirements - however these assets may not be 'ringfenced' for this purpose. See fund manager website for details. Collaborations & Affiliations

PRI signatory

Find fund management companies that have signed up to the UN backed 'Principles of Responsible Investment'.

TNFD forum member (AFM company wide)

A member of the Taskforce for Nature Related Financial Disclosures group which aims to aid risk management and shift money towards nature-positive outcomes. Resources

In-house responsible ownership / voting expertise

Find fund management companies that employ people to steer and support fund managers in voting shares at company AGM's and EGMs in ways that are consistent with encouraging higher ESG/sustainability standards.

Employ specialist ESG / SRI / sustainability researchers

Find a fund management company that directly employs specialist ESG/SRI/sustainability researchers or analysts. This allows asset managers to discuss environmental, social and governance risks and opportunities directly with companies.

Use specialist ESG / SRI / sustainability research companies

Find fund management companies that makes use of expert external research companies. This can help deliver specialist expertise and means resources are pooled with other investors.

ESG specialists on all investment desks (AFM company wide)

Finds organisations / fund managers that have one or more ESG/sustainability experts on all investment teams or 'desks' (all asset types) Accreditations

PRI A+ rated (AFM company wide)

Finds organisations / fund managers that have an A+ PRI rating - meaning they are highly rated according to the 'Principles of Responsible Investment' Engagement Approach

Regularly lead collaborative ESG initiatives (AFM company wide)

Find fund management companies that regularly initiate or run industry wide (collaborative) investor projects aimed at raising environmental, social and governance standards amongst investee companies.

Encourage responsible corporate taxation (AFM company wide)

Find fund management companies that are working with the companies they invest in to encourage more responsible corporate taxation.

Engaging on climate change issues

Fund manager has stewardship /responsible ownership strategy that is focused on addressing climate change with investee assets.

Engaging with fossil fuel companies on climate change

Asset manager has a stewardship /responsible ownership strategy that involves working with fossil fuel companies on climate change related issues. See fund manager website for details.

Engaging to reduce plastics pollution / waste

Asset manager has stewardship /responsible ownership strategy with involves encouraging investee asset to reduce plastic waste and pollution.

Engaging to encourage responsible mining practices

Asset manager has a stewardship / responsible ownership policy that means they are working to encourage more responsible mining practices - where environmental and social issues are properly dealt with by the companies they invest in.

Engaging on biodiversity / nature issues

The asset manager has a responsible ownership / stewardship strategy that focuses on biodiversity and nature issues relating to the assets they invest the aim of which will be to reduce harm and or deliver improvement. Strategies vary. https://tnfd.global

Engaging to encourage a Just Transition

Asset manager has a responsible ownership / stewardship strategy which means they are working to encourage the shift to more sustainable business practices in ways that respect and are sensitive to social issues and the impact change has on people effected by the changes that are taking place. https://www.transitionpathwayinitiative.org/ https://transitiontaskforce.net/

Engaging on human rights issues

Asset manager has responsible ownership / stewardship strategy in place which aims to address human rights issues in investee companies (and potentially their suppliers) with the aim of raising standards

Engaging on labour / employment issues

Asset manager has responsible ownership / stewardship strategy in place that aims to improve labour standards for the benefit of employees in investee companies (and potentially their suppliers)

Engaging on diversity, equality and / or inclusion issues

Asset management company has a stewardship strategy in place which involves working to raise diversity, equality and inclusion standards across investee assets

Engaging to stop modern slavery

working with the assets they hold to help stamp out modern slavery - where direct or indirect company employees are exploited for business benefits.

Engaging on governance issues

Fund managers have stewardship strategies in place that focus on improving governance standards across investee assets

Engaging on responsible supply chain issues

Has a stewardship / responsible ownership strategy that encourages responsible supply chain - ie the managers will discuss environmental, social and governance issues with investee companies with the aim of raising standards

Engaging on the responsible use of AI

Working to address sustainability, ESG and related concerns around artificial intelligence. Company Wide Exclusions

Controversial weapons avoidance policy (AFM company wide)

Find fund management companies (not funds) that avoid investment in 'controversial weapons' across all of their funds and other investment vehicles.

Fossil fuel exclusion policy (AFM company wide)

Find fund management companies that avoid investment in fossil fuel companies (e.g. coal, oil and gas) across all of their funds. (and/ or other assets.)

Review(ing) carbon / fossil fuel exposure for all funds (AFM company wide)

Find funds / fund managers that are reviewing, or have reviewed, their exposure to carbon intensive industries including (but not only) mining, oil and gas companies. (Typically with reference to climate change.)

Coal divestment policy (AFM company wide)

This asset manager has a strategy in place that will lead them to exit direct investments in the coal mining industry. Managers ability to do this may depend on the geographic regions in which they invest.

Coal exclusion policy (group wide coal mining exclusion policy)

This asset manager excludes direct investment in the coal mining industry. Managers ability to do this may depend on the geographic regions in which they invest. Climate & Net Zero Transition

Net Zero commitment (AFM company wide)

Fund management organisations that have pledged to reduce their greenhouse gas emissions to ‘net zero’. Strategies vary - this area is changing rapidly.

Voting policy includes net zero targets (AFM company wide)

Fund manager AGM / EGM voting strategy has processes in place that mean they will normally be expected to vote in a way that will encourage the transition to net zero greenhouse gas emissions.

Publish 'CEO owned' Climate Risk policy (AFM company wide)

Find fund management companies that have published a Climate Risk policy or statement that is signed / owned by their Chief Executive.

Net Zero - have set a Net Zero target date (AFM company wide)

This asset management company has set a date by which they plan to achieve net zero greenhouse gas / CO2e emissions.

Encourage carbon / greenhouse gas reduction (AFM company wide)

Find fund management companies that are working with the companies they invest in to encourage reductions in carbon dioxide and other greenhouse gas emissions.

Carbon transition plan published (AFM company wide)

Finds organisations / fund managers that have a company wide carbon transition plan - meaning that they have plotted a path to how they will move away from activities that produce or use carbon based energy sources (that emit greenhouse gases) towards clean, alternative, renewable energy sources.

‘Forward Looking Climate Metrics’ published / ITR (AFM company wide)

Finds organisations / fund managers that have published ‘forward looking climate metrics’ e.g. 'implied temperature rise' data that are a total of the asset management company's share (% owned) of all the investee company emissions of the assets they manage, as well as their own direct and other indirect emissions.

Carbon offsetting – do NOT offset carbon as part of net zero plan (AFM company wide)

This asset management company plans to achieve net zero greenhouse gas (CO2e) emissions by reducing their emissions. Calculations and scope vary.

In-house carbon / GHG reduction policy (AFM company wide)

Find fund management companies that are working to reduce their own (fund management company) carbon/greenhouse gas emissions.

Working towards a ‘Net Zero’ commitment (AFM company wide)

Finds organisations / fund management companies that are in the process of working out how to make a ‘net zero commitment’ - meaning that when that is finalised they will have started the process of reducing their total greenhouse gas emissions to'zero'.

Committed to SBTi / Science Based Targets Initiative

See https://sciencebasedtargets.org/ Transparency

Publish responsible ownership / stewardship report (AFM company wide)

Find fund management companies that publish a report detailing their responsible investment ownership - also known as 'Stewardship' - activity.

Full SRI / responsible ownership policy information on company website

Find companies that publish information about their sustainable and responsible investment strategies on their company website.

Full SRI / responsible ownership policy information available on request

Find fund management companies that will supply information about their sustainable and responsible investment activity on request.

Just Transition policy on website (AFM company wide)

This asset management company has published information on their website about the delivery of a 'just transition' - ie the delivery of the necessary shift to a sustainable future that takes full account of social implications - how change effects people. See eg https://www.unepfi.org/social-issues/just-transition/ or LSE Grantham

Publish full voting record (AFM company wide)

Fund management companies that publish a full record of how they vote their shares at AGMs (annual general meetings) and EGMs (extraordinary general meetings). Voting strategies have an important role to play encouraging higher environmental, social and governance standards.

Sustainability transition plan publicly available (AFM company wide)

This asset management company has published a plan that explains how they are to become a sustainable business - without significant negative environmental or social impacts.

Paris Alignment plan publicly available (AFM company wide)

This asset management company has published a plan that explains how they will align to the climate change commitments made at the Paris Climate Talks, COP21.

Net Zero transition plan publicly available (AFM company wide)

This asset management company has published a plan that explains how they are going to achieve net zero greenhouse gas / CO2e emissions. Sustainable, Responsible &/or ESG Policy:These funds aim to invest at least 75% in ESG Assets (please see the Prospectus for the detailed definitions of the types of ESG Assets we invest in), and we utilise the three ‘E’s of ESG integration – Enforce – Enhance – Engage – within the Future World index building blocks: We first Enforce our Future World Protection List Methodology. Although L&G prioritises company engagement over exclusions, when combined with engagement and voting, targeted exclusions can also be a very powerful tool. We then look to Enhance the ESG profile by tilting towards those companies or issuers with higher ESG score in ESG index funds or using Active View to consider ESG credentials in our active funds. Finally, we Engage. Through our approach to investment stewardship, we seek to improve companies’ standards by engaging with them and using our voice. Please see below for further details. Enforce The following aspects are incorporated as an initial exclusion policy in defining the investable universe for our core equity building blocks. The standards set here are based on our L&G Future World Protection list; a set of exclusions based on companies who fail to meet either globally accepted principles of business practice, or whose business is incompatible with a low-carbon transition.

Enhance We then look to Enhance the ESG profile of the fund through a number of mechanisms: ESG tilts: we have developed a rules-based and transparent methodology by which to score companies against ESG metrics which generates the L&G ESG Score. We developed the scores with the aim of improving market standards globally, while monitoring ESG developments across our entire investment universe. This proprietary scoring framework is the foundation of our Future World Index funds range. The L&G ESG Score aligns with how we engage with, and vote on, the companies in which we invest. To facilitate this process, we publish the scores and explain the metrics on which they are based. Our methodology is based on a transparent framework to assess companies, in order to avoid creating an investment 'black box' and enhance the role of investors to reward and penalise companies based on clear and consistent global standards. Our score comprises 34 ESG data points that measure companies against what we believe are global minimum standards and were selected based on three guiding principles. Each of the 34 data points are assessed and scored, creating a sub-score at the theme level. Individual themes are then aggregated to form the environmental, social, governance and transparency scores. Please refer to the L&G ESG Score methodology for further information. We implement the score within the Future World ESG Multi-Index funds by tilting towards companies that have higher ESG scores and away from those with lower scores. In addition, the scores enable us to incentivise companies to improve their ESG profile through a transparent methodology. We also use ESG Active View to consider ESG credentials in our active funds. Targeted self-decarbonisation: the equity indices behind our core equity building blocks are designed to glide towards a 2050 net zero target, initially reducing emissions by 50% relative to market index and will structurally reduce by 7% annually. Engage L&G engages on behalf of all our clients’ assets, and represents all clients in carrying out voting, engagement and advocacy activities in order to protect and enhance asset values over the long term and speak with one voice in our discussions with companies. Our Investment Stewardship team is not afraid to express its views, voting every share with one voice, without abstentions. We never abstain unless it is technically impossible for us to vote. In 2023, L&G cast roughly 149,000 votes and engaged with 2,050 companies. We have participated in longstanding direct and collective engagement with policymakers on climate, including associations such as the PRI, CA100+, IIGCC, TCFD, and TPI. We note that the carbon footprint of the portfolio is important to you; we also believe that climate is an incredibly important topic. As part of our longstanding engagement programme, the Climate Impact Pledge, we hold over 5000 companies across 20 climate-critical sectors accountable on their climate ambitions and disclosures through our votes and targeted divestment decisions. The fund invests at least 75% in collective investment schemes. Hence, the integration of environmental, social and governance considerations in the fund will primarily occur on the level of the collective investment schemes which we will use to populate our asset allocation. The choice of underlying building blocks has a material impact on the aggregate ESG score and the carbon metrics of our core equity and credit allocation relative to a composite comparator of market-cap weighted indices. We regularly monitor and publish these metrics on a monthly basis to assess the portfolio’s exposure to climate risk and carbon footprint. This is done on a complete look-through basis using underlying scores and carbon metrics for individual companies. Process:The ESG policy and process for the fund is described in the previous section. Our ESG Score and ESG Active View (which utilises its own separate ESG score) is described as follows: ESG Score We have developed a rules-based and transparent methodology by which to score companies against ESG metrics. The ESG Score aligns with how we engage with, and vote on, the companies in which we invest. To facilitate this process, we publish the scores and explain the metrics on which they are based. Our methodology is based on a transparent framework to assess companies, in order to avoid creating an investment 'black box' and enhance the role of investors to reward and penalise companies based on clear and consistent standards. Our score comprises 32 data points that measure companies against what we believe are global minimum standards and were selected based on three guiding principles.