Downloads & support for financial services professionals

This page is pending review

Helping you to offer advice on ESG, ethical and sustainable investments

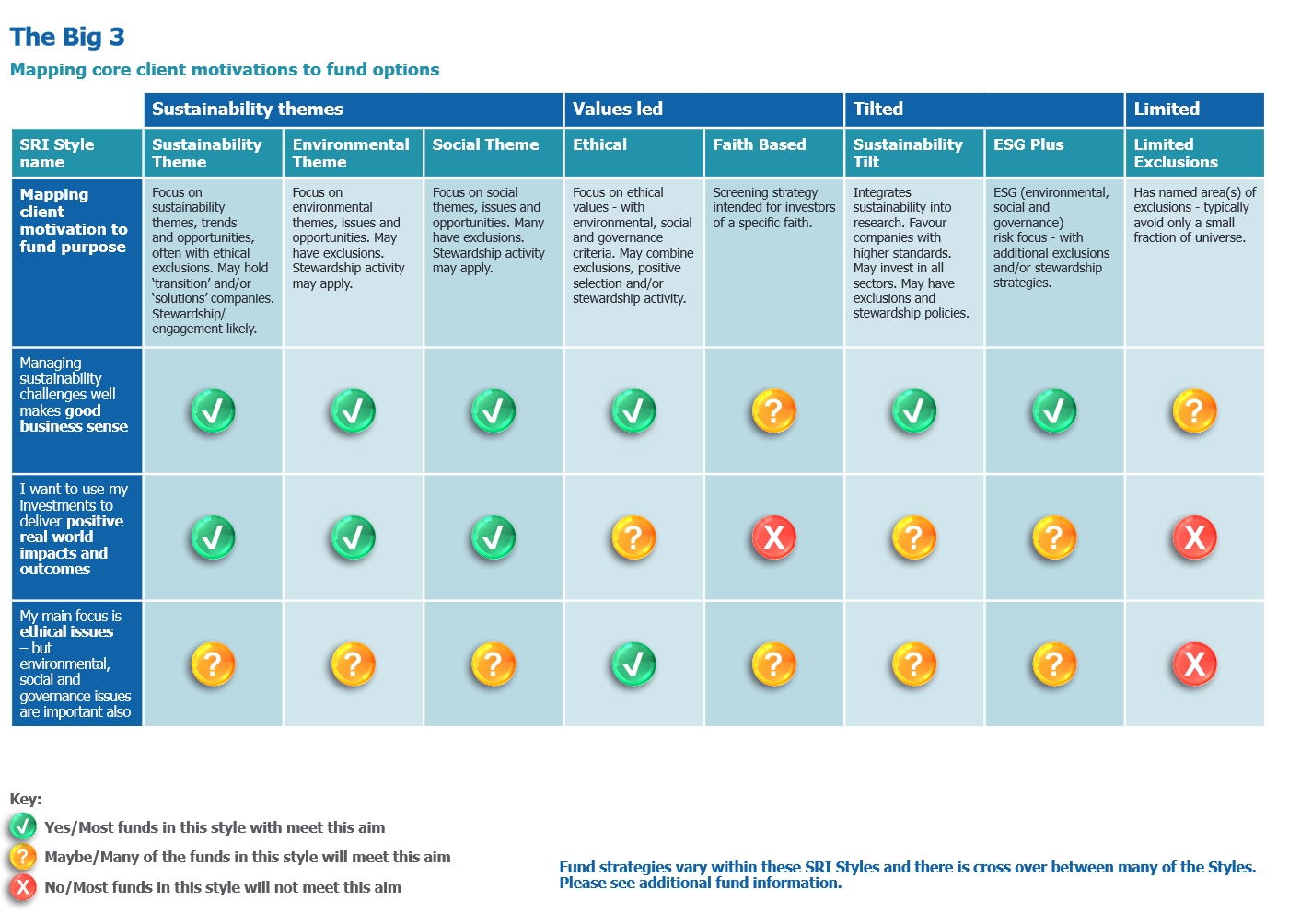

This download includes and introduction to Fund EcoMarket, maps ‘SRI Styles’ against the ‘Big 3’ core client motivations and 7 client examples as well as fact finding information and what to watch out for over the coming year.

Fund EcoMarket tool downloads – NEW (September 2023)

- Download a printable version of the SRI Stylefinder questions (formatted for use as a supplementary questionnaire)here SRI STYLEFINDER_TOOL_2023_v3 _FINAL

- Download a printable version of the filter options on Fund EcoMarket (formatted for use as a supplementary questionnaire) here SRI QUESTIONNAIRE_2023_v3 – FINAL

- Download a verbose list of the filter options on Fund EcoMarket (which includes all filter defintions) here FEM verbose filter list Nov 25

For further information on fact finding see Fact Finding Support.

- For recent news articles see our ‘In the Media’ page

App

To download our fund database as a (free) App search ‘Fund EcoMarket’ on the iOS (Apple) App Store or use the link on the home page for both iOS and Android.

- The app has brief adviser prompts/suggested client text under the ‘?’ on each filter field.

- For more information about the App click here

Videos

- SRI Services YouTube channel

Online training

- Julia Dreblow is the technical author and lead presenter of the PIMFA ESG Academy (launched 2020). See the brief promotional video here.

Archive:

- ’30 People, 30 years, 30 words’ Celebrating 30 years of ethical investment in the UK.

- This ‘guide’ includes ’30 expert opinions’ on ‘Why it matters where we invest’, many of whom were what was then often referred to as ‘the founding fathers of (UK) ethical investment’.

- The document was compiled by Julia Dreblow in 2014 (kindly published by PanaceaAdviser) to celebrate ’30 years’ since the launch of the UKs first ethical fund in 1984 (the Stewardship funds). Contributors include diverse ‘leaders’ from the period 1984 to 2014.

- Each contributor explains in ’30 words’ why it matters where we invest. Many also contributed addition text to explain their views in further detail and explain their personal stories.

- CII Thinkpiece ‘SRI: Environmentally, Socially and Financially Useful‘ by Julia Dreblow, published 19 September 2016