-

Woke, war and waiting - ILP Moneyfacts article December 2023

Published on: 13/12/2023

-

ESG and armaments

Published on: 15/11/2023

-

21 October 2020 'SRI Services & Partners' annual event registration

Published on: 08/04/2020

-

SRI Services & Partners event roundup

Published on: 14/10/2019

-

interactive investor launches ethical 'ACE' list with help from SRI Services

Published on: 10/09/2019

-

MiFID ii - ESG & Sustainability upgrade

Published on: 24/05/2019

-

Sustainable Finance Initiative - MiFID II suitability requirements - feedback requested

Published on: 08/06/2018

-

Citywire Wealth Manager 'Screened, Themed & Engaged' event article

Published on: 03/11/2017

-

ILP Moneyfacts SRI articles: Climate Risk and Ethical Fund Survey

Published on: 07/08/2017

-

NRG - a topsy turvy case study

Published on: 28/07/2017

-

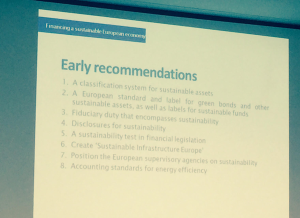

HLEG - EU sustainable finance interim report published

Published on: 19/07/2017

-

SwissRe switch all assets to ESG indices

Published on: 06/07/2017

-

Actuaries issued climate change Risk Alert

Published on: 16/06/2017