-

FCA postpones extending SDR label to portfolios

Published on: 19/02/2025

-

Green Taxonomy consultation published

Published on: 18/11/2024

-

Regulating ESG ratings providers

Published on: 18/11/2024

-

Draft BSI Sustainable Funds PAS 7342 - available for public comment

Published on: 29/05/2024

-

'Adviser Sustainability Group' Terms of Reference and member names published

Published on: 05/03/2024

-

FCA publishes 'Finance for positive sustainable change' discussion paper

Published on: 13/02/2023

-

FT Adviser article - will SDR confine greenwash to history

Published on: 14/11/2022

-

SRI Services & Partners event videos

Published on: 24/10/2022

-

'The future of (sustainable) investment' - Moneyfacts article

Published on: 23/08/2021

-

Regulatory developments in sustainable investment (July 2021)

Published on: 12/07/2021

-

EU ESG consultations - SFDR & Disclosure

Published on: 19/06/2020

-

Coronavirus and ESG - early fund manager responses

Published on: 29/03/2020

-

EU Taxonomy Final Report

Published on: 23/03/2020

-

FCA Feedback Statement on Climate Change and Green Finance

Published on: 18/10/2019

-

More than a third of pension schemes considering appointing IFA - XPS. (So be informed about ESG!)

Published on: 17/10/2019

-

PRA & FCA Climate Financial Risk Forum- first meeting

Published on: 22/03/2019

-

Investment Association to consult on Sustainability and Responsible Investment

Published on: 04/02/2019

-

SRI Services responds to FCA Climate Change and Green Finance Consultation

Published on: 04/02/2019

-

FCA DP18/8 consultation: Climate Change and Green Finance deadline looming

Published on: 16/01/2019

-

FCA opens discussion on impact of climate change and green finance on financial services

Published on: 15/10/2018

-

UK Government changes pension trustee duties and rules to include ESG

Published on: 12/09/2018

-

SRI Services welcomes FCAs proposed review on SRI, ESG & ethical concerns

Published on: 20/07/2018

-

DWP pension consultation - deadline 16 July

Published on: 12/07/2018

-

Pension Funds and Social Investment - final government report

Published on: 18/06/2018

-

Sustainable Finance Initiative - MiFID II suitability requirements - feedback requested

Published on: 08/06/2018

-

Green Finance Taskforce report

Published on: 10/04/2018

-

Its a cultural thing.

Published on: 15/03/2018

-

EU Announces Sustainable Finance Action Plan

Published on: 15/03/2018

-

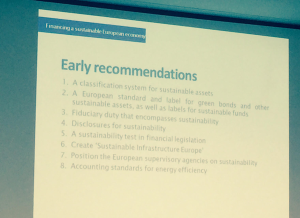

EU HLEG Final Report - Sustainable Finance

Published on: 15/02/2018

-

Green Finance Inquiry (UK)

Published on: 16/01/2018

-

Pension funds & Social Investment - plus ESG, Stewardship and Ethics

Published on: 18/12/2017

-

Why should DC pension schemes consider ESG and SRI (x 12!)

Published on: 13/12/2017

-

Growing a Culture of Social Impact Investing in the UK

Published on: 27/11/2017

-

DWP consultation: Disclosure of costs, charges and investments in DC schemes

Published on: 21/11/2017

-

Good work Gov!

Published on: 06/10/2017

-

HLEG - EU sustainable finance interim report published

Published on: 19/07/2017

-

Pensions & Social Investment: Law Commission review

Published on: 27/06/2017