-

World Economic Forum publish new global risk report

Published on: 20/01/2026

-

Parasol Lost - new climate risk report from the Institute of Actuaries

Published on: 14/01/2026

-

Mansion House speech highlights sustainable finance

Published on: 20/11/2024

-

Fiduciary Duty, pensions and climate change

Published on: 27/02/2024

-

SRI Services welcomes TPT framework

Published on: 12/10/2023

-

SRI Service opposes backtracking on UK climate strategy

Published on: 21/09/2023

-

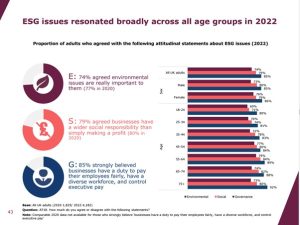

FCA Financial Lives survey shows - yes - growing interest in ESG

Published on: 13/09/2023

-

IFoA report: The Emperors new climate scenarios

Published on: 10/07/2023

-

Church of England to exclude oil and gas companies

Published on: 10/07/2023

-

Climate Change Committee report critical of UK government progress towards Net Zero

Published on: 29/06/2023

-

UK Green Finance Strategy 2023

Published on: 03/04/2023

-

Latest IPCC climate change report

Published on: 29/03/2023

-

FT Adviser article - will SDR confine greenwash to history

Published on: 14/11/2022

-

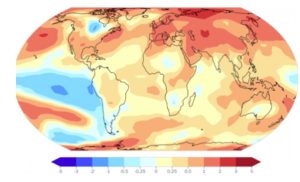

WMO - Eight Warmest Years

Published on: 07/11/2022

-

UN 'Closing Window' Emissions gap report 2022

Published on: 28/10/2022

-

FCA publishes review of TCFD aligned disclosures

Published on: 11/08/2022

-

FCA publishes review of TCFD aligned disclosures

Published on: 11/08/2022

-

London Climate Week - (free) Excel event tickets - 28 & 29 June

Published on: 15/06/2022

-

'Man who jumps on bandwagon accuses fellow passengers of being on bandwagon'

Published on: 23/05/2022

-

How global events are affecting impact and sustainable investments

Published on: 28/04/2022

-

Normalising Net Zero - ILP Moneyfacts sustainable investment article

Published on: 15/12/2021

-

Greening Finance Roadmap 2021 & adviser reference

Published on: 21/10/2021

-

SRI Services & Partners Good Money Week event 2021

Published on: 18/09/2021

-

Regulatory developments in sustainable investment (July 2021)

Published on: 12/07/2021

-

Independent Assessment of UK Climate Risk - report

Published on: 17/06/2021

-

The day everything changed for big oil?

Published on: 27/05/2021

-

'Stick or Twist' - our recent Investment Life and Pensions Moneyfacts article

Published on: 18/05/2021

-

Climate of Change - Investment Life and Pensions Moneyfacts article

Published on: 15/02/2021

-

SRI Services & Partners Good Money Week 2020 event videos now live!

Published on: 28/10/2020

-

Investment Life & Pension Moneyfacts SRI feature

Published on: 22/07/2020

-

Searches for ESG funds increase rapidly - with sustainability issues dominating

Published on: 02/07/2020

-

EU Taxonomy Final Report

Published on: 23/03/2020

-

BlackRock sustainability announcement

Published on: 17/01/2020

-

UKSIF 'Ownership Day' fund manager survey 'Oil Pressure Gauge'

Published on: 02/05/2019

-

Understanding Sustainability funds

Published on: 18/04/2019

-

Global Sustainable Investment Alliance (GSIA) report published

Published on: 05/04/2019

-

PRA & FCA Climate Financial Risk Forum- first meeting

Published on: 22/03/2019

-

SRI Services responds to FCA Climate Change and Green Finance Consultation

Published on: 04/02/2019

-

FCA DP18/8 consultation: Climate Change and Green Finance deadline looming

Published on: 16/01/2019

-

'Sustainability & Suitability' SRI event videos

Published on: 08/11/2018

-

Why Climate Change Matters to Investors - Lord Deben video from our 3 October event

Published on: 25/10/2018

-

FCA opens discussion on impact of climate change and green finance on financial services

Published on: 15/10/2018

-

New PRA report: The Impact of climate change on the UK banking sector

Published on: 30/09/2018

-

UK Government changes pension trustee duties and rules to include ESG

Published on: 12/09/2018

-

ILP Moneyfacts: SRI lightbulb moment editorial

Published on: 12/07/2018

-

EU proposes action to support sustainable finance

Published on: 25/05/2018

-

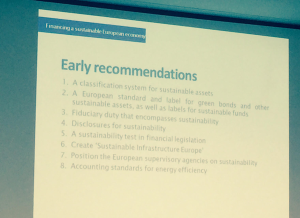

EU Announces Sustainable Finance Action Plan

Published on: 15/03/2018

-

EU HLEG Final Report - Sustainable Finance

Published on: 15/02/2018

-

Green Finance Inquiry (UK)

Published on: 16/01/2018

-

ILP Moneyfacts SRI articles: Climate Risk and Ethical Fund Survey

Published on: 07/08/2017

-

NRG - a topsy turvy case study

Published on: 28/07/2017

-

HLEG - EU sustainable finance interim report published

Published on: 19/07/2017

-

TCFD report final report - managing climate risk

Published on: 29/06/2017

-

Actuaries issued climate change Risk Alert

Published on: 16/06/2017