-

Eurosif reponds to EU's SFDR 2.0 proposals

Published on: 27/02/2026

-

SFDR 2.0 published

Published on: 21/11/2025

-

Exploring SDR on the CISI 'Operations Unpacked' podcast

Published on: 20/10/2025

-

FCA developments - new consultation includes SDR clarifications

Published on: 20/09/2025

-

FRC revises Stewardship Code

Published on: 09/06/2025

-

FCA Financial Lives Survey 2024 - responsible investment highlights

Published on: 22/05/2025

-

FCA delays SDR portfolio labelling work (for now)

Published on: 29/04/2025

-

BSI PAS 7342 sustainable fund specification published

Published on: 26/03/2025

-

EU Omnibus - simplification of sustainability rules

Published on: 13/03/2025

-

SDR fund labelling March update

Published on: 03/03/2025

-

FCA Climate Adaptation report

Published on: 20/02/2025

-

FCA postpones extending SDR label to portfolios

Published on: 19/02/2025

-

Does the UK need a Green Taxonomy?

Published on: 07/02/2025

-

Mansion House speech highlights sustainable finance

Published on: 20/11/2024

-

Regulating ESG ratings providers

Published on: 18/11/2024

-

SRI Services and partners 2024 event videos

Published on: 18/10/2024

-

SRI Services and Partners annual Good Money Week event 2024

Published on: 07/10/2024

-

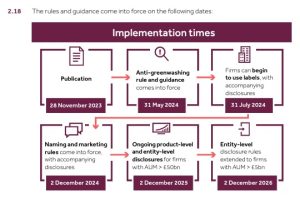

FCA updates - Naming and Marketing 'flexibility'

Published on: 10/09/2024

-

SDR update - July ILP Moneyfacts article

Published on: 24/07/2024

-

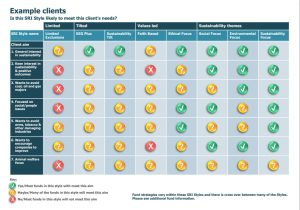

SDR update - a whistlestop tour for financial advisers

Published on: 19/07/2024

-

The FCA's welcome Anti-Greenwash rule is now live - our thoughts

Published on: 31/05/2024

-

Draft BSI Sustainable Funds PAS 7342 - available for public comment

Published on: 29/05/2024

-

New Anti Greenwash rules and portfolio rules announced by FCA

Published on: 25/04/2024

-

What is SDR? article just published in ILP Moneyfacts

Published on: 13/03/2024

-

'Adviser Sustainability Group' Terms of Reference and member names published

Published on: 05/03/2024

-

Appointment to Vice Chair of new working group for financial advisers

Published on: 16/01/2024

-

Introduction to SDR - video

Published on: 15/01/2024

-

FCA Sustainability Disclosure and Labelling Regime published

Published on: 28/11/2023

-

FCA finds further work required to embed its ESG and SI principles in funds

Published on: 20/11/2023

-

SRI Services welcomes TPT framework

Published on: 12/10/2023

-

SRI Service opposes backtracking on UK climate strategy

Published on: 21/09/2023

-

Rollercoasters and regulators - the ESG boom and beyond

Published on: 14/07/2023

-

Climate Change Committee report critical of UK government progress towards Net Zero

Published on: 29/06/2023

-

ESG ratings consultation

Published on: 03/04/2023

-

UK Green Finance Strategy 2023

Published on: 03/04/2023

-

UN High Seas Treaty

Published on: 29/03/2023

-

FCA publishes 'Finance for positive sustainable change' discussion paper

Published on: 13/02/2023

-

SDR consultation feedback

Published on: 31/01/2023

-

SDR: What and Why?

Published on: 14/12/2022

-

FCA SDR consultation paper video

Published on: 07/12/2022

-

Professional Adviser article - Whistle stop tour of sustainability disclosure requirements

Published on: 14/11/2022

-

SRI Services welcomes FCA's landmark SDR consultation.

Published on: 25/10/2022

-

SRI Services & Partners event videos

Published on: 24/10/2022

-

Foundations for Growth (awaiting SDR) article - ILP Moneyfacts

Published on: 14/10/2022

-

FCA publishes review of TCFD aligned disclosures

Published on: 11/08/2022

-

FCA publishes review of TCFD aligned disclosures

Published on: 11/08/2022

-

How SDR should help financial advisers

Published on: 14/07/2022

-

FT Adviser article - How should we label ESG funds?

Published on: 09/02/2022

-

What recent sustainability developments may mean for financial advisers

Published on: 10/11/2021

-

Appointment to FCA 'Disclosure and Labels Advisory Group'

Published on: 04/11/2021

-

Greening Finance Roadmap 2021 & adviser reference

Published on: 21/10/2021

-

'The future of (sustainable) investment' - Moneyfacts article

Published on: 23/08/2021

-

SRI Services welcomes new FCA 'ESG and Sustainable Investment Principles'

Published on: 19/07/2021

-

Regulatory developments in sustainable investment (July 2021)

Published on: 12/07/2021

-

Eurosif welcomes new EU Sustainable Finance Package

Published on: 11/05/2021

-

ESG: More Than a Protest - Citywire infographic and article

Published on: 08/03/2021

-

Climate of Change - Investment Life and Pensions Moneyfacts article

Published on: 15/02/2021

-

Building Trust in Sustainable Investment - FCA keynote speech at SRI Services Good Money Week event

Published on: 26/11/2020

-

EU ESG consultations - SFDR & Disclosure

Published on: 19/06/2020

-

Investment Association Responsible Investment Framework announced

Published on: 18/11/2019

-

FCA Feedback Statement on Climate Change and Green Finance

Published on: 18/10/2019

-

MiFID ii - ESG & Sustainability upgrade

Published on: 24/05/2019

-

PRA & FCA Climate Financial Risk Forum- first meeting

Published on: 22/03/2019

-

SRI Services responds to FCA Climate Change and Green Finance Consultation

Published on: 04/02/2019

-

ESMA MIFID II Sustainability Consultation

Published on: 20/01/2019

-

FCA DP18/8 consultation: Climate Change and Green Finance deadline looming

Published on: 16/01/2019

-

'Sustainability & Suitability' SRI event videos

Published on: 08/11/2018

-

Why Climate Change Matters to Investors - Lord Deben video from our 3 October event

Published on: 25/10/2018

-

FCA opens discussion on impact of climate change and green finance on financial services

Published on: 15/10/2018

-

New PRA report: The Impact of climate change on the UK banking sector

Published on: 30/09/2018

-

UK Government changes pension trustee duties and rules to include ESG

Published on: 12/09/2018

-

SRI Services welcomes FCAs proposed review on SRI, ESG & ethical concerns

Published on: 20/07/2018

-

DWP pension consultation - deadline 16 July

Published on: 12/07/2018

-

Pension Funds and Social Investment - final government report

Published on: 18/06/2018

-

Sustainable Finance Initiative - MiFID II suitability requirements - feedback requested

Published on: 08/06/2018

-

EU proposes action to support sustainable finance

Published on: 25/05/2018

-

Green Finance Taskforce report

Published on: 10/04/2018

-

Its a cultural thing.

Published on: 15/03/2018

-

EU Announces Sustainable Finance Action Plan

Published on: 15/03/2018

-

EU HLEG Final Report - Sustainable Finance

Published on: 15/02/2018

-

Green Finance Inquiry (UK)

Published on: 16/01/2018

-

Pension funds & Social Investment - plus ESG, Stewardship and Ethics

Published on: 18/12/2017

-

Why should DC pension schemes consider ESG and SRI (x 12!)

Published on: 13/12/2017

-

Growing a Culture of Social Impact Investing in the UK

Published on: 27/11/2017

-

DWP consultation: Disclosure of costs, charges and investments in DC schemes

Published on: 21/11/2017

-

Good work Gov!

Published on: 06/10/2017

-

HLEG - EU sustainable finance interim report published

Published on: 19/07/2017

-

TCFD report final report - managing climate risk

Published on: 29/06/2017

-

Pensions & Social Investment: Law Commission review

Published on: 27/06/2017

-

Actuaries issued climate change Risk Alert

Published on: 16/06/2017