-

FCA developments - new consultation includes SDR clarifications

Published on: 20/09/2025

-

FCA Financial Lives Survey 2024 - responsible investment highlights

Published on: 22/05/2025

-

FCA delays SDR portfolio labelling work (for now)

Published on: 29/04/2025

-

FCA Climate Adaptation report

Published on: 20/02/2025

-

FCA postpones extending SDR label to portfolios

Published on: 19/02/2025

-

Regulating ESG ratings providers

Published on: 18/11/2024

-

FCA publishes sustainability disclosure practice examples

Published on: 04/11/2024

-

SRI Services and partners 2024 event videos

Published on: 18/10/2024

-

FCA updates - Naming and Marketing 'flexibility'

Published on: 10/09/2024

-

Adviser Sustainability Group seeking adviser opinions

Published on: 19/07/2024

-

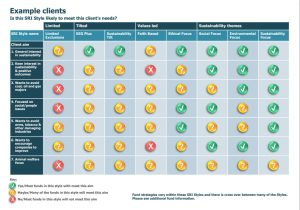

SDR update - a whistlestop tour for financial advisers

Published on: 19/07/2024

-

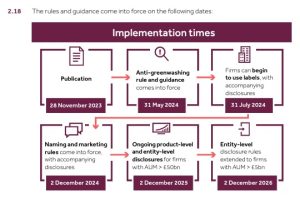

The FCA's welcome Anti-Greenwash rule is now live - our thoughts

Published on: 31/05/2024

-

New Anti Greenwash rules and portfolio rules announced by FCA

Published on: 25/04/2024

-

What is SDR? article just published in ILP Moneyfacts

Published on: 13/03/2024

-

'Adviser Sustainability Group' Terms of Reference and member names published

Published on: 05/03/2024

-

Appointment to Vice Chair of new working group for financial advisers

Published on: 16/01/2024

-

FCA Sustainability Disclosure and Labelling Regime published

Published on: 28/11/2023

-

FCA finds further work required to embed its ESG and SI principles in funds

Published on: 20/11/2023

-

SRI Services & Partners event videos 2023

Published on: 17/10/2023

-

Last chance to sign up to our annual event!

Published on: 29/09/2023

-

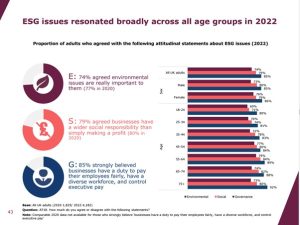

FCA Financial Lives survey shows - yes - growing interest in ESG

Published on: 13/09/2023

-

Climate Change Committee report critical of UK government progress towards Net Zero

Published on: 29/06/2023

-

ESG ratings consultation

Published on: 03/04/2023

-

FCA publishes 'Finance for positive sustainable change' discussion paper

Published on: 13/02/2023

-

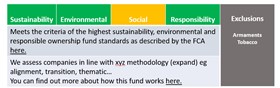

SDR: What and Why?

Published on: 14/12/2022

-

FCA SDR consultation paper video

Published on: 07/12/2022

-

Professional Adviser article - Whistle stop tour of sustainability disclosure requirements

Published on: 14/11/2022

-

FT Adviser article - will SDR confine greenwash to history

Published on: 14/11/2022

-

SRI Services welcomes FCA's landmark SDR consultation.

Published on: 25/10/2022

-

SRI Services & Partners event videos

Published on: 24/10/2022

-

Scribe from our annual event!

Published on: 21/10/2022

-

SRI Services and Partners annual event 6 October 2022

Published on: 12/08/2022

-

'Man who jumps on bandwagon accuses fellow passengers of being on bandwagon'

Published on: 23/05/2022

-

Further thoughts on sustainable fund labelling

Published on: 31/03/2022

-

SRI Services response to FCA SDR and labels discussion paper DP21/4

Published on: 17/01/2022

-

Normalising Net Zero - ILP Moneyfacts sustainable investment article

Published on: 15/12/2021

-

Appointment to FCA 'Disclosure and Labels Advisory Group'

Published on: 04/11/2021

-

Greening Finance Roadmap 2021 & adviser reference

Published on: 21/10/2021

-

SRI Services & Partners Good Money Week event 2021

Published on: 18/09/2021

-

SRI Services welcomes new FCA 'ESG and Sustainable Investment Principles'

Published on: 19/07/2021

-

Regulatory developments in sustainable investment (July 2021)

Published on: 12/07/2021

-

Climate considerations now embedded across main UK financial regulators

Published on: 25/03/2021

-

Building Trust in Sustainable Investment - FCA keynote speech at SRI Services Good Money Week event

Published on: 26/11/2020

-

SRI Services & Partners Good Money Week 2020 event videos now live!

Published on: 28/10/2020

-

Keynote speaker announced for 21 October SRI Services and Partners event

Published on: 02/09/2020

-

EU ESG consultations - SFDR & Disclosure

Published on: 19/06/2020

-

Understanding Greenwash

Published on: 13/11/2019

-

FCA Feedback Statement on Climate Change and Green Finance

Published on: 18/10/2019

-

PRA & FCA Climate Financial Risk Forum- first meeting

Published on: 22/03/2019

-

FCA DP18/8 consultation: Climate Change and Green Finance deadline looming

Published on: 16/01/2019

-

How not to do SRI. Guardian article on Goldman Sachs 'Just' fund

Published on: 30/09/2018

-

SRI Services welcomes FCAs proposed review on SRI, ESG & ethical concerns

Published on: 20/07/2018

-

Obligatory ‘ethical’ fact finding?

Published on: 07/12/2017

-

Pensions & Social Investment: Law Commission review

Published on: 27/06/2017